0001638290false00016382902024-11-062024-11-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 06, 2024 |

MasterCraft Boat Holdings, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-37502 |

06-1571747 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

100 Cherokee Cove Drive |

|

Vonore, Tennessee |

|

37885 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 423 884-2221 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock |

|

MCFT |

|

The Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 6, 2024, MasterCraft Boat Holdings, Inc. announced its financial results for its fiscal 2025 quarter ended September 29, 2024. The full text of the press release issued in connection with the announcement is furnished as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

The information in this Form 8-K (including Exhibit 99.1) shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly provided by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

The following exhibits are being furnished as part of this report:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

MASTERCRAFT BOAT HOLDINGS, INC. |

|

|

|

|

Date: |

November 6, 2024 |

By: |

/s/ TIMOTHY M. OXLEY |

|

|

|

Timothy M. Oxley

Chief Financial Officer, Treasurer and Secretary |

Exhibit 99.1

FOR IMMEDIATE RELEASE

MasterCraft Boat Holdings, Inc. Reports Fiscal 2025 First Quarter Results

VONORE, Tenn. – November 6, 2024 – MasterCraft Boat Holdings, Inc. (NASDAQ: MCFT) today announced financial results for its fiscal 2025 first quarter ended September 29, 2024.

The overview, commentary, and results provided herein relate to our continuing operations, which exclude our former Aviara segment.

Overview:

▪Net sales for the first quarter were $65.4 million, down $28.9 million, or 30.7%, from the prior-year period

▪Income from continuing operations was $1.0 million, or $0.06 per diluted share

▪Adjusted Net Income, a non-GAAP measure, was $1.9 million, or $0.12 per diluted share

▪Adjusted EBITDA, a non-GAAP measure, was $3.8 million, down $10.2 million from the prior-year period

▪Share repurchases of $3.5 million during the quarter

Brad Nelson, Chief Executive Officer, commented, “Our business executed well during the first quarter as we delivered results above expectations despite facing a backdrop of continued economic and industry headwinds. Our strong quarter was led by significant progress rebalancing dealer inventories and sets a strong foundation for the rest of the fiscal year. With the summer selling season now complete, we are focused on shipping our enhanced product ahead of the boat show season, while we continue to carefully manage dealer health.”

Nelson continued, “We maintain a disciplined approach to capital allocation as we prioritize balance sheet resilience throughout the business cycle. Our strong balance sheet and cash flow generation is a significant advantage which provides us with abundant financial flexibility. We are well positioned to pursue our capital allocation priorities, including targeted investment in long-term growth through focused innovation, product, and brand development.”

On August 8, 2024, we announced that we had entered into an asset purchase agreement, pursuant to which we will transfer rights to the Aviara brand of luxury dayboats and certain related assets to a subsidiary of MarineMax, Inc. The transaction was completed on October 18, 2024. Additionally, on September 12, 2024, we announced that we had entered into an agreement to sell our Aviara manufacturing facility for $26.5 million. The transaction is expected to be completed in our fiscal 2025 second quarter. The Company has reported the results of operations for its Aviara segment as discontinued operations in our condensed

consolidated statement of operations and the related assets and liabilities held-for-sale are classified as held-for-sale in our condensed consolidated balance sheets.

On September 27, 2024, the Company entered into the Fourth Amendment to the Credit Agreement to obtain the necessary consents and waivers to the restrictions in the covenants of the Credit Agreement, as related to the Aviara transaction and plans to sell certain facility assets, and a waiver to the fixed charge covenant ratio for certain periods. In conjunction with the amendment, the Company drew $49.5 million on its Revolving Credit Facility, leaving $50.5 million of available borrowing capacity.

First Quarter Results

For the first quarter of fiscal 2025, MasterCraft Boat Holdings, Inc. reported consolidated net sales of $65.4 million, down $28.9 million from the first quarter of fiscal 2024. The decrease in net sales was primarily due to lower unit volumes and unfavorable model mix, as expected.

Gross margin percentage declined 570 basis points during the first quarter of fiscal 2025, compared to the prior-year period. Lower margins were the result of lower cost absorption due to planned decreased production volume and higher dealer incentives as a percentage of net sales. Dealer incentives include measures taken by the Company to assist dealers as the retail environment remains very competitive.

Operating expenses decreased $1.1 million for the first quarter of fiscal 2025, compared to the prior-year period. The decrease in operating expenses was a result of lower share-based compensation expense and lower professional fees.

