Form 8-K - Current report

30 January 2025 - 8:59AM

Edgar (US Regulatory)

0000880117falseSANFILIPPO JOHN B & SON INC00008801172025-01-292025-01-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): January 29, 2025 (January 29, 2025) |

JOHN B. SANFILIPPO & SON, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

0-19681 |

36-2419677 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

1703 N. RANDALL ROAD |

|

Elgin, Illinois |

|

60123-7820 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (847) 289-1800 |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $.01 par value per share |

|

JBSS |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

The following information is furnished pursuant to Item 2.02, “Results of Operations and Financial Condition”.

On January 29, 2025, John B. Sanfilippo & Son, Inc. issued a press release regarding its financial results for the second quarter and twenty-six weeks ended December 26, 2024. This press release is attached hereto as Exhibit 99.1 and incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

The exhibits furnished herewith are listed in the Exhibit Index of this Current Report on Form 8-K.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

JOHN B. SANFILIPPO & SON, INC. |

|

|

|

|

Date: |

January 29, 2025 |

By: |

/s/ Frank S. Pellegrino |

|

|

|

Frank S. Pellegrino

Chief Financial Officer, Executive Vice President,

Finance and Administration |

John B. Sanfilippo & Son, Inc. Reports Fiscal 2025 Second Quarter Results

Second Quarter Sales Volume Increased 7.1% with Volume Growth Across all Distribution Channels.

Elgin, IL, January 29, 2025 -- John B. Sanfilippo & Son, Inc. (NASDAQ: JBSS) (the “Company”) today announced financial results for its fiscal 2025 second quarter ended December 26, 2024.

Second Quarter Summary

•Net sales increased $9.8 million, or 3.4%, to $301.1 million

•Sales volume increased 6.4 million pounds, or 7.1%, to 96.3 million pounds

•Gross profit decreased 9.8% to $52.3 million

•Diluted EPS decreased 29.3% to $1.16 per share

CEO Commentary

“We are pleased to report our largest quarterly sales volume and highest quarterly net sales in our company’s history in the second quarter. This achievement was driven by the second consecutive quarter of sales volume increases across all three of our distribution channels as we execute on our Long-Range Plan. Additionally, our bars sales volume increased by approximately 28% over the prior year quarter. We remain encouraged by the sales volume growth across our company and are focused on enhancing profitability through operational efficiencies and optimized pricing strategies” stated Jeffrey T. Sanfilippo, Chief Executive Officer.

Second Quarter Results

Net Sales

Net sales for the second quarter of fiscal 2025 increased $9.8 million, or 3.4%, to $301.1 million. This increase is attributed to a 7.1% increase in sales volume (pounds sold to customers) that was partially offset by a 3.4% decrease in the weighted average sales price per pound. The decrease in the weighted average selling price primarily resulted from higher sales volume of lower priced bars, granola and private brand recipe nuts (pecans and walnuts). Additionally, strategic pricing decisions and competitive pricing pressures contributed to the overall decrease in weighted average selling prices and contributed to increased sales volume.

Sales Volume

Consumer Distribution Channel + 2.9%

The sales volume increase was driven by a 27.6% growth in bars volume due to a mass merchandising retailer returning to normalized inventory levels. In addition, sales volume increases in pecans, walnuts and snack and trail mix, mainly due to new distribution, contributed to the increase, which was partially offset by a sales volume decrease due to soft consumer demand, as well as downsized pack sizes and the discontinuation of peanut butter, all at the same mass merchandising retailer. Furthermore, this volume increase was partially offset by soft consumer demand and decreased seasonal nut and trail mix volume at another mass merchandising retailer.

The sales volume increase was primarily attributable to a 3.8% increase in the sales volume of Fisher recipe nuts, mainly due to increased merchandising activity at several customers. Additionally, sales volume of Southern Style Nuts increased 11.8% driven by a return to normalized inventory levels and increased sales velocity at a club store customer.

