News Summary

- Fourth-quarter revenue was $14.3 billion, down 7%

year-over-year (YoY). Full-year revenue was $53.1 billion, down 2%

YoY.

- Fourth-quarter earnings per share (EPS) attributable to Intel

was $(0.03); non-GAAP EPS attributable to Intel was $0.13.

Full-year EPS attributable to Intel was $(4.38); non-GAAP EPS

attributable to Intel was $(0.13).

- Forecasting first-quarter 2025 revenue of $11.7 billion to

$12.7 billion; expecting first-quarter EPS attributable to Intel of

$(0.27) and non-GAAP EPS attributable to Intel of $0.00.

Intel Corporation today reported fourth-quarter and full-year

2024 financial results.

“The fourth quarter was a positive step forward as we delivered

revenue, gross margin and EPS above our guidance,” said Michelle

Johnston Holthaus, interim co-CEO of Intel and CEO of Intel

Products. “Our renewed focus on strengthening and simplifying our

product portfolio, combined with continued progress on our process

roadmap, is positioning us to better serve the needs of our

customers. Dave and I are taking actions to enhance our competitive

position and create shareholder value.”

“The cost reduction plan we announced last year to improve the

trajectory of the company is having an impact,” said David Zinsner,

interim co-CEO and chief financial officer of Intel. “We are

fostering a culture of efficiency across the business while driving

toward greater returns on our invested capital and improved

profitability. Our Q1 outlook reflects seasonal weakness magnified

by macro uncertainties, further inventory digestion and competitive

dynamics. We will remain highly focused on execution to build on

our progress and unlock value.”

Q4 2024 Financial Results

GAAP

Non-GAAP

Q4 2024

Q4 2023

vs. Q4 2023

Q4 2024

Q4 2023

vs. Q4 2023

Revenue ($B)

$14.3

$15.4

down 7%

Gross margin

39.2%

45.7%

down 6.5 ppts

42.1%

48.8%

down 6.7 ppts

R&D and MG&A ($B)

$5.1

$5.6

down 9%

$4.6

$4.9

down 6%

Operating margin (loss)

2.9%

16.8%

down 13.9 ppts

9.6%

16.7%

down 7.1 ppts

Tax rate

125.5%

4.6%

up 120.9 ppts

13.0%

13.0%

—

Net income (loss) attributable to Intel

($B)

$(0.1)

$2.7

down 105%

$0.6

$2.3

down 75%

Earnings (loss) per share attributable to

Intel—diluted

$(0.03)

$0.63

down 105%

$0.13

$0.54

down 76%

In the fourth quarter, the company generated $3.2 billion in

cash from operations.

Full reconciliations between GAAP and non-GAAP measures are

provided below.

Full-Year 2024 Financial

Results

GAAP

Non-GAAP

2024

2023

vs. 2023

2024

2023

vs. 2023

Revenue ($B)

$53.1

$54.2

down 2%

Gross margin

32.7%

40.0%

down 7.3 ppts

36.0%

43.6%

down 7.6 ppts

R&D and MG&A ($B)

$22.1

$21.7

up 2%

$19.4

$19.0

up 2%

Operating margin (loss)

(22.0)%

0.2%

down 22.2 ppts

(0.5)%

8.6%

down 9.1 ppts

Tax rate

71.6%

(119.8)%

up 191.4 ppts

13.0%

13.0%

—

Net income (loss) attributable to Intel

($B)

$(18.8)

$1.7

n/m*

$(0.6)

$4.4

down 113%

Earnings (loss) per share attributable to

Intel—diluted

$(4.38)

$0.40

n/m*

$(0.13)

$1.05

down 112%

For the full year, the company generated $8.3 billion in cash

from operations and paid dividends of $1.6 billion.

*

Not meaningful

Business Unit Summary

In October 2022, Intel announced an internal foundry operating

model, which took effect in the first quarter of 2024 and created a

foundry relationship between its Intel Products business

(collectively CCG, DCAI and NEX) and its Intel Foundry business

(including Foundry Technology Development, Foundry Manufacturing

and Supply Chain, and Foundry Services, formerly IFS). The foundry

operating model is designed to reshape operational dynamics and

drive greater transparency, accountability, and focus on costs and

efficiency. In furtherance of Intel's internal foundry operating

model, Intel announced in the third quarter of 2024 its intent to

establish Intel Foundry as an independent subsidiary. The company

also previously announced its intent to operate Altera® as a

standalone business. Altera was previously included in DCAI's

segment results and, beginning in the first quarter of 2024, is

included in "all other." As a result of these changes, the company

modified its segment reporting in the first quarter of 2024 to

align to this new operating model. All prior-period segment data

has been retrospectively adjusted to reflect the way the company

internally receives information and manages and monitors its

operating segment performance starting in fiscal year 2024. There

are no changes to Intel’s consolidated financial statements for any

prior periods.

