FALSE000182600000018260002023-07-032023-07-030001826000us-gaap:CommonStockMember2023-07-032023-07-030001826000us-gaap:WarrantMember2023-07-032023-07-03

| | |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION |

WASHINGTON, D.C. 20549FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) July 3, 2023

Latch, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware | 001-39688 | 85-3087759 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | |

508 West 26th Street, Suite 6G, New York, NY | 10001 |

| (Address of principal executive offices) | (Zip Code) |

(917) 338-3915

Registrant’s telephone number, including area code

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

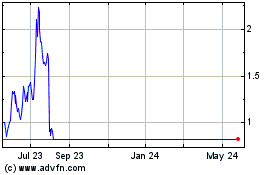

| Common stock, par value $0.0001 per share | LTCH | The Nasdaq Stock Market LLC |

| Warrants, each whole warrant exercisable for one share of Common stock at an exercise price of $11.50 per share | LTCHW | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.05. Costs Associated with Exit or Disposal Activities.

On July 10, 2023, Latch, Inc. (the “Company”) announced that it had commenced a reduction in force authorized by the Company’s board of directors (the “Board”) on July 7, 2023 to streamline its business operations, reduce costs and complexities in the business and create further operating efficiencies. The reduction in force, which the Company commenced on July 10, 2023 and expects to complete by the fourth quarter of 2023, impacts approximately 82 employees, or approximately 59% of the Company’s current full-time employees. The Company estimates that it will incur approximately $5.3 million to $5.8 million of total cash restructuring and related charges, primarily related to severance and benefit costs (excluding the impact of stock-based compensation), substantially all of which is expected to be incurred in the third and fourth quarters of 2023.

With respect to stock-based compensation, also as part of this reduction in force, the Company plans to modify the affected employees’ stock awards to allow a portion of the awards to vest that otherwise would have been forfeited. However, as a result of the reversal of previously recognized stock-based compensation expense for stock awards being forfeited and a reduction in the fair value of the awards vesting in connection with this reduction in force, the Company expects to recognize a net reduction of stock-based compensation expense of approximately $7.5 million to $8.0 million in the third and fourth quarters of 2023. This estimate may change due to future changes in the Company’s stock price.

The Company may incur additional expenses not currently contemplated due to events associated with the reduction in force. The charges that the Company expects to incur in connection with the reduction in force are estimates and subject to a number of assumptions, and actual results may differ materially.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

David Lillis Employment Agreement

On July 3, 2023, the Company and David Lillis entered into an employment agreement (the “Employment Agreement”), effective July 3, 2023. Pursuant to the Employment Agreement, Mr. Lillis will serve as Senior Vice President of Finance beginning on July 17, 2023 (the “Start Date”) and is expected to be appointed as Chief Financial Officer of the Company later in 2023.

Mr. Lillis, age 48, previously served as Chief Financial Officer of RubinBrown LLP, an accounting and professional consulting firm. In such role, which began in 2021, Mr. Lillis served as the top finance executive for the firm and was responsible for all financial operations. Prior to that, Mr. Lillis was Business Finance Officer of Mastercard Global Prepaid where he oversaw financial strategy for the division following the merger of Mastercard Worldwide’s Prepaid Management Services and Global Prepaid divisions. Prior to the 2018 merger, Mr. Lillis was Business Finance Officer of Mastercard’s Prepaid Management Services division, a role he began in 2016. Mr. Lillis originally joined Mastercard in 2012 as Vice President, Finance - Operations and Technology. Before joining Mastercard, he spent four years as Vice President, Brokerage Finance - Operations & IT at Wells Fargo Advisors. His additional work experience includes roles at CNA Insurance, First National Bank of Naperville, Pfizer, Inc. and KPMG LLP. Mr. Lillis has a Bachelor of Business Administration degree and an Executive Master of Business Administration degree from the University of Notre Dame. He is a Chartered Financial Analyst and a Certified Public Accountant.

Pursuant to the Employment Agreement, Mr. Lillis will receive a base salary of $350,000 and a target bonus of 50% of such base salary. Mr. Lillis’s base salary and annual bonus for 2023 will be pro-rated for the partial employment year. Mr. Lillis will also receive an initial grant of 968,179 restricted stock units (“RSUs”) following effectiveness of the Company’s applicable Registration Statement on Form S-8. One-third of the RSUs will vest on the first anniversary of the Start Date, and the remainder will vest quarterly in equal installments through the third anniversary of the Start Date.

In the event Mr. Lillis is terminated without Cause (as defined in the Employment Agreement) or resigns from the Company for Good Reason (as defined in the Employment Agreement) (each, a “Qualifying Termination”), Mr. Lillis will receive: (a) a cash severance payment equal to the sum of his annual base salary and

target bonus; (b) any accrued annual bonus; and (c) up to 12 months of subsidized premiums for continued coverage under one or more of the Company’s group medical, dental or vision plans pursuant to the Consolidated Omnibus Budget Reconciliation Act of 1985, as amended. Additionally, in the event such Qualifying Termination occurs during the three (3) months prior to, or the twenty-four (24) months following, the date of a qualifying Change in Control (as defined in the Employment Agreement), in addition to the payments and benefits described in the previous sentence, all of Mr. Lillis’ unvested equity or equity-based awards granted under the Company’s equity award plans will immediately become 100% vested.

The description of the Employment Agreement set forth above does not purport to be complete and is qualified in its entirety by reference to the full text of the Employment Agreement, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K (this “Report”) and incorporated herein by reference.

Michael Brian Jones Departure

On July 10, 2023, the Company and Michael Brian Jones, the Company’s Co-Founder and Chief Technology Officer, mutually agreed that Mr. Jones would step down as the Company’s Chief Technology Officer and, effective as of such date, will no longer serve as an “executive officer” of the Company under Rule 3b-7 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Mr. Jones will remain employed with the Company and serve as a Technical Advisor until September 1, 2023. Beginning July 10, 2023, Luciano Panaro will serve as the Company’s Chief Technology Officer.

Also on July 10, 2023, Mr. Jones and the Company entered into a Transition and Separation Agreement (the “Transition Agreement”), pursuant to the Board’s exercise of discretion. The Transition Agreement provides that, subject to Mr. Jones’s continued compliance with the restrictive covenants in any written agreements between Mr. Jones and the Company, Mr. Jones will be entitled to receive, after his last date of employment with the Company, severance compensation of $406,250, the acceleration of the vesting of 50,000 of his outstanding RSUs and the extension of his post-termination exercise window for certain of his outstanding stock options. The Transition Agreement also contains a general release of claims against the Company and provisions regarding the protection of the Company’s proprietary and confidential information that apply indefinitely.

The foregoing description of the Transition Agreement is qualified in its entirety by the Transition Agreement, a copy of which is filed as Exhibit 10.2 to this Report and incorporated herein by reference.

Item 7.01. Regulation FD Disclosure.

On July 10, 2023, the Company issued a press release related to the information described in Items 2.05 and 5.02 above (the “Press Release”). A copy of the Press Release is furnished as Exhibit 99.1 to this Report.

