As

filed Pursuant to Rule 424(b)(5)

Registration

No. 333-267236

PROSPECTUS

SUPPLEMENT

(To

Prospectus dated September 9, 2022)

Indaptus

Therapeutics, Inc.

1,817,017

Shares of Common Stock

We

are offering 1,817,017 shares of our common stock, par value $0.01 per share (“common stock”) in a registered direct offering

pursuant to this prospectus supplement and the accompanying prospectus and securities purchase agreements, dated November 22, 2024, by

and between the Company and certain accredited and institutional investors (the “Purchase Agreements”).

In

a concurrent private placement, we are also selling to such investors unregistered warrants to purchase up to an aggregate of 1,817,017

shares of our common stock (the “PIPE Warrants”). Each PIPE Warrant will be exercisable for one share of our common stock

(the “PIPE Warrant Shares”) at an exercise price of $1.05 per share and will have a term of five years from the date of issuance.

The PIPE Warrants and the PIPE Warrant Shares are not being registered under the Securities Act of 1933, as amended (the “Securities

Act”), and are being offered pursuant to the exemptions provided in Section 4(a)(2) under the Securities Act, and Rule 506(b) promulgated

thereunder, and are not being offered pursuant to this prospectus supplement and the accompanying prospectus.

We

are offering 1,817,017 shares of our common stock and accompanying PIPE Warrants in a concurrent private placement to investors at a

combined offering price of $1.175 per share.

One

of the investors in the offering is our chief executive officer, who is purchasing 42,553 shares of our common stock and PIPE Warrants

to purchase 42,553 shares of common stock in the concurrent private placement.

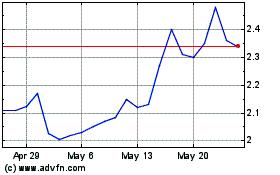

Our

common stock is listed on the Nasdaq Capital Market under the symbol “INDP.” On November 21, 2024, the last reported sale

price of the common stock on the Nasdaq Capital Market was $1.05 per share. There is no established public trading market for the PIPE

Warrants, and we do not expect a market to develop. In addition, we do not intend to list the PIPE Warrants on the Nasdaq Capital Market,

any other national securities exchange or any other nationally recognized trading system.

As

of the date of this prospectus supplement, the aggregate market value of our outstanding common stock held by non-affiliates is $16,532,202.57,

which was calculated based on 8,667,402 shares of outstanding common stock that were held by non-affiliates as of November 14, 2024 and

a price per share of $1.91, the closing price of our common stock on October 22, 2024. Pursuant to General Instruction I.B.6. of Form

S-3, in no event will we sell securities pursuant to the registration statement (of which this prospectus supplement forms a part) with

a value more than one-third of the aggregate market value of our common stock held by non-affiliates in any 12-month period, so long

as the aggregate market value of our common stock held by non-affiliates is less than $75.0 million. During the prior 12-calendar-month

period that ends on, and includes, the date of this prospectus, we have sold an aggregate of $3,375,558.70 of securities pursuant to

General Instruction I.B.6. of Form S-3. Accordingly, we are currently eligible under General Instruction I.B.6 of Form S-3 to offer and

sell shares of our common stock having an aggregate offering price of up to $2,135,145.49.

Investing

in the common stock involves risks. See “Risk Factors” beginning on page S-3 of this prospectus supplement and on page 2

of the accompanying prospectus.

We

have engaged Paulson Investment Company, LLC (the “Placement Agent”), as our exclusive placement agent in connection with

the registered direct offering. The Placement Agent is not purchasing the securities offered by us in the registered direct offering

and is not required to sell any specific number or dollar amount of securities, but will assist us in connection with such offering on

a reasonable best efforts basis.

| | |

Per

Share and

PIPE Warrant | | |

Total | |

| Offering price | |

$ | 1.175 | | |

$ | 2,134,995 | |

| Placement agent fees(1) | |

$ | 0.08225 | | |

$ | 145,950 | |

| Proceeds to us, before expenses (2) | |

$ | 1.09275 | | |

$ | 1,989,045 | |

| (1) |

We have also agreed to (i)

pay the Placement Agent a fee equal to 7% of the gross proceeds raised in the offering and (ii) issue to the Placement Agent, or its

designees, warrants to purchase a number of our common stock equal to 7% of the aggregate number of shares of common stock issued in

this offering, at an exercise price of $1.3125 per share (125% of the exercise price of the PIPE Warrants) and will expire

five years following the commencement of the sales pursuant to this offering (“Placement Agent Warrant”). However, there

will be no fees paid to the Placement Agent with respect to 42,553 shares sold to Mr. Meckler. See the section captioned “Plan

of Distribution” in this prospectus supplement for additional information. |

| (2) |

The amount of the offering

proceeds to us presented in this table does not give effect to the exercise, if any, of the PIPE Warrants being issued in the concurrent

private placement. |

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus supplement or accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Delivery

of the shares of common stock offered hereby is expected to take place on or about November 25, 2024, subject to satisfaction of customary

closing conditions.

Paulson

Investment Company, LLC

The

date of this prospectus supplement is November 22, 2024.

TABLE

OF CONTENTS

PROSPECTUS

SUPPLEMENT

PROSPECTUS

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

document is in two parts. The first part is the prospectus supplement, including the documents incorporated by reference, which describes

the specific terms of this offering. The second part, the accompanying prospectus, including the documents incorporated by reference,

provides more general information. Generally, when we refer to this prospectus, we are referring to both parts of this document combined.

Before you invest, you should carefully read this prospectus supplement, the accompanying prospectus, all information incorporated by

reference herein and therein, as well as the additional information described under “Where You Can Find More Information; Incorporation

by Reference” on page S-13 of this prospectus supplement. These documents contain information you should consider when making your

investment decision. This prospectus supplement may add, update or change information contained in the accompanying prospectus. To the

extent that any statement that we make in this prospectus supplement is inconsistent with statements made in the accompanying prospectus

or any documents incorporated by reference, the statements made in this prospectus supplement will be deemed to modify or supersede those

made in the accompanying prospectus and such documents incorporated by reference.

You

should rely only on the information contained or incorporated by reference in this prospectus supplement, the accompanying prospectus

and in any free writing prospectuses we may provide to you in connection with this offering. Neither we nor the Placement Agent have

authorized any other person to provide you with any information that is different. If anyone provides you with different or inconsistent

information, you should not rely on it. We are offering to sell, and seeking offers to buy, the securities offered hereby only in jurisdictions

where offers and sales are permitted. The distribution of this prospectus supplement and the offering of the securities offered hereby

in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession of this prospectus supplement

must inform themselves about, and observe any restrictions relating to, the offering of the securities offered hereby and the distribution

of this prospectus supplement outside the United States. This prospectus supplement does not constitute, and may not be used in connection

with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus supplement by any person in any

jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

Unless

otherwise indicated, information contained in this prospectus supplement, the accompanying prospectus or the documents incorporated by

reference, concerning our industry and the markets in which we operate, including our general expectations and market position, market

opportunity and market share, is based on information from our own management estimates and research, as well as from industry and general

publications and research, surveys and studies conducted by third parties. Management estimates are derived from publicly available information,

our knowledge of our industry and assumptions based on such information and knowledge, which we believe to be reasonable. In addition,

assumptions and estimates of our and our industry’s future performance are necessarily subject to a high degree of uncertainty

and risk due to a variety of factors, including those described in “Risk Factors” in this prospectus supplement, the accompanying

prospectus and in our Annual Report on Form 10-K for the year ended December 31, 2023 and Quarterly Report on Form 10-Q for the quarter

ended September 30, 2024, which are incorporated by reference into this prospectus supplement. These and other important factors could

cause our future performance to differ materially from our assumptions and estimates. See “Special Note Regarding Forward-Looking

Statements.”

