Medallion Bank Reports 2021 Second Quarter Results and Declares Series F Preferred Stock Dividend

31 July 2021 - 6:01AM

Medallion Bank (Nasdaq: MBNKP, “the Bank”), an FDIC-insured bank

providing consumer loans for the purchase of recreational vehicles,

boats, and home improvements, along with loan origination services

to fintech partners, announced today its 2021 second quarter

results. The Bank is a wholly owned subsidiary of Medallion

Financial Corp. (Nasdaq: MFIN).

2021 Second Quarter Highlights

- Record quarterly net income of $17.5 million compared to net

income of $1.8 million in the prior year period.

- Quarterly net interest income of $33.1 million, compared to

$28.1 million in the prior year period.

- Quarterly benefit for loan losses was $0.4 million, driven by

lower consumer borrower defaults and recoveries from previous

period loan losses, compared to a quarterly provision of $16.4

million in the prior year period.

- Net charge-offs were 3.93% of average loans outstanding,

compared to 1.38% in the prior year period.

- Recreation and home improvement loans in a state of delinquency

were 1.6% of the total combined recreation and home improvement

loan portfolios.

- The gross recreation and home improvement loan portfolios grew

12% and 31%, respectively, from June 30, 2020.

- Total assets were $1.4 billion, and the Bank had $242.2 million

in capital and a Tier 1 leverage ratio of 18.09% as of June 30,

2021.

Donald Poulton, President and Chief Executive Officer of

Medallion Bank, stated, “The performance of our consumer lending

businesses continues to be reflected in our bottom-line results.

For three consecutive quarters, we have delivered a return on

assets above 3%, and a return on equity over 20%, levels that

demonstrate our impressive margins and strength of our earnings

stream. Earnings for the quarter were a record $17.5 million and

follow two quarters of more than $13 million in net income. We

expect our strong capital position will continue to allow us to

grow the loan portfolios in our two key segments while we adhere to

our high credit quality standards, both of which are key components

of the Bank’s strategy.”

Recreation Lending Segment

- The Bank’s recreation loan portfolio grew 12.2% to $891.6

million as of June 30, 2021, compared to $794.4 million at June 30,

2020.

- Net interest income for the second quarter was $26.0 million

compared to $23.8 million in the prior year period.

- Recreation loans were at 70% of loans receivable as of June 30,

2021, as compared to 67% at June 30, 2020.

- The provision for recreation loan losses was $1.0 million,

compared to $8.3 million in the prior year period.

- Recreation loan delinquencies 90 days or more past due were

$2.8 million, or 0.3% of gross recreation loans, as of June 30,

2021, compared to $3.5 million, or 0.5%, at June 30, 2020.

Home Improvement Lending Segment

- The Bank’s home improvement loan portfolio grew 30.5% to $368.4

million as of June 30, 2021, compared to $282.3 million at June 30,

2020.

- Net interest income for the second quarter was $7.3 million

compared to $5.1 million in the prior year period.

- Home improvement loans were 29% of loans receivable as of June

30, 2021, as compared to 24% at June 30, 2020.

- The provision for home improvement loan losses was $0.7

million, compared to $0.8 million in the prior year period.

- Home improvement loan delinquencies 90 days or more past due

were $69,000, or 0.02% of gross home improvement loans as of June

30, 2021, compared to $137,000, or 0.05%, at June 30, 2020.

Medallion Lending Segment

- Medallion loans were 1.0% of the Bank’s total loans receivable

as of June 30, 2021.

- Total gross exposure of the segment

(which is net of loan loss allowance and includes loans in process

of foreclosure and remarketed assets) declined to $38.6 million, or

2.7% of total assets, as of June 30, 2021.

Unless otherwise specified, loan portfolios are presented net of

deferred loan acquisition costs.

On July 29, 2021, the Bank’s Board of Directors declared a

quarterly cash dividend of $0.50 per share on the Bank’s

Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock,

Series F, which trades on the Nasdaq Capital Market under the

ticker symbol “MBNKP.” The dividend is payable on October 1, 2021

to holders of record at the close of business on September 15,

2021.

About Medallion Bank

Medallion Bank specializes in providing consumer loans for the

purchase of recreational vehicles, boats and home improvements, and

offering loan origination services to fintech partners. The Bank

works directly with thousands of dealers, contractors and financial

service providers serving their customers throughout the United

States. Medallion Bank is a Utah-chartered, FDIC-insured industrial

bank headquartered in Salt Lake City and is a wholly owned

subsidiary of Medallion Financial Corp. (Nasdaq: MFIN).

For more information, visit www.medallionbank.com

Please note that this press release contains forward-looking

statements that involve risks and uncertainties relating to

business performance, cash flow, costs, sales, net investment

income, earnings, returns and growth. These statements are often,

but not always, made through the use of words or phrases such as

“believe,” “continue to,” “expect,” “should”, “strategy,” and

“will” or the negative version of those words or other comparable

words or phrases of a future or forward-looking nature. These

statements relate to our future earnings, returns, capital levels,

growth prospects, asset quality and pursuit of our strategy.

Medallion Bank’s actual results may differ significantly from the

results discussed in such forward-looking statements. For a

description of certain risks to which Medallion Bank is or may be

subject, please refer to the factors discussed under the captions

“Cautionary Note Regarding Forward-Looking Statements” and “Risk

Factors” included in Medallion Bank’s Form 10-K for the year ended

December 31, 2020, and in its Quarterly Reports on Form 10-Q, filed

with the FDIC. Medallion Bank’s Form 10-K, Form 10-Qs and other

FDIC filings are available in the Investor Relations section of

Medallion Bank’s website. In addition, Medallion Bank’s financial

results for any period are not necessarily indicative of Medallion

Financial Corp.’s results for the same period.

