0001701758FALSE00017017582024-12-172024-12-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 17, 2024

THE LOVESAC COMPANY

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-38555 | | 32-0514958 |

| (State or other jurisdiction of | | (Commission | | (I.R.S. Employer |

| incorporation) | | File Number) | | Identification No.) |

| | | | | |

| | | Two Landmark Square, Suite 300 Stamford, Connecticut 06901 | | |

(Address of Principal Executive Offices, and Zip Code) |

(888) 636-1223

Registrant’s Telephone Number, Including Area Code

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, par value $0.00001 per share | | LOVE | | The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

In connection with the previously announced 2024 Investor Day hosted by the Lovesac Company (the “Company”) taking place today, December 17, 2024 at 10 a.m. Eastern Time, the Company has made available to investors fiscal 2026 financial targets and a medium term outlook. The press release is attached hereto as Exhibit 99.1, and has been made available on our website at https://investor.lovesac.com.

The information set forth under this Item 7.01, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing, except as otherwise expressly stated in such filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

Dated: December 17, 2024 | | |

| | |

| | THE LOVESAC COMPANY |

| | | |

| | By: | /s/ Keith Siegner |

| | Name: | Keith Siegner |

| | Title: | Executive Vice President and Chief Financial Officer |

THE LOVESAC COMPANY DETAILS STRATEGIC FRAMEWORK AND MULTI-YEAR FINANCIAL ALGORITHM AT INVESTOR DAY

STAMFORD, Conn., December 17, 2024 (GLOBE NEWSWIRE) -- The Lovesac Company (Nasdaq: LOVE) (“Lovesac” or the “Company”), the home furnishing brand best known for its Sactionals, The World's Most Adaptable Couch, will host an Investor Day today, December 17, 2024, at 10:00 am ET. Interested parties may access the webcast of the event, related published materials and a replay of the event by accessing Lovesac’s IR website at https://investor.lovesac.com/.

The event will feature presentations by members of Lovesac’s leadership team, followed by a live question-and-answer session.

Chief Executive Officer, Shawn Nelson, President and Chief Operating Officer, Mary Fox, Executive Vice President and Chief Financial Officer, Keith Siegner, and other members of the senior leadership team will provide an in-depth review of the company's strategic framework, new products, growth initiatives, commitment to operational excellence, and financial ambitions.

In connection with the event, the Company has introduced a multi-year financial algorithm. The Company estimates a normalized year to achieve the following:

•Annual Net Sales Growth of +10% to +15%;

•Gross Margin Rate of 59% to 60%;

•Advertising & Marketing of ~12.5% of Net Sales;

•Annual Adjusted EBITDA Margin Rate Expansion of 50 basis points to 100 basis points; and

•Annual EPS Growth of at least 25%.

Specifically for Fiscal 2026, the Company provided the following preliminary expectations:

•Annual Net Sales Growth of +7% to +12%;

•Gross Margin Rate of ~59%;

•Advertising & Marketing of ~12.5% of Net Sales;

•Annual Adjusted EBITDA Margin Rate Expansion of 100 basis points to 150 basis points; and

•Annual EPS Growth of at least 100%.

The above financial targets assume annual industry outperformance of +10% to +15% and a tax rate of ~26.5%, and does not consider any potential impact from any new tariffs.

About The Lovesac Company:

Based in Stamford, Connecticut, The Lovesac Company is a technology driven company that designs, manufactures and sells unique, high quality furniture derived through its proprietary Designed For Life approach which results in products that are built to last a lifetime and designed to evolve as our customers’ lives do. Our current product offering is comprised of modular couches called Sactionals, premium foam beanbag chairs called Sacs, and their associated home decor accessories. Innovation is at the center of our design philosophy with all of our core products protected by a robust portfolio of utility patents. We market and sell our products primarily online directly at www.lovesac.com, supported by direct-to-consumer touch-feel points in the form of our own showrooms as well as through shop-in-shops and pop-up-shops with third party retailers. LOVESAC, SACTIONALS, DESIGNED FOR LIFE, and THE WORLD'S MOST

ADAPTABLE COUCH are trademarks of The Lovesac Company and are Registered in the U.S. Patent and Trademark Office.

Non-GAAP Information:

Adjusted EBITDA is defined as a non-GAAP financial measure by the Securities and Exchange Commission (the “SEC”) that is a supplemental measure of financial performance not required by, or presented in accordance with, GAAP. We define “Adjusted EBITDA” as earnings before interest, taxes, depreciation and amortization, adjusted for the impact of certain non-cash and other items that we do not consider in our evaluation of ongoing operating performance. These items include management fees, equity-based compensation expense, write-offs of property and equipment, deferred rent, financing expenses and certain other charges and gains that we do not believe reflect our underlying business performance. We have reconciled this non-GAAP financial measure with the most directly comparable GAAP financial measure within the schedules attached hereto. Statements regarding our expectations as to fiscal 2025 Adjusted EBITDA do not include certain charges and costs. These items include equity-based compensation expense and certain other charges and gains that we do not believe reflect our underlying business performance. We are not able to provide a reconciliation of our non-GAAP financial guidance to the corresponding GAAP measures without unreasonable effort because of the uncertainty and variability of the nature and amount of these future charges and costs. This is due to the inherent difficulty of forecasting the timing of certain events that have not yet occurred and are out of the Company’s control.