Income from continuing operations was $1.0 million for the first quarter of fiscal 2025, compared to $8.5 million in the prior-year period. Diluted income from continuing operations per share was $0.06, compared to $0.50 for the first quarter of fiscal 2024.

Adjusted Net income was $1.9 million for the first quarter of fiscal 2025, or $0.12 per diluted share, compared to $10.3 million, or $0.60 per diluted share, in the prior-year period.

Adjusted EBITDA was $3.8 million for the first quarter of fiscal 2025, compared to $14.0 million in the prior-year period. Adjusted EBITDA margin was 5.9% for the first quarter, down from 14.9% for the prior-year period.

See “Non-GAAP Measures” below for a reconciliation of Adjusted EBITDA, Adjusted EBITDA margin, Adjusted Net Income, and Adjusted Net Income per share, which we refer to collectively as the “Non-GAAP Measures”, to the most directly comparable financial measures presented in accordance with GAAP.

Outlook

Concluded Nelson, “Given the incremental retail visibility and progress reducing field inventories during the quarter, we are raising the lower end of our full year guidance. We are encouraged by recent industry and economic developments, including easing interest rates, which could commence a return to a more normalized environment by catalyzing wholesale and retail demand for recreational boats. We will continue to monitor retail results, dealer

sentiment, and broader economic conditions closely and are well-equipped to adjust our production plans for a range of scenarios.”

The Company’s outlook is as follows:

•For full year fiscal 2025, we now expect consolidated net sales to be between $270 million and $300 million, with Adjusted EBITDA between $17 million and $26 million, and Adjusted Earnings per share of between $0.55 and $0.95. Capital expenditures are projected to be approximately $12 million for the full year.

•For fiscal second quarter 2025, consolidated net sales are expected to be approximately $60 million, with Adjusted EBITDA of approximately $1.0 million, and Adjusted Loss per share of approximately ($0.01).

Conference Call and Webcast Information

MasterCraft Boat Holdings, Inc. will host a live conference call and webcast to discuss fiscal first quarter 2025 results today, November 6, 2024, at 8:30 a.m. EST. Participants may access the conference call live via webcast on the investor section of the Company’s website, Investors.MasterCraft.com, by clicking on the webcast icon. To participate via telephone, please register in advance at this link. Upon registration, all telephone participants will receive a confirmation email detailing how to join the conference call, including the dial-in number along with a unique passcode and registrant ID that can be used to access the call. A replay of the conference call and webcast will be archived on the Company's website.

About MasterCraft Boat Holdings, Inc.

Headquartered in Vonore, Tenn., MasterCraft Boat Holdings, Inc. (NASDAQ: MCFT) is a leading innovator, designer, manufacturer and marketer of recreational powerboats through its three brands, MasterCraft, Crest, and Balise. For more information about MasterCraft Boat Holdings, and its three brands, visit: Investors.MasterCraft.com, www.MasterCraft.com, www.CrestPontoonBoats.com, and www.BalisePontoonBoats.com.

Forward-Looking Statements

This press release includes forward-looking statements (as such term is defined in the Private Securities Litigation Reform Act of 1995). Forward-looking statements can often be identified by such words and phrases as “believes,” “anticipates,” “expects,” “intends,” “estimates,” “may,” “will,” “should,” “continue” and similar expressions, comparable terminology or the negative thereof, and include statements in this press release concerning the resilience of our business model, our intention to drive value and accelerate growth, the sale of our Merritt Island facility, and our financial outlook.

Forward-looking statements are subject to risks, uncertainties and other important factors that could cause actual results to differ materially from those expressed or implied in the forward-looking statements, including, but not limited to: the potential effects of supply chain disruptions and production inefficiencies, general economic conditions, political uncertainty (including as a result of the upcoming 2024 elections), demand for our products, inflation, changes in consumer preferences, competition within our industry, our ability to maintain a

reliable network of dealers, elevated inventories resulting in increased costs for dealers, our ability to manage our manufacturing levels and our fixed cost base, the successful introduction of our new products, including our new Balise brand, the success of our strategic divestments, geopolitical conflicts, such as the conflict between Russia and Ukraine and the conflict in the Gaza Strip and general unrest in the Middle East, and financial institution disruptions. These and other important factors discussed under the caption “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended June 30, 2024, filed with the Securities and Exchange Commission (the “SEC”) on August 30, 2024, could cause actual results to differ materially from those indicated by the forward-looking statements. The discussion of these risks is specifically incorporated by reference into this press release.

