0001084554false--12-31Q320240.001100000000000.0012500000013698274 | | September 30, | | | December 31, | |

| | 2024 | | | 2023 | |

Trade payables | | $ | 0.1 | | | $ | 0.1 | |

Accrued research and development expenses | | | 0.2 | | | | — | |

Accrued legal and consulting expenses | | | 0.1 | | | | 0.4 | |

Accrued bonus | | | 0.8 | | | | — | |

Total | | $ | 1.2 | | | $ | 0.5 | |

05473625038435459924514041093354955247500000.00210001500000010845542024-01-012024-09-300001084554us-gaap:SubsequentEventMember2024-10-012024-10-240001084554us-gaap:SubsequentEventMember2024-10-012024-11-010001084554ltbr:AvailableForSaleSecuritiesMember2023-01-012023-09-300001084554ltbr:AvailableForSaleSecuritiesMember2024-01-012024-09-300001084554ltbr:AvailableForSaleSecuritiesMember2023-09-300001084554ltbr:AvailableForSaleSecuritiesMember2024-09-300001084554ltbr:CommonShareIssuancesTwoMemberltbr:MaxiimumMember2023-01-012023-09-300001084554ltbr:CommonShareIssuancesTwoMemberltbr:MaxiimumMember2024-01-012024-09-300001084554ltbr:MiniimumMemberltbr:CommonShareIssuancesOneMember2023-01-012023-09-300001084554ltbr:MiniimumMemberltbr:CommonShareIssuancesOneMember2024-01-012024-09-300001084554ltbr:TwoThousandTwentyEquityIncentivePlanMember2024-02-012024-02-270001084554ltbr:TwoThousandTwentyEquityIncentivePlanMember2024-09-300001084554ltbr:TwoThousandTwentyEquityIncentivePlanMember2024-01-012024-09-300001084554ltbr:CommonShareIssuancesThreeMember2023-01-012023-09-300001084554ltbr:CommonShareIssuancesThreeMember2024-01-012024-09-300001084554ltbr:CommonShareIssuancesThreeMember2023-09-300001084554ltbr:CommonShareIssuancesThreeMember2024-09-300001084554ltbr:RestrictedStockAwardActivityMember2023-01-012023-09-300001084554ltbr:RestrictedStockAwardActivityMember2023-12-310001084554ltbr:RestrictedStockAwardActivityMember2024-09-300001084554ltbr:RestrictedStockAwardActivityMember2024-01-012024-09-300001084554ltbr:TwoConsultantMember2023-01-012023-09-300001084554ltbr:TwoConsultantMember2024-01-012024-09-300001084554srt:BoardOfDirectorsChairmanMember2022-12-150001084554srt:BoardOfDirectorsChairmanMember2023-11-200001084554srt:BoardOfDirectorsChairmanMember2024-01-012024-09-300001084554us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2024-01-012024-09-300001084554srt:BoardOfDirectorsChairmanMember2024-08-190001084554srt:BoardOfDirectorsChairmanMember2022-12-012022-12-150001084554srt:BoardOfDirectorsChairmanMember2023-11-012023-11-200001084554srt:BoardOfDirectorsChairmanMember2024-08-012024-08-1900010845542019-05-012019-05-080001084554us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-09-300001084554us-gaap:GeneralAndAdministrativeExpenseMember2023-07-012023-09-300001084554us-gaap:GeneralAndAdministrativeExpenseMember2024-01-012024-09-300001084554us-gaap:GeneralAndAdministrativeExpenseMember2024-07-012024-09-300001084554ltbr:MiniimumMember2023-09-300001084554ltbr:MaxiimumMember2023-09-300001084554ltbr:MiniimumMember2024-09-300001084554ltbr:MaxiimumMember2024-09-300001084554ltbr:MiniimumMember2023-01-012023-09-300001084554ltbr:MaxiimumMember2023-01-012023-09-300001084554ltbr:MiniimumMember2024-01-012024-09-300001084554ltbr:MaxiimumMember2024-01-012024-09-300001084554ltbr:ResearchAndDevelopmentExpenseRatenIcnMember2024-01-012024-09-300001084554ltbr:ResearchAndDevelopmentExpenseINLProjestMember2024-01-012024-09-300001084554ltbr:ResearchAndDevelopmentExpenseINLProjestMember2023-01-012023-09-300001084554ltbr:ResearchAndDevelopmentExpenseINLProjestMember2023-07-012023-09-300001084554ltbr:ResearchAndDevelopmentExpenseINLProjestMember2024-07-012024-09-300001084554ltbr:RomaniaFeasibilityStudyMember2024-07-012024-09-300001084554us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-09-300001084554us-gaap:ResearchAndDevelopmentExpenseMember2024-01-012024-09-300001084554us-gaap:ResearchAndDevelopmentExpenseMember2023-07-012023-09-300001084554us-gaap:ResearchAndDevelopmentExpenseMember2024-07-012024-09-300001084554ltbr:ResearchAndDevelopmentExpenseOtherOutsideRandDExpensesMember2023-01-012023-09-300001084554ltbr:ResearchAndDevelopmentExpenseOtherOutsideRandDExpensesMember2024-01-012024-09-300001084554ltbr:ResearchAndDevelopmentExpenseOtherOutsideRandDExpensesMember2023-07-012023-09-300001084554ltbr:ResearchAndDevelopmentExpenseOtherOutsideRandDExpensesMember2024-07-012024-09-300001084554ltbr:ResearchAndDevelopmentExpenseAllocatedEmployeeCompensationStockbasedCompensationMember2023-01-012023-09-300001084554ltbr:ResearchAndDevelopmentExpenseAllocatedEmployeeCompensationStockbasedCompensationMember2024-01-012024-09-300001084554ltbr:ResearchAndDevelopmentExpenseAllocatedEmployeeCompensationStockbasedCompensationMember2023-07-012023-09-300001084554ltbr:ResearchAndDevelopmentExpenseAllocatedEmployeeCompensationStockbasedCompensationMember2024-07-012024-09-300001084554ltbr:ResearchAndDevelopmentExpenseCentrusEnergyFEEDStudyMember2023-01-012023-09-300001084554ltbr:ResearchAndDevelopmentExpenseCentrusEnergyFEEDStudyMember2024-01-012024-09-300001084554ltbr:ResearchAndDevelopmentExpenseCentrusEnergyFEEDStudyMember2023-07-012023-09-300001084554ltbr:ResearchAndDevelopmentExpenseCentrusEnergyFEEDStudyMember2024-07-012024-09-300001084554ltbr:ResearchAndDevelopmentExpenseRomaniaFeasibilityStudyMember2023-01-012023-09-300001084554ltbr:ResearchAndDevelopmentExpenseRomaniaFeasibilityStudyMember2024-01-012024-09-300001084554ltbr:ResearchAndDevelopmentExpenseRomaniaFeasibilityStudyMember2023-07-012023-09-300001084554ltbr:ResearchAndDevelopmentExpenseRomaniaFeasibilityStudyMember2024-07-012024-09-300001084554ltbr:ResearchAndDevelopmentExpenseINLMember2024-01-012024-09-300001084554ltbr:ResearchAndDevelopmentExpenseINLMember2024-07-012024-09-300001084554ltbr:ResearchAndDevelopmentExpenseINLMember2023-01-012023-09-300001084554ltbr:ResearchAndDevelopmentExpenseINLMember2023-07-012023-09-300001084554ltbr:RATENICNMember2024-06-252024-07-020001084554ltbr:RATENICNMember2024-09-300001084554ltbr:StrategicPartnershipProjectAgreementMember2024-03-012024-03-260001084554ltbr:FeedStudyWithCentrusEnergyMember2024-01-012024-09-300001084554ltbr:CentrusEnergyFEEDStudyMember2023-01-012023-12-310001084554ltbr:RomaniaFeasibilityStudyMember2023-01-012023-12-310001084554ltbr:INLProjectMember2023-01-012023-12-3100010845542023-01-012023-12-310001084554ltbr:CentrusEnergyFEEDStudyMember2024-01-012024-09-300001084554ltbr:RomaniaFeasibilityStudyMember2024-01-012024-09-300001084554ltbr:INLProjectMember2024-01-012024-09-300001084554us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberltbr:MaxiimumMember2023-05-310001084554us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberltbr:MiniimumMember2023-05-310001084554us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2023-12-310001084554us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2024-09-300001084554ltbr:BattelleEnergyAllianceLLCMember2022-12-310001084554ltbr:TreasuryBillsLevelTwoMember2023-09-300001084554ltbr:TreasuryBillsLevelThreeMember2024-09-300001084554ltbr:TreasuryBillsLevelTwoMember2024-09-300001084554ltbr:TreasuryBillsLevelOneMember2024-09-300001084554us-gaap:RetainedEarningsMember2024-09-300001084554us-gaap:AdditionalPaidInCapitalMember2024-09-300001084554us-gaap:CommonStockMember2024-09-300001084554us-gaap:RetainedEarningsMember2024-07-012024-09-300001084554us-gaap:AdditionalPaidInCapitalMember2024-07-012024-09-300001084554us-gaap:CommonStockMember2024-07-012024-09-3000010845542024-06-300001084554us-gaap:RetainedEarningsMember2024-06-300001084554us-gaap:AdditionalPaidInCapitalMember2024-06-300001084554us-gaap:CommonStockMember2024-06-3000010845542024-04-012024-06-300001084554us-gaap:RetainedEarningsMember2024-04-012024-06-300001084554us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-300001084554us-gaap:CommonStockMember2024-04-012024-06-3000010845542024-03-310001084554us-gaap:RetainedEarningsMember2024-03-310001084554us-gaap:AdditionalPaidInCapitalMember2024-03-310001084554us-gaap:CommonStockMember2024-03-3100010845542024-01-012024-03-310001084554us-gaap:RetainedEarningsMember2024-01-012024-03-310001084554us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310001084554us-gaap:CommonStockMember2024-01-012024-03-310001084554us-gaap:RetainedEarningsMember2023-12-310001084554us-gaap:AdditionalPaidInCapitalMember2023-12-310001084554us-gaap:CommonStockMember2023-12-3100010845542023-09-300001084554us-gaap:RetainedEarningsMember2023-09-300001084554us-gaap:AdditionalPaidInCapitalMember2023-09-300001084554us-gaap:CommonStockMember2023-09-300001084554us-gaap:RetainedEarningsMember2023-07-012023-09-300001084554us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-300001084554us-gaap:CommonStockMember2023-07-012023-09-3000010845542023-06-300001084554us-gaap:RetainedEarningsMember2023-06-300001084554us-gaap:AdditionalPaidInCapitalMember2023-06-300001084554us-gaap:CommonStockMember2023-06-3000010845542023-04-012023-06-300001084554us-gaap:RetainedEarningsMember2023-04-012023-06-300001084554us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001084554us-gaap:CommonStockMember2023-04-012023-06-3000010845542023-03-310001084554us-gaap:RetainedEarningsMember2023-03-310001084554us-gaap:AdditionalPaidInCapitalMember2023-03-310001084554us-gaap:CommonStockMember2023-03-3100010845542023-01-012023-03-310001084554us-gaap:RetainedEarningsMember2023-01-012023-03-310001084554us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001084554us-gaap:CommonStockMember2023-01-012023-03-3100010845542022-12-310001084554us-gaap:RetainedEarningsMember2022-12-310001084554us-gaap:AdditionalPaidInCapitalMember2022-12-310001084554us-gaap:CommonStockMember2022-12-3100010845542023-01-012023-09-3000010845542023-07-012023-09-3000010845542024-07-012024-09-3000010845542023-12-3100010845542024-09-3000010845542024-10-31iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended: September 30, 2024

