UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16 OF

THE

SECURITIES EXCHANGE ACT OF 1934

For

the month of: September 2024

Commission

File Number: 001-36903

KORNIT

DIGITAL LTD.

(Translation

of Registrant’s name into English)

12

Ha’Amal Street

Park

Afek

Rosh

Ha’Ayin 4824096 Israel

(Address

of Principal Executive Office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

CONTENTS

Board

Approval of Share Repurchase Plan

On

September 10, 2024, Kornit Digital Ltd. (“Kornit” or the “Company”) announced that its board of

directors (the “Board”) has approved a plan for the repurchase of up to $100 million (in addition to amounts previously

approved for repurchase) of the Company’s ordinary shares, par value 0.01 New Israeli Shekels per share (“ordinary shares”).

Kornit

may effect the prospective repurchases by way of a variety of methods, including open market purchases, privately negotiated transactions

or otherwise, all in accordance with U.S. securities laws and regulations, including Rule 10b-18 under the U.S. Securities Exchange Act

of 1934, as amended (the “Exchange Act”). Kornit may also, from time to time, enter into plans that are compliant

with Rule 10b5-1 of the Exchange Act to facilitate repurchases of its ordinary shares under the Board authorization.

In

accordance with Section 7C of the Israeli Companies Regulations (Leniencies for Companies Whose Securities are Listed for Trading Outside

of Israel), 5760-2000 (the “Leniency Regulations”), the repurchase plan will go into effect 30 days after notice of

the Board’s adoption of the plan is provided to the Company’s material creditors and secured creditors, assuming that no

such creditors objects to the Company regarding the repurchase plan within 30 days of being provided that notice. If any such objections

are received by the Company during that 30-day period, Israeli court approval of the repurchase plan would be required.

A

copy of the press release by which the Company announced the repurchase plan, which is entitled “Kornit Digital Announces Board

Authorization of $100 Million Share Repurchase Program”, is furnished as Exhibit 99.1 hereto.

Incorporation

by Reference

The

contents of this Report of Foreign Private Issuer on Form 6-K (but excluding the contents of Exhibit 99.1 hereto) are hereby incorporated

by reference into the Company’s Registration Statements on Form S-8 (File No.’s 333-203970, 333-214015, 333-217039, 333-223794, 333-230567, 333-237346, 333-254749,

and 333-263975)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

KORNIT DIGITAL LTD. |

| |

|

|

| Date: September 10, 2024 |

By: |

/s/ Lauri

Hanover |

| |

Name: |

Lauri Hanover |

| |

Title: |

Chief Financial Officer |

Exhibit 99.1

Investor

Contact:

Jared Maymon

Global Head of Investor Relations & Strategic

Finance

Jared.Maymon@Kornit.com

Kornit Digital Announces Board Authorization

of $100 Million Share Repurchase Program

Rosh-Ha`Ayin, Israel – September 10,

2024 – Kornit Digital Ltd. (“Kornit” or the “Company”) (Nasdaq: KRNT), a worldwide market leader in

sustainable, on-demand, digital fashion and textile production technologies, today announced that its Board of Directors has authorized

a program to repurchase up to $100 million of the Company’s ordinary shares as part of its capital allocation strategy. This repurchase

program, in addition to the $65 million of aggregate share repurchases executed by the Company since 2023, reflects the Board’s

confidence in the Company’s strategy and long-term potential, while demonstrating ongoing commitment to driving value creation for

its shareholders.

Under the Board authorized repurchase program,

the Company’s ordinary shares may be repurchased from time to time using a variety of methods, which may include open market purchases,

privately negotiated transactions or otherwise, all in accordance with U.S. securities laws and regulations, including Rule 10b-18 under

the U.S. Securities Exchange Act of 1934, as amended (the "Exchange Act"). The Company may also, from time to time, enter into

plans that are compliant with Rule 10b5-1 of the Exchange Act to facilitate repurchases of its shares under this authorization. The repurchase

program does not obligate the Company to acquire any particular amount of ordinary shares, and the repurchase program may be suspended

or discontinued at any time at the Company's discretion. Repurchases under the repurchase program may begin after the conclusion of a

30-day period for creditors of the Company to object to the Company's intent to effect a deemed distribution by way of repurchase in accordance

with the Israeli Companies Regulations (Relief for Public Companies Whose Securities are Traded on Stock Exchanges Outside of Israel),

5760-2000 and the Israeli Companies Regulations (Approval of Distribution), 5761–2001. The actual timing, number, and value

of shares to be repurchased will depend on a number of factors, including the market price of the Company's ordinary shares, general market

and economic conditions, any objections received by the Company from its creditors, the Company's financial results and liquidity, and

other considerations. The Company expects to fund repurchases with cash on hand.

About Kornit Digital

Kornit Digital (NASDAQ: KRNT) is a worldwide market

leader in sustainable, on-demand, digital fashion and textile production technologies. The Company offers end-to-end solutions including

digital printing systems, inks, consumables, software, and fulfillment services through its global fulfillment network. Headquartered

in Israel with offices in the USA, Europe, and Asia Pacific, Kornit Digital serves customers in more than 100 countries and states worldwide.

To learn more about how Kornit Digital is boldly transforming the world of fashion and textiles, visit www.kornit.com.

Forward Looking Statements

Certain statements in this press release are “forward-looking

statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and other U.S. securities laws. Forward-looking

statements are characterized by the use of forward-looking terminology such as “will,” “expects,” “anticipates,”

“believes,” “intends,” “planned,” or other similar words. These forward-looking statements include,

but are not limited to, statements relating to the Company’s objectives, plans and strategies, including with respect to the Company’s

authorized share repurchase program, statements regarding the Company’s results of operations and financial condition and all statements

that address developments that the Company expects or anticipates will or may occur in the future. Forward-looking statements are not

guarantees of future performance and are subject to risks and uncertainties. The Company has based these forward-looking statements on

assumptions and assessments made by its management in light of their experience and their perception of historical trends, current conditions,

expected future developments and other factors they believe to be appropriate. Important factors that could cause actual results, developments

and business decisions to differ materially from those anticipated in these forward-looking statements include, among other things: potential

objection to the share repurchase program by the Company’s creditors and/or failure to receive Israeli court approval after any

such objection; the Company’s degree of success in developing, introducing and selling new or improved products and product enhancements

including specifically the Company’s Poly Pro and Presto products, and the Company’s Apollo direct-to-garment platform; the

extent of the Company’s ability to increase sales of its systems, ink and consumables; the development of the market for digital

textile printing; and those additional factors referred to under “Risk Factors” in Item 3.D of the Company’s Annual

Report on Form 20-F for the year ended December 31, 2023, filed with the SEC on March 28, 2024. Any forward-looking statements in this

press release are made as of the date hereof, whether as a result of new information, future events or otherwise, except as required by

law.

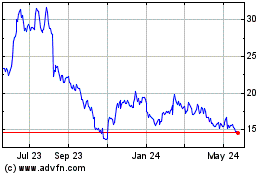

Kornit Digital (NASDAQ:KRNT)

Historical Stock Chart

From Dec 2024 to Jan 2025

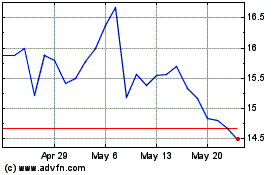

Kornit Digital (NASDAQ:KRNT)

Historical Stock Chart

From Jan 2024 to Jan 2025