Second Quarter Sales Volume Increased 7.1% with Volume Growth

Across all Distribution Channels.

John B. Sanfilippo & Son, Inc. (NASDAQ: JBSS) (the

“Company”) today announced financial results for its fiscal 2025

second quarter ended December 26, 2024.

Second Quarter Summary

- Net sales increased $9.8 million, or 3.4%, to $301.1

million

- Sales volume increased 6.4 million pounds, or 7.1%, to 96.3

million pounds

- Gross profit decreased 9.8% to $52.3 million

- Diluted EPS decreased 29.3% to $1.16 per share

CEO Commentary

“We are pleased to report our largest quarterly sales volume and

highest quarterly net sales in our company’s history in the second

quarter. This achievement was driven by the second consecutive

quarter of sales volume increases across all three of our

distribution channels as we execute on our Long-Range Plan.

Additionally, our bars sales volume increased by approximately 28%

over the prior year quarter. We remain encouraged by the sales

volume growth across our company and are focused on enhancing

profitability through operational efficiencies and optimized

pricing strategies,” stated Jeffrey T. Sanfilippo, Chief Executive

Officer.

Second Quarter Results

Net Sales

Net sales for the second quarter of fiscal 2025 increased $9.8

million, or 3.4%, to $301.1 million. This increase is attributed to

a 7.1% increase in sales volume (pounds sold to customers) that was

partially offset by a 3.4% decrease in the weighted average sales

price per pound. The decrease in the weighted average selling price

primarily resulted from higher sales volume of lower priced bars,

granola and private brand recipe nuts (pecans and walnuts).

Additionally, strategic pricing decisions and competitive pricing

pressures contributed to the overall decrease in weighted average

selling prices and contributed to increased sales volume.

Sales Volume

Consumer Distribution Channel + 2.9%

- Private Brand + 4.0% The sales volume increase was

driven by a 27.6% growth in bars volume due to a mass merchandising

retailer returning to normalized inventory levels. In addition,

sales volume increases in pecans, walnuts and snack and trail mix,

mainly due to new distribution, contributed to the increase, which

was partially offset by a sales volume decrease due to soft

consumer demand, as well as downsized pack sizes and the

discontinuation of peanut butter, all at the same mass

merchandising retailer. Furthermore, this volume increase was

partially offset by soft consumer demand and decreased seasonal nut

and trail mix volume at another mass merchandising retailer.

- Branded* + 3.4% The sales volume increase was primarily

attributable to a 3.8% increase in the sales volume of Fisher

recipe nuts, mainly due to increased merchandising activity at

several customers. Additionally, sales volume of Southern Style

Nuts increased 11.8% driven by a return to normalized inventory

levels and increased sales velocity at a club store customer.

Commercial Ingredients Distribution Channel + 1.4%

The sales volume increase was primarily driven by higher sales

of peanut crushing stock to peanut oil processors and distribution

to a new food service customer, partially offset by lost business

to another customer.

Contract Manufacturing Distribution Channel + 55.6%

The sales volume increase was driven by increased granola volume

processed in our Lakeville facility. This increase was partially

offset by reduced peanut and cashews sales volume to a major

customer due to soft consumer demand.

________________________

* Includes Fisher recipe nuts,

Fisher snack nuts, Orchard Valley Harvest and Southern Style

Nuts.

Gross Profit

Gross profit decreased by $5.7 million to $52.3 million mainly

due to lower selling prices caused by competitive pricing pressures

and strategic pricing decisions as well as higher commodity

acquisition costs for most tree nuts. This decrease was partially

offset by the improved profitability of bars as compared to the

corresponding quarter in the prior year, in which we acquired

certain snack bar assets located at Lakeville, Minnesota (the

“Lakeville Acquisition”). Gross profit margin decreased to 17.4% of

net sales from 19.9% in the comparable quarter of the previous year

due to the reasons noted above.

Operating Expenses, net

Total operating expenses increased $2.5 million in the quarterly

comparison mainly due to a one-time $2.2 million bargain purchase

gain associated with the Lakeville Acquisition, which did not recur

in the current quarter. Additionally, increases in freight, rent

and compensation expenses contributed to the increase, which were

significantly offset by decreases in incentive compensation expense

and consulting and marketing expense. Total operating expenses, as

a percentage of net sales, increased to 10.9% from 10.4% in the

prior comparable quarter due to the reasons noted above, which was

partially offset by a higher net sales base.

Inventory

The value of total inventories on hand at the end of the current

second quarter increased $8.5 million, or 4.3%. The increase was

mainly due to higher commodity acquisition costs for almost all

major tree nuts and chocolate as well as higher on hand quantities

of almonds and cashews. These increases were partially offset by

decreased bars related inventory. The weighted average cost per

pound of raw nut and dried fruit input stock on hand increased

33.7% year over year, mainly due higher commodity acquisition costs

for almost all major tree nuts.

