false

0001811210

0001811210

2025-02-25

2025-02-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (date of earliest event reported):

February 25, 2025

Lucid

Group, Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

001-39408 |

85-0891392 |

(State or other jurisdiction

of

incorporation or organization) |

(Commission File

Number) |

(I.R.S. Employer Identification

No.) |

| |

|

|

7373

Gateway Boulevard

Newark,

CA |

|

94560 |

| (Address of Principal Executive

Offices) |

|

(Zip Code) |

| Registrant’s telephone number, including

area code: (510)

648-3553 |

| |

| (Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered

pursuant to Section 12(b) of the Act:

| Title

of each class | |

Trading

Symbol(s) | |

Name

of each exchange on which registered |

| Class

A Common Stock, $0.0001 par value per share | |

LCID | |

The

Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

On February 25, 2025, Lucid Group, Inc. (“Lucid”

or the “Company”) registered for resale up to (i) 100,000 shares of the Company’s Series A Convertible

Preferred Stock, par value $0.0001 per share (the “Series A Convertible Preferred Stock”), (ii) 297,567,387

shares of the Company’s Class A Common Stock, par value $0.0001 per share (“Common Stock”), which

may be issued upon conversion of the Series A Convertible Preferred Stock as of December 31, 2024, (iii) 75,000 shares

of the Company’s Series B Convertible Preferred Stock, par value $0.0001 per share (the “Series B Convertible

Preferred Stock”), (iv) 177,103,144 shares of Common Stock, which may be issued upon conversion of the Series B

Convertible Preferred Stock as of December 31, 2024, and (v) 396,188,386 shares of Common Stock, pursuant to a registration

statement and a related prospectus supplement filed by the Company with the Securities and Exchange Commission.

The Company is filing a copy of the legal opinion

and consent of Skadden, Arps, Slate, Meagher & Flom LLP as Exhibit 5.1 to this Current Report on Form 8-K to add such

exhibit to the Company’s Registration Statement on Form S-3ASR (File No. 333-282677).

| Item 9.01 | Financial Statements and Exhibits |

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: February 25, 2025 |

Lucid Group, Inc. |

| |

|

| |

By: |

/s/ Taoufiq Boussaid |

| |

|

Taoufiq Boussaid |

| |

|

Chief Financial Officer |

Exhibit 5.1

| Skadden, Arps, Slate, Meagher & Flom llp |

| 525 UNIVERSITY AVENUE |

| PALO ALTO,

CALIFORNIA 94301 |

FIRM/AFFILIATE |

| --------- |

OFFICES |

| TEL: (650) 470-4500 |

------- |

| FAX: (650) 470-4570 |

BOSTON |

| www.skadden.com |

CHICAGO |

|

HOUSTON |

| |

LOS ANGELES |

| |

PALO ALTO |

| |

WASHINGTON, D.C. |

| |

WILMINGTON |

| |

--------- |

| |

ABU DHABI |

| |

BEIJING |

| |

BRUSSELS |

| |

FRANKFURT |

| |

HONG KONG |

| |

LONDON |

| |

MUNICH |

| |

PARIS |

| |

SÃO PAULO |

| |

SEOUL |

| |

SINGAPORE |

| |

TOKYO |

| |

TORONTO |

February 25, 2025

Lucid Group, Inc.

7373 Gateway Boulevard

Newark, California 94560

| |

Re: |

Lucid Group, Inc. |

| |

|

Registration Statement on Form S-3ASR |

Ladies and Gentlemen:

We have acted as special United States counsel to

Lucid Group, Inc., a Delaware corporation (the “Company”), in connection with the resale by the selling stockholder identified

in Schedule A hereto (the “Selling Stockholder”) of up to (i) 100,000 shares of the Company’s Series A Convertible

Preferred Stock, par value $0.0001 per share (the “Series A Convertible Preferred Stock”), (ii) 297,567,387 shares

of the Company’s Class A Common Stock (the “Series A Conversion Shares”), par value $0.0001 per share (“Common

Stock”), which may be issued upon conversion of the Series A Convertible Preferred Stock as of December 31, 2024, (iii) 75,000

shares of the Company’s Series B Convertible Preferred Stock, par value $0.0001 per share (the “Series B Convertible

Preferred Stock”, and together with the Series A Convertible Preferred Stock, the “Convertible Preferred Stock”),

(iv) 177,103,144 shares of Common Stock, which may be issued upon conversion of the Series B Convertible Preferred Stock as

of December 31, 2024 (the “Series B Conversion Shares”, and together with the Series A Conversion Shares, the