Business Unit Revenue and

Trends

Q4 2024

vs. Q4 2023

2024

vs. 2023

Intel Products:

Client Computing Group (CCG)

$8.0 billion

down

9

%

$30.3 billion

up

4

%

Data Center and AI (DCAI)

$3.4 billion

down

3

%

$12.8 billion

up

1

%

Network and Edge (NEX)

$1.6 billion

up

10

%

$5.8 billion

up

1

%

Total Intel Products revenue

$13.0 billion

down

6

%

$48.9 billion

up

3

%

Intel Foundry

$4.5 billion

down

13

%

$17.5 billion

down

7

%

All other

$1.0 billion

down

20

%

$3.8 billion

down

32

%

Intersegment eliminations

$(4.3) billion

$(17.2) billion

Total net revenue

$14.3 billion

down

7

%

$53.1 billion

down

2

%

Intel Products Highlights

- CCG: Intel continues to lead the AI PC category. The

company is on track to ship more than 100 million AI PCs by the end

of 2025, and is working with more than 200 ISVs across more than

400 features to optimize their software on Intel silicon. At CES,

Intel introduced the Intel® Core™ Ultra 200V series mobile

processors with Intel vPro®, empowering businesses with AI-driven

productivity and enhanced IT management. The company also unveiled

the Intel® Core™ Ultra 200H and HX series mobile processors,

delivering industry-leading performance, efficiency and platform

capabilities, alongside a landmark reduction in power usage. Intel

expects to further strengthen its client roadmap with the launch of

Panther Lake, its lead product on the Intel 18A process technology,

in the second half of 2025.

- DCAI: Intel collaborated with Dell Technologies on the

Dell PowerEdge XE7740 server, which uses dual Intel® Xeon® 6 with

Performance-cores and up to eight double-wide accelerators,

including Intel® Gaudi® 3 AI accelerators. Intel also showcased its

MRDIMMs memory technology, the fastest memory system ever created,

in Intel® Xeon® 6 data center processors, achieving a significant

increase in bandwidth that would normally take multiple generations

to reach.

- NEX: At CES, Intel launched a new line of Intel® Core™

Ultra processors for edge computing, prioritizing scalability and

performance across various AI applications.

- Intel and AMD are seeing strong engagement from the x86

Ecosystem Advisory Group. Following the group’s inaugural meeting

this month at Intel's headquarters, Intel and AMD initiated work to

drive key architectural features that enable compatibility across

platforms, simplify software development and support needs of

developers.

Intel Foundry Highlights

- In December, Intel Foundry achieved full tape-out of an Intel

16-based design for an external customer, with plans for volume

manufacturing later this year at Intel Ireland, the company's lead

European wafer fabrication center.

- Process tool installation is underway in Fab 52 in Arizona in

support of ramping Intel 18A production this year.

- Intel signed a definitive agreement with the U.S. Department of

Commerce awarding the company up to $7.86 billion in direct funding

under the U.S. CHIPS and Science Act. Intel achieved initial

milestones, receiving $1.1 billion in the fourth quarter of 2024

and $1.1 billion in January 2025. The CHIPs agreement supports

Intel’s essential role in advancing domestic leading-edge

semiconductor R&D and manufacturing that are critical to

economic and national security.

- At IEDM 2024, Intel Foundry’s Technology Research team

demonstrated industry-first advancements in transistor and advanced

packaging technologies that help meet future demands for AI.

Intel Foundry Direct Connect

Event

On April 29, 2025, Intel Foundry will host its annual flagship

event, Intel Foundry Direct Connect, in San Jose, California. The

event will feature talks from Intel leaders, customers, industry

technologists and ecosystem partners as they share details of Intel

Foundry's strategy, process technology, and advanced packaging and

test capabilities. The event will also include an ecosystem

exhibition and networking opportunities. For information about the

event, please visit

https://www.intel.com/content/www/us/en/events/foundry-direct-connect.html.

Business Outlook

Intel's guidance for the first quarter of 2025 includes both

GAAP and non-GAAP estimates as follows:

Q1 2025

GAAP

Non-GAAP

Revenue

$11.7-12.7 billion

Gross Margin

33.8%

36.0%

Tax Rate

(32)%

12%

Earnings (Loss) Per Share Attributable to

Intel—Diluted

$(0.27)

$0.00

Reconciliations between GAAP and non-GAAP financial measures are

included below. Actual results may differ materially from Intel’s

business outlook as a result of, among other things, the factors

described under “Forward-Looking Statements” below. The gross

margin and EPS outlooks are based on the mid-point of the revenue

range.

Earnings Webcast

Intel will hold a public webcast at 2 p.m. PST today to discuss

the results for its fourth quarter of 2024. The live public webcast

can be accessed on Intel's Investor Relations website at

www.intc.com. The corresponding earnings presentation and webcast

replay will also be available on the site.