Commercial Ingredients Distribution Channel + 1.4%

The sales volume increase was primarily driven by higher sales of peanut crushing stock to peanut oil processors and distribution to a new food service customer, partially offset by lost business to another customer.

Contract Manufacturing Distribution Channel + 55.6%

The sales volume increase was driven by increased granola volume processed in our Lakeville facility. This increase was partially offset by reduced peanut and cashews sales volume to a major customer due to soft consumer demand.

Gross Profit

Gross profit decreased by $5.7 million to $52.3 million mainly due to lower selling prices caused by competitive pricing pressures and strategic pricing decisions as well as higher commodity acquisition costs for most tree nuts. This decrease was partially offset by the improved profitability of bars as compared to the corresponding quarter in the prior year, in which we acquired certain snack bar assets located at Lakeville, Minnesota (the “Lakeville Acquisition”). Gross profit margin decreased to 17.4% of net sales from 19.9% in the comparable quarter of the previous year due to the reasons noted above.

Operating Expenses, net

Total operating expenses increased $2.5 million in the quarterly comparison mainly due to a one-time $2.2 million bargain purchase gain associated with the Lakeville Acquisition, which did not recur in the current quarter. Additionally, increases in freight, rent and compensation expenses contributed to the increase, which were significantly offset by decreases in incentive compensation expense and consulting and marketing expense. Total operating expenses, as a percentage of net sales, increased to 10.9% from 10.4% in the prior comparable quarter due to the reasons noted above, which was partially offset by a higher net sales base.

Inventory

The value of total inventories on hand at the end of the current second quarter increased $8.5 million, or 4.3%. The increase was mainly due to higher commodity acquisition costs for almost all major tree nuts and chocolate as well as higher on hand quantities of almonds and cashews. These increases were partially offset by decreased bars related inventory. The weighted average cost per pound of raw nut and dried fruit input stock on hand increased 33.7% year over year, mainly due higher commodity acquisition costs for almost all major tree nuts.

________________________

* Includes Fisher recipe nuts, Fisher snack nuts, Orchard Valley Harvest and Southern Style Nuts.

Six Month Results

•Net sales increased 9.9% to $577.3 million. Excluding the fiscal 2025 first quarter impact of the Lakeville Acquisition, which was completed on September 29, 2023 (the first day of our second fiscal quarter of fiscal 2024), net sales increased 2.2% to $536.8 million. The increase in net sales was primarily attributable to a 4.1% increase in sales volume, which was partially offset by a 1.9% decrease in weighted average selling price per pound.

•Sales volume increased 14.9%. Sales volume increased in all three distribution channels resulting mainly from the impact of the Lakeville Acquisition.

•Gross profit margin decreased 4.8% to 17.1% of net sales. The decrease was mainly attributable to lower selling prices due to competitive pricing pressures and strategic pricing decisions, as well as increased commodity acquisition costs for almost all major nut commodities. This was partially offset by the improved profitability of bars.

•Operating expenses were relatively unchanged at $62.4 million compared to $62.8 million in the prior year to date period.

•Diluted EPS decreased 31.4%, or $0.99 per diluted share, to $2.16.

In closing, Mr. Sanfilippo commented, “As we look ahead to the second half of fiscal 2025, we plan to complete the consolidation of our Elgin and Lakeville distribution operations into our new location in Huntley, Illinois. Additionally, we will continue to execute on our plan to add manufacturing equipment with the goal of increasing our production capabilities and increasing efficiency. This is an exciting time for our company as we execute on our future growth strategies. We are committed to creating long-term shareholder value through these strategic initiatives and continued operational excellence. I want to extend my heartfelt thanks to all our employees for their hard work and dedication, which have been instrumental in achieving these milestones.”

Conference Call

The Company will host an investor conference call and webcast on Thursday, January 30, 2025, at 10:00 a.m. Eastern (9:00 a.m. Central) to discuss these results. To participate in the call via telephone, please register using the following Participant Registration link:

https://register.vevent.com/register/BI9570d6572fdf44bd8a9e9eeda859df93. Once registered, attendees will receive a dial-in number and their own unique PIN number. This call is also being webcast by Notified and can be accessed at the Company’s website at www.jbssinc.com.