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _____________ to _____________

Commission File Number: 001-34487

LIGHTBRIDGE CORPORATION |

(Exact name of registrant as specified in its charter) |

Nevada | | 91-1975651 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

11710 Plaza America Drive, Suite 2000 Reston, VA 20190

(Address of principal executive offices, Zip Code)

(571) 730-1200

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class: | | Trading Symbol(s): | | Name of Each Exchange on Which Registered: |

Common Stock, $0.001 par value | | LTBR | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer | ☐ | Accelerated Filer | ☐ |

Non- accelerated Filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The number of shares outstanding of the issuer’s common stock, as of October 31, 2024 is as follows:

Class of Securities | | Shares Outstanding |

Common Stock, $0.001 par value | | 15,766,902 |

LIGHTBRIDGE CORPORATION

FORM 10-Q

SEPTEMBER 30, 2024

PART I-FINANCIAL INFORMATION

ITEM 1. CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

LIGHTBRIDGE CORPORATION

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

| | September 30, | | | December 31, | |

| | 2024 | | | 2023 | |

ASSETS | |

Current Assets | | | | | | |

Cash and cash equivalents | | $ | 26,634,951 | | | $ | 28,598,445 | |

Prepaid expenses and other current assets | | | 403,922 | | | | 207,063 | |

Total Current Assets | | | 27,038,873 | | | | 28,805,508 | |

Other Assets | | | | | | | | |

Prepaid project costs and other long-term assets | | | 472,875 | | | | 483,000 | |

Trademarks | | | 108,865 | | | | 108,865 | |

Total Assets | | $ | 27,620,613 | | | $ | 29,397,373 | |

| | | | | | | | |

LIABILITIES AND STOCKHOLDERS’ EQUITY |

Current Liabilities | | | | | | | | |

Accounts payable and accrued liabilities | | $ | 1,159,566 | | | $ | 486,326 | |

Total Current Liabilities | | | 1,159,566 | | | | 486,326 | |

| | | | | | | | |

Commitments and contingencies - Note 5 | | | | | | | | |

| | | | | | | | |

Stockholders’ Equity | | | | | | | | |

Preferred stock, $0.001 par value, 10,000,000 authorized shares, 0 shares issued and outstanding at September 30, 2024 and December 31, 2023 | | | — | | | | — | |

Common stock, $0.001 par value, 25,000,000 authorized, 15,276,331 shares and 13,698,274 shares issued and outstanding at September 30, 2024 and December 31, 2023, respectively | | | 15,276 | | | | 13,698 | |

Additional paid-in capital | | | 186,693,926 | | | | 181,295,125 | |

Accumulated deficit | | | (160,248,155 | ) | | | (152,397,776 | ) |

Total Stockholders’ Equity | | | 26,461,047 | | | | 28,911,047 | |

Total Liabilities and Stockholders’ Equity | | $ | 27,620,613 | | | $ | 29,397,373 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

LIGHTBRIDGE CORPORATION

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

| | Three Months Ended | | | Nine Months Ended | |

| | September 30, | | | September 30, | |

| | 2024 | | | 2023 | | | 2024 | | | 2023 | |

| | | | | | | | | | | | |

Revenue | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | |

Operating Expenses | | | | | | | | | | | | | | | | |

General and administrative | | | 1,676,209 | | | | 1,609,142 | | | | 5,626,567 | | | | 5,071,889 | |

Research and development | | | 1,298,601 | | | | 552,751 | | | | 3,232,036 | | | | 1,367,650 | |

Total Operating Expenses | | | 2,974,810 | | | | 2,161,893 | | | | 8,858,603 | | | | 6,439,539 | |

| | | | | | | | | | | | | | | | |

Other Operating Income | | | | | | | | | | | | | | | | |

Contributed services - research and development | | | — | | | | — | | | | — | | | | 31,028 | |

Total Other Operating Income | | | — | | | | — | | | | — | | | | 31,028 | |

Operating Loss | | | (2,974,810 | ) | | | (2,161,893 | ) | | | (8,858,603 | ) | | | (6,408,511 | ) |

| | | | | | | | | | | | | | | | |

Other Income | | | | | | | | | | | | | | | | |

Interest income | | | 318,649 | | | | 322,065 | | | | 1,008,224 | | | | 869,879 | |

Total Other Income | | | 318,649 | | | | 322,065 | | | | 1,008,224 | | | | 869,879 | |

| | | | | | | | | | | | | | | | |

Net Loss Before Income Taxes | | | (2,656,161 | ) | | | (1,839,828 | ) | | | (7,850,379 | ) | | | (5,538,632 | ) |

Income taxes | | | — | | | | — | | | | — | | | | — | |

Net Loss | | $ | (2,656,161 | ) | | $ | (1,839,828 | ) | | $ | (7,850,379 | ) | | $ | (5,538,632 | ) |

| | | | | | | | | | | | | | | | |

Net Loss Per Common Share | | | | | | | | | | | | | | | | |

Basic and Diluted | | $ | (0.19 | ) | | $ | (0.15 | ) | | $ | (0.57 | ) | | $ | (0.47 | ) |

| | | | | | | | | | | | | | | | |

Weighted Average Number of Common Shares Outstanding | | | | | | | | | | | | | | | | |

Basic and Diluted | | | 14,189,787 | | | | 12,252,342 | | | | 13,871,756 | | | | 11,902,010 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements. |

LIGHTBRIDGE CORPORATION

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2024 AND 2023

| | | | | | | | Additional | | | | | | Total | |

| | Common Stock | | | Paid-in | | | Accumulated | | | Stockholders’ | |

| | Shares | | | Amount | | | Capital | | | Deficit | | | Equity | |

| | | | | | | | | | | | | | | |

Balance - January 1, 2023 | | | 11,900,217 | | | $ | 11,900 | | | $ | 173,595,385 | | | $ | (144,489,130 | ) | | $ | 29,118,155 | |

