false

0001417926

0001417926

2024-09-25

2024-09-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported) September 25, 2024

INVO

BIOSCIENCE, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-39701 |

|

20-4036208 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

No.) |

5582

Broadcast Court

Sarasota,

FL 34240

(Address

of principal executive offices, including zip code)

(978)

878-9505

(Registrant’s

telephone number, including area code)

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common Stock, $0.0001 par

value |

|

INVO |

|

The Nasdaq Stock Market

LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On

September 25, 2024, INVO Bioscience, Inc. (the “Company”) entered into a Standard Merchant Cash Advance Agreement (the “Agreement”)

with a buyer (the “Buyer”) under which the Buyer purchased $384,250 of the Company’s future sales for a gross purchase

price of $265,000 (the “Transaction”). The Company received net proceeds of $251,750. Until the purchase price has been repaid,

the Company agreed to pay the Buyer $9,606 per week. The Company intends to use the proceeds for working capital and general corporate

purposes.

The

Company received approval from its senior secured lender, Decathlon Alpha V, L.P. (“Decathlon”) to consummate the Transaction

pursuant to an Amended and Restated First Amendment (the “Amendment”) to Revenue Loan and Security Agreement, dated September

29, 2023 between the Company and Decathlon (the “Revenue Loan and Security Agreement”). Pursuant to the Amendment, the minimum

interest multiples set forth in the Revenue Loan and Security Agreement will automatically increase by 0.15x as of December 1, 2024 if

the Company does not receive equity investments in the net amount of $1,000,000 by November 30, 2024.

Decathlon,

the Buyer, and the Company also signed a subordination agreement in which the Buyer subordinated its rights under the transaction to

those of Decathlon.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The

information set forth in Item 1.01 is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Date: October 1, 2024 |

INVO BIOSCIENCE, INC. |

| |

|

| |

/s/ Steven

Shum |

| |

Steven Shum |

| |

Chief Executive Officer |

Exhibit

10.1

Exhibit

10.2

AMENDED

AND RESTATED FIRST AMENDMENT TO REVENUE LOAN AND SECURITY AGREEMENT

This

amended and restated first amendment (this “Restated First Amendment”) to that certain Revenue Loan and Security Agreement

dated September 29, 2023 (the “Agreement”), by and among Steven Shum (“Key Person”), INVO Bioscience

Inc., a Nevada corporation (the “Company”), the Guarantors identified on the signature page hereto, and Decathlon

Alpha V, L.P., a Delaware limited partnership (“Lender”), is effective as of September 24, 2024 (the “Restated

First Amendment Date”). Unless otherwise defined herein, all capitalized terms have the meanings given to them in the Agreement.

The

Company has requested that Lender consent to Company entering into a “Standard Merchant Cash Advance Agreement” with Cedar

Advance LLC to obtain a cash advance in the net amount of $251,750. In connection with and as a

material inducement to Lender to make an accommodation with respect to this request, the Company desires to make amendments to the Agreement

as provided herein.

Provided

that Cedar Advance LLC executes a subordination agreement in form satisfactory to Lender, the Company and Lender hereby agree as follows:

1. Amendments.

1.1. Permitted

Indebtedness. Schedule 11.4 to the Agreement is hereby replaced with Schedule 11.4 attached hereto.

1.2. Permitted

Liens. Schedule 11.5 to the Agreement is hereby replaced with Schedule 11.5 attached hereto.

1.3. Minimum

Interest. If the Company does not receive equity investments during the period between the Restated First Amendment Date and November

30, 2024 in the net amount of $1,000,0000 all minimum Interest multiples on Schedule 11.3 to the Agreement will automatically

increase by 0.15x effective as of December 1, 2024.

2. Transaction

Costs. Pursuant to Section 12.7 of the Agreement, Company will reimburse Lender for all fees and expenses incurred by Lender

relating to this Amendment. Without limiting the foregoing, Company shall pay Lender $750 related to Lender’s fees and expenses

incurred in connection with this Amendment and the subordination agreement between Lender and Cedar Advance LLC.

3. No

Other Changes. In all other respects, the Agreement shall remain in full force and effect.