Six Month Results

- Net sales increased 9.9% to $577.3 million. Excluding

the fiscal 2025 first quarter impact of the Lakeville Acquisition,

which was completed on September 29, 2023 (the first day of our

second fiscal quarter of fiscal 2024), net sales increased 2.2% to

$536.8 million. The increase in net sales was primarily

attributable to a 4.1% increase in sales volume, which was

partially offset by a 1.9% decrease in weighted average selling

price per pound.

- Sales volume increased 14.9%. Sales volume increased in

all three distribution channels resulting mainly from the impact of

the Lakeville Acquisition.

- Gross profit margin decreased 4.8% to 17.1% of

net sales. The decrease was mainly attributable to lower selling

prices due to competitive pricing pressures and strategic pricing

decisions, as well as increased commodity acquisition costs for

almost all major nut commodities. This was partially offset by the

improved profitability of bars.

- Operating expenses were relatively unchanged at $62.4

million compared to $62.8 million in the prior year to date

period.

- Diluted EPS decreased 31.4%, or $0.99 per diluted share,

to $2.16.

In closing, Mr. Sanfilippo commented, “As we look ahead to the

second half of fiscal 2025, we plan to complete the consolidation

of our Elgin and Lakeville distribution operations into our new

location in Huntley, Illinois. Additionally, we will continue to

execute on our plan to add manufacturing equipment with the goal of

increasing our production capabilities and increasing efficiency.

This is an exciting time for our company as we execute on our

future growth strategies. We are committed to creating long-term

shareholder value through these strategic initiatives and continued

operational excellence. I want to extend my heartfelt thanks to all

our employees for their hard work and dedication, which have been

instrumental in achieving these milestones.”

Conference Call

The Company will host an investor conference call and webcast on

Thursday, January 30, 2025, at 10:00 a.m. Eastern (9:00 a.m.

Central) to discuss these results. To participate in the call via

telephone, please register using the following Participant

Registration link:

https://register.vevent.com/register/BI9570d6572fdf44bd8a9e9eeda859df93.

Once registered, attendees will receive a dial-in number and their

own unique PIN number. This call is also being webcast by Notified

and can be accessed at the Company’s website at

www.jbssinc.com.

About John B. Sanfilippo & Son, Inc.

Based in Elgin, Illinois, John B. Sanfilippo & Son, Inc. is

a processor, packager, marketer and distributor of nut and dried

fruit products, snack bars, and dried cheese snacks, that are sold

under the Company’s Fisher ®, Orchard Valley Harvest ®, Squirrel

Brand ®, Southern Style Nuts ® and Just the Cheese ® brand names

and under a variety of private brands.

Forward Looking Statements

Some of the statements in this release are forward-looking.

These forward-looking statements may be generally identified by the

use of forward-looking words and phrases such as “will”, “intends”,

“may”, “believes”, “anticipates”, “should” and “expects” and are

based on the Company’s current expectations or beliefs concerning

future events and involve risks and uncertainties. Consequently,

the Company’s actual results could differ materially. The Company

undertakes no obligation to update publicly or otherwise revise any

forward-looking statements, whether as a result of new information,

future events or other factors that affect the subject of these

statements, except where expressly required to do so by law. Among

the factors that could cause results to differ materially from

current expectations are: (i) sales activity for the Company’s

products, such as a decline in sales to one or more key customers,

or to customers or in the nut category generally, in some or all

channels, a change in product mix to lower price products, a

decline in sales of private brand products or changing consumer

preferences, including a shift from higher margin products to lower

margin products; (ii) changes in the availability and costs of raw

materials and ingredients and the impact of fixed price commitments

with customers; (iii) the ability to pass on price increases to

customers if commodity costs rise and the potential for a negative

impact on demand for, and sales of, our products from price

increases; (iv) the ability to measure and estimate bulk inventory,

fluctuations in the value and quantity of the Company’s nut

inventories due to fluctuations in the market prices of nuts and

bulk inventory estimation adjustments, respectively; (v) the

Company’s ability to appropriately respond to, or lessen the

negative impact of, competitive and pricing pressures; (vi) losses

associated with product recalls, product contamination, food

labeling or other food safety issues, or the potential for lost

sales or product liability if customers lose confidence in the

safety of the Company’s products or in nuts or nut products in

general, or are harmed as a result of using the Company’s products;

(vii) the ability of the Company to control costs (including

inflationary costs) and manage shortages or other disruptions in

areas such as inputs, transportation and labor; (viii) uncertainty

in economic conditions, including the potential for inflation or

economic downturn leading to decreased consumer demand; (ix) the

timing and occurrence (or nonoccurrence) of other transactions and

events which may be subject to circumstances beyond the Company’s

control; (x) the adverse effect of labor unrest or disputes,

litigation and/or legal settlements, including potential

unfavorable outcomes exceeding any amounts accrued; (xi) losses due

to significant disruptions at any of our production or processing

facilities or employee unavailability due to labor shortages; (xii)

the ability to implement our Long-Range Plan, including growing our

branded and private brand product sales, diversifying our product

offerings (including by the launch of new products) and expanding

into alternative sales channels; (xiii) technology disruptions or

failures or the occurrence of cybersecurity incidents or breaches;

(xiv) the inability to protect the Company’s brand value,

intellectual property or avoid intellectual property disputes; (xv)

our ability to manage the impacts of changing weather patterns on

raw material availability due to climate change; and (xvi) our

ability to operate the acquired snack bar related assets of

TreeHouse and realize efficiencies and synergies from such

acquisition.

