0001764013FALSE00017640132024-11-072024-11-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 7, 2024

IMMUNOVANT, INC.

(Exact name of Registrant as specified in its Charter)

| | | | | | | | | | | |

| Delaware | 001-38906 | 83-2771572 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (IRS Employer Identification No.) |

| | |

| 320 West 37th Street | | |

| New York, | NY | | 10018 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (917) 580-3099

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | |

| Common Stock, $0.0001 par value per share | | IMVT | | The Nasdaq Stock Market LLC | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition

On November 7, 2024, Immunovant, Inc., or the Company, issued a press release announcing its financial results for its fiscal second quarter and six months ended September 30, 2024. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information contained in this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information in this Item 2.02 shall not be incorporated by reference in any filing with the U.S. Securities and Exchange Commission, or the SEC, made by the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 8.01. Other Events

As described in the press release, the Company will host a conference call and webcast to provide business updates for investors at 8:00 a.m. ET on November 7, 2024. A copy of the presentation to be used by the Company during the conference call is filed as Exhibit 99.2 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | | | | |

| Exhibit No. | | Description | |

| 99.1 | | | |

99.2 | | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | |

| IMMUNOVANT, INC. |

| | |

| By: | | /s/ Eva Renee Barnett |

| | | Eva Renee Barnett |

| | | Chief Financial Officer |

Date: November 7, 2024 | | | |

Exhibit 99.1

Immunovant Provides Development Updates and Reports Financial Results for the Quarter Ended September 30, 2024

•Five Investigational New Drug (IND) applications cleared across a range of therapeutic areas and FDA divisions for lead asset, IMVT-1402

•Proof of concept data from batoclimab trial in Graves’ disease (GD) demonstrate potential of deeper IgG reduction with potent FcRn inhibition to transform treatment for GD patients who are not well controlled on antithyroid drugs (ATDs); initiation of potentially registrational trial to evaluate IMVT-1402 in GD expected by year end

•IND cleared for IMVT-1402 in rheumatoid arthritis (RA), with potential best-in-class profile in difficult-to-treat (D2T) RA; initiation of potentially registrational trial to evaluate IMVT-1402 in D2T RA expected by March 31, 2025

•On track to initiate potentially registrational trials with IMVT-1402 in four to five indications, inclusive of GD and D2T RA, by March 31, 2025

•Batoclimab trials in myasthenia gravis (MG) and chronic inflammatory demyelinating polyneuropathy (CIDP) fully enrolled to support data disclosures by March 31, 2025; data from batoclimab trials in thyroid eye disease (TED) now expected in the second half of calendar year 2025; all batoclimab data will inform future trials with IMVT-1402

•Immunovant to host development update call today, November 7, at 8 a.m. ET

NEW YORK, November 7, 2024 – Immunovant, Inc. (Nasdaq: IMVT), a clinical-stage immunology company dedicated to enabling normal lives for people with autoimmune diseases, today reported development updates and financial results for its fiscal second quarter ended September 30, 2024.

Immunovant continues to focus on moving rapidly to unlock the full potential of its lead asset, IMVT-1402, for the benefit of people with underserved autoantibody-driven diseases. With five IND applications now cleared, the company remains on course to initiate four to five potentially registrational clinical development programs by March 31, 2025. These INDs are expected to support evaluation of IMVT-1402 in a variety of indications and therapeutic areas. As previously announced, Immunovant anticipates initiating clinical trials evaluating IMVT-1402 in a total of ten indications by March 31, 2026.

“Since announcing the Phase 1 data for IMVT-1402 a year ago, we have made tremendous progress in advancing IMVT-1402 towards multiple potentially registrational study initiations. We’re ahead of our goal to activate three INDs by calendar year end and we are very excited about all five cleared INDs – both those that have been announced and those that have not yet been announced. In terms of announced indications, we believe our first-in-class program with IMVT-1402 in GD has the potential to transform the treatment of GD patients who respond poorly to ATDs,” said Pete Salzmann, M.D., chief executive officer of Immunovant.

“We are also excited to announce expansion of our IMVT-1402 development program into Rheumatology. Our first program in Rheumatology will be a potentially registrational study in patients with D2T RA where we believe that deeper IgG reduction has the potential to deliver better clinical outcomes in an important subset of patients with elevated RA-specific autoantibodies (ACPA). People living with D2T RA have already exhausted multiple therapeutic options yet continue to suffer from active disease, persistent disability and pain,” Salzmann continued. “We believe IMVT-1402 can deliver meaningful clinical benefit in ACPA-positive (ACPA+) D2T RA patients, with a potentially best-in-class profile driven by deeper IgG reduction.”

FcRn inhibition represents an attractive mechanism as a potential treatment for the approximately 70,000 US patients with D2T, ACPA+ RA. Recently disclosed in-class data demonstrated that both higher baseline ACPA levels and deeper ACPA reduction correlated with better clinical improvement in ACPA+ RA patients treated with an FcRn inhibitor. Having received FDA clearance of the IND for IMVT-1402 in RA, Immunovant plans to initiate a potentially registrational trial in ACPA+ D2T RA by March 31, 2025. The trial builds on in-class learning in terms of its target population (enriched for above-normal ACPA levels) and trial design (open-label lead-in followed by randomized withdrawal). The trial will leverage IMVT-1402’s higher dose (600 mg) during the open-label induction phase of the clinical trial to maximize reduction in ACPA levels.

