Immunovant, Inc. (Nasdaq: IMVT), a clinical-stage

immunology company dedicated to enabling normal lives for people

with autoimmune diseases, today reported development updates and

financial results for its fiscal second quarter ended September 30,

2024.

Immunovant continues to focus on moving rapidly to unlock the

full potential of its lead asset, IMVT-1402, for the benefit of

people with underserved autoantibody-driven diseases. With five IND

applications now cleared, the company remains on course to initiate

four to five potentially registrational clinical development

programs by March 31, 2025. These INDs are expected to support

evaluation of IMVT-1402 in a variety of indications and therapeutic

areas. As previously announced, Immunovant anticipates initiating

clinical trials evaluating IMVT-1402 in a total of ten indications

by March 31, 2026.

“Since announcing the Phase 1 data for IMVT-1402 a year ago, we

have made tremendous progress in advancing IMVT-1402 towards

multiple potentially registrational study initiations. We’re ahead

of our goal to activate three INDs by calendar year end and we are

very excited about all five cleared INDs – both those that have

been announced and those that have not yet been announced. In terms

of announced indications, we believe our first-in-class program

with IMVT-1402 in GD has the potential to transform the treatment

of GD patients who respond poorly to ATDs,” said Pete Salzmann,

M.D., chief executive officer of Immunovant.

“We are also excited to announce expansion of our IMVT-1402

development program into Rheumatology. Our first program in

Rheumatology will be a potentially registrational study in patients

with D2T RA where we believe that deeper IgG reduction has the

potential to deliver better clinical outcomes in an important

subset of patients with elevated RA-specific autoantibodies (ACPA).

People living with D2T RA have already exhausted multiple

therapeutic options yet continue to suffer from active disease,

persistent disability and pain,” Salzmann continued. “We believe

IMVT-1402 can deliver meaningful clinical benefit in ACPA-positive

(ACPA+) D2T RA patients, with a potentially best-in-class profile

driven by deeper IgG reduction.”

FcRn inhibition represents an attractive mechanism as a

potential treatment for the approximately 70,000 US patients with

D2T, ACPA+ RA. Recently disclosed in-class data demonstrated that

both higher baseline ACPA levels and deeper ACPA reduction

correlated with better clinical improvement in ACPA+ RA patients

treated with an FcRn inhibitor. Having received FDA clearance of

the IND for IMVT-1402 in RA, Immunovant plans to initiate a

potentially registrational trial in ACPA+ D2T RA by March 31, 2025.

The trial builds on in-class learning in terms of its target

population (enriched for above-normal ACPA levels) and trial design

(open-label lead-in followed by randomized withdrawal). The trial

will leverage IMVT-1402’s higher dose (600 mg) during the

open-label induction phase of the clinical trial to maximize

reduction in ACPA levels.

Recent Highlights and Upcoming Milestones

Endocrinology Program

In September 2024, Immunovant provided a GD program update

consisting of new epidemiologic data characterizing unmet need in

GD patients who are relapsed, uncontrolled or intolerant of ATDs,

additional results from the batoclimab GD study, and an overview of

the IMVT-1402 development program in GD. In November

2024, additional data on the efficacy and safety of batoclimab in

Graves’ thyroidal and extrathyroidal disease were presented in an

oral presentation at the American Thyroid Association (ATA) 2024

Annual Meeting. These data showed that a 60% response rate (defined

as T3 and T4 falling below the upper limit of normal (ULN) without

increasing the ATD dose) was achieved by Week 2, demonstrating the

rapidity of response to batoclimab 680mg dosed weekly. Meaningful

improvements in proptosis and lid aperture were also observed at

both Week 12 and Week 24. Pronounced improvements in multiple

Thyroid-Related Patient-Reported Outcomes (ThyPRO-39) measurement

scales were also observed, with ATD-Free Responders (defined as T3

and T4 falling below the ULN and ceasing all ATD medications)

reporting greater improvements than other participants.

The batoclimab data in Graves’ disease support the potential for

deep IgG reduction to modify the underlying pathophysiology of the

disease, which could enable a transformation of the treatment of

Graves’ disease for patients not well controlled on ATDs.

Immunovant remains on track to initiate the first potentially

registrational trial of IMVT-1402 in GD by calendar year end.

Competition for clinical trial participants with acute, active

TED has increased over the course of the company’s Phase 3 program

to evaluate batoclimab for the treatment of thyroid eye disease

(TED). As a result, top-line results are now expected to be

available in the second half of calendar year 2025, along with a

decision on whether to advance batoclimab to registration in TED.