Any such forward-looking statements represent management's estimates as of the date of this press release. These forward-looking statements should not be relied upon as representing our views as of any date subsequent to the date of this press release. We undertake no obligation (and we expressly disclaim any obligation) to update or supplement any forward-looking statements that may become untrue or cause our views to change, whether because of new information, future events, changes in assumptions or otherwise. Comparison of results for current and prior periods are not intended to express any future trends or indications of future performance, unless expressed as such, and should only be viewed as historical data.

Use of Non-GAAP Financial Measures

To supplement the Company’s consolidated financial statements prepared in accordance with United States generally accepted accounting principles (“GAAP”), the Company uses certain non-GAAP financial measures in this release. Reconciliations of the Non-GAAP measures used in this release to the most comparable GAAP measures for the respective periods can be found in tables immediately following the consolidated statements of operations. The Non-GAAP Measures have limitations as analytical tools and should not be considered in isolation or as a substitute for the Company’s financial results prepared in accordance with GAAP.

Results of Operations for the Three Months Ended September 29, 2024

MASTERCRAFT BOAT HOLDINGS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(Dollars in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

September 29, |

|

|

October 1, |

|

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

Net sales |

|

$ |

65,359 |

|

|

$ |

94,305 |

|

Cost of sales |

|

|

53,561 |

|

|

|

71,830 |

|

Gross profit |

|

|

11,798 |

|

|

|

22,475 |

|

Operating expenses: |

|

|

|

|

|

|

Selling and marketing |

|

|

2,874 |

|

|

|

3,084 |

|

General and administrative |

|

|

7,470 |

|

|

|

8,376 |

|

Amortization of other intangible assets |

|

|

450 |

|

|

|

462 |

|

Total operating expenses |

|

|

10,794 |

|

|

|

11,922 |

|

Operating income |

|

|

1,004 |

|

|

|

10,553 |

|

Other income (expense): |

|

|

|

|

|

|

Interest expense |

|

|

(987 |

) |

|

|

(878 |

) |

Interest income |

|

|

1,192 |

|

|

|

1,352 |

|

Income before income tax expense |

|

|

1,209 |

|

|

|

11,027 |

|

Income tax expense |

|

|

193 |

|

|

|

2,496 |

|

Income from continuing operations |

|

|

1,016 |

|

|

|

8,531 |

|

Loss from discontinued operations, net of tax |

|

|

(6,161 |

) |

|

|

(2,336 |

) |

Net income (loss) |

|

$ |

(5,145 |

) |

|

$ |

6,195 |

|

|

|

|

|

|

|

|

Income (loss) per share |

|

|

|

|

|

|

Basic |

|

|

|

|

|

|

Continuing operations |

|

$ |

0.06 |

|

|

$ |

0.50 |

|

Discontinued operations |

|

|

(0.37 |

) |

|

|

(0.14 |

) |

Net income (loss) |

|

$ |

(0.31 |

) |

|

$ |

0.36 |

|

|

|

|

|

|

|

|

Diluted |

|

|

|

|

|

|

Continuing operations |

|

$ |

0.06 |

|

|

$ |

0.50 |

|

Discontinued operations |

|

|

(0.37 |

) |

|

|

(0.14 |

) |

Net income (loss) |

|

$ |

(0.31 |

) |

|

$ |

0.36 |

|

|

|

|

|

|

|

|

Weighted average shares used for computation of: |

|

|

|

|

|

|

Basic earnings per share |

|

|

16,544,941 |

|

|

|

17,156,283 |

|

Diluted earnings per share |

|

|

16,544,941 |

|

|

|

17,224,608 |

|

MASTERCRAFT BOAT HOLDINGS, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(Dollars in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