**

Signatures on following page **

The

parties have executed this Amendment as of the First Amendment Date.

| COMPANY: |

|

| |

|

|

| INVO BIOSCIENCE, INC. |

|

| |

|

|

| By: |

|

|

| |

Steven

Shum, CEO |

|

| |

|

|

| LENDER: |

|

| |

|

|

| DECATHLON ALPHA V, L.P. |

|

| |

|

|

| By: |

Decathlon Alpha GP V, LLC |

|

| |

|

|

| Its: |

General Partner |

|

| |

|

|

| By: |

|

|

| |

Wayne

Cantwell, Managing Director |

|

| |

|

|

| KEY PERSON: |

|

| |

|

|

| By: |

|

|

| |

Steven

Shum |

|

| |

|

|

| GUARANTORS: |

|

| |

|

|

| BIO X CELL INC |

|

| |

|

|

| By: |

|

|

| |

Steve

Shum, President |

|

| |

|

|

| INVO CENTERS LLC |

|

| |

|

|

| By: |

|

|

| |

Steve

Shum, Managing Member |

|

| |

|

|

| WOOD VIOLET FERTILITY LLC |

|

| |

|

|

| By: |

|

|

| |

Steve

Shum, Managing Member |

|

| |

|

|

| FERTILITY LABS OF WISCONSIN LLC |

|

| |

|

|

| By: |

|

|

| |

Steve

Shum, Managing Member |

|

| |

|

|

| ORANGE BLOSSOM FERTILITY LLC |

|

| |

|

|

| By: |

|

|

| |

Steve

Shum, Managing Member |

|

SCHEDULE

11.4

PERMITTED

INDEBTEDNESS

“Permitted

Indebtedness” is:

(a) Company’s

and the Company Entities’ Indebtedness to Lender under this Agreement and the other Transaction Documents;

(b) Current

and future equipment lease financing secured only by a security interest in the financed equipment (the “Permitted Equipment

Leases”);

(c) unsecured

Indebtedness to trade creditors incurred in the ordinary course of business;

(d) Indebtedness

incurred as a result of endorsing negotiable instruments received in the ordinary course of any Company Entity’s business; and

(e) Indebtedness

incurred pursuant to that certain Standard Merchant Cash Advance Agreement between the Company and Cedar Advance LLC dated September

16, 2024 in the “Net Funds Provided” amount of $251,750 (the “Cedar Advance Loan”).

SCHEDULE

11.5

PERMITTED

LIENS

“Permitted

Liens” are:

(a) Liens

existing on the Effective Date and shown on the Perfection Certificates or arising under this Agreement and the other Transaction Documents;

(b) Liens

for taxes, fees, assessments or other government charges or levies, either not delinquent or being contested in good faith and for which

the applicable Company Entity maintains adequate reserves on its books, provided that no notice of any such Lien has been filed or recorded

under the Internal Revenue Code of 1986, as amended , and the Treasury Regulations adopted thereunder;

(c) Liens

securing Permitted Equipment Leases;

(d) statutory

Liens securing claims or demands of materialmen, mechanics, carriers, warehousemen, landlords and other Persons imposed without action

of such parties, provided they have no priority over any of Lender’s Lien and the aggregate amount of such Liens does not exceed

$10,000 at any one time;

(e) leases

or subleases of real property granted in the ordinary course of business, if the leases, subleases, licenses and sublicenses do not prohibit

granting Lender a security interest; and

(f) banker’s

liens, rights of setoff and Liens in favor of financial institutions incurred made in the ordinary course of business arising in connection

with a Company Entity’s deposit accounts or securities accounts held at such institutions to secure solely payment of fees and

similar costs and expenses;

(g) Liens

to secure payment of workers’ compensation, employment insurance, old-age pensions, social security and other like obligations

incurred in the ordinary course of business (other than Liens imposed by ERISA);

(h) Liens

arising from judgments, decrees or attachments in circumstances not constituting an Event of Default under Section 7.4;

(i) easements,

reservations, rights-of-way, restrictions, minor defects or irregularities in title and similar charges or encumbrances affecting real

property not constituting a Material Adverse Effect;

(j) non-exclusive

licenses of intellectual property granted to third parties in the ordinary course of business;

(k) non-exclusive

licenses of intellectual property granted to third parties in the ordinary course of business in connection with joint ventures and corporate

collaborations; and

(l) Liens

securing the Cedar Advance Loan, provided Cedar Advance LLC has executed a subordination agreement in form satisfactory to Lender.