When

we refer to “Indaptus,” “we,” “our,” “us” and the “Company” in this prospectus

supplement, we mean Indaptus Therapeutics, Inc. and its consolidated subsidiaries, unless otherwise specified.

This

prospectus supplement also includes trademarks, tradenames and service marks that are the property of other organizations. Solely for

convenience, trademarks and tradenames referred to in this prospectus supplement appear without the ® and ™ symbols, but those

references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights

or that the applicable owner will not assert its rights, to these trademarks and tradenames.

PROSPECTUS

SUPPLEMENT SUMMARY

This

summary highlights selected information about us, this offering and information appearing elsewhere in this prospectus supplement, in

the accompanying prospectus and in the documents we incorporate by reference. This summary is not complete and does not contain all of

the information you should consider before investing in our securities. Before making an investment decision, to fully understand this

offering and its consequences to you, you should carefully read this entire prospectus supplement and the accompanying prospectus, including

“Risk Factors” beginning on page S-3 of this prospectus supplement and the financial statements and related notes and the

other information that we incorporate by reference into this prospectus supplement.

Our

Company

We

are a clinical biotechnology company developing a novel and patented systemically-administered anti-cancer and anti-viral immunotherapy.

We have evolved from more than a century of immunotherapy advances. Our approach is based on the hypothesis that efficient activation

of both innate and adaptive immune cells and associated anti-tumor and anti-viral immune responses will require a multi-targeted package

of immune system activating signals that can be administered safely intravenously. Our patented technology is composed of single strains

of attenuated and killed, non-pathogenic, Gram-negative bacteria, designed to have reduced i.v. toxicity, but largely uncompromised ability

to prime or activate many of the cellular components of innate and adaptive immunity. This approach has led to broad anti-tumor and anti-viral

activity in preclinical models, including durable anti-tumor response synergy observed with each of four different classes of existing

agents, including NSAIDs, checkpoint therapy, targeted antibody therapy and low-dose chemotherapy. Tumor eradication by our technology

was associated with induction of both innate and adaptive immunological memory and, importantly, did not require provision of or targeting

a tumor antigen in preclinical models. We have carried out successful current Good Manufacturing Practice (cGMP) manufacturing of our

lead clinical candidate, Decoy20.

Corporate

Information

Our

principal executive offices are located at 3 Columbus Circle, 15th Floor, New York, NY 10019 and our telephone number is (646) 427-2727.

Our website address is http://www.indaptusrx.com. The information contained on, or that can be accessed through, our website is neither

a part of nor incorporated into this prospectus. We have included our website address in this prospectus solely as an inactive textual

reference.

THE

OFFERING

| Common stock

offered by us |

|

1,817,017 shares. |

| |

|

|

| Common stock to be outstanding

immediately after this offering |

|

12,013,901

shares (assuming no exercise of the PIPE Warrants to be issued in the concurrent private placement).

|

| |

|

|

| Concurrent private placement of PIPE Warrants |

|

In a concurrent private placement,

we are selling to the institutional and accredited investors PIPE Warrants to purchase up to an aggregate of 1,817,017 shares of our

common stock. Each PIPE Warrant will be exercisable for one share of our common stock at an exercise price of $1.05 per share and will

have a term of five years from the date of issuance. The PIPE Warrants and PIPE Warrant Shares are being offered pursuant to the exemptions

provided in Section 4(a)(2) under the Securities Act, and Rule 506(b) promulgated thereunder, and they are not being offered pursuant

to this prospectus supplement and the accompanying prospectus. Please see “Concurrent Private Placement of PIPE Warrants”

on page S-9. |

| |

|

|

| Use of proceeds |

|

We estimate the net proceeds from this offering

will be approximately $1.8 million, after deducting placement agent fees and estimated offering expenses payable by us. |

| |

|

|

| |

|

We intend to use the net proceeds of this

offering to fund our research and development activities and for working capital and general corporate purposes. Please see “Use

of Proceeds” on page S-6. |

| |

|

|

| Risk factors |

|

See “Risk Factors” beginning on

page S-3 of this prospectus supplement and in the documents incorporated by reference into this prospectus supplement for a discussion

of factors that you should read and consider before investing in our securities. |

| |

|

|

| Listing |

|

Our common stock is listed on The Nasdaq Capital

Market under the symbol “INDP.” |

| |

|

|

| Transfer agent |

|

VStock Transfer, LLC |

The

number of shares of our common stock to be outstanding immediately after this offering is based on 10,196,884 shares of our common stock

outstanding as of September 30, 2024 and excludes:

| |

● |

2,487,822 shares of common

stock issuable upon exercise of outstanding options under our Indaptus 2021 Stock Incentive Plan, or the 2021 Plan, at a weighted exercise

price of $9.20; |

| |

|

|

| |

● |

503,608 shares of common

stock reserved for potential future issuance pursuant to the 2021 Plan; |

| |

|

|

| |

● |

4,734,624 shares of common

stock issuable upon the exercise of outstanding warrants at a weighted average exercise price of $8.75 per share; |

| |

|

|

| |

● |

3,781,330 shares of common

stock reserved for issuance pursuant to a committed equity facility with Lincoln Park Capital Fund, LLC, or the Committed Equity Facility;

and |

| |

|

|

| |

● |

124,212 shares of common

stock issuable upon the exercise of warrants issued to the designees of the Placement Agent as compensation in connection with this

offering, at an exercise price of $1.3125 per share. |

Unless

otherwise indicated, this prospectus supplement reflects and assumes:

| |

● |

no exercise of the outstanding

options described above; and |

| |

|

|

| |

● |

no exercise of the outstanding

warrants described above. |

RISK

FACTORS

Investing

in our securities involves a high degree of risk. Before investing in our securities, you should consider carefully the risks described

below, together with the other information contained in this prospectus supplement, the accompanying prospectus or incorporated by reference

herein or therein, including the risks and uncertainties discussed under “Risk Factors” in our Annual Report on Form 10-K

for the year ended December 31, 2023 and Quarterly Report on Form 10-Q for the quarter ended September 30, 2024, which are incorporated

by reference into this prospectus supplement. If any of the risks incorporated by reference or set forth below occur, our business, financial

condition, results of operations and future growth prospects could be materially and adversely affected. In these circumstances, the

market price of our securities could decline, and you may lose all or part of your investment.

Risks

Related to this Offering

Purchasers

of common stock and accompanying PIPE Warrants in this offering will experience immediate and substantial dilution in the book value

of their investment. You may experience further dilution upon exercise of options and warrants.