“Conversion Shares”), and (v) 396,188,386 shares of Common Stock (the “Secondary Shares”). We have been advised

that (i) the Series A Convertible Preferred Stock was issued pursuant to a subscription agreement (the “Series A

Subscription Agreement”), dated as of March 24, 2024, between the Company and Ayar Third Investment Company (“Ayar”),

(ii) the Series B Convertible Preferred Stock was issued pursuant to a subscription agreement, dated as of August 4, 2024,

between the Company and Ayar (the “Series B Subscription Agreement”), and (iii) the Secondary Shares were issued

pursuant to a subscription agreement, dated as of October 16, 2024, between the Company and Ayar (the “Secondary Shares Subscription

Agreement”, and together with the Series A Subscription Agreement and Series B Subscription Agreement, the “Subscription

Agreements”).

Lucid Group, Inc.

February 25, 2025

Page 2

This opinion letter is being furnished in accordance

with the requirements of Item 601(b)(5) of Regulation S-K under the Securities Act of 1933 (the “Securities Act”).

In rendering the opinions stated herein, we have

examined and relied upon the following:

(a) the

registration statement on Form S-3ASR (File No. 333-282677) of the Company relating to Common Stock, preferred stock and other

securities of the Company filed on October 16, 2024 with the Securities and Exchange Commission (the “Commission”) under

the Securities Act, allowing for delayed offerings pursuant to Rule 415 of the General Rules and Regulations under the Securities

Act (the “Rules and Regulations”), including the information deemed to be a part of the registration statement pursuant

to Rule 430B of the Rules and Regulations (such registration statement being hereinafter referred to as the “Registration

Statement”);

(b) the

prospectus, dated October 16, 2024 (the “Base Prospectus”), which forms a part of and is included in the Registration

Statement;

(c) the

prospectus supplement, dated February 25, 2025 (together with the Base Prospectus, the “Prospectus”), relating

to the offering of the Convertible Preferred Stock, the Secondary Shares and the Conversion Shares, in the form filed with the Commission

pursuant to Rule 424(b) of the Rules and Regulations;

(d) executed

copies of the Subscription Agreements;

(e) an

executed copy of a certificate of Brian Tomkiel, General Counsel, Corporate Secretary, and Compliance Officer of the Company, dated the

date hereof (the “Secretary’s Certificate”);

Lucid Group, Inc.

February 25, 2025

Page 3

(f) a

copy of the Company’s Third Amended and Restated Certificate of Incorporation, as in effect on December 28, 2023, certified

by the Secretary of State of the State of Delaware as of February 25, 2025, and certified pursuant to the Secretary’s Certificate

(the “Amended and Restated Certificate of Incorporation”);

(g) a

copy of the Company’s Second Amended and Restated Bylaws, as amended and in effect on December 28, 2023 and as of the date

hereof, and certified pursuant to the Secretary’s Certificate (the “Bylaws”);

(h) copies

of the Company’s certificate of designations of the Series A Convertible Preferred Stock (the “Series A Certificate

of Designations”) and the Company’s certificate of designations of the Series B Convertible Preferred Stock (the “Series B

Certificate of Designations”, and together with the Series A Certificate of Designations, the “Certificates of Designations”),

certified by the Secretary of State of the State of Delaware as of February 25, 2025 and February 25, 2025, respectively, and

certified pursuant to the Secretary’s Certificate; and

(i) copies

of certain resolutions of the Board of Directors of the Company, adopted on December 28, 2023 and October 15, 2024, certain

resolutions of the Special Pricing Subcommittee of the Pricing Committee thereof, adopted on March 23, 2024, July 30, 2024 and

October 16, 2024, and certain resolutions of the Audit Committee thereof, adopted on March 23, 2024, August 2, 2024 and

October 11, 2024, certified pursuant to the Secretary’s Certificate.

We have also examined originals or copies, certified

or otherwise identified to our satisfaction, of such records of the Company and such agreements, certificates and receipts of public officials,

certificates of officers or other representatives of the Company, the Selling Stockholder and others, and such other documents as we have

deemed necessary or appropriate as a basis for the opinions stated below, including the facts and conclusions set forth in the Secretary’s

Certificate and the factual representations and warranties contained in the Subscription Agreements.