Forward-Looking Statements

This release contains forward-looking statements that involve a

number of risks and uncertainties. Words such as "accelerate",

"achieve", "aim", "ambitions", "anticipate", "believe",

"committed", "continue", "could", "designed", "estimate", "expect",

"forecast", "future", "goals", "grow", "guidance", "intend",

"likely", "may", "might", "milestones", "next generation",

"objective", "on track", "opportunity", "outlook", "pending",

"plan", "position", "possible", "potential", "predict", "progress",

"ramp", "roadmap", "seek", "should", "strive", "targets", "to be",

"upcoming", "will", "would", and variations of such words and

similar expressions are intended to identify such forward-looking

statements, which may include statements regarding:

- our business plans, strategy and leadership and anticipated

benefits therefrom, including with respect to our foundry strategy,

Smart Capital strategy, partnerships with Apollo and Brookfield, AI

strategy, organizational structure, and management, including our

search for a new CEO;

- projections of our future financial performance, including

future revenue, gross margins, capital expenditures, profitability,

and cash flows;

- future cash requirements, the availability, uses, sufficiency,

and cost of capital resources, and sources of funding, including

for future capital and R&D investments and for returns to

stockholders, and credit ratings expectations;

- future products, services, and technologies, and the expected

goals, timeline, ramps, progress, availability, production,

regulation, and benefits of such products, services, and

technologies, including future process nodes and packaging

technology, product roadmaps, schedules, future product

architectures, expectations regarding process performance, per-watt

parity, and metrics, and expectations regarding product and process

competitiveness;

- projected manufacturing capacities, volumes, costs, and yield

trends;

- internal and external manufacturing plans, including

manufacturing expansion projects and the financing therefor;

- supply expectations, including regarding constraints,

limitations, pricing, and industry shortages;

- plans and goals related to Intel's foundry business, including

with respect to anticipated governance, customers, future

manufacturing capacity, and service, technology, and IP

offerings;

- expected timing and impact of acquisitions, divestitures, and

other significant transactions, including the sale of our NAND

memory business;

- expected timing, completion and impacts of restructuring

activities and cost-saving or efficiency initiatives;

- future social and environmental performance goals, measures,

strategies, and results;

- our anticipated growth, future market share, and trends in our

businesses and operations;

- projected growth and trends in markets relevant to our

businesses;

- expectations regarding CHIPS Act funding and other governmental

awards or potential future governmental incentives;

- future technology trends and developments, such as AI;

- future macro environmental and economic conditions;

- geopolitical tensions and conflicts and their potential impact

on our business;

- tax- and accounting-related expectations;

- expectations regarding our relationships with certain

sanctioned parties; and

- other characterizations of future events or circumstances.

Such statements involve many risks and uncertainties that could

cause our actual results to differ materially from those expressed

or implied, including those associated with:

- the high level of competition and rapid technological change in

our industry;

- the significant long-term and inherently risky investments we

are making in R&D and manufacturing facilities that may not

realize a favorable return;

- the complexities and uncertainties in developing and

implementing new semiconductor products and manufacturing process

technologies;

- implementing new business strategies and investing in new

businesses and technologies;

- our ability to time and scale our capital investments

appropriately and successfully secure favorable alternative

financing arrangements and government grants;

- changes in demand for our products and the margins we are able

to make on them;

- macroeconomic conditions and geopolitical tensions and

conflicts, including geopolitical and trade tensions between the US

and China, tensions and conflict affecting Israel and the Middle

East, rising tensions between mainland China and Taiwan, and the

impacts of Russia's war on Ukraine;

- the evolving market for products with AI capabilities;

- our complex global supply chain, including from disruptions,

delays, trade tensions and conflicts, or shortages;

- product defects, errata, and other product issues, particularly

as we develop next-generation products and implement

next-generation manufacturing process technologies;

- potential security vulnerabilities in our products;

- increasing and evolving cybersecurity threats and privacy

risks;

- IP risks, including related litigation and regulatory

proceedings;

- the ongoing need to attract, retain, and motivate key talent,

including engineering and management talent, as we have undertaken

multiple significant headcount reductions and had significant

management changes in the last few years, including our CEO;

- strategic transactions and investments;

- sales-related risks, including customer concentration and the

use of distributors and other third parties;

- our debt obligations and our ability to access sources of

capital;

- our having ceased to return capital to stockholders;

- complex and evolving laws and regulations across many

jurisdictions;

- fluctuations in currency exchange rates;

- changes in our effective tax rate;

- environmental, health, safety, and product regulations;

- our initiatives and new legal requirements with respect to

corporate responsibility matters; and

- other risks and uncertainties described in this release, our

2024 Form 10-K, and our other filings with the SEC.

Given these risks and uncertainties, readers are cautioned not

to place undue reliance on such forward-looking statements. Readers

are urged to carefully review and consider the various disclosures

made in this release and in other documents we file from time to

time with the SEC that disclose risks and uncertainties that may

affect our business.

Unless specifically indicated otherwise, the forward-looking

statements in this release do not reflect the potential impact of

any divestitures, mergers, acquisitions, or other business

combinations that have not been completed as of the date of this

filing. In addition, the forward-looking statements in this release

are based on management's expectations as of the date of this

release, unless an earlier date is specified, including

expectations based on third-party information and projections that

management believes to be reputable. We do not undertake, and

expressly disclaim any duty, to update such statements, whether as

a result of new information, new developments, or otherwise, except

to the extent that disclosure may be required by law.

About Intel

Intel (Nasdaq: INTC) is an industry leader, creating

world-changing technology that enables global progress and enriches

lives. Inspired by Moore’s Law, we continuously work to advance the

design and manufacturing of semiconductors to help address our

customers’ greatest challenges. By embedding intelligence in the

cloud, network, edge and every kind of computing device, we unleash

the potential of data to transform business and society for the

better. To learn more about Intel’s innovations, go to

newsroom.intel.com and intel.com.

