false

0001857044

0001857044

2024-11-12

2024-11-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported) November 12, 2024

INDAPTUS

THERAPEUTICS, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-40652 |

|

86-3158720 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

| 3

Columbus Circle |

|

|

| 15th

Floor |

|

|

| New

York, New York |

|

10019 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(646)

427-2727

(Registrant’s

telephone number, including area code)

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of each exchange on which registered |

| Common

Stock, $0.01 par value |

|

INDP |

|

Nasdaq

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933

(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02. Results of Operations and Financial Condition.

On

November 12, 2024, Indaptus Therapeutics, Inc. (the “Company”) issued a press release announcing its financial results for

the quarter ended September 30, 2024. The full text of the press release is furnished as Exhibit 99.1 to this Current Report on Form

8-K and is incorporated herein by reference.

The

information in this Current Report on Form 8-K (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section

18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that

Section, nor shall it be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended,

or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date:

November 12, 2024

| |

INDAPTUS

THERAPEUTICS, INC. |

| |

|

|

| |

By:

|

/s/

Nir Sassi |

| |

Name:

|

Nir

Sassi |

| |

Title:

|

Chief

Financial Officer |

Exhibit

99.1

Indaptus

Therapeutics Reports Third Quarter 2024 Financial Results and Provides Corporate Update

NEW

YORK (November 12, 2024) - Indaptus Therapeutics, Inc. (Nasdaq: INDP) (“Indaptus” or the “Company”), a clinical

stage biotechnology company dedicated to pioneering innovative cancer and viral infection treatments, today announced financial results

for the third quarter ended September 30, 2024, and provided a corporate update.

Jeffrey

Meckler, Indaptus Therapeutics’ Chief Executive Officer, commented, “The recent announcement highlighting our clinical supply

agreement with BeiGene is an important milestone, representing a significant step forward in our clinical development as we plan the

first clinical trial combining BeiGene’s anti-PD-1 antibody, tislelizumab, with Indaptus’ Decoy20 product candidate for cancer

treatment. PD-1 inhibitors have proven meaningful in treating multiple cancer types, and we are optimistic that we can improve patient

outcomes by broadly and safely stimulating the immune system to enhance the effectiveness of currently approved treatments. We have also

progressed our Phase 1 clinical trial to now allow for unrestricted enrollment of patients in weekly administration at the lower Decoy20

dose, which will enable us to gather more safety and efficacy data, which is important for assessing the full potential of Decoy20. Those

data will guide how we initiate the combination trial next year. To date, Decoy20 continues to be well tolerated and we are anxiously

awaiting further outcomes, which we will report as the trial progresses. We continue to carefully manage our resources and will provide

status updates as they develop.”

Key

recent highlights:

| ● | Announced

clinical supply agreement with BeiGene to evaluate novel cancer treatment combinations for

the treatment of patients with advanced solid tumors |

| ● | Initiated

unrestricted enrollment of patients in Indaptus’ Phase 1 clinical trial of Decoy20

allowing for weekly dosing based on encouraging safety data |

| |

● |

Announced

that Dr. Michael Newman, Founder and Chief Scientific Officer, has published his groundbreaking research in the peer-reviewed journal,

Frontiers in Immunology. The article was titled, “Invention and Characterization of a Systemically Administered, Attenuated

and Killed Bacteria-Based Multiple Immune Receptor Agonist for Antitumor Immunotherapy” |

| ● | Completed

a $3 million registered direct offering and concurrent private placement on August 8, 2024

(the “August 2024 Offering”), for net proceeds of approximately $2.5 million |

| ● | Participated

in Lumanity webinar regarding the future of innate immunity in cancer immunotherapy |

Financial

Highlights for the Third Quarter Ended September 30, 2024

Research

and development expenses for the three months ended September 30, 2024, were approximately $1.5 million, a decrease of approximately

$0.7 million compared with approximately $2.2 million in the three months ended September 30, 2023. The decrease for the three-month

period was primarily due to the development of our manufacturing processes of Decoy20 that were conducted in the three months ended September

30, 2023. Research and development expenses for the nine months ended September 30, 2024, were approximately $4.8 million, a decrease

of approximately $0.8 million compared with approximately $5.6 million in the nine months ended September 30, 2023. The decrease for

the nine-month period was primarily due to a decrease of approximately $1.1 million in the development of our manufacturing processes

of Decoy20 that were conducted in 2023 and was offset by an increase of approximately $0.3 million in our Phase 1 clinical trial and

in payroll and related expenses.

