0001823239FALSE00018232392024-12-032024-12-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

| | | | | | | | |

| | |

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934 |

Date of Report (Date of earliest event reported): December 3, 2024

Maravai LifeSciences Holdings, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-39725 | | 85-2786970 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | | | | | | | |

| 10770 Wateridge Circle Suite 200 San Diego, California | 92121 |

| (Address of principal executive offices) | (Zip Code) |

| | | | |

| (858) 546-0004 | |

| (Registrant’s telephone number, including area code) | |

| | | | |

| Not Applicable (Former name or former address, if changed since last report.) | |

| | | | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange

on which registered |

| Class A Common Stock, $0.01 par value | | MRVI | | The Nasdaq Stock Market LLC |

| | | | (Nasdaq Global Select Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR § 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR § 240.12b-2).

| | | | | |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revisited financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Board Leadership Transition

On December 3, 2024, Carl Hull, Executive Chairman of the Board of Directors (the “Board”) of Maravai LifeSciences Holdings, Inc. (the “Company”), notified the Board of his decision to retire as Executive Chairman and to resign from the Board, both effective as of December 5, 2024. Mr. Hull’s retirement as an executive employee of the Company and his resignation from the Board were not related to any disagreement with the Company’s management, the Board or any committee of the Board on any matter related to the Company’s operations, policies or practices.

On December 4, 2024, the Board appointed Robert Andrew Eckert as a director and Chairman of the Board, effective as of December 5, 2024 (the “Effective Date”), to succeed Mr. Hull as Chairman of the Board. Mr. Eckert will serve as a Class I director for a term continuing until the Company’s 2027 annual meeting of stockholders and until his successor has been duly elected and qualified, or until his earlier resignation or removal.

In connection with his service as Chairman of the Board, Mr. Eckert will be eligible to receive an annual cash retainer of $175,000, commencing January 1, 2025, which retainer shall be paid in arrears in four equal installments. Furthermore, subject to his service as Chairman of the Board on the respective grant date, Mr. Eckert will receive the following grants of restricted stock units (“RSUs”) pursuant to, and subject to the terms of, the Company’s 2020 Omnibus Incentive Plan (the “Plan”) and associated award agreements (collectively, the “Equity Awards”): (i) an initial RSU award with a grant date fair value of $750,000 (based on the closing price of the Company’s Class A common stock on the date of grant), of which one-third of the RSUs shall be fully vested upon the date of grant, and the remaining RSUs shall vest in two equal installments on the date of the 2025 Annual Meeting of Shareholders of the Company (the “2025 Annual Meeting Date”) and the one-year anniversary of the 2025 Annual Meeting Date (the “2024 RSUs”), and (ii) a subsequent RSU award expected to be granted on the 2025 Annual Meeting Date with a grant date fair value of $500,000 (based on the closing price of the Company’s Class A common stock on the date of grant), of which one-half of the RSUs shall be fully vested upon the date of grant and the remaining RSUs shall vest on the one-year anniversary of the date of grant (the “2025 RSUs”). Vesting of the Equity Awards is generally subject to Mr. Eckert’s continued service as a member of the Board through each vesting date, subject to the acceleration of vesting of a portion of each RSU award upon a “change in control” of the Company (as defined in the Plan). Consistent with the Company’s previously adopted grant practices, the Company will grant the 2024 RSU award to Mr. Eckert effective as of December 16, 2024, which is the first trading day following the 15th day of the month of the effective date of his appointment (since December 15th is not a trading day). The Company expects to grant the 2025 RSU award to Mr. Eckert effective as of the 2025 Annual Meeting Date. Following the grant of the Equity Awards and commencing in 2026, Mr. Eckert shall be eligible to receive the same annual RSU award as other non-employee directors in accordance with the Company’s previously-disclosed compensation policy for non-employee directors.

In addition, Mr. Eckert will enter into the Company’s standard form of indemnification agreement, a copy of which is filed as Exhibit 10.10 to the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission on February 29, 2024.