Recent Highlights and Upcoming Milestones

Endocrinology Program

In September 2024, Immunovant provided a GD program update consisting of new epidemiologic data characterizing unmet need in GD patients who are relapsed, uncontrolled or intolerant of ATDs, additional results from the batoclimab GD study, and an overview of the IMVT-1402 development program in GD. In November 2024, additional data on the efficacy and safety of batoclimab in Graves’ thyroidal and extrathyroidal disease were presented in an oral presentation at the American Thyroid Association (ATA) 2024 Annual Meeting. These data showed that a 60% response rate (defined as T3 and T4 falling below the upper limit of normal (ULN) without increasing the ATD dose) was achieved by Week 2, demonstrating the rapidity of response to batoclimab 680mg dosed weekly. Meaningful improvements in proptosis and lid aperture were also observed at both Week 12 and Week 24. Pronounced improvements in multiple Thyroid-Related Patient-Reported Outcomes (ThyPRO-39) measurement scales were also observed, with ATD-Free Responders (defined as T3 and T4 falling below the ULN and ceasing all ATD medications) reporting greater improvements than other participants.

The batoclimab data in Graves’ disease support the potential for deep IgG reduction to modify the underlying pathophysiology of the disease, which could enable a transformation of the treatment of Graves’ disease for patients not well controlled on ATDs. Immunovant remains on track to initiate the first potentially registrational trial of IMVT-1402 in GD by calendar year end.

Competition for clinical trial participants with acute, active TED has increased over the course of the company’s Phase 3 program to evaluate batoclimab for the treatment of thyroid eye disease (TED). As a result, top-line results are now expected to be available in the second half of calendar year 2025, along with a decision on whether to advance batoclimab to registration in TED. Data from this trial will be leveraged to inform the overall program in GD for the Company’s lead asset, IMVT-1402.

Neurology Program

As previously reported, Immunovant completed enrollment of the batoclimab pivotal trial in MG, with top-line results expected to be reported by March 31, 2025. Results from this trial are expected to inform a decision regarding next steps for batoclimab in MG and the design of the MG program for IMVT-1402, which Immunovant expects to initiate by March 31, 2025.

Enrollment of study participants has completed in the Phase 2b trial evaluating batoclimab in chronic inflammatory demyelinating polyneuropathy (CIDP) for those patients to be included in the period 1 data readout expected by March 31, 2025. A decision to enroll additional patients in the batoclimab CIDP study will be made following the readout of period 1 data. Those results, as well as observations drawn from public disclosures of other studies in CIDP, will be used to inform the trial design for a potentially registrational program for IMVT-1402 in CIDP.

Corporate Update

Immunovant also announced today that it appointed Melanie Gloria as Chief Operating Officer, effective November 18, 2024. Ms. Gloria brings over 20 years of experience in the biotechnology industry, including leadership roles at Acelyrin, Horizon Therapeutics and AbbVie. At AbbVie and Horizon she led teams to achieve global approvals of HUMIRA®, Viekera Pak®, Mavyret®, Skyrizi®, Rinvoq®, TEPEZZA®, and ORILISSA®. “I am thrilled to welcome Melanie to Immunovant where her success in driving late-stage drug development will be incredibly valuable,” said Salzmann. “Melanie’s proven drug development capabilities are a great fit for Immunovant’s portfolio.”

Webcast Details

Immunovant will host a webcast at 8:00 a.m. ET today to discuss these updates. Please click register here to register for the event. The live webcast will also be available under the News & Events section of Immunovant’s website. A replay of the event and presentation will be available immediately following the event.

Financial Highlights for Fiscal Second Quarter Ended September 30, 2024:

Cash Position: As of September 30, 2024, Immunovant’s cash and cash equivalents totaled approximately $472.9 million.

R&D Expenses: Research and development expenses were $97.3 million for the three months ended September 30, 2024, compared to $48.0 million for the three months ended September 30, 2023. The increase was primarily due to activities in preparation for potential future clinical trials of IMVT-1402, including contract manufacturing costs for drug substance, higher overall clinical trial costs related to our batoclimab pivotal clinical trials, and elevated personnel-related expenses. The increase was partially offset by lower overall costs related to our IMVT-1402 Phase 1 trial and nonclinical studies.

G&A Expenses: General and administrative expenses were $18.5 million for the three months ended September 30, 2024, compared to $13.8 million for the three months ended September 30, 2023. The

increase was primarily due to higher personnel-related expenses, legal and other professional fees, and information technology costs.

Net Loss: Net loss was $109.1 million ($0.74 per common share) for the three months ended September 30, 2024, compared to $58.7 million ($0.45 per common share) for the three months ended September 30, 2023. Net loss for the three months ended September 30, 2024 and September 30, 2023 included $12.7 million and $10.5 million, respectively, related to non-cash stock-based compensation expense.

Common Stock: As of September 30, 2024, there were 146,565,049 shares of common stock issued and outstanding.