Exhibit

10.3

SUBORDINATION

AGREEMENT

THIS

SUBORDINATION AGREEMENT (this “Agreement”) is made as of September 18, 2024, among:

INVO

BIOSCIENCE INC., a Nevada corporation,

5582

Broadcast Court

Sarasota,

FL 34240

(“Debtor”);

DECATHLON,

ALPHA V L.P., a Delaware limited partnership,

1441

West Ute Boulevard, Suite 240

Park

City, UT 84098

(the

“Senior Creditor”);

and

CEDAR

ADVANCE LLC

5401

Collins Avenue, CU-9A

Miami

Beach, FL 33140

(the

“Subordinating Creditor”).

BACKGROUND

The

Senior Creditor has made certain credit available to Debtor pursuant to a Revenue Loan and Security Agreement dated September 29, 2023

(the “Senior Credit Agreement”), between Debtor and the Senior Creditor.

The

Subordinating Creditor intends to made certain credit available to Debtor pursuant to a Standard Merchant Cash Advance Agreement dated

as of September 20, 2024 (the “MCA Agreement”), between the Debtor and Subordinating Creditor.

AGREEMENT

The

parties agree as follows:

1. Subordination.

Subordinating Creditor hereby subordinates to Senior Creditor any security interest or lien that Subordinating Creditor may have in any

property of Debtor. Notwithstanding the respective dates of attachment or perfection of the security interests of Subordinating Creditor

and the security interests of Senior Creditor, all now existing and hereafter arising security interests of Senior Creditor in any property

of Debtor and all proceeds thereof (the “Collateral”), including, without limitation, the “Collateral,”

as defined in the Senior Credit Agreement, shall at all times be senior to the security interests of Subordinating Creditor. Subordinating

Creditor hereby acknowledges and agrees that (i) Subordinating Creditor shall not contest, challenge or dispute the validity, attachment,

perfection, priority or enforceability of Senior Creditor’s security interest in the Collateral, or the validity, priority or enforceability

of the Senior Debt (as defined below), and (ii) the provisions of this Agreement will apply fully and unconditionally even in the event

that Senior Creditor’s security interest in the Collateral (or any portion thereof) are unperfected or if perfection lapses or

ceases for any reason. All amounts owed by Debtor to Subordinating Creditor, whether currently existing or hereafter arising (the “Subordinated

Debt”), are subordinated in right of payment to all obligations of Debtor to Senior Creditor now existing or hereafter arising,

including, without limitation, the Obligations (as defined in the Senior Credit Agreement), together with all costs of collecting such

obligations (including attorneys’ fees), including, all interest accruing after the commencement by or against Debtor of any bankruptcy,

reorganization or similar proceeding (such obligations, collectively, the “Senior Debt”).

2. No

Actions. Subordinating Creditor will not demand or receive from Debtor (and Debtor will not pay to Subordinating Creditor) all or

any part of the Subordinated Debt, by way of payment, prepayment, setoff, lawsuit or otherwise, nor will Subordinating Creditor exercise

any remedy with respect to any property of Debtor, nor will Subordinating Creditor accelerate the Subordinated Debt, or commence, or

cause to commence, prosecute or participate in any administrative, legal or equitable action against Debtor, until such time as (a) the

Senior Debt has been fully paid in cash, (b) Senior Creditor has no commitment or obligation to lend any further funds to Debtor, and

(c) all financing agreements between Senior Creditor and Debtor are terminated or expired by their terms. Notwithstanding the foregoing,

Debtor may pay to Subordinating Creditor regularly scheduled payments as set forth in the MCA Agreement in the amount of no more than

$9,606.00 per week. Nothing in the foregoing sentence shall prohibit Subordinating Creditor from converting all or any part of the Subordinated

Debt into equity securities of Debtor, provided that, if such securities have any call, put, or other conversion features that would

obligate Debtor to declare or pay dividends, make distributions, or otherwise pay any money or deliver any other securities or consideration

to the holder thereof, Subordinating Creditor hereby agrees that Debtor may not declare, pay, or make such dividends, distributions or

other payments to Subordinating Creditor, and Subordinating Creditor shall not accept any such dividends, distributions or other payments.

Subordinating Creditor shall promptly deliver to Senior Creditor in the form received (except for endorsement or assignment by Subordinating

Creditor where required by Senior Creditor) for application to the Senior Debt any payment, distribution, security or proceeds received

by Subordinating Creditor with respect to the Subordinated Debt other than in accordance with this Agreement. Notwithstanding anything

to the contrary in this Agreement, Debtor may make payments on the Subordinated Debt at any time prior to the earlier of (x) default

by Debtor with respect to the Senior Debt, and (y) notice from Senior Creditor that no further payments may be made to the Subordinating

Creditor. Debtor will provide Senior Creditor with prompt written notice of all payments made to the Subordinating Creditor on the Subordinated

Debt; such notices to include at least the date and the amount of payment.

