UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the Month of September 2024

Commission File Number 001-35948

Kamada Ltd.

(Translation of registrant’s name into English)

2 Holzman Street

Science Park, P.O. Box 4081

Rehovot 7670402

Israel

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒

Form 40-F ☐

This Form 6-K is being incorporated by reference

into the Registrant’s Form S-8 Registration Statements, File Nos. 333-192720,

333-207933, 333-215983,

333-222891, 333-233267

and 333-265866.

The following exhibit is attached:

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: September 23, 2024 |

KAMADA LTD. |

| |

|

| |

By: |

/s/ Nir Livneh |

| |

|

Nir Livneh

Vice President General Counsel and

Corporate Secretary |

EXHIBIT INDEX

3

Exhibit 99.1

Kamada Announces Expansion of Plasma Collection

Operations in Texas with the Opening of New Site in Houston

| ● | New Plasma Collection Center in Houston Now Open, with

Planned Annual Collection Capacity of Approximately 50,000 Liters and an Estimated Annual Revenue Contribution of $8 Million to $10 Million

at its Full Capacity |

| ● | Center Will Collect Normal Source Plasma and Specialty

Plasma, such as Anti-Rabies and Anti-D, and is Anticipated to be One of the Largest Sites for Specialty Plasma Collection in the U.S. |

| ● | The New Center Supports Kamada’s Strategy and Development

as a Leading Global Vertically-Integrated Specialty Plasma-Derived Company |

| ● | Kamada Expects to Open its Third Plasma Collection Center

in San Antonio, TX, During the First Half of 2025 |

REHOVOT, Israel, and HOBOKEN, NJ – September

23, 2024 -- Kamada Ltd. (NASDAQ: KMDA; TASE: KMDA.TA), a global biopharmaceutical company with a portfolio of marketed products indicated

for rare and serious conditions and a leader in the specialty plasma-derived field, today announced the expansion of its plasma collection

operations with the opening of a new plasma collection center in Houston, TX. The new 12,000 square foot center is operated by Kamada’s

wholly owned subsidiary, Kamada Plasma, and is planned to support over 50 donor beds with an estimated total collection capacity of approximately

50,000 liters annually.

“We are extremely pleased to announce the

opening of our new state-of-the-art plasma collection center in Houston,” said Amir London, Chief Executive Officer of Kamada. “The

opening of this center is an important milestone in Kamada’s development and vertical integration, expanding the collection capacity of

specialty plasma for our internal use beyond our existing site in Beaumont, TX. The new center in Houston is expected to be one of the

largest sites for specialty plasma collection in the U.S. and will also collect normal source plasma to be sold to third parties. We are

especially grateful for the skilled and experienced team of plasma collection experts we have hired to lead the development and operations

of our new center.”

Kamada intends to submit to the FDA a prior approval

supplement to Kamada Plasma’s existing Biologics License Application (BLA) for the approval of the Houston site, as well as a plasma master

file (PMF) to the European Medicines Agency (EMA), during the first half of 2025. The FDA and EMA’s regulatory process for obtaining

approval for plasma collection centers includes onsite inspection. During the review process, the company is authorized to collect plasma

donations at the center. Kamada currently anticipates approval decisions within 9-12 months of submissions.

In addition to the new Houston center, the company

has begun construction of its third plasma collection site in San Antonio, TX, which is expected to open during the first half of 2025.

Each collection center is expected to contribute annual revenues of $8 million to $10 million in sales of normal source plasma at its

full capacity.

About Kamada

Kamada Ltd. (the “Company”) is a global

biopharmaceutical company with a portfolio of marketed products indicated for rare and serious conditions and a leader in the specialty

plasma-derived field, focused on diseases of limited treatment alternatives. The Company is also advancing an innovative development pipeline

targeting areas of significant unmet medical need. The Company’s strategy is focused on driving profitable growth from its significant

commercial catalysts as well as its manufacturing and development expertise in the plasma-derived and biopharmaceutical fields. The Company’s

commercial products portfolio includes six FDA approved plasma-derived biopharmaceutical products: CYTOGAM®, KEDRAB®, WINRHO SDF®,

VARIZIG®, HEPAGAM B® and GLASSIA®, as well as KAMRAB®, KAMRHO (D)® and two types of equine-based anti-snake venom

(ASV) products. The Company distributes its commercial products portfolio directly, and through strategic partners or third-party distributors

in more than 30 countries, including the U.S., Canada, Israel, Russia, Argentina, Brazil, India, Australia and other countries in Latin

America, Europe, the Middle East, and Asia. The Company leverages its expertise and presence in the Israeli market to distribute, for

use in Israel, more than 25 pharmaceutical products that are supplied by international manufacturers. During recent years the Company

added eleven biosimilar products to its Israeli distribution portfolio, which, subject to the European Medicines Agency (EMA) and the

