Filed

by Srivaru Holding Limited

pursuant

to Rule 425 under the Securities Act of 1933

and

deemed filed pursuant to Rule 14a-2

under

the Securities Exchange Act of 1934

Subject

Company: Mobiv Acquisition Corp.

COMMISSION

FILE NO. FOR REGISTRATION STATEMENT ON

FORM

F-4 FILED BY SRIVARU HOLDING LIMITED: 333-272717

Mobiv

Acquisition Corp Announces Redemption Results in Connection with Planned Merger with SRIVARU Holding Limited

Shareholders

electing to redeem have until approximately 3:00 pm Eastern Time on the day prior to closing to reverse their redemptions and participate

in a pro rata distribution of the additional 2.5 million shares.

DELAWARE,

USA, September 27, 2023 — Mobiv Acquisition Corp (Nasdaq: MOBVU, MOBV, MOBVW) (“Mobiv” or the “Company”),

a special purpose acquisition company, today provided a business update regarding the planned merger with SRIVARU Holding Limited, a

Cayman Islands exempted company (“SRIVARU”), a commercial-stage provider of premium electric motorcycles. The Company announces

that holders of approximately 5,530,395 of the Company’s Class A Common Stock exercised their right to redeem their shares for

a pro-rata portion of the available funds in the Company’s trust account, reflecting redemptions of approximately 97.5% of the

total Class A Common Stock outstanding as of the Company’s contractual redemption expiration deadline of 5:00 pm Eastern Time on

September 26, 2023 (the “Redemption Expiration Date”).

Following

the Redemption Expiration Date, no additional shareholders will have the right to redeem; however, shareholders that have elected to

redeem will have the opportunity to reverse their redemption election and participate in the 2.5 million bonus shares pool until approximately

3:00 pm Eastern Time on the day prior to closing. Shareholders that reverse their redemption will be entitled to receive a pro-rata share

of the additional 2,500,000 ordinary shares of the Company, granted in accordance with the amendment to the agreement and plan of merger

with SRIVARU, as previously announced on August 9, 2023. In order for public stockholders to receive a pro rata portion of the

2.5 million share pool, public stockholders need to be stockholders as of 3:00 pm Eastern Time, on the day prior to the closing. As of

the Redemption Expiration Date, stockholders holding the remaining 142,992 shares of the Company’s Class A Comon Stock would be

entitled to a pro rata portion of the 2.5 million shares, equating to approximately 17 shares per 1 unredeemed share, as may be reduced

by redemption recissions.

Peter

Bilitsch, CEO of Mobiv, stated, “We truly appreciate the support of our shareholders that elected to remain invested in our Company.

We believe this is a testament to their confidence and conviction in the potential of SRIVARU following the planned merger. Moreover,

shareholders that elected to redeem will still have the opportunity until approximately 3:00 pm Eastern Time on the day prior to closing

to participate in a pro-rata share of the additional 2.5 million share distribution, by electing to reverse their redemptions.”

“We

are more excited than ever about SRIVARU as they continue to execute on all fronts and we believe they are well-positioned to establish

a leadership position within the Indian and global premium electric two-wheel markets. Notably, the global electric two-wheel vehicle

market was valued at US$51.22 billion in 2020 alone, with the Asia-Pacific region leading in market share. SRIVARU’s Prana™

is redefining the premium category as a result of its attractive price point and patented and patent-pending technology, which results

in increased safety, stability, and comfort. Moreover, the vehicle’s integrated charger operates on home electric networks and

does not require a specialized charging infrastructure, a key competitive advantage in many markets around the world. We look forward

to our shareholder meeting on September 28, 2023, and providing further updates on the planned merger,” concluded Mr. Bilitsch.

About

Mobiv Acquisition Corp

The

Company is a newly incorporated blank check company organized for the purpose of effecting a merger, share exchange, asset acquisition,

share purchase, reorganization or similar business combination with a target business. The Company may pursue a business combination

target in any industry or geographic region and will invest using the lens of the UN Sustainable Development Goals, which reflect social

and environmental mega-trends that are re-shaping our world. https://mobiv.ac/

Forward

Looking Statements

This

communication may contain a number of “forward-looking statements” as defined in the Private Securities Litigation Reform

Act of 1995. Forward-looking statements include information concerning Mobiv’s or SRIVARU’s possible or assumed future results

of operations, business strategies, debt levels, competitive position, industry environment, potential growth opportunities and the effects

of regulation, including whether the Business Combination will generate returns for stockholders or shareholders, respectively. These

forward-looking statements are based on Mobiv’s or SRIVARU’s management’s current expectations, estimates, projections

and beliefs, as well as a number of assumptions concerning future events. When used in this communication, the words “estimates,”

“projected,” “expects,” “anticipates,” “forecasts,” “plans,” “intends,”

“believes,” “seeks,” “may,” “will,” “should,” “future,” “propose”

and variations of these words or similar expressions (or the negative versions of such words or expressions) are intended to identify

forward-looking statements.