3. Insolvency

of Debtor. In the event of Debtor’s insolvency, reorganization or any case or proceeding under any bankruptcy or insolvency

law or laws relating to the relief of debtors, including, without limitation, any voluntary or involuntary bankruptcy, insolvency, receivership

or other similar statutory or common law proceeding or arrangement involving Debtor, the readjustment of its liabilities, any assignment

for the benefit of its Subordinating Creditors or any marshalling of its assets or liabilities (each, an “Insolvency Proceeding”),

(a) this Agreement shall remain in full force and effect in accordance with Section 510(a) of the United States Bankruptcy Code, (b)

the Collateral shall include, without limitation, all Collateral arising during or after any such Insolvency Proceeding, and (c) Senior

Creditor’s claims against Debtor and the estate of Debtor shall be paid in full before any payment is made to Subordinating Creditor.

4. Notice

of Default. Subordinating Creditor shall give Senior Creditor prompt written notice of the occurrence of any default or event of

default under any document, promissory note, instrument, or agreement evidencing or relating to the Subordinated Debt, and shall, simultaneously

with giving any notice of default to Debtor, provide Senior Creditor with a copy of any notice of default given to Debtor.

5. Appointment

as Attorney-in-Fact. Until the Senior Debt has been fully paid in cash and Senior Creditor’s agreements to lend any funds to

Debtor have been terminated or have expired by their terms, Subordinating Creditor irrevocably appoints Senior Creditor as Subordinating

Creditor’s attorney-in-fact, and grants to Senior Creditor a power of attorney with full power of substitution, in the name of

Subordinating Creditor, for the use and benefit of Senior Creditor, without notice to Subordinating Creditor, to perform at Senior Creditor’s

option the following acts in any Insolvency Proceeding involving Debtor: (a) to file the appropriate claim or claims in respect of the

Subordinated Debt on behalf of Subordinating Creditor if Subordinating Creditor does not do so prior to thirty (30) days before the expiration

of the time to file claims in such Insolvency Proceeding and if Senior Creditor elects, in its sole discretion, to file such claim or

claims; and (b) to accept or reject any plan of reorganization or arrangement on behalf of Subordinating Creditor and to otherwise vote

Subordinating Creditor’s claims in respect of any Subordinated Debt in any manner that Senior Creditor deems appropriate for the

enforcement of its rights hereunder.

6. Limitations

in Insolvency Proceedings. In addition to and without limiting the foregoing: (a) until the Senior Debt has been fully paid in cash

and Senior Creditor’s agreements to lend any funds to Debtor have been terminated or have expired by their terms, Subordinating

Creditor shall not commence or join in any involuntary bankruptcy petition or similar judicial proceeding against Debtor, and (b) if

an Insolvency Proceeding occurs: (i) Subordinating Creditor shall not assert, without the prior written consent of Senior Creditor, any

claim, motion, objection or argument in respect of the Collateral in connection with any Insolvency Proceeding that could otherwise be

asserted or raised in connection with such Insolvency Proceeding, including, without limitation, any claim, motion, objection or argument

seeking adequate protection or relief from the automatic stay in respect of the Collateral, (ii) Senior Creditor may consent to the use

of cash collateral on such terms and conditions and in such amounts as it shall in good faith determine without seeking or obtaining

the consent of Subordinating Creditor as (if applicable) holder of an interest in the Collateral, (iii) if use of cash collateral by

Debtor is consented to by Senior Creditor, Subordinating Creditor shall not oppose such use of cash collateral on the basis that Subordinating

Creditor’s interest in the Collateral (if any) is impaired by such use or inadequately protected by such use, or on any other ground,

and (iv) Subordinating Creditor shall not object to, or oppose, any sale or other disposition of any assets comprising all or part of

the Collateral, free and clear of security interests, liens and claims of any party, including Subordinating Creditor, under Section

363 of the United States bankruptcy Code or otherwise, on the basis that the interest of Subordinating Creditor in the Collateral (if

any) is impaired by such sale or inadequately protected as a result of such sale, or on any other ground (and, if requested by Senior

Creditor, Subordinating Creditor shall affirmatively and promptly consent to such sale or disposition of such assets), if Senior Creditor

has consented to, or supports, such sale or disposition of such assets.