In our examination, we have assumed the genuineness

of all signatures, including electronic signatures, the legal capacity and competency of all natural persons, the authenticity of all

documents submitted to us as originals, the conformity to original documents of all documents submitted to us as facsimile, electronic,

certified or photocopied copies, and the authenticity of the originals of such copies. With respect to our opinion set forth in paragraph

1 below, we have assumed that (i) the Company received the consideration for the Convertible Preferred Stock and the Secondary Shares

set forth in the applicable Subscription Agreements and board resolutions and (ii) each issuance of the Convertible Preferred Stock

and the Secondary Shares has been registered in the Company’s share registry. As to any facts relevant to the opinions stated herein

that we did not independently establish or verify, we have relied upon statements and representations of officers and other representatives

of the Company and the Selling Stockholder and others and of public officials, including the facts and conclusions set forth in the Amended

and Restated Certificate of Incorporation and the Secretary’s Certificate and the factual representations and warranties set forth

in the Subscription Agreements.

Lucid Group, Inc.

February 25, 2025

Page 4

We do not express any opinion with respect to the

laws of any jurisdiction other than the General Corporation Law of the State of Delaware (the “DGCL”).

As used herein, “Organizational Documents”

means those documents listed in paragraphs (f) through (h) above,

Based upon the foregoing and subject to the qualifications

and assumptions stated herein, we are of the opinion that:

1. The

Convertible Preferred Stock and the Secondary Shares have been duly authorized by all requisite corporate action on the part of the Company

under the DGCL and have been validly issued and are fully paid and nonassessable.

2. The

Conversion Shares have been duly authorized by all requisite corporate action on the part of the Company under the DGCL and upon conversion

of the Convertible Preferred Stock into Conversion Shares in accordance with the terms of the applicable Certificate of Designations,

will be validly issued, fully paid and nonassessable.

In addition, in rendering the foregoing opinions

we have assumed that:

(a) the

Company’s issuance of the Conversion Shares does not and will not and the Company’s issuance of the Convertible Preferred

Stock and the Secondary Shares did not (i) except to the extent expressly stated in the opinions contained herein, violate any statute

to which the Company or such issuance is subject, or (ii) constitute a violation of, or a breach under, or require the consent or

approval of any other person under, any agreement or instrument binding on the Company (except that we do not and will not make this assumption

with respect to the Organizational Documents or those agreements or instruments expressed to be governed by the laws of the State of New

York which are listed in Part II of the Registration Statement or the Company’s Annual Report on Form 10-K for the year

ended December 31, 2024, although we have assumed compliance with any covenant, restriction or provision with respect to financial

ratios or tests or any aspect of the financial condition or results of operations of the Company contained in such agreements or instruments),

and we have further assumed that the Company will continue to have sufficient authorized shares of Common Stock; and

(b) the

Company’s authorized capital stock is as set forth in the Amended and Restated Certificate of Incorporation and the Certificates

of Designations, and we have relied solely on the certified copies thereof issued by the Secretary of State of the State of Delaware and

have not made any other inquiries or investigations.

This opinion letter shall be interpreted in accordance

with customary practice of United States lawyers who regularly give opinions in transactions of this type.

Lucid Group, Inc.

February 25, 2025

Page 5

We hereby consent to the reference to our firm under

the heading “Validity Of The Securities” in the Prospectus forming part of the Registration Statement. We also hereby consent

to the filing of this opinion letter with the Commission as an exhibit to the Company’s Current Report on Form 8-K being filed

on the date hereof and incorporated by reference into the Registration Statement. In giving this consent, we do not thereby admit that

we are within the category of persons whose consent is required under Section 7 of the Securities Act or the Rules and Regulations.

This opinion letter is expressed as of the date hereof unless otherwise expressly stated, and we disclaim any undertaking to advise you

of any subsequent changes in the facts stated or assumed herein or of any subsequent changes in applicable laws.

| |

Very truly yours, |

| |

|

| |

/s/ Skadden, Arps, Slate, Meagher & Flom LLP |

BDP

Lucid Group, Inc.

February 25, 2025

Page 6

Schedule A

Ayar Third Investment Company

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

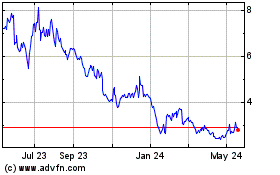

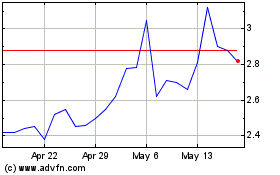

Lucid (NASDAQ:LCID)

Historical Stock Chart

From Jan 2025 to Feb 2025

Lucid (NASDAQ:LCID)

Historical Stock Chart

From Feb 2024 to Feb 2025