UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2024

Commission File Number 001-36903

KORNIT DIGITAL LTD.

(Translation of Registrant’s name into English)

12 Ha’Amal Street

Park Afek

Rosh Ha’Ayin 4824096 Israel

(Address of Principal Executive Office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒

Form 40-F ☐

CONTENTS

Results of Operations and Financial Condition— Quarter

and Nine Months Ended September 30, 2024

On November 6, 2024, Kornit

Digital Ltd. (“Kornit”) issued a press release entitled “Kornit Digital Reports Third Quarter 2024 Results,”

in which Kornit reported its results of operations for the quarter and nine months ended September 30, 2024. A copy of that press release

is furnished as Exhibit 99.1 hereto.

Kornit is holding a conference

call on November 6, 2024 to discuss its results for the quarter and nine months ended September 30, 2024 and, in connection with that

call, is making available to its investors a slide presentation to provide additional information regarding its business and its financial

results. That slide presentation is attached as Exhibit 99.2 to this Report of Foreign Private Issuer on Form 6-K (this “Form

6-K”) and is incorporated herein by reference.

Exhibits

Incorporation by Reference

The U.S. GAAP financial

information contained in the (i) consolidated balance sheets, (ii) consolidated statements of operations and (iii) consolidated statements

of cash flows included in the press release attached as Exhibit 99.1 to this Report of Foreign Private Issuer on Form 6-K is hereby incorporated

by reference into Kornit’s Registration Statements on Form S-8 (File No.’s 333-203970, 333-214015, 333-217039, 333-223794,

333-230567, 333-237346, 333-254749, and 333-263975).

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

KORNIT DIGITAL LTD. |

| |

|

|

| Date: November 6, 2024 |

By: |

/s/ Lauri Hanover |

| |

Name: |

Lauri Hanover |

| |

Title: |

Chief Financial Officer |

2

Exhibit 99.1

Investor

Contact:

Jared Maymon

Global Head of Investor Relations & Strategic

Finance

Jared.Maymon@Kornit.com

Kornit Digital Reports Third Quarter 2024 Results

| ● | Third

quarter revenues of $50.7 million, in line with previous guidance |

| ● | Third

quarter GAAP net loss of $0.9 million; non-GAAP net income of $5.5 million |

| ● | Continued

positive cash generation from operations |

| ● | Significant

year-over-year improvement in non-GAAP gross margin and return to adjusted EBITDA profitability |

| ● | Industry-leading

platforms, Apollo and Atlas MAX, continue to gain adoption among screen-replacement customers, driven by the new AIC model |

Rosh-Ha’Ayin, Israel

– November 6, 2024 – Kornit Digital Ltd. (“Kornit” or the “Company”) (Nasdaq: KRNT), a global

leader in sustainable, on-demand, digital fashion and textile production technologies, today reported results for the third quarter ended

September 30, 2024.

“I am very pleased with the operational

progress we achieved this quarter. We delivered gross margin expansion, returned to adjusted EBITDA profitability, and maintained positive

cash generation as planned,” said Ronen Samuel, Kornit’s Chief Executive Officer.

He continued, “Our unsurpassed Apollo and

MAX-powered products combined with our revamped go-to-market and our All-Inclusive-Click model are already expanding our serviceable market.

This quarter we announced new customers such as Print Palace and Custom Ink that have chosen Kornit to shift their production from screen

to digital-direct-to-garment. We are simultaneously seeing signs of a return to a growth-focused mindset from our core market with customers

such as Monster Digital, Mad Engine Global and DO Apparel, all of whom have announced expansion of their on-demand digital production

fleets with Kornit.”

“We are entering 2025 with the right products

and the right model, and we are laser-focused on executing the plan we laid out at our Investor Event in September,” Mr. Samuel

concluded.

Third Quarter 2024 Results of Operations

| ● | Total

revenue for the third quarter of 2024 was $50.7 million compared with $59.2 million in the prior year period, due primarily to lower

systems revenues. |

| ● | GAAP

gross profit margin for the third quarter of 2024 was 47.7% compared with 34.8% in the prior year period. On a non-GAAP basis, gross

profit margin was 50.3% compared with 37.4% in the prior year period. |

| ● | GAAP

operating expenses for the third quarter of 2024 were $31.3 million compared with $35.3 million in the prior year period. On a non-GAAP

basis, operating expenses decreased by 14% to $26.8 million compared with the prior year period. |

| ● | GAAP

net loss for the third quarter of 2024 was $0.9 million, or ($0.02) per basic share, compared with net loss of $8.2 million, or ($0.17)

per basic share, for the third quarter of 2023. |

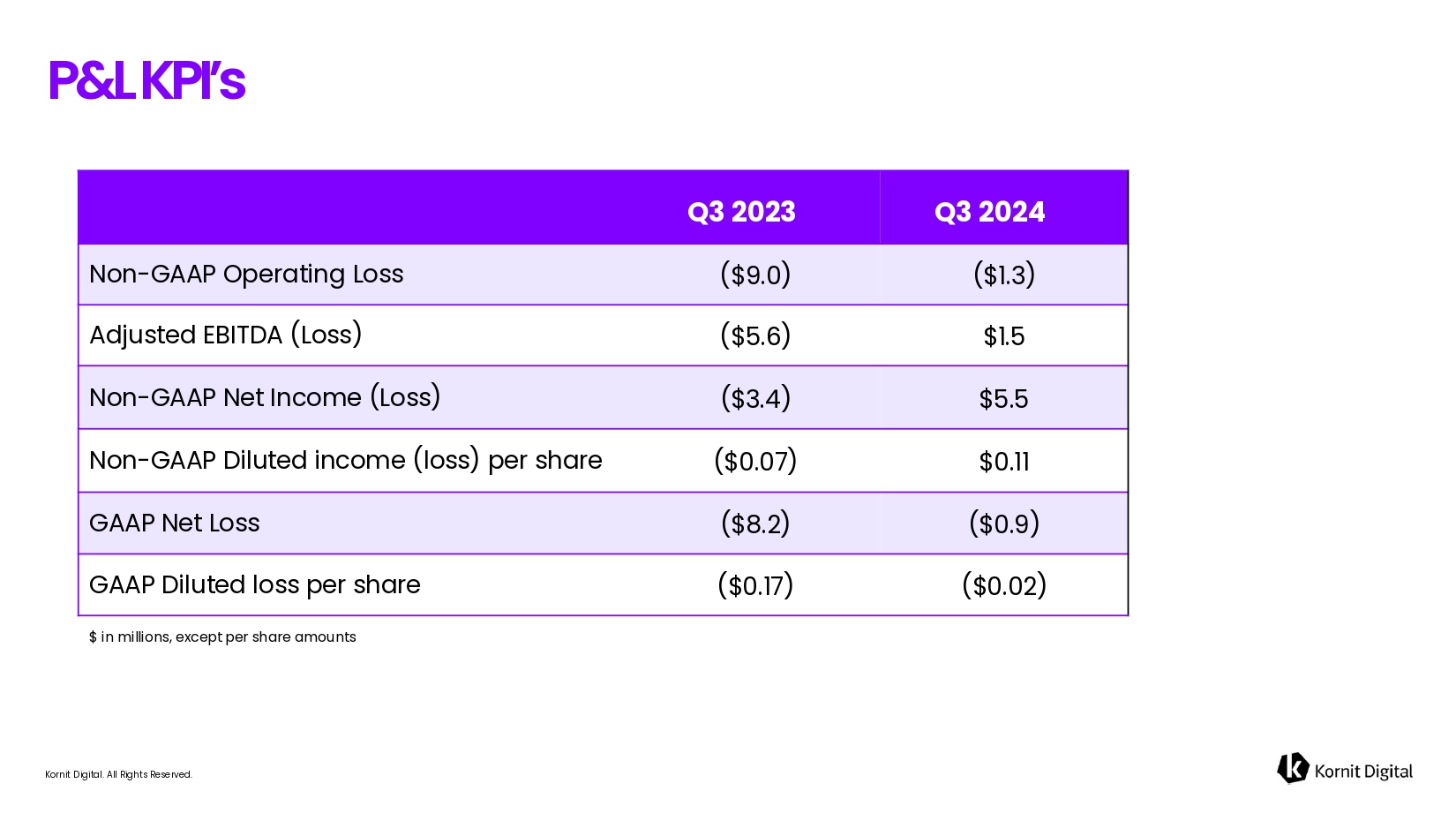

| ● | Non-GAAP

net income for the third quarter of 2024 was $5.5 million, or $0.11 per diluted share, compared with non-GAAP net loss of $3.4 million,

or ($0.07) per basic share, for the third quarter of 2023. |

| ● | Adjusted

EBITDA for the third quarter of 2024 was $1.5 million compared with adjusted EBITDA loss of $5.6 million for the third quarter of 2023.