7. Financing

Statements. By the execution of this Agreement, Subordinating Creditor hereby authorizes Senior Creditor to amend any financing statements

filed by Subordinating Creditor against Debtor as follows:

“In

accordance with a certain Subordination Agreement by and among the [Secured Party], the Debtor, and Decathlon Alpha IV, L.P., the [Secured

Party] has subordinated any security interest or lien that [Secured Party] may have in any property of the Debtor to the security interest

of Decathlon Alpha IV, L.P. in all assets of the Debtor, notwithstanding the respective dates of attachment or perfection of the security

interest of the [Secured Party] and Decathlon Alpha IV, L.P.”

8.

Reinstatement. If at any time after payment in full of the Senior Debt any payments of the Senior Debt must be disgorged by Senior

Creditor for any reason (including, without limitation, any Insolvency Proceeding), this Agreement and the relative rights and priorities

set forth herein shall be reinstated as to all such disgorged payments as though such payments had not been made and Subordinating Creditor

shall immediately pay over to Senior Creditor all payments received with respect to the Subordinated Debt to the extent that such payments

would have been prohibited hereunder. At any time and from time to time, without notice to Subordinating Creditor, Senior Creditor may

take such actions with respect to the Senior Debt as Senior Creditor, in its sole discretion, may deem appropriate, including, without

limitation, terminating advances to Debtor, increasing the principal amount, extending the time of payment, increasing applicable interest

rates, renewing, compromising or otherwise amending the terms of any documents affecting the Senior Debt and any Collateral securing

the Senior Debt, and enforcing or failing to enforce any rights against Debtor or any other person. No such action or inaction shall

impair or otherwise affect Senior Creditor’s rights hereunder.

9.

Amendment of Subordinated Debt Documents. No amendment of the documents evidencing or relating to the Subordinated Debt shall

directly or indirectly modify the provisions of this Agreement in any manner which might terminate or impair the subordination of the

Subordinated Debt or the subordination of the security interest or lien that Subordinating Creditor may have in any property of Debtor.

10. Binding

Agreement. All necessary action on the part of Subordinating Creditor necessary for the authorization of this Agreement and the performance

of all obligations of Subordinating Creditor hereunder has been taken. This Agreement constitutes the legal, valid and binding obligation

of Subordinating Creditor, enforceable against Subordinating Creditor in accordance with its terms. The execution, delivery and performance

of and compliance with this Agreement by Subordinating Creditor will not violate any material applicable law, rule or regulation.

11. Assigns.

This Agreement shall bind any successors or assignees of Subordinating Creditor and shall benefit any successors or assigns of Senior

Creditor; provided, however, Subordinating Creditor agrees that, prior and as conditions precedent to Subordinating Creditor assigning

all or any portion of the Subordinated Debt: (i) Subordinating Creditor shall give Senior Creditor prior written notice of such assignment,

and (ii) such successor or assignee, as applicable, shall execute a written agreement whereby such successor or assignee expressly agrees

to assume and be bound by all terms and conditions of this Agreement with respect to Subordinating Creditor. This Agreement shall remain

effective until terminated in writing by Senior Creditor. This Agreement is solely for the benefit of Subordinating Creditor and Senior

Creditor and not for the benefit of Debtor or any other party. Subordinating Creditor further agrees that if Debtor is in the process

of refinancing any portion of the Senior Debt with a new lender, and if Senior Creditor makes a request of Subordinating Creditor, Subordinating

Creditor shall agree to enter into a new subordination agreement with the new lender on substantially the terms and conditions of this

Agreement.

12.

Further Assurances. Subordinating Creditor hereby agrees to execute such documents and/or take such further action as Senior

Creditor may at any time or times reasonably request in order to carry out the provisions and intent of this Agreement, including,

without limitation, ratifications and confirmations of this Agreement from time to time hereafter, as and when requested by Senior

Creditor.

13. No

Obligation. None of the provisions of this Agreement shall be deemed or construed to constitute a commitment or an obligation on

the part of Senior Creditor to make any future loans or other extensions of credit or financial accommodation to Debtors or any other

person.