© Intel Corporation. Intel, the Intel logo, and other Intel

marks are trademarks of Intel Corporation or its subsidiaries.

Other names and brands may be claimed as the property of

others.

Intel Corporation

Consolidated Statements of Income

and Other Information

Three Months Ended

Twelve Months Ended

(In Millions, Except Per Share Amounts;

Unaudited)

Dec 28, 2024

Dec 30, 2023

Dec 28, 2024

Dec 30, 2023

Net revenue

$

14,260

$

15,406

$

53,101

$

54,228

Cost of sales

8,676

8,359

35,756

32,517

Gross margin

5,584

7,047

17,345

21,711

Research and development

3,876

3,987

16,546

16,046

Marketing, general, and administrative

1,239

1,617

5,507

5,634

Restructuring and other charges

57

(1,142

)

6,970

(62

)

Operating expenses

5,172

4,462

29,023

21,618

Operating income (loss)

412

2,585

(11,678

)

93

Gains (losses) on equity investments,

net

316

86

242

40

Interest and other, net

(129

)

117

226

629

Income (loss) before taxes

599

2,788

(11,210

)

762

Provision for (benefit from) taxes

752

128

8,023

(913

)

Net income (loss)

(153

)

2,660

(19,233

)

1,675

Less: net income (loss) attributable to

non-controlling interests

(27

)

(9

)

(477

)

(14

)

Net income (loss) attributable to

Intel

$

(126

)

$

2,669

$

(18,756

)

$

1,689

Earnings (loss) per share attributable

to Intel—basic

$

(0.03

)

$

0.63

$

(4.38

)

$

0.40

Earnings (loss) per share attributable

to Intel—diluted

$

(0.03

)

$

0.63

$

(4.38

)

$

0.40

Weighted average shares of common stock

outstanding:

Basic

4,319

4,222

4,280

4,190

Diluted

4,319

4,260

4,280

4,212

Three Months Ended

(In Millions; Unaudited)

Dec 28, 2024

Dec 30, 2023

Earnings per share of common stock

information:

Weighted average shares of common stock

outstanding—basic

4,319

4,222

Dilutive effect of employee equity

incentive plans

—

38

Weighted average shares of common stock

outstanding—diluted

4,319

4,260

Other information:

(In Thousands; Unaudited)

Dec 28, 2024

Sep 28, 2024

Dec 30, 2023

Employees

Intel

99.5

115.0

116.2

Mobileye and other subsidiaries

5.4

5.4

5.0

NAND1

4.0

3.7

3.6

Total Intel

108.9

124.1

124.8

1

Employees of the NAND memory business,

which we divested to SK hynix on completion of the first closing on

Dec. 29, 2021, and fully deconsolidated in Q1 2022. Upon completion

of the second closing of the divestiture, which remains pending and

subject to closing conditions, the NAND employees will be excluded

from the total Intel employee number.

Intel Corporation

Consolidated Balance Sheets

(In Millions, Except Par Value;

Unaudited)

Dec 28, 2024

Dec 30, 2023

Assets

Current assets:

Cash and cash equivalents

$

8,249

$

7,079

Short-term investments

13,813

17,955

Accounts receivable, net

3,478

3,402

Inventories

Raw materials

1,344

1,166

Work in process

7,432

6,203

Finished goods

3,422

3,758

12,198

11,127

Other current assets

9,586

3,706

Total current assets

47,324

43,269

Property, plant, and equipment,

net

107,919

96,647

Equity investments

5,383

5,829

Goodwill

24,693

27,591

Identified intangible assets,

net

3,691

4,589

Other long-term assets

7,475

13,647

Total assets

$

196,485

$

191,572

Liabilities and stockholders'

equity

Current liabilities:

Accounts payable

12,556

8,578

Accrued compensation and benefits

3,343

3,655

Short-term debt

3,729

2,288

Income taxes payable

1,756

1,107

Other accrued liabilities

14,282

12,425

Total current liabilities

35,666

28,053

Debt

46,282

46,978

Other long-term liabilities

9,505

6,576

Stockholders' equity:

Common stock, $0.001 par value, 10,000

shares authorized; 4,330 shares issued and outstanding (4,228

issued and outstanding in 2023) and capital in excess of par

value

50,949

36,649

Accumulated other comprehensive income

(loss)

(711

)

(215

)

Retained earnings

49,032

69,156

Total Intel stockholders'

equity

99,270

105,590

Non-controlling interests

5,762

4,375

Total stockholders' equity

105,032

109,965

Total liabilities and stockholders'

equity

$

196,485

$

191,572

Intel Corporation

Consolidated Statements of Cash

Flows

Twelve Months Ended

(In Millions; Unaudited)

Dec 28, 2024

Dec 30, 2023

Cash and cash equivalents, beginning of

period

$

7,079

$

11,144

Cash flows provided by (used for)

operating activities:

Net income (loss)

(19,233

)

1,675

Adjustments to reconcile net income (loss)

to net cash provided by operating activities:

Depreciation

9,951

7,847

Share-based compensation

3,410

3,229

Restructuring and other charges

3,491

(424

)

Amortization of intangibles

1,428

1,755

(Gains) losses on equity investments,

net

(246

)

(42

)

Deferred taxes

6,132

(2,033

)

Impairments and net (gain) loss on

retirement of property, plant, and equipment

2,252

33

Changes in assets and liabilities:

Accounts receivable

(75

)

731

Inventories

(1,105

)

2,097

Accounts payable

634

(801

)

Accrued compensation and benefits

(218

)

(614

)

Income taxes

(356

)

(1,498

)

Other assets and liabilities

2,223

(484

)

Total adjustments

27,521

9,796

Net cash provided by (used for)

operating activities

8,288

11,471

Cash flows provided by (used for)

investing activities:

Additions to property, plant, and

equipment

(23,944

)

(25,750

)

Proceeds from capital-related government

incentives

1,936

1,011

Acquisitions, net of cash acquired

(82

)

(13

)

Purchases of short-term investments

(37,940

)

(44,414

)

Maturities and sales of short-term

investments

41,463

44,077

Sales of equity investments

1,047

472

Other investing

(736

)

576

Net cash provided by (used for)

investing activities

(18,256

)

(24,041

)

Cash flows provided by (used for)

financing activities:

Issuance of commercial paper, net of

issuance costs

7,349

—

Repayment of commercial paper

(7,349

)

(3,944

)

Partner contributions

12,714

1,511

Proceeds from sales of subsidiary

shares

—

2,959

Additions to property, plant, and

equipment

(1,178

)

—

Issuance of long-term debt, net of

issuance costs

2,975

11,391

Repayment of debt

(2,288

)

(423

)

Proceeds from sales of common stock

through employee equity incentive plans

987

1,042

Restricted stock unit withholdings

(631

)

(534

)

Payment of dividends to stockholders

(1,599

)

(3,088

)

Other financing

158

(409

)

Net cash provided by (used for)

financing activities

11,138

8,505

Net increase (decrease) in cash and

cash equivalents

1,170

(4,065

)

Cash and cash equivalents, end of

period

$

8,249

$

7,079

Intel Corporation

Supplemental Operating Segment

Results

Three Months Ended

Twelve Months Ended

(In Millions; Unaudited)

Dec 28, 2024

Dec 30, 2023

Dec 28, 2024

Dec 30, 2023

Operating segment revenue:

Intel Products:

Client Computing Group

$

8,017

$

8,844

$

30,290

$

29,258

Data Center and AI

3,387

3,503

12,817

12,635

Network and Edge

1,623

1,471

5,842

5,774

Total Intel Products revenue

13,027

13,818

48,949

47,667

Intel Foundry

4,502

5,175

17,543

18,910

All other1

1,042

1,297

3,824

5,608

Intersegment eliminations

(4,311

)

(4,884

)

(17,215

)

(17,957

)

Total net revenue

$

14,260

$

15,406

$

53,101

$

54,228

Segment operating income

(loss):

Intel Products:

Client Computing Group

$

3,056

$

3,567

$

10,920

$

9,513

Data Center and AI

233

738

1,338

1,620

Network and Edge

340

109

931

204

Total Intel Products operating income

(loss)

3,629

4,414

13,189

11,337

Intel Foundry

(2,260

)

(1,319

)

(13,408

)

(6,955

)

All Other1

118

142

(84

)

1,079

Intersegment eliminations

(281

)

(251

)

(157

)

(203

)

Corporate unallocated

(794

)

(401

)

(11,218

)

(5,165

)

Total operating income (loss)

$

412

$

2,585

$

(11,678

)

$

93

1

The 'All Other' category includes

results from non-reportable segments, including Altera, Mobileye,

startups supporting our initiatives, and historical results from

divested businesses.

Intel Corporation Explanation of Non-GAAP

Measures

In addition to disclosing financial results in accordance with

US GAAP, this document references non-GAAP financial measures

below. We believe these non-GAAP financial measures provide

investors with useful supplemental information about our operating

performance, enable comparison of financial trends and results

between periods where certain items may vary independent of

business performance, and allow for greater transparency with

respect to key metrics used by management in operating our business

and measuring our performance. These non-GAAP financial measures

are used in our performance-based RSUs and our cash bonus

plans.

Our non-GAAP financial measures reflect adjustments based on one

or more of the following items, as well as the related effects to

income taxes and net income (loss) attributable to non-controlling

interests effects. Income tax effects are calculated using a fixed

long-term projected tax rate. For 2024 and 2023, we determined the

projected non-GAAP tax rate to be 13%. For 2025, we determined the

projected non-GAAP tax rate to be 12%. We project this long-term

non-GAAP tax rate on at least an annual basis using a five-year

non-GAAP financial projection that excludes the income tax effects

of each adjustment. The projected non-GAAP tax rate also considers

factors such as our tax structure, our tax positions in various

jurisdictions, and key legislation in significant jurisdictions

where we operate. This long-term non-GAAP tax rate may be subject

to change for a variety of reasons, including the rapidly evolving

global tax environment, significant changes in our geographic

earnings mix, or changes to our strategy or business operations.