Financial Highlights for Fiscal Six Months Ended September 30, 2024:

R&D Expenses: Research and development expenses were $172.7 million for the six months ended September 30, 2024, compared to $98.5 million for the six months ended September 30, 2023. The increase was primarily due to activities in preparation for potential future clinical trials of IMVT-1402, including contract manufacturing costs for drug substance, higher overall clinical trial costs related to our batoclimab pivotal clinical trials, and elevated personnel-related expenses. The increase was partially offset by lower overall costs related to our IMVT-1402 Phase 1 trial and nonclinical studies.

IPR&D Expenses: There were no acquired in-process research and development expenses for the six months ended September 30, 2024. During the six months ended September 30, 2023, acquired in-process research and development expenses were $12.5 million related to the achievement of development and regulatory milestones for batoclimab under the terms of the HanAll in-license agreement.

G&A Expenses: General and administrative expenses were $37.3 million for the six months ended September 30, 2024, compared to $29.2 million for the six months ended September 30, 2023. The increase was primarily due to higher personnel-related expenses, legal and other professional fees, and information technology costs.

Net Loss: Net loss was $196.3 million ($1.34 per common share) for the six months ended September 30, 2024, compared to $132.6 million ($1.01 per common share) for the six months ended September 30, 2023. Net loss for the six months ended September 30, 2024 and September 30, 2023 included $26.1 million and $21.2 million, respectively, related to non-cash stock-based compensation expense.

About Immunovant, Inc.

Immunovant, Inc. is a clinical-stage immunology company dedicated to enabling normal lives for people with autoimmune diseases. As a trailblazer in anti-FcRn technology, the Company is developing innovative, targeted therapies to meet the complex and variable needs of people with autoimmune diseases. For additional information on the Company, please visit immunovant.com.

Forward-Looking Statements

This press release contains forward-looking statements for the purposes of the safe harbor provisions under The Private Securities Litigation Reform Act of 1995 and other federal securities laws. The use of words such as “can,” “may,” “might,” “will,” “would,” “should,” “expect,” “believe,” “estimate,” “design,” “plan,” “anticipate,” “intend,” and other similar expressions are intended to identify forward-looking statements. Such forward looking statements include statements regarding Immunovant’s expectations regarding the timing, design, and results of clinical trials of IMVT-1402 and batoclimab, including the number and timing of (a) FDA clearance with respect to IND applications, (b) potential registrational programs and clinical trials of IMVT-1402, (c) expected data readouts from batoclimab trials in MG and CIDP, and (d) estimates of the target populations for IMVT-1402, including in RA; Immunovant’s plan to develop IMVT-1402 and batoclimab across a broad range of indications; and potential benefits of IMVT-1402’s unique product attributes and potential best-in-class profile. All forward-looking statements are based on estimates and assumptions by Immunovant’s management that, although Immunovant believes to be reasonable, are inherently uncertain. All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that Immunovant expected. Such risks and uncertainties include, among others: Immunovant may not be able to protect or enforce its intellectual property rights; initial results or other preliminary analyses or results of early clinical trials may not be predictive of final trial results or of the results of later clinical trials; the timing and availability of data from clinical trials; the timing of discussions with regulatory agencies, as well as regulatory submissions and potential approvals; the continued development of Immunovant’s product candidates, including the number and timing of the commencement of additional clinical trials; Immunovant’s scientific approach, clinical trial design, indication selection, and general development progress; future clinical trials may not confirm any safety, potency, or other product characteristics described or assumed in this press release; any product candidate that Immunovant develops may not progress through clinical development or receive required regulatory approvals within expected timelines or at all; Immunovant’s product candidates may not be beneficial to patients, or even if approved by regulatory authorities, successfully commercialized; the potential impact of macroeconomic and geopolitical factors on Immunovant’s business operations and supply chain, including its clinical development plans and timelines; Immunovant’s business is heavily dependent on the successful development, regulatory approval, and commercialization of IMVT-1402 and/or batoclimab; Immunovant is at various stages of clinical development for IMVT-1402 and batoclimab; and Immunovant will require additional capital to fund its operations and advance IMVT-1402 and batoclimab through clinical development. These and other risks and uncertainties are more fully described in Immunovant’s periodic and other reports filed with the Securities and Exchange Commission (SEC), including in the section titled “Risk Factors” in Immunovant’s Form 10-Q to be filed with the SEC on November 7, 2024, and Immunovant’s subsequent filings with the SEC. Any forward-looking statement speaks only as of the date on which it was made. Immunovant undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

IMMUNOVANT, INC.

Consolidated Statements of Operations

(Unaudited, in thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Six Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

Operating expenses: | | | | | | | |

| Research and development | $97,272 | | $47,959 | | $172,745 | | $98,534 |

| Acquired in-process research and development | — | | — | | — | | 12,500 |

| General and administrative | 18,471 | | 13,841 | | 37,279 | | 29,243 |

Total operating expenses | 115,743 | | 61,800 | | 210,024 | | 140,277 |

Interest income | (6,073) | | (3,572) | | (13,254) | | (7,637) |

Other income, net | (629) | | (20) | | (657) | | (484) |

Loss before provision for income taxes | (109,041) | | (58,208) | | (196,113) | | (132,156) |

Provision for income taxes | 78 | | 454 | | 156 | | 443 |

Net loss | $(109,119) | | $(58,662) | | $(196,269) | | $(132,599) |

Net loss per common share – basic and diluted | $(0.74) | | $(0.45) | | $(1.34) | | $(1.01) |

Weighted-average common shares outstanding – basic and diluted | 146,468,991 | | 131,155,642 | | 146,313,696 | | 130,872,717 |

IMMUNOVANT, INC.