The

offering price per share of common stock and accompanying PIPE Warrants in this offering is substantially higher than the net tangible

book value per share of our common stock before giving effect to this offering. Accordingly, if you purchase common stock and accompanying

PIPE Warrants in this offering, you will incur immediate substantial dilution of approximately $0.5262 per share, representing the difference

between the offering price per share of common stock and accompanying PIPE Warrants and our as adjusted net tangible book value as of

September 30, 2024. For a further description of the dilution that you will experience immediately after this offering, see the section

in this prospectus supplement entitled “Dilution.”

Future

sales and issuances of our common stock or rights to purchase common stock, including pursuant to our equity incentive plans, could result

in additional dilution of the percentage ownership of our stockholders and could cause our stock price to fall.

Additional

capital will be needed in the future to continue our planned operations. To the extent we issue additional equity securities to raise

capital or pursuant to our equity incentive plans or other contractual obligations, our stockholders may experience substantial dilution.

We may sell common stock, convertible securities or other equity securities in one or more transactions at prices and in a manner we

determine from time to time. If we sell or issue common stock, convertible securities or other equity securities in more than one transaction,

investors may be materially diluted by subsequent sales. These sales may also result in material dilution to our existing stockholders,

and new investors could gain rights superior to our existing stockholders.

In

addition, sales of a substantial number of shares of our outstanding common stock in the public market could occur at any time. These

sales, or the perception in the market that the holders of a large number of shares of common stock intend to sell shares, could reduce

the market price of our common stock. Significant portions of these shares are held by a relatively small number of stockholders. Sales

by our stockholders of a substantial number of shares, or the expectation that such sales may occur, could significantly reduce the market

price of our common stock.

We

have broad discretion to determine how to use the funds raised in this offering, and may use them in ways that may not enhance our operating

results or the price of our common stock.

Our

management will have broad discretion over the use of proceeds from this offering, and we could spend the proceeds from this offering

in ways our stockholders may not agree with or that do not yield a favorable return, if at all. We intend to use the net proceeds to

fund our research and development activities and for working capital and general corporate purposes. However, our use of these proceeds

may differ substantially from our current plans. If we do not invest or apply the proceeds of this offering in ways that improve our

operating results, we may fail to achieve expected financial results, which could cause our stock price to decline.

We

have identified conditions and events that raise substantial doubt regarding our ability to continue as a going concern.

We

have incurred net losses and utilized cash in operations since inception. In addition, as of September 30, 2024, we had approximately

$7.4 million in cash and cash equivalents, and during the nine months ended September 30, 2024, we used approximately $8.9 million of

cash in operations and expect to continue to incur significant cash outflows and incur future additional losses to execute our operating

plan. While we intend to finance our cash needs principally through collaborations, strategic alliances, or license agreements with third

parties and/or debt or equity financings, we cannot provide any assurance that new financing will be available to us on commercially

acceptable terms or in the amounts required, if at all. Due to the uncertainty in securing additional funding, and the insufficient amount

of cash and cash equivalents as of September 30, 2024, we have concluded that substantial doubt exists about our ability to continue

as a going concern within one year after the date of the filing of our Quarterly Report on Form 10-Q for the quarter ended September

30, 2024, which was November 11, 2024. While the closing of this offering will improve our cash position, the net proceeds from this

transaction may not be sufficient to overcome the previously disclosed substantial doubt regarding our ability to continue as a going

concern. If we are unsuccessful in securing sufficient financing, we may need to delay, reduce, or eliminate our research and development

programs, which could adversely affect our business prospects, or cease operations.

Our

future operations are dependent upon the successful entry into collaborations, strategic alliances, or license agreements with third

parties and/or on the identification and successful completion of equity or debt financing and the achievement of profitable operations

at an indeterminate time in the future. There can be no assurances that we will be successful in completing these collaborations or alliances,

equity or debt financing or in achieving profitability. As such, there can be no assurance that we will be able to continue as a going

concern.

Substantial

doubt about our ability to continue as a going concern may materially and adversely affect the price per share of our common stock, and

it may be more difficult for us to obtain financing. If potential collaborators decline to do business with us or potential investors

decline to participate in any future financings due to such concerns, our ability to increase our cash position may be limited. The perception

that we may not be able to continue as a going concern may cause others to choose not to deal with us due to concerns about our ability

to meet our contractual obligations. If we are unable to continue as a going concern, you could lose all or part of your investment in

our company.

A

substantial number of shares of our common stock will be sold in this offering, which could cause the price of our common stock to decline.

In

this offering, we will sell 1,817,017 shares of our common stock, which represented approximately 15% of our outstanding shares of common

stock as of September 30, 2024 after giving effect to this offering. In addition, in a concurrent private placement, we are selling PIPE

Warrants to purchase up to 1,817,017 shares of common stock at an exercise price of $1.05 per share. This sale could adversely affect

the price of our common stock on The Nasdaq Capital Market. We cannot predict the effect, if any, that market sales of the shares of

common stock issued in this offering or issued upon exercise of the warrants issued in this offering will have on the market price of

our common stock. In addition, a decline in the price of our common stock might impede our ability to raise capital through the issuance

of additional shares of our common stock or other equity securities, and may cause you to lose part or all of your investment in our

common stock.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

The

information in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein

and any free writing prospectus that we have authorized for use in connection with this offering contain forward-looking statements and

information within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended,

or the Exchange Act, which are subject to the “safe harbor” created by those sections. These forward-looking statements include,

but are not limited to, statements regarding our product candidates’ development, including the timing and design of the Phase

1 clinical trial of Decoy20; our expectations regarding the recommended Phase 2 dose for subsequent multi-dosing and combination studies

and related timing; our expectations and plans regarding our clinical supply agreement with BeiGene and our plans to advance clinical

evaluation of the combination of BeiGene’s anti-PD-1 antibody, tislelizumab, with Decoy20; our plans to seek FDA approval and to

initiate a combination trial, and the timing thereof; the anticipated effects of our product candidates; our plans to develop and commercialize

our product candidates; the market potential and treatment potential of our product candidates, including Decoy20; our commercialization,

marketing and manufacturing capabilities and strategy; our expectations about the willingness of healthcare professionals to use our

product candidates; our general business strategy and the plans and objectives of management for future operations; our research and

development activities and costs; our future results of operations and condition; the sufficiency of our cash and cash equivalents to

fund our ongoing activities and our ability to continue as a going concern; and the impact of current macroeconomic conditions on our

operations, ability to access capital, and liquidity. The words “anticipates”, “believes”, “estimates”,

“expects”, “intends”, “targets”, “may”, “plans”, “projects”,

“potential”, “will”, “would”, “could” and similar expressions are intended to identify

forward-looking statements, although not all forward-looking statements contain these identifying words. All such forward-looking statements

involve significant risks and uncertainties, including, but not limited to, statements regarding:

| |

● |

our plans to develop and

potentially commercialize our technology; |

| |

|

|

| |

● |

the timing and cost of our

planned investigational new drug application and any clinical trials; |

| |

|

|

| |

● |

the completion and receipt

of favorable results in any clinical trials; |

| |

|

|

| |

● |

our ability to obtain and

maintain regulatory approval of any product candidate; |

| |

|

|

| |

● |

our ability to protect and

maintain our intellectual property and licensing arrangements; |

| |

|

|

| |

● |

our ability to develop, manufacture

and commercialize our product candidates; |

| |

|

|

| |

● |

the risk of product liability

claims, the availability of reimbursement, the influence of extensive and costly government regulation; |

| |

|

|

| |

● |

our estimates regarding future

revenue, expenses capital requirements and the need for additional financing; |

| |

|

|

| |

● |

our ability to continue as

a going concern; and |

| |

|

|

| |

● |

our intended use of proceeds

from this offering. |

As

more fully described under the heading “Risk Factors” and elsewhere in this prospectus supplement and under “Risk Factors”

in our Annual Report on Form 10-K for the year ended December 31, 2023 and Quarterly Report on Form 10-Q for the quarter ended September

