false0001294133Inogen Inc00012941332024-07-262024-07-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): July 26, 2024 |

INOGEN, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-36309 |

33-0989359 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

859 Ward Drive |

|

Goleta, California |

|

93111 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (805) 562-0500 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.001 par value |

|

INGN |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Jason Somer Transition Agreement

As previously announced in the Current Report on Form 8-K filed by Inogen, Inc. (the “Company”), dated July 2, 2024, the Company and Jason Somer, Executive Vice President, General Counsel and Secretary of the Company, mutually determined that Mr. Somer would separate from the Company on July 19, 2024. Mr. Somer’s role as an officer and employee of the Company ended effective July 19, 2024 (the “Separation Date”). In connection with the separation of Mr. Somer’s employment with the Company, on July 26, 2024, Mr. Somer and the Company entered into a transition agreement and release related to the termination of Mr. Somer’s employment with the Company (the “Transition Agreement”).

The Transition Agreement provides that, subject to (a) Mr. Somer’s execution of the Transition Agreement, (b) the Transition Agreement becoming effective, and (c) Mr. Somer’s continued compliance with the terms of the Transition Agreement, the Company will provide Mr. Somer with the severance benefits consistent with Mr. Somer’s Employment and Severance Agreement with the Company, dated July 12, 2021.

The summary of the Transition Agreement set forth above does not purport to be complete and is qualified in its entirety by reference to the full text of the Transition Agreement, which is attached to this Current Report on Form 8-K as Exhibit 10.1 and incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

INOGEN, INC. |

|

|

|

|

Date: |

July 31, 2024 |

By: |

/s/ Michael Bourque |

|

|

|

Michael Bourque

Executive Vice President

Chief Financial Officer

Treasurer

(Principal Accounting and Financial Officer) |

TRANSITION AGREEMENT AND RELEASE

This Transition Agreement and Release (“Agreement”) is made by and between Jason M. Somer (“Employee”) and Inogen, Inc. (the “Company”) (collectively referred to as the “Parties” or individually referred to as a “Party”) as of July 19, 2024 (“Effective Date”).

WHEREAS, Employee signed an At-Will Employment, Confidential Information, Invention Assignment, and Arbitration Agreement with the Company dated July 12, 2021 (the “Employment Agreement”);

WHEREAS, Employee has been employed at-will by the Company pursuant to the terms and conditions of the Employment Agreement and other agreements completed on his first day of employment on July 12, 2021;

WHEREAS, Employee previously was granted awards of some or all of stock options, restricted stock, restricted stock units, performance restricted stock, and performance stock units in each case, that are outstanding as of the date hereof (each, an “Equity Award”) subject to the terms and conditions of the applicable Company equity plan under which the Equity Award was granted and an award agreement memorializing the Equity Award (the plan and award agreement together, the “Stock Agreements”);

WHEREAS, the Parties have determined that Employee’s employment with the Company will end no later than July 19, 2024 (“Separation Date”); and

WHEREAS, the Parties wish to resolve any and all disputes, claims, complaints, grievances, charges, actions, petitions, and demands that the Employee may have against the Company and any of the Releasees (as defined below), including, but not limited to, any and all claims arising out of or in any way related to Employee’s employment with or separation from the Company;

NOW, THEREFORE, in consideration of the mutual promises made herein, the Company and Employee hereby agree as follows:

COVENANTS

1.Consideration. The Parties acknowledge and agree that the following consideration exceeds, is in lieu of, and fully replaces any severance under Section 8 of the Employment Agreement:

a.Severance Benefits. If and only if (x) Employee executes this Agreement (on or after the Separation Date) and does not revoke the Agreement and (y) Employee fulfills all of the terms and conditions of this Agreement, including, without limitation, complying with the covenants contained herein, then, following the Separation Date, and subject to Section 2 below, Employee will be entitled to the following (collectively, the “Severance Benefits”):