Adjusted EBITDA margin for the third quarter of 2024 was 2.9% compared with -9.5% for the third quarter of 2023. |

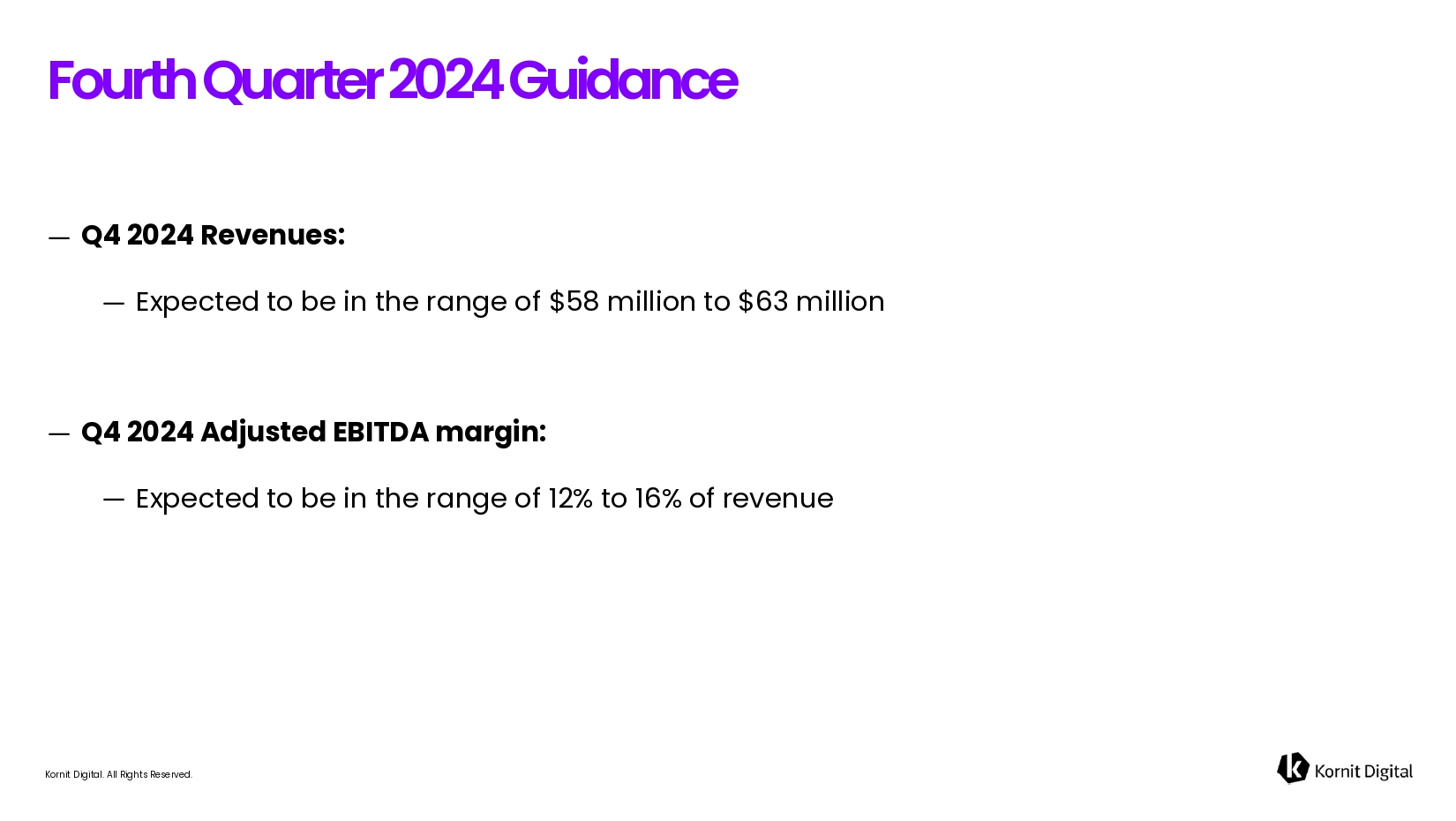

Fourth Quarter 2024 Guidance

For the fourth quarter of 2024, the Company expects

revenues to be in the range of $58 million to $63 million and adjusted EBITDA margin between 12% to 16%.

Third Quarter Earnings Conference Call Information

The Company will host a conference call today

at 8:30 a.m. ET, or 3:30 p.m. Israel time, to discuss the results, followed by a question-and-answer session with the investor community.

A live webcast of the call can be accessed

at ir.kornit.com. To access the call, participants may dial toll-free at 1-877-407-0792 or 1-201-689-8263. The international number is

1 809 406 247.

To listen to a replay of the conference

call, dial toll-free 1-844-512-2921 or 1-412-317-6671 and enter access ID 13746039. The telephonic replay will be available approximately

three hours after the completion of the live call until 11:59 pm ET on November 20, 2024. The call will also be available for replay via

the webcast link on Kornit’s Investor Relations website.

About Kornit Digital

Kornit Digital (NASDAQ: KRNT) is a worldwide market

leader in sustainable, on-demand, digital fashion, and textile production technologies. The company offers end-to-end solutions including

digital printing systems, inks, consumables, software, and fulfillment services through its global fulfillment network. Headquartered

in Israel with offices in the USA, Europe, and Asia Pacific, Kornit Digital serves customers in more than 100 countries and states worldwide.

To learn more about how Kornit Digital is boldly transforming the world of fashion and textiles, visit www.kornit.com.

Forward Looking Statements

Certain statements in this press release are “forward-looking

statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and other U.S. securities laws. Forward-looking

statements are characterized by the use of forward-looking terminology such as “will,” “expects,” “anticipates,”

“continue,” “believes,” “should,” “intended,” “guidance,” “preliminary,”

“future,” “planned,” or other words. These forward-looking statements include, but are not limited to, statements

relating to the Company’s objectives, plans and strategies, statements of preliminary or projected results of operations or of financial

condition and all statements that address activities, events, or developments that the Company intends, expects, projects, believes or

anticipates will or may occur in the future. Forward-looking statements are not guarantees of future performance and are subject to risks

and uncertainties. The Company has based these forward-looking statements on assumptions and assessments made by its management in light

of their experience and their perception of historical trends, current conditions, expected future developments and other factors they

believe to be appropriate. Important factors that could cause actual results, developments and business decisions to differ materially

from those anticipated in these forward-looking statements include, among other things: the duration and severity of adverse macro-economic

headwinds that were caused by inflationary pressures and higher interest rates, which have impacted, and may continue to impact, in an

adverse manner, the Company’s operations, financial position and cash flows, in part due to the adverse impact on the Company’s

customers and suppliers; the Company’s degree of success in developing, introducing and selling new or improved products and product

enhancements including specifically the Company’s Poly Pro and Presto products, and the Company’s Apollo direct-to-garment

platform; the extent of the Company’s ability to consummate sales to large accounts with multi-system delivery plans; the degree

of the Company’s ability to fill orders for its systems and consumables; the extent of the Company’s ability to increase sales

of its systems, ink and consumables; the extent of the Company’s ability to leverage its global infrastructure build-out; the development

of the market for digital textile printing; the availability of alternative ink; competition; sales concentration; changes to the Company’s

relationships with suppliers; the extent of the Company’s success in marketing; and those additional factors referred to under “Risk

Factors” in Item 3.D of the Company’s Annual Report on Form 20-F for the year ended December 31, 2023, filed with the SEC

on March 28, 2024. Any forward-looking statements in this press release are made as of the date hereof, whether as a result of new information,

future events or otherwise, except as required by law.

Non-GAAP Discussion Disclosure

The Company presents certain non-GAAP financial

measures, in this press release and in the accompanying conference call to discuss the Company’s quarterly results. These non-GAAP

financial measures reflect adjustments to corresponding GAAP financial measures in order to exclude the impact of the following: share-based

compensation expenses; amortization of intangible assets; restructuring expenses; foreign exchange differences associated with ASC 842;

and non-cash deferred tax income.

The Company defines “Adjusted EBITDA”

as non-GAAP operating income (loss), which reflects the adjustments described in the preceding paragraph, as further adjusted to exclude

depreciation expense.

The purpose of the foregoing non-GAAP financial

measures is to convey the Company’s performance exclusive of non-cash charges and other items that are considered by management

to be outside of the Company’s core operating results. These non-GAAP measures are among the primary factors management uses in

planning for and forecasting future periods. Furthermore, the non-GAAP measures are regularly used internally to understand, manage, and

evaluate the Company’s business and make operating decisions, and the Company believes that they are useful to investors as a consistent

and comparable measure of the ongoing performance of the Company’s business. The Company’s non-GAAP financial measures are

not meant to be considered in isolation or as a substitute for comparable GAAP measures and should be read only in conjunction with the

Company’s consolidated financial statements prepared in accordance with GAAP. Additionally, these non-GAAP financial measures may

differ materially from the non-GAAP financial measures used by other companies.

The reconciliation tables included below present

a reconciliation of our non-GAAP financial measures to the most directly comparable GAAP financial measures.

KORNIT DIGITAL LTD.