30, 2024, which are incorporated by reference into this prospectus supplement, many important factors affect our ability to achieve our

stated objectives and to develop and commercialize any product candidates. We may not actually achieve the plans, intentions or expectations

disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. These forward-looking

statements involve risks and uncertainties that could cause our actual results to differ materially from those in the forward-looking

statements, including, without limitation, the risks and uncertainties set forth in our filings with the SEC. You should read this prospectus

supplement, the accompanying prospectus and the documents incorporated by reference herein and therein and any free writing prospectuses

that we have authorized for use in this offering with the understanding that our actual results or events could differ materially from

the plans, intentions and expectations disclosed in the forward-looking statements that we make. The forward-looking statements are applicable

only as of the date on which they are made, and we do not assume any obligation to update any forward-looking statements, whether as

a result of new information, future events or otherwise, except as required by law.

USE

OF PROCEEDS

We

estimate that the net proceeds from this offering and the concurrent private placement, after deducting placement agent fees and estimated

offering expenses payable by us, will be approximately $1.8 million. This estimate excludes the proceeds, if any, from the PIPE Warrants

sold in the concurrent private placement. We cannot predict when or if any such warrants will be exercised. It is possible that the warrants

may expire and may never be exercised.

We

intend to use the net proceeds of this offering to fund our research and development activities and for working capital and general corporate

purposes.

Based

on the planned use of proceeds, we believe that the net proceeds from this offering and the concurrent private placement and our existing

cash and cash equivalents will be sufficient to enable us to fund our operating expenses and capital expenditure requirements into the

second quarter of 2025. We have based this estimate on assumptions that may prove to be incorrect, and we could utilize our available

capital resources sooner than we currently expect. The amounts and timing of our actual expenditures will depend on numerous factors,

including the factors described under “Risk Factors” in this prospectus supplement, the accompanying prospectus and the documents

incorporated by reference herein and therein, as well as the amount of cash used in our operations. We may find it necessary or advisable

to use the net proceeds for other purposes, and we will have broad discretion in the application of the net proceeds. While the closing

of this offering will improve our cash position, the net proceeds from this transaction may not be sufficient to overcome the previously

disclosed substantial doubt regarding our ability to continue as a going concern.

Pending

the uses described above, we plan to invest the net proceeds from this offering in short-term, interest-bearing securities, investment

grade securities, certificates of deposit or direct or guaranteed obligations of the U.S. government. In addition, while we have not

entered into any agreements, commitments or understandings relating to any significant transaction as of the date of this prospectus

supplement, we may use a portion of the net proceeds to pursue acquisitions, joint ventures and other strategic transactions.

DIVIDEND

POLICY

We

have never declared or paid cash dividends on our capital stock. We currently intend to retain our future earnings, if any, for use in

our business and therefore do not anticipate paying cash dividends in the foreseeable future. Payment of future dividends, if any, will

be at the discretion of our board of directors after taking into account various factors, including our financial condition, operating

results, current and anticipated cash needs and plans for expansion.

DILUTION

If

you invest in this offering, your ownership interest will be immediately diluted to the extent of the difference between the offering

price per share of common stock and accompanying PIPE Warrant and the as adjusted net tangible book value per share of our common stock

after this offering.

As

of September 30, 2024, we had a net tangible book value of approximately $6.0 million, or $0.5890 per share of common stock. Our net

tangible book value per share represents total tangible assets less total liabilities, divided by the number of shares of common stock

outstanding at September 30, 2024.

After

giving effect to the issuance and sale by us of 1,817,017 shares of common stock and PIPE Warrants to purchase 1,817,017 shares of common

stock at an offering price of $1.1750 per share and accompanying PIPE Warrant in this offering and after deducting placement agent fees

and estimated offering expenses payable by us, and assuming no exercise of the PIPE Warrants, our as adjusted net tangible book value

as of September 30, 2024 would have been approximately $7.8 million, or approximately $0.6488 per share. This amount represents an immediate

increase in net tangible book value of $0.0598 per share to our existing stockholders and an immediate dilution in as adjusted net tangible

book value of approximately $0.5262 per share to new investors purchasing securities in this offering.

Dilution

per share to new investors is determined by subtracting as adjusted net tangible book value per share after this offering from the offering

price per share of common stock and accompanying PIPE Warrant paid by new investors. The following table illustrates this dilution on

a per share basis:

| Offering price per share of common

stock and accompanying PIPE Warrant | |

| | | |

$ | 1.1750 | |

| Net tangible book value

per share as of September 30, 2024 | |

$ | 0.5890 | | |

| | |

| Increase

in net tangible book value per share attributable to this offering | |

| 0.0598 | | |

| | |

| As adjusted net tangible

book value per share after this offering | |

| | | |

| 0.6488 | |

| Dilution per share to

new investors participating in this offering | |

| | | |

$ | 0.5262 | |

The

above discussion and table are based on 10,196,884 shares of our common stock outstanding as of September 30, 2024 and excludes:

| |

● |

2,487,822 shares of common

stock issuable upon exercise of outstanding options under the 2021 Plan at a weighted exercise price of $9.20; |

| |

|

|

| |

● |

503,608 shares of common

stock reserved for potential future issuance pursuant to the 2021 Plan; |

| |

|

|

| |

● |

4,734,624 shares of common

stock issuable upon the exercise of warrants outstanding at a weighted average exercise price of $8.75 per share; |

| |

|

|

| |

● |

3,781,330 shares of common

stock reserved for issuance pursuant to the Committed Equity Facility; and |

| |

|

|

| |

● |

124,212 shares of common

stock issuable upon the exercise of warrants issued to the designees of the Placement Agent as compensation in connection with this

offering, at an exercise price of $1.3125 per share. |

To

the extent any of these outstanding options or warrants are exercised at a price less than the offering price, there may be further dilution

to purchasers of our securities in this offering.

CONCURRENT

PRIVATE PLACEMENT OF PIPE WARRANTS

In

the concurrent private placement, we will issue to the investors in this offering, PIPE Warrants to purchase up to an aggregate of 1,817,017

shares of common stock at an exercise price equal to $1.05 per share (subject to standard adjustments for stock splits, stock dividend,

rights offerings and pro rata distributions). The PIPE Warrant is being sold together with the shares of common stock being sold in this

offering, and we will receive additional proceeds from the PIPE Warrant to the extent such PIPE Warrant is exercised for cash.