General

and administrative expenses for the three months ended September 30, 2024, were approximately $1.7 million, a decrease of approximately

$0.3 million compared with approximately $2.0 million in the three months ended September 30, 2023. The decrease was primarily due to

stock-based compensation, legal fees and recruitment costs. General and administrative expenses for the nine months ended September 30,

2024, were approximately $6.4 million, a decrease of approximately $0.2 million compared with approximately $6.6 million in the nine

months ended September 30, 2023. The decrease for the nine-month period was primarily due to a decrease of approximately $0.7 million

in legal fees, payroll and related expenses, recruitment costs and directors’ and officers’ insurance expenses, and was offset

by an increase of approximately $0.5 million in investor relations and business development expenses.

Loss

per share for the three months ended September 30, 2024, was approximately $0.32 compared with approximately $0.47 for the three months

ended September 30, 2023. Loss per share for the nine months ended September 30, 2024, was approximately $1.23 compared with approximately

$1.36 per share for the nine months ended September 30, 2023.

As

of September 30, 2024, the Company had cash and cash equivalents of approximately $7.4 million. As of December 31, 2023, the Company

had cash and cash equivalents of $13.4 million. The Company expects that its current cash and cash equivalents will support its ongoing

operating activities into the first quarter of 2025. This cash runway guidance is based on the Company’s current operational plans

and excludes any additional funding and any business development activities that may be undertaken. Indaptus continues to assess all

financing options that would support its corporate strategy.

Net

cash used in operating activities was approximately $8.9 million for the nine months ended September 30, 2024, compared with net cash

used in operating activities of approximately $10.8 million for the nine months ended September 30, 2023. The decrease resulted primarily

from a decrease in our research and development activities and general and administrative expenses and by net changes in operating asset

and liability items.

There

was no net cash provided by or used in investing activities in the nine months ended September 30, 2024. Net cash provided by investing

activities was approximately $17.1 million for the nine months ended September 30, 2023, which was related to the maturity of $24.0 million

in marketable securities, offset by net investment of approximately $6.9 million in marketable securities.

Net

cash provided by financing activities for the nine months ended September 30, 2024, was approximately $2.9 million, which was provided

by the issuance and sale of our common stock under the ATM Agreement and the issuance and sale of our common stock and warrants in the

August 2024 Offering. There was no net cash provided by or used in financing activities in the nine months ended September 30, 2023.

About

Indaptus Therapeutics

Indaptus

Therapeutics has evolved from more than a century of immunotherapy advances. The Company’s novel approach is based on the hypothesis

that efficient activation of both innate and adaptive immune cells and pathways and associated anti-tumor and anti-viral immune responses

will require a multi-targeted package of immune system-activating signals that can be administered safely intravenously (i.v.). Indaptus’

patented technology is composed of single strains of attenuated and killed, non-pathogenic, Gram-negative bacteria producing a multiple

Toll-like receptor (TLR), Nucleotide oligomerization domain (NOD)-like receptor (NLR) and Stimulator of interferon genes (STING) agonist

Decoy platform. The product candidates are designed to have reduced i.v. toxicity, but largely uncompromised ability to prime or activate

many of the cells and pathways of innate and adaptive immunity. Decoy product candidates represent an antigen-agnostic technology that

have produced single-agent activity against metastatic pancreatic and orthotopic colorectal carcinomas, single agent eradication of established

antigen-expressing breast carcinoma, as well as combination-mediated eradication of established hepatocellular carcinomas, pancreatic

and non-Hodgkin’s lymphomas in standard pre-clinical models, including syngeneic mouse tumors and human tumor xenografts. In pre-clinical

studies tumor eradication was observed with Decoy product candidates in combination with anti-PD-1 checkpoint therapy, low-dose chemotherapy,

a non-steroidal anti-inflammatory drug, or an approved, targeted antibody. Combination-based tumor eradication in pre-clinical models