i.Continuation of Payment. The Company agrees to pay the Base Salary for twelve (12) months (the “Severance Term”) (26 pay periods at the gross amount of $13,269.23 each), less all applicable taxes and payable in accordance with the Company’s regular payroll practices, it being agreed that each installment of Base Salary payable hereunder shall be deemed to be a separate payment for purposes of Section 409A of the Code. Such payments will commence in the payroll following the Effective Date of this Agreement;

ii.COBRA Reimbursement. The Company shall pay the premium payments for COBRA coverage in an amount equal to the Company-paid portion for such benefits as of immediately prior to the Separation Date for a period of up to the first twelve (12) full calendar months following the Separation Date, provided Employee timely elects and

pays the employee’s portion for continuation coverage pursuant to the Consolidated Omnibus Budget Reconciliation Act of 1985, as amended (“COBRA”), within the time period prescribed pursuant to COBRA. Employee agrees to provide notice to the Company within five (5) business days after accepting any other employment or alternate coverage. Notwithstanding the preceding, if the Company determines in its sole discretion that it cannot provide COBRA reimbursement benefits without potentially violating applicable law (including, without limitation, Section 2716 of the Public Health Service Act), the Company will instead provide the Employee a taxable payment in an amount equal to the Company-paid portion of the monthly COBRA premium to continue the Employee’s group health coverage in effect on the date of termination of employment (which amount will be based on the premium for the first month of COBRA coverage) and will commence in the month following the month of the Separation Date and continue for the period of months indicated in this paragraph.

b.General. Employee acknowledges that without this Agreement, Employee is otherwise not entitled to the consideration listed in this Section 1. Employee further acknowledges and agrees that Employee’s separation from the Company does not entitle Employee to any severance or other post-employment benefits beyond the consideration set forth herein (including, without limitation, any such severance or post-employment benefits described in the Employment Agreement). Employee acknowledges that the Employment Agreement is fully replaced by and superseded by this Agreement, except for the confidentiality provisions which survive. Therefore, Employee waives any rights to severance or other post-employment benefits under the Employment Agreement. Following the Separation Date, in exchange for Employee’s execution and non-revocation of this Agreement, Employee will receive the severance benefits set forth in Section 1 above. (provided, however, that the Company may modify the Agreement pursuant to or otherwise as may be required by applicable law). The Parties agree that changes to this Agreement, whether material or immaterial, do not restart the running of any consideration period.

2.Board Resignation. On the Separation Date, Employee agrees to resign all directorships, committee memberships or other positions held within the Company.

3.Benefits; Equity Awards. Employee’s health insurance benefits shall cease no later than the last day of the month in which the Separation Date occurs, subject to Employee’s right to continue Employee’s health insurance under COBRA. Employee’s participation in all benefits and incidents of employment, including, but not limited to, vesting in Equity Awards, and the accrual of bonuses and paid time off, will cease as of the Separation Date. Employee acknowledges that as of the Separation Date, (a) the then-unvested portion of the Equity Awards will cease vesting and be immediately forfeited pursuant to the Stock Agreements and (b) the then-vested, outstanding, and exercisable stock options that are Equity Awards shall remain exercisable for a limited period of time in accordance with the applicable Stock Agreements.

4.Payment of Salary and Receipt of All Benefits. Employee acknowledges and represents that, other than the consideration set forth in this Agreement, the Company and its agents have paid or provided all salary, wages, bonuses, accrued vacation/paid time off, notice periods, premiums, leaves, housing allowances, relocation costs, interest, severance, outplacement costs, fees, reimbursable expenses, commissions, stock, stock options, vesting, and any and all other benefits and compensation due to Employee.