Management uses this non-GAAP tax rate in managing internal short-

and long-term operating plans and in evaluating our performance; we

believe this approach facilitates comparison of our operating

results and provides useful evaluation of our current operating

performance. Non-GAAP adjustments attributable to non-controlling

interests are calculated by adjusting for the minority stockholder

portion of non-GAAP adjustments we make for relevant

acquisition-related costs, share-based compensation, restructuring

and other charges, and income tax effects, as applicable to each

majority-owned subsidiary.

Our non-GAAP financial measures should not be considered a

substitute for, or superior to, financial measures calculated in

accordance with US GAAP, and the financial results calculated in

accordance with US GAAP and reconciliations from these results

should be carefully evaluated.

Non-GAAP adjustment or

measure

Definition

Usefulness to management and

investors

Acquisition-related adjustments

Amortization of acquisition-related

intangible assets consists of amortization of intangible assets

such as developed technology, brands, and customer relationships

acquired in connection with business combinations. Charges related

to the amortization of these intangibles are recorded within both

cost of sales and MG&A in our US GAAP financial statements.

Amortization charges are recorded over the estimated useful life of

the related acquired intangible asset, and thus are generally

recorded over multiple years.

We exclude amortization charges for our

acquisition-related intangible assets for purposes of calculating

certain non-GAAP measures because these charges are inconsistent in

size and are significantly impacted by the timing and valuation of

our acquisitions. These adjustments facilitate a useful evaluation

of our current operating performance and comparison to our past

operating performance and provide investors with additional means

to evaluate cost and expense trends.

Share-based compensation

Share-based compensation consists of

charges related to our employee equity incentive plans.

We exclude charges related to share-based

compensation for purposes of calculating certain non-GAAP measures

because we believe these adjustments provide comparability to peer

company results and because these charges are not viewed by

management as part of our core operating performance. We believe

these adjustments provide investors with a useful view, through the

eyes of management, of our core business model, how management

currently evaluates core operational performance, and additional

means to evaluate expense trends, including in comparison to other

peer companies.

Restructuring and other charges

Restructuring charges are costs associated

with a restructuring plan and are primarily related to employee

severance and benefit arrangements. 2024 mainly includes charges

associated with the 2024 Restructuring Plan, primarily composed of

cash-based employee severance and benefit arrangements, and cash

and non-cash charges related to real estate exits and

consolidations, as well as non-cash construction-in-progress asset

impairments resulting from business exit activities. Other charges

include periodic goodwill and asset impairments, and other costs

associated with certain non-core activities. 2024 includes non-cash

charges resulting from the impairment of goodwill and certain

acquired intangible assets. 2023 includes a benefit as a result of

developments in the VLSI litigation and two legal related fees,

which we do not expect to recur, relating to an annulled EC-imposed

fine and a termination fee relating to Tower. 2023 also includes

costs associated with a formal restructuring plan approved in 2022

and are primarily related to employee severance and benefit

arrangements.

We exclude restructuring and other

charges, including any adjustments to charges recorded in prior

periods, for purposes of calculating certain non-GAAP measures

because these costs do not reflect our core operating performance.

These adjustments facilitate a useful evaluation of our core

operating performance and comparisons to past operating results and

provide investors with additional means to evaluate expense

trends.

(Gains) losses on equity investments,

net

(Gains) losses on equity investments, net

consists of ongoing mark-to-market adjustments on marketable equity

securities, observable price adjustments on non-marketable equity

securities, related impairment charges, and the gains (losses) from

the sale of equity investments and other.

We exclude these non-operating gains and

losses for purposes of calculating certain non-GAAP measures to

provide comparability between periods. The exclusion reflects how

management evaluates the core operations of the business.

(Gains) losses from divestiture

(Gains) losses are recognized at the close

of a divestiture, or over a specified deferral period when deferred

consideration is received at the time of closing. Based on our

ongoing obligation under the NAND wafer manufacturing and sale

agreement entered into in connection with the first closing of the

sale of our NAND memory business in 2021, a portion of the initial

closing consideration was deferred and will be recognized between

first and second closing.

We exclude gains or losses resulting from

divestitures for purposes of calculating certain non-GAAP measures

because they do not reflect our current operating performance.

These adjustments facilitate a useful evaluation of our current

operating performance and comparisons to past operating

results.

Interest received related to an annulled

European Commission (EC) fine

Interest received in 2024 related to an

annulled EC-imposed fine that was paid in 2009 and refunded to us

in 2022.

We exclude this non-operating and

non-recurring interest income for purposes of calculating certain

non-GAAP measures because this adjustment facilitates comparison to

past results and provides a useful evaluation of our current

performance.

Deferred tax assets valuation

allowances

A non-cash charge recorded to provision

for (benefit from) income taxes related to a discreet valuation

allowance recorded against our US deferred tax assets.

We excluded a discrete non-cash charge in

2024 related to a valuation allowance established against our US

deferred tax assets due to a historical cumulative loss for GAAP

purposes. We excluded the discreet valuation allowance when

calculating certain non-GAAP measures, as there is no such

historical cumulative loss on a non-GAAP basis. Because of the size

of the charge, the adjustment facilitates a useful evaluation of

our core operating performance and comparisons to our past

operating results.