Consolidated Balance Sheets

(Unaudited, in thousands, except share and per share data)

| | | | | | | | | | | |

| September 30, 2024 |

| March 31, 2024 |

Assets |

|

|

|

Current assets: |

|

|

|

Cash and cash equivalents | $ 472,941 |

| $ 635,365 |

Accounts receivable | 1,876 |

| 5,337 |

Prepaid expenses and other current assets | 32,555 |

| 25,068 |

Total current assets | 507,372 |

| 665,770 |

Operating lease right-of-use assets | 45 |

| 133 |

Other assets | 7,619 |

| — |

Property and equipment, net | 671 |

| 462 |

Total assets | $ 515,707 |

| $ 666,365 |

Liabilities and Stockholders’ Equity |

|

|

|

Current liabilities: |

|

|

|

Accounts payable | $ 20,727 |

| $ 7,155 |

Accrued expenses | 45,879 |

| 41,315 |

Current portion of operating lease liabilities | 47 |

| 138 |

Total current liabilities | 66,653 |

| 48,608 |

Total liabilities | 66,653 |

| 48,608 |

Commitments and contingencies |

|

|

|

Stockholders’ equity: |

|

|

|

Series A preferred stock, par value $0.0001 per share, 10,000 shares authorized, issued and outstanding at September 30, 2024 and March 31, 2024 | — |

| — |

Preferred stock, par value $0.0001 per share, 10,000,000 shares authorized, no shares issued and outstanding at September 30, 2024 and March 31, 2024 | — |

| — |

Common stock, par value $0.0001 per share, 500,000,000 shares authorized, 146,565,049 shares issued and outstanding at September 30, 2024 and 500,000,000 shares authorized, 145,582,999 shares issued and outstanding at March 31, 2024 | 14 |

| 14 |

Additional paid-in capital | 1,469,082 |

| 1,441,518 |

Accumulated other comprehensive income | 1,910 |

| 1,908 |

Accumulated deficit | (1,021,952) |

| (825,683) |

Total stockholders’ equity | 449,054 |

| 617,757 |

Total liabilities and stockholders’ equity | $ 515,707 | | $ 666,365 |

|

|

|

|

Contact:

Renee Barnett, MBA

Chief Financial Officer

Immunovant, Inc.

info@immunovant.com

Immunovant Development Update November 7, 2024 Exhibit 99.2

Forward-looking statements 2 This presentation contains forward-looking statements for the purposes of the safe harbor provisions under The Private Securities Litigation Reform Act of 1995 and other federal securities laws. The use of words such as "can," “may,” “might,” “will,” “would,” “should,” “expect,” “believe,” “estimate,” “design,” “plan,” "intend," "anticipate," and other similar expressions are intended to identify forward-looking statements. Such forward looking statements include Immunovant’s expectations regarding patient enrollment, timing, design, and results of clinical trials of its product candidates and indication selections; Immunovant's plan to develop IMVT-1402 and batoclimab across a broad range of autoimmune indications; expectations with respect to these planned clinical trials including the number and timing of (a) trials Immunovant expects to initiate, (b) FDA clearance with respect to IND applications, and (c) potential pivotal or registrational programs and clinical trials of IMVT-1402; the size and growth of the potential markets for Immunovant's product candidates and indication selections, including any estimated market opportunities; Immunovant’s plan to explore in subsequent study periods follow-on treatment with alternative dosing regimens; Immunovant's beliefs regarding the potential benefits of IMVT- 1402's and batoclimab's unique product attributes and first-in-class or best-in-class potential, as applicable; Immunovant’s anticipated strategic reprioritization from batoclimab to IMVT-1402; and whether, if approved, IMVT-1402 or batcolimab will be successfully distributed, marketed or commercialized. All forward-looking statements are based on estimates and assumptions by Immunovant’s management that, although Immunovant believes to be reasonable, are inherently uncertain. All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that Immunovant expected. Such risks and uncertainties include, among others: initial results or other preliminary analyses or results of early clinical trials may not be predictive of final trial results or of the results of later clinical trials; results of animal studies may not be predictive of results in humans; the timing and availability of data from clinical trials; the timing of discussions with regulatory agencies, as well as regulatory submissions and potential approvals; the continued development of Immunovant’s product candidates, including the timing of the commencement of additional clinical trials; Immunovant’s scientific approach, clinical trial design, indication selection, and general development progress; future clinical trials may not confirm any safety, potency, or other product characteristics described or assumed in this presentation; any product candidate that Immunovant develops may not progress through clinical development or receive required regulatory approvals within expected timelines or at all; Immunovant’s product candidates may not be beneficial to patients, or even if approved by regulatory authorities, successfully commercialized; the effect of global factors such as geopolitical tensions and adverse macroeconomic conditions on Immunovant’s business operations and supply chains, including its clinical development plans and timelines; Immunovant’s business is heavily dependent on the successful development, regulatory approval and commercialization of batoclimab and IMVT-1402; Immunovant is in various stages of clinical development for IMVT-1402 and batoclimab; and Immunovant will require additional capital to fund its operations and advance IMVT-1402 and batoclimab through clinical development. These and other risks and uncertainties are more fully described in Immunovant’s periodic and other reports filed with the Securities and Exchange Commission (SEC), including in the section titled “Risk Factors” in Immunovant’s most recent Quarterly Report on Form 10-Q for the quarter ended September 30, 2024, filed with the SEC on November 7, 2024, and Immunovant’s subsequent filings with the SEC. Any forward-looking statement speaks only as of the date on which it was made. Immunovant undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. and IMMUNOVANT® are registered trademarks of Immunovant Sciences GmbH. All other trademarks, trade names, service marks, and copyrights appearing in this presentation are the property of their respective owners. Dates used in this presentation refer to the applicable calendar year unless otherwise noted.