5.Release of Claims. Employee agrees that the consideration hereof represents settlement in full of all outstanding obligations owed to Employee by the Company and its current and former officers, directors, employees, agents, investors, attorneys, shareholders, administrators, affiliates, benefit plans, plan administrators, professional employer organization or co-employer, insurers, trustees, divisions, and subsidiaries, and predecessor and successor corporations and assigns (collectively,

the “Releasees”). Employee, on Employee’s own behalf and on behalf of Employee’s respective heirs, family members, executors, agents, and assigns, hereby and forever releases the Releasees from, and agrees not to sue concerning, or in any manner to institute, prosecute, or pursue, any claim, complaint, charge, duty, obligation, or cause of action relating to any matters of any kind, whether presently known or unknown, suspected or unsuspected, that Employee may possess against any of the Releasees arising from any omissions, acts, facts, or damages that have occurred up until and including the date Employee signs this Agreement, including, without limitation:

a.any and all claims relating to or arising from Employee’s employment relationship with the Company, the decision to terminate that relationship, and the termination of that relationship;

b.any and all claims relating to, or arising from, Employee’s right to purchase, or actual purchase of shares of stock of the Company, including, without limitation, any claims for fraud, misrepresentation, breach of fiduciary duty, breach of duty under applicable state corporate law, and securities fraud under any state or federal law;

c.any and all claims under the law of any jurisdiction, including, but not limited to, wrongful discharge of employment; constructive discharge from employment; termination in violation of public policy; discrimination; harassment; retaliation; breach of contract, both express and implied; breach of covenant of good faith and fair dealing, both express and implied; promissory estoppel; negligent or intentional infliction of emotional distress; fraud; negligent or intentional misrepresentation; negligent or intentional interference with contract or prospective economic advantage; unfair business practices; defamation; libel; slander; negligence; personal injury; assault; battery; invasion of privacy; false imprisonment; conversion; and disability benefits;

d.any and all claims for violation of any federal, state, or municipal statute, including, but not limited to, the following, each as may be amended, and except as prohibited by law: Title VII of the Civil Rights Act of 1964; the Civil Rights Act of 1991; the Rehabilitation Act of 1973; the Americans with Disabilities Act of 1990; the Equal Pay Act; the Fair Labor Standards Act; the Fair Credit Reporting Act; the Employee Retirement Income Security Act of 1974; the Worker Adjustment and Retraining Notification Act; the Family and Medical Leave Act; the Age Discrimination in Employment Act of 1967, and the Older Workers Benefit Protection Act; the Uniformed Services Employment and Reemployment Rights Act; the Immigration Reform and Control Act; the National Labor Relations Act; any claims under the California Labor Code (inclusive of sections 132a and 4553), as well as any claims under the California Fair Employment and Housing Act, California Constitution, the California Labor Code (including but not limited to Sections 132a and 4553), the California Government Code, the California Civil Code, the California Penal Code, and the California Family Rights Act;

e.any and all claims for violation of the federal or any state constitution

f.any and all claims arising out of any other laws and regulations relating to employment or employment discrimination;

g.any claim for any loss, cost, damage, or expense arising out of any dispute over the nonwithholding or other tax treatment of any of the proceeds received by Employee as a result of this Agreement; and

h.any and all claims for attorneys’ fees and costs.

Employee agrees that the release set forth in this section shall be and remain in effect in all respects as a complete general release as to the matters released up and until Employee signs this Agreement. This release does not extend to any obligations incurred under this Agreement. This release does not release claims that cannot be released as a matter of law. Any and all disputed wage claims that are released herein shall be subject to binding arbitration except as required by applicable law. This

release does not extend to any right Employee may have to unemployment compensation benefits or workers’ compensation benefits.

6.California Civil Code Section 1542. Employee acknowledges that Employee has been advised to consult with legal counsel and is familiar with the provisions of California Civil Code Section 1542, a statute that otherwise prohibits the release of unknown claims, which provides as follows:

A GENERAL RELEASE DOES NOT EXTEND TO CLAIMS THAT THE CREDITOR OR RELEASING PARTY DOES NOT KNOW OR SUSPECT TO EXIST IN HIS OR HER FAVOR AT THE TIME OF EXECUTING THE RELEASE AND THAT, IF KNOWN BY HIM OR HER, WOULD HAVE MATERIALLY AFFECTED HIS OR HER SETTLEMENT WITH THE DEBTOR OR RELEASED PARTY.