The

PIPE Warrant and the PIPE Warrant Shares issuable upon the exercise of such PIPE Warrant are not being registered under the Securities

Act, are not being offered pursuant to this prospectus supplement and the accompanying prospectus and are being offered pursuant to the

exemption provided in Section 4(a)(2) under the Securities Act and/or Rule 506(b) promulgated thereunder. Accordingly, the purchaser

may only sell common stock issued upon exercise of the PIPE Warrant pursuant to an effective registration statement under the Securities

Act covering the resale of those shares, an exemption under Rule 144 under the Securities Act or another applicable exemption under the

Securities Act.

We

have agreed to file a registration statement within sixty days of the date of the Purchase Agreement to register the PIPE Warrant Shares

for resale. We have also agreed to use commercially reasonable efforts to cause such registration statement to become effective within

ninety days following the closing date of this offering and to use commercially reasonable efforts to keep such registration statement

effective at all times until the earlier of (i) the date that no purchaser owns any PIPE Warrants or PIPE Warrant Shares issuable

upon exercise thereof and (ii) the two year anniversary of the closing date.

The

summary below is not complete and is subject to, and qualified in its entirety by, the provisions of Purchase Agreement and the PIPE

Warrants, which will be filed with the SEC as an exhibit to a Current Report on Form 8-K in connection with the concurrent private placement

and incorporated by reference into the registration statement of which this prospectus supplement and the accompanying prospectus form

a part. Prospective investors should carefully review the terms and provisions of the form of PIPE Warrant for a complete description

of the terms and conditions of the PIPE Warrant.

Duration

and Exercise Price

The

PIPE Warrant has an exercise price of $1.05 per share and will be immediately exercisable upon issuance. The PIPE Warrant will expire

five years following the issuance of the PIPE Warrant. The PIPE Warrant contains standard adjustments to the exercise price including

for stock splits, stock dividend, rights offerings and pro rata distributions.

Exercisability

The

PIPE Warrant will be immediately exercisable, at the option of each holder and until the expiration date, in whole or in part, by delivering

to us a duly executed exercise notice accompanied by payment in full for the number of purchased upon such exercise (except in the case

of a cashless exercise as discussed below).

Exercise

Limitation

A

holder (together with its affiliates) may not exercise any portion of the PIPE Warrant to the extent that the holder would beneficially

own more than 4.99% or 9.99%, depending on the individual investor, of the outstanding common stock immediately after exercise (the “Beneficial

Ownership Limitation”), except that upon at least 61 days’ prior notice from the holder to us, the holder may increase the

Beneficial Ownership Limitation, provided that the Beneficial Ownership Limitation in no event exceeds 19.99%. No fractional shares of

common stock will be issued in connection with the exercise of a PIPE Warrant. In lieu of fractional shares, we will pay the holder either

an amount in cash equal to the fractional amount multiplied by the exercise price or round such fractional share to a whole share.

Cashless

Exercise

In

lieu of making the cash payment otherwise contemplated to be made to us upon such exercise in payment of the aggregate exercise price,

the holder may, in the event the shares underlying the PIPE Warrant, or the PIPE Warrant Shares, are not registered under the Securities

Act, elect instead to receive upon such exercise (either in whole or in part) the net number of shares of common stock determined according

to a formula set forth in the PIPE Warrant.

Transferability

Subject

to applicable laws, a PIPE Warrant may be transferred at the option of the holder upon surrender of the PIPE Warrant to us together with

the appropriate instruments of transfer.

Exchange

Listing

We

do not intend to list the PIPE Warrants on any securities exchange or nationally recognized trading system.

Rights

as a Stockholder

Except

as otherwise provided in the PIPE Warrant or by virtue of such holder’s ownership of common stock, the holders of the PIPE Warrant

do not have the rights or privileges of holders of our common stock, including any voting rights, until they exercise the PIPE Warrant.

PLAN

OF DISTRIBUTION

Subject

to the terms and conditions of a placement agency agreement, Paulson Investment Company, LLC, which we refer to as the placement agent,

has agreed to act as our exclusive placement agent in connection with this offering of our securities pursuant to this prospectus supplement

and the accompanying prospectus. The placement agent is not purchasing or selling any securities offered by this prospectus supplement

and the accompanying prospectus. We have entered into purchase agreements directly with investors in connection with this offering and

we will only sell securities offered hereby to investors which have entered into purchase agreements. The public offering price of the

securities was determined based upon arm’s-length negotiations between the purchasers and us.

Commissions

and Expenses

We

have agreed to pay the placement agent an aggregate cash placement fee equal to seven percent (7.0%) of the gross proceeds in

this offering. There will be no fees paid to the Placement Agent with respect to 42,553 shares sold to our Chief Executive Officer.

The

following table provides information regarding the amount of the placement agent fees to be paid to the placement agent by us, before

expenses assuming the purchase of all of the securities offered hereby:

| | |

Per

share and

PIPE Warrant | | |

Total | |

| Offering price | |

$ | 1.175 | | |

$ | 2,134,995 | |

| Placement Agent fees | |

$ | 0.08225 | | |

$ | 145,950 | |

Because

there is no minimum offering amount required as a condition to closing in this offering, the actual total offering commissions, if any,

are not presently determinable and may be substantially less than the maximum amount set forth above. We have also agreed to pay the

placement agent a non-accountable sum of $25,000 in connection with this offering.

Our

obligation to issue and sell securities to the purchasers is subject to the conditions set forth in the purchase agreements, which may

be waived by us at our discretion. A purchaser’s obligation to purchase securities is subject to the conditions set forth in such

purchaser’s purchase agreement, which may also be waived at such purchaser’s discretion.

We

currently anticipate that the sale of the securities will be completed on or about November 25, 2024. We estimate the total offering

expenses of this offering that will be payable by us, excluding the placement agent’s fees, will be approximately $200,000, which

includes legal and printing costs, various other fees and reimbursement of the placements agent’s expenses.

Placement

Agent Warrants

In

addition, we have agreed to issue to the Placement Agent, or its designees, at the closing of this offering, warrants to purchase 7.0%

of the number of shares of our common stock sold in this offering (or warrants to purchase up to 124,212 shares of our common stock).

Such warrants will have substantially the same terms as the PIPE Warrants being sold and issued in the private placement, except that

the Placement Agent’s warrants will be exercisable six months from the issue date, have a term of five years from the issue date

of the common stock warrants sold to the investors in the offering and will have an exercise price equal to 125% of the offering price

per share sold to investors in the offering (or $1.3125 per share). Neither the Placement Agent’s warrants nor the shares of our

common stock issuable upon exercise thereof are being registered hereby.

Indemnification

We

have agreed to indemnify the placement agent against certain liabilities, including liabilities under the Securities Act of 1933, as

amended, or the Securities Act, and the Exchange Act. We have also agreed to contribute to payments the placement agent may be required

to make in respect of such liabilities.

The

placement agent may be deemed to be an underwriter within the meaning of Section 2(a)(11) of the Securities Act, and any commissions

received by it and any profit realized on the sale of our securities offered hereby by it while acting as principal might be deemed to

be underwriting discounts or commissions under the Securities Act. As an underwriter, the placement agent would be required to comply

with the requirements of the Securities Act and the Exchange Act, including, without limitation, Rule 10b-5 and Regulation M under the

Exchange Act. These rules and regulations may limit the timing of purchases and sales of our securities by the placement agent acting

as principal. Under these rules and regulations, the placement agent may not (i) engage in any stabilization activity in connection with

our securities or (ii) bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities, other

than as permitted under the Exchange Act, until it has completed its participation in the distribution.