produced innate and adaptive immunological memory, involved activation of both innate and adaptive immune cells, and was associated with

induction of innate and adaptive immune pathways in tumors after only one i.v. dose of Decoy product candidate, with associated “cold”

to “hot” tumor inflammation signature transition. The Decoy platform has also been shown to induce activation, polarization

or maturation of human macrophages, dendritic, NK, NKT, CD4 T and CD8 T cells in vitro. IND-enabling, nonclinical toxicology studies

demonstrated i.v. administration without sustained induction of hallmark biomarkers of cytokine release syndromes, possibly due to passive

targeting to liver, spleen, and tumor, followed by rapid elimination of the product candidate. Indaptus’ Decoy product candidates

have also produced meaningful single agent activity against chronic hepatitis B virus (HBV) and chronic human immunodeficiency virus

(HIV) infections in pre-clinical models.

Forward-Looking

Statements

This

press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act. These include statements

regarding management’s expectations, beliefs and intentions regarding, among other things: our expectations and plans regarding

our clinical supply agreement with BeiGene; our plans to advance clinical evaluation of the combination of BeiGene’s anti-PD-1

antibody, tislelizumab, with Decoy20; our ability to gather more safety and efficacy data from our Phase 1 clinical trial; our plans

to seek FDA approval and to initiate a combination trial, and the timing thereof; the anticipated effects of our product candidates,

including Decoy20; the plans and objectives of management for future operations; our research and development activities and costs; the

sufficiency of our cash and cash equivalents to fund our ongoing activities and our cash management strategy; and our assessment of financing

options to support our corporate strategy. Forward-looking statements can be identified by the use of forward-looking words such as “believe”,

“expect”, “intend”, “plan”, “may”, “should”, “could”, “might”,

“seek”, “target”, “will”, “project”, “forecast”, “continue” or

“anticipate” or their negatives or variations of these words or other comparable words or by the fact that these statements

do not relate strictly to historical matters. Because forward-looking statements relate to matters that have not yet occurred, these

statements are inherently subject to risks and uncertainties that could cause our actual results to differ materially from any future

results expressed or implied by the forward-looking statements. Many factors could cause actual activities or results to differ materially

from the activities and results anticipated in forward-looking statements, including, but not limited to the following: our limited operating

history; conditions and events that raise substantial doubt regarding our ability to continue as going concern; the need for, and our

ability to raise, additional capital given our lack of current cash flow; our clinical and preclinical development, which involves a

lengthy and expensive process with an uncertain outcome; our incurrence of significant research and development expenses and other operating

expenses, which may make it difficult for us to attain profitability; our pursuit of a limited number of research programs, product candidates

and specific indications and failure to capitalize on product candidates or indications that may be more profitable or have a greater

likelihood of success; our ability to obtain and maintain regulatory approval of any product candidate; the market acceptance of our

product candidates; our reliance on third parties to conduct our preclinical studies and clinical trials and perform other tasks; our

reliance on third parties for the manufacture of our product candidates during clinical development; our ability to successfully commercialize

Decoy20 or any future product candidates; our ability to obtain or maintain coverage and adequate reimbursement for our products; the

impact of legislation and healthcare reform measures on our ability to obtain marketing approval for and commercialize Decoy20 and any

future product candidates; product candidates of our competitors that may be approved faster, marketed more effectively, and better tolerated

than our product candidates; our ability to adequately protect our proprietary or licensed technology in the marketplace; the impact

of, and costs of complying with healthcare laws and regulations, and our failure to comply with such laws and regulations; information

technology system failures, cyberattacks or deficiencies in our cybersecurity; and unfavorable global economic conditions. These and

other important factors discussed under the caption “Risk Factors” included in our Quarterly Report on Form 10-Q for the

quarter ended September 30, 2024 to be filed with the SEC, our most recent Annual Report on Form 10-K filed with the SEC on March 13,

2024, and our other filings with the SEC, could cause actual results to differ materially from those indicated by the forward-looking

statements made in this press release. All forward-looking statements speak only as of the date of this press release and are expressly

qualified in their entirety by the cautionary statements included in this press release. We undertake no obligation to update or revise

forward-looking statements to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated

events, except as required by applicable law.