Employee, being aware of said code section, agrees to expressly waive any rights Employee may have thereunder, as well as under any other statute or common law principles of similar effect.

7.Trade Secrets and Confidential Information/Company Property; Insider Trading Policy. Employee reaffirms and agrees to observe and abide by the terms of the Confidentiality Agreement, including but not limited to the provisions therein regarding nondisclosure of the Company’s trade secrets and confidential and proprietary information. Employee agrees to return, as of a date determined by the CEO, all documents and other items provided to Employee by the Company, developed or obtained by Employee in connection with Employee’s employment with the Company, or otherwise belonging to the Company, including, but not limited to, all passwords to any software or other programs or data that Employee used in performing services for the Company. Employee acknowledges and agrees to comply, at all times, with the terms of the Company’s insider trading policy.

Employee agrees and acknowledges that failure to abide with the covenants in the Confidentiality Agreement and this Agreement would be a basis for the Company to terminate Employee’s employment with the Company prior to the anticipated Separation Date and would result in the Company not being obligated to pay or provide the severance benefits set forth in Section 1.

8.Breach. In addition to the rights provided in the “Attorneys’ Fees” section below, Employee acknowledges and agrees that any material breach of this Agreement (unless such breach constitutes a legal action by Employee challenging or seeking a determination in good faith of the validity of the waiver under the ADEA), or of any confidentiality provision of the Employment Agreement, shall entitle the Company immediately to recover and/or cease providing the consideration provided to Employee under this Agreement and to obtain damages, except as provided by law, provided, however, that the Company shall not recover One Hundred Dollars ($100.00) of the consideration already paid pursuant to Section 1 of this Agreement, and such amount shall serve as full and complete consideration for the promises and obligations assumed by Employee under this Agreement and the Confidentiality Agreement.

9.No Admission of Liability. Employee understands and acknowledges that this Agreement constitutes a compromise and settlement of any and all actual or potential disputed claims by Employee. No action taken by the Company hereto, either previously or in connection with this Agreement, shall be deemed or construed to be (a) an admission of the truth or falsity of any actual or potential claims or (b) an acknowledgment or admission by the Company of any fault or liability whatsoever to Employee or to any third party.

10.Costs. The Parties shall each bear their own costs, attorneys’ fees, and other fees incurred in connection with the preparation of this Agreement.

11.Tax Consequences. The Company makes no representations or warranties with respect to the tax consequences of the payments and any other consideration provided to Employee or made on Employee’s behalf under the terms of this Agreement or the Supplemental Release. Employee

agrees and understands that Employee is responsible for payment, if any, of local, state, and/or federal taxes on the payments and any other consideration provided hereunder by the Company and any penalties or assessments thereon. Employee further agrees to indemnify and hold the Releasees harmless from any claims, demands, deficiencies, penalties, interest, assessments, executions, judgments, or recoveries by any government agency against the Company for any amounts claimed due on account of (a) Employee’s failure to pay or delayed payment of, federal or state taxes, or (b) damages sustained by the Company by reason of any such claims, including attorneys’ fees and costs.

12.Section 409A. It is intended that this Agreement complies with, or is exempt from, Internal Revenue Code Section 409A and the final regulations and official guidance thereunder (“Section 409A”) and any ambiguities herein will be interpreted to so comply and/or be exempt from Section 409A. Each payment and benefit to be paid or provided under this Agreement is intended to constitute a series of separate payments for purposes of Section 1.409A-2(b)(2) of the Treasury Regulations. The Company and Employee will work together in good faith to consider either (i) amendments to this Agreement; or (ii) revisions to this Agreement with respect to the payment of any awards, which are necessary or appropriate to avoid imposition of any additional tax or income recognition prior to the actual payment to Employee under Section 409A. In no event will the Releasees reimburse Employee for any taxes that may be imposed on Employee as a result of Section 409A.