September 29, |

|

|

June 30, |

|

|

|

2024 |

|

|

2024 |

|

ASSETS |

|

|

|

|

|

|

CURRENT ASSETS: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

14,160 |

|

|

$ |

7,394 |

|

Held-to-maturity securities |

|

|

68,649 |

|

|

|

78,846 |

|

Accounts receivable, net of allowances of $164 and $101, respectively |

|

|

13,538 |

|

|

|

11,455 |

|

Income tax receivable |

|

|

1,275 |

|

|

|

499 |

|

Inventories, net |

|

|

37,296 |

|

|

|

36,972 |

|

Prepaid expenses and other current assets |

|

|

6,475 |

|

|

|

8,686 |

|

Current assets held-for-sale |

|

|

4,980 |

|

|

|

11,222 |

|

Total current assets |

|

|

146,373 |

|

|

|

155,074 |

|

Property, plant and equipment, net |

|

|

52,498 |

|

|

|

52,314 |

|

Goodwill |

|

|

28,493 |

|

|

|

28,493 |

|

Other intangible assets, net |

|

|

33,200 |

|

|

|

33,650 |

|

Deferred income taxes |

|

|

18,761 |

|

|

|

18,584 |

|

Deferred debt issuance costs, net |

|

|

432 |

|

|

|

272 |

|

Other long-term assets |

|

|

8,103 |

|

|

|

7,917 |

|

Non-current assets held-for-sale |

|

|

21,287 |

|

|

|

21,680 |

|

Total assets |

|

$ |

309,147 |

|

|

$ |

317,984 |

|

LIABILITIES AND EQUITY |

|

|

|

|

|

|

CURRENT LIABILITIES: |

|

|

|

|

|

|

Accounts payable |

|

$ |

13,052 |

|

|

$ |

10,431 |

|

Income tax payable |

|

|

4 |

|

|

|

— |

|

Accrued expenses and other current liabilities |

|

|

50,241 |

|

|

|

55,068 |

|

Current portion of long-term debt, net of unamortized debt issuance costs |

|

|

— |

|

|

|

4,374 |

|

Current liabilities held-for-sale |

|

|

9,671 |

|

|

|

8,063 |

|

Total current liabilities |

|

|

72,968 |

|

|

|

77,936 |

|

Long-term debt, net of unamortized debt issuance costs |

|

|

49,500 |

|

|

|

44,887 |

|

Unrecognized tax positions |

|

|

8,390 |

|

|

|

8,549 |

|

Other long-term liabilities |

|

|

2,462 |

|

|

|

2,551 |

|

Long-term liabilities held-for-sale |

|

|

180 |

|

|

|

182 |

|

Total liabilities |

|

|

133,500 |

|

|

|

134,105 |

|

COMMITMENTS AND CONTINGENCIES |

|

|

|

|

|

|

EQUITY: |

|

|

|

|

|

|

Common stock, $.01 par value per share — authorized, 100,000,000 shares; issued and outstanding, 16,816,392 shares at September 29, 2024 and 16,759,109 shares at June 30, 2024 |

|

|

168 |

|

|

|

167 |

|

Additional paid-in capital |

|

|

56,804 |

|

|

|

59,892 |

|

Retained earnings |

|

|

118,475 |

|

|

|

123,620 |

|

MasterCraft Boat Holdings, Inc. equity |

|

|

175,447 |

|

|

|

183,679 |

|

Noncontrolling interest |

|

|

200 |

|

|

|

200 |

|

Total equity |

|

|

175,647 |

|

|

|

183,879 |

|

Total liabilities and equity |

|

$ |

309,147 |

|

|

$ |

317,984 |

|

Supplemental Operating Data

The following table presents certain supplemental operating data for the periods indicated:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

September 29, |

|

|

October 1, |

|

|

|

|

|

|

|

2024 |

|

|

2023 |

|

|

Change |

|

|

(Dollars in thousands) |

Unit sales volume: |

|

|

|

|

|

|

|

|

|

|

MasterCraft |

|

|

374 |

|

|

|

494 |

|

|

|

(24.3 |

) |

% |

Pontoon |

|

|

177 |

|

|

|

362 |

|

|

|

(51.1 |

) |

% |

Consolidated |

|

|

551 |

|

|

|

856 |

|

|

|

(35.6 |

) |

% |

Net sales: |

|

|

|

|

|

|

|

|

|

|

MasterCraft |

|

$ |

55,533 |

|

|

$ |

75,836 |

|

|

|

(26.8 |

) |

% |

Pontoon |

|

|

9,826 |

|

|

|

18,469 |

|

|

|

(46.8 |

) |

% |

Consolidated |

|

$ |

65,359 |

|

|

$ |

94,305 |

|

|

|

(30.7 |

) |

% |

Net sales per unit: |

|

|

|

|

|

|

|

|

|

|

MasterCraft |

|

$ |

148 |

|

|

$ |

154 |

|

|

|

(3.9 |

) |

% |

Pontoon |

|

|

56 |

|

|

|

51 |

|

|

|

9.8 |

|

% |

Consolidated |

|

|

119 |

|

|

|

110 |

|

|

|

8.2 |

|

% |

Gross margin |

|

|

18.1 |

% |

|

|

23.8 |

% |

|

(570) bps |

Non-GAAP Measures

EBITDA, Adjusted EBITDA, EBITDA margin, and Adjusted EBITDA margin

We define EBITDA as income from continuing operations, before interest, income taxes, depreciation and amortization. We define Adjusted EBITDA as EBITDA further adjusted to eliminate certain non-cash charges or other items that we do not consider to be indicative of our core and/or ongoing operations. For the periods presented herein, the adjustments include share-based compensation, and CEO transition and organizational realignment costs. We define EBITDA margin and Adjusted EBITDA margin as EBITDA and Adjusted EBITDA, respectively, each expressed as a percentage of Net sales.