The foregoing description of the material terms of the Equity Awards is not complete and is qualified in its entirety by reference to the full text of the forms of award agreements, copies of which are included as Exhibit 10.1 and Exhibit 10.2 to this Current Report on Form 8-K and incorporated herein by reference.

There are no arrangements or understandings between Mr. Eckert and any other person pursuant to which he was appointed as a director of the Company, and there is no family relationship between Mr. Eckert and any of the Company’s other directors or executive officers or other person nominated or chosen by the Company to become a director or executive officer of the Company. In addition, the Company is not aware of any transaction in which Mr. Eckert has a direct or indirect material interest that would require disclosure under Item 404(a) of Regulation S-K promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Item 7.01. Regulation FD Disclosure.

A copy of the press release announcing the appointment of Mr. Eckert as Chairman of the Board is attached hereto as Exhibit 99.1.

The information contained in this Item 7.01 and Exhibit 99.1 hereto shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

The following exhibits are furnished as part of this Current Report on Form 8-K:

| | | | | | | | |

| Exhibit No. | | Description of Exhibit |

| 10.1 | | |

| 10.2 | | |

99.1* | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

_______________ | | | | | |

* | Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of Exchange Act, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such filing. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| MARAVAI LIFESCIENCES HOLDINGS, INC. |

| | |

Date: December 5, 2024 | By: | /s/ Kevin M. Herde |

| Name: | Kevin M. Herde |

| Title: | Chief Financial Officer |

MARAVAI LIFESCIENCES HOLDINGS, INC.

2020 OMNIBUS INCENTIVE PLAN

RESTRICTED STOCK UNIT GRANT NOTICE

Pursuant to the terms and conditions of the Maravai LifeSciences Holdings, Inc. 2020 Omnibus Incentive Plan, as amended from time to time (the “Plan”), Maravai LifeSciences Holdings, Inc., a Delaware corporation (the “Company”), hereby grants to the individual listed below (“Participant”) the number of restricted stock units (the “RSUs”) set forth below. This award of RSUs (this “Award”) is subject to the terms and conditions set forth herein and in the Restricted Stock Unit Agreement attached hereto as Exhibit A (the “Agreement”), which is incorporated herein by reference. Capitalized terms used but not defined herein shall have the meanings set forth in the Plan.

Participant:

Grant Date:

Number of RSUs:

Vesting Commencement Date: [Date of Grant]

Vesting Schedule: Subject to the Agreement, the Plan and other terms and conditions set forth herein, (i) 1/3rd of the RSUs will vest on the Vesting Commencement Date set forth above, (ii) 1/3rd of the RSUs will vest on the date of the 2025 Annual Meeting of Stockholders of the Company (the “2025 Annual Meeting Date”), and 1/3rd of the RSUs will vest on the first anniversary of the 2025 Annual Meeting Date, in each case so long as Participant has not incurred a Termination of Service prior to the applicable vesting date:

[Signature Page Follows]

By Participant’s signature below, Participant agrees to be bound by the terms of this Grant Notice, the Plan and the Agreement. Participant has reviewed the Plan, this Grant Notice and the Agreement in their entirety, has had an opportunity to obtain the advice of counsel prior to executing this Grant Notice and fully understands all provisions of the Plan, this Grant Notice and the Agreement. Participant hereby agrees to accept as binding, conclusive and final all decisions or interpretations of the Administrator upon any questions arising under the Plan, this Grant Notice or the Agreement. This Grant Notice may be executed in one or more counterparts (including portable document format (.pdf) and facsimile counterparts), each of which shall be deemed to be an original, but all of which together shall constitute one and the same agreement.

Notwithstanding any provision of this Grant Notice or the Agreement, if Participant has not executed this Grant Notice within 90 days following the Grant Date set forth above, Participant will be deemed to have accepted this Award, subject to all of the terms and conditions of this Grant Notice, the Agreement and the Plan.

MARAVAI LIFESCIENCES PARTICIPANT

HOLDINGS, INC.

By:

Name: Kurt A. Oreshack

Title: Secretary and General Counsel

Exhibit A

RESTRICTED STOCK UNIT AGREEMENT

Capitalized terms not specifically defined in this Agreement have the meanings specified in the Grant Notice or, if not defined in the Grant Notice, in the Plan.