We believe that these non-GAAP financial measures not only provide its management with comparable financial data for internal financial analysis but also provide meaningful supplemental information to investors. Specifically, these non-GAAP financial measures allow investors to better understand the performance of our business, facilitate a more meaningful comparison of our actual results on a period-over-period basis and provide for a more complete understanding of factors and trends affecting our business. We have provided this information as a means to evaluate the results of our ongoing operations alongside GAAP measures such as gross profit, operating income (loss) and net income (loss). Other companies in our industry may calculate these items differently than we do. These non-GAAP measures should not be considered as a substitute for the most directly comparable financial measures prepared in accordance with GAAP, such as net income (loss) or net income (loss) per share as a measure of financial performance, cash flows from operating activities as a measure of liquidity, or any other performance measure derived in accordance with GAAP. Non-GAAP financial measures have limitations as analytical tools, and investors should not consider them in isolation or as a substitute for analysis of the Company’s results as reported under GAAP.

Cautionary Statement Concerning Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other legal authority. Forward-looking statements can be identified by words such as “may,” “continue(s),” “believe,” “anticipate,” “could,” “should,” “intend,” “plan,” “will,” “aim(s),” “can,” “would,” “expect(s),” “expectation(s),” “estimate(s),” “project(s),” “forecast(s)”, “positioned,” “approximately,” “potential,” “goal,” “pro forma,” “strategy,” “outlook” or the negative of these words or other similar terms or expressions that concern our expectations, strategy, plans, or intentions. All statements, other than statements of historical facts, included in this press release under the heading “Outlook” and all statements regarding strategy, future operations and launch of new products, the pace and success of new products, future financial position or projections or algorithms, future revenue, projected expenses, sustainability goals, prospects, plans and objectives of management are forward-looking statements. These statements are based on management’s current expectations, beliefs and assumptions concerning the future of our business, anticipated events and trends, the economy and other future conditions. We may not actually achieve the plans, carry out the intentions or meet the expectations disclosed in the forward-looking statements and you should not rely on these forward-looking statements. Actual results and performance could differ materially from those projected in the forward-looking statements as a result of many factors. Among the key factors that could cause actual results to differ materially from those expressed or implied in the forward-looking statements include: business disruptions or other consequences of economic instability, political instability, civil unrest, armed hostilities, natural and man-made disasters,

pandemics or other public health crises, or other catastrophic events; the impact of changes or declines in consumer spending and increases in interest rates and inflation on our business, sales, results of operations and financial condition; our ability to manage and sustain our growth and profitability effectively, including in our ecommerce business, forecast our operating results, and manage inventory levels; active, pending or threatened litigation, our ability to improve our products and develop and launch new products; our ability to successfully open and operate new showrooms; our ability to advance, implement or achieve the goals set forth in our ESG Report; our ability to realize the expected benefits of investments in our supply chain and infrastructure; disruption in our supply chain and dependence on foreign manufacturing and imports for our products; execution of our share purchase program and its expected benefits for enhancing long-term shareholder value; our ability to acquire new customers and engage existing customers; reputational risk associated with increased use of social media; our ability to attract, develop and retain highly skilled associates and employees; system interruption or failures in our technology infrastructure needed to service our customers, process transactions and fulfill orders; any inability to implement and maintain effective internal control over financial reporting or inability to remediate any internal controls deemed ineffective; the impact of the restatement of our previously issued audited financial statements as of and for the year ended January 29, 2023 and our unaudited condensed financial statements for the quarterly periods ended April 30, 2023, October 30, 2022, July 31, 2022 and May 1, 2022, and the related litigation and investigation related to such restatements; unauthorized disclosure of sensitive or confidential information through breach of our computer system; the ability of third-party providers to continue uninterrupted service; the impact of tariffs, and the countermeasures and tariff mitigation initiatives; the regulatory environment in which we operate, our ability to maintain, grow and enforce our brand and intellectual property rights and avoid infringement or violation of the intellectual property rights of others; and our ability to compete and succeed in a highly competitive and evolving industry, as well as those risks and uncertainties disclosed under the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our most recent Form 10-K and in our Form 10-Qs filed with the Securities and Exchange Commission, and similar disclosures in subsequent reports filed with the SEC, which are available on our investor relations website at investor.lovesac.com and on the SEC website at www.sec.gov. Any forward-looking statement made by us in this press release speaks only as of the date on which we make it. We disclaim any intent or obligation to update these forward-looking statements to reflect events or circumstances that exist after the date on which they were made.

Investor Relations Contact:

Caitlin Churchill, ICR

(203) 682-8200

InvestorRelations@lovesac.com

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

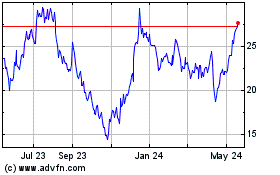

Lovesac (NASDAQ:LOVE)

Historical Stock Chart

From Dec 2024 to Jan 2025

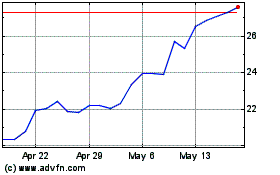

Lovesac (NASDAQ:LOVE)

Historical Stock Chart

From Jan 2024 to Jan 2025