Adjusted Net Income and Adjusted Net Income per share

We define Adjusted Net Income and Adjusted Net Income per share as income from continuing operations, adjusted to eliminate certain non-cash charges or other items that we do not consider to be indicative of our core and/or ongoing operations and reflecting income tax expense on adjusted net income before income taxes at our estimated annual effective tax rate. For the periods presented herein, these adjustments include other intangible asset amortization, share-based compensation, and CEO transition and organizational realignment costs.

The Non-GAAP Measures are not measures of net income or operating income as determined under GAAP. The Non-GAAP Measures are not measures of performance in accordance with GAAP and should not be considered as an alternative to net income, net income per share, or operating cash flows determined in accordance with GAAP. Additionally, Adjusted EBITDA is not intended to be a measure of cash flow. We believe that the inclusion of the Non-GAAP Measures is appropriate to provide additional information to investors because securities analysts and investors use the Non-GAAP Measures to assess our operating performance across periods on a consistent basis and to evaluate the relative risk of an investment in our securities. We use Adjusted Net Income and Adjusted Net Income

per share to facilitate a comparison of our operating performance on a consistent basis from period to period that, when viewed in combination with our results prepared in accordance with GAAP, provides a more complete understanding of factors and trends affecting our business than does GAAP measures alone. We believe Adjusted Net Income and Adjusted Net Income per share assists our board of directors, management, investors, and other users of the financial statements in comparing our net income on a consistent basis from period to period because it removes certain non-cash items and other items that we do not consider to be indicative of our core and/or ongoing operations and reflecting income tax expense on adjusted net income before income taxes at our estimated annual effective tax rate. The Non-GAAP Measures have limitations as an analytical tool and should not be considered in isolation or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are:

•Although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future and the Non-GAAP Measures do not reflect any cash requirements for such replacements;

•The Non-GAAP Measures do not reflect our cash expenditures, or future requirements for capital expenditures or contractual commitments;

•The Non-GAAP Measures do not reflect changes in, or cash requirements for, our working capital needs;

•Certain Non-GAAP Measures do not reflect our tax expense or any cash requirements to pay income taxes;

•Certain Non-GAAP Measures do not reflect interest expense, or the cash requirements necessary to service interest payments on our indebtedness; and

•The Non-GAAP Measures do not reflect the impact of earnings or charges resulting from matters we do not consider to be indicative of our core and/or ongoing operations, but may nonetheless have a material impact on our results of operations.

In addition, because not all companies use identical calculations, our presentation of the Non-GAAP Measures may not be comparable to similarly titled measures of other companies, including companies in our industry.

We do not provide forward-looking guidance for certain financial measures on a GAAP basis because we are unable to predict certain items contained in the GAAP measures without unreasonable efforts. These items may include acquisition-related costs, litigation charges or settlements, impairment charges, and certain other unusual adjustments.

The following table presents a reconciliation of income from continuing operations as determined in accordance with GAAP to EBITDA and Adjusted EBITDA, and income from continuing operations margin to EBITDA margin and Adjusted EBITDA margin (each expressed as a percentage of net sales) for the periods indicated:

|

|

|

|

|

|

|

|

|

|

|

|

|

(Dollars in thousands) |

|

Three Months Ended |

|

|

September 29, |

|

|

% of Net |

|

October 1, |

|

|

% of Net |

|

|

2024 |

|

|

sales |

|

2023 |

|

|

sales |

Income from continuing operations |

|

$ |

1,016 |

|

|

1.6% |

|

$ |

8,531 |

|

|

9.0% |

Income tax expense |

|

|

193 |

|

|

|

|

|

2,496 |

|

|

|

Interest expense |

|

|

987 |

|

|

|

|

|

878 |

|

|

|

Interest income |

|

|

(1,192 |

) |

|

|

|

|

(1,352 |

) |

|

|

Depreciation and amortization |

|

|

2,074 |

|

|

|

|

|

2,109 |

|

|

|

EBITDA |

|

|

3,078 |

|

|

4.7% |

|

|

12,662 |

|

|

13.4% |

Share-based compensation |

|

|

430 |

|

|

|

|

|

910 |

|

|

|

CEO transition and organizational realignment costs(a) |

|

|

334 |

|

|

|

|

|

436 |

|

|

|

Adjusted EBITDA |

|

$ |

3,842 |

|

|

5.9% |

|

$ |

14,008 |

|

|

14.9% |

The following table sets forth a reconciliation of income from continuing operations as determined in accordance with GAAP to Adjusted Net Income for the periods indicated:

|

|

|

|

|

|

|

|

(Dollars in thousands, except per share data) |

Three Months Ended |

|

|

September 29, |

|

|

October 1, |

|

|

2024 |

|

|

2023 |

|

Income from continuing operations |

$ |

1,016 |

|

|

$ |

8,531 |

|

Income tax expense |

|

193 |

|

|

|

2,496 |

|

Amortization of acquisition intangibles |

|

450 |

|

|

|

462 |

|

Share-based compensation |

|

430 |

|

|

|

910 |

|

CEO transition and organizational realignment costs(a) |

|

334 |

|

|

|

436 |

|

Adjusted Net Income before income taxes |

|

2,423 |

|

|

|

12,835 |

|

Adjusted income tax expense(b) |

|

485 |

|

|

|

2,567 |

|

Adjusted Net Income |

$ |

1,938 |

|

|

$ |

10,268 |

|

|

|

|

|

|

|

Adjusted net income per common share |

|

|

|

|

|

Basic |

$ |

0.12 |

|

|

$ |

0.60 |

|

Diluted |

$ |

0.12 |

|

|

$ |

0.60 |

|

Weighted average shares used for the computation of (c): |

|

|

|

|

|

Basic Adjusted net income per share |

|

16,544,941 |

|

|

|

17,156,283 |

|

Diluted Adjusted net income per share |

|

16,544,941 |

|

|

|

17,224,608 |

|

The following table presents the reconciliation of income from continuing operations per diluted share to Adjusted Net Income per diluted share for the periods indicated:

|

|

|

|

|

|

|

|

(Dollars in thousands, except per share data) |

Three Months Ended |

|

|

September 29, |

|

|

October 1, |

|

|

2024 |

|

|

2023 |

|

Income from continuing operations per diluted share |

$ |

0.06 |

|

|

$ |

0.50 |

|

Impact of adjustments: |

|

|

|

|

|

Income tax expense |

|

0.01 |

|

|

|

0.14 |

|

Amortization of acquisition intangibles |

|

0.03 |

|

|

|

0.03 |

|

Share-based compensation |

|

0.03 |

|

|

|

0.05 |

|

CEO transition and organizational realignment costs(a) |

|

0.02 |

|

|

|

0.03 |

|

Adjusted Net Income per diluted share before income taxes |

|

0.15 |

|

|

|

0.75 |

|

Impact of adjusted income tax expense on net income per diluted share before income taxes(b) |

|

(0.03 |

) |

|

|

(0.15 |

) |

Adjusted Net Income per diluted share |

$ |

0.12 |

|

|

$ |

0.60 |

|

(a)Represents amounts paid for legal fees and recruiting costs associated with the CEO transition, as well as non-recurring severance costs incurred as part of the Company's strategic organizational realignment undertaken in connection with the transition.

(b)For fiscal 2025 and 2024, income tax expense reflects an income tax rate of 20.0% for each period presented.

(c)Represents the Weighted Average Shares used for the computation of Basic and Diluted earnings per share as presented on the Consolidated Statements of Operations to calculate Adjusted Net Income per diluted share for all periods presented herein.

Investor Contact:

MasterCraft Boat Holdings, Inc.

John Zelenak

Manager of Treasury & Investor Relations

Email: investorrelations@mastercraft.com

# # #

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

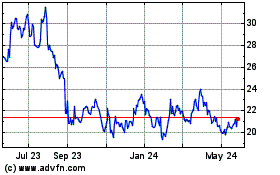

MasterCraft Boat (NASDAQ:MCFT)

Historical Stock Chart

From Feb 2025 to Mar 2025

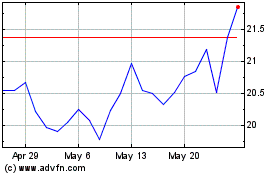

MasterCraft Boat (NASDAQ:MCFT)

Historical Stock Chart

From Mar 2024 to Mar 2025