Shares issued - registered offerings - net of offering costs | | | 169,978 | | | | 170 | | | | 730,882 | | | | — | | | | 731,052 | |

Shares issued to consultant and directors for services | | | 55,835 | | | | 56 | | | | 214,944 | | | | — | | | | 215,000 | |

Stock-based compensation | | | — | | | | — | | | | 284,360 | | | | — | | | | 284,360 | |

Net loss for the three months ended March 31, 2023 | | | — | | | | — | | | | — | | | | (2,026,580 | ) | | | (2,026,580 | ) |

Balance - March 31, 2023 | | | 12,126,030 | | | $ | 12,126 | | | $ | 174,825,571 | | | $ | (146,515,710 | ) | | $ | 28,321,987 | |

| | | | | | | | | | | | | | | | | | | | |

Shares issued - registered offerings - net of offering costs | | | 320,023 | | | | 320 | | | | 1,583,010 | | | | — | | | | 1,583,330 | |

Shares issued pursuant to restricted stock awards | | | 35,088 | | | | 35 | | | | (35 | ) | | | — | | | | — | |

Shares issued to consultant for services | | | 3,658 | | | | 4 | | | | 14,996 | | | | — | | | | 15,000 | |

Stock-based compensation | | | — | | | | — | | | | 316,798 | | | | — | | | | 316,798 | |

Net loss for the three months ended June 30, 2023 | | | — | | | | — | | | | — | | | | (1,672,224 | ) | | | (1,672,224 | ) |

Balance - June 30, 2023 | | | 12,484,799 | | | $ | 12,485 | | | $ | 176,740,340 | | | $ | (148,187,934 | ) | | $ | 28,564,891 | |

| | | | | | | | | | | | | | | | | | | | |

Shares issued - registered offerings - net of offering costs | | | 446,850 | | | | 447 | | | | 2,166,657 | | | | — | | | | 2,167,104 | |

Shares issued to consultant for services | | | 2,577 | | | | 2 | | | | 14,998 | | | | — | | | | 15,000 | |

Stock-based compensation | | | — | | | | — | | | | 300,729 | | | | — | | | | 300,729 | |

Net loss for the three months ended September 30, 2023 | | | — | | | | — | | | | — | | | | (1,839,828 | ) | | | (1,839,828 | ) |

Balance - September 30, 2023 | | | 12,934,226 | | | $ | 12,934 | | | $ | 179,222,724 | | | $ | (150,027,762 | ) | | $ | 29,207,896 | |

|

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements. |

LIGHTBRIDGE CORPORATION

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2024 AND 2023

(Continued)

| | | | | | | | Additional | | | | | | Total | |

| | Common Stock | | | Paid-in | | | Accumulated | | | Stockholders’ | |

| | Shares | | | Amount | | | Capital | | | Deficit | | | Equity | |

| | | | | | | | | | | | | | | |

Balance - January 1, 2024 | | | 13,698,274 | | | $ | 13,698 | | | $ | 181,295,125 | | | $ | (152,397,776 | ) | | $ | 28,911,047 | |

Shares issued - registered offerings - net of offering costs | | | 427,300 | | | | 428 | | | | 1,221,554 | | | | — | | | | 1,221,982 | |

Shares issued to consultant and directors for services | | | 64,206 | | | | 64 | | | | 254,936 | | | | — | | | | 255,000 | |

Stock-based compensation | | | — | | | | — | | | | 456,904 | | | | — | | | | 456,904 | |

Net loss for the three months ended March 31, 2024 | | | — | | | | — | | | | — | | | | (2,819,584 | ) | | | (2,819,584 | ) |

Balance - March 31, 2024 | | | 14,189,780 | | | $ | 14,190 | | | $ | 183,228,519 | | | $ | (155,217,360 | ) | | $ | 28,025,349 | |

| | | | | | | | | | | | | | | | | | | | |

Shares issued - registered offerings - net of offering costs | | | 400,831 | | | | 400 | | | | 982,242 | | | | — | | | | 982,642 | |

Shares issued to consultant for services | | | 5,000 | | | | 5 | | | | 14,995 | | | | — | | | | 15,000 | |

Net share settlement for withholding taxes paid upon vesting of restricted stock awards | | | (4,134 | ) | | | (4 | ) | | | (10,579 | ) | | | — | | | | (10,583 | ) |

Stock-based compensation | | | — | | | | — | | | | 384,216 | | | | — | | | | 384,216 | |

Net loss for the three months ended June 30, 2024 | | | — | | | | — | | | | — | | | | (2,374,634 | ) | | | (2,374,634 | ) |

Balance – June 30, 2024 | | | 14,591,477 | | | $ | 14,591 | | | $ | 184,599,393 | | | $ | (157,591,994 | ) | | $ | 27,021,990 | |

| | | | | | | | | | | | | | | | | | | | |

Shares issued - registered offerings - net of offering costs | | | 608,690 | | | | 609 | | | | 1,511,132 | | | | — | | | | 1,511,741 | |

Shares issued to consultant for services | | | 76,164 | | | | 76 | | | | 194,924 | | | | — | | | | 195,000 | |

Stock-based compensation | | | — | | | | — | | | | 388,477 | | | | — | | | | 388,477 | |

Net loss for the three months ended September 30, 2024 | | | — | | | | — | | | | — | | | | (2,656,161 | ) | | | (2,656,161 | ) |

Balance - September 30, 2024 | | | 15,276,331 | | | $ | 15,276 | | | $ | 186,693,926 | | | $ | (160,248,155 | ) | | $ | 26,461,047 | |

|

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements. |

LIGHTBRIDGE CORPORATION

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

| | Nine Months Ended | |

| | September 30, | |

| | 2024 | | | 2023 | |

Operating Activities | | | | | | |

Net Loss | | $ | (7,850,379 | ) | | $ | (5,538,632 | ) |

Adjustments to reconcile net loss from operations to net cash used in operating activities: | | | | | | | | |

Common stock issued for services | | | 50,806 | | | | 30,000 | |

Stock-based compensation | | | 1,229,597 | | | | 901,887 | |

| | | | | | | | |

Changes in operating assets and liabilities: | | | | | | | | |

Prepaid expenses and other current assets | | | (37,665 | ) | | | (137,139 | ) |

Prepaid project costs and other long-term assets | | | 10,125 | | | | (141,375 | ) |

Accounts payable and accrued liabilities | | | 928,240 | | | | 740,308 | |

Net Cash Used in Operating Activities | | | (5,669,276 | ) | | | (4,144,951 | ) |

| | | | | | | | |

Investing Activities | | | | | | | | |

Trademarks | | | — | | | | (640 | ) |

Net Cash Used in Investing Activities | | | — | | | | (640 | ) |

| | | | | | | | |

Financing Activities | | | | | | | | |

Net proceeds from the issuances of common stock and tax payments for share settlement of equity awards | | | 3,705,782 | | | | 4,481,486 | |

Net Cash Provided by Financing Activities | | | 3,705,782 | | | | 4,481,486 | |

| | | | | | | | |

Net (Decrease) Increase in Cash and Cash Equivalents | | | (1,963,494 | ) | | | 335,895 | |

Cash and Cash Equivalents, Beginning of Period | | | 28,598,445 | | | | 28,899,997 | |

Cash and Cash Equivalents, End of Period | | $ | 26,634,951 | | | $ | 29,235,892 | |

| | | | | | | | |

Supplemental Disclosure of Cash Flow Information | | | | | | | | |

Cash paid during the period: | | | | | | | | |

Interest paid | | $ | — | | | $ | — | |

Income taxes paid | | $ | — | | | $ | — | |

Non-Cash Financing Activities: | | | | | | | | |

Payment of accrued liabilities with common stock | | $ | 255,000 | | | $ | 215,000 | |

Common stock issued for consulting services | | $ | 180,000 | | | $ | — | |

| | | | | | | | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements. |

LIGHTBRIDGE CORPORATION

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Note 1. Nature of Operations, Basis of Presentation, Summary of Significant Accounting Policies and Recent Accounting Pronouncements

Nature of Operations and Basis of Presentation

When used in these notes, the terms “Lightbridge,” “Company,” “we,” “us” or “our” mean Lightbridge Corporation and all entities included in the condensed consolidated financial statements.