The information set forth in Item 7.01, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Forward-Looking Statements

This Report contains certain forward-looking statements within the meaning of the federal securities laws, including statements regarding adoption of the Company’s technology and products. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “would,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Forward-looking information includes, but is not limited to, statements regarding: (a) the reduction in force and (b) the changes in the Company’s management, and the impact of each on the Company’s business. Many factors could cause actual future events to differ materially from the forward-looking statements in this document, including: (i) the Company’s ability to regain and maintain compliance with the listing standards of the Nasdaq Stock Market; (ii) the Company’s ability to timely complete the ongoing restatement of its consolidated financial statements for 2019, 2020, 2021 and the first quarter of 2022, and the impact of the reduction in force thereon; (iii) the Company’s ability to file its delinquent periodic reports with the Securities and Exchange Commission (the “SEC”) by August 4, 2023;

(iv) the expected performance of the Company’s stock; (v) the Company’s ability to implement business plans and changes and developments in the industry in which the Company competes, including successfully integrating Honest Day’s Work into its operations following the July 3, 2023 closing of the acquisition thereof; and (vi) the Company’s response to any of the aforementioned factors. Many factors could cause actual future events to differ materially from the forward-looking statements in this Report. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of the Company’s Annual Report on Form 10-K filed with the SEC on March 1, 2022, and other documents subsequently filed by the Company from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and the Company assumes no obligation to update or revise these forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law, including the securities laws of the United States and the rules and regulations of the SEC. The Company does not give any assurance that it will achieve its expectations.

Item 9.01. Financial Statement and Exhibits.

| | | | | | | | |

Exhibit

Number | | Description |

|

| 10.1 | | |

| 10.2 | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File, formatted in Inline XBRL (included as Exhibit 101). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | Latch, Inc. |

| | | |

| Date: | July 10, 2023 | By: | /s/ Priyen Patel |

| | | Name: | Priyen Patel |

| | | Title: | General Counsel & Corporate Secretary |

Employment Agreement

This Employment Agreement and all exhibits hereto (this “Agreement”), dated as of July 3, 2023, is made by and between Latch, Inc. (“Latch”), and David Lillis (“Employee”) (collectively referred to herein as the “Parties” or individually referred to as a “Party”), and will become effective as of July 3, 2023 “Effective Date”).

RECITALS

WHEREAS, Latch wishes to employ Employee initially as its SVP of Finance; and

WHEREAS, the Parties desire to enter into an agreement setting forth the terms of such employment as of the Effective Date, subject to the terms and conditions of this Agreement.

NOW, THEREFORE, in consideration of the foregoing and of the respective covenants and agreements set forth below, the Parties hereto agree as follows:

AGREEMENT

1.Employment.

(a)General. Beginning on July 17, 2023 (the “Start Date”), the Company shall employ Employee, and Employee shall be employed by the Company, for the period and in the positions set forth in this Section 1, and subject to the other terms and conditions herein provided. As a condition of Employee’s employment with the Company, Employee will be required to sign this Agreement, Exhibit B (Covenant Agreement), and Exhibit C (Disclosure and Authorization to Procure Background Information), which are incorporated herein by reference. Additionally, the Company’s offer of employment to Employee is contingent upon Employee’s successful completion of all facets of the Company’s pre-employment screening process, which includes confirmation that Employee is legally able to work for the Company in the United States in the position offered to Employee, and a background investigation which will include a credit check because the position Employee has been offered is a non-clerical position having regular access to trade secrets, intelligence information, or national security information.

(b)At-Will Employment. The Company and Employee acknowledge that Employee’s employment is and shall continue to be at-will, as defined under applicable law, and that Employee’s employment with the Company may be terminated by either Party at any time for any or no reason (subject to the notice requirements of Section 3(b)). This “at-will” nature of Employee’s employment shall remain unchanged during Employee’s tenure as an employee and may not be changed, except in an express writing signed by Employee and a duly authorized officer of the Company. If Employee’s employment terminates for any reason, Employee shall not be entitled to any severance payments, benefits, award or compensation other than as provided in this Agreement or otherwise agreed to in writing by the Company (including pursuant to the terms of any equity award agreement) or as provided by applicable law. The term of this Agreement (the “Term”) shall commence on the Effective Date and end on the date this Agreement is terminated under Section 3.

(c)Positions and Duties. During the Term, Employee shall initially serve as SVP of Finance of the Company, and, after the Company has completed all filings related to the Restatement (as hereinafter defined), the current Interim Chief Financial Officer has ceased to serve in such role, and upon appointment by the Board of Directors of the Company (the “Board”), the Company expects to appoint Employee as Chief Financial Officer of the Company, in each case with such responsibilities, duties and authority normally associated with such position and as may from time to time be reasonably assigned to Employee by the Board and the Company’s Chief Executive Officer. Employee shall initially report to the Interim Chief Financial Officer of the Company and will report to the Chief Executive Officer of the

Company when and if Employee is appointed as the Chief Financial Officer of the Company. Employee shall devote substantially all of Employee’s working time and efforts to the business and affairs of the Company (which shall include service to its affiliates, if applicable) and shall not engage in outside business activities (including serving on outside boards or committees) without the consent of the Board, provided that Employee shall be permitted to (i) manage Employee’s personal, financial and legal affairs, (ii) participate in trade associations, and (iii) serve on the board of directors of not-for-profit or tax-exempt charitable organizations or, with the consent of the Board (not to be unreasonably withheld), the board of directors of non-competitive for-profit businesses, in each case, subject to compliance with this Agreement and provided that such activities do not materially interfere with Employee’s performance of Employee’s duties and responsibilities hereunder. Employee agrees to observe and comply with the reasonable rules and policies of the Company as adopted by the Company from time to time (to the extent they do not conflict with the terms of this Agreement), in each case, as amended from time to time, and as delivered or made available to Employee (each, a “Policy”).

2.Compensation and Related Matters.

(a)Annual Compensation.

(i)Annual Base Salary. During the Term, Employee shall receive a base salary at a rate initially of $350,000 per annum, which shall be paid in accordance with the customary payroll practices of the Company and shall be pro-rated for partial years of employment. Such annual base salary shall be reviewed and may be adjusted for increase, but not decrease (unless mutually agreed to by the parties), from time to time (such annual base salary, as it may be adjusted from time to time, the “Annual Base Salary”) by the Company’s management prior to Employee’s appointment as the Company’s Chief Financial Officer and after such appointment, by the Board or its compensation committee (“Compensation Committee”).

(ii)Annual Cash Bonus Opportunity. During the Term, Employee will be eligible to participate in an annual incentive program established by the Board or Compensation Committee with target level annual incentive compensation opportunities as may be determined by the Board or Compensation Committee from time to time taking into account annual compensation opportunities made available to similarly situated executives at peer companies. Employee’s initial annual target incentive bonus opportunity (the “Target Bonus”) shall be 50% of the Annual Base Salary and under no circumstances shall the Target Bonus be less than 50% of the Annual Base Salary (unless mutually agreed to by the parties). The annual bonus payable under the incentive program (“Annual Bonus”) shall be based on the achievement of performance goals or such other criteria as may be determined by the Board or Compensation Committee. The payment of any Annual Bonus pursuant to the incentive program shall be subject to Employee’s continued employment with the Company through the date of payment, except as otherwise provided in Section 4(b). The Annual Bonus shall be paid to Employee when paid generally to other senior executives of the Company, but in any event, to the extent determinable as of such time, not later than March 15th of the year immediately following the applicable year for which such Annual Bonus is being paid. Employee’s Annual Bonus for 2023 will be pro-rated for the partial employment year.