Article I.

GENERAL

I.1Award of RSUs. The Company has granted the RSUs to Participant effective as of the grant date set forth in the Grant Notice (the “Grant Date”). Each RSU represents the right to receive one Share as set forth in this Agreement. Participant will have no right to the distribution of any Shares or payment of any cash until the time (if ever) the RSUs have vested.

I.2Incorporation of Terms of Plan. The RSUs are subject to the terms and conditions set forth in this Agreement and the Plan, which is incorporated herein by reference. In the event of any inconsistency between the Plan and this Agreement, the terms of the Plan will control.

I.3Unsecured Promise. The RSUs will at all times prior to settlement represent an unsecured Company obligation payable only from the Company’s general assets.

Article II.

VESTING; FORFEITURE AND SETTLEMENT

II.1Vesting; Forfeiture.

(a)The RSUs will vest according to the vesting schedule in the Grant Notice. In the event of Participant’s Termination of Service for any reason, all unvested RSUs will immediately and automatically be cancelled and forfeited, except as otherwise determined by the Administrator or provided in a binding written agreement between Participant and the Company.

(b)Notwithstanding anything in the Grant Notice, this Agreement or the Plan to the contrary, (i) the RSUs will vest in their entirety upon Participant’s Termination of Service due to Participant’s death or Disability, and (ii) in the event of a Change in Control, so long as Participant continuously provides services to the Company or any Affiliate from the Grant Date through the consummation of such Change in Control, any unvested RSUs that would have vested due to Participant’s continued service to the Company during the twelve (12) months following such Change in Control shall vest in their entirety upon such Change in Control.

II.2Settlement. As soon as administratively practicable following the vesting of RSUs pursuant to Section 2.1, but in no event later than 30 days after such vesting date, the Company shall deliver to Participant a number of Shares equal to the number of RSUs subject to this Award. All Shares issued hereunder shall be delivered either by delivering one or more certificates for such shares to Participant or by entering such shares in book-entry form, as determined by the Committee in its sole discretion. The value of Shares shall not bear any interest owing to the passage of time.

Article III.

TAXATION AND TAX WITHHOLDING

III.1Representation. Participant represents to the Company that Participant has reviewed with Participant’s own tax advisors the tax consequences of this Award and the

transactions contemplated by the Grant Notice and this Agreement. Participant is relying solely on such advisors and not on any statements or representations of the Company or any of its agents.

III.2Tax Withholding. To the extent that the receipt, vesting or settlement of this Award results in compensation income or wages to the Participant for federal, state, local and/or foreign tax purposes, Participant shall make arrangements satisfactory to the Company regarding the payment of, any income tax, social insurance contribution or other applicable taxes that are required to be withheld in respect of this Award, which arrangements include the delivery of cash or cash equivalents, Shares (including previously owned Shares (which is not subject to any pledge or other security interest), net settlement, a broker-assisted sale, or other cashless withholding or reduction of the amount of shares otherwise issuable or delivered pursuant to this Award), other property, or any other legal consideration the Committee deems appropriate. If such tax obligations are satisfied through net settlement or the surrender of previously owned Shares, the maximum number of Shares that may be so withheld (or surrendered) shall be the number of Shares that have an aggregate Fair Market Value on the date of withholding or surrender equal to the aggregate amount of such tax liabilities determined based on the greatest withholding rates for federal, state, local and/or foreign tax purposes, including payroll taxes, that may be utilized without creating adverse accounting treatment for the Company with respect to this Award, as determined by the Committee. Any fraction of a Share required to satisfy such tax obligations shall be disregarded and the amount due shall be paid instead in cash to Participant. Participant acknowledges that there may be adverse tax consequences upon the receipt, vesting or settlement of this Award or disposition of the underlying shares and that Participant has been advised, and hereby is advised, to consult a tax advisor. Participant represents that Participant is in no manner relying on the Board, the Committee, the Company or an Affiliate or any of their respective managers, directors, officers, employees or authorized representatives (including attorneys, accountants, consultants, bankers, lenders, prospective lenders and financial representatives) for tax advice or an assessment of such tax consequences.