• Significant progress on IMVT-1402 development plan • Graves' Disease, potential First-in-Class Opportunity, with impact on thyroidal and extrathyroidal disease • Difficult-to-Treat Rheumatoid Arthritis, potential Best-in-Class Opportunity • Conclusion Agenda 3 1 . 2 3 4

IMVT-1402 Development Progress 4

Favorable Analyte Profile Phase 1 data supports a favorable analyte profile with no or minimal effect on albumin and LDL 1. Not including any potential patent term extension 5 Our lead asset: IMVT-1402 has a combination of potentially best-in-class attributes not seen with other anti-FcRns Novel, fully human, monoclonal antibody inhibiting FcRn-mediated recycling of IgG + IMVT-1402 ++ + + + Convenient Administration Formulated for simple subcutaneous injection that may enable self-administration at home Compelling Patent Protection Issued U.S. patent covers composition of matter, method of use and methods for manufacturing to 20431 Deep IgG Lowering Phase 1 data suggests deep dose- dependent IgG lowering

Potential best-in-class product profile opens broad range of indication opportunities for IMVT-1402 6 Best-in-Class • Other underserved patient populations • Potential to enhance PTS via focus on subset of patients with autoantibodies of interest and leverage IMVT-1402 potency • Examples – ACPA+ Difficult-to-Treat Rheumatoid Arthritis Other auto- immune, class data suggestive First-in-Class • Assuming differentiated benefit/risk profile and simple SC delivery, opportunity to leverage potency of IMVT-1402 to further expand applicable patient types for anti-FcRn development • Example – Graves’ disease High unmet need, biologic plausibility Best-in-Class • IgG autoantibodies part of disease pathophysiology • Insights from later-stage anti-FcRn programs may be leveraged together with IMVT-1402 potency to optimize development approach for IMVT-1402 • Example – Myasthenia Gravis Classic autoAb, class data positive SC: subcutaneous; PTS: Probability of technical success

Significant progress in advancing lead asset IMVT-1402 to potentially pivotal study initiations across broad development portfolio 7 Five INDs cleared across a range of therapeutic areas and FDA divisions, including GD (Endocrinology) and RA (Rheumatology) On track to initiate an exciting portfolio of 10 indications by March 2026 Batoclimab experience informs ability to accelerate IMVT-1402 development+

Graves’ Disease First-in-class Potential 8

Lower is Better: Deeper IgG reductions drove meaningfully higher response rates, positioning IMVT-1402 to potentially be best-in-class Proof of concept achieved in Graves’ Disease, positioning IMVT-1402 to potentially be best-in-class and first-in-class >75% Response Rate in Patients Uncontrolled on Anti-Thyroid Drugs (ATDs): T3 and T4 rapidly normalized by Week 12 without an increase in ATDs in 76% of patients >50% of Patients are ATD-Free Responders: 56% of patients not only achieved normal T3 and T4 levels but also ceased ATD therapy entirely by 12 weeks High Unmet Need Yields Attractive Commercial Opportunity: 25-30% of Graves’ Disease patients per year are uncontrolled on / intolerant to ATDs with no pharmacologic options IMVT-1402 IND Cleared: Received FDA greenlight, enabling straight to pivotal transition 9

10 Graves’ Disease Phase 2 study design tests two doses of batoclimab 12 weeks of 680mg followed by 12 weeks of 340mg in Graves’ Disease patients uncontrolled on ATDs Treatment Period: 24 weeks N = 25 340mg batoclimab QW SC (Week 12-24) 680mg batoclimab QW SC (Week 0-12) Key Endpoint: Proportion of participants who: • Achieve normalization of T3 and T4 or have T3 / T4 below LLN, and • Do not increase in ATD Inclusiona • Subjects with active Graves’ Disease as documented by presence of elevated stimulatory TSH- R-Ab • Subjects hyperthyroid despite ATD ATD Treatment: Stable ATD dose at screening Goal to taper ATD during treatment period a: Additional inclusion and exclusion criteria not listed on slide ATD: Anti-thyroid medications; QW: Weekly; SC: Subcutaneous; LLN: Lower limit of normal

23% ATD-Free Responders 60% ATD-Free Responders Week 24 IgG Reduction < 70% (N = 3/13) Week 24 IgG Reduction ≥ 70% (N = 6/10) 11 Deeper IgG reduction at 24 weeks was associated with a meaningfully higher ATD-free responder rate Note: Excludes two patient discontinuations given no IgG data available for these patients at this time point. % of participants who achieve normal T3 and T4 or have T3 or T4 below LLN, and ceased all ATD medications Treatment Period: (24 weeks) N = 25 340mg batoclimab QW SC (Week 12-24) 680mg batoclimab QW SC (Week 0-12) ≥ 70% IgG Reduction < 70% IgG Reduction 12 weeks 680mg → 12 weeks 340mg12 weeks 680mg → 12 weeks 340mg