The Company was formed on October 6, 2006, when Thorium Power, Ltd., which was incorporated in the state of Nevada on February 2, 1999, merged with Thorium Power, Inc. (TPI), which was incorporated in the state of Delaware on January 8, 1992. On September 29, 2009, the Company changed its name from Thorium Power, Ltd. to Lightbridge Corporation and began its focus on developing and commercializing metallic nuclear fuels. The Company is a nuclear fuel technology company developing its next generation nuclear fuel technology. These condensed consolidated financial statements include the accounts of the Company and the Company’s wholly-owned subsidiaries, TPI, and Lightbridge International Holding LLC, a Delaware limited liability company. These wholly-owned subsidiaries are inactive, and all significant intercompany transactions and balances have been eliminated in consolidation.

The accompanying unaudited condensed consolidated financial statements of Lightbridge Corporation and its subsidiaries have been prepared in accordance with the rules and regulations of the Securities and Exchange Commission, or the SEC, including the instructions to Form 10-Q and Regulation S-X. Certain information and footnote disclosures normally included in financial statements prepared in accordance with generally accepted accounting principles in the United States of America, including a summary of the Company’s significant accounting policies, have been condensed or omitted from these statements pursuant to such rules and regulations and, accordingly, they do not include all the information and footnotes necessary for comprehensive condensed consolidated financial statements and should be read in conjunction with the audited consolidated financial statements for the year ended December 31, 2023, included in the Annual Report on Form 10-K for the year ended December 31, 2023 filed with the SEC on March 4, 2024.

In the opinion of the management of the Company, all adjustments, which are of a normal recurring nature, necessary for a fair statement of the results for the three and nine-month periods have been made. Results for the interim period presented are not necessarily indicative of the results that might be expected for the entire fiscal year.

Summary of Significant Accounting Policies

Fair Value of Financial Instruments

The Company determines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between unaffiliated market participants at the measurement date.

Accounting Standards Codification (ASC), Fair Value Measurement (ASC 820), establishes a fair value hierarchy that prioritizes the inputs used to measure fair value. Assets and liabilities measured at fair value are categorized based on whether the inputs are observable in the market and the degree that the inputs are observable. The hierarchy gives the highest priority to active markets for identical assets and liabilities (Level 1 measurement) and the lowest priority to unobservable inputs (Level 3 measurement). The categorization of financial instruments within the valuation hierarchy is based on the lowest level of input that is significant to the fair value measurement. The three levels of the fair value hierarchy are as follows:

Level 1 - Observable inputs such as quoted prices in active markets for identical assets or liabilities;

Level 2 - Inputs other than quoted prices that are observable for the asset or liability, either directly or indirectly. These include quoted prices for similar assets or liabilities in active markets, quoted prices for identical or similar assets or liabilities in markets that are not active and inputs other than quoted prices that are observable for the asset or liability; and

Level 3 - Unobservable inputs that reflect management’s assumptions.

For disclosure purposes, assets and liabilities are classified in their entirety in the fair value hierarchy level based on the lowest level of input that is significant to the overall fair value measurement. The Company’s assessment of the significance of a particular input to the fair value measurement requires judgment and may affect the placement within the fair value hierarchy levels.

The Company’s financial instruments consist principally of cash and cash equivalents, accounts payable and accrued liabilities. The carrying amounts of accounts payable and accrued liabilities are considered to be a Level 1 measurement, representative of their respective fair values because of the short-term nature of those instruments.

At the end of the reporting period, the Company reviews U.S. treasury instruments held to determine whether the securities are of the most recent issuance of that security with the same maturity (referred to as “on-the-run”, which is the most liquid version of the maturity band). If a U.S. treasury instrument held at the end of the reporting period was from the most recent issuance it is classified as level 1, otherwise it is referred to as “off-the-run” and is classified as level 2. During the nine months ended September 30, 2024 and 2023, there were $0 transfers from level 1 to level 2 related to U.S. Treasury instruments acquired on-the-run that as of the reporting period became off-the-run, respectively.

The following table summarizes the valuation of the Company’s cash equivalents (rounded in millions) that fall within the fair value hierarchy at September 30, 2024. There were no cash equivalents at December 31, 2023.

Assets | | Level I | | | Level II | | | Level III | |

Treasury Bills | | $ | — | | | $ | 20.0 | | | $ | — | |

Certain Risks and Uncertainties

The Company will need additional funding and/or in-kind support via a combination of strategic alliances, government grants, further offerings of equity securities, or an offering of debt securities in order to support its future research and development (R&D) activities required to further enhance and complete the development and commercialization of its fuel products.

There can be no assurance that the Company will be able to successfully continue to conduct its operations if there is a lack of financial resources available in the future to continue its fuel development activities, and a failure to do so would have a material adverse effect on the Company’s future R&D activities, financial position, results of operations, and cash flows. Also, the success of the Company’s operations will be subject to other numerous contingencies, some of which are beyond management’s control. These contingencies include general and regional economic conditions, contingent liabilities, potential competition with other nuclear fuel developers, including those entities developing accident tolerant fuels (ATFs), changes in government regulations, risks related to the R&D of our nuclear fuel, regulatory approval of the Company’s fuel, support for nuclear power, changes in accounting and taxation standards, inability to achieve overall short-term and long-term R&D milestones toward commercialization, future impairment charges to the Company’s assets, and global or regional catastrophic events. The Company may also be subject to various additional political, economic, and other uncertainties.

Recent Accounting Pronouncements

In November 2023, the Financial Accounting Standards Board (FASB) issued ASU No. 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures (ASU 2023-07), which expands on the required disclosure of incremental segment information. The new guidance is effective for fiscal years beginning after December 15, 2023, and interim periods within fiscal years beginning after December 15, 2024, with early adoption permitted. The Company does not expect this guidance to have a material impact on its consolidated financial statements and related disclosures.

In December 2023, the FASB issued ASU No. 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures (ASU 2023-09), which requires companies to annually disclose categories in the effective tax rate reconciliation and additional information about income taxes paid. The new guidance is effective for annual periods beginning after December 15, 2024, with early adoption permitted. The Company expects the new standard to have an immaterial effect on its consolidated financial statements and related disclosures upon adoption.

In August 2020, the FASB issued ASU 2020-06, Debt-Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging- Contracts in Entity’s Own Equity (Subtopic 815-40), which simplifies the complexity associated with applying U.S. GAAP for certain financial instruments with characteristics of liabilities and equity. This ASU (1) simplifies the accounting for convertible debt instruments and convertible preferred stock by removing the existing guidance in ASC 470-20, Debt: Debt with Conversion and Other Options, that requires entities to account for beneficial conversion features and cash conversion features in equity, separately from the host convertible debt or preferred stock; (2) revises the scope exception from derivative accounting in Subtopic 815-40 for freestanding financial instruments and embedded features that are both indexed to the issuer’s own stock and classified in stockholders’ equity, by removing certain criteria required for equity classification; and (3) revises the guidance in ASC 260, Earnings Per Share, to require entities to calculate diluted earnings per share for convertible instruments by using the if-converted method. ASU 2020-06 is effective for fiscal years beginning after December 15, 2023, including interim periods within those fiscal years. Early adoption is permitted, but no earlier than fiscal years beginning after December 15, 2020, including interim periods within those fiscal years. Adoption is either through a modified retrospective method or a full retrospective method of transition. The Company adopted this guidance on January 1, 2024 and the adoption did not have a material impact on its results of operations, financial position, and disclosures because the Company does not have any transactions or instruments to which this standard applies. If in the future, the Company issues new convertible debt, warrants or other instruments, the standard may have a material effect, but it cannot be determined at this time.

The Company has evaluated other recently issued, but not yet effective, accounting standards that have been issued or proposed by the FASB or other standards-setting bodies through the filing date of these unaudited condensed consolidated financial statements and do not believe the future adoption of any such standards will have a material impact on the Company’s consolidated financial statements and related disclosures.

Note 2. Net Loss Per Share

Basic net loss per share is computed using the weighted-average number of common shares outstanding during the reporting period, except that it does not include unvested common shares subject to repurchase or cancellation. Diluted net loss per share is computed using the weighted-average number of common shares and, if dilutive, potential common shares outstanding during the period. Potential common shares consist of the incremental common shares issuable upon the exercise of stock options.