About John B. Sanfilippo & Son, Inc.

Based in Elgin, Illinois, John B. Sanfilippo & Son, Inc. is a processor, packager, marketer and distributor of nut and dried fruit products, snack bars, and dried cheese snacks, that are sold under the Company’s Fisher ®, Orchard Valley Harvest ®, Squirrel Brand ®, Southern Style Nuts ® and Just the Cheese ® brand names and under a variety of private brands.

Forward Looking Statements

Some of the statements in this release are forward-looking. These forward-looking statements may be generally identified by the use of forward-looking words and phrases such as “will”, “intends”, “may”, “believes”, “anticipates”, “should” and “expects” and are based on the Company’s current expectations or beliefs concerning future events and involve risks and uncertainties. Consequently, the Company’s actual results could differ materially. The Company undertakes no obligation to update publicly or otherwise revise any forward-looking statements, whether as a result of new information, future events or other factors that affect the subject of these statements, except where expressly required to do so by law. Among the factors that could cause results to differ materially from current expectations are: (i) sales activity for the Company’s products, such as a decline in sales to one or more key customers, or to customers or in the nut category generally, in some or all channels, a change in product mix to lower price products, a decline in sales of private brand products or changing consumer preferences, including a shift from higher margin products to lower margin products; (ii) changes in the availability and costs of raw materials and ingredients and the impact of fixed price commitments with customers; (iii) the ability to pass on price increases to customers if commodity costs rise and the potential for a negative impact on demand for, and sales of, our products from price increases; (iv) the ability to measure and estimate bulk inventory, fluctuations in the value and quantity of the Company’s nut inventories due to fluctuations in the market prices of nuts and bulk inventory estimation adjustments, respectively; (v) the Company’s ability to appropriately respond to, or lessen the negative impact of, competitive and pricing pressures; (vi) losses associated with product recalls, product contamination, food labeling or other food safety issues, or the potential for lost sales or product liability if customers lose confidence in the safety of the Company’s products or in nuts or nut products in general, or are harmed as a result of using the Company’s products; (vii) the ability of the Company to control costs (including inflationary costs) and manage shortages or other disruptions in areas such as inputs, transportation and labor; (viii) uncertainty in economic conditions, including the potential for inflation or economic downturn leading to decreased consumer demand; (ix) the timing and occurrence (or nonoccurrence) of other transactions and events which may be subject to circumstances beyond the Company’s control; (x) the adverse effect of labor unrest or disputes, litigation and/or legal settlements, including potential unfavorable outcomes exceeding any amounts accrued; (xi) losses due to significant disruptions at any of our production or processing facilities or employee unavailability due to labor shortages; (xii) the ability to implement our Long-Range Plan, including growing our branded and private brand product sales, diversifying our product offerings (including by the launch of new products) and expanding into alternative sales channels; (xiii) technology disruptions or failures or the occurrence of cybersecurity incidents or breaches; (xiv) the inability to protect the Company’s brand value, intellectual property or avoid intellectual property disputes; (xv) our ability to manage the impacts of changing weather patterns on raw material availability due to climate change; and (xvi) our ability to operate the acquired snack bar related assets of TreeHouse and realize efficiencies and synergies from such acquisition.