680mg QW 340mg QW 12 We observed meaningful improvements in proptosis and lid aperture in Graves’ Disease patients treated with batoclimab Note: Excludes one patient discontinuation at Week 12 (N=24) and two patient discontinuations at Week 24 (N=23) given no data available for these patients at these timepoints. Change from Baseline in Proptosis (N=25) Change from Baseline in Lid Aperture (N=25) -3 -2 -1 0 Baseline Week 12 Week 24 M ed ia n ch an ge fr om b as el in e, m m 1 680mg QW 340mg QW -4 -3 -2 -1 0 Baseline Week 12 Week 24 M ed ia n ch an ge fr om b as el in e, m m 1 Treatment Period: (24 weeks) N = 25 340mg batoclimab QW SC (Week 12-24) 680mg batoclimab QW SC (Week 0-12)

13 ATD-free responders reported more pronounced improvements to quality of life, with ~90% experiencing normal quality of life by Week 24 Notes: ThyPRO-39: Thyroid-Related Patient-Reported Outcome; 1) Includes N=14 patients who were not ATD-free responders at Week 24; 2) Patients represented if selected 0 or 1 = “No Impact at All” to Question: In the past 4 weeks, has your thyroid disease had a negative effect on your quality of life? Week 24 ATD-Free Responders (N=9) QoL Impact Scale: % of Responders with Normal QoL2 All Other Patients (On ATDs at Week 24) (N=14)1 QoL Impact Scale: % of Patients with Normal QoL2 44% 56% 89% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Baseline Week 12 Week 24 % o f P ar tic ip an ts w ith N o Im pa ct to Q oL (S co re 0 -1 )1 38% 33% 43% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Baseline Week 12 Week 24 % o f P ar tic ip an ts w ith N o Im pa ct to Q oL (S co re 0 -1 )1

14 Real-world in-depth chart review of 1,000+ patient records from 140 endocrinologists indicates ~25% have never achieved euthyroid status on ATDs *Excludes patients who have received definitive treatment; Sources: Patient Chart Audit analysis (n=988 on ATD, n=1120 total) by Immunovant Real World Chart Audit Methodology 1. As part of the endocrinologist survey, each healthcare provider was asked to complete N=8 Graves’ Disease patient charts for a total of 1,120 charts collected via randomized selection to minimize bias 2. Chart selection followed various qualifications: 1. Diagnosed with Graves’ Disease 2. Seen by the healthcare provider in the past 3 months 3. Under the healthcare provider’s care for at least 6 months 4. First visit in the past 3 years 5. Either on ATD therapy currently or previously 61%16% 23% Achieved euthyroid status Achieved euthyroid status with difficulty / titration / and/or relapse(s) Never achieved euthyroid status Characterization of Thyroid Control with ATD Therapy (n=998 Patient Charts*, % of patients)

15 First pivotal trial for IMVT-1402 in Graves’ Disease Treatment Period: 52 weeks N = 240 R an do m iz at io n (1 :1 :1 ) Primary Endpoint at Week 26: Proportion of participants who become euthyroidb and stop ATD Key Secondary Endpoint at Week 52: Proportion of participants who become euthyroidb and stop ATD Design enables study of remission as upside Inclusiona • Adults with active Graves’ Disease as documented by presence of TSH-R binding autoantibodies • Subjects on an ATD for ≥12 weeks before the Screening Visit • Subjects who are hyperthyroid based on suppressed TSH despite ATD a: Additional inclusion and exclusion criteria not listed on slide b: Euthyroid = T3/T4 and TSH within normal limits QW: Weekly; SC: Subcutaneous Group 1 Group 3 Group 2 ATD titration to lowest effective dose (including 0 mg/day) to maintain euthyroidism Period 2 (26 weeks blinded treatment) Period 1 (26 weeks blinded treatment) 600 mg IMVT-1402 QW SC 600 mg IMVT-1402 QW SC 600 mg IMVT-1402 QW SC Placebo QW SC Placebo QW SC Placebo QW SC 600 mg IMVT-1402 QW SC O ff- Tr ea tm en t F ol lo w -u p (5 2 w ee ks ) TRAb Responder? No Yes

16 IMVT-1402 is potentially best and first-in-class in Graves’ Disease High dose batoclimab rapidly achieved a 76% response rate in patients uncontrolled on ATDs, meaningfully exceeding 50% response rate bar01 High dose batoclimab rapidly achieved a 56% ATD-free response rate in patients uncontrolled on ATDs, meaningfully exceeding 30% ATD-free response rate bar 02 Strong correlation observed between degree of IgG lowering and clinical outcomes yields potential best-in-class and first-in-class opportunity for IMVT-1402 03 IMVT-1402 Graves’ Disease IND cleared, enabling straight to pivotal transition04 Real world claims data indicates 25-30% of Graves’ Disease patients per year are relapsed, uncontrolled on or intolerant to ATDs with no existing pharmacologic options representing an attractive commercial opportunity with limited competition 05