Israeli Ministry of Health approvals, are expected to be launched in Israel through 2028. The Company owns an FDA licensed plasma collection

center in Beaumont, Texas, which currently specializes in the collection of hyper-immune plasma used in the manufacture of KAMRHO (D),

KARAB and KEDRAB and recently opened a new plasma collection center in Houston, Texas in which it plans to collect normal source plasma

and specialty plasma, such as Anti-Rabies and Anti-D. In addition to the Company’s commercial operation, it invests in research

and development of new product candidates. The Company’s leading investigational product is an inhaled AAT for the treatment of

AAT deficiency, for which it is continuing to progress the InnovAATe clinical trial, a randomized, double-blind, placebo-controlled, pivotal

Phase 3 trial. FIMI Opportunity Funds, the leading private equity firm in Israel, is the Company’s controlling shareholder, beneficially

owning approximately 38% of the outstanding ordinary shares.

Cautionary Note Regarding Forward-Looking Statements

This release includes forward-looking statements

within the meaning of Section 21E of the U.S. Securities Exchange Act of 1934, as amended, and the safe harbor provisions of the U.S.

Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that are not historical facts, including statements

regarding: 1) an estimated total annual collection capacity of approximately 50,000 liters and an estimated annual revenue contribution

of $8 to $10 million of the new plasma collection center in Houston from sales of normal source plasma at its full capacity; 2) the center

will collect normal source plasma to be sold to third parties and specialty plasma such as Anti-Rabies and Anti-D, and is expected to

be one of the largest sites for specialty plasma collection in the U.S; 3) Kamada expects to open its third plasma collection center in

San Antonio during the first half of 2025; 4) the new center is planned to support over 50 donor beds; 5) the company plans to submit

with the FDA a prior approval supplement to Kamada Plasma’s Biologics License Application (BLA) for the approval of the Houston site and

submit with the European Medicines Agency (EMA) a plasma master file (PMF) for its approval, during the first half of 2025 and currently

anticipates such approvals decision within 9-12 months of submission; and 6) each collection center is expected to contribute annual revenues

of $8 to $10 million from sales of normal source plasma at its full capacity. Forward-looking statements are based on Kamada’s current

knowledge and its present beliefs and expectations regarding possible future events and are subject to risks, uncertainties and assumptions.

Actual results and the timing of events could differ materially from those anticipated in these forward-looking statements as a result

of several factors including, but not limited to the evolving nature of the conflicts in the Middle East and the impact of such conflicts

in Israel, the Middle East and the rest of the world, the impact of these conflicts on market conditions and the general economic, industry

and political conditions in Israel, the U.S. and globally, continuation of inbound and outbound international delivery routes, continued

demand for Kamada’s products, financial conditions of the Company’s customer, suppliers and services providers, Kamada’s

ability to integrate the new product portfolio into its current product portfolio, Kamada’s ability to grow the revenues of its

new product portfolio, and leverage and expand its international distribution network, ability to reap the benefits of the acquisition

of the plasma collection center, including the ability to open additional U.S. plasma centers, and acquisition of the FDA-approved plasma-derived

hyperimmune commercial products, the ability to continue enrollment of the pivotal Phase 3 InnovAATe clinical trial, unexpected results

of clinical studies, Kamada’s ability to manage operating expenses, additional competition in the markets that Kamada competes,

regulatory delays, including the BLA and PMF approvals related to the plasma collection centers, prevailing market conditions and the

impact of general economic, industry or political conditions in the U.S., Israel or otherwise, and other risks detailed in Kamada’s

filings with the U.S. Securities and Exchange Commission (the “SEC”) including those discussed in its most recent Annual Report

on Form 20-F and in any subsequent reports on Form 6-K, each of which is on file or furnished with the SEC and available at the SEC’s

website at www.sec.gov. The forward-looking statements made herein speak only as of the date of this announcement and Kamada undertakes

no obligation to update publicly such forward-looking statements to reflect subsequent events or circumstances, except as otherwise required

by law.

CONTACTS:

Chaime Orlev

Chief Financial Officer

IR@kamada.com

Brian Ritchie

LifeSci Advisors, LLC

212-915-2578

britchie@LifeSciAdvisors.com

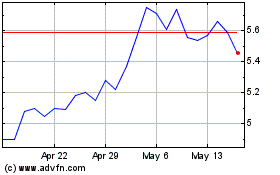

Kamada (NASDAQ:KMDA)

Historical Stock Chart

From Oct 2024 to Nov 2024

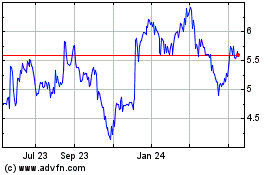

Kamada (NASDAQ:KMDA)

Historical Stock Chart

From Nov 2023 to Nov 2024