Adjusted free cash flow

We reference a non-GAAP financial measure

of adjusted free cash flow, which is used by management when

assessing our sources of liquidity, capital resources, and quality

of earnings. Adjusted free cash flow is operating cash flow

adjusted for (1) additions to property, plant, and equipment, net

of proceeds from capital-related government incentives and net

partner contributions, and (2) payments on finance leases.

This non-GAAP financial measure is helpful

in understanding our capital requirements and sources of liquidity

by providing an additional means to evaluate the cash flow trends

of our business.

Net capital spending

We reference a non-GAAP financial measure

of net capital spending, which is additions to property, plant, and

equipment, net of proceeds from capital-related government

incentives and net partner contributions.

We believe this measure provides investors

with useful supplemental information about our capital investment

activities and capital offsets, and allows for greater transparency

with respect to a key metric used by management in operating our

business and measuring our performance.

Intel Corporation Supplemental Reconciliations

of GAAP Actuals to Non-GAAP Actuals

Set forth below are reconciliations of the non-GAAP financial

measure to the most directly comparable US GAAP financial measure.

These non-GAAP financial measures should not be considered a

substitute for, or superior to, financial measures calculated in

accordance with US GAAP, and the reconciliations from US GAAP to

Non-GAAP actuals should be carefully evaluated. Please refer to

"Explanation of Non-GAAP Measures" in this document for a detailed

explanation of the adjustments made to the comparable US GAAP

measures, the ways management uses the non-GAAP measures, and the

reasons why management believes the non-GAAP measures provide

useful information for investors.

Three Months Ended

Twelve Months Ended

(In Millions, Except Per Share Amounts;

Unaudited)

Dec 28, 2024

Dec 30, 2023

Dec 28, 2024

Dec 30, 2023

GAAP gross margin

$

5,584

$

7,047

$

17,345

$

21,711

Acquisition-related adjustments

207

300

879

1,235

Share-based compensation

210

172

875

705

Non-GAAP gross margin

$

6,001

$

7,519

$

19,099

$

23,651

GAAP gross margin percentage

39.2

%

45.7

%

32.7

%

40.0

%

Acquisition-related adjustments

1.5

%

1.9

%

1.7

%

2.3

%

Share-based compensation

1.5

%

1.1

%

1.6

%

1.3

%

Non-GAAP gross margin

percentage

42.1

%

48.8

%

36.0

%

43.6

%

GAAP R&D and MG&A

$

5,115

$

5,604

$

22,053

$

21,680

Acquisition-related adjustments

(41

)

(42

)

(165

)

(172

)

Share-based compensation

(441

)

(623

)

(2,535

)

(2,524

)

Non-GAAP R&D and MG&A

$

4,633

$

4,939

$

19,353

$

18,984

GAAP operating income (loss)

$

412

$

2,585

$

(11,678

)

$

93

Acquisition-related adjustments

248

342

1,044

1,407

Share-based compensation

651

795

3,410

3,229

Restructuring and other charges

57

(1,142

)

6,970

(62

)

Non-GAAP operating income

(loss)

$

1,368

$

2,580

$

(254

)

$

4,667

GAAP operating margin (loss)

2.9

%

16.8

%

(22.0

)%

0.2

%

Acquisition-related adjustments

1.7

%

2.2

%

2.0

%

2.6

%

Share-based compensation

4.6

%

5.2

%

6.4

%

6.0

%

Restructuring and other charges

0.4

%

(7.4

)%

13.1

%

(0.1

)%

Non-GAAP operating margin

9.6

%

16.7

%

(0.5

)%

8.6

%

GAAP tax rate

125.5

%

4.6

%

71.6

%

(119.8

)%

Deferred tax assets valuation

allowance

—

%

—

%

(71.6

)%

—

%

Income tax effects

(112.5

)%

8.4

%

13.0

%

132.8

%

Non-GAAP tax rate

13.0

%

13.0

%

13.0

%

13.0

%

GAAP net income (loss) attributable to

Intel

$

(126

)

$

2,669

$

(18,756

)

$

1,689

Acquisition-related adjustments

248

342

1,044

1,407

Share-based compensation

651

795

3,410

3,229

Restructuring and other charges

57

(1,142

)

6,970

(62

)

(Gains) losses on equity investments,

net

(316

)

(86

)

(242

)

(40

)

(Gains) losses from divestiture

(39

)

(39

)

(156

)

(153

)

Interest received related to an annulled

EC fine

(560

)

—

(560

)

—

Adjustments attributable to

non-controlling interest

(16

)

(18

)

(396

)

(66

)

Deferred tax assets valuation

allowances

—

—

9,925

—

Income tax effects

669

(218

)

(1,805

)

(1,581

)

Non-GAAP net income (loss) attributable

to Intel

$

568

$

2,303

$

(566

)

$

4,423

(In Millions, Except Per Share

Amounts)

Dec 28, 2024

Dec 30, 2023

Dec 28, 2024

Dec 30, 2023

GAAP earnings (loss) per share

attributable to Intel—diluted

$

(0.03

)