14. No

Impairment. Senior Creditor may, at any time, and from time to time, either before or after any such notice of revocation, without

the consent of or notice to Subordinating Creditor, without incurring responsibility to Subordinating Creditor, and without impairing

or releasing any of its rights or any of the obligations of Subordinating Creditor hereunder: (a) change the interest rate or change

the amount of payment or extend the time of payment or renew or otherwise alter the terms of any Senior Debt or any instrument evidencing

the same in any manner; (b) release anyone liable in any manner for the payment or collection of the Senior Debt or any part thereof;

(c) exercise or refrain from exercising any right against Debtors or others (including Subordinating Creditor); and (d) apply any sums

received by Senior Creditor, by whomsoever paid and however realized, to Senior Debt in such manner as Senior Creditor deems appropriate

in its sole discretion.

15. No

Waiver. No waiver shall be deemed to be made by Senior Creditor of any of its rights hereunder unless the same shall be in writing

signed on behalf of Senior Creditor, and each such waiver, if any, shall be a waiver only with respect to the specific matter or matters

to which the waiver relates and shall in no way impair the rights of Senior Creditor or the obligations of Subordinating Creditor to

Senior Creditor in any other respect at any other time.

16. Several

Obligations. If more than one Subordinating Creditor shall sign this Agreement, then the covenants, promises and agreements herein

contained shall be construed to be the several promises, covenants and agreements of each of those signers.

17. Severability.

In the event that any provision of this Agreement is deemed to be invalid by reason of the operation of any law or by reason of the interpretation

placed thereon by any court or governmental authority, the validity, legality, and enforceability of the remaining terms and provisions

of this Agreement shall not in any way be affected or impaired thereby, all of which shall remain in full force and effect, and the affected

term or provision shall be modified to the minimum extent permitted by law so as to achieve most fully the intention of this Agreement.

18. Counterparts.

This Agreement may be executed in one or more counterparts, each of which shall be deemed to be an original, but all of which taken together

shall be one and the same instrument. Delivery of an executed signature page of this Agreement by facsimile transmission or in a .pdf

or similar electronic file shall be effective as delivery of a manually executed counterpart hereof.

19. Governing

Law. This Agreement shall be governed by and construed in accordance with the internal laws of the Applicable Jurisdiction (as defined

in the Senior Credit Agreement) without giving effect to its choice of law provisions that would result in the application of the laws

of a different jurisdiction. Any judicial proceeding against Subordinating Creditor with respect to this Agreement may be brought in

any federal or state court of competent jurisdiction located in the Applicable Jurisdiction. Each of the parties hereto acknowledges

that it participated in the negotiation and drafting of this Agreement and that, accordingly, none of them shall move or petition a court

construing this Agreement to construe it more stringently against one party than against any other.

[Signature

page follows]

The

parties hereto have executed this Agreement as of the day and year first above written.

| |

SUBORDINATING

CREDITOR: |

| |

|

| |

CEDAR

ADVANCE LLC |

| |

|

|

| |

|

| |

By: |

|

| |

Its: |

|

| |

|

|

| |

SENIOR

CREDITOR: |

| |

|

| |

DECATHLON

ALPHA V, L.P. |

| |

|

|

| |

By:

|

Decathlon

Alpha GP V, LLC |

| |

Its:

|

General

Partner |

| |

|

|

| |

|

| |

By:

|

Wayne

Cantwell |

| |

Its:

|

Managing

Director |

The

undersigned, being the Debtor referred to in the Agreement, hereby acknowledge receipt of a copy thereof and agrees to all of the terms

and provisions thereof, and agrees to and with Senior Creditor named therein that the undersigned will not consent to or participate

in any act whatever which is in violation of any of the provisions of such Agreement. The undersigned hereby authorizes Senior Creditor,

without notice to the undersigned, to declare all of the Senior Debt to be due and payable forthwith upon any violation of the undersigned

of any of the provisions of such Agreement.

| |

DEBTOR: |

| |

|

| |

INVO

BIOSCIENCE, INC. |

| |

|

|

| |

|

| |

By:

|

Steven

Shum |

| |

Its:

|

CEO |

Signature

page to Subordination Agreement

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

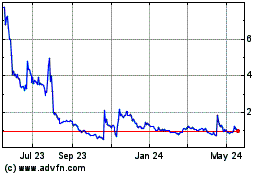

INVO BioScience (NASDAQ:INVO)

Historical Stock Chart

From Oct 2024 to Nov 2024

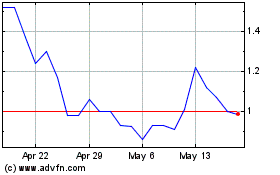

INVO BioScience (NASDAQ:INVO)

Historical Stock Chart

From Nov 2023 to Nov 2024