13.Authority. The Company represents and warrants that the undersigned has the authority to act on behalf of the Company and to bind the Company and all who may claim through it to the terms and conditions of this Agreement. Employee represents and warrants that Employee has the capacity to act on Employee’s own behalf and on behalf of all who might claim through Employee to bind them to the terms and conditions of this Agreement. Each Party warrants and represents that there are no liens or claims of lien or assignments in law or equity or otherwise of or against any of the claims or causes of action released herein.

14.Protected Activity Not Prohibited. Employee understands that nothing in this Agreement shall in any way limit or prohibit Employee from engaging in any Protected Activity. Protected Activity includes: (i) filing and/or pursuing a charge, complaint, or report with, or otherwise communicating, cooperating, or participating in any investigation or proceeding that may be conducted by any federal, state or local government agency or commission, including the Securities and Exchange Commission, the Equal Employment Opportunity Commission, the Occupational Safety and Health Administration, and the National Labor Relations Board (“Government Agencies”); and/or (ii) discussing or disclosing information about unlawful acts in the workplace, such as harassment or discrimination or any other conduct that Employee has reason to believe is unlawful; (iii) disclosing or discussing the terms, wages, and working conditions of Employee’s employment as protected by applicable law. Employee understands that in connection with such Protected Activity, Employee is permitted to disclose documents or other information as permitted by law, without giving notice to, or receiving authorization from, the Company. Notwithstanding the foregoing, Employee agrees to take all reasonable precautions to prevent any unauthorized use or disclosure of any Company trade secrets, proprietary information, or confidential information that does not involve unlawful acts in the workplace or the activity otherwise protected herein. Employee further understands that Protected Activity does not include the disclosure of any Company attorney-client privileged communications or attorney work product. Any language in the Confidentiality Agreement regarding Employee’s right to engage in Protected Activity that conflicts with, or is contrary to, this section is superseded by this Agreement. In addition, pursuant to the Defend Trade Secrets Act of 2016, Employee is notified that an individual will not be held criminally or civilly liable under any federal or state trade secret law for the disclosure of a trade secret that (i) is made in confidence to a federal, state, or local government official (directly or indirectly) or to an attorney solely for the purpose of reporting or investigating a suspected violation of law, or (ii) is made in a complaint or other document filed in a lawsuit or other proceeding, if (and only if) such filing is made under seal.

In addition, an individual who files a lawsuit for retaliation by an employer for reporting a suspected violation of law may disclose the trade secret to the individual’s attorney and use the trade secret information in the court proceeding, if the individual files any document containing the trade secret under seal and does not disclose the trade secret, except pursuant to court order.

15.No Litigation Assistance. Employee represents that Employee has no lawsuits, claims, or actions pending in Employee’s name, or on behalf of any other person or entity, against the Company or any of the other Releasees. Employee agrees not to commence, maintain, prosecute or participate in (except as may be required by law, pursuant to court order, or in response to a valid subpoena) any action, charge, complaint, or proceeding of any kind (on Employee’s own behalf and/or on behalf of any other person or entity and/or on behalf of or as a member of any alleged class of persons) in any court, or before any administrative or investigative body or agency (whether public, quasi-public or private) against the Company or any other Releasee’s with respect to any act, omission, transaction or occurrence arising out of Employee’s employment at the Company. To the extent Employee is permitted by law to exercise rights in a government agency forum, by signing this Agreement, Employee understands that Employee is waiving Employee's right to receive monetary relief based on claims asserted in any such agency proceeding, except where such a waiver is prohibited, such as Employee's right to receive an award for information provided to any government agencies.