Data from this trial will be leveraged to inform the overall

program in GD for the Company’s lead asset, IMVT-1402.

Neurology Program

As previously reported, Immunovant completed enrollment of the

batoclimab pivotal trial in MG, with top-line results expected to

be reported by March 31, 2025. Results from this trial are expected

to inform a decision regarding next steps for batoclimab in MG and

the design of the MG program for IMVT-1402, which Immunovant

expects to initiate by March 31, 2025.

Enrollment of study participants has completed in the Phase 2b

trial evaluating batoclimab in chronic inflammatory demyelinating

polyneuropathy (CIDP) for those patients to be included in the

period 1 data readout expected by March 31, 2025. A decision

to enroll additional patients in the batoclimab CIDP study will be

made following the readout of period 1 data. Those results, as well

as observations drawn from public disclosures of other studies in

CIDP, will be used to inform the trial design for a potentially

registrational program for IMVT-1402 in CIDP.

Corporate Update

Immunovant also announced today that it appointed Melanie Gloria

as Chief Operating Officer, effective November 18, 2024. Ms. Gloria

brings over 20 years of experience in the biotechnology industry,

including leadership roles at Acelyrin, Horizon Therapeutics and

AbbVie. At AbbVie and Horizon she led teams to achieve global

approvals of HUMIRA®, Viekera Pak®, Mavyret®, Skyrizi®, Rinvoq®,

TEPEZZA®, and ORILISSA®. “I am thrilled to welcome Melanie to

Immunovant where her success in driving late-stage drug development

will be incredibly valuable,” said Salzmann. “Melanie’s proven drug

development capabilities are a great fit for Immunovant’s

portfolio.”

Webcast Details

Immunovant will host a webcast at 8:00 a.m. ET today to discuss

these updates. Please click register

here to register for the event.

The live webcast will also be available under the News & Events

section of Immunovant’s website. A replay of the event and

presentation will be available immediately following the event.

Financial Highlights for Fiscal Second Quarter Ended

September 30, 2024:

Cash Position: As of September 30, 2024,

Immunovant’s cash and cash equivalents totaled approximately $472.9

million.

R&D Expenses: Research and development

expenses were $97.3 million for the three months ended September

30, 2024, compared to $48.0 million for the three months ended

September 30, 2023. The increase was primarily due to activities in

preparation for potential future clinical trials of IMVT-1402,

including contract manufacturing costs for drug substance, higher

overall clinical trial costs related to our batoclimab pivotal

clinical trials, and elevated personnel-related expenses. The

increase was partially offset by lower overall costs related to our

IMVT-1402 Phase 1 trial and nonclinical studies.

G&A Expenses: General and administrative

expenses were $18.5 million for the three months ended September

30, 2024, compared to $13.8 million for the three months ended

September 30, 2023. The increase was primarily due to higher

personnel-related expenses, legal and other professional fees, and

information technology costs.

Net Loss: Net loss was $109.1 million ($0.74

per common share) for the three months ended September 30, 2024,

compared to $58.7 million ($0.45 per common share) for the three

months ended September 30, 2023. Net loss for the three months

ended September 30, 2024 and September 30, 2023 included $12.7

million and $10.5 million, respectively, related to non-cash

stock-based compensation expense.

Common Stock: As of September 30, 2024, there

were 146,565,049 shares of common stock issued and outstanding.

Financial Highlights for Fiscal Six Months Ended

September 30, 2024:

R&D Expenses: Research and development

expenses were $172.7 million for the six months ended September 30,

2024, compared to $98.5 million for the six months ended September

30, 2023. The increase was primarily due to activities in

preparation for potential future clinical trials of IMVT-1402,

including contract manufacturing costs for drug substance, higher

overall clinical trial costs related to our batoclimab pivotal

clinical trials, and elevated personnel-related expenses. The

increase was partially offset by lower overall costs related to our

IMVT-1402 Phase 1 trial and nonclinical studies.

IPR&D Expenses: There were no acquired

in-process research and development expenses for the six months

ended September 30, 2024. During the six months ended September 30,

2023, acquired in-process research and development expenses were

$12.5 million related to the achievement of development and

regulatory milestones for batoclimab under the terms of the HanAll

in-license agreement.

G&A Expenses: General and administrative

expenses were $37.3 million for the six months ended September 30,

2024, compared to $29.2 million for the six months ended September

30, 2023. The increase was primarily due to higher

personnel-related expenses, legal and other professional fees, and

information technology costs.