Article IV.

OTHER PROVISIONS

IV.1Adjustments. Participant acknowledges that the RSUs and the Shares subject to the RSUs are subject to adjustment, modification and termination in certain events as provided in this Agreement and the Plan.

IV.2Notices. All notices and other communications under this Agreement shall be in writing and shall be delivered to the parties at the following addresses (or at such other address for a party as shall be specified by like notice):

If to the Company, unless otherwise designated by the Company in a written notice to Participant (or other holder):

Maravai LifeSciences Holdings, Inc.

Attn: General Counsel

10770 Wateridge Circle Suite 200

San Diego, CA 92121

If to Participant, at Participant’s last known address on file with the Company. Any notice that is delivered personally or by overnight courier or telecopier in the manner provided herein shall be deemed to have been duly given to Participant when it is mailed by the Company or, if such notice is not mailed to Participant, upon receipt by Participant. Any notice that is

addressed and mailed in the manner herein provided shall be conclusively presumed to have been given to the party to whom it is addressed at the close of business, local time of the recipient, on the fourth day after the day it is so placed in the mail.

IV.3Titles. Titles are provided herein for convenience only and are not to serve as a basis for interpretation or construction of this Agreement.

IV.4Conformity to Securities Laws. Participant acknowledges that the Plan, the Grant Notice and this Agreement are intended to conform to the extent necessary with all Applicable Laws and, to the extent Applicable Laws permit, will be deemed amended as necessary to conform to Applicable Laws.

IV.5Successors and Assigns. The Company may assign any of its rights under this Agreement to single or multiple assignees, and this Agreement will inure to the benefit of the successors and assigns of the Company. Subject to the restrictions on transfer set forth in the Plan, this Agreement will be binding upon and inure to the benefit of the heirs, legatees, legal representatives, successors and assigns of the parties hereto.

IV.6Limitations Applicable to Section 16 Persons. Notwithstanding any other provision of the Plan or this Agreement, if Participant is subject to Section 16 of the Exchange Act, the Plan, the Grant Notice, this Agreement, the RSUs will be subject to any additional limitations set forth in any applicable exemptive rule under Section 16 of the Exchange Act (including any amendment to Rule 16b-3) that are requirements for the application of such exemptive rule. To the extent Applicable Laws permit, this Agreement will be deemed amended as necessary to conform to such applicable exemptive rule.

IV.7Entire Agreement. The Plan, the Grant Notice and this Agreement (including any exhibit hereto) constitute the entire agreement of the parties and supersede in their entirety all prior undertakings and agreements of the Company and Participant with respect to the subject matter hereof.

IV.8Agreement Severable. In the event that any provision of the Grant Notice or this Agreement is held illegal or invalid, the provision will be severable from, and the illegality or invalidity of the provision will not be construed to have any effect on, the remaining provisions of the Grant Notice or this Agreement.

IV.9Limitation on Participant’s Rights. Participation in the Plan confers no rights or interests other than as herein provided. This Agreement creates only a contractual obligation on the part of the Company as to amounts payable and may not be construed as creating a trust. Neither the Plan nor any underlying program, in and of itself, has any assets. Participant will have only the rights of a general unsecured creditor of the Company with respect to amounts credited and benefits payable, if any, with respect to the RSUs, and rights no greater than the right to receive cash or the Shares as a general unsecured creditor with respect to the RSUs, as and when settled pursuant to the terms of this Agreement.

IV.10Non-Transferability. During the lifetime of Participant, the RSUs may not be sold, pledged, assigned or transferred in any manner other than by will or the laws of descent and distribution, unless and until the Shares underlying the RSUs have been issued, and all restrictions applicable to such Shares have lapsed. Neither the RSUs not any interest or right therein shall be liable for the debts, contracts or engagements of Participant or his or her successors in interest or shall be subject to disposition by transfer, alienation, anticipation, pledge, encumbrance, assignment or any other means whether such disposition be voluntary or involuntary or by operation of law by judgment, levy, attachment, garnishment or any other legal

or equitable proceedings (including bankruptcy), and any attempted disposition thereof shall be null and void and of no effect, except to the extent that such disposition is permitted by the preceding sentence.