Difficult-to-Treat Rheumatoid Arthritis Best-in-Class Potential 17

KOL Discussion 18 Pete Salzmann, MD Chief Executive Officer, Immunovant Peter Taylor, MA, PhD, FRCP, FRCPE University of Oxford

Despite tremendous progress in the treatment of rheumatoid arthritis (RA), a subset of patients do not respond well to available therapies 191. Aletaha D, Smolen JS. JAMA. 2018;320(13):1360. DMARDs: disease-modifying antirheumatic drugs Key Takeaways1 • RA is a chronic, progressive disease that causes joint inflammation and pain • Most common systemic autoimmune disease, affecting 18M globally and 1.5M in the US • Medical therapy is used to help control joint inflammation; treatment options include a variety of conventional oral, targeted synthetic and biologic DMARDs • Inadequate disease control can result in irreversible joint erosions Significant Impact Source: Nakshabandi N al. et al. Radiology in Rheumatology, 2021.

Anti-FcRn mechanism may lower pathogenic IgG autoantibodies and immune complexes In addition to cellular autoimmunity and cytokine dysregulation, autoantibodies also play a role in the pathophysiology of RA Rheumatoid factor (RF) and ACPA autoantibodies are present in ~75% of RA patients1 1. Okada et al. Ann Rheum Dis 2019;78; 446-453 2. Image: Mueller A-L et al. Cells, 2021; 10(11), 3017 RF: rheumatoid factor, ACPA: anti-citrullinated protein autoantibodies 20

Understanding the pathophysiologic relevance of ACPA autoantibodies in rheumatoid arthritis Antigen presenting cells (APCs) process and present citrullinated peptides to T cells T cells activate B cells to generate autoantibodies Immune complex formation upregulates pro-inflammatory cytokines ACPA may bind to osteoclasts and thereby promote bone erosion Source: Brito Rocha et al. Advances in Rheumatology (2019) 59:2 ACPA: anti-citrullinated protein autoantibodies 21

What is difficult-to-treat RA and why is innovation needed? 221. Roodenrijs NMT et al. Ann Rheum Dis 2018;1705 -09, 2. Nagy G, et al. Ann Rheum Dis 2021; 80: 31-35 EULAR: European League Against Rheumatism Collaborative Initiative; DMARD: disease-modifying antirheumatic drug; QoL: Quality of Life Need for More Options • Estimated 5-20% of patients remain symptomatic despite multiple treatment rounds1 • These patients need new therapies and approaches, according to a global survey of 410 rheumatologists • Difficult-to-treat (D2T) RA defined by EULAR as:2 • Multiple DMARD failures • Signs suggestive of active/progressive disease • Symptom management viewed as problematic to doctor and/or patient • At least moderate disease activity as defined by composite endpoints which include tender and swollen joint counts • Progressive joint damage on imaging • Inability to decrease chronic glucocorticoid therapy below 7.5mg/day • Ongoing RA symptoms and QoL impact despite therapy D2T RA Criteria

Publicly available nipocalimab data in RA demonstrated proof of mechanism and showed that deeper ACPA IgG reduction correlated with clinical response1 23 Percent Changes from Baseline at Trough in ACPA IgG Levels versus (A) DAS-28 CRP Remission and (B) ACR50 Response at Week 12 1. Pharmacodynamic effects of nipocalimab in patients with moderate to severe active rheumatoid arthritis (RA): Results from the multicenter, randomized, double-blinded, placebo-controlled Phase 2A IRIS-RA study. Janssen Research & Development, ACR poster, November 2023. Proportions of Participants Who Achieved ACR50 Response at Week 12 by ACPA Select results from a study of FcRn inhibition vs placebo in biologic experienced RA patients

Of the 1.5M US RA patients1, a subset progresses to D2T status in a relatively short period of time and requires new therapeutic options 1. Aletaha D, Smolen JS. JAMA. 2018;320(13):1360. 2. GlobalData Analysis and Forecast, 2023. 3. Okada et al. Ann Rheum Dis 2019;78; 446-453. 4. Murray K et al. Arthritis Res Ther 2021; 23(1):25. 5. Rosenberg V et al. Adv Ther 2023; 40(10):4504-4522. 6. Paudel ML. Rheumatology (Oxford) 2024: 318 b/tsDMARD: biologic (b) or targeted synthetic (ts) disease-modifying antirheumatic drug 24 Epidemiology Patient Journey Learnings ~50% of patients fail their first b/tsDMARD therapy within the first year of treatment 4,5 Fewer than 50% of RA patients remain on first therapy In a large US registry, the median time to meeting D2T criteria was 4 years, in those who were D2T6 D2T emerges for some in ~4 years 5% – 20% of all RA patients meet the criteria for D2T in the US6 5% - 20% of RA patients are D2T Severe Disease: 490K2 Autoantibody Positive: 75%3 Inadequate Response to Prior b/tsDMARDs: 20%2 ~70K Target Addressable Population X X =