(iii)Long-Term Incentive Award. During the Term, Employee will be eligible to participate and receive awards under the Company’s 2021 Incentive Award Plan (the “2021 Plan”), the Company’s 2023 Employment Inducement Award Plan or other applicable incentive award plan adopted by the Company from time to time (as amended from time to time and together with any successor plan(s), collectively, the “Plan”). Employee’s awards thereunder shall be in such amounts and in such forms as may be determined by the Board or Compensation Committee taking into account the compensation practices and programs (including the long-term incentive compensation opportunities) for similarly situated executives at peer companies. Employee will receive a one-time new hire equity incentive compensation award, which is expected to be in the form of a grant of restricted stock units, subject to (i) approval by the Board

or the equity plan administrator, as applicable (the “Administrator”) and (ii) effectiveness of the Company’s Registration Statement on Form S-8 registering shares under the applicable Plan (the “Form S-8”), and in accordance with applicable securities laws and the requirements of the applicable Plan (the “Initial RSU Grant”). Upon issuance, such Initial RSU Grant, will (i) represent the right to receive 968,179 shares of common stock of the Company, (ii) contain a vesting start date of July 17, 2023 (the “Vesting Start Date”), (iii) contain a three year vesting schedule whereby one-third (1/3) of the shares subject to the Initial RSU Grant will vest on the first anniversary of the Vesting Start Date and one-twelfth (1/12) of the shares subject to the RSU Grant will vest quarterly thereafter for the remaining two years, provided in each case that Employee continues to be employed by the Company on the relevant date, and (iv) contain other provisions determined by the Board or Administrator, as applicable, in its sole discretion. The Initial RSU Grant will be subject to the terms of the applicable Plan and other customary terms and conditions, which will be fully set forth in an award notice and restricted stock unit agreement (collectively, including any exhibits thereto, the “Equity Documents”). Copies of the Equity Documents will be provided for review and signature as promptly as practicable following (x) approval of the Initial RSU Grant by the Board or Administrator and (y) satisfaction of all applicable securities law and other regulatory requirements, including effectiveness of the Form S-8.

(b)Benefits. During the Term, Employee shall be eligible to participate in employee benefit plans, programs and arrangements of the Company, subject to the terms and eligibility requirements thereof and as such plans, programs and arrangements may be amended or in effect from time to time. In no event shall Employee be eligible to participate in any severance plan or program of the Company, except as set forth in Section 4 of this Agreement.

(c)Vacation. During the Term, Employee shall be entitled to paid personal leave in accordance with the Company’s Policies. Employee shall be entitled to unlimited vacation, regardless of then-current Company Policies, subject to approval by Employee’s manager, such approval not to be unreasonably withheld.

(d)Business Expenses. During the Term, the Company shall reimburse Employee for all reasonable travel and other business expenses incurred by Employee in the performance of Employee’s duties to the Company in accordance with the Company’s expense reimbursement Policy. The Company shall reimburse Employees reasonable documented attorney’s fees (a redacted summary invoice from Employee’s counsel provided to Company shall be sufficient) incurred in connection with the review of this Agreement up to $10,000.

(e)Key Person Insurance. At any time during the Term, the Company shall have the right (but not the obligation) to insure the life of Employee for the Company’s sole benefit. The Company shall have the right to determine the amount of insurance and the type of policy. Employee shall reasonably cooperate with the Company in obtaining such insurance by submitting to physical examinations, by supplying all information reasonably required by any insurance carrier, and by executing all necessary documents reasonably required by any insurance carrier, provided that any information provided to an insurance company or broker shall not be provided to the Company without the prior written authorization of Employee. Employee shall incur no financial obligation by executing any required document, and shall have no interest in any such policy.

(f)Indemnification and D&O Insurance. The Company shall indemnify, defend and hold harmless (unless prohibited by law, applicable regulation, or listing standard) (and advance expenses to) Employee to the greatest extent permitted by applicable state law, including, only to the extent permitted under applicable state law, against and in respect of any and all actions, suits, proceedings, claims, demands, judgments, costs, expenses (including, without limitation, attorneys’ fees), losses, and damages resulting from Employee’s performance of Employee’s duties or obligations with the Company (or its affiliates) whether Employee is made a party or threatened to be made a party to any action, suit, or proceeding, whether civil, criminal, administrative or investigative. The Company shall provide

Employee with coverage under a directors’ and officers’ liability insurance policy to the same extent provided to other senior executives and directors of the Company.

3.Termination of Employment.

Employee’s employment hereunder and the Term may be terminated by the Company or Employee, as applicable, without any breach of this Agreement under the following circumstances and the Term will end on the Date of Termination:

(a)Circumstances.

(i)Death. Employee’s employment hereunder shall terminate upon Employee’s death.

(ii)Disability. If Employee has incurred a Disability, as defined below, the Company may terminate Employee’s employment.

(iii)Termination for Cause. The Company may terminate Employee’s employment for Cause, as defined below.

(iv)Termination without Cause. The Company may terminate Employee’s employment without Cause.

(v)Resignation from the Company with Good Reason. Employee may resign Employee’s employment with the Company with Good Reason, as defined below.

(vi)Resignation from the Company without Good Reason. Employee may resign Employee’s employment with the Company for any reason other than Good Reason or for no reason.

(b)Notice of Termination. Any termination of Employee’s employment by the Company or by Employee under this Section 3 (other than termination pursuant to Section 3(a)(i)) shall be communicated by a written notice to the other Party hereto (i) indicating the specific termination provision in this Agreement relied upon, (ii) setting forth in reasonable detail the facts and circumstances claimed to provide a basis for termination of Employee’s employment under the provision so indicated, if applicable, and (iii) specifying a Date of Termination which, if submitted by Employee, shall be at least thirty (30) days following the date of such notice (a “Notice of Termination”); provided, however, that in the event that Employee delivers a Notice of Termination to the Company, the Company may, in its sole discretion, change the Date of Termination to any date that occurs following the date of the Company’s receipt of such Notice of Termination and is prior to the date specified in such Notice of Termination, but the termination will still be considered a resignation by Employee; provided, however, that the Company shall in such event pay Employee all wages (including base salary and incentive compensation) Employee would have earned during the 30 day period following the date of such notice. The failure by either Party to set forth in the Notice of Termination any fact or circumstance which contributes to a showing of Cause or Good Reason shall not waive any right of the Party hereunder or preclude the Party from asserting such fact or circumstance in enforcing the Party’s rights hereunder.

(c)Company Obligations upon Termination. Upon termination of Employee’s employment pursuant to any of the circumstances listed in this Section 3, Employee (or Employee’s estate, if applicable) shall be entitled to receive the sum of: (i) the portion of Employee’s Annual Base Salary earned through the Date of Termination, but not yet paid to Employee (payable on the Company’s next payroll date); (ii) any expense reimbursements owed to Employee pursuant to Section 2(d), payable pursuant to the applicable policy; and (iii) any amount accrued and arising from Employee’s participation in, or benefits accrued under any employee benefit plans, programs or arrangements, which amounts shall

be payable in accordance with the terms and conditions of such employee benefit plans, programs or arrangements (collectively, the “Company Arrangements”). Except as otherwise expressly required by law (e.g., COBRA) or applicable plan, program, or arrangement or as specifically provided herein, all of Employee’s rights to salary, severance, benefits, bonuses and other compensatory amounts hereunder (if any) shall cease upon the termination of Employee’s employment hereunder. In the event that Employee’s employment is terminated by the Company for any reason, Employee’s sole and exclusive remedy for severance benefits shall be to receive the payments and benefits described in this Section 3(c) or Section 4, as applicable.

(d)Deemed Resignation. Upon termination of Employee’s employment for any reason, Employee shall be deemed to have resigned from all offices and directorships, if any, then held with the Company or any of its subsidiaries.

