Form SC 13D/A - General Statement of Acquisition of Beneficial Ownership: [Amend]

29 October 2024 - 5:52AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D/A

Under the Securities Exchange Act of 1934

(Amendment No. 3)*

MDxHealth SA

(Name of Issuer)

Common Stock

(Title of Class of Securities)

B5950S113

(CUSIP Number)

|

MVM Partners, LLC

Old City Hall

45 School Street

Boston, MA 02108

Attn: Eric Bednarski |

|

Troutman Pepper Hamilton Sanders LLP

400 Berwyn Park

899 Cassatt Road

Berwyn, PA 19312

Attn: Scott Jones, Esq. |

(Name, Address and Telephone Number of Person Authorized

to Receive Notices and Communications)

September 27, 2024

(Date of Event Which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to

report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f)

or 240.13d-1(g), check the following box. ¨

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter the disclosures provided in a prior cover page. |

| |

|

The information required on the remainder of this cover page shall not

be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”)

or otherwise subject to the liabilities of that section of the Exchange Act but shall be subject to all other provisions of the Exchange

Act (however, see the Notes).

CUSIP No. 58286E102

| 1 |

NAMES OF REPORTING PERSONS |

|

|

| MVM Partners, LLC |

|

|

| |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) |

¨ |

| |

(b) |

¨ |

| |

|

| 3 |

SEC USE ONLY |

|

|

| |

|

|

| |

|

| 4 |

SOURCE OF FUNDS (SEE INSTRUCTIONS) |

|

|

| OO |

|

|

| |

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E) |

|

¨ |

| |

|

|

| |

|

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

|

| Delaware |

|

|

| |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER |

|

|

| 0 |

|

|

| |

|

| 8 |

SHARED VOTING POWER |

|

|

| 4,700,457 |

|

|

| |

|

| 9 |

SOLE DISPOSITIVE POWER |

|

|

| 0 |

|

|

| |

|

| 10 |

SHARED DISPOSITIVE POWER |

|

|

| 4,700,457 |

|

|

| |

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

|

| 4,700,457 |

|

|

| |

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS) |

|

¨ |

| |

|

|

| |

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

|

| 9.94% |

|

|

| |

|

| |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS) |

|

|

| 14 |

|

|

|

|

|

| |

PN |

|

|

CUSIP No. 58286E102

| 1 |

NAMES OF REPORTING PERSONS |

|

|

| MVM V LP |

|

|

| |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) |

¨ |

| |

(b) |

¨ |

| |

|

| 3 |

SEC USE ONLY |

|

|

| |

|

|

| |

|

| 4 |

SOURCE OF FUNDS (SEE INSTRUCTIONS) |

|

|

| OO |

|

|

| |

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E) |

|

¨ |

| |

|

|

| |

|

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

|

| United Kingdom |

|

|

| |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER |

|

|

| 0 |

|

|

| |

|

| 8 |

SHARED VOTING POWER |

|

|

| 4,605,499 |

|

|

| |

|

| 9 |

SOLE DISPOSITIVE POWER |

|

|

| 0 |

|

|

| |

|

| 10 |

SHARED DISPOSITIVE POWER |

|

|

| 4,605,499 |

|

|

| |

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

|

| 4,605,499 |

|

|

| |

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS) |

|

¨ |

| |

|

|

| |

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

|

| 9.74% |

|

|

| |

|

| |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS) |

|

|

| 14 |

|

|

|

|

|

| |

PN |

|

|

CUSIP No. 58286E102

| 1 |

NAMES OF REPORTING PERSONS |

|

|

| MVM GP (No.5) LP |

|

|

| |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) |

¨ |

| |

(b) |

¨ |

| |

|

| 3 |

SEC USE ONLY |

|

|

| |

|

|

| |

|

| 4 |

SOURCE OF FUNDS (SEE INSTRUCTIONS) |

|

|

| OO |

|

|

| |

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E) |

|

¨ |

| |

|

|

| |

|

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

|

| United Kingdom |

|

|

| |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER |

|

|

| 0 |

|

|

| |

|

| 8 |

SHARED VOTING POWER |

|

|

| 94,958 |

|

|

| |

|

| 9 |

SOLE DISPOSITIVE POWER |

|

|

| 0 |

|

|

| |

|

| 10 |

SHARED DISPOSITIVE POWER |

|

|

| 94,958 |

|

|

| |

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

|

| 94,958 |

|

|

| |

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS) |

|

¨ |

| |

|

|

| |

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

|

|

0.20% |

|

|

| |

|

|

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS) |

|

|

|

PN |

|

|

| |

|

|

Explanatory Note

This Amendment No.3 amends and supplements the Schedule 13D filed by the

Reporting Persons on December 23, 2022 (as subsequently amended, the “Schedule 13D”). Capitalized terms used herein and not

defined have the meaning ascribed to such terms in the Schedule 13D.