The

foregoing does not purport to be a complete statement of the terms and conditions of the placement agent agreement and purchase agreements.

A copy of the placement agent agreement and the form of purchase agreement with the investors will be included as exhibits to our Current

Report on Form 8-K that will be filed with the SEC and incorporated by reference into the Registration Statement of which this prospectus

supplement forms a part. See “Where You Can Find More Information.”

Other

From

time to time, the placement agent and its affiliates have provided, or may in the future provide, various investment banking, financial

advisory and other services to us and our affiliates for which services they have received, or may in the future receive, customary fees.

There are no present arrangements for such future services. In the course of their businesses, the placement agent and its affiliates

may actively trade our securities or loans for their own account or for the accounts of customers, and, accordingly, the placement agent

and its affiliates may at any time hold long or short positions in such securities or loans.

Our

common stock is listed on The Nasdaq Capital Market under the symbol “INDP”. We do not plan to list the Common Warrants on

The Nasdaq Capital Market or any other securities exchange or trading market.

LEGAL

MATTERS

The

validity of the securities offered hereby will be passed upon for us by Latham & Watkins LLP.

EXPERTS

Our

consolidated financial statements as of December 31, 2023 and 2022, and for each of the years then ended, have been incorporated by reference

herein in reliance upon the report of Haskell & White LLP, independent registered public accounting firm, and upon the authority

of said firm as experts in accounting and auditing.

WHERE

YOU CAN FIND MORE INFORMATION; INCORPORATION BY REFERENCE

Available

Information

We

file reports, proxy statements and other information with the SEC. The SEC maintains a web site that contains reports, proxy and information

statements and other information about issuers, such as us, who file electronically with the SEC. The address of that website is www.sec.gov.

Our

web site address is www.indaptusrx.com. The information on our web site, however, is not, and should not be deemed to be, a part of this

prospectus supplement.

This

prospectus supplement and the accompanying prospectus are part of a registration statement that we filed with the SEC and do not contain

all of the information in the registration statement. The full registration statement may be obtained from the SEC or us, as provided

below. Other documents establishing the terms of the offered securities are or may be filed as exhibits to the registration statement.

Statements in this prospectus supplement about these documents are summaries and each statement is qualified in all respects by reference

to the document to which it refers. You should refer to the actual documents for a more complete description of the relevant matters.

You may inspect a copy of the registration statement through the SEC’s website, as provided above.

Incorporation

by Reference

The

SEC’s rules allow us to “incorporate by reference” information into this prospectus supplement and the accompanying

prospectus, which means that we can disclose important information to you by referring you to another document filed separately with

the SEC. The information incorporated by reference is deemed to be part of this prospectus supplement and the accompanying prospectus,

and subsequent information that we file with the SEC will automatically update and supersede that information. Any statement contained

in a previously filed document incorporated by reference will be deemed to be modified or superseded for purposes of this prospectus

supplement and the accompanying prospectus to the extent that a statement contained in this prospectus supplement or the accompanying

prospectus modifies or replaces that statement.

We

incorporate by reference the following information or documents that we have filed with the SEC:

| |

● |

Our Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on March 13, 2024. |

| |

|

|

| |

● |

Our Quarterly Reports on

Form 10-Q for the quarter ended March 31, 2024, filed with the SEC on May 8, 2024; for the quarter ended June 30, 2024, filed with

the SEC on August 12, 2024; and for the quarter ended September 30, 2024, filed with the SEC on November 12, 2024. |

| |

|

|

| |

● |

Our Current Reports on Form

8-K filed with the SEC on January 23, 2024, March 4, 2024, March 25, 2024, May 22, 2024, June 7, 2024, August 8, 2024 and October 22, 2024. |

| |

|

|

| |

● |

Our annual Proxy Statement

on Schedule 14A relating to our annual meeting of stockholders, filed on April 26, 2024 (with respect to those portions incorporated

by reference into our Annual Report on Form 10-K for the year ended December 31, 2023). |

| |

|

|

| |

● |

The description of our common

stock contained in our Registration Statement on Form 8-A, filed with the SEC on July 23, 2021, and any amendment or report filed with

the SEC for the purpose of updating the description. |

We

incorporate by reference into this prospectus supplement and accompanying prospectus all reports and other documents we subsequently

file with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended, between the date

of this prospectus supplement and the termination of the offering of the securities described in this prospectus supplement. We are not,

however, incorporating by reference any documents or portions thereof, whether specifically listed above or filed in the future, that

are not deemed “filed” with the SEC, including any information furnished pursuant to Items 2.02 or 7.01 of Form 8-K or related

exhibits furnished pursuant to Item 9.01 of Form 8-K. The reports and documents specifically listed above or filed in the future (excluding

any information furnished to, rather than filed with, the SEC) are deemed to be part of this prospectus supplement and accompanying prospectus

from the date of the filing of such reports and documents.

You

may request a free copy of any of the documents incorporated by reference in this prospectus supplement and the accompanying prospectus

(other than exhibits, unless they are specifically incorporated by reference in the documents) by writing or telephoning us at the following

address:

Indaptus

Therapeutics, Inc.

3 Columbus Circle, 15th Floor

New York, NY 10019

(646) 427-2727

Exhibits

to the filings will not be sent, however, unless those exhibits have specifically been incorporated by reference in this prospectus supplement

and the accompanying prospectus.

PROSPECTUS

$200,000,000

Common

Stock

Preferred

Stock

Subscription

Rights

Debt

Securities

Warrants

Units

INDAPTUS

THERAPEUTICS, INC.

We

may offer, issue and sell from time to time up to $200,000,000, of our common stock, preferred stock, subscription rights, debt securities,

warrants and a combination of such securities, separately or as units, in one or more offerings. This prospectus provides a general description

of offerings of these securities that we may undertake.

We

refer to the shares of common stock, preferred stock, subscription rights, debt securities, warrants and units collectively as “securities”

in this prospectus.

Each

time we sell securities pursuant to this prospectus, we will provide in a supplement to this prospectus the price and any other material

terms of any such offering. Any prospectus supplement may also add, update or change information contained in this prospectus. You should

read this prospectus and any applicable prospectus supplement, as well as the documents incorporated by reference or deemed incorporated

by reference into this prospectus, carefully before you invest in any securities. This prospectus may not be used to offer or sell

securities unless accompanied by a prospectus supplement.

We

may, from time to time, offer to sell the securities, through public or private transactions, directly or through underwriters, agents

or dealers, on or off the Nasdaq Capital Market, at prevailing market prices or at privately negotiated prices. If any underwriters,

agents or dealers are involved in the sale of any of these securities, the applicable prospectus supplement will set forth the names

of the underwriter, agent or dealer and any applicable fees, commissions or discounts.

Our

shares of common stock are traded on the Nasdaq Capital Market under the symbol “INDP.” The last reported sale price of our

shares of common stock, as reported on the Nasdaq Capital Market on August 31, 2022 was $2.52.