Net Loss: Net loss was $196.3 million ($1.34

per common share) for the six months ended September 30, 2024,

compared to $132.6 million ($1.01 per common share) for the six

months ended September 30, 2023. Net loss for the six months ended

September 30, 2024 and September 30, 2023 included $26.1 million

and $21.2 million, respectively, related to non-cash stock-based

compensation expense.

About Immunovant, Inc.

Immunovant, Inc. is a clinical-stage immunology company

dedicated to enabling normal lives for people with autoimmune

diseases. As a trailblazer in anti-FcRn technology, the Company is

developing innovative, targeted therapies to meet the complex and

variable needs of people with autoimmune diseases. For additional

information on the Company, please visit immunovant.com.

Forward-Looking Statements

This press release contains forward-looking statements for the

purposes of the safe harbor provisions under The Private Securities

Litigation Reform Act of 1995 and other federal securities laws.

The use of words such as “can,” “may,” “might,” “will,” “would,”

“should,” “expect,” “believe,” “estimate,” “design,” “plan,”

“anticipate,” “intend,” and other similar expressions are intended

to identify forward-looking statements. Such forward looking

statements include statements regarding Immunovant’s expectations

regarding the timing, design, and results of clinical trials of

IMVT-1402 and batoclimab, including the number and timing of (a)

FDA clearance with respect to IND applications, (b) potential

registrational programs and clinical trials of IMVT-1402,

(c) expected data readouts from batoclimab trials in MG and

CIDP, and (d) estimates of the target populations for

IMVT-1402, including in RA; Immunovant’s plan to develop IMVT-1402

and batoclimab across a broad range of indications; and potential

benefits of IMVT-1402’s unique product attributes and potential

best-in-class profile. All forward-looking statements are based on

estimates and assumptions by Immunovant’s management that, although

Immunovant believes to be reasonable, are inherently uncertain. All

forward-looking statements are subject to risks and uncertainties

that may cause actual results to differ materially from those that

Immunovant expected. Such risks and uncertainties include, among

others: Immunovant may not be able to protect or enforce its

intellectual property rights; initial results or other preliminary

analyses or results of early clinical trials may not be predictive

of final trial results or of the results of later clinical trials;

the timing and availability of data from clinical trials; the

timing of discussions with regulatory agencies, as well as

regulatory submissions and potential approvals; the continued

development of Immunovant’s product candidates, including the

number and timing of the commencement of additional clinical

trials; Immunovant’s scientific approach, clinical trial design,

indication selection, and general development progress; future

clinical trials may not confirm any safety, potency, or other

product characteristics described or assumed in this press release;

any product candidate that Immunovant develops may not progress

through clinical development or receive required regulatory

approvals within expected timelines or at all; Immunovant’s product

candidates may not be beneficial to patients, or even if approved

by regulatory authorities, successfully commercialized; the

potential impact of macroeconomic and geopolitical factors on

Immunovant’s business operations and supply chain, including its

clinical development plans and timelines; Immunovant’s business is

heavily dependent on the successful development, regulatory

approval, and commercialization of IMVT-1402 and/or batoclimab;

Immunovant is at various stages of clinical development for

IMVT-1402 and batoclimab; and Immunovant will require additional

capital to fund its operations and advance IMVT-1402 and batoclimab

through clinical development. These and other risks and

uncertainties are more fully described in Immunovant’s periodic and

other reports filed with the Securities and Exchange Commission

(SEC), including in the section titled “Risk Factors” in

Immunovant’s Form 10-Q to be filed with the SEC on November 7,

2024, and Immunovant’s subsequent filings with the SEC. Any

forward-looking statement speaks only as of the date on which it

was made. Immunovant undertakes no obligation to publicly update or

revise any forward-looking statement, whether as a result of new

information, future events or otherwise.

|

|

|

IMMUNOVANT, INC.Consolidated Statements of

Operations(Unaudited, in thousands, except share and per

share data) |

| |

| |

Three Months EndedSeptember

30, |

|

Six Months EndedSeptember

30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

Research and development |

$ |

97,272 |

|

|

$ |

47,959 |

|

|

$ |

172,745 |

|

|

$ |

98,534 |

|

|

Acquired in-process research and development |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