| Item 3. |

Source or Amount of Funds or Other Consideration. |

Item 3 of the Schedule 13D is amended

and supplemented as follows:

On September 27, 2024, the Issuer closed a public offering (the “Offering”) of (i) 20,000,000 Ordinary Shares of the Issuer

at a public offering price of $2.00 per Ordinay Share. The Funds acquired an aggregate of 150,000 Ordinary Shares in the Offering for

a total purchase price of $300,000.

| Item 4. |

Purpose of Transaction. |

Item 4 of the Schedule 13D is amended

and supplemented as follows:

The information set forth

in Items 3, 5 and 6 of this Schedule 13D is hereby incorporated by reference.

The Reporting Persons intend to continuously review their investment in the Issuer, and may in the future determine (i) to acquireadditional

securities of the Issuer, through open market purchases, private agreements or otherwise, (ii) to dispose of all or a portion ofthe securities

of the Issuer owned by them, (iii) to undertake an extraordinary corporate transaction such as a tender offer or exchangeoffer for some

or all of the shares of Common Stock not held by the Reporting Persons or a merger, acquisition, consolidation or otherbusiness combination

or reorganization involving the Issuer, (iv) to engage in any hedging or similar transactions with respect tosecurities of the Issuer;

or (v) to take any other available course of action. Notwithstanding anything contained herein, the ReportingPersons specifically reserve

the right to change their intention with respect to any or all of such matters. In reaching any decision as totheir course of action (as

well as to the specific elements thereof), the Reporting Persons currently expect that they would take intoconsideration a variety of

factors, including, but not limited to, the following: the Issuer’s business and prospects; other developmentsconcerning the

Issuer and its businesses generally; other business opportunities available to the Reporting Persons; developments withrespect

to the business of the Reporting Persons; changes in law and government regulations; general economic conditions; and moneyand

stock market conditions, including the market price of the securities of the Issuer and currency fluctuations.

| Item 5. |

Interest in Securities of the Issuer. |

Item 5 of the Schedule 13D is amended

and supplemented as follows:

The information contained in the cover pages of this Amendment is incorporated herein by reference. The percentages used in this Amendment

are calculated based upon on a total of 47,288,093 outstanding shares of Common Stock of the Issuer as reported in the Issuer’s

Prospectus Supplement (to Prospectus Dated December 19, 2022) filed on September 26, 2024.

Each of the Reporting Persons may be deemed

a member of a “group” with the other Reporting Persons for purposes of Rule 13d-5(b)(1) of the Securities Exchange Act of

1934, as amended (the “Exchange Act”), and may be deemed to share power to vote or direct thevote of (and share power to dispose

or direct the disposition of) the securities of the Issuer owned by the other Reporting Persons. Thefiling of this Amendment shall not

be deemed an admission that the Reporting Persons are, for purposes of Section 13(d) of theExchange Act, the beneficial owners of any

securities of the Issuer he or it does not directly own. Each of the Reporting Personsspecifically disclaims beneficial ownership of the

securities of the Issuer reported herein that he or it does not directly own.

SIGNATURES

After reasonable inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

| Dated: October 28, 2024 |

MVM Partners, LLC |

| |

|

| |

By: |

/s/ Eric Bednarski |

| |

Name: |

Eric Bednarski |

| |

Title: |

Vice President |

| |

|

|

| |

MVM V LP |

| |

By: MVM Partners, LLC, its Fund Manager |

| |

By: |

/s/ Eric Bednarski |

| |

Name: |

Eric Bednarski |

| |

Title: |

Vice President |

| |

|

|

| |

MVM GP (No. 5) LP |

| |

By: MVM Partners, LLC, its Fund Manager |

| |

By: |

/s/ Eric Bednarski |

| |

Name: |

Eric Bednarski |

| |

Title: |

Vice President |

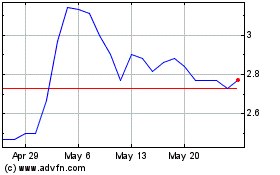

MDxHealth (NASDAQ:MDXH)

Historical Stock Chart

From Oct 2024 to Nov 2024

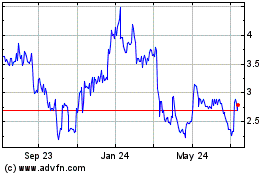

MDxHealth (NASDAQ:MDXH)

Historical Stock Chart

From Nov 2023 to Nov 2024