16.Cooperation. Through the Separation Date and during the one (1) year period following the Employee’s execution of this Agreement, Employee agrees to make himself reasonably available to and cooperate with the Company in any manner requested by the Company. Employee understands and agrees that his cooperation would include, but not be limited to, timely responding to emails from the Company; answering questions from the Company in a timely, truthful, and complete manner; meeting with Company representatives and agents at reasonable times for regular business needs and litigation needs; volunteering to the Company any pertinent information; and providing to the Company all relevant documents that are or may come into his possession or under his control. Employee understands that in the event the Company asks for his cooperation in accordance with the terms of this paragraph, no additional compensation will be provided, however, the Company will reimburse Employee solely for reasonable and necessary expenses upon prior approval and submission of appropriate documentation.

17.No Representations. Employee represents that Employee has had an opportunity to consult with an attorney, and has carefully read and understands the scope and effect of the provisions of this Agreement. Employee represents that this Agreement is executed freely and voluntarily without coercion. Employee has not relied upon any representations or statements made by the Company that are not specifically set forth in this Agreement.

18.Return of Property. Employee’s signature below constitutes Employee’s certification under penalty of perjury that Employee has returned all documents and other items provided to Employee by the Company, developed or obtained by Employee in connection with Employee’s employment with the Company, or otherwise belonging to the Company (whether physical, electronic, or otherwise), including but not limited to any computer, laptop, tablet, mobile phone, or other device; remote access device; security badge or other access device or mechanism; hard drive, thumb drive, or other storage device; garage pass; or any other hardware, software, or other item of Company property, as well as all passwords to any software or other programs or data that Employee used in performing services for the Company; and Employee further certifies that Employee has searched all of Employee’s physical and electronic property for such property and information and that Employee has not retained, and has returned to the Company, any such property or information (including any electronic or archival copies that may be incidentally retained).

19.ARBITRATION. EXCEPT AS PROHIBITED BY LAW, THE PARTIES AGREE THAT ANY AND ALL DISPUTES ARISING OUT OF THE TERMS OF THE TRANSITION AGREEMENT