4.Severance Payments.

(a)Termination for Cause, or Termination Upon Death, Disability or Resignation from the Company Without Good Reason. If Employee’s employment shall terminate as a result of Employee’s death pursuant to Section 3(a)(i) or Disability pursuant to Section 3(a)(ii), pursuant to Section 3(a)(iii) for Cause, or pursuant to Section 3(a)(vi) for Employee’s resignation from the Company without Good Reason, then Employee shall not be entitled to any severance payments or benefits, except as provided in Section 3(c) and, in the case of termination of employment as a result of death pursuant to Section 3(a)(i) or Disability pursuant to Section 3(a)(ii), the Company shall pay Employee (or Employee’s estate, if applicable) to the extent unpaid as of the Date of Termination, an amount of cash equal to any Annual Bonus earned by Employee for the Company’s fiscal year prior to the fiscal year in which the Date of Termination occurs, as determined by the Board in its reasonable and good faith discretion based upon actual performance achieved, which Annual Bonus, if any, shall be paid to Employee (or Employee’s estate, if applicable) in the fiscal year in which the Date of Termination occurs when bonuses for such prior fiscal year are paid in the ordinary course to actively employed senior executives of the Company, but not later than March 15 of the year following the year of termination (the “Accrued Annual Bonus”). In addition, in the case of termination of employment as a result of death pursuant to Section 3(a)(i) or Disability pursuant to Section 3(a)(ii), the Company shall pay Employee (or Employee’s estate, if applicable) a pro-rated Annual Bonus for the year in which such termination occurs (based on the number of days Employee was employed during the year), as determined by the Board in its reasonable and good faith discretion based upon actual performance achieved (with any subjective individual performance goals treated as achieved at not less than target), which pro-rated Annual Bonus, if any, shall be paid to Employee (or Employee’s estate, if applicable) in the fiscal year after the Date of Termination when bonuses are paid in the ordinary course to actively employed senior executives of the Company, but not later than March 15 of the year following the year of termination (the “Pro rata Bonus”).

(b)Termination without Cause or Resignation from the Company with Good Reason. If Employee’s employment terminates without Cause pursuant to Section 3(a)(iv), or pursuant to Section 3(a)(v) due to Employee’s resignation with Good Reason, then except as otherwise provided under Section 4(c) and subject to Employee signing on or before the 60th day following Employee’s Separation from Service (as defined below), and not revoking, a release of claims substantially in the form attached as Exhibit A to this Agreement (the “Release”) and Employee’s continued compliance in all material respects with Section 5 (provided, that the Company shall provide Employee with written notice of any such noncompliance and not less than thirty (30) days to cure the noncompliance if capable of cure), the Company shall pay Employee in addition to payments and benefits set forth in Section 3(c), the following:

(i)An amount in cash equal to the sum of (i) the Annual Base Salary plus (ii) the Target Bonus, payable in the form of salary continuation in regular installments over the twelve-month period following the date of Employee’s Separation from Service (the “Severance Period”) (provided that such payments will not begin until the Release is executed and not revoked) in accordance with the Company’s normal payroll practices;

(ii)the Accrued Annual Bonus (if any); and

(iii)if Employee timely elects to receive continued medical, dental or vision coverage under one or more of the Company’s group medical, dental or vision plans pursuant to the Consolidated Omnibus Budget Reconciliation Act of 1985, as amended (“COBRA”), then the Company shall directly pay, or reimburse Employee for, the COBRA premiums for Employee and Employee’s covered dependents under such plans, less the amount Employee would have had to pay to receive such coverage as an active employee based on the cost sharing levels in effect on the Date of Termination, during the period commencing on Employee’s Separation from Service and ending upon the earliest of (A) the last day of the Severance Period, (B) the date that Employee and/or Employee’s covered dependents become no longer eligible for COBRA or (C) the date Employee becomes eligible to receive medical, dental or vision coverage, as applicable, from a subsequent employer (and Employee agrees to promptly notify the Company of such eligibility) (the “COBRA Continuation Period”). Notwithstanding the foregoing, if the Company determines it cannot provide the foregoing benefit without potentially violating applicable law (including, without limitation, Section 2716 of the Public Health Service Act) or incurring an excise tax, the Company shall in lieu thereof provide to Employee a taxable monthly payment in an amount equal to the monthly COBRA premium that Employee would be required to pay to continue Employee’s and Employee’s covered dependents’ group health coverage in effect on the Date of Termination (which amount shall be based on the premium for the first month of COBRA coverage), less the amount Employee would have had to pay to receive group health coverage as an active employee for Employee and his or her covered dependents based on the cost sharing levels in effect on the Date of Termination, which payments shall continue for the remainder of the COBRA Continuation Period.

(c)Change in Control. In lieu of the payments and benefits set forth in Section 4(b), in the event Employee’s employment terminates without Cause pursuant to Section 3(a)(iv), or pursuant to Section 3(a)(v) due to Employee’s resignation with Good Reason, in either case, during the three (3) month period prior to the date of Change in Control or on or within twenty-four (24) months following the date of a Change in Control, subject to Employee signing on or before the 60th day following Employee’s Separation from Service, and not revoking, the Release and Employee’s continued compliance in all material respects with Section 5 (provided, that the Company shall provide Employee with written notice of any such noncompliance and not less than thirty (30) days to cure the noncompliance if capable of cure), the Company shall pay Employee, in addition to the payments and benefits set forth in Section 3(c), the following:

(i)an amount in cash equal to the sum of (i) the Annual Base Salary plus (ii) the Target Bonus. Such amount shall be payable in a single lump sum within thirty (30) days after execution of the Release, provided, however, that such amount shall be paid in a lump sum only if such payment is in compliance with Section 409A (as defined below) and shall otherwise be paid on the same schedule as set forth in Section 4(b)(i);

(ii)the Accrued Annual Bonus (if any);

(iii)the payment set forth in Section 4(b)(iii); and

(iv)all unvested equity or equity-based awards held by Employee and that were granted under the Plan shall immediately become 100% vested, provided, however, that any performance-based award will remain subject to attainment of the relevant performance goals unless a more favorable provision is contained in an applicable award agreement, and outstanding options shall remain exercisable for the remainder of their original option term, subject to earlier termination in connection with a corporate event or transaction to the extent permitted under the applicable equity incentive plan.

(d)Survival. Notwithstanding anything to the contrary in this Agreement, the provisions of Sections 2(f) and 5 through 9 will survive the termination of Employee’s employment and the termination of the Term.

5.Covenants. The provisions of Exhibit B (the “Covenant Agreement”) are expressly incorporated into this Agreement and Employee agrees to abide by the terms set forth therein. Employee acknowledges that the provisions of the Covenant Agreement will survive the termination of Employee’s employment and the termination of the Term to the extent such provisions are intended to extend beyond Employee’s period of employment with the Company.

6.Assignment and Successors.

The Company may assign its rights and obligations under this Agreement to any successor to all or substantially all of the business or the assets of the Company (by merger or otherwise). This Agreement shall be binding upon and inure to the benefit of the Company, Employee and their respective successors, assigns, personal and legal representatives, executors, administrators, heirs, distributees, devisees, and legatees, as applicable. None of Employee’s rights or obligations may be assigned or transferred by Employee, other than Employee’s rights to payments hereunder, which may be transferred only by will or operation of law. Notwithstanding the foregoing, Employee shall be entitled, to the extent permitted under applicable law and applicable Company Arrangements, to select and change a beneficiary or beneficiaries to receive compensation hereunder following Employee’s death by giving written notice thereof to the Company.