These

forward-looking statements are not guarantees of future performance, conditions or results, and involve a number of known and unknown

risks, uncertainties, assumptions and other important factors, many of which are outside SRIVARU’s or Mobiv’s management’s

control, that could cause actual results to differ materially from the results discussed in the forward-looking statements. These risks,

uncertainties, assumptions and other important factors include, but are not limited to: (a) the occurrence of any event, change or other

circumstances that could give rise to the termination of negotiations and any subsequent definitive agreements with respect to the Business

Combination; (b) the outcome of any legal proceedings that may be instituted against Mobiv, SRIVARU or others following the announcement

of the Business Combination and any definitive agreements with respect thereto; (c) the inability to complete the Business Combination

due to the failure to obtain approval of the stockholders of Mobiv, to obtain financing to complete the Business Combination or to satisfy

other conditions to closing; (d) changes to the proposed structure of the Business Combination that may be required or appropriate as

a result of applicable laws or regulations or as a condition to obtaining regulatory approval of the Business Combination; (e) the ability

to meet the applicable stock exchange listing standards following the consummation of the Business Combination; (f) the inability to

complete the private placement or backstop transactions contemplated by the Business Combination Agreement and related agreements, as

applicable; (g) the risk that the Business Combination disrupts current plans and operations of SRIVARU or its subsidiaries as a result

of the announcement and consummation of the transactions described herein; (h) the ability to recognize the anticipated benefits of the

Business Combination, which may be affected by, among other things, competition, the ability of SRIVARU to grow and manage growth profitably,

maintain relationships with customers and suppliers and retain its management and key employees; (i) costs related to the Business Combination;

(j) changes in applicable laws or regulations, including legal or regulatory developments (including, without limitation, accounting

considerations) which could result in the need for Mobiv to restate its historical financial statements and cause unforeseen delays in

the timing of the Business Combination and negatively impact the trading price of Mobiv’s securities and the attractiveness of

the Business Combination to investors; (k) the possibility that SRIVARU and Mobiv may be adversely affected by other economic, business,

and/or competitive factors; (l) SRIVARU’s ability to execute its business plans and strategies, (m) SRIVARU’s estimates of

expenses and profitability and (n) other risks and uncertainties indicated from time to time in the final prospectus of Mobiv, including

those under “Risk Factors” therein, and other documents filed or to be filed with the SEC by Mobiv. You are cautioned not

to place undue reliance upon any forward-looking statements, which speak only as of the date made.

Forward-looking

statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and

SRIVARU and Mobiv assume no obligation and, except as required by law, do not intend to update or revise these forward-looking statements,

whether as a result of new information, future events, or otherwise. Neither SRIVARU nor Mobiv gives any assurance that either SRIVARU

or Mobiv will achieve its expectations.

Additional

Information about the Transactions and Where to Find It.

In

connection with the proposed business combination between SRIVARU and Mobiv (the “Business Combination”) SRIVARU has filed

a registration statement on Form F-4 (as may be amended from time to time, the “Registration Statement”) that includes a

preliminary proxy statement of Mobiv and a registration statement/preliminary prospectus of SRIVARU, and after the Registration Statement

is declared effective, Mobiv will mail a definitive proxy statement/prospectus relating to the Business Combination to Mobiv’s

stockholders. The Registration Statement, including the proxy statement/prospectus contained therein, when declared effective by the

Securities and Exchange Commission (“SEC”), will contain important information about the Business Combination and the other

matters to be voted upon at a meeting of Mobiv’s stockholders to be held to approve the Business Combination and related matters.

This communication does not contain all the information that should be considered concerning the Business Combination and other matters

and is not intended to provide the basis for any investment decision or any other decision in respect of such matters. SRIVARU and Mobiv

may also file other documents with the SEC regarding the Business Combination. Mobiv stockholders and other interested persons are advised

to read, when available, the preliminary proxy statement/prospectus and the amendments thereto and the definitive proxy statement/prospectus

and other documents filed in connection with the Business Combination, as these materials will contain important information about Mobiv,

SRIVARU and the Business Combination.

When

available, the definitive proxy statement/prospectus and other relevant materials for the Business Combination will be mailed to Mobiv

stockholders as of a record date to be established for voting on the Business Combination. Stockholders will also be able to obtain copies

of the preliminary proxy statement/prospectus, the definitive proxy statement/prospectus and other documents filed or that will be filed

with the SEC by Mobiv through the website maintained by the SEC at www.sec.gov, or by directing a request to the contacts mentioned below.

Participants

in the Solicitation

Mobiv,

SRIVARU and their respective directors and officers may be deemed participants in the solicitation of proxies of Mobiv stockholders in

connection with the Business Combination. Mobiv stockholders and other interested persons may obtain, without charge, more detailed information

regarding the directors and officers of Mobiv and a description of their interests in Mobiv is contained in Mobiv’s final prospectus

related to its initial public offering, dated August 3, 2022, and in Mobiv’s subsequent filings with the SEC. Information regarding

the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to Mobiv stockholders in connection with

the Business Combination and other matters to be voted upon at the Mobiv stockholder meeting are set forth in the Registration Statement.

Additional information regarding the interests of participants in the solicitation of proxies in connection with the Business Combination

is included in the Registration Statement that SRIVARU has filed with the SEC. You may obtain free copies of these documents as described

in the preceding paragraph.

Disclaimer

This

communication relates to a proposed business combination between SRIVARU and Mobiv. This document does not constitute an offer to sell

or exchange, or the solicitation of an offer to buy or exchange, any securities, nor shall there be any sale of securities in any jurisdiction

in which such offer, sale or exchange would be unlawful prior to registration or qualification under the securities laws of any such

jurisdiction.

Company

Contact:

Mobiv

Acquisition Corp

850

Library Avenue, Suite 204

Newark,

Delaware 19711

Attn.:

Mr. Peter Bilitsch

Chief

Executive Officer

Email:

peter.bilitsch@mobiv.ac

Tel.:

+13027386680

Investor

& Media Contact

Crescendo

Communications, LLC

Tel:

(212) 671-1020

Email:

MOBV@Crescendo-IR.com

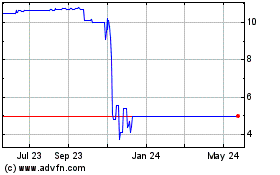

Mobiv Acquisition (NASDAQ:MOBVU)

Historical Stock Chart

From Mar 2025 to Apr 2025

Mobiv Acquisition (NASDAQ:MOBVU)

Historical Stock Chart

From Apr 2024 to Apr 2025