MacroGenics Provides Update on Corporate Progress, Second Quarter 2024 Financial Results

07 August 2024 - 6:01AM

MacroGenics, Inc. (NASDAQ: MGNX), a biopharmaceutical company

focused on discovering, developing, manufacturing and

commercializing innovative antibody-based therapeutics for the

treatment of cancer, today provided an update on its recent

corporate progress and reported financial results for the quarter

ended June 30, 2024.

“We are pleased to have the opportunity to present updated

safety and efficacy data from our Phase 2 TAMARACK trial of vobra

duo at the upcoming European Society for Medical Oncology (ESMO)

Congress in September," said Scott Koenig, M.D., Ph.D., President

and CEO of MacroGenics. “In addition, we recently solidified our

cash position with the receipt of $100.0 million in milestones,

following the positive Phase 3 top-line results from Incyte’s

registrational studies of retifanlimab in both anal and lung

cancer.”

Updates on Proprietary Investigational

Programs

Recent progress and anticipated events related to MacroGenics’

investigational product candidates are highlighted below.

B7-H3-Directed Therapies

-

Vobramitamab duocarmazine (vobra duo) is an

antibody-drug conjugate (ADC) that targets B7-H3, an antigen with

broad expression across multiple solid tumors and a member of the

B7 family of molecules involved in immune regulation.

- The TAMARACK Phase

2 study of vobra duo is being conducted in patients with metastatic

castration-resistant prostate cancer (mCRPC) who were previously

treated with one prior androgen receptor axis-targeted therapy

(ARAT). Participants may have received up to one prior

taxane-containing regimen, but no other chemotherapy agents. The

TAMARACK study is designed to evaluate vobra duo at two different

doses: 2.0 mg/kg or 2.7 mg/kg every four weeks (q4W). MacroGenics

completed enrollment of the TAMARACK study in the fourth quarter of

2023, and the study has reached its landmark primary endpoint of

6-month radiographic progression-free survival (rPFS) rate. While

mCRPC study participants are no longer being dosed in the study,

participants continue to be monitored for adverse events, disease

progression and survival.

- Updated TAMARACK

safety and efficacy data, including the study’s primary endpoint,

will be presented in a poster session at the ESMO Congress in

September 2024. This data will be based on a data cut-off date of

July 9, 2024. The abstract submitted to ESMO in May was based on an

April 12 data cut off. MacroGenics expects to have the mature

efficacy findings, including median rPFS, in the second half of

2024 and plans to present the data at a subsequent medical

conference.

- Following the ESMO

poster presentation, the Company plans to host a conference call

with investors to discuss the TAMARACK data and potential next

steps for vobra duo.

- MacroGenics

continues to enroll a Phase 1/2 dose escalation study of vobra duo

in combination with lorigerlimab in patients with various advanced

solid tumors. The Company anticipates commencing a dose expansion

study of this combination later this year.

-

MGC026 is a clinical B7-H3-targeting ADC that is

site-specifically conjugated to exatecan, a topoisomerase I

inhibitor payload developed by Synaffix (a Lonza company). With

distinct mechanisms of action, vobra duo and MGC026 may address

different cancers, tumor stages, or be used in combination with

alternate agents — or potentially with one another — to enhance

their clinical utility. A Phase 1 dose escalation study of MGC026

in patients with advanced solid tumors is ongoing.

Lorigerlimab

- Lorigerlimab is a

bispecific, tetravalent PD-1 × CTLA-4 DART® molecule. In addition

to the ongoing study of lorigerlimab in combination with vobra duo

mentioned above, MacroGenics is enrolling LORIKEET, a randomized

Phase 2 study of lorigerlimab in combination with docetaxel vs.

docetaxel alone in second-line, chemotherapy-naïve mCRPC patients.

A total of 150 patients are planned to be treated in the 2:1

randomized study. The current trial design includes a primary study

endpoint of rPFS. The Company anticipates completing enrollment of

the study in 2024 or early 2025 and providing a clinical update in

the first half of 2025.

Emerging ADC Pipeline

- MGC028 is a

preclinical ADC incorporating an ADAM9-targeting antibody and

represents the second MacroGenics ADC molecule that incorporates

Synaffix’s novel site-specific linker and topoisomerase I

inhibitor-based cytotoxic payload. ADAM9 (a disintegrin and

metalloprotease domain 9) is a member of the ADAM family of

multifunctional type 1 transmembrane proteins that play a role in

tumorigenesis and cancer progression and is overexpressed in

multiple cancers, making it an attractive target for cancer

treatment. The Company continues to anticipate submitting an

investigational new drug (IND) application for MGC028 by the end of

2024 and initiating a Phase 1 clinical study in 2025.