AND ITS SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(U.S. dollars in thousands)

| | |

September 30, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| | |

(Unaudited) | | |

(Audited) | |

| ASSETS | |

| | |

| |

| CURRENT ASSETS: | |

| | |

| |

| Cash and cash equivalents | |

$ | 113,861 | | |

$ | 39,605 | |

| Short-term bank deposit | |

| 169,401 | | |

| 235,600 | |

| Marketable securities | |

| 217,949 | | |

| 57,292 | |

| Trade receivables, net | |

| 74,132 | | |

| 93,632 | |

| Inventory | |

| 66,326 | | |

| 67,712 | |

| Other accounts receivable and prepaid expenses | |

| 27,509 | | |

| 28,546 | |

| Total current assets | |

| 669,178 | | |

| 522,387 | |

| | |

| | | |

| | |

| LONG-TERM ASSETS: | |

| | | |

| | |

| Marketable securities | |

| 59,910 | | |

| 223,203 | |

| Deposits and other long-term assets | |

| 20,704 | | |

| 8,209 | |

| Severance pay fund | |

| 298 | | |

| 283 | |

| Property,plant and equipment, net | |

| 46,144 | | |

| 50,905 | |

| Operating lease right-of-use assets | |

| 19,248 | | |

| 23,782 | |

| Intangible assets, net | |

| 6,145 | | |

| 7,647 | |

| Goodwill | |

| 29,164 | | |

| 29,164 | |

| Total long-term assets | |

| 181,613 | | |

| 343,193 | |

| | |

| | | |

| | |

| Total assets | |

| 850,791 | | |

| 865,580 | |

| | |

| | | |

| | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |

| | | |

| | |

| CURRENT LIABILITIES: | |

| | | |

| | |

| Trade payables | |

| 5,061 | | |

| 6,936 | |

| Employees and payroll accruals | |

| 12,483 | | |

| 12,121 | |

| Deferred revenues and advances from customers | |

| 1,541 | | |

| 2,158 | |

| Operating lease liabilities | |

| 3,251 | | |

| 5,073 | |

| Other payables and accrued expenses | |

| 18,210 | | |

| 23,814 | |

| Total current liabilities | |

| 40,546 | | |

| 50,102 | |

| | |

| | | |

| | |

| LONG-TERM LIABILITIES: | |

| | | |

| | |

| Accrued severance pay | |

| 1,037 | | |

| 1,080 | |

| Operating lease liabilities | |

| 15,585 | | |

| 18,533 | |

| Other long-term liabilities | |

| 118 | | |

| 198 | |

| Total long-term liabilities | |

| 16,740 | | |

| 19,811 | |

| | |

| | | |

| | |

| SHAREHOLDERS’ EQUITY | |

| 793,505 | | |

| 795,667 | |

| | |

| | | |

| | |

| Total liabilities and shareholders’ equity | |

$ | 850,791 | | |

$ | 865,580 | |

KORNIT DIGITAL LTD.

AND ITS SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(U.S. dollars in thousands, except share and per share data)

| | |

Three Months Ended | | |

Nine Months Ended | |

| | |

September 30, | | |

September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

(Unaudited) | | |

(Unaudited) | |

| | |

| | |

| | |

| | |

| |

| Revenues | |

| | |

| | |

| | |

| |

| Products | |

$ | 36,996 | | |

$ | 45,486 | | |

$ | 100,375 | | |

$ | 117,472 | |

| Services | |

| 13,736 | | |

| 13,738 | | |

| 42,754 | | |

| 45,729 | |

| Total revenues | |

| 50,732 | | |

| 59,224 | | |

| 143,129 | | |

| 163,201 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cost of revenues | |

| | | |

| | | |

| | | |

| | |

| Products | |

| 14,647 | | |

| 25,392 | | |

| 43,609 | | |

| 68,391 | |

| Services | |

| 11,875 | | |

| 13,212 | | |

| 38,887 | | |

| 42,425 | |

| Total cost of revenues | |

| 26,522 | | |

| 38,604 | | |

| 82,496 | | |

| 110,816 | |

| | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

| 24,210 | | |

| 20,620 | | |

| 60,633 | | |

| 52,385 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development, net | |

| 9,973 | | |

| 12,038 | | |

| 31,797 | | |

| 38,027 | |

| Sales and marketing | |

| 14,441 | | |

| 15,586 | | |

| 43,213 | | |

| 48,927 | |

| General and administrative | |

| 6,919 | | |

| 7,654 | | |

| 21,728 | | |

| 25,143 | |

| Total operating expenses | |

| 31,333 | | |

| 35,278 | | |

| 96,738 | | |

| 112,097 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating loss | |

| (7,123 | ) | |

| (14,658 | ) | |

| (36,105 | ) | |

| (59,712 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Financial income, net | |

| 6,720 | | |

| 6,304 | | |

| 18,501 | | |

| 18,726 | |

| Loss before taxes on income | |

| (403 | ) | |

| (8,354 | ) | |

| (17,604 | ) | |

| (40,986 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Taxes on income (tax benefit) | |

| 505 | | |

| (193 | ) | |

| 1,412 | | |

| 431 | |

| Net loss | |

$ | (908 | ) | |

$ | (8,161 | ) | |

$ | (19,016 | ) | |

$ | (41,417 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Basic loss per share | |

$ | (0.02 | ) | |

$ | (0.17 | ) | |

$ | (0.40 | ) | |

$ | (0.84 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of shares used in computing basic net loss per share | |

| 47,604,224 | | |

| 48,968,244 | | |

| 47,583,631 | | |

| 49,469,717 | |

| | |

| | | |

| | | |

| | | |

| | |

| Diluted loss per share | |

$ | (0.02 | ) | |

$ | (0.17 | ) | |

$ | (0.40 | ) | |

$ | (0.84 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of shares used in computing diluted net loss per share | |

| 47,604,224 | | |

| 48,968,244 | | |

| 47,583,631 | | |

| 49,469,717 | |

KORNIT DIGITAL LTD.

AND ITS SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP CONSOLIDATED STATEMENTS OF OPERATIONS

(U.S. dollars in thousands, except share and per share data)