The outstanding securities noted below have been excluded from the computation of diluted weighted shares outstanding for the three and nine months ended September 30, 2024 and 2023, as they would have been anti-dilutive due to the Company’s losses at September 30, 2024 and 2023 and also because the exercise price of certain of these outstanding securities was greater than the average closing price of the Company’s common stock.

| | Three and Nine Months Ended | |

| | September 30, | |

| | 2024 | | | 2023 | |

Stock options outstanding | | | 547,362 | | | | 503,843 | |

Restricted stock awards outstanding | | | 545,992 | | | | 451,404 | |

Total | | | 1,093,354 | | | | 955,247 | |

Note 3. Prepaid Project Costs and Other Long-term Assets

In 2022, the Company entered into two agreements with Idaho National Laboratory (INL), in collaboration with the United States Department of Energy (DOE), to support the development of Lightbridge Fuel™. At the time of signing, the Company made advanced payments for future project work totaling $0.4 million to Battelle Energy Alliance, LLC (BEA), DOE’s operating contractor for INL. In May 2023, the Company and INL modified the agreements to extend the contract term to May 2029, aligning it with the duration of the irradiation testing and increasing the advanced payments by $0.1 million to $0.5 million. The prepaid project costs were $0.5 million as of September 30, 2024 and December 31, 2023, recorded under Other Assets - Prepaid project costs and other long-term assets on the accompanying condensed consolidated balance sheets.

Note 4. Accounts Payable and Accrued Liabilities

Accounts payable and accrued liabilities consisted of the following (rounded in millions):

| | September 30, | | | December 31, | |

| | 2024 | | | 2023 | |

Trade payables | | $ | 0.1 | | | $ | 0.1 | |

Accrued research and development expenses | | | 0.2 | | | | — | |

Accrued legal and consulting expenses | | | 0.1 | | | | 0.4 | |

Accrued bonus | | | 0.8 | | | | — | |

Total | | $ | 1.2 | | | $ | 0.5 | |

Note 5. Commitments and Contingencies

As of September 30, 2024 and December 31, 2023, the Company had total project task orders and contractual commitments for R&D work for the following three R&D projects (rounded in millions):

| | September 30, | | | December 31, | |

| | 2024 | | | 2023 | |

INL Project | | $ | 2.4 | | | $ | 2.9 | |

Romania Feasibility Study | | | — | | | | 0.2 | |

Centrus Energy FEED Study | | | — | | | | 0.5 | |

Total | | $ | 2.4 | | | $ | 3.6 | |

Project Task Statements - INL Project

On March 26, 2024, the Company and BEA entered into Modification No. 2 to the Project Task Statement (PTS) under the Strategic Partnership Project Agreement (SPPA), dated December 9, 2022, as amended on May 23, 2023, by and between the Company and BEA. Pursuant to the terms of Modification No. 2, the potential amounts payable by the Company to reimburse BEA for its expenses and employee time were increased by approximately $0.6 million, bringing the total estimated cost for the work to be performed under the “umbrella” SPPA to $1.7 million.

After Modification No. 2, total cash payments from the Company to BEA under both Agreements were estimated at approximately $4.3 million (excluding project contingencies) on a cost reimbursable basis over the performance periods under the initial releases.

As of September 30, 2024, the Company had approximately $2.4 million in outstanding PTSs to BEA relating to the R&D work being conducted under the SPPA and “umbrella” Cooperative Research and Development Agreement (CRADA) at INL. Performance of work under these agreements may be terminated at any time by either party, without any liability, after the effective date of termination, upon giving a thirty-day written notice under the SPPA and a sixty-day written notice under the CRADA, to the other party. In the event of termination, the Company shall be responsible for BEA’s costs (including the closeout costs), through the effective date of termination, but in no event shall the Company’s cost responsibility exceed the total estimated cost stated in each PTS and any subsequent modification to the PTS.

On October 24, 2024, the Company and BEA entered into Modification No. 3 PTS under the SPPA. See Note 8. Subsequent Events of the Notes to our condensed consolidated financial statements included in Part I. Item 1. Financial Statements, of this Quarterly Report on Form 10-Q for additional information concerning Modification No. 3.

Romania Feasibility Study of Lightbridge Fuel™ for use in CANDU reactors

On October 16, 2023, the Company engaged Institutul de Cercetări Nucleare Pitești, a subsidiary of Regia Autonoma Tehnologii pentru Energia Nucleara (RATEN ICN) in Romania to perform an engineering study to assess the compatibility and suitability of Lightbridge Fuel™ for use in CANDU reactors.

On July 2, 2024, the Company and RATEN ICN agreed to a change order modifying the remaining scope, schedule, and total fee for the engineering study. The revised total fee was $0.2 million. As of September 30, 2024, the Company had approximately $27,000 in remaining outstanding project commitments to RATEN ICN, payable upon the acceptance of the final engineering study report by the Company.

FEED Study with Centrus Energy for a Lightbridge Pilot Fuel Fabrication Facility

On December 5, 2023, the Company entered into an agreement with Centrus Energy Corp. (Centrus Energy) to conduct a front-end engineering and design (FEED) study to evaluate deployment of a Lightbridge Pilot Fuel Fabrication Facility (LPFFF) to manufacture Lightbridge Fuel™ using high-assay low-enriched uranium (HALEU) at the American Centrifuge Plant in Piketon. In the second quarter of 2024, Centrus completed Phase 1 of the FEED Study and issued a report.

On June 27, 2024, the Company and Centrus Energy agreed to a Change Order modifying the remaining scope, schedule, and total fee for the FEED study. The revised total fee was $0.3 million with $0.1 million as the remaining amount due to Centrus Energy, upon the acceptance of the final FEED study report by the Company. In the third quarter of 2024, Centrus completed the remaining scope of work as modified under the Change Order and submitted its final report that was accepted by the Company. Subsequently, the Company made its final payment due under the agreement and Change Order to Centrus and has no further obligations to Centrus under the agreement or Change Order.

Operating Leases

The Company leased office space for a 12-month term from January 1, 2024 through December 31, 2024 with a monthly payment of approximately $8,000. The future minimum lease payments required under the non-cancellable operating leases for 2024 total approximately $0.1 million. Total rent expense for the three and nine months ended September 30, 2024 was approximately $24,000 and $73,000, respectively. Total rent expense for the three and nine months ended September 30, 2023 was approximately $23,000 and $70,000, respectively.

Note 6. Research and Development Costs

INL Project

In 2022, Lightbridge entered into agreements with BEA, to support the development of Lightbridge Fuel™. These framework agreements use an innovative structure that consists of an “umbrella” SPPA and an “umbrella” CRADA, with an initial duration of seven years. Throughout the duration of these umbrella agreements, all R&D work contracted with BEA is through the issuance of PTSs. The initial phase of work under the two agreements is expected to culminate in future irradiation testing in the Advanced Test Reactor of fuel samples using enriched uranium supplied by the DOE. The initial phase of work aims to generate irradiation performance data for Lightbridge’s delta-phase uranium-zirconium alloy relating to various thermophysical properties. Data gathered during future post-irradiation examination work are expected to support fuel performance modeling and regulatory licensing efforts for the commercial deployment of Lightbridge Fuel™. For the three and nine months ended September 30, 2024, the Company recorded $0.4 million and $1.1 million in R&D expenses associated with INL, respectively. For the three and nine months ended September 30, 2023, the Company recorded $0.3 million and $0.6 million in R&D expenses associated with INL, respectively.

Romania Feasibility Study

On October 16, 2023, the Company engaged RATEN ICN in Romania to perform an engineering study to assess the compatibility and suitability of Lightbridge Fuel™ for use in CANDU reactors. The total price of approximately $0.2 million is payable in three installments, including an advance payment of $0.1 million and an interim milestone payment and final payment totaling approximately $0.1 million. For the three and nine months ended September 30, 2024, the Company recorded zero and $0.1 million, respectively in R&D expenses associated with RATEN ICN.

Centrus Energy FEED Study

On December 5, 2023, the Company entered into an agreement with Centrus Energy to conduct a FEED study to evaluate deployment of a LPFFF at the American Centrifuge Plant in Piketon, Ohio. For the three and nine months ended September 30, 2024, the Company recorded $0.1 million and $0.3 million, respectively in R&D expenses associated with this FEED study.

In the second quarter of 2024, Centrus completed Phase 1 of the FEED Study and issued a report. In the Company’s judgement, the preliminary labor effort and schedule estimates show that the Piketon site may be better suited for deployment of an industrial-scale facility rather than a much smaller pilot-scale fuel fabrication facility the Company is looking to establish over the next few years. In the third quarter of 2024, Centrus completed the remaining scope of work as modified under the Change Order and submitted its final report that was accepted by the Company. Subsequently, the Company made its final payment due under the agreement and Change Order to Centrus and has no further obligations to Centrus under the agreement or Change Order.