Contacts:

|

|

Company: |

Investor Relations: |

Frank S. Pellegrino |

John Beisler or Steven Hooser |

Chief Financial Officer |

Three Part Advisors, LLC |

847-214-4138 |

817-310-8776 |

-more-

JOHN B. SANFILIPPO & SON, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

(Dollars in thousands, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Quarter Ended |

|

|

For the Twenty-Six Weeks Ended |

|

|

|

December 26,

2024 |

|

|

December 28,

2023 |

|

|

December 26,

2024 |

|

|

December 28,

2023 |

|

Net sales |

|

$ |

301,067 |

|

|

$ |

291,222 |

|

|

$ |

577,263 |

|

|

$ |

525,327 |

|

Cost of sales |

|

|

248,816 |

|

|

|

233,283 |

|

|

|

478,468 |

|

|

|

410,366 |

|

Gross profit |

|

|

52,251 |

|

|

|

57,939 |

|

|

|

98,795 |

|

|

|

114,961 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Selling expenses |

|

|

22,620 |

|

|

|

21,001 |

|

|

|

42,459 |

|

|

|

42,993 |

|

Administrative expenses |

|

|

10,262 |

|

|

|

11,563 |

|

|

|

19,960 |

|

|

|

22,016 |

|

Bargain purchase gain, net |

|

|

— |

|

|

|

(2,226 |

) |

|

|

— |

|

|

|

(2,226 |

) |

Total operating expenses |

|

|

32,882 |

|

|

|

30,338 |

|

|

|

62,419 |

|

|

|

62,783 |

|

Income from operations |

|

|

19,369 |

|

|

|

27,601 |

|

|

|

36,376 |

|

|

|

52,178 |

|

Other expense: |

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

772 |

|

|

|

1,055 |

|

|

|

1,288 |

|

|

|

1,282 |

|

Rental and miscellaneous expense, net |

|

|

347 |

|

|

|

260 |

|

|

|

758 |

|

|

|

616 |

|

Pension expense (excluding service costs) |

|

|

361 |

|

|

|

350 |

|

|

|

722 |

|

|

|

700 |

|

Total other expense, net |

|

|

1,480 |

|

|

|

1,665 |

|

|

|

2,768 |

|

|

|

2,598 |

|

Income before income taxes |

|

|

17,889 |

|

|

|

25,936 |

|

|

|

33,608 |

|

|

|

49,580 |

|

Income tax expense |

|

|

4,294 |

|

|

|

6,765 |

|

|

|

8,354 |

|

|

|

12,821 |

|

Net income |

|

$ |

13,595 |

|

|

$ |

19,171 |

|

|

$ |

25,254 |

|

|

$ |

36,759 |

|

Basic earnings per common share |

|

$ |

1.17 |

|

|

$ |

1.65 |

|

|

$ |

2.17 |

|

|

$ |

3.17 |

|

Diluted earnings per common share |

|

$ |

1.16 |

|

|

$ |

1.64 |

|

|

$ |

2.16 |

|

|

$ |

3.15 |

|

Weighted average shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

— Basic |

|

|

11,647,791 |

|

|

|

11,611,409 |

|

|

|

11,640,598 |

|

|

|

11,603,185 |

|

— Diluted |

|

|

11,710,091 |

|

|

|

11,667,555 |

|

|

|

11,713,727 |

|

|

|

11,671,149 |

|

JOHN B. SANFILIPPO & SON, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

(Dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 26,

2024 |

|

|

June 27,

2024 |

|

|

December 28,

2023 |

|

ASSETS |

|

|

|

|

|

|

|

|

|

CURRENT ASSETS: |

|

|

|

|

|

|

|

|

|

Cash |

|

$ |

336 |

|

|

$ |

484 |

|

|

$ |

1,975 |

|

Accounts receivable, net |

|

|

81,200 |

|

|

|

84,960 |

|

|

|

77,416 |

|

Inventories |