12,500 |

|

|

General and administrative |

|

18,471 |

|

|

|

13,841 |

|

|

|

37,279 |

|

|

|

29,243 |

|

|

Total operating expenses |

|

115,743 |

|

|

|

61,800 |

|

|

|

210,024 |

|

|

|

140,277 |

|

| Interest income |

|

(6,073 |

) |

|

|

(3,572 |

) |

|

|

(13,254 |

) |

|

|

(7,637 |

) |

| Other income, net |

|

(629 |

) |

|

|

(20 |

) |

|

|

(657 |

) |

|

|

(484 |

) |

| Loss before provision for

income taxes |

|

(109,041 |

) |

|

|

(58,208 |

) |

|

|

(196,113 |

) |

|

|

(132,156 |

) |

| Provision for income

taxes |

|

78 |

|

|

|

454 |

|

|

|

156 |

|

|

|

443 |

|

| Net loss |

$ |

(109,119 |

) |

|

$ |

(58,662 |

) |

|

$ |

(196,269 |

) |

|

$ |

(132,599 |

) |

| Net loss per common share –

basic and diluted |

$ |

(0.74 |

) |

|

$ |

(0.45 |

) |

|

$ |

(1.34 |

) |

|

$ |

(1.01 |

) |

| Weighted-average common shares

outstanding – basic and diluted |

|

146,468,991 |

|

|

|

131,155,642 |

|

|

|

146,313,696 |

|

|

|

130,872,717 |

|

|

|

|

IMMUNOVANT, INC.Consolidated Balance

Sheets(Unaudited, in thousands, except share and per share

data) |

| |

| |

September 30, 2024 |

|

March 31, 2024 |

| Assets |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

472,941 |

|

|

$ |

635,365 |

|

|

Accounts receivable |

|

1,876 |

|

|

|

5,337 |

|

|

Prepaid expenses and other current assets |

|

32,555 |

|

|

|

25,068 |

|

|

Total current assets |

|

507,372 |

|

|

|

665,770 |

|

| Operating lease right-of-use

assets |

|

45 |

|

|

|

133 |

|

| Other assets |

|

7,619 |

|

|

|

— |

|

| Property and equipment, net |

|

671 |

|

|

|

462 |

|

| Total

assets |

$ |

515,707 |

|

|

$ |

666,365 |

|

| Liabilities and

Stockholders’ Equity |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

20,727 |

|

|

$ |

7,155 |

|

|

Accrued expenses |

|

45,879 |

|

|

|

41,315 |

|

|

Current portion of operating lease liabilities |

|

47 |

|

|

|

138 |

|

|

Total current liabilities |

|

66,653 |

|

|

|

48,608 |

|

|

Total liabilities |

|

66,653 |

|

|

|

48,608 |

|

| Commitments and

contingencies |

|

|

|

| Stockholders’ equity: |

|

|

|

|

Series A preferred stock, par value $0.0001 per share, 10,000

shares authorized, issued and outstanding at September 30,

2024 and March 31, 2024 |

|

— |

|

|

|

— |

|

|

Preferred stock, par value $0.0001 per share, 10,000,000 shares

authorized, no shares issued and outstanding at September 30,

2024 and March 31, 2024 |

|

— |

|

|

|

— |

|

|

Common stock, par value $0.0001 per share, 500,000,000 shares

authorized, 146,565,049 shares issued and outstanding at

September 30, 2024 and 500,000,000 shares authorized,

145,582,999 shares issued and outstanding at March 31,

2024 |

|

14 |

|

|

|

14 |

|

|

Additional paid-in capital |

|

1,469,082 |

|

|

|

1,441,518 |

|

|

Accumulated other comprehensive income |

|

1,910 |

|

|

|

1,908 |

|

|

Accumulated deficit |

|

(1,021,952 |

) |

|

|

(825,683 |

) |

|

Total stockholders’ equity |

|

449,054 |

|

|

|

617,757 |

|

| Total liabilities and

stockholders’ equity |

$ |

515,707 |

|

|

$ |

666,365 |

|

| |

|

|

|

Contact:Renee Barnett, MBAChief Financial

OfficerImmunovant, Inc.info@immunovant.com

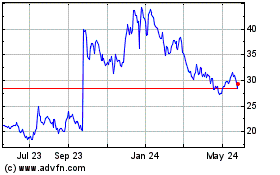

Immunovant (NASDAQ:IMVT)

Historical Stock Chart

From Oct 2024 to Nov 2024

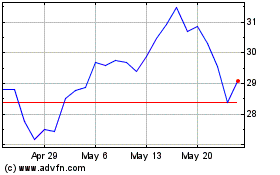

Immunovant (NASDAQ:IMVT)

Historical Stock Chart

From Nov 2023 to Nov 2024