Company Contact:Investor

Relations212-328-2176InvestorRelations@medallion.com

|

MEDALLION BANKSTATEMENTS OF

OPERATIONS(UNAUDITED) |

| |

|

For the Three Months Ended June 30, |

| (In

thousands) |

|

|

2021 |

|

|

2020 |

|

|

Total interest income |

|

$ |

37,594 |

|

$ |

33,989 |

|

|

Total interest expense |

|

|

4,465 |

|

|

5,920 |

|

|

Net interest income |

|

|

33,129 |

|

|

28,069 |

|

|

|

|

|

|

|

Provision (benefit) for loan losses |

|

|

(374 |

) |

|

16,437 |

|

|

Net interest income after provision for loan

losses |

|

|

33,503 |

|

|

11,632 |

|

|

|

|

|

|

|

Other income (loss) |

|

|

|

|

Write-downs of loan collateral in process of foreclosure and other

assets |

|

|

(1,424 |

) |

|

(655 |

) |

|

Other non-interest income |

|

|

442 |

|

|

49 |

|

|

Total other loss |

|

|

(982 |

) |

|

(606 |

) |

|

|

|

|

|

|

Non-interest expense |

|

|

|

|

Salaries and benefits |

|

|

2,798 |

|

|

2,552 |

|

|

Loan servicing |

|

|

2,704 |

|

|

2,833 |

|

|

Collection costs |

|

|

1,120 |

|

|

1,141 |

|

|

Regulatory fees |

|

|

456 |

|

|

236 |

|

|

Professional fees |

|

|

474 |

|

|

418 |

|

|

Occupancy and equipment |

|

|

187 |

|

|

228 |

|

|

Other |

|

|

866 |

|

|

1,036 |

|

|

Total non-interest expense |

|

|

8,605 |

|

|

8,444 |

|

| |

|

|

|

|

Income before income taxes |

|

|

23,916 |

|

|

2,582 |

|

|

Provision for income taxes |

|

|

6,397 |

|

|

761 |

|

|

|

|

|

|

|

Net income |

|

$ |

17,519 |

|

$ |

1,821 |

|

|

MEDALLION BANKBALANCE

SHEETS(UNAUDITED) |

| (In

thousands) |

June 30, 2021 |

December 31, 2020 |

June 30, 2020 |

|

Assets |

|

|

|

|

Cash and federal funds sold |

$ |

61,563 |

|

$ |

58,977 |

|

$ |

87,872 |

|

|

Investment securities, available-for-sale |

|

48,307 |

|

|

46,792 |

|

|

47,495 |

|

|

Loans, inclusive of net deferred loan acquisition costs |

|

1,274,846 |

|

|

1,167,748 |

|

|

1,181,380 |

|

|

Allowance for loan losses |

|

(52,799 |

) |

|

(65,557 |

) |

|

(78,574 |

) |

|

Loans, net |

|

1,222,047 |

|

|

1,102,191 |

|

|

1,102,806 |

|

|

Loan collateral in process of foreclosure |

|

32,768 |

|

|

35,557 |

|

|

24,901 |

|

|

Fixed assets and right-of-use assets, net |

|

3,308 |

|

|

3,418 |

|

|

3,631 |

|

|

Deferred tax assets |

|

7,936 |

|

|

11,839 |

|

|

15,394 |

|

|

Due from affiliates |

|

- |

|

|

3,298 |

|

|

- |

|

|

Income tax receivable |

|

- |

|

|

549 |

|

|

- |

|

|

Accrued interest receivable and other assets |

|

|

33,911 |

|

|

28,746 |

|

|

35,459 |

|

| Total

assets |

$ |

1,409,840 |

|

$ |

1,291,367 |

|

$ |

1,317,558 |

|

| |

|

|

|

|

|

Liabilities and shareholders' equity |

|

|

|

|

Deposits and other funds borrowed |

$ |

1,152,068 |

|

$ |

1,065,398 |

|

$ |

1,075,319 |

|

|

Accrued interest payable |

|

1,196 |

|

|

1,515 |

|

|

1,734 |

|

|

Income taxes payable |

|

|

4,643 |

|

|

- |

|

|

4,887 |

|

|

Other liabilities |

|

10,256 |

|

|

5,980 |

|

|

10,994 |

|

|

Due to affiliates |

|

(487 |

) |

|

- |

|

|

1,141 |

|

| Total

liabilities |

|

1,167,676 |

|

|

1,072,893 |

|

|

1,094,075 |

|

| |

|

|

|

|

| Total

shareholders' equity |

|

242,164 |

|

|

218,474 |

|

|

223,483 |

|

| Total

liabilities and shareholders' equity |

$ |

1,409,840 |

|

$ |

1,291,367 |

|

$ |

1,317,558 |

|

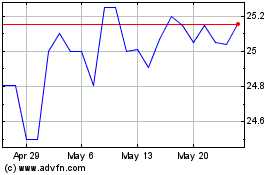

Medallion Bank (NASDAQ:MBNKP)

Historical Stock Chart

From Feb 2025 to Mar 2025

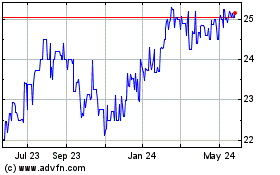

Medallion Bank (NASDAQ:MBNKP)

Historical Stock Chart

From Mar 2024 to Mar 2025