|

|

205,842 |

|

|

|

196,563 |

|

|

|

197,335 |

|

Prepaid expenses and other current assets |

|

|

19,320 |

|

|

|

12,078 |

|

|

|

13,040 |

|

|

|

|

306,698 |

|

|

|

294,085 |

|

|

|

289,766 |

|

|

|

|

|

|

|

|

|

|

|

PROPERTIES, NET: |

|

|

174,129 |

|

|

|

165,094 |

|

|

|

161,743 |

|

|

|

|

|

|

|

|

|

|

|

OTHER LONG-TERM ASSETS: |

|

|

|

|

|

|

|

|

|

Intangibles, net |

|

|

16,807 |

|

|

|

17,572 |

|

|

|

18,334 |

|

Deferred income taxes |

|

|

3,900 |

|

|

|

3,130 |

|

|

|

562 |

|

Operating lease right-of-use assets |

|

|

29,019 |

|

|

|

27,404 |

|

|

|

6,867 |

|

Other assets |

|

|

14,700 |

|

|

|

8,290 |

|

|

|

7,187 |

|

|

|

|

64,426 |

|

|

|

56,396 |

|

|

|

32,950 |

|

TOTAL ASSETS |

|

$ |

545,253 |

|

|

$ |

515,575 |

|

|

$ |

484,459 |

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES & STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES: |

|

|

|

|

|

|

|

|

|

Revolving credit facility borrowings |

|

$ |

49,753 |

|

|

$ |

20,420 |

|

|

$ |

32,052 |

|

Current maturities of long-term debt |

|

|

834 |

|

|

|

737 |

|

|

|

704 |

|

Accounts payable |

|

|

64,585 |

|

|

|

53,436 |

|

|

|

62,955 |

|

Bank overdraft |

|

|

1,953 |

|

|

|

545 |

|

|

|

1,500 |

|

Accrued expenses |

|

|

32,937 |

|

|

|

50,802 |

|

|

|

31,080 |

|

|

|

|

150,062 |

|

|

|

125,940 |

|

|

|

128,291 |

|

|

|

|

|

|

|

|

|

|

|

LONG-TERM LIABILITIES: |

|

|

|

|

|

|

|

|

|

Long-term debt, less current maturities |

|

|

5,969 |

|

|

|

6,365 |

|

|

|

6,742 |

|

Retirement plan |

|

|

26,773 |

|

|

|

26,154 |

|

|

|

27,338 |

|

Long-term operating lease liabilities |

|

|

25,754 |

|

|

|

24,877 |

|

|

|

5,141 |

|

Other |

|

|

11,064 |

|

|

|

9,626 |

|

|

|

9,710 |

|

|

|

|

69,560 |

|

|

|

67,022 |

|

|

|

48,931 |

|

|

|

|

|

|

|

|

|

|

|

STOCKHOLDERS' EQUITY: |

|

|

|

|

|

|

|

|

|

Class A Common Stock |

|

|

26 |

|

|

|

26 |

|

|

|

26 |

|

Common Stock |

|

|

92 |

|

|

|

91 |

|

|

|

91 |

|

Capital in excess of par value |

|

|

137,858 |

|

|

|

135,691 |

|

|

|

133,432 |

|

Retained earnings |

|

|

187,815 |

|

|

|

186,965 |

|

|

|

175,096 |

|

Accumulated other comprehensive income (loss) |

|

|

1,044 |

|

|

|

1,044 |

|

|

|

(204 |

) |

Treasury stock |

|

|

(1,204 |

) |

|

|

(1,204 |

) |

|

|

(1,204 |

) |

TOTAL STOCKHOLDERS’ EQUITY |

|

|

325,631 |

|

|

|

322,613 |

|

|

|

307,237 |

|

TOTAL LIABILITIES & STOCKHOLDERS’ EQUITY |

|

$ |

545,253 |

|

|

$ |

515,575 |

|

|

$ |

484,459 |

|

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

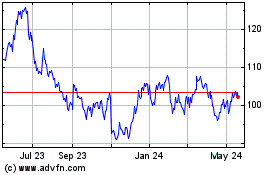

John B Sanfilippo and Son (NASDAQ:JBSS)

Historical Stock Chart

From Dec 2024 to Jan 2025

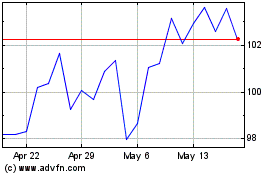

John B Sanfilippo and Son (NASDAQ:JBSS)

Historical Stock Chart

From Jan 2024 to Jan 2025