JOHN B. SANFILIPPO & SON,

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(Unaudited)

(Dollars in thousands, except per

share amounts)

For the Quarter Ended

For the Twenty-Six Weeks

Ended

December 26, 2024

December 28, 2023

December 26, 2024

December 28, 2023

Net sales

$

301,067

$

291,222

$

577,263

$

525,327

Cost of sales

248,816

233,283

478,468

410,366

Gross profit

52,251

57,939

98,795

114,961

Operating expenses:

Selling expenses

22,620

21,001

42,459

42,993

Administrative expenses

10,262

11,563

19,960

22,016

Bargain purchase gain, net

—

(2,226

)

—

(2,226

)

Total operating expenses

32,882

30,338

62,419

62,783

Income from operations

19,369

27,601

36,376

52,178

Other expense:

Interest expense

772

1,055

1,288

1,282

Rental and miscellaneous expense, net

347

260

758

616

Pension expense (excluding service

costs)

361

350

722

700

Total other expense, net

1,480

1,665

2,768

2,598

Income before income taxes

17,889

25,936

33,608

49,580

Income tax expense

4,294

6,765

8,354

12,821

Net income

$

13,595

$

19,171

$

25,254

$

36,759

Basic earnings per common share

$

1.17

$

1.65

$

2.17

$

3.17

Diluted earnings per common share

$

1.16

$

1.64

$

2.16

$

3.15

Weighted average shares outstanding

— Basic

11,647,791

11,611,409

11,640,598

11,603,185

— Diluted

11,710,091

11,667,555

11,713,727

11,671,149

JOHN B. SANFILIPPO & SON,

INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

(Dollars in thousands)

December 26, 2024

June 27, 2024

December 28, 2023

ASSETS

CURRENT ASSETS:

Cash

$

336

$

484

$

1,975

Accounts receivable, net

81,200

84,960

77,416

Inventories

205,842

196,563

197,335

Prepaid expenses and other current

assets

19,320

12,078

13,040

306,698

294,085

289,766

PROPERTIES, NET:

174,129

165,094

161,743

OTHER LONG-TERM ASSETS:

Intangibles, net

16,807

17,572

18,334

Deferred income taxes

3,900

3,130

562

Operating lease right-of-use assets

29,019

27,404

6,867

Other assets

14,700

8,290

7,187

64,426

56,396

32,950

TOTAL ASSETS

$

545,253

$

515,575

$

484,459

LIABILITIES & STOCKHOLDERS'

EQUITY

CURRENT LIABILITIES:

Revolving credit facility borrowings

$

49,753

$

20,420

$

32,052

Current maturities of long-term debt

834

737

704

Accounts payable

64,585

53,436

62,955

Bank overdraft

1,953

545

1,500

Accrued expenses

32,937

50,802

31,080

150,062

125,940

128,291

LONG-TERM LIABILITIES:

Long-term debt, less current

maturities

5,969

6,365

6,742

Retirement plan

26,773

26,154

27,338

Long-term operating lease liabilities

25,754

24,877

5,141

Other

11,064

9,626

9,710

69,560

67,022

48,931

STOCKHOLDERS' EQUITY:

Class A Common Stock

26

26

26

Common Stock

92

91

91

Capital in excess of par value

137,858

135,691

133,432

Retained earnings

187,815

186,965

175,096

Accumulated other comprehensive income

(loss)

1,044

1,044

(204

)

Treasury stock

(1,204

)

(1,204

)

(1,204

)

TOTAL STOCKHOLDERS’ EQUITY

325,631

322,613

307,237

TOTAL LIABILITIES & STOCKHOLDERS’

EQUITY

$

545,253

$

515,575

$

484,459

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250129828592/en/

Company: Frank S. Pellegrino Chief Financial

Officer 847-214-4138

Investor Relations: John Beisler or Steven Hooser

Three Part Advisors, LLC 817-310-8776

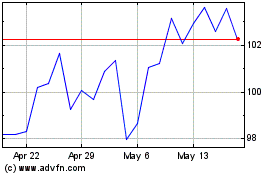

John B Sanfilippo and Son (NASDAQ:JBSS)

Historical Stock Chart

From Dec 2024 to Jan 2025

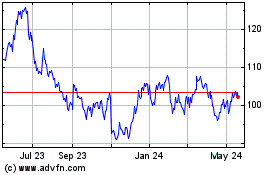

John B Sanfilippo and Son (NASDAQ:JBSS)

Historical Stock Chart

From Jan 2024 to Jan 2025