| | |

Three Months Ended | | |

Nine Months Ended | |

| | |

September 30, | | |

September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

(Unaudited) | | |

(Unaudited) | |

| | |

| | |

| | |

| | |

| |

| Revenues | |

$ | 50,732 | | |

$ | 59,224 | | |

$ | 143,129 | | |

$ | 163,201 | |

| | |

| | | |

| | | |

| | | |

| | |

| GAAP cost of revenues | |

$ | 26,522 | | |

$ | 38,604 | | |

$ | 82,496 | | |

$ | 110,816 | |

| Cost of product recorded for share-based compensation (1) | |

| (502 | ) | |

| (632 | ) | |

| (1,494 | ) | |

| (1,811 | ) |

| Cost of service recorded for share-based compensation (1) | |

| (422 | ) | |

| (467 | ) | |

| (1,294 | ) | |

| (1,311 | ) |

| Intangible assets amortization on cost of product (2) | |

| (231 | ) | |

| (267 | ) | |

| (760 | ) | |

| (793 | ) |

| Intangible assets amortization on cost of service (2) | |

| (160 | ) | |

| (160 | ) | |

| (480 | ) | |

| (480 | ) |

| Restructuring expenses (3) | |

| - | | |

| - | | |

| (914 | ) | |

| (89 | ) |

| Non-GAAP cost of revenues | |

$ | 25,207 | | |

$ | 37,078 | | |

$ | 77,554 | | |

$ | 106,332 | |

| | |

| | | |

| | | |

| | | |

| | |

| GAAP gross profit | |

$ | 24,210 | | |

$ | 20,620 | | |

$ | 60,633 | | |

$ | 52,385 | |

| Gross profit adjustments | |

| 1,315 | | |

| 1,526 | | |

| 4,942 | | |

| 4,484 | |

| Non-GAAP gross profit | |

$ | 25,525 | | |

$ | 22,146 | | |

$ | 65,575 | | |

$ | 56,869 | |

| | |

| | | |

| | | |

| | | |

| | |

| GAAP operating expenses | |

$ | 31,333 | | |

$ | 35,278 | | |

$ | 96,738 | | |

$ | 112,097 | |

| Share-based compensation (1) | |

| (4,431 | ) | |

| (4,050 | ) | |

| (13,884 | ) | |

| (13,822 | ) |

| Intangible assets amortization (2) | |

| (87 | ) | |

| (117 | ) | |

| (262 | ) | |

| (457 | ) |

| Restructuring expenses (3) | |

| - | | |

| - | | |

| (757 | ) | |

| (206 | ) |

| Non-GAAP operating expenses | |

$ | 26,815 | | |

$ | 31,111 | | |

$ | 81,835 | | |

$ | 97,612 | |

| | |

| | | |

| | | |

| | | |

| | |

| GAAP Financial income, net | |

$ | 6,720 | | |

$ | 6,304 | | |

$ | 18,501 | | |

$ | 18,726 | |

| Foreign exchange losses associated with ASC 842 | |

| 441 | | |

| (704 | ) | |

| 557 | | |

| (1,201 | ) |

| Non-GAAP Financial income , net | |

$ | 7,161 | | |

$ | 5,600 | | |

$ | 19,058 | | |

$ | 17,525 | |

| | |

| | | |

| | | |

| | | |

| | |

| GAAP Taxes on income | |

$ | 505 | | |

$ | (193 | ) | |

$ | 1,412 | | |

$ | 431 | |

| Non-cash deferred tax income | |

| (173 | ) | |

| 255 | | |

| - | | |

| 578 | |

| Non-GAAP Taxes on income | |

$ | 332 | | |

$ | 62 | | |

$ | 1,412 | | |

$ | 1,009 | |

| | |

| | | |

| | | |

| | | |

| | |

| GAAP net loss | |

$ | (908 | ) | |

$ | (8,161 | ) | |

$ | (19,016 | ) | |

$ | (41,417 | ) |

| Share-based compensation (1) | |

| 5,355 | | |

| 5,149 | | |

| 16,672 | | |

| 16,944 | |

| Intangible assets amortization (2) | |

| 478 | | |

| 544 | | |

| 1,502 | | |

| 1,730 | |

| Restructuring expenses (3) | |

| - | | |

| - | | |

| 1,671 | | |

| 295 | |

| Foreign exchange losses associated with ASC 842 | |

| 441 | | |

| (704 | ) | |

| 557 | | |

| (1,201 | ) |

| Non-cash deferred tax income | |

| 173 | | |

| (255 | ) | |

| - | | |

| (578 | ) |

| Non-GAAP net income (loss) | |

$ | 5,539 | | |

$ | (3,427 | ) | |

$ | 1,386 | | |

$ | (24,227 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| GAAP diluted loss per share | |

$ | (0.02 | ) | |

$ | (0.17 | ) | |

$ | (0.40 | ) | |

$ | (0.84 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Non-GAAP diluted income (loss) per share | |

$ | 0.11 | | |

$ | (0.07 | ) | |

$ | 0.03 | | |

$ | (0.49 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of shares | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Shares used in computing GAAP diluted net loss per share | |

| 47,604,224 | | |

| 48,968,244 | | |

| 47,583,631 | | |

| 49,469,717 | |

| | |

| | | |

| | | |

| | | |

| | |

| Shares used in computing Non-GAAP diluted net loss per share | |

| 49,988,803 | | |

| 48,968,244 | | |

| 49,166,345 | | |

| 49,469,717 | |

| | |

| | | |

| | | |

| | | |

| | |

| (1) Share-based compensation | |

| | | |

| | | |

| | | |

| | |

| Cost of product revenues | |

$ | 502 | | |

$ | 632 | | |

$ | 1,494 | | |

$ | 1,811 | |

| Cost of service revenues | |

| 422 | | |

| 467 | | |

| 1,294 | | |

| 1,311 | |

| Research and development | |

| 1,384 | | |

| 1,478 | | |

| 4,055 | | |

| 4,430 | |

| Sales and marketing | |

| 1,650 | | |

| 1,747 | | |

| 5,016 | | |

| 5,054 | |

| General and administrative | |

| 1,397 | | |

| 825 | | |

| 4,813 | | |

| 4,338 | |

| | |

$ | 5,355 | | |

$ | 5,149 | | |

$ | 16,672 | | |

$ | 16,944 | |

| (2) Intangible assets amortization | |

| | | |

| | | |

| | | |

| | |

| Cost of product revenues | |

$ | 231 | | |

$ | 267 | | |

$ | 760 | | |

$ | 793 | |

| Cost of service revenues | |

| 160 | | |

| 160 | | |

| 480 | | |

| 480 | |

| Sales and marketing | |

| 87 | | |

| 117 | | |

| 262 | | |

| 457 | |

| | |

$ | 478 | | |

$ | 544 | | |

$ | 1,502 | | |

$ | 1,730 | |

| | |

| | | |

| | | |

| | | |

| | |

| (3) Restructuring expenses | |

| | | |

| | | |

| | | |

| | |

| Cost of product revenues | |

$ | - | | |

$ | - | | |

$ | 865 | | |

$ | 89 | |

| Cost of service revenues | |

| - | | |

| - | | |

| 49 | | |

| - | |

| Research and development | |

| - | | |

| - | | |

| 235 | | |

| 20 | |

| Sales and marketing | |

| - | | |

| - | | |

| 190 | | |

| 186 | |

| General and administrative | |

| - | | |

| - | | |

| 332 | | |

| - | |

| | |

$ | - | | |

$ | - | | |

$ | 1,671 | | |

$ | 295 | |

KORNIT DIGITAL LTD.

AND ITS SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(U.S. dollars in thousands)

| | |

Three Months Ended | | |

Nine Months Ended | |

| | |

September 30, | | |

September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

(Unaudited) | | |

(Unaudited) | |

| Cash flows from operating activities: | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

| |

| Net loss | |

$ | (908 | ) | |

$ | (8,161 | ) | |

$ | (19,016 | ) | |

$ | (41,417 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | | |

| | | |

| | |

| Depreciation and amortization | |

| 3,219 | | |

| 3,886 | | |

| 9,734 | | |

| 11,413 | |

| Fair value of warrants deducted from revenues | |

| - | | |

| 3,325 | | |

| 3,273 | | |

| 9,001 | |

| Share-based compensation | |

| 5,355 | | |

| 5,149 | | |

| 16,672 | | |

| 16,944 | |

| Amortization of premium and accretion of discount on marketable securities, net | |

| (287 | ) | |

| 148 | | |

| (278 | ) | |

| 673 | |

| Realized loss on sale and redemption of marketable securities | |

| - | | |

| 44 | | |

| - | | |

| 41 | |

| Change in operating assets and liabilities: | |

| | | |

| | | |

| | | |

| | |

| Trade receivables, net | |

| 5,329 | | |

| (8,921 | ) | |

| 19,500 | | |

| (25,777 | ) |

| Other accounts receivables and prepaid expenses | |

| (447 | ) | |

| (686 | ) | |

| 1,037 | | |

| (1,452 | ) |

| Inventory | |

| 4,094 | | |

| 4,567 | | |

| 130 | | |

| 6,507 | |

| Operating leases right-of-use assets and liabilities, net | |

| 339 | | |

| (711 | ) | |

| (236 | ) | |

| (1,723 | ) |

| Deposits and other long term assets | |

| (440 | ) | |

| (301 | ) | |

| (1,659 | ) | |

| (2,179 | ) |

| Trade payables | |

| 227 | | |

| (1,887 | ) | |

| (1,706 | ) | |

| (3,589 | ) |

| Employees and payroll accruals | |

| 914 | | |

| (1,284 | ) | |

| 1,436 | | |

| 1,205 | |

| Deferred revenues and advances from customers | |

| 55 | | |

| (414 | ) | |

| (617 | ) | |

| (3,651 | ) |

| Other payables and accrued expenses | |

| (3,880 | ) | |

| (2,152 | ) | |

| (6,070 | ) | |

| (2,190 | ) |

| Accrued severance pay, net | |

| 4 | | |

| (76 | ) | |

| (58 | ) | |

| (138 | ) |

| Other long - term liabilities | |

| (20 | ) | |

| (254 | ) | |

| (80 | ) | |

| (944 | ) |

| Net cash provided by (used in) operating activities | |

| 13,554 | | |

| (7,728 | ) | |

| 22,062 | | |

| (37,276 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Purchase of property, plant and equipment | |

| (774 | ) | |

| (1,003 | ) | |

| (3,497 | ) | |

| (6,072 | ) |

| Investing in long term assets | |

| (9,723 | ) | |

| - | | |

| (9,723 | ) | |

| - | |

| Proceeds from short-term bank deposits, net | |

| 73,995 | | |

| 3 | | |

| 66,199 | | |

| 54,938 | |

| Proceeds from sales and redemption of marketable securities | |

| 7,000 | | |

| 1,990 | | |

| 10,494 | | |

| 7,240 | |

| Proceeds from maturities of marketable securities | |

| 8,750 | | |

| 2,970 | | |

| 44,629 | | |

| 14,222 | |

| Investment in marketable securities | |

| (1,282 | ) | |

| (5,516 | ) | |

| (45,901 | ) | |

| (24,451 | ) |

| Net cash provided by (used in) investing activities | |

| 77,966 | | |

| (1,556 | ) | |

| 62,201 | | |

| 45,877 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Exercise of employee stock options | |

| 115 | | |

| 198 | | |

| 122 | | |

| 293 | |

| Payments related to shares withheld for taxes | |

| (296 | ) | |

| - | | |

| (1,074 | ) | |

| (437 | ) |

| Repurchase of ordinary shares | |

| - | | |

| (15,948 | ) | |

| (9,055 | ) | |

| (36,766 | ) |

| Net cash used in financing activities | |

| (181 | ) | |

| (15,750 | ) | |

| (10,007 | ) | |

| (36,910 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Increase (decrease) in cash and cash equivalents | |

| 91,339 | | |

| (25,034 | ) | |

| 74,256 | | |

| (28,309 | ) |

| Cash and cash equivalents at the beginning of the period | |

| 22,522 | | |

| 101,322 | | |

| 39,605 | | |

| 104,597 | |

| Cash and cash equivalents at the end of the period | |

$ | 113,861 | | |

$ | 76,288 | | |

$ | 113,861 | | |

$ | 76,288 | |

| | |

| | | |

| | | |

| | | |

| | |

| Non-cash investing and financing activities: | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Purchase of property and equipment on credit | |