The

aggregate market value of our outstanding common stock held by non-affiliates pursuant to General Instruction I.B.6 of Form S-3 was $19,171,306,

which was calculated based on 8,258,597 shares of common stock outstanding, as of August 31, 2022, of which 5,757,149 shares were

held by non-affiliates, and a price per share of $3.33 which was the closing sale price of our common stock on the Nasdaq Capital Market

on August 5, 2022. We have not offered any securities pursuant to General Instruction I.B.6 of Form S-3 during the 12 calendar months

prior to and including the date of this prospectus.

Investing

in our securities involves risks. See the section entitled “Risk Factors” included in or incorporated by reference into the

accompanying prospectus supplement beginning on page 2 and in the documents we incorporate by reference in this prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is September 9, 2022

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement that we filed with the Securities and Exchange Commission, or SEC, utilizing a “shelf”

registration process. Under this shelf registration process, we may offer and sell separately or together in any combination the securities

described in this prospectus in one or more offerings up to a total price to the public of $200,000,000. The offer and sale of securities

under this prospectus may be made from time to time, in one or more offerings, in any manner described under the section in this prospectus

entitled “Plan of Distribution.” This prospectus does not contain all of the information set forth in the registration statement,

certain parts of which are omitted in accordance with the rules and regulations of the SEC. Accordingly, you should refer to the registration

statement and its exhibits for further information about us and our securities. Copies of the registration statement and its exhibits

are on file with the SEC. Statements contained in this prospectus concerning the documents we have filed with the SEC are not intended

to be comprehensive, and in each instance we refer you to a copy of the actual document filed as an exhibit to the registration statement

or otherwise filed with the SEC.

This

prospectus provides you with a general description of the securities we may offer. Each time we sell securities we will provide this

prospectus and a prospectus supplement that will contain specific information about the terms of that offering. The prospectus supplement

may also add, update or change information contained in this prospectus, and may also contain information about any material federal

income tax considerations relating to the securities covered by the prospectus supplement. You should carefully read both this prospectus

and any prospectus supplement together with additional information under the headings “Where You Can Find More Information”

and “Incorporation of Certain Documents by Reference.”

The

prospectus supplement to be attached to the front of this prospectus may describe, as applicable: the terms of the securities offered;

the public offering price; the price paid for the securities; net proceeds; and the other specific terms related to the offering of the

securities.

We

have not authorized anyone to provide you with information different from that contained or incorporated by reference in this prospectus

or any accompanying prospectus supplement or any “free writing prospectus.” We are offering to sell, and seeking offers to

buy, securities only in jurisdictions where offers and sales are permitted. The information contained in this prospectus and in any accompanying

prospectus supplement is accurate only as of the dates of their covers, regardless of the time of delivery of this prospectus or any

prospectus supplement or of any sale of our securities. Our business, financial condition, results of operations, and prospects may have

changed since those dates. You should rely only on the information contained or incorporated by reference in this prospectus or any accompanying

prospectus supplement. To the extent there is a conflict between the information contained in this prospectus and the prospectus supplement,

you should rely on the information in the prospectus supplement, provided that if any statement in one of these documents is inconsistent

with a statement in another document having a later date — for example, a document incorporated by reference into this prospectus

or any prospectus supplement — the statement in the document having the later date modifies or supersedes the earlier statement.

This

prospectus incorporates by reference market data and certain industry data and forecasts that were obtained from market research databases,

consultant surveys commissioned by us, publicly available information, reports of governmental agencies and industry publications and

surveys. Industry surveys, publications, consultant surveys commissioned by us and forecasts generally state that the information contained

therein has been obtained from sources believed to be reliable. We have relied on certain data from third-party sources, including internal

surveys, industry forecasts and market research, which we believe to be reliable based on our management’s knowledge of the industry.

Statements as to our market position are based on the most currently available data. While we are not aware of any misstatements regarding

the industry data presented in this prospectus, our estimates involve risks and uncertainties and are subject to change based

on various factors, including those discussed or referred to under the heading “Risk Factors” in this prospectus, and under

similar headings in the other documents that are incorporated herein by reference.

Certain

figures included in this prospectus have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables

may not be an arithmetic aggregation of the figures that precede them.

All

references to “we,” “us,” “our,” “Indaptus Therapeutics”, “Indaptus”, “the

Company” and “our company”, in this prospectus are to Indaptus Therapeutics, Inc. (formerly Intec Parent, Inc.) and,

where appropriate, its consolidated subsidiaries Intec Pharma Ltd. and Decoy Biosystems, Inc. References to “Intec Parent”

refer to Intec Parent, Inc., the successor of Intec Pharma Ltd. following the Domestication Merger, references to “Intec Israel”

refer to Intec Pharma Ltd., the predecessor of Indaptus prior to the Domestication Merger, and references to “Decoy” refer

to Decoy Biosystems, Inc., the entity acquired by Indaptus in connection with the Merger described elsewhere in this prospectus.

RISK

FACTORS

An

investment in our securities involves a high degree of risk. The prospectus supplement applicable to each offering of our securities

will contain a discussion of the risks applicable to an investment in our securities. Before deciding whether to invest in our securities,

you should carefully consider the specific factors discussed under the heading “Risk Factors” in the applicable prospectus

supplement, together with all of the other information contained or incorporated by reference in the prospectus supplement or appearing

or incorporated by reference in this prospectus. You should also consider the risks, uncertainties and assumptions discussed under Item

1A, “Risk Factors,” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2021, and any subsequent Quarterly

Report on Form 10-Q or Current Report on Form 8-K which are incorporated herein by reference, as updated or superseded by the risks and

uncertainties described under similar headings in the other documents that are filed after the date hereof and incorporated by reference

into this prospectus and any prospectus supplement related to a particular offering. The risks and uncertainties we have described are

not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also

affect our operations. Past financial performance may not be a reliable indicator of future performance, and historical trends should

not be used to anticipate results or trends in future periods. If any of these risks actually occurs, our business, business prospects,

financial condition or results of operations could be seriously harmed. This could cause the trading price of our common stock to decline,

resulting in a loss of all or part of your investment. Please also read carefully the section below entitled “Forward-Looking Statements.”