IMVT-1402 Path Forward in Difficult-to-Treat Rheumatoid Arthritis 25

Period 2: Blinded randomized withdrawal (12 wks) Period 1 : Open-label, active treatment lead-in (16 wks) Pivotal study design in rheumatoid arthritis Inclusion • CRP > upper limit of normal (ULN) • Active RA defined as ≥ 6/68 tender/painful joints (TJC), ≥ 6/66 swollen joints (SJC), and DAS28-CRP > 4.1 • Anti-citrullinated protein antibody positive (ACPA+) • Inadequate response to 2 or 3, but not more than 3, classes of b/tsDMARDs • On stable treatment with csDMARD Sc re en in g Pe rio d (u p to 5 w ks ) 600mg IMVT-1402 QW SC 600mg IMVT-1402 QW SC R an do m iz ed T re at m en t R es po nd er s* (1 :1 :1 ) 300mg IMVT-1402 QW SC Placebo QW SC Primary endpoint: For participants achieving ACR20 response at Weeks 14 and 16, proportion of participants who achieve ACR20 response at Week 28 Secondary endpoint: Change from baseline in CDAI and SDAI at Weeks 16 to Week 28Sa fe ty F ol lo w -u p Pe rio d (4 w ks ) *Meets ACR20 criteria at Week 14 & Week 16 Endpoints Global Trial with N=120 Participants 26

With pivotal program in RA, IMVT-1402 has the potential to achieve a best-in-class profile for people with difficult-to-treat RA 271. Paudel ML. Rheumatology (Oxford) 2024: 318. 2. Taylor PC et al. “Efficacy and Safety of Nipocalimab in Patients with Moderate to Severe Active Rheumatoid Arthritis (RA): The Multicenter, Randomized, Double-blinded, Placebo-controlled Phase 2a IRIS-RA Study Presented at ACR, Nov 10-15, 2023. ACPA: anticitrullinated protein autoantibodies High Unmet Need Subgroup 5-20% of RA patients are difficult-to-treat (D2T) (failed at least 3 therapies)1 Autoantibody Pathology ACPA positive RA is associated with severe disease and poor outcomes; publicly disclosed, in-class data from another FcRn inhibitor encouraging2 Enhanced Study Design Open label lead-in with randomized withdrawal attractive for D2T population that is enriched for higher baseline ACPA levels Lower is Better We believe deeper ACPA antibody reduction expected to correlate with improved clinical efficacy within the anti-FcRn class IMVT-1402 IND Active Received FDA IND clearance, enabling planned study initiation in early calendar year 2025

Two opportunities for lead asset IMVT-1402 to potentially transform the treatment paradigm for patients struggling to achieve success with existing therapies 28 01 02 03 04 Graves' Disease First-in-Class Potential Rheumatoid Arthritis Best-in-Class Potential Meaningful unmet need for subset of patients Underlying pathology driven by IgG Ab Patients not well controlled on ATDs In-class proof-of-concept data Patients with D2T RA, multiple therapies failed FcRn inhibition observed to lower TRAb FcRn inhibition observed to lower ACPA Higher response rate across multiple measures with ≥70% IgG reduction1 IMVT-1402 trial design 600mg dose for deep IgG reduction; Primary endpoint includes off-ATD 600mg dose for deep IgG reduction; Open-label lead-in Response rate higher for patients with high baseline ACPA & deep IgG reduction2 1. Data on file at Immunovant 2. Pharmacodynamic effects of nipocalimab in patients with moderate to severe active rheumatoid arthritis (RA): Results from the multicenter, randomized, double-blinded, placebo-controlled Phase 2A IRIS-RA study. Janssen Research & Development, ACR poster, November 2023.

Jul 2025 Multiple near-term milestones for enhanced value creation 29 Jan 2025 TED: Topline results for both trials expected in 2H 2025 MG: Topline Phase 3 results, and CIDP: Initial Phase 2b period 1 data expected by March 31, 20252 Apr 2026 1. Indications #1 through #5 will be potentially registrational programs, Indications #6 through #10 may be proof-of-concept or potentially registrational programs 2. Enrollment completed for MG. For CIDP, enrollment completed for patients included in the period 1 data expected by March 31, 2025. No further patients will be enrolled until after such period 1 data is disclosed. All Indications through #10: Expected to be initiated by March 31, 2026 Indication #1 (GD): Expect to initiate potentially registrational trial by December 31, 2024 Batoclimab IMVT-1402 Jul 2024 Indications #2 through #4 or #5 (including RA): Expected to be initiated by March 31, 2025 On track to initiate 4-5 potentially registrational programs for IMVT-1402 by March 31, 2025 and trials in a total of 10 indications by March 31, 20261

v3.24.3

Cover

|

Nov. 07, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 07, 2024

|

| Entity Registrant Name |

IMMUNOVANT, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-38906

|

| Entity Tax Identification Number |

83-2771572

|

| Entity Address, Address Line One |

320 West 37th Street

|

| Entity Address, City or Town |

New York,

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10018

|

| City Area Code |

917

|

| Local Phone Number |

580-3099

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value per share

|

| Trading Symbol |

IMVT

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001764013

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

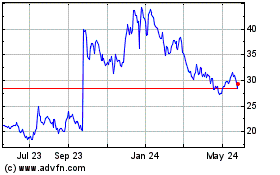

Immunovant (NASDAQ:IMVT)

Historical Stock Chart

From Oct 2024 to Nov 2024

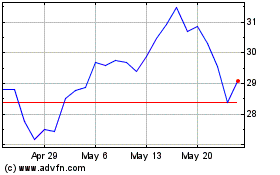

Immunovant (NASDAQ:IMVT)

Historical Stock Chart

From Nov 2023 to Nov 2024