| 145 | | |

| 74 | | |

| 145 | | |

| 74 | |

| Inventory transferred to be used as property and equipment and long term assets | |

| 175 | | |

| 531 | | |

| 1,576 | | |

| 531 | |

| Property, plant and equipment transferred to be used as inventory | |

| - | | |

| - | | |

| 320 | | |

| 734 | |

| Lease liabilities arising from obtaining right-of-use assets | |

| 337 | | |

| 322 | | |

| (1,071 | ) | |

| 5,809 | |

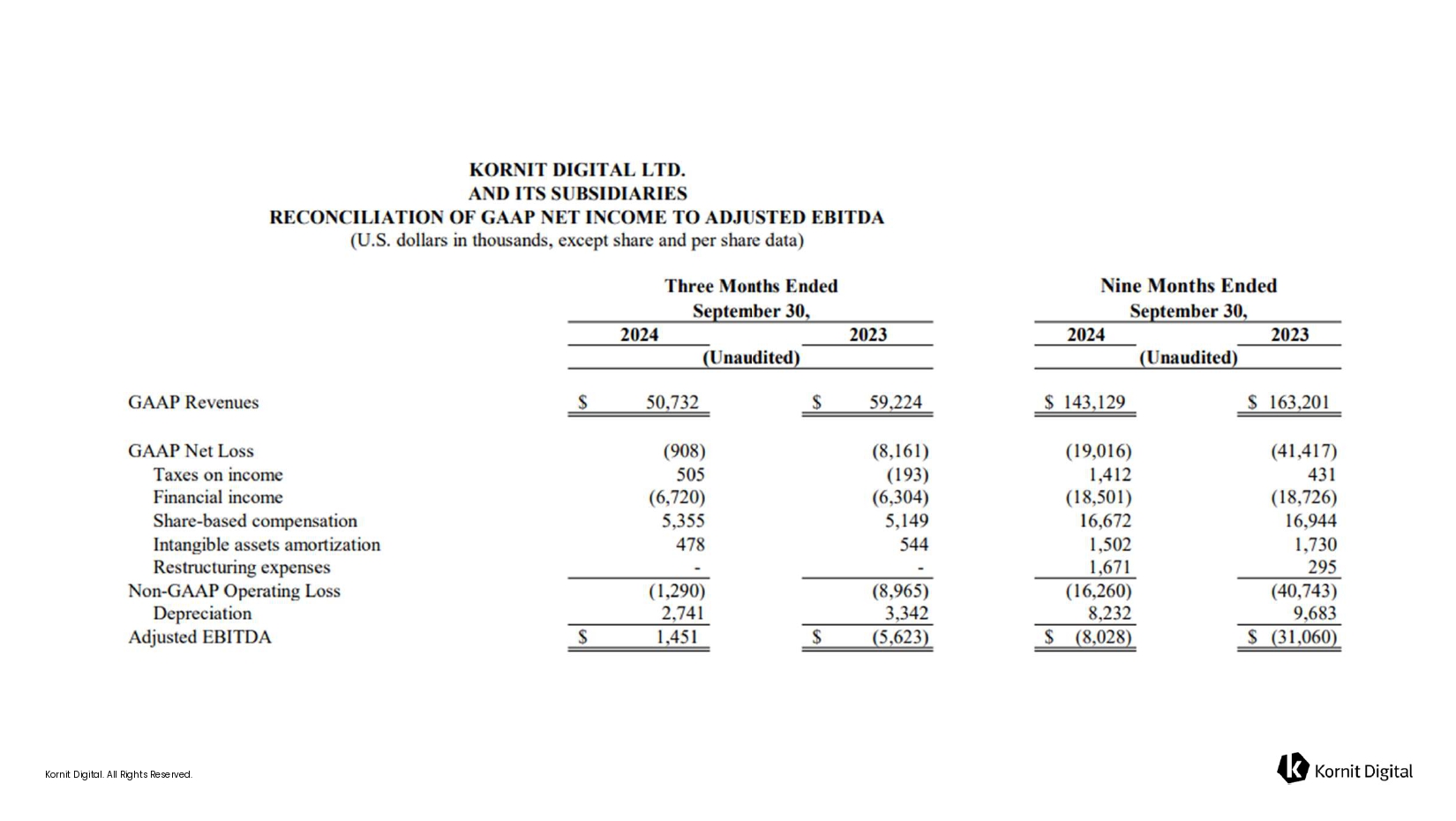

KORNIT DIGITAL LTD.

AND ITS SUBSIDIARIES

RECONCILIATION OF GAAP NET INCOME TO ADJUSTED

EBITDA

(U.S. dollars in thousands, except share and per

share data)

| | |

Three Months Ended | | |

Nine Months Ended | |

| | |

September 30, | | |

September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

(Unaudited) | | |

(Unaudited) | |

| | |

| | |

| | |

| | |

| |

| GAAP Revenues | |

$ | 50,732 | | |

$ | 59,224 | | |

$ | 143,129 | | |

$ | 163,201 | |

| | |

| | | |

| | | |

| | | |

| | |

| GAAP Net Loss | |

| (908 | ) | |

| (8,161 | ) | |

| (19,016 | ) | |

| (41,417 | ) |

| Taxes on income | |

| 505 | | |

| (193 | ) | |

| 1,412 | | |

| 431 | |

| Financial income | |

| (6,720 | ) | |

| (6,304 | ) | |

| (18,501 | ) | |

| (18,726 | ) |

| Share-based compensation | |

| 5,355 | | |

| 5,149 | | |

| 16,672 | | |

| 16,944 | |

| Intangible assets amortization | |

| 478 | | |

| 544 | | |

| 1,502 | | |

| 1,730 | |

| Restructuring expenses | |

| - | | |

| - | | |

| 1,671 | | |

| 295 | |

| Non-GAAP Operating Loss | |

| (1,290 | ) | |

| (8,965 | ) | |

| (16,260 | ) | |

| (40,743 | ) |

| Depreciation | |

| 2,741 | | |

| 3,342 | | |

| 8,232 | | |

| 9,683 | |

| Adjusted EBITDA | |

$ | 1,451 | | |

$ | (5,623 | ) | |

$ | (8,028 | ) | |

$ | (31,060 | ) |

Exhibit

99.2

Kornit Digital. All Rights Reserved. Kornit Digital. All Rights Reserved. Kornit Digital (NASDAQ: KRNT) Third Quarter 2024 Earnings Conference Call Supporting Slides November 6, 2024 Kornit Digital. All Rights Reserved.

Kornit Digital. All Rights Reserved. On Today’s Call Ronen Samuel CEO Lauri Hanover CFO Jared Maymon Investor Relations

Kornit Digital. All Rights Reserved. Safe Harbor This presentation contains “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and other U . S . securities laws . Forward - looking statements are characterized by the use of forward - looking terminology such as “will,” “expects,” “anticipates,” “continue,” “believes,” “should,” “intended,” “guidance,” “preliminary,” “future,” “planned,” or other words . These forward - looking statements include, but are not limited to, statements relating to the Company’s objectives, plans and strategies, statements of preliminary or projected results of operations or of financial condition and all statements that address activities, events, or developments that the Company intends, expects, projects, believes or anticipates will or may occur in the future . Forward - looking statements are not guarantees of future performance and are subject to risks and uncertainties . The Company has based these forward - looking statements on assumptions and assessments made by its management in light of their experience and their perception of historical trends, current conditions, expected future developments and other factors they believe to be appropriate . Important factors that could cause actual results, developments and business decisions to differ materially from those anticipated in these forward - looking statements include, among other things : the duration and severity of adverse macro - economic headwinds that were caused by inflationary pressures and higher interest rates, which have impacted, and may continue to impact, in an adverse manner, the Company’s operations, financial position and cash flows, in part due to the adverse impact on the Company’s customers and suppliers ; the Company’s degree of success in developing, introducing and selling new or improved products and product enhancements including specifically the Company’s Poly Pro and Presto products, and the Company’s Apollo direct - to - garment platform ; the extent of the Company’s ability to consummate sales to large accounts with multi - system delivery plans ; the degree of the Company’s ability to fill orders for its systems and consumables ; the extent of the Company’s ability to increase sales of its systems, ink and consumables ; the extent of the Company’s ability to leverage its global infrastructure build - out ; the development of the market for digital textile printing ; the availability of alternative ink ; competition ; sales concentration ; changes to the Company’s relationships with suppliers ; the extent of the Company’s success in marketing ; and those additional factors referred to under “Risk Factors” in Item 3 . D of the Company’s Annual Report on Form 20 - F for the year ended December 31 , 2023 , filed with the SEC on March 28 , 2024 . Any forward - looking statements in this press release are made as of the date hereof, whether as a result of new information, future events or otherwise, except as required by law . In addition to U . S . GAAP financials, this presentation includes certain non - GAAP financial measures . These non - GAAP financial measures are in addition to, and not a substitute for or superior to, measures of financial performance prepared in accordance with U . S . GAAP . Please see the reconciliation table that appears among the financial tables in our earnings release being issued today, which earnings release is attached as Exhibit 99 . 1 to our report of foreign private issuer on Form 6 - K being furnished to the SEC today, which reconciliation table is incorporated by reference in this presentation . This presentation contains statistical data that we obtained from industry publications and reports generated by third parties . Although we believe that the publications and reports are reliable, we have not independently verified this statistical data . Kornit, Kornit Digital, the K logo, and NeoPigment are trademarks of Kornit Digital Ltd . All other trademarks are the property of their respective owners and are used for reference purposes only . Such use should not be construed as an endorsement of our products or services .