Partnered Programs

-

MGD024 is a next-generation, humanized CD123 × CD3

DART molecule designed to minimize cytokine-release syndrome, while

maintaining anti-tumor cytolytic activity, and permitting

intermittent dosing. MacroGenics continues to enroll patients in a

Phase 1 dose-escalation study of MGD024 in patients with

CD123-positive neoplasms, including acute myeloid leukemia and

myelodysplastic syndromes. Under an October 2022 exclusive option

and collaboration agreement, Gilead Sciences, Inc. (Gilead) has the

option to license MGD024 at predefined decision points during the

Phase 1 study.

- ZYNYZ®

(retifanlimab-dlwr) is a humanized monoclonal antibody

targeting PD-1 that the Company licensed to Incyte Corporation

(Incyte) in 2017. Incyte recently announced positive Phase 3

top-line results for its registrational studies of retifanlimab in

squamous cell carcinoma of the anal canal and non-small cell lung

cancer and continues to conduct global studies of retifanlimab

across multiple indications.Subsequent to June 30, 2024,

MacroGenics announced the achievement of $100.0 million in

milestones from Incyte related to development progress of

retifanlimab, following an agreement on July 24, 2024, pursuant to

which certain milestones were deemed to have been met. MacroGenics

is further eligible to receive up to a total of $210.0 million in

remaining development and regulatory milestones and up to $330.0

million in potential commercial milestones from Incyte. MacroGenics

receives tiered royalties of 15% to 24% from Incyte on any global

net sales of the product and manufactures a portion of Incyte’s

global commercial supply of retifanlimab.

Second Quarter 2024 Financial

Results

- Cash Position:

Cash, cash equivalents and marketable securities balance as of

June 30, 2024, was $140.4 million, compared to $229.8 million

as of December 31, 2023. The June 30, 2024 balance did

not include the $100.0 million in milestones subsequently

received from Incyte.

- Revenue: Total

revenue was $10.8 million for the quarter ended June 30, 2024,

compared to total revenue of $13.1 million for the quarter ended

June 30, 2023. The decrease was primarily due to less revenue

recognized under the Provention Asset Purchase Agreement and was

partially offset by increased revenue from the Company’s

collaboration with Gilead and increased contract manufacturing

revenue.

- R&D Expenses:

Research and development expenses were $51.7 million for the

quarter ended June 30, 2024, compared to $43.2 million for the

quarter ended June 30, 2023. The increase was primarily due to

manufacturing and IND-enabling costs related to MGC028.

- SG&A Expenses:

Selling, general and administrative expenses were

$14.4 million for the quarter ended June 30, 2024,

compared to $13.7 million for the quarter ended June 30,

2023.

- Net Income (Loss):

Net loss was $55.7 million for the quarter ended June 30,

2024, compared to net income of $57.5 million for the quarter ended

June 30, 2023. Net income for the quarter ended June 30,

2023 included approximately $100.0 million as a component of Other

Income related to the sale of the Company’s single-digit royalty

interest on global net sales of TZIELD® (teplizumab-mzwv) to DRI

Healthcare Acquisitions LP in March 2023.

- Shares

Outstanding: Shares of common stock outstanding as of

June 30, 2024 were 62,720,969.

- Cash Runway

Guidance: MacroGenics anticipates that its cash, cash

equivalents and marketable securities balance of $140.4 million as

of June 30, 2024, plus the $100.0 million in milestones

subsequently received from Incyte, in addition to projected and

anticipated future payments from partners and product revenues

should support its cash runway into 2026. The Company’s expected

funding requirements reflect anticipated expenditures related to

the Phase 2 TAMARACK clinical trial, the Phase 2 LORIKEET study as

well as MacroGenics’ other ongoing clinical and preclinical

studies.