FORWARD-LOOKING

STATEMENTS

This

prospectus, including the information incorporated by reference into this prospectus, contains, and any prospectus supplement may contain

statements that are forward-looking statements about our expectations, beliefs or intentions regarding, among other things, our product

development efforts, business, financial condition, results of operations, strategies, plans and prospects. In addition, from time to

time, we or our representatives have made or may make forward-looking statements, orally or in writing. Forward-looking statements can

be identified by the use of forward-looking words such as “believe,” “expect,” “intend,” “plan,”

“may,” “should,” “anticipate,” “could,” “might,” “seek,” “target,”

“will,” “project,” “forecast,” “continue” or their negatives or variations of these words

or other comparable words or by the fact that these statements do not relate strictly to historical matters. These forward-looking statements

may be included in, among other things, various filings made by us with the SEC, press releases or oral statements made by or with the

approval of one of our authorized executive officers. Forward-looking statements relate to anticipated or expected events, activities,

trends or results as of the date they are made. Because forward-looking statements relate to matters that have not yet occurred, these

statements are inherently subject to risks and uncertainties that could cause our actual results to differ materially from any future

results expressed or implied by the forward-looking statements. Many factors could cause our actual activities or results to differ materially

from the activities and results anticipated in forward-looking statements, including, but not limited to:

| |

● |

our

plans to develop and potentially commercialize our technology; |

| |

|

|

| |

● |

the

timing and cost of our planned investigational new drug application and any clinical trials; |

| |

|

|

| |

● |

the

completion and receipt of favorable results in any clinical trials; |

| |

|

|

| |

● |

our

ability to obtain and maintain regulatory approval of any product candidate; |

| |

|

|

| |

● |

our

ability to protect and maintain our intellectual property and licensing arrangements; |

| |

|

|

| |

● |

our

ability to develop, manufacture and commercialize our product candidates; |

| |

|

|

| |

● |

the

risk of product liability claims, the availability of reimbursement, the influence of extensive and costly government regulation;

and |

| |

|

|

| |

● |

our

estimates regarding future revenue, expenses capital requirements and the need for additional financing. |

| |

|

|

We

believe these forward-looking statements are reasonable; however, these statements are only current predictions and are subject to known

and unknown risks, uncertainties and other factors that may cause our or our industry’s actual results, levels of activity, performance

or achievements to be materially different from those anticipated by the forward-looking statements. We discuss or refer you to

many of these risks in this prospectus in greater detail under the heading “Risk Factors” and elsewhere in this prospectus.

Given these uncertainties, you should not rely upon forward-looking statements as predictions of future events.

All

forward-looking statements attributable to us or persons acting on our behalf speak only as of the date hereof and are expressly qualified

in their entirety by the cautionary statements included in this prospectus. We undertake no obligations to update or revise forward-looking

statements to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events, except

as required by law. In evaluating forward-looking statements, you should consider these risks and uncertainties and not place undue reliance

on our forward-looking statements.

PROSPECTUS

SUMMARY

Our

Business

We

are a pre-clinical biotechnology company developing a novel and patented systemically-administered anti-cancer and anti-viral immunotherapy.

Our technology has evolved from more than a century of immunotherapy advances. Our approach is based on the hypothesis that efficient

activation of both innate and adaptive immune cells and associated anti-tumor and anti-viral immune responses will require a multi-targeted

package of immune system activating signals that can be administered safely intravenously. Our patented technology is composed of single

strains of attenuated and killed, non-pathogenic, Gram-negative bacteria, with reduced i.v. toxicity, but largely uncompromised ability

to prime or activate many of the cellular components of innate and adaptive immunity. This approach has led to broad anti-tumor and anti-viral

activity, including safe, durable anti-tumor response synergy with each of five different classes of existing agents, including checkpoint

therapy, targeted antibody therapy and low-dose chemotherapy in pre-clinical models. Tumor eradication by our technology has demonstrated

activation of both innate and adaptive immunological memory and, importantly, does not require provision of or targeting a tumor antigen

in pre-clinical models. We have carried out successful GMP manufacturing of our lead clinical candidate, Decoy20, and completed other

IND-enabling studies.

Unlike

many competitor products, our technology does not depend on targeting with or to a specific antigen, providing broad applicability across

multiple indications. Our product candidates are designed to have a much shorter half-life and produce less systemic exposure than small

molecule, antibody or human cell-based therapies, potentially reducing the risk of non-specific auto-immune reactions. Our technology

produces single agent activity and/or combination therapy-based durable responses of lymphoma, hepatocellular, colorectal and pancreatic

tumors and has also produced significant single agent activity against chronic hepatitis B virus (HBV) and chronic human immunodeficiency

virus (HIV) infections in pre-clinical models. In May 2022, the U.S. Food and Drug Administration cleared our Investigational New Drug,

or IND, application for a Phase 1 clinical trial in patients with advanced solid tumors where currently approved therapies have failed

and plan to commence a Phase 1 clinical trial in the second half of 2022 targeting solid tumors. Target indications include, but not limited to, colorectal, hepatocellular (± HBV), bladder, cervical

and pancreatic carcinoma.

Decoy

Merger

On

August 3, 2021, we completed our merger with Decoy following the satisfaction or waiver of the conditions set forth in the Merger Agreement,

dated as of March 15, 2021 among the Company, Decoy, Intec Israel, Domestication Merger Sub Ltd., an Israeli company and a wholly-owned

subsidiary of the Company, or Domestication Merger Sub, and Dillon Merger Subsidiary Inc., a Delaware corporation and wholly owned subsidiary

of the Company, or Merger Sub, pursuant to which Merger Sub merged with and into Decoy, with Decoy surviving as a wholly owned subsidiary

of the Company, or the Merger, and the business conducted by Decoy became the business conducted by the combined company.

Previously,

on July 27, 2021, we, Intec Israel and Domestication Merger Sub completed the previously announced domestication merger pursuant to the

terms and conditions of the Domestication Merger Agreement, whereby Domestication Merger Sub merged with and into Intec Israel, with

Intec Israel being the surviving entity and a wholly-owned subsidiary of ours. At the time of the Domestication Merger, Intec Israel

continued to possess all of its assets, rights, powers and property as constituted immediately prior to the Domestication Merger and

continued to be subject to all of its debts, liabilities and obligations as constituted immediately prior to the Domestication Merger.

Also,

in connection with the Merger, we changed our name from “Intec Parent, Inc.” to “Indaptus Therapeutics, Inc.”.

Following

completion of the Merger, our shares of common stock commenced trading at market open on August 4, 2021, on the Nasdaq Capital Market

under the name “Indaptus Therapeutics, Inc.” and ticker symbol “INDP” and under the new CUSIP 45339J 105.

Winding

Down of Accordion Pill Business

In

connection with the completion of the Merger, on August 4, 2021, our board of directors determined to wind down the Accordion Pill business

of Intec Israel which was recently completed.

In

connection with the winding down, we laid off all our employees and we terminated our contracts with counterparties, including the termination

of the Process Development Agreement between Intec Israel and LTS Lohmann Therapie Systeme AG, and the termination of the unprotected

lease agreement between Intec Israel and its landlord for the lease of offices located in Jerusalem, Israel.

Private

Placement

In

connection with the Merger, on July 23, 2021, we entered into a securities purchase agreement, or the Purchase Agreement, with a certain

institutional investor, or the Purchaser, pursuant to which we agreed to sell and issue, in a private placement, or the Private Placement,

a pre-funded warrant to purchase up to 2,727,273 shares of our common stock, or the Pre-funded Warrant, and a warrant to purchase up

to 2,727,273 of our common stock at a purchase price of $10.99 per Pre-funded Warrant and associated Warrant, for aggregate gross proceeds

to us of approximately $30.0 million, before deducting the placement agent’s fees and other offering expenses payable by the Company.

The Warrant has a term of five and one-half years, is exercisable immediately following the issuance date and has an exercise price of

$11.00 per share, subject to adjustment as set forth therein.

On

August 3, 2021, the Private Placement closed and in September 2021, the Pre-Funded Warrants were fully exercised. In addition, we issued

to the placement agent a warrant to purchase 136,364 shares of our common stock at an exercise price of $13.75.

Corporate