The following table presents the total R&D expenses for the three and nine months ended September 30, 2024 and 2023 (rounded to millions):

| | Three Months Ended | | | Nine Months Ended | |

| | September 30, | | | September 30, | |

| | 2024 | | | 2023 | | | 2024 | | | 2023 | |

INL Project | | $ | 0.4 | | | $ | 0.2 | | | $ | 1.1 | | | $ | 0.5 | |

Romania Feasibility Study | | | — | | | | — | | | | 0.1 | | | | — | |

Centrus Energy FEED Study | | | 0.1 | | | | — | | | | 0.3 | | | | — | |

Allocated employee compensation and stock-based compensation expenses | | | 0.5 | | | | 0.2 | | | | 1.2 | | | | 0.5 | |

Other outside R&D expenses | | | 0.3 | | | | 0.1 | | | | 0.5 | | | | 0.3 | |

Total | | $ | 1.3 | | | $ | 0.5 | | | $ | 3.2 | | | $ | 1.3 | |

Note 7. Stockholders’ Equity and Stock-Based Compensation

At September 30, 2024, the Company had 15,276,331 common shares outstanding (including outstanding RSAs totaling 545,992 shares). Also outstanding were stock options relating to 547,362 shares of common stock (of which 527,697 stock options were vested), all totaling 15,823,693 shares of common stock and all common stock equivalents, potentially outstanding at September 30, 2024.

At December 31, 2023, the Company had 13,698,274 common shares outstanding (including outstanding RSAs totaling 557,688 shares). Also outstanding were stock options relating to 510,787 shares of common stock (of which 498,177 stock options were vested), all totaling 14,209,061 shares of common stock and all common stock equivalents, outstanding at December 31, 2023.

Common Stock Equity Offerings

At-the-Market (ATM) Offerings

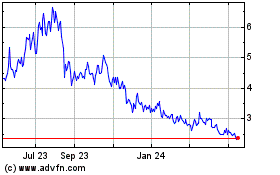

On May 28, 2019, the Company entered into an at-the-market equity offering sales agreement with Stifel, Nicolaus & Company, Incorporated (Stifel), which was amended on April 9, 2021 and May 8, 2024 (the ATM Agreement), pursuant to which the Company may issue and sell shares of its common stock from time to time through Stifel as the Company’s sales agent. On May 8, 2024, the Company entered into an amendment to the ATM Agreement with Stifel. Under this amended agreement, the Company pays Stifel a commission equal to 3.0% of the aggregate gross proceeds of any sales of common stock under the agreement. The offering of common stock pursuant to this agreement can be terminated with 10 days written notice by either party. Sales of the Company’s common stock through Stifel, if any, will be made by any method that is deemed to be an “at-the-market” equity offering as defined in Rule 415 promulgated under the Securities Act of 1933.

On March 29, 2024, the Company filed a shelf registration statement on Form S-3, registering the sale of up to $75.0 million of the Company’s securities, which registration statement was declared effective on April 19, 2024. On May 10, 2024, the Company filed a prospectus supplement, which was further supplemented on July 19, 2024 and August 9, 2024, pursuant to which the Company may offer and sell shares of its common stock having an aggregate offering price of up to $12.6 million from time to time through its ATM.

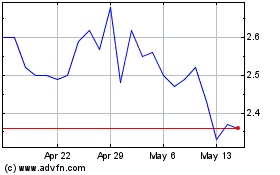

The Company records its ATM sales on a settlement date basis. The Company sold 1.4 million shares under the ATM for the nine months ended September 30, 2024 resulting in net proceeds of $3.7 million (stock issuance costs were approximately $0.4 million). The Company sold approximately 0.9 million shares under the ATM for the nine months ended September 30, 2023 resulting in net proceeds of $4.5 million (stock issuance costs were $0.2 million).

Stock-based Compensation

Amendment to 2020 Equity Incentive Plan

On March 9, 2020, the Board of Directors adopted the Company’s 2020 Omnibus Incentive Plan (the 2020 Plan). On September 3, 2020, the shareholders approved the 2020 Plan to authorize grants of the following types of awards: (a) Options, (b) Stock Appreciation Rights, (c) Restricted Stock and Restricted Stock Units, and (d) Other Stock-Based and Cash-Based Awards. The total number of shares of common stock available for issuance under the 2020 Plan is 2,500,000 shares with 1,471,026 shares available for future issuance at September 30, 2024. On February 27, 2024, the Board of Directors approved an increase of 700,000 shares to the authorized number of shares under the 2020 Equity Incentive Plan, increasing the total authorized number of shares from 1,800,000 shares to 2,500,000 shares. This increase was approved by the stockholders at the shareholders’ annual meeting on April 19, 2024.

Stock Options

During the nine months ended September 30, 2024, the Company issued 71,330 stock options to two consultants. These options were assigned a fair value of $1.19 per share (total fair value of $85,000). During the nine months ended September 30, 2023, the Company issued 28,538 stock options to two consultants. These options were assigned a fair value of $1.68 per share (total fair value of $47,830).

Common Stock

Consultants’ Stock Issuances

For the nine months ended September 30, 2024 and 2023, the Company issued 13,201 shares (with stock prices at $3.00 to $4.00 per share) and 9,985 shares (with stock prices at $3.89 to $5.82 per share) of common stock, respectively, to its investor relations firm for services provided during the period, recorded to general and administrative expenses. The expense recorded for these share issuances was $15,000 for each quarter with a weighted average grant date fair value of $3.41 per share.

On August 19, 2024, the Board of Directors approved an equity grant valued at $180,000 to a consulting and investment research firm, for corporate advisory services to be provided over a twelve-month period, and preparation and dissemination of a report regarding the Company, which resulted in issuing the consultant 71,713 shares of common stock, valued on the grant date at $2.51 per share. This compensation cost of $180,000 is recognized on a straight-line basis over the requisite service period. Approximately $21,000 of stock-based compensation expense was recorded to general and administrative expenses for the three and nine months ended September 30, 2024.

As of September 30, 2024, the unrecognized compensation cost of approximately $159,000 was recorded under Prepaid expenses and other current assets on the accompanying condensed consolidated balance sheets, which is expected to be recognized over a remaining service period of 0.8 years.

Directors’ Stock Issuances

On November 20, 2023, the Board of Directors approved an equity grant valued at $240,000 in total to its six directors, which resulted in granting a total of 60,456 shares of common stock, valued on the grant date at $3.97 per share, which vested and were issued on January 2, 2024.

On December 15, 2022, the Board of Directors approved an equity grant valued at $200,000 in total to its five independent directors, recorded in general and administrative expenses, which resulted in granting a total of 52,085 shares of common stock to the five independent directors, valued on the grant date at $3.84 per share, which vested and were issued on January 3, 2023.

Restricted Stock Awards

As of September 30, 2024 and December 31, 2023, there were 545,992 and 557,688 restricted stock awards (RSAs) included in the total issued and outstanding common stock. A total of $1.1 million and $0.9 million of compensation expense was recorded for the nine months ended September 30, 2024 and 2023, respectively. Compensation expense is recognized straight line over the three-year vesting period.

As of September 30, 2024, total unrecognized compensation cost related to restricted stock units was $1.45 million, which is expected to be recognized over a remaining weighted-average vesting period of 1.64 years.

Stock-Based Compensation Expense

Stock Options

The following assumptions were used in the Black-Scholes pricing model to determine the fair value of stock options granted during the nine months ended September 30, 2024 and 2023:

| | Nine Months Ended | |

| | September 30, | |

| | 2024 | | | 2023 | |

Expected volatility | | 75.36%-92.89% | | | 68.13%-95.70% | |

Risk free interest rate | | 3.76%-4.54% | | | 4.21%-4.88% | |

Dividend yield rate | | | — | | | | — | |

Weighted average years | | 2 – 6 years | | | 1 – 6 years | |

Closing price per share - common stock | | $2.49 – $2.62 | | | $4.31 - $4.35 | |

Total non-cash stock-based compensation expense recorded related to options granted and restricted stock awards included in the Company’s unaudited condensed consolidated statements of operations for the three and nine months ended September 30, 2024 and 2023 are as follows (rounded in millions):

| | For the Three Months Ended | | | For the Nine Months Ended | |

| | September 30, | | | September 30, | |

| | 2024 | | | 2023 | | | 2024 | | | 2023 | |

Research and development expenses | | $ | 0.1 | | | $ | — | | | $ | 0.2 | | | $ | 0.1 | |

General and administrative expenses | | $ | 0.3 | | | $ | 0.3 | | | $ | 1.0 | | | $ | 0.8 | |

Total stock-based compensation expense | | $ | 0.4 | | | $ | 0.3 | | | $ | 1.2 | | | $ | 0.9 | |

Note 8. Subsequent Events

ATM Sales

Sales of common stock under the Company’s ATM from October 1, 2024 to November 1, 2024 amounted to 485,571 shares, which resulted in total net proceeds of approximately $1.4 million.