No Conference Call

Given the embargoed TAMARACK data being presented at the

upcoming ESMO presentation, the Company’s management has entered a

quiet period and will not be hosting a conference call to discuss

its financial results or corporate progress for the quarter ended

June 30, 2024. The Company intends to resume its quarterly results

conference calls in the future.

|

MACROGENICS, INC.SELECTED CONSOLIDATED

BALANCE SHEET DATA(Amounts in

thousands) |

| |

| |

June 30, 2024 |

|

December 31, 2023 |

| |

(unaudited) |

|

|

|

Cash, cash equivalents and marketable securities |

$ |

140,372 |

|

|

$ |

229,805 |

|

| Total assets |

|

201,137 |

|

|

|

298,418 |

|

| Deferred revenue |

|

79,321 |

|

|

|

80,894 |

|

| Total stockholders'

equity |

|

57,819 |

|

|

|

152,613 |

|

| |

|

|

|

|

|

|

|

|

MACROGENICS, INC.CONSOLIDATED STATEMENTS

OF OPERATIONS AND COMPREHENSIVE INCOME

(LOSS)(Unaudited)(Amounts in

thousands, except share and per share data) |

| |

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Revenues: |

|

|

|

|

|

|

|

|

Collaborative and other agreements |

$ |

2,065 |

|

|

$ |

6,021 |

|

|

$ |

3,514 |

|

|

$ |

22,708 |

|

|

Product sales, net |

|

5,248 |

|

|

|

5,062 |

|

|

|

10,109 |

|

|

|

8,552 |

|

|

Contract manufacturing |

|

2,893 |

|

|

|

1,587 |

|

|

|

5,169 |

|

|

|

5,202 |

|

|

Royalty revenue |

|

98 |

|

|

|

— |

|

|

|

258 |

|

|

|

421 |

|

|

Government agreements |

|

493 |

|

|

|

466 |

|

|

|

851 |

|

|

|

749 |

|

| Total revenues |

|

10,797 |

|

|

|

13,136 |

|

|

|

19,901 |

|

|

|

37,632 |

|

| Costs and expenses: |

|

|

|

|

|

|

|

|

Cost of product sales |

|

176 |

|

|

|

258 |

|

|

|

446 |

|

|

|

371 |

|

|

Cost of manufacturing services |

|

2,647 |

|

|

|

919 |

|

|

|

4,493 |

|

|

|

4,329 |

|

|

Research and development |

|

51,732 |

|

|

|

43,229 |

|

|

|

97,760 |

|

|

|

89,101 |

|

|

Selling, general and administrative |

|

14,423 |

|

|

|

13,692 |

|

|

|

29,133 |

|

|

|

27,219 |

|

| Total costs and expenses |

|

68,978 |

|

|

|

58,098 |

|

|

|

131,832 |

|

|

|

121,020 |

|

| Loss from operations |

|

(58,181 |

) |

|

|

(44,962 |

) |

|

|

(111,931 |

) |

|

|

(83,388 |

) |

| Gain on royalty monetization

arrangement |

|

— |

|

|

|

100,930 |

|

|

|

— |

|

|

|

100,930 |

|

| Interest and other income |

|

2,523 |

|

|

|

2,275 |

|

|

|

5,216 |

|

|

|

3,348 |

|

| Interest and other

expense |

|

(6 |

) |

|

|

(774 |

) |

|

|

(1,139 |

) |

|

|

(1,430 |

) |

| Net income (loss) |

|

(55,664 |

) |

|

|

57,469 |

|

|

|

(107,854 |

) |

|

|

19,460 |

|

| Other comprehensive income

(loss): |

|

|

|

|

|

|

|

| Unrealized gain (loss) on

investments |

|

11 |

|

|

|

(80 |

) |

|

|

(18 |

) |

|

|

(67 |

) |

| Comprehensive income

(loss) |

$ |

(55,653 |

) |

|

$ |

57,389 |

|

|

$ |

(107,872 |

) |

|

$ |

19,393 |

|

| |

|

|

|

|

|

|

|

| Net income (loss) per common

share: |

|

|

|

|

|

|

|

|

Basic |

$ |

(0.89 |

) |

|

$ |

0.93 |

|

|

$ |

(1.73 |

) |

|

$ |

0.31 |

|

|

Diluted |

$ |

(0.89 |

) |

|

$ |

0.92 |

|

|

$ |

(1.73 |

) |

|

$ |

0.31 |

|

| Weighted average common shares

outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

62,663,677 |

|

|

|

61,880,096 |

|

|

|

62,477,108 |

|

|

|

61,845,151 |

|

|

Diluted |

|

62,663,677 |

|

|

|

62,261,646 |

|

|

|

62,477,108 |

|

|

|

62,030,710 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

About MacroGenics, Inc.