7.Certain Definitions.

(a)Cause. “Cause” shall mean, after written notice of the following and Employee’s failure to cure within fifteen (15) days of receipt of notice from the Company (provided, that a notice and cure opportunity shall only be required to the extent any such matter is curable):

(i)Employee’s conviction of, or admission of guilt or plea of nolo contendere to, (A) any felony or (B) any misdemeanor involving moral turpitude, deceit, dishonesty or fraud;

(ii)any act by Employee involving fraud, embezzlement, theft or willful misconduct in connection with the Employee’s duties or in the course of the Employee’s employment with the Company;

(iii)any conduct by or at the direction of Employee constituting a breach of Employee duty of loyalty or other fiduciary duty owing to the Company;

(iv)Employee’s violation of Company policies that has a detrimental effect on the Company;

(v)Employee’s willful refusal (other than due to physical or mental incapacity) to substantially perform his duties; or

(vi)Employee’s willful refusal to carry out the reasonable and lawful instructions of the Board.

(b)Change in Control. “Change in Control” shall have the meaning set forth in the 2021 Plan, as in effect on the Effective Date, provided that such event also constitutes an event described in Treasury Regulation Section 1.409A-3(i)(5). For avoidance of doubt, the transaction contemplated by that certain Agreement and Plan of Merger (the “Merger Agreement’) entered into on May 15, 2023 by and among the Company, LS Key Merger Sub 1, Inc., a Delaware corporation, LS Key Merger Sub 2, LLC, a Delaware limited liability company, and Honest Day’s Work, Inc., a Delaware corporation, does not constitute a Change in Control under this Agreement.

(c)Code. “Code” shall mean the Internal Revenue Code of 1986, as amended, and the regulations and guidance promulgated thereunder.

(d)Date of Termination. “Date of Termination” shall mean (i) if Employee’s employment is terminated by Employee’s death, the date of Employee’s death; or (ii) if Employee’s employment is terminated pursuant to Section 3(a)(ii)-(vi) either the date indicated in the Notice of Termination or the date specified by the Company pursuant to Section 3(b), whichever is earlier.

(e)Disability. “Disability” shall mean, at any time the Company sponsors a long-term disability plan for the Company’s employees, “disability” as defined in such long-term disability plan for the purpose of determining a participant’s eligibility for benefits, provided, however, if the long-term disability plan contains multiple definitions of disability, “Disability” shall refer to that definition of disability which, if Employee qualified for such disability benefits, would provide coverage for the longest period of time. The determination of whether Employee has a Disability shall be made by the person or persons required to make disability determinations under the long-term disability plan. At any time the Company does not sponsor a long-term disability plan for its employees, “Disability” shall mean Employee’s inability to perform, with reasonable accommodation, the essential functions of Employee’s positions hereunder for a total of 180 days within a 12 month period as a result of incapacity due to mental or physical illness as determined by a physician selected by the Company or its insurers and acceptable to Employee or Employee’s legal representative, with such agreement as to acceptability not to be unreasonably withheld or delayed. Any refusal by Employee to submit to a medical examination for the purpose of determining Disability shall be deemed to constitute conclusive evidence of Employee’s Disability.

(f)Good Reason. For the sole purpose of determining Employee’s right to severance payments and benefits as described above, Employee’s resignation will be with “Good Reason” if Employee has resigned following the occurrence of any of the following events other than with Employee’s consent or at his direction: (i) a diminution in Employee’s combined Annual Base Salary and Target Bonus, other than a reduction of less than 10% (aggregating all prior reductions) that is implemented in connection with a contemporaneous reduction of base salaries and bonuses affecting other senior executives of the Company; (ii) a diminution in duties, responsibilities or authority or an adverse change in title, it being understood that Employee’s transition to Chief Financial Officer of the Company shall not be considered “Good Reason”; (iii) a material reduction in Employee’s employee benefits, including but not limited to medical and dental insurance, short- and long- term disability insurance, retirement benefits, and any other benefits provided under Sections 2(b) and 2(c) hereof, to which Employee is entitled immediately prior to such reduction (other than in connection with a general decrease in the benefits of all similarly situated employees); (iv) the relocation of Employee’s primary office to a location outside a 50 mile radius from the City of St. Louis, Missouri (unless Employee is made a remote employee); (v) a material breach by the Company of any term of Employee’s Employment Agreement; (vi) a failure by the Company to obtain the express written assumption of this Agreement by any successor to the Company; (vii) failure by the Company to appoint Employee as Chief Financial Officer by the earlier to occur of (a) 60 days after Restatement or (b) January 1, 2024; or (viii) Company fails to issue the Initial RSU Grant by January 1, 2024. Notwithstanding the foregoing, no Good Reason will have occurred unless and until: (a) Employee has provided the Company, within sixty (60) days of Employee’s knowledge of the occurrence of the facts and circumstances underlying the Good Reason event, written notice stating with specificity the applicable facts and circumstances underlying such finding of Good Reason; (b) the Company has had an opportunity to cure the same within thirty (30) days after the receipt of such notice; and (c) the Company shall have failed to so cure within such period.

(g)Restatement. “Restatement” shall mean the Company’s public filing of its financial statements for 2022, 2021, 2020, 2019, and the first and second quarters of 2023.

8.Parachute Payments.

(a)Notwithstanding any other provisions of this Agreement or any Company equity plan or agreement, in the event that any payment or benefit by the Company or otherwise to or for the benefit of Employee, whether paid or payable or distributed or distributable pursuant to the terms of this Agreement or otherwise (all such payments and benefits, including the payments and benefits under Section 4 hereof, being hereinafter referred to as the “Total Payments”), would be subject (in whole or in part) to the excise tax imposed by Section 4999 of the Code (the “Excise Tax”), then the Total Payments shall be reduced (in the order provided in Section 8(b)) to the minimum extent necessary to avoid the imposition of the Excise Tax on the Total Payments, but only if (i) the net amount of such Total Payments, as so reduced (and after subtracting the net amount of federal, state and local income and employment taxes on such reduced Total Payments and after taking into account the phase out of itemized deductions and personal exemptions attributable to such reduced Total Payments), is greater than or equal to (ii) the net amount of such Total Payments without such reduction (but after subtracting the net amount of federal, state and local income and employment taxes on such Total Payments and the amount of the Excise Tax to which Employee would be subject in respect of such unreduced Total Payments and after taking into account the phase out of itemized deductions and personal exemptions attributable to such unreduced Total Payments).

(b)The Total Payments shall be reduced in the following order: (i) reduction on a pro rata basis of any cash severance payments that are exempt from Section 409A of the Code (“Section 409A”), (ii) reduction on a pro rata basis of any non-cash severance payments or benefits that are exempt from Section 409A, (iii) reduction on a pro rata basis of any other payments or benefits that are exempt from Section 409A, and (iv) reduction of any payments or benefits otherwise payable to Employee on a pro rata basis or such other manner that complies with Section 409A; provided, in case of clauses (ii), (iii) and (iv), that reduction of any payments attributable to the acceleration of vesting of Company equity awards shall be first applied to Company equity awards that would otherwise vest last in time.