IV.11Legends. If a stock certificate is issued with respect to the Shares delivered hereunder, such certificate shall bear such legend or legends as the Committee deems appropriate in order to reflect the restrictions set forth in this Agreement and to ensure compliance with the terms and provisions of this Agreement, the rules, regulations and other requirements of the Securities and Exchange Commission and any other Applicable Laws. If the Shares issued hereunder are held in book-entry form, then such entry will reflect that the Shares are subject to the restrictions set forth in this Agreement.

IV.12No Right to Continued Service or Awards. Nothing in the Plan, the Grant Notice or this Agreement confers upon Participant any right to continue in the service of the Company or any Affiliate or interferes with or restricts in any way the rights of the Company and its Subsidiaries, which rights are hereby expressly reserved, to discharge or terminate the services of Participant at any time for any reason whatsoever, with or without Cause, except to the extent expressly provided otherwise in a written agreement between the Company or an Affiliate and Participant. The grant of the RSUs is a one-time benefit and does not create any contractual or other right to receive a grant of Awards or benefits in lieu of Awards in the future. Any future Awards will be granted at the sole discretion of the Company.

IV.13Satisfaction of Claims. Any issuance or transfer of Shares or other property to Participant or Participant’s legal representative, heir, legatee or distribute, in accordance with the Plan, the Grant Notice and this Agreement shall be in full satisfaction of all claims of such person hereunder.

IV.14Counterparts. The Grant Notice may be executed in one or more counterparts, including by way of any electronic signature, subject to Applicable Law, each of which will be deemed an original and all of which together will constitute one instrument.

IV.15Company Recoupment of Awards. Participant’s rights with respect to this Award shall in all events be subject to (a) any right that the Company may have under any Company recoupment policy or other agreement or arrangement with Participant, or (b) any right or obligation that the Company may have regarding the clawback of “incentive-based compensation” under Section 10D of the Exchange Act and any applicable rules and regulations promulgated thereunder from time to time by the U.S. Securities and Exchange Commission.

* * * * *

MARAVAI LIFESCIENCES HOLDINGS, INC.

2020 OMNIBUS INCENTIVE PLAN

RESTRICTED STOCK UNIT GRANT NOTICE

Pursuant to the terms and conditions of the Maravai LifeSciences Holdings, Inc. 2020 Omnibus Incentive Plan, as amended from time to time (the “Plan”), Maravai LifeSciences Holdings, Inc., a Delaware corporation (the “Company”), hereby grants to the individual listed below (“Participant”) the number of restricted stock units (the “RSUs”) set forth below. This award of RSUs (this “Award”) is subject to the terms and conditions set forth herein and in the Restricted Stock Unit Agreement attached hereto as Exhibit A (the “Agreement”), which is incorporated herein by reference. Capitalized terms used but not defined herein shall have the meanings set forth in the Plan.

Participant:

Grant Date:

Number of RSUs:

Vesting Commencement Date: [Date of Grant]

Vesting Schedule: Subject to the Agreement, the Plan and other terms and conditions set forth herein, (i) 1/2 of the RSUs will vest on the Vesting Commencement Date set forth above and (ii) 1/2 of the RSUs will vest on the first anniversary of the Vesting Commencement Date, so long as Participant has not incurred a Termination of Service prior to the vesting date:

[Signature Page Follows]

By Participant’s signature below, Participant agrees to be bound by the terms of this Grant Notice, the Plan and the Agreement. Participant has reviewed the Plan, this Grant Notice and the Agreement in their entirety, has had an opportunity to obtain the advice of counsel prior to executing this Grant Notice and fully understands all provisions of the Plan, this Grant Notice and the Agreement. Participant hereby agrees to accept as binding, conclusive and final all decisions or interpretations of the Administrator upon any questions arising under the Plan, this Grant Notice or the Agreement. This Grant Notice may be executed in one or more counterparts (including portable document format (.pdf) and facsimile counterparts), each of which shall be deemed to be an original, but all of which together shall constitute one and the same agreement.

