MDxHealth Announces Launch of Offering of Ordinary Shares

26 September 2024 - 6:05AM

MDxHealth Announces Launch of Offering of

Ordinary Shares

IRVINE, CA, and HERSTAL,

BELGIUM –September 25, 2024 (GlobeNewswire) –

MDxHealth SA (NASDAQ: MDXH) (“mdxhealth” or the

“Company”), a commercial-stage precision

diagnostics company, announced the launch of a proposed offering of

$40.0 million of ordinary shares of the Company without nominal

value ("Ordinary Shares") in a registered public

offering (the “Offering”). The Company also

expects to grant the underwriters a 30-day option to purchase up to

15% of the Ordinary Shares being offered, excluding any Ordinary

Shares purchased directly from the Company in the Offering pursuant

to any separate Securities Purchase Agreement. TD Cowen and William

Blair are acting as joint book-running managers for the Offering.

The Offering is subject to market and other conditions, and there

can be no assurance as to whether or when the Offering may be

completed, or as to the actual size or terms of the Offering,

including the price per Ordinary Share and number of Ordinary

Shares sold in the Offering.

The Ordinary Shares described above are being offered by

mdxhealth pursuant to a registration statement previously filed

with and subsequently declared effective by the Securities and

Exchange Commission (“SEC”). A preliminary

prospectus supplement relating to the Offering has been filed with

the SEC and is available on the SEC’s website

at http://www.sec.gov. This press release does not constitute

an offer to sell or a solicitation of an offer to buy securities of

the Company nor shall there be any offer, solicitation or sale of

these securities in any state or other jurisdiction in which such

offer, solicitation or sale would be unlawful prior to registration

or qualification or publication of an offering prospectus under the

securities laws of any such state or jurisdiction. Any offers,

solicitations or offers to buy, or any sales of securities, if at

all, will be made in accordance with the registration requirements

of the United States Securities Act of 1933.

Copies of the preliminary prospectus supplement, and

accompanying base prospectus relating to this offering, may be

obtained from TD Securities (USA) LLC, 1 Vanderbilt Avenue, New

York, NY 10017, by email at TD.ECM_Prospectus@tdsecurities.com or

by telephone at (855) 495-9846 and William Blair & Company,

L.L.C., Attention: Prospectus Department, 150 North Riverside

Plaza, Chicago, IL 60606, or by telephone at (800) 621-0687, or by

email at prospectus@williamblair.com.

For more information:

mdxhealthinfo@mdxhealth.com

LifeSci Advisors (IR & PR)US: +1 949 271

9223ir@mdxhealth.com

IMPORTANT INFORMATION

This press release contains forward-looking statements regarding

the proposed offering and the intended use of proceeds from the

offering. The offering is subject to market and other conditions

and there can be no assurance as to whether or when the offering

may be completed or as to the actual size or terms of the offering.

Forward-looking statements involve known and unknown risks,

uncertainties and other factors that could cause actual results to

differ materially, including those risks disclosed in the section

“Risk Factors” included in the preliminary prospectus supplement

for the offering and in greater detail in our filings with the SEC.

The Company cautions readers not to place undue reliance on any

forward-looking statements. The Company expressly disclaims any

obligation to update any such forward-looking statements in this

release to reflect any change in its expectations with regard

thereto or any change in events, conditions or circumstances on

which any such statement is based unless required by law or

regulation. This press release does not constitute an offer or

invitation for the sale or purchase of securities or assets of

mdxhealth in any jurisdiction. No securities of mdxhealth may be

offered or sold within the United States without registration under

the U.S. Securities Act of 1933, as amended, or in compliance with

an exemption therefrom, and in accordance with any applicable U.S.

securities laws.

No public offering will be made and no one has taken

any action that would, or is intended to, permit a public offering

in any country or jurisdiction, other than the United States, where

any such action is required, including in Belgium. Belgian

investors, other than qualified investors within the meaning of

Regulation (EU) 2017/1129 on the prospectus to be published when

securities are offered to the public or admitted to trading on a

regulated market (the “Prospectus Regulation”),

will not be eligible to participate in the Offering (whether in

Belgium or elsewhere). The transaction to which this press release

relates will only be available to, and will be engaged in only

with, in member states of the European Economic Area, persons

falling within the meaning of Article 2(e) of the Prospectus

Regulation, and in the United Kingdom, investment professionals

falling within article 19 (5) of the Financial Services and Markets

Act 2000 (Financial Promotion) Order 2005 (the

“Order”), persons falling within article 49 (2),

(a) to (d) of the Order and other persons to whom it may lawfully

be communicated.

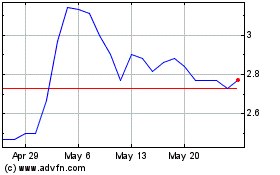

MDxHealth (NASDAQ:MDXH)

Historical Stock Chart

From Oct 2024 to Nov 2024

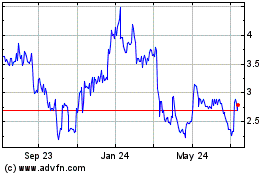

MDxHealth (NASDAQ:MDXH)

Historical Stock Chart

From Nov 2023 to Nov 2024