INL Contract

On October 24, 2024, the Company and BEA entered into Modification No. 3 PTS under the SPPA, dated December 9, 2022, as amended on May 23, 2023 and March 26, 2024, by and between the Company and BEA. This modification was done to increase funding for additional demonstration extrusions. Pursuant to the terms of Modification No. 3, the potential amounts payable by the Company to reimburse BEA for its expenses and employee time were increased by approximately $0.3 million, bringing the total estimated cost for the work to be performed under the “umbrella” SPPA to $2.0 million.

After Modification No. 3, total cash payments from the Company to BEA under both Agreements were estimated at approximately $4.6 million (excluding project contingencies) on a cost reimbursable basis over the performance periods under the initial releases.

FORWARD-LOOKING STATEMENTS

In addition to historical information, this Quarterly Report on Form 10-Q contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact are statements that could be deemed forward-looking statements. We use words such as “believe,” “expect,” “anticipate,” “project,” “target,” “plan,” “optimistic,” “intend,” “aim,” “will,” “may,” or similar expressions, which are intended to identify forward-looking statements. Such statements include, among others:

| · | those concerning market and business segment growth, demand, and acceptance of our nuclear fuel technology and other steps toward the commercialization of Lightbridge Fuel™; |

| | |

| · | any projections of sales, earnings, revenue, margins, or other financial items; |

| | |

| · | any statements of the plans, strategies, and objectives of management for future operations and the timing and outcome of the development of our nuclear fuel technology; |

| | |

| · | any statements regarding future economic conditions or performance; |

| | |

| · | any statements about future financings and liquidity; |

| | |

| · | the Company’s anticipated financial resources and position; and |

| | |

| · | all assumptions, expectations, predictions, intentions, or beliefs about future events and other statements that are not historical facts. |

You are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, as well as assumptions that if they were to ever materialize or prove incorrect, could cause the results of the Company to differ materially from those expressed or implied by such forward-looking statements. Such risks and uncertainties, among others, include:

| · | our ability to commercialize our nuclear fuel technology, including risks related to the design and testing of nuclear fuel incorporating our technology and the degree of market adoption of the Company’s product and service offerings; |

| | |

| · | dependence on strategic partners; |

| | |

| · | any adverse changes to our agreements or relationship with the U.S. government and its national laboratories; |

| | |

| · | our ability to fund our future operations, including general corporate overhead and outside research and development (R&D) expenses, and continue as a going concern; |

| | |

| · | the future market and demand for our fuel for nuclear reactors and our ability to attract customers; |

| | |

| · | our ability to manage the business effectively in a rapidly evolving market; |

| | |

| · | our ability to employ and retain qualified employees and consultants that have experience in the nuclear industry; |

| · | competition and competitive factors in the markets in which we compete, including from accident tolerant fuels (ATFs); |

| | |

| · | the availability of nuclear test reactors and the risks associated with unexpected changes in our nuclear fuel development timeline; |

| | |

| · | the increased costs associated with metallization of our nuclear fuel; |

| | |

| · | uncertainties related to conducting business in foreign countries; |

| | |

| · | public perception of nuclear energy generally; |

| | |

| · | changes in laws, rules, and regulations governing our business; |

| | |

| · | changes in the political environment; |

| | |

| · | development and utilization of, and challenges to, our intellectual property domestically and abroad; |

| | |

| · | the trading price of our securities is likely to be volatile, and purchasers of our securities could incur substantial losses; and |

| | |

| · | the other risks and uncertainties identified in Item 1A. Risk Factors included in our Annual Report on Form 10-K for the year ended December 31, 2023, our Quarterly Report on Form 10-Q for the period ended March 31, 2024, and this Quarterly Report on Form 10-Q for the period ended September 30, 2024. |

Most of these factors are beyond our ability to predict or control and you should not put undue reliance on any forward-looking statement. Future events and actual results could differ materially from those set forth in, contemplated by or underlying the forward-looking statements. Forward-looking statements speak only as of the date on which they are made. The Company assumes no obligation and does not intend to update these forward-looking statements for any reason after the date of the filing of this report, to conform these statements to actual results or to changes in our expectations, except as required by law.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following Management’s Discussion and Analysis of Financial Condition and Results of Operations, or MD&A, is intended to help the reader understand Lightbridge Corporation, our operations, and our present business environment. MD&A is provided as a supplement to, and should be read in conjunction with, our condensed consolidated financial statements and the accompanying notes thereto contained in Part I, Item 1 of this report, as well as those included in our Annual Report on Form 10-K for the year ended December 31, 2023.

This MD&A consists of the following sections:

| · | Overview of Our Business and Development of Lightbridge Fuel™ - a general overview of our business and updates; |

| | |

| · | Critical Accounting Estimates - a discussion of critical judgments and estimates; |

| | |

| · | Operations Review - an analysis of our consolidated results of operations for the periods presented in our condensed consolidated financial statements; and |

| | |

| · | Liquidity, Capital Resources, and Financial Position - an analysis of our cash flows and an overview of our financial position. |

As discussed in more detail under “Forward-Looking Statements” preceding this MD&A, the following discussion contains forward-looking statements that are based on our management’s current expectations, estimates, and projections, which are subject to a number of risks and uncertainties. Our actual results may differ materially from those discussed in these forward-looking statements because of the risks and uncertainties inherent in future events, including those set forth under “Forward-Looking Statements” and Part II. Item 1A. Risk Factors included herein.

OVERVIEW OF OUR BUSINESS AND DEVELOPMENT OF LIGHTBRIDGE FUELTM

When used in this Quarterly Report on Form 10-Q, the terms “Lightbridge”, the “Company”, “we”, “our”, and “us” refer to Lightbridge Corporation together with its wholly-owned subsidiaries Lightbridge International Holding LLC and Thorium Power Inc. Lightbridge’s principal executive offices are located at 11710 Plaza America Drive, Suite 2000, Reston, Virginia, 20190, USA.

Our Business

At Lightbridge, we are developing next generation nuclear fuel for water-cooled reactors that could significantly improve the economics and safety of existing and new nuclear power plants, large and small, and enhance proliferation resistance of spent nuclear fuel while supplying clean energy to the electric grid or to “behind the meter” customers for electric power, including data centers. We project that the world’s energy and climate needs can only be met if nuclear power’s share of the energy-generating mix grows substantially in the coming decades. We believe Lightbridge can benefit from a growing nuclear power industry, and that our nuclear fuel can help enable that growth to happen.

We believe our metallic fuel will offer significant economic and safety benefits over traditional nuclear fuel, primarily because of the superior heat transfer properties and the resulting lower operating temperature of all-metal fuel. We also believe that uprating a reactor with Lightbridge Fuel™ will add incremental electricity at a lower levelized cost than any other means of generating baseload electric power, including fossil, hydroelectric energy source, or any traditional nuclear fuel. Uses could include additional power required for data centers.

Emerging nuclear technologies include small modular reactors (SMRs), which are now in the development and licensing phases. We expect that Lightbridge Fuel™ can provide water-cooled SMRs with the same benefits our technology brings to large reactors, with such benefits being even more meaningful to the economic case for deployment of SMRs, including potential load following capability when included on a virtually zero-carbon electric grid with renewable energy sources. We expect Lightbridge Fuel™ to generate more power in SMRs than traditional nuclear fuels.

We have built a significant portfolio of patents, and we anticipate testing our nuclear fuel through third-party vendors and others, including the United States Department of Energy’s (DOE) national laboratories. Currently, we are performing the majority of our R&D activities within and in collaboration with the DOE’s national laboratories.

Recent Developments

Idaho National Laboratory Agreements

In December 2022, Lightbridge entered into agreements with Battelle Energy Alliance, LLC (BEA), the DOE’s operating contractor for Idaho National Laboratory (INL), to support the development of Lightbridge Fuel™. The framework agreements use an innovative structure that consists of an “umbrella” Strategic Partnership Project Agreement (SPPA) and an “umbrella” Cooperative Research and Development Agreement (CRADA), each with BEA, with an initial duration of seven years.

We anticipate that the initial phase of work under the two agreements that has been released will culminate in casting and extrusion of unclad fuel material samples using enriched uranium supplied by the DOE that will subsequently be inserted for irradiation testing in the Advanced Test Reactor (ATR) at INL. The initial phase of work aims to generate irradiation performance data for Lightbridge’s delta-phase uranium-zirconium alloy relating to various thermophysical properties. The data will support fuel performance modeling and regulatory licensing efforts for commercial deployment of Lightbridge Fuel™. We use a rolling wave planning approach for project management purposes on the released scopes of work. It is an iterative planning technique in which the work to be accomplished in the near term is planned in detail, while work further in the future is planned at a higher level. As such, periodic revisions to the scope and/or cost estimates are anticipated.