Notwithstanding any provision of this Grant Notice or the Agreement, if Participant has not executed this Grant Notice within 90 days following the Grant Date set forth above, Participant will be deemed to have accepted this Award, subject to all of the terms and conditions of this Grant Notice, the Agreement and the Plan.

MARAVAI LIFESCIENCES PARTICIPANT

HOLDINGS, INC.

By:

Name: Kurt A. Oreshack

Title: Secretary and General Counsel

Exhibit A

RESTRICTED STOCK UNIT AGREEMENT

Capitalized terms not specifically defined in this Agreement have the meanings specified in the Grant Notice or, if not defined in the Grant Notice, in the Plan.

Article I.

GENERAL

I.1Award of RSUs. The Company has granted the RSUs to Participant effective as of the grant date set forth in the Grant Notice (the “Grant Date”). Each RSU represents the right to receive one Share as set forth in this Agreement. Participant will have no right to the distribution of any Shares or payment of any cash until the time (if ever) the RSUs have vested.

I.2Incorporation of Terms of Plan. The RSUs are subject to the terms and conditions set forth in this Agreement and the Plan, which is incorporated herein by reference. In the event of any inconsistency between the Plan and this Agreement, the terms of the Plan will control.

I.3Unsecured Promise. The RSUs will at all times prior to settlement represent an unsecured Company obligation payable only from the Company’s general assets.

Article II.

VESTING; FORFEITURE AND SETTLEMENT

II.1Vesting; Forfeiture.

(a)The RSUs will vest according to the vesting schedule in the Grant Notice. In the event of Participant’s Termination of Service for any reason, all unvested RSUs will immediately and automatically be cancelled and forfeited, except as otherwise determined by the Administrator or provided in a binding written agreement between Participant and the Company.

(b)Notwithstanding anything in the Grant Notice, this Agreement or the Plan to the contrary, (i) the RSUs will vest in their entirety upon Participant’s Termination of Service due to Participant’s death or Disability, and (ii) in the event of a Change in Control, so long as Participant continuously provides services to the Company or any Affiliate from the Grant Date through the consummation of such Change in Control, any unvested RSUs that would have vested due to Participant’s continued service to the Company during the six (6) months following such Change in Control shall vest in their entirety upon such Change in Control.

II.2Settlement. As soon as administratively practicable following the vesting of RSUs pursuant to Section 2.1, but in no event later than 30 days after such vesting date, the Company shall deliver to Participant a number of Shares equal to the number of RSUs subject to this Award. All Shares issued hereunder shall be delivered either by delivering one or more certificates for such shares to Participant or by entering such shares in book-entry form, as determined by the Committee in its sole discretion. The value of Shares shall not bear any interest owing to the passage of time.

Article III.

TAXATION AND TAX WITHHOLDING

III.1Representation. Participant represents to the Company that Participant has reviewed with Participant’s own tax advisors the tax consequences of this Award and the

transactions contemplated by the Grant Notice and this Agreement. Participant is relying solely on such advisors and not on any statements or representations of the Company or any of its agents.

III.2Tax Withholding. To the extent that the receipt, vesting or settlement of this Award results in compensation income or wages to the Participant for federal, state, local and/or foreign tax purposes, Participant shall make arrangements satisfactory to the Company regarding the payment of, any income tax, social insurance contribution or other applicable taxes that are required to be withheld in respect of this Award, which arrangements include the delivery of cash or cash equivalents, Shares (including previously owned Shares (which is not subject to any pledge or other security interest), net settlement, a broker-assisted sale, or other cashless withholding or reduction of the amount of shares otherwise issuable or delivered pursuant to this Award), other property, or any other legal consideration the Committee deems appropriate. If such tax obligations are satisfied through net settlement or the surrender of previously owned Shares, the maximum number of Shares that may be so withheld (or surrendered) shall be the number of Shares that have an aggregate Fair Market Value on the date of withholding or surrender equal to the aggregate amount of such tax liabilities determined based on the greatest withholding rates for federal, state, local