Contact:

investors@indaptusrx.com

Investor

Relations Contact:

CORE

IR

Louie Toma

louie@coreir.com

Media

Contact:

Cuttlefish

Communications

Shira

Derasmo

shira@cuttlefishpr.com

917-280-2497

INDAPTUS

THERAPEUTICS, INC.

Unaudited

Condensed Consolidated Balance Sheets

| | |

September 30, 2024 | | |

December 31, 2023 | |

| Assets | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 7,380,686 | | |

$ | 13,362,053 | |

| Prepaid expenses and other current assets | |

| 248,737 | | |

| 633,156 | |

| | |

| | | |

| | |

| Total current assets | |

| 7,629,423 | | |

| 13,995,209 | |

| | |

| | | |

| | |

| Non-current assets: | |

| | | |

| | |

| Property and equipment, net | |

| - | | |

| 735 | |

| Right-of-use asset | |

| 105,655 | | |

| 173,206 | |

| Other assets | |

| 504,728 | | |

| 754,728 | |

| | |

| | | |

| | |

| Total non-current assets | |

| 610,383 | | |

| 928,669 | |

| | |

| | | |

| | |

| Total assets | |

$ | 8,239,806 | | |

$ | 14,923,878 | |

| | |

| | | |

| | |

| Liabilities and stockholders’ equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable and other current liabilities | |

$ | 2,128,491 | | |

$ | 2,672,327 | |

| Operating lease liability, current portion | |

| 103,982 | | |

| 101,705 | |

| | |

| | | |

| | |

| Total current liabilities | |

| 2,232,473 | | |

| 2,774,032 | |

| | |

| | | |

| | |

| Non-current liabilities: | |

| | | |

| | |

| Operating lease liability, net of current portion | |

| 4,007 | | |

| 73,348 | |

| | |

| | | |

| | |

| Total non-current liabilities | |

| 4,007 | | |

| 73,348 | |

| | |

| | | |

| | |

| Total liabilities | |

| 2,236,480 | | |

| 2,847,380 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Common stock: $0.01 par value, 200,000,000 shares authorized as of September 30, 2024 and December 31, 2023; 10,196,884 shares issued and outstanding as of September 30, 2024 and 8,401,047 shares issued and outstanding as of December 31, 2023 | |

| 101,969 | | |

| 84,011 | |

| Additional paid in capital | |

| 62,209,493 | | |

| 57,409,643 | |

| Accumulated deficit | |

| (56,308,136 | ) | |

| (45,417,156 | ) |

| | |

| | | |

| | |

| Total stockholders’ equity | |

| 6,003,326 | | |

| 12,076,498 | |

| | |

| | | |

| | |

| Total liabilities and stockholders’ equity | |

$ | 8,239,806 | | |

$ | 14,923,878 | |

Unaudited

Condensed Consolidated Statements of Operations and Comprehensive Loss

| | |

Three Months Ended

September 30, | | |

Nine Months Ended

September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

$ | 1,466,037 | | |

$ | 2,226,688 | | |

$ | 4,771,152 | | |

$ | 5,587,073 | |

| General and administrative | |

| 1,676,020 | | |

| 2,021,724 | | |

| 6,423,029 | | |

| 6,611,767 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total operating expenses | |

| 3,142,057 | | |

| 4,248,412 | | |

| 11,194,181 | | |

| 12,198,840 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (3,142,057 | ) | |

| (4,248,412 | ) | |

| (11,194,181 | ) | |

| (12,198,840 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other income, net | |

| 73,021 | | |

| 326,024 | | |

| 303,201 | | |

| 778,149 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (3,069,036 | ) | |

$ | (3,922,388 | ) | |

$ | (10,890,980 | ) | |

$ | (11,420,691 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss available to common stockholders per share of common stock, basic and diluted | |