(c)All determinations regarding the application of this Section 8 shall be made by an accounting firm or consulting group with experience in performing calculations regarding the applicability of Section 280G of the Code and the Excise Tax selected by the Company and reasonably acceptable to Employee (the “Independent Advisors”). For purposes of determinations, no portion of the Total Payments shall be taken into account which, in the opinion of the Independent Advisors, (i) does not constitute a “parachute payment” within the meaning of Section 280G(b)(2) of the Code (including by reason of Section 280G(b)(4)(A) of the Code) or (ii) constitutes reasonable compensation for services actually rendered, within the meaning of Section 280G(b)(4)(B) of the Code, in excess of the “base amount” (as defined in Section 280G(b)(3) of the Code) allocable to such reasonable compensation. The costs of obtaining such determination and all related fees and expenses (including related fees and expenses incurred in any later audit) shall be borne by the Company.

(d)In the event it is later determined that a greater reduction in the Total Payments should have been made to implement the objective and intent of this Section 8, the excess amount shall be returned promptly by Employee to the Company.

9.Miscellaneous Provisions.

(a)Governing Law. This Agreement shall be governed, construed, interpreted and enforced in accordance with its express terms, and otherwise in accordance with the substantive laws of the State of Missouri without reference to the principles of conflicts of law of the State of Missouri or any other jurisdiction that would result in the application of the laws of a jurisdiction other than the State of Missouri, and where applicable, the laws of the United States.

(b)Validity. The invalidity or unenforceability of any provision or provisions of this Agreement shall not affect the validity or enforceability of any other provision of this Agreement, which shall remain in full force and effect.

(c)Notices. Any notice, request, claim, demand, document and other communication hereunder to any Party shall be effective upon receipt (or refusal of receipt) and shall be in writing and delivered personally or sent by facsimile, email or certified or registered mail, postage prepaid, as follows:

(i)If to the Company, to the General Counsel of the Company at the Company’s headquarters,

(ii)If to Employee, to the last address that the Company has in its personnel records for Employee, or

(iii)At any other address as any Party shall have specified by notice in writing to the other Party.

(d)Counterparts. This Agreement may be executed in several counterparts, each of which shall be deemed to be an original, but all of which together will constitute one and the same Agreement. Signatures delivered by facsimile or PDF shall be deemed effective for all purposes.

(e)Entire Agreement. The terms of this Agreement, and the Covenant Agreement incorporated herein by reference as set forth in Section 5, are intended by the Parties to be the final expression of their agreement with respect to the subject matter hereof and supersede all prior understandings and agreements, whether written or oral, including any prior employment offer letter or employment agreement between Employee and the Company. The Parties further intend that this Agreement shall constitute the complete and exclusive statement of their terms and that no extrinsic evidence whatsoever may be introduced in any judicial, administrative, or other legal proceeding to vary the terms of this Agreement.

(f)Amendments; Waivers. This Agreement may not be modified, amended, or terminated except by an instrument in writing, signed by Employee and a duly authorized officer of Company. By an instrument in writing similarly executed, Employee or a duly authorized officer of the Company may waive compliance by the other Party with any specifically identified provision of this Agreement that such other Party was or is obligated to comply with or perform; provided, however, that such waiver shall not operate as a waiver of, or estoppel with respect to, any other or subsequent failure. No failure to exercise and no delay in exercising any right, remedy, or power hereunder will preclude any other or further exercise of any other right, remedy, or power provided herein or by law or in equity.

(g)Construction. This Agreement shall be deemed drafted equally by both the Parties. Its language shall be construed as a whole and according to its fair meaning. Any presumption or principle that the language is to be construed against any Party shall not apply. The headings in this Agreement are only for convenience and are not intended to affect construction or interpretation. Any references to paragraphs, subparagraphs, sections or subsections are to those parts of this Agreement, unless the context clearly indicates to the contrary. Also, unless the context clearly indicates to the contrary, (i) the plural includes the singular and the singular includes the plural; (ii) “and” and “or” are each used both conjunctively and disjunctively; (iii) “any,” “all,” “each,” or “every” means “any and all,” and “each and every”; (iv) “includes” and “including” are each “without limitation”; (v) “herein,” “hereof,” “hereunder” and other similar compounds of the word “here” refer to the entire Agreement and not to any particular paragraph, subparagraph, section or subsection; and (vi) all pronouns and any variations thereof shall be deemed to refer to the masculine, feminine, neuter, singular or plural as the identity of the entities or persons referred to may require.

(h)Arbitration. Any controversy, claim or dispute arising out of or relating to this Agreement, shall be settled solely and exclusively by a binding arbitration process administered by JAMS in St. Louis, Missouri. Such arbitration shall be conducted in accordance with the then-existing JAMS Employment Arbitration Rules and Procedures, which are available at http://www.jamsadr.com/rules-employment-arbitration/, with the following exceptions if in conflict: (i) one arbitrator who is a retired judge shall be chosen by the parties; and (ii) Company shall pay the expenses and fees of the arbitrator, together with other expenses of the arbitration incurred or approved by the arbitrator. Each Party shall bear its own attorney’s fees and expenses; provided, that if Employee is the prevailing party in any proceeding (including in any court action referenced below), the Company shall, unless the arbitrator or judge, as applicable, determines that it is not reasonable under the circumstances, promptly reimburse Employee for any reasonable attorney fees and costs incurred in connection with such proceeding. The Parties agree to abide by all decisions and awards rendered in such proceedings. Such decisions and awards rendered by the arbitrator shall be final and conclusive. All such controversies, claims or disputes shall be settled in this manner in lieu of any action at law or equity; provided, however, that nothing in this subsection shall be construed as precluding the bringing of an action for injunctive relief or specific performance as provided in this Agreement or the Covenant Agreement. This dispute resolution process and any arbitration hereunder shall be confidential and neither any Party nor the neutral arbitrator shall disclose the existence, contents or results of such process without the prior written consent of all Parties, except where necessary or compelled in a court to enforce this arbitration provision or an award from such arbitration or otherwise in a legal proceeding. If JAMS no longer exists or is otherwise unavailable, the Parties agree that the American Arbitration Association (“AAA”) shall administer the arbitration in accordance with its then-existing employment arbitration rules as modified by this subsection. In such event, all references herein to JAMS shall mean AAA. Notwithstanding the foregoing, Employee and the Company each have the right to resolve any issue or dispute over intellectual property rights by court action instead of arbitration.

(i)Enforcement. If any provision of this Agreement is held to be illegal, invalid or unenforceable under present or future laws effective during the Term, such provision shall be fully severable; this Agreement shall be construed and enforced as if such illegal, invalid or unenforceable provision had never comprised a portion of this Agreement; and the remaining provisions of this Agreement shall remain in full force and effect and shall not be affected by the illegal, invalid or unenforceable provision or by its severance from this Agreement. Furthermore, in lieu of such illegal, invalid or unenforceable provision there shall be added automatically as part of this Agreement a provision as similar in terms to such illegal, invalid or unenforceable provision as may be possible and be legal, valid and enforceable.

(j)Withholding. The Company shall be entitled to withhold from any amounts payable under this Agreement any federal, state, local or foreign withholding or other taxes or charges which the Company is required to withhold. The Company shall be entitled to rely on the advice of counsel if any questions as to the amount or requirement of withholding shall arise.

(k)Section 409A.

(i)General. The intent of the Parties is that the payments and benefits under this Agreement comply with or be exempt from Section 409A and, accordingly, to the maximum extent permitted, this Agreement shall be interpreted to be in compliance therewith. If the Company and Employee agree in good faith that the payments and benefits under this Agreement would not comply with Section 409A, the parties hereto shall reasonably and in good faith attempt to modify this Agreement to comply with Section 409A while endeavoring to maintain the intended economic benefits hereunder.