Kornit Digital. All Rights Reserved. Business Highlights

Kornit Digital. All Rights Reserved. ― Revenues of $ 50.7 million and adjusted EBITDA margin of 2.9 % ― Within the guidance range provided in August ― Generated positive cash from operations for Q � 2024 ― Gross margin improved significantly year - over - year, climbing to upwards of 50 % Third Quarter 2024 Recap

Kornit Digital. All Rights Reserved. ― Traditionally analog - centric producers are realizing the benefits of speed, creativity, and sustainability ― Apollo coupled with AIC is driving the shift ― 12 out of 15 Apollos have been shipped this year ― The remainder is scheduled for deployment before the peak season ― Recent collaborations include industry leaders like Print Palace, T - Formation, Custom Ink, and more ― Adding to our pipeline of pure - play analog producers making decisive investments in digital Market update

Kornit Digital. All Rights Reserved. ― Directly addresses a multi - billion impression market of longer runs ― Removes barriers to entry and provides a predictable cost structure ― Shipped a number of Atlas MAX units on the model in addition to the 12 Apollos YTD ― Remain on track to ship 30 Apollos in 2025, with approximately 20 on the AIC model ― Firm visibility on more than half of 2025 shipments ― Progress aligns with the LT targets provided at our recent Investor Event in September ― LT targets highlighted revenue growth, more recurring revenue, and enhanced profitability All - inclusive Click (AIC) Pilot Program Recap & Update

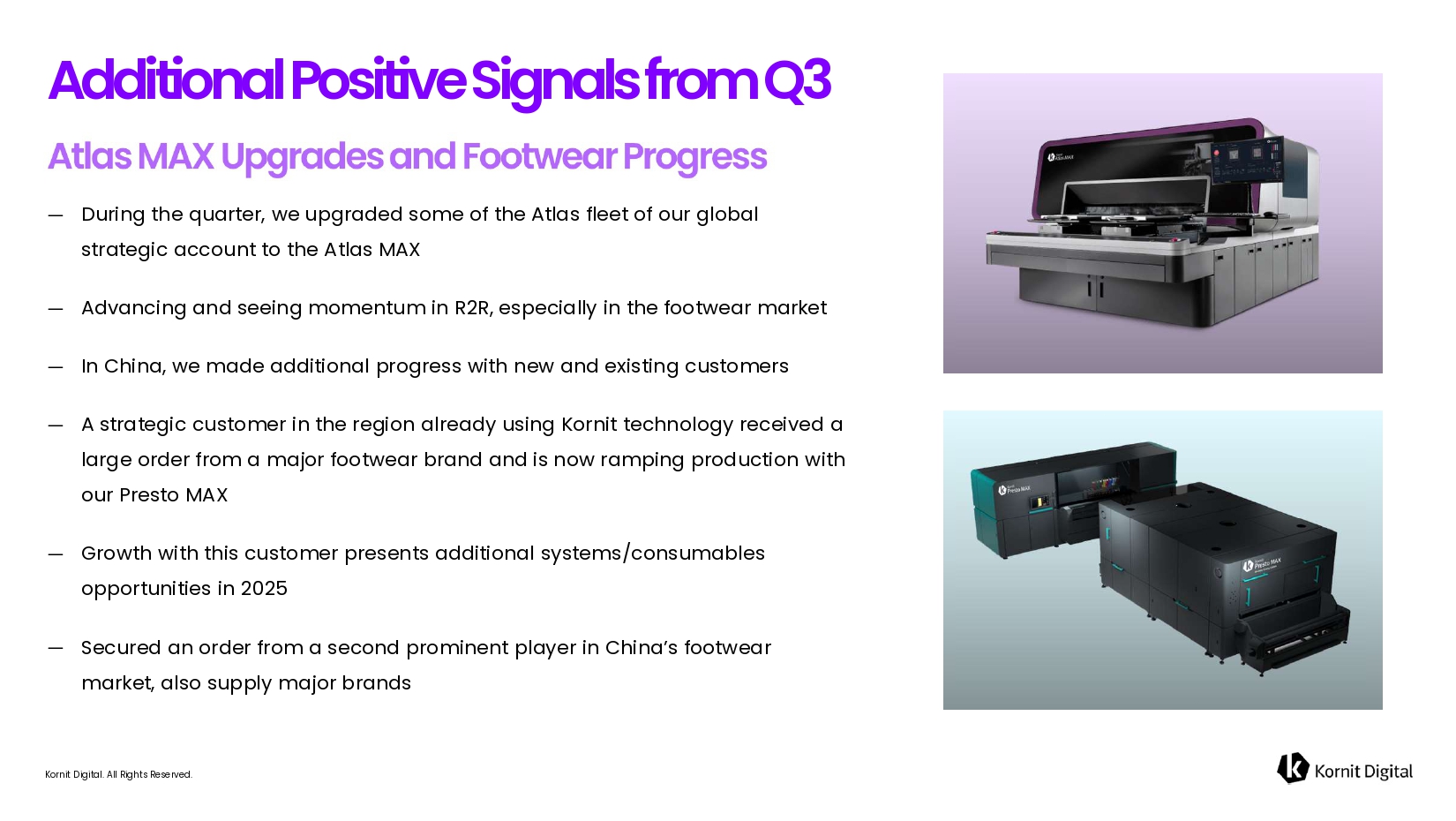

Kornit Digital. All Rights Reserved. ― During the quarter, we upgraded some of the Atlas fleet of our global strategic account to the Atlas MAX ― Advancing and seeing momentum in R2R, especially in the footwear market ― In China, we made additional progress with new and existing customers ― A strategic customer in the region already using Kornit technology received a large order from a major footwear brand and is now ramping production with our Presto MAX ― Growth with this customer presents additional systems/consumables opportunities in 2025 ― Secured an order from a second prominent player in China’s footwear market, also supply major brands Additional Positive Signals from Q3

Kornit Digital. All Rights Reserved. ― Now entering the peak season in Q4, and the market is showing signs of improvement ― Improvement is validated by strong consumables ordering, and systems orders from Q3 planned to be delivered in Q4 ― Better visibility paired with the growing momentum of AIC & Apollo supports expectation of year - over - year growth in Q4 ― Continue to expect H2 to be at least 20% higher than H1 sequentially Fourth Quarter & H 2 view

Kornit Digital. All Rights Reserved. ― We are seeing signs of stabilization and recovery which are building confidence in our ability to achieve profitable growth ― Kornit is well - positioned to lead the digital transformation with the right products and model ― Expecting to deliver strong value for our customers, shareholders, and employees alike in 2025 Concluding Remarks