$ | (0.32 | ) | |

$ | (0.47 | ) | |

$ | (1.23 | ) | |

$ | (1.36 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of shares used in calculating net loss per share, basic and diluted | |

| 9,510,447 | | |

| 8,401,047 | | |

| 8,832,630 | | |

| 8,401,047 | |

| Net loss | |

$ | (3,069,036 | ) | |

$ | (3,922,388 | ) | |

$ | (10,890,980 | ) | |

$ | (11,420,691 | ) |

| Other comprehensive income (loss): | |

| | | |

| | | |

| | | |

| | |

| Reclassification adjustment for interest earned on marketable securities included in net loss | |

| - | | |

| (140,567 | ) | |

| - | | |

| (430,993 | ) |

| Change in unrealized gain on marketable securities | |

| - | | |

| 6,412 | | |

| - | | |

| 334,559 | |

| Comprehensive loss | |

$ | (3,069,036 | ) | |

$ | (4,056,543 | ) | |

$ | (10,890,980 | ) | |

$ | (11,517,125 | ) |

Unaudited

Condensed Consolidated Statements of Cash Flows

| | |

For the Nine Months Ended | |

| | |

September 30, | |

| | |

2024 | | |

2023 | |

| Cash flows from operating activities: | |

| | | |

| | |

| Net loss | |

$ | (10,890,980 | ) | |

$ | (11,420,691 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Depreciation | |

| 735 | | |

| 964 | |

| Stock-based compensation | |

| 2,001,727 | | |

| 2,220,413 | |

| Interest earned on marketable securities | |

| - | | |

| (430,993 | ) |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Prepaid expenses and other current and non- current assets | |

| 634,419 | | |

| (84,568 | ) |

| Accounts payable and other current liabilities | |

| (673,829 | ) | |

| (1,088,785 | ) |

| Operating lease right-of-use asset and liability, net | |

| 487 | | |

| 290 | |

| Net cash used in operating activities | |

| (8,927,441 | ) | |

| (10,803,370 | ) |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Maturity of marketable securities | |

| - | | |

| 24,000,000 | |

| Purchase of marketable securities | |

| - | | |

| (6,859,432 | ) |

| Net cash provided by investing activities | |

| - | | |

| 17,140,568 | |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Proceeds from issuance of shares of common stock and warrants | |

| 3,375,590 | | |

| - | |

| Issuance costs | |

| (429,516 | ) | |

| - | |

| Net cash provided by financing activities | |

| 2,946,074 | | |

| - | |

| | |

| | | |

| | |

| Net (decrease) increase in cash and cash equivalents | |

| (5,981,367 | ) | |

| 6,337,198 | |

| | |

| | | |

| | |

| Cash and cash equivalents at beginning of period | |

| 13,362,053 | | |

| 9,626,800 | |

| | |

| | | |

| | |

| Cash and cash equivalents at end of period | |

$ | 7,380,686 | | |

$ | 15,963,998 | |

| | |

| | | |

| | |

| Noncash investing and financing activities | |

| | | |

| | |

| Transaction costs in accounts payable and other current liabilities | |

$ | 129,993 | | |

$ | - | |

| Change in unrealized gain/loss on marketable securities | |

$ | - | | |

$ | (96,434 | ) |

| ASC 842 lease renewal option exercise | |

$ | - | | |

$ | 236,506 | |

| Reclassification of security deposit | |

$ | - | | |

$ | 16,477 | |

v3.24.3

Cover

|

Nov. 12, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 12, 2024

|

| Entity File Number |

001-40652

|

| Entity Registrant Name |

INDAPTUS

THERAPEUTICS, INC.

|

| Entity Central Index Key |

0001857044

|

| Entity Tax Identification Number |

86-3158720

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

3

Columbus Circle

|

| Entity Address, Address Line Two |

15th

Floor

|

| Entity Address, City or Town |

New

York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10019

|

| City Area Code |

(646)

|

| Local Phone Number |

427-2727

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $0.01 par value

|

| Trading Symbol |

INDP

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

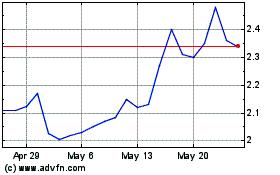

Indaptus Therapeutics (NASDAQ:INDP)

Historical Stock Chart

From Jan 2025 to Feb 2025

Indaptus Therapeutics (NASDAQ:INDP)

Historical Stock Chart

From Feb 2024 to Feb 2025