(ii)Separation from Service. Notwithstanding anything in this Agreement to the contrary, any compensation or benefits payable under this Agreement that is designated under this Agreement as payable upon Employee’s termination of employment shall be payable only upon Employee’s “separation from service” with the Company within the meaning of Section 409A (a

“Separation from Service”) and, except as provided below, if Employee would otherwise have the ability to control the calendar year in which such payment or benefits would be made or provided, any such compensation or benefits described in Section 5 shall not be paid, or, in the case of installments, shall not commence payment, until the thirtieth (30th) day following Employee’s Separation from Service (the “First Payment Date”). Any installment payments that would have been made to Employee during the thirty (30) day period immediately following Employee’s Separation from Service but for the preceding sentence shall be paid to Employee on the First Payment Date and the remaining payments shall be made as provided in this Agreement. (iii)Specified Employee. Notwithstanding anything in this Agreement to the contrary, if Employee is deemed by the Company at the time of Employee’s Separation from Service to be a “specified employee” for purposes of Section 409A, to the extent delayed commencement of any portion of the benefits to which Employee is entitled under this Agreement is required in order to avoid a prohibited distribution under Section 409A, such portion of Employee’s benefits shall not be provided to Employee prior to the earlier of (i) the expiration of the six-month period measured from the date of Employee’s Separation from Service with the Company or (ii) the date of Employee’s death. Upon the first business day following the expiration of the applicable Section 409A period, all payments deferred pursuant to the preceding sentence shall be paid in a lump sum to Employee (or Employee’s estate or beneficiaries), and any remaining payments due to Employee under this Agreement shall be paid as otherwise provided herein.

(iv)Expense Reimbursements. To the extent that any reimbursements under this Agreement are subject to Section 409A, (i) any such reimbursements payable to Employee shall be paid to Employee no later than December 31 of the year following the year in which the expense was incurred, (ii) Employee shall submit Employee’s reimbursement request promptly following the date the expense is incurred, (iii) the amount of expenses reimbursed in one year shall not affect the amount eligible for reimbursement in any subsequent year, other than medical expenses referred to in Section 105(b) of the Code, and (iv) Employee’s right to reimbursement under this Agreement will not be subject to liquidation or exchange for another benefit.

(v)Installments. Employee’s right to receive any installment payments under this Agreement, including without limitation any continuation salary payments that are payable on Company payroll dates, shall be treated as a right to receive a series of separate payments and, accordingly, each such installment payment shall at all times be considered a separate and distinct payment as permitted under Section 409A. Except as otherwise permitted under Section 409A, no payment hereunder shall be accelerated or deferred unless such acceleration or deferral would not result in additional tax or interest pursuant to Section 409A.

10.Employee Acknowledgement.

Employee acknowledges that Employee has read and understands this Agreement, is fully aware of its legal effect, has not acted in reliance upon any representations or promises made by the Company other than those contained in writing herein, and has entered into this Agreement freely based on Employee’s own judgment.

[Signature Page Follows]

IN WITNESS WHEREOF, the Parties have executed this Agreement on the date and year first above written.

| | | | | | | | |

| | LATCH, INC. |

| | |

| By: | /s/ Priyen Patel |

| | Name: Priyen Patel |

| | Title: General Counsel |

| | |

| | |

| | Employee |

| | |

| | /s/ David Lillis |

| | David Lillis |

[Signature Page to Employment Agreement]

EXHIBIT A

Separation Agreement and Release

This Separation Agreement and Release (“Agreement”) is made by and between ________________ (“Employee”) and Latch, Inc. (the “Company”) (collectively referred to as the “Parties” or individually referred to as a “Party”). Capitalized terms used but not defined in this Agreement shall have the meanings set forth in the Employment Agreement (as defined below).

WHEREAS, the Parties have previously entered into that certain Employment Agreement, dated as of _____, ____ (the “Employment Agreement”) and that certain Covenant Agreement (as defined in the Employment Agreement); and

WHEREAS, in connection with Employee’s termination of employment with the Company or a subsidiary or affiliate of the Company effective ________, 20__, the Parties wish to resolve any and all disputes, claims, complaints, grievances, charges, actions, petitions, and demands that Employee may have against the Company and any of the Releases as defined below, including, but not limited to, any and all claims arising out of or in any way related to Employee’s employment with or separation from the Company or its subsidiaries or affiliates but, for the avoidance of doubt, nothing herein will be deemed to release any rights or remedies in connection with Employee’s ownership of vested equity securities of the Company, vested benefits, compensation earned but not yet paid, severance payments, or Employee’s right to indemnification or liability insurance provided by the Company or any of its affiliates pursuant to contract or applicable law (collectively, the “Retained Claims”).

NOW, THEREFORE, in consideration of the severance payments and benefits described in Section 4 of the Employment Agreement, which, pursuant to the Employment Agreement, are conditioned on Employee’s execution and non-revocation of this Agreement, and in consideration of the mutual promises made herein, the Company and Employee hereby agree as follows:

1. Severance Payments and Benefits; Salary and Benefits. The Company agrees to provide Employee with the severance payments and benefits described in Section [4(b)/4(c)] of the Employment Agreement, payable at the times set forth in, and subject to the terms and conditions of, the Employment Agreement. In addition, to the extent not already paid, and subject to the terms and conditions of the Employment Agreement, the Company shall pay or provide to Employee all other payments or benefits described in Section 3(c) of the Employment Agreement, subject to and in accordance with the terms thereof.

2. Release of Claims and Covenant not to Sue. Employee agrees that, other than with respect to the Retained Claims, the foregoing consideration represents settlement in full of all outstanding obligations owed to Employee by the Company, any of its direct or indirect subsidiaries or affiliates, and any of its or their current and former officers, directors, equityholders, managers, employees, agents, investors, attorneys, shareholders, administrators, affiliates, benefit plans, plan administrators, insurers, trustees, divisions, and subsidiaries and predecessor and successor corporations and assigns (collectively, the “Releasees”) related to Employee’s employment with the Company or its subsidiaries or termination therefrom. Employee, on Employee’s own behalf and on behalf of any of Employee’s affiliated companies or entities and any of their respective heirs, family members, executors, agents, and assigns, other than with respect to the Retained Claims, hereby and forever releases the Releasees from, and agrees not to sue concerning, or in any manner to institute, prosecute, or pursue, any claim, complaint, charge, duty, obligation, or cause of action relating to any matters of any kind, whether presently known or unknown, suspected or unsuspected, that Employee may possess against any of the Releasees arising from any omissions, acts, facts, or damages that have occurred up until and including the date Employee signs this Agreement relating to Employee’s employment with the Company or its subsidiaries or termination therefrom, including, without limitation:

(a) any and all claims relating to or arising from Employee’s employment or service relationship with the Company or any of its direct or indirect subsidiaries and the termination of that relationship;

(b) any and all claims relating to, or arising from, Employee’s right to purchase, or actual purchase of any shares of stock or other equity interests of the Company or any of its affiliates, including, without limitation, any claims for fraud, misrepresentation, breach of fiduciary duty, breach of duty under applicable state law, and securities fraud under any state or federal law;

(c) any and all claims for wrongful discharge of employment; termination in violation of public policy; discrimination; harassment; retaliation; breach of contract, both express and implied; breach of covenant of good faith and fair dealing, both express and implied; promissory estoppel; negligent or intentional infliction of emotional distress; fraud; negligent or intentional misrepresentation; negligent or intentional interference with contract or prospective economic advantage; unfair business practices; defamation; libel; slander; negligence; personal injury; assault; battery; invasion of privacy; false imprisonment; conversion; and disability benefits;