OR THIS SUPPLEMENTAL RELEASE, THEIR INTERPRETATION, EMPLOYEE’S EMPLOYMENT WITH THE COMPANY OR THE TERMS THEREOF, OR ANY OF THE MATTERS HEREIN RELEASED, SHALL BE SUBJECT TO ARBITRATION PURSUANT TO THE FEDERAL ARBITRATION ACT (9 U.S.C. § 1, ET SEQ.) (THE “FAA”), AND THAT THE FAA SHALL GOVERN AND APPLY TO THIS ARBITRATION AGREEMENT WITH FULL FORCE AND EFFECT; HOWEVER, WITHOUT LIMITING ANY PROVISIONS OF THE FAA, A MOTION OR PETITION OR ACTION TO COMPEL ARBITRATION MAY ALSO BE BROUGHT IN STATE COURT UNDER THE PROCEDURAL PROVISIONS OF SUCH STATE’S LAWS RELATING TO MOTIONS OR PETITIONS OR ACTIONS TO COMPEL ARBITRATION. EMPLOYEE AGREES THAT, TO THE FULLEST EXTENT PERMITTED BY LAW, EMPLOYEE MAY BRING ANY SUCH ARBITRATION PROCEEDING ONLY IN EMPLOYEE’S INDIVIDUAL CAPACITY. ANY ARBITRATION WILL OCCUR IN SANTA BARBARA COUNTY, CALIFORNIA, BEFORE JAMS, PURSUANT TO ITS EMPLOYMENT ARBITRATION RULES & PROCEDURES (“JAMS RULES”), EXCEPT AS EXPRESSLY PROVIDED IN THIS “ARBITRATION” SECTION. THE PARTIES AGREE THAT THE ARBITRATOR SHALL HAVE THE POWER TO DECIDE ANY MOTIONS BROUGHT BY ANY PARTY TO THE ARBITRATION, INCLUDING MOTIONS FOR SUMMARY JUDGMENT AND/OR ADJUDICATION, AND MOTIONS TO DISMISS AND DEMURRERS, APPLYING THE STANDARDS SET FORTH UNDER THE CALIFORNIA CODE OF CIVIL PROCEDURE. THE PARTIES AGREE that the arbitrator shall issue a written decision on the merits. THE PARTIES ALSO AGREE THAT THE ARBITRATOR SHALL HAVE THE POWER TO AWARD ANY REMEDIES AVAILABLE UNDER APPLICABLE LAW, AND THAT THE ARBITRATOR MAY AWARD ATTORNEYS’ FEES AND COSTS TO THE PREVAILING PARTY, WHERE PERMITTED BY APPLICABLE LAW. THE ARBITRATOR MAY GRANT INJUNCTIONS AND OTHER RELIEF IN SUCH DISPUTES. THE DECISION OF THE ARBITRATOR SHALL BE FINAL, CONCLUSIVE, AND BINDING ON THE PARTIES TO THE ARBITRATION. THE PARTIES AGREE THAT THE PREVAILING PARTY IN ANY ARBITRATION SHALL BE ENTITLED TO INJUNCTIVE RELIEF IN ANY COURT OF COMPETENT JURISDICTION TO ENFORCE THE ARBITRATION AWARD. THE PARTIES TO THE ARBITRATION SHALL EACH PAY AN EQUAL SHARE OF THE COSTS AND EXPENSES OF SUCH ARBITRATION, AND EACH PARTY SHALL SEPARATELY PAY FOR ITS RESPECTIVE COUNSEL FEES AND EXPENSES; PROVIDED, HOWEVER, THAT THE ARBITRATOR MAY AWARD ATTORNEYS’ FEES AND COSTS TO THE PREVAILING PARTY, EXCEPT AS PROHIBITED BY LAW. THE PARTIES HEREBY AGREE TO WAIVE THEIR RIGHT TO HAVE ANY DISPUTE BETWEEN THEM RESOLVED IN A COURT OF LAW BY A JUDGE OR JURY. NOTWITHSTANDING THE FOREGOING, THIS “ARBITRATION” SECTION WILL NOT PREVENT EITHER PARTY FROM SEEKING INJUNCTIVE RELIEF (OR ANY OTHER PROVISIONAL REMEDY) FROM ANY COURT HAVING JURISDICTION OVER THE PARTIES AND THE SUBJECT MATTER OF THEIR DISPUTE RELATING TO THE TRANSITION AGREEMENT, THIS SUPPLEMENTAL RELEASE, AND THE AGREEMENTS INCORPORATED THEREIN AND HEREIN BY REFERENCE. SHOULD ANY PART OF THE ARBITRATION AGREEMENT CONTAINED IN THIS PARAGRAPH CONFLICT WITH ANY OTHER ARBITRATION AGREEMENT BETWEEN THE PARTIES, THE PARTIES AGREE THAT THIS ARBITRATION AGREEMENT SHALL GOVERN.

20.Severability. In the event that any provision or any portion of any provision of this Agreement, or any surviving agreement made a part hereof becomes or is declared by a court of competent jurisdiction or arbitrator to be illegal, unenforceable, or void, this Agreement shall continue in full force and effect without said provision or portion of provision.

21.Attorneys’ Fees. Except with regard to a legal action challenging or seeking a determination in good faith of the validity of the ADEA waiver, in the event that either Party brings an action to

enforce or effect its rights under this Agreement, the prevailing Party shall be entitled to recover its costs and expenses, including the costs of mediation, arbitration, litigation, court fees, and reasonable attorneys’ fees incurred in connection with such an action.

22.Entire Agreement. This Agreement represents the entire agreement and understanding between the Company and Employee concerning the subject matter of this Agreement and Employee’s employment with and separation from the Company and the events leading thereto and associated therewith, and supersedes and replaces any and all prior agreements and understandings concerning the subject matter of this Agreement and Employee’s relationship with the Company (including, for example, the Employment Agreement), but with the exception of the Confidentiality Agreement and the Stock Agreements.