The Company anticipates entering into additional modifications to the PTS under the SPPA and/or CRADA with INL to expand the scope of work, including performing additional extrusions, updating the experiment design for irradiation testing of coupon samples in the ATR, as well as other potential activities. The Company is discussing these additional scopes and timing of work with INL to be performed under the two “umbrella” agreements with BEA; which we anticipate will significantly increase our R&D expenses for the SPPA and/or CRADA. As of the date of this filing we are working with INL on defining the revised project plans and the revised total project costs estimates. Discussions with INL regarding these additional project scopes and timelines are ongoing. The successful execution of this project is subject to risks, including potential delays, cost overruns, regulatory challenges, and changes in funding availability, and if the project scope does increase, that the project will be successfully executed or completed. Regardless of whether further project modifications occur, the Company believes that due to resource and manufacturing equipment constraints, INL may not be able to meet the Company’s preferred project timeline, and that total project cost will likely exceed the initial budget.

We anticipate that subsequent phases of work under the two umbrella agreements that have not yet been released may include post-irradiation examination of the irradiated fuel material coupons, loop irradiation testing in the ATR, and post-irradiation examination of one or more uranium-zirconium fuel rodlets, as well as transient experiments in the Transient Reactor Test Facility at INL.

In 2023, we worked with INL to complete and issue a Quality Implementation Plan for our collaborative project at INL which was an essential first step to ensure all future work performed at INL on the project would meet the U.S. nuclear industry quality assurance requirements. Additionally, we worked with INL to demonstrate casting of delta-phase uranium-zirconium ingots with depleted uranium using existing INL equipment. As part of that effort, we cast several laboratory-scale ingots using depleted uranium and zirconium alloy materials.

On March 18, 2024, we announced a successful extrusion demonstration at INL of a billet into an unclad cylindrical rod, made of depleted uranium and zirconium alloy using the same composition of uranium and zirconium elements in the alloy as what is planned to be ultimately used in Lightbridge Fuel™. Subsequent to that, INL has successfully completed the extrusion of another unclad cylindrical rod, made of depleted uranium and zirconium alloy. A series of additional extrusions have been planned.

On March 26, 2024, the Company and BEA entered into Modification No. 2 project task statement (PTS) under the SPPA, dated December 9, 2022, as amended on May 23, 2023, by and between the Company and BEA. Pursuant to the terms of Modification No. 2, the potential amounts payable by the Company to reimburse BEA for its expenses and employee time were increased by approximately $0.6 million, bringing the total estimated cost for the work to be performed under the “umbrella” SPPA to $1.7 million.

On October 24, 2024, the Company and BEA entered into Modification No. 3 PTS under the SPPA, dated December 9, 2022, as amended on May 23, 2023 and March 26, 2024, by and between the Company and BEA. Pursuant to the terms of Modification No. 3, the potential amounts payable by the Company to reimburse BEA for its expenses and employee time were increased by approximately $0.3 million, bringing the total estimated cost for the work to be performed under the “umbrella” SPPA to $2.0 million.

After Modification No. 3, total cash payments from the Company to BEA under both Agreements were estimated at approximately $4.6 million (excluding project contingencies) on a cost reimbursable basis over the performance periods under the initial releases.

FEED Study with Centrus Energy for a Lightbridge Pilot Fuel Fabrication Facility

On December 5, 2023, we entered into an agreement with Centrus Energy Corp. (Centrus Energy) to conduct a front-end engineering and design (FEED) study for a Lightbridge Pilot Fuel Fabrication Facility (LPFFF) to manufacture Lightbridge Fuel™ using high-assay low-enriched uranium (HALEU) at the American Centrifuge Plant in Piketon, Ohio. The FEED study’s objective was to identify infrastructure and licensing requirements as well as the estimated cost and construction schedule for the LPFFF. Centrus Energy’s wholly-owned subsidiary, American Centrifuge Operating, LLC, was leading the study.

In the second quarter of 2024, the Company and Centrus Energy completed Phase 1 of the FEED Study. On June 27, 2024, Lightbridge and Centrus Energy agreed to a Change Order modifying the remaining scope, schedule, and cost for the FEED study. The total fee was $0.3 million with $0.1 million due upon acceptance of the final report by the Company. In the third quarter of 2024, Centrus completed the remaining scope of work as modified under the Change Order and submitted its final report that was accepted by the Company. In our judgement, the labor effort and schedule estimates show that the Piketon site may be better suited for deployment of an industrial-scale facility rather than a much smaller pilot-scale fuel fabrication facility the Company is looking to establish over the next few years. As such, the Company will not proceed with deployment of a Lightbridge Pilot Fuel Fabrication Facility (LPFFF) at the Piketon site at this time. The Company is currently exploring other options/sites for deployment of the LPFFF.

The Company expensed approximately $0.3 million in connection with the work that has been completed by Centrus Energy and has no further obligations to Centrus under the agreement or Change Order.

Romania Feasibility Study of Lightbridge Fuel™ for use in CANDU reactors

On October 16, 2023, we engaged Institutul de Cercetări Nucleare Pitești, a subsidiary of Regia Autonoma Tehnologii pentru Energia Nucleara (RATEN ICN) in Romania to perform an engineering study to assess the compatibility and suitability of Lightbridge Fuel™ for use in CANDU reactors. This assessment covers key areas including mechanical design, neutronics analysis, and thermal and thermal-hydraulic evaluations. The findings from this engineering study will play an important role in guiding future economic evaluations and navigating potential regulatory licensing-related issues for potential use of Lightbridge Fuel™ in CANDU reactors. On July 2, 2024, we issued a change order adding a new task to the remaining scope of this engineering study. Following the change order, the Company will be obligated to pay a total fee of approximately $0.2 million for this engineering study, which is expected to be completed in 2024.

Nuclear Energy University Program Awards

Texas A&M University (TAMU), NuScale Power, and Structural Integrity Associates are working on a 3-year study of our nuclear fuel, led by TAMU. In mid-2023, TAMU was awarded $1 million by the DOE’s Nuclear Energy University Program (NEUP) R&D Awards to conduct this study. The project entails a characterization of the performance of the Lightbridge Fuel™ Helical Cruciform advanced fuel design, which will generate sets of experimental data on friction factor, flow, and heat transfer behavior under NuScale’s SMR simulated normal and off-normal conditions.

We previously announced the ongoing NEUP project with the Massachusetts Institute of Technology (MIT). The study led by MIT and funded by DOE relates to evaluation of accident tolerant fuels (ATFs) in various SMRs. The project aims to simulate the fuel and safety performance of Lightbridge Fuel™ for the NuScale SMR and provide scoping analysis to improve the safety and economics of water-cooled SMRs.

We do not have any contractual obligations with the collaboration teams working on the above-mentioned projects and will not receive any revenue or record any economic benefits from these awards.

Future Steps Toward Our Fuel Development and Timeline For The Commercialization of Our Nuclear Fuel Assemblies

We anticipate fuel development milestones for Lightbridge Fuel™ over the next 2-3 years will consist of the following:

| · | continue to execute SPPA/CRADA work at INL leading to casting and extrusion of unclad fuel material samples using enriched uranium and their subsequent insertion for irradiation testing in the ATR; |

| | |

| · | complete a feasibility study for the use of our nuclear fuel in CANDU heavy water reactors; and |

| | |

| · | commence manufacturing efforts relating to co-extrusion of cladded rodlets for loop irradiation testing. |

The long-term milestones towards development and commercialization of nuclear fuel assemblies include, among other things, irradiating nuclear material samples and prototype fuel rods with enriched uranium in test reactors, conducting post-irradiation examination of irradiated material samples and/or prototype fuel rods, performing thermal-hydraulic experiments, performing seismic and other out-of-reactor experiments, performing advanced computer modeling and simulations to support fuel qualification, designing a lead test assembly (LTA), entering into a lead test rod/assembly agreement(s) with a host reactor(s), demonstrating the production process of lead test rods and/or lead test assemblies at a pilot-scale fuel fabrication facility and demonstrating the operation of lead test rods and/or lead test assemblies in commercial reactors.

There are inherent uncertainties in the cost and outcomes of the many steps needed for successful deployment of our fuel in commercial nuclear reactors, which makes it difficult to accurately predict the timing of the commercialization of our nuclear fuel technology. However, based on our best estimate and assuming adequate R&D funding levels, we expect to begin demonstration of lead test rods and/or possibly LTAs with our metallic fuel in commercial reactors in the 2030s and begin receiving purchase orders for initial fuel reload batches from utilities 15-20 years from now, with deployment of our nuclear fuel in the first reload batch in a commercial reactor taking place approximately two years thereafter. We are exploring ways of shortening this timeframe that may include securing access to expanded irradiation test loop capacity in existing or new research reactor facilities.

CRITICAL ACCOUNTING ESTIMATES