(d) any and all claims for violation of any federal, state, or municipal statute, including, but not limited to, Title VII of the Civil Rights Act of 1964; the Civil Rights Act of 1991; the Rehabilitation Act of 1973; the Americans with Disabilities Act of 1990; the Equal Pay Act; the Fair Labor Standards Act; the Fair Credit Reporting Act; the Age Discrimination in Employment Act of 1967; the Older Workers Benefit Protection Act; the Employee Retirement Income Security Act of 1974; the Worker Adjustment and Retraining Notification Act; the Family and Medical Leave Act; and the Sarbanes-Oxley Act of 2002;

(e) any and all claims for violation of the federal or any state constitution;

(f) any and all claims arising out of any other laws and regulations relating to employment or employment discrimination;

(g) any claim for any loss, cost, damage, or expense arising out of any dispute over the non-withholding or other tax treatment of any of the proceeds received by Employee as a result of this Agreement;

(h) any and all claims arising out of the wage and hour and wage payments laws and regulations of the state or states in which Employee has provided service to the Company or any of its affiliates; and

(i) any and all claims for attorneys’ fees and costs.

Employee agrees that the release set forth in this section shall be and remain in effect in all respects as a complete general release as to the matters released. Employee hereby acknowledges that Employee is aware of the principle that a general release does not extend to claims that the releasor does not know or suspect to exist in his or her favor at the time of executing the release, which, if known by him or her, must have materially affected his or her settlement with the releasee. With knowledge of this principle, Employee hereby agrees to expressly waive any rights Employee may have to that effect. This release does not release claims that cannot be released as a matter of law, including, but not limited to, Employee’s right to report possible violations of federal law or regulation to any governmental agency or entity in accordance with the provisions of and rules promulgated under Section 21F of the Securities Exchange Act of 1934 or Section 806 of the Sarbanes-Oxley Act of 2002, or any other whistleblower protection provisions of state or federal law or regulation and any right to receive an award for information provided thereunder, Employee’s right to file a charge with or participate in a charge by the Equal Employment Opportunity Commission, or any other local, state, or federal administrative body or government agency that is authorized to enforce or administer laws related to employment, against the Company for discrimination (with the understanding that Employee’s release of claims herein bars Employee from recovering such monetary relief from the Company or any Releasee for any alleged discriminatory treatment), claims for unemployment compensation or any state disability insurance benefits pursuant to the terms of applicable state law, claims to continued participation in certain of the Company’s group benefit plans pursuant to the terms and conditions of COBRA, claims to any benefit

entitlements vested as the date of separation of Employee’s employment, pursuant to written terms of any employee benefit plan of the Company or its affiliates and Employee’s right under applicable law and any Retained Claim. This release further does not release claims for breach of Section 3(c) or Section 4 of the Employment Agreement.

3. Acknowledgment of Waiver of Claims under ADEA. Employee understands and acknowledges that Employee is waiving and releasing any rights Employee may have under the Age Discrimination in Employment Act of 1967 (“ADEA”), and that this waiver and release is knowing and voluntary. Employee understands and agrees that this waiver and release does not apply to any rights or claims that may arise under the ADEA after the date Employee signs this Agreement. Employee understands and acknowledges that the consideration given for this waiver and release is in addition to anything of value to which Employee was already entitled. Employee further understands and acknowledges that Employee has been advised by this writing that: (a) Employee should consult with an attorney prior to executing this Agreement; (b) Employee has [21] days within which to consider this Agreement, and the Parties agree that such time period to review this Agreement shall not be extended upon any material or immaterial changes to this Agreement; (c) Employee has seven business days following Employee’s execution of this Agreement to revoke this Agreement pursuant to written notice to the General Counsel of the Company; (d) this Agreement shall not be effective until after the revocation period has expired; and (e) nothing in this Agreement prevents or precludes Employee from challenging or seeking a determination in good faith of the validity of this waiver under the ADEA, nor does it impose any condition precedent, penalties, or costs for doing so, unless specifically authorized by federal law. In the event Employee signs this Agreement and returns it to the Company in less than the [21] day period identified above, Employee hereby acknowledges that Employee has freely and voluntarily chosen to waive the time period allotted for considering this Agreement.

4. Severability. In the event that any provision or any portion of any provision hereof or any surviving agreement made a part hereof becomes or is declared by a court of competent jurisdiction or arbitrator to be illegal, unenforceable, or void, this Agreement shall continue in full force and effect without said provision or portion of provision.

5. No Oral Modification. This Agreement may only be amended in a writing signed by Employee and a duly authorized officer of the Company.

6. Governing Law; Dispute Resolution. This Agreement shall be subject to the provisions of Sections 9(a), 9(c), and 9(h) of the Employment Agreement.

7. Effective Date. Employee has seven business days after Employee signs this Agreement to revoke it and this Agreement will become effective on the day immediately following the seventh business day after Employee signed this Agreement (the “Effective Date”).

8. Voluntary Execution of Agreement. Employee understands and agrees that Employee executed this Agreement voluntarily, without any duress or undue influence on the part or behalf of the Company or any third party, with the full intent of releasing all of Employee’s claims against the Company and any of the other Releasees. Employee acknowledges that: (a) Employee has read this Agreement; (b) Employee has not relied upon any representations or statements made by the Company that are not specifically set forth in this Agreement; (c) Employee has been represented in the preparation, negotiation, and execution of this Agreement by legal counsel of Employee’s own choice or has elected not to retain legal counsel; (d) Employee understands the terms and consequences of this Agreement and of the releases it contains; and (e) Employee is fully aware of the legal and binding effect of this Agreement.

IN WITNESS WHEREOF, the Parties have executed this Agreement on the respective dates set forth below.

| | | | | |

| EMPLOYEE |

| |

| Dated: | [_____________] |

| |

| COMPANY |

| By: | |

Dated: | Name: Title: |

EXHIBIT B

Covenant Agreement

In consideration of, and as a condition of Employee’s employment Employee and the Company hereby agree as follows (capitalized terms not otherwise defined below have the meanings set forth in the Employment Agreement to which this Covenant Agreement is attached as an exhibit). For the purposes of this Covenant Agreement, “Company” means Latch Systems, Inc. and its current and future affiliates, as applicable.

1.Company Property.

a.All correspondence, records, documents, software, promotional materials and other Company property (including, without limitation, Confidential Information and Company Inventions (each as defined below)) and all copies thereof, which come into Employee’s possession by, through or in the course of Employee’s employment, regardless of the source and whether created by Employee or not, are the sole and exclusive property of the Company, and immediately upon the termination of Employee’s employment for any reason, or any time at the Company’s request, Employee shall return to the Company all such property of the Company, as well as Third Party Information (as defined below), and certify in writing that Employee has fully complied with the foregoing obligation.

b.Upon the earlier of (i) any request of the Company and (ii) five (5) days after the date of Employee’s termination hereunder for any reason, Employee shall deliver promptly to the Company all customer lists, sales and service manuals and data, equipment, computers, printers, facsimile machines, office equipment, cellular telephones, records, manuals, books, blank forms, documents, databases, files, letters, memoranda, notes, notebooks, reports, data, tables, calculations or copies thereof, which are the property of the Company or which relate in any way to the business of the Company, and all of other property, trade secrets, Company Inventions or Confidential Information of the Company, as well as Third Party Information, which are in Employee’s possession, care or control.