23.No Assignments or Oral Modification. Employee represents and warrants that Employee has the capacity to act on Employee’s own behalf and on behalf of all who might claim through Employee to bind them to the terms and conditions of this Agreement. Employee warrants and represents that there are no liens or claims of lien or assignments in law or equity or otherwise of or against any of the claims or causes of action released herein. This Agreement may only be amended in a writing signed by Employee and the person signing on behalf of the Company below (or such other representative of the Company specifically authorized to agree to modifications of this Agreement).

24.Governing Law. This Agreement shall be governed by the laws of the State of California without regard for choice-of-law provisions.

25.Effective Date. Employee understands that this Agreement shall be null and void if not executed by Employee and received by the Company on or before August 9, 2024, which is at least 21 days for Employee to review and consider its terms. This Agreement will become effective on the expiration of the Revocation Period, provided it has been signed by both Parties (the “Effective Date”). In the event Employee signs this Agreement and returns it to the Company prior to the deadline set forth above, Employee hereby acknowledges that Employee has knowingly and voluntarily chosen to waive the time period allotted for considering this Agreement.

26.Counterparts. This Agreement may be executed in counterparts and by facsimile, and each counterpart and facsimile shall have the same force and effect as an original and shall constitute an effective, binding agreement on the part of each of the undersigned.

27.Consideration and Revocation Period. Employee understands and acknowledges that Employee is waiving and releasing any rights Employee may have (including those under the Age Discrimination in Employment Act of 1967 (“ADEA”)), and that this waiver and release is knowing and voluntary. Employee understands and agrees that this waiver and release does not apply to any rights or claims that may arise under the ADEA after the date Employee signs this Agreement. Employee understands and acknowledges that the consideration given for this waiver and release is in addition to anything of value to which Employee was already entitled. Employee further understands and acknowledges that Employee has been advised by this writing that: (a) Employee should consult with an attorney prior to executing this Agreement; (b) Employee has twenty-one (21) days within which to consider this Agreement; (c) Employee has seven (7) days following Employee’s execution of this Agreement to revoke this Agreement in writing to Jennifer Yi Boyer at jennifer.yiboyer@inogen.net (“Revocation Period”); (d) this Agreement shall not be effective until after the Revocation Period has expired; and (e) nothing in this Agreement prevents or precludes Employee from challenging or seeking a determination in good faith of the validity of this waiver under the ADEA, nor does it impose any condition precedent, penalties, or costs for doing so, unless specifically authorized by federal law. In the event Employee signs this Agreement and returns it to the Company in less than the 21-day period identified above, Employee hereby acknowledges that Employee has knowingly, freely and voluntarily chosen to waive the time period allotted for considering this Agreement. Employee acknowledges and understands that any revocation of this Agreement must be accomplished by a written notification to the person executing

this Agreement on the Company’s behalf that is received prior to the Effective Date. The Parties agree that changes, whether material or immaterial, do not restart the running of the 21-day review period.

Employee and the Company expressly declare and represent that they have read and understood the meaning of the terms and conditions contained in this Agreement, and that they have had the opportunity to consult with legal counsel prior to executing this Agreement. Employee may not sign this Agreement prior to the Separation Date and this Agreement will expire if not executed by August 9, 2024.

Employee and the Company further declare and

IN WITNESS WHEREOF, the Parties have executed this Agreement on the respective dates set forth below.

|

|

|

|

|

|

|

|

|

|

|

|

Dated: July 19, 2024 |

|

/s/ Jason Somer |

|

|

JASON SOMER, an individual |

|

|

|

|

|

|

|

|

INOGEN, INC. |

|

|

|

|

|

|

Dated: July 26, 2024 |

|

By: /s/ Jennifer Yi Boyer |

|

|

Jennifer Yi Boyer |

|

|

Chief Human Resources Officer |

|

|

|

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

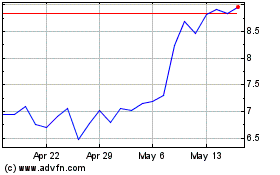

Inogen (NASDAQ:INGN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Inogen (NASDAQ:INGN)

Historical Stock Chart

From Nov 2023 to Nov 2024