$

0.63

$

(4.38

)

$

0.40

Acquisition-related adjustments

0.06

0.08

0.24

0.33

Share-based compensation

0.15

0.18

0.80

0.77

Restructuring and other charges

0.01

(0.27

)

1.63

(0.01

)

(Gains) losses on equity investments,

net

(0.07

)

(0.02

)

(0.06

)

(0.01

)

(Gains) losses from divestiture

(0.01

)

(0.01

)

(0.04

)

(0.04

)

Interest received related to an annulled

EC fine

(0.13

)

—

(0.13

)

—

Adjustments attributable to

non-controlling interest

—

—

(0.09

)

(0.02

)

Deferred tax assets valuation

allowance

—

—

2.32

—

Income tax effects

0.15

(0.05

)

(0.42

)

(0.37

)

Non-GAAP earnings (loss) per share

attributable to Intel—diluted

$

0.13

$

0.54

$

(0.13

)

$

1.05

GAAP net cash provided by (used for)

operating activities

$

3,165

$

4,624

$

8,288

$

11,471

Net purchase of property, plant, and

equipment

(4,667

)

(5,929

)

(10,515

)

(23,228

)

Payments on finance leases

(1

)

—

(1

)

(96

)

Adjusted free cash flow

$

(1,503

)

$

(1,305

)

$

(2,228

)

$

(11,853

)

GAAP net cash provided by (used for)

investing activities

$

(3,764

)

$

(5,318

)

$

(18,256

)

$

(24,041

)

GAAP net cash provided by (used for)

financing activities

$

63

$

152

$

11,138

$

8,505

Intel Corporation Supplemental Reconciliations

of GAAP Outlook to Non-GAAP Outlook

Set forth below are reconciliations of the non-GAAP financial

measure to the most directly comparable US GAAP financial measure.

These non-GAAP financial measures should not be considered a

substitute for, or superior to, financial measures calculated in

accordance with US GAAP, and the financial outlook prepared in

accordance with US GAAP and the reconciliations from this Business

Outlook should be carefully evaluated. Please refer to "Explanation

of Non-GAAP Measures" in this document for a detailed explanation

of the adjustments made to the comparable US GAAP measures, the

ways management uses the non-GAAP measures, and the reasons why

management believes the non-GAAP measures provide useful

information for investors.

Q1 2025 Outlook1

Approximately

GAAP gross margin percentage

33.8

%

Acquisition-related adjustments

0.9

%

Share-based compensation

1.3

%

Non-GAAP gross margin

percentage

36.0

%

GAAP tax rate

(32

)%

Income tax effects

44

%

Non-GAAP tax rate

12

%

GAAP earnings (loss) per share

attributable to Intel—diluted

$

(0.27

)

Acquisition-related adjustments

0.04

Share-based compensation

0.16

Restructuring and other charges

0.02

(Gains) losses from divestiture

(0.01

)

Adjustments attributable to

non-controlling interest

(0.01

)

Income tax effects

0.07

Non-GAAP earnings (loss) per share

attributable to Intel—diluted

$

0.00

1

Non-GAAP gross margin percentage and

non-GAAP earnings (loss) per share attributable to Intel outlook

based on the mid-point of the revenue range.

Intel Corporation Supplemental Reconciliations

of Other GAAP to Non-GAAP Forward-Looking Estimates

Set forth below are reconciliations of the non-GAAP financial

measure to the most directly comparable US GAAP financial measure.

These non-GAAP financial measures should not be considered a

substitute for, or superior to, financial measures calculated in

accordance with US GAAP, and the reconciliations should be

carefully evaluated. Please refer to "Explanation of Non-GAAP

Measures" in this document for a detailed explanation of the

adjustments made to the comparable US GAAP measures, the ways

management uses the non-GAAP measures, and the reasons why

management believes the non-GAAP measures provide useful

information for investors.

(In Billions)

Full-Year 2025

Approximately

GAAP additions to property, plant and

equipment (gross capital expenditures)

$

20.0

Proceeds from capital-related government

incentives

(4.0 - 6.0

)

Partner contributions, net

(4.0 - 5.0

)

Non-GAAP net capital spending

$8.0 - $11.0

GAAP R&D and MG&A

$

20.0

Acquisition-related adjustments

(0.1

)

Share-based compensation

(2.4

)

Non-GAAP R&D and MG&A

$

17.5

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250130580777/en/

Kylie Altman Investor Relations 1-916-356-0320

kylie.altman@intel.com

Sophie Won Metzger Media Relations 1-408-653-0475

sophie.won@intel.com

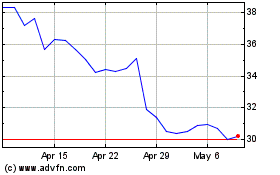

Intel (NASDAQ:INTC)

Historical Stock Chart

From Feb 2025 to Mar 2025

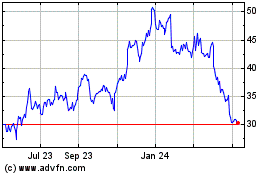

Intel (NASDAQ:INTC)

Historical Stock Chart

From Mar 2024 to Mar 2025