MacroGenics (the Company) is a biopharmaceutical company focused

on discovering, developing, manufacturing and commercializing

innovative monoclonal antibody-based therapeutics for the treatment

of cancer. The Company generates its pipeline of product candidates

primarily from its proprietary suite of next-generation

antibody-based technology platforms, which have applicability

across broad therapeutic domains. The combination of MacroGenics'

technology platforms and protein engineering expertise has allowed

the Company to generate promising product candidates and enter into

several strategic collaborations with global pharmaceutical and

biotechnology companies. For more information, please see the

Company's website at www.macrogenics.com. MacroGenics, the

MacroGenics logo, MARGENZA and DART are trademarks or registered

trademarks of MacroGenics, Inc.

Cautionary Note on Forward-Looking

Statements

Any statements in this press release about future expectations,

plans and prospects for MacroGenics (“Company”), including

statements about the Company’s strategy, future operations,

clinical development of and regulatory plans for the Company’s

therapeutic candidates, including trial design, initiation and

enrollment in clinical trials, expected timing of results from

clinical trials, discussions with regulatory agencies, commercial

prospects of or product revenues from the Company’s products and

product candidates, if approved, manufacturing services revenue,

milestone or opt-in payments from the Company’s collaborators, the

Company’s anticipated milestones and future expectations and plans

and prospects for the Company, as well as future global net sales

of TZIELD and the Company’s ability to achieve the milestone

payments set forth under the terms of the agreement with DRI (or

its successors or assigns with respect to such agreement), the

Company’s current cash resources supporting our planned operating

expenses and capital requirements into 2026 and other statements

containing the words “subject to”, "believe", “anticipate”, “plan”,

“expect”, “intend”, “estimate”, “potential,” “project”, “may”,

“will”, “should”, “would”, “could”, “can”, the negatives thereof,

variations thereon and similar expressions, or by discussions of

strategy constitute forward-looking statements within the meaning

of Section 27A of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934. Actual results may differ

materially from those indicated by such forward-looking statements

as a result of various important factors, including: risks that

TZIELD, vobramitamab duocarmazine, lorigerlimab, ZYNYZ, MARGENZA or

any other product candidate’s revenue, expenses and costs may not

be as expected, risks relating to TZIELD, vobramitamab

duocarmazine, lorigerlimab, ZYNYZ, MARGENZA or any other product

candidate’s market acceptance, competition, reimbursement and

regulatory actions; future data updates, especially with respect to

vobramitamab duocarmazine; our ability to provide manufacturing

services to our customers; the uncertainties inherent in the

initiation and enrollment of future clinical trials; the

availability of financing to fund the internal development of our

product candidates; expectations of expanding ongoing clinical

trials; availability and timing of data from ongoing clinical

trials; expectations for the timing and steps required in the

regulatory review process; expectations for regulatory approvals;

expectations of future milestone payments; the impact of

competitive products; our ability to enter into agreements with

strategic partners and other matters that could affect the

availability or commercial potential of the Company's product

candidates; business, economic or political disruptions due to

catastrophes or other events, including natural disasters,

terrorist attacks, civil unrest and actual or threatened armed

conflict, or public health crises; costs of litigation and the

failure to successfully defend lawsuits and other claims against

us; and other risks described in the Company's filings with the

Securities and Exchange Commission. In addition, the

forward-looking statements included in this press release represent

the Company's views only as of the date hereof. The Company

anticipates that subsequent events and developments will cause the

Company's views to change. However, while the Company may elect to

update these forward-looking statements at some point in the

future, the Company specifically disclaims any obligation to do so,

except as may be required by law. These forward-looking statements

should not be relied upon as representing the Company's views as of

any date subsequent to the date hereof.

CONTACTS: Jim Karrels, Senior Vice President, CFO 1-301-251-5172

info@macrogenics.com

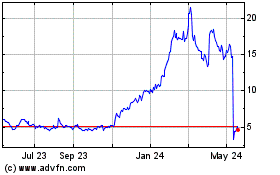

MacroGenics (NASDAQ:MGNX)

Historical Stock Chart

From Oct 2024 to Nov 2024

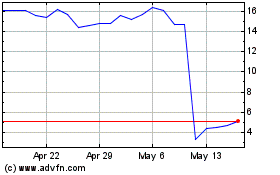

MacroGenics (NASDAQ:MGNX)

Historical Stock Chart

From Nov 2023 to Nov 2024