Kornit Digital. All Rights Reserved. Financial Highlights

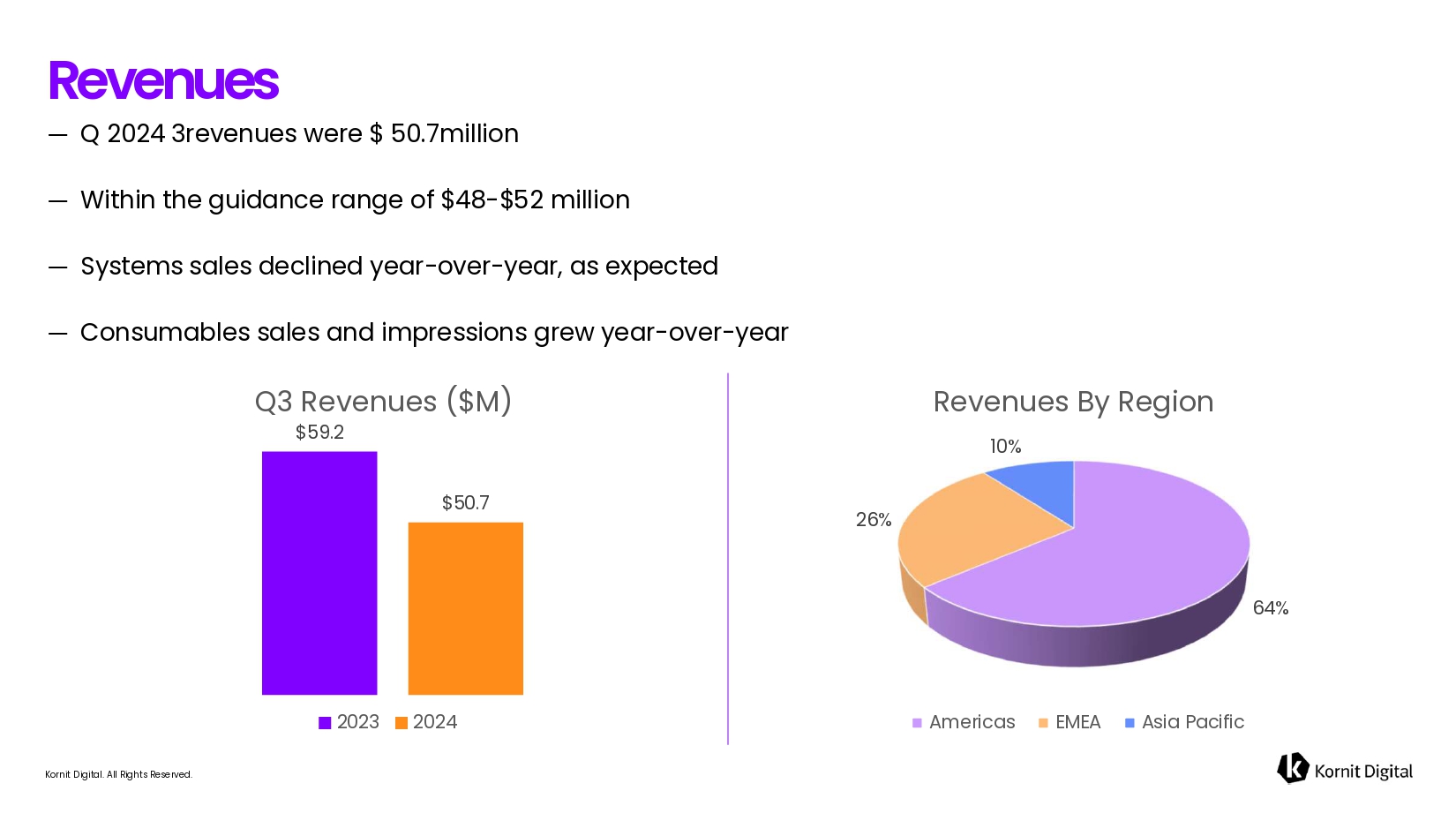

Kornit Digital. All Rights Reserved. ― Q ʦ 2024 revenues were $ ʨʣ . ʪ million ― Within the guidance range of $ ʧʫ - $ 52 million ― Systems sales declined year - over - year, as expected ― Consumables sales and impressions grew year - over - year Revenues $59.2 $50.7 Q3 Revenues ($M) 2023 2024 64% 26% 10 % Revenues By Region Americas EMEA Asia Pacific

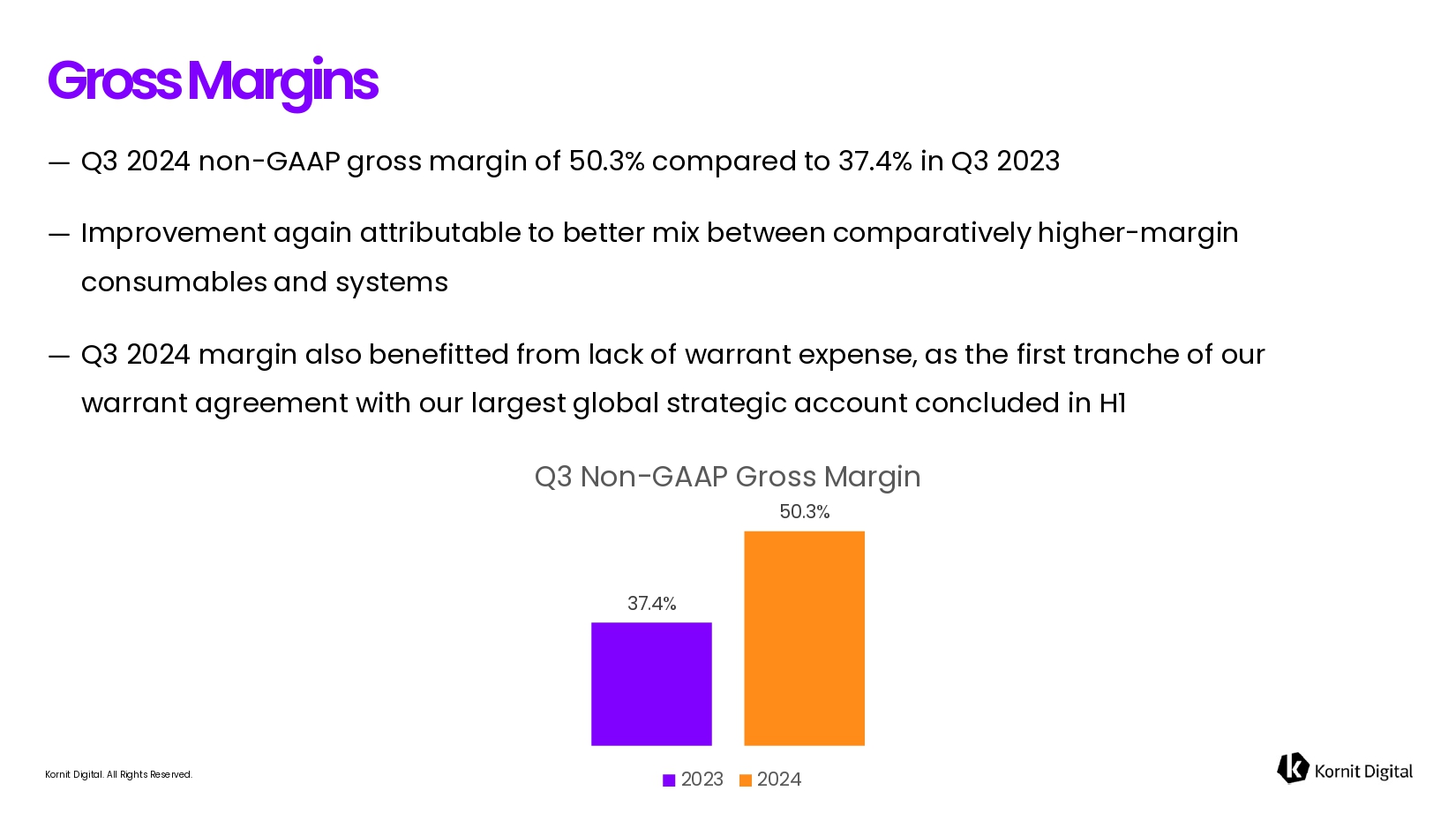

Kornit Digital. All Rights Reserved. ― Q3 2024 non - GAAP gross margin of 50.3% compared to 37.4% in Q3 2023 ― Improvement again attributable to better mix between comparatively higher - margin consumables and systems ― Q3 2024 margin also benefitted from lack of warrant expense, as the first tranche of our warrant agreement with our largest global strategic account concluded in H1 Gross Margins 37.4% 50.3% Q3 Non - GAAP Gross Margin 2023 2024

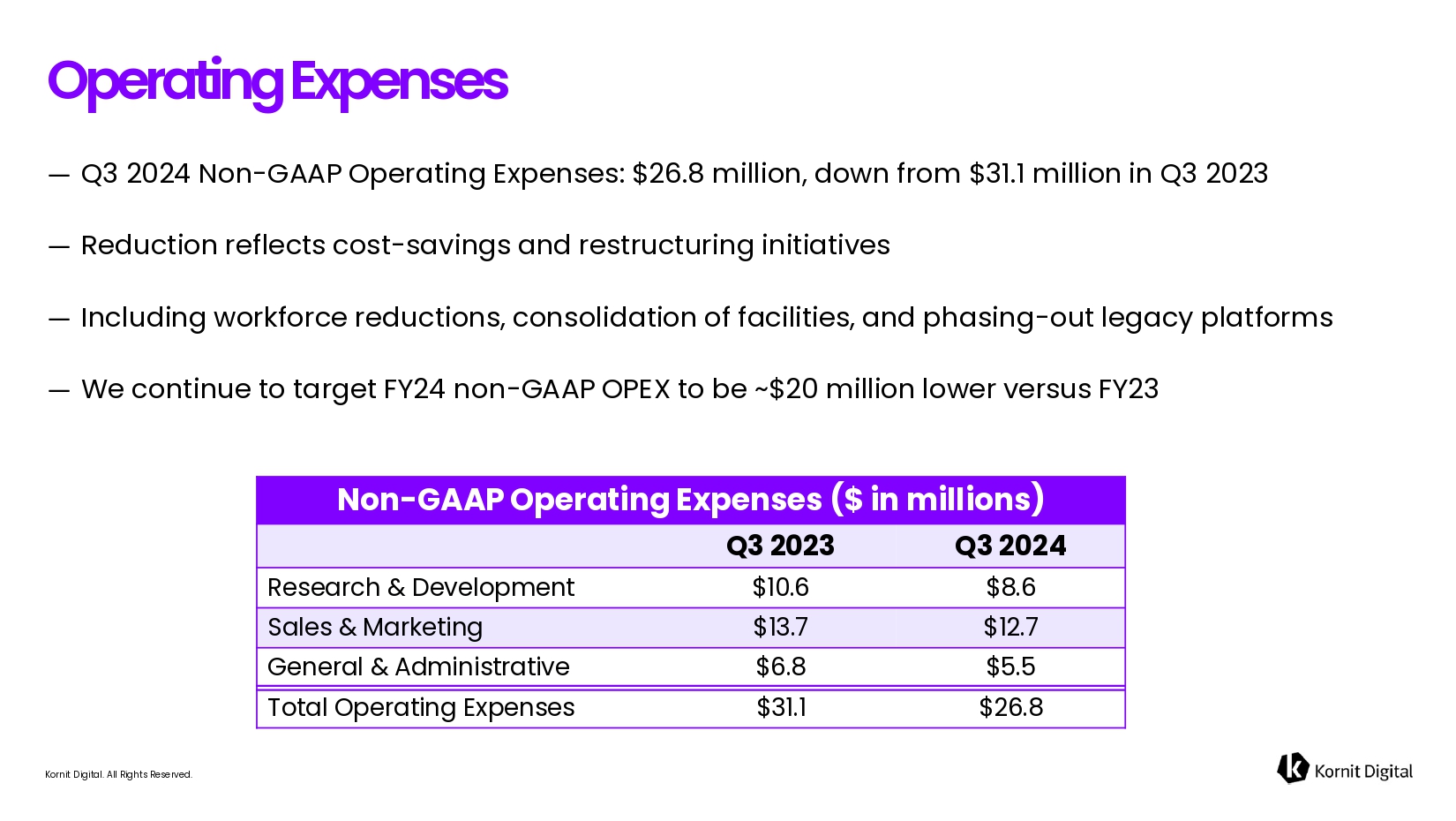

Kornit Digital. All Rights Reserved. ― Q3 2024 Non - GAAP Operating Expenses: $26.8 million, down from $31.1 million in Q3 2023 ― Reduction reflects cost - savings and restructuring initiatives ― Including workforce reductions, consolidation of facilities, and phasing - out legacy platforms ― We continue to target FY24 non - GAAP OPEX to be ~$20 million lower versus FY23 Operating Expenses Non - GAAP Operating Expenses ($ in millions) Q3 2024 Q 3 2023 $8.6 $10.6 Research & Development $12.7 $13.7 Sales & Marketing $5.5 $6.8 General & Administrative $26.8 $31.1 Total Operating Expenses (1)

Kornit Digital. All Rights Reserved. P&L KPI’s Q3 2024 Q3 2023 ($1.3) ($9.0) Non - GAAP Operating Loss $1.5 ($5.6) Adjusted EBITDA (Loss) $5.5 ($3.4) Non - GAAP Net Income (Loss) $0.11 ($0.07) Non - GAAP Diluted income (loss) per share ($0.9) ($8.2) GAAP Net Loss ($0.02) ($0.17) GAAP Diluted loss per share $ in millions, except per share amounts

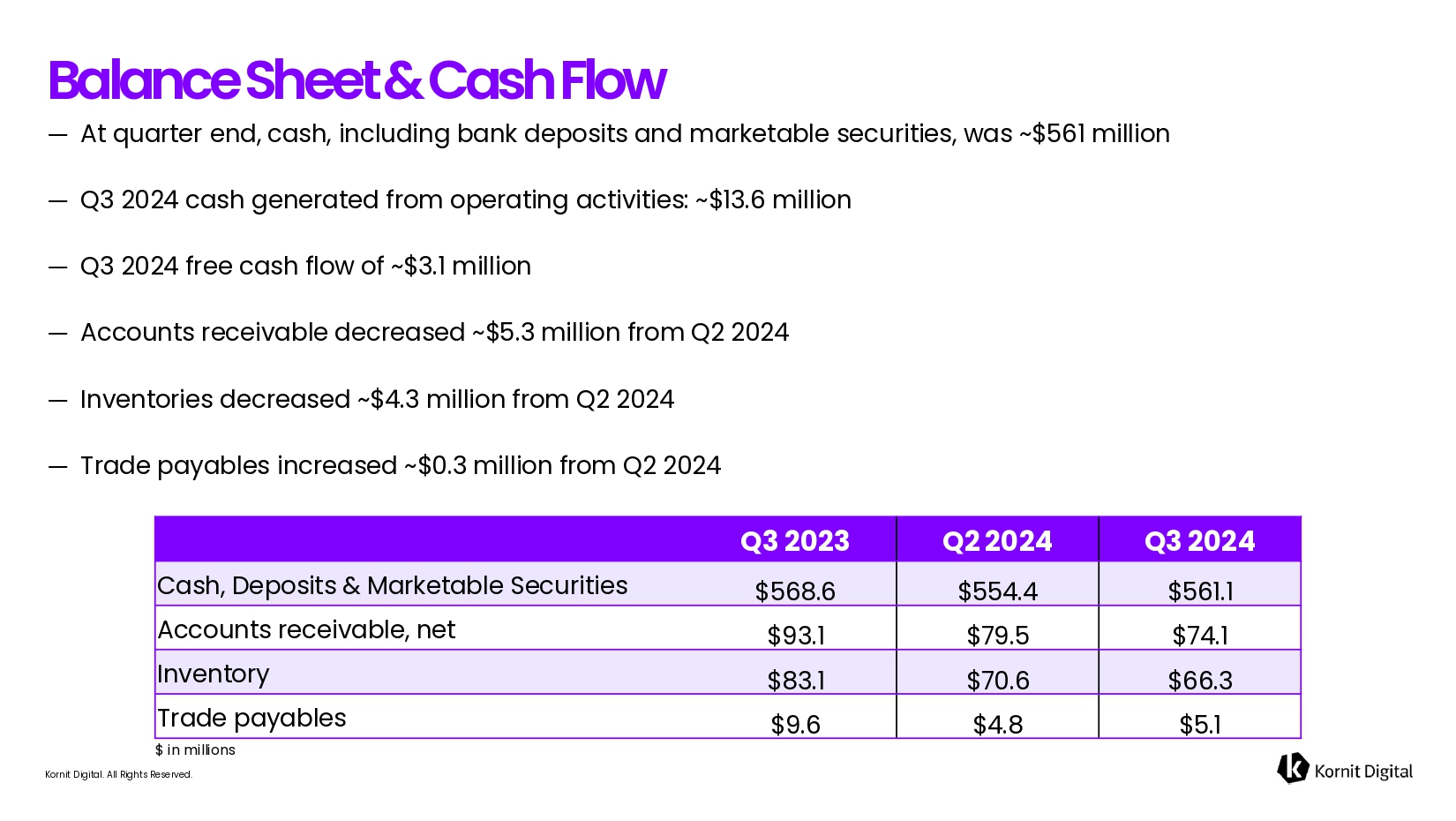

Kornit Digital. All Rights Reserved. ― At quarter end, cash, including bank deposits and marketable securities, was ~$561 million ― Q3 2024 cash generated from operating activities: ~$13.6 million ― Q3 2024 free cash flow of ~$3.1 million ― Accounts receivable decreased ~$5.3 million from Q2 2024 ― Inventories decreased ~$4.3 million from Q2 2024 ― Trade payables increased ~$0.3 million from Q2 2024 Balance Sheet & Cash Flow Q3 2024 Q2 2024 Q3 2023 $561.1 $554.4 $568.6 Cash, Deposits & Marketable Securities $74.1 $79.5 $93.1 Accounts r eceivable, net $66.3 $70.6 $83.1 Inventory $5.1 $4.8 $9.6 Trade p ayables $ in millions

Kornit Digital. All Rights Reserved. ― According to Israeli law, we were subject to a 30 - day waiting period ― The end of this 30 - day period landed within our Q3 blackout window ― We will be able to begin execution of the new $100m program following the conclusion of the blackout period Share Repurchase Program

Kornit Digital. All Rights Reserved. ― We are on track to ship 15 Apollo systems in 2024, with 10 on the AIC model ― These systems will provide a solid base of recurring revenue as we move into 2025 ― Looking ahead to 2025, we expect to ship 30 Apollo systems ― Of the 30 systems, we expected 20 to be delivered under our AIC model ― These incremental systems will expand our base of recurring revenue, as we laid out at our Investor Event in September AIC Pilot Program Update

Kornit Digital. All Rights Reserved. ― Q4 2024 Revenues: ― Expected to be in the range of $58 million to $63 million ― Q4 2024 Adjusted EBITDA margin: ― Expected to be in the range of 12% to 16% of revenue Fourth Quarter 2024 Guidance

Kornit Digital. All Rights Reserved.

Kornit Digital. All Rights Reserved. Thank You!

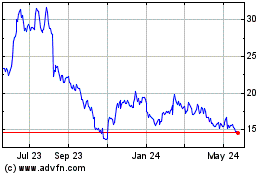

Kornit Digital (NASDAQ:KRNT)

Historical Stock Chart

From Nov 2024 to Dec 2024

Kornit Digital (NASDAQ:KRNT)

Historical Stock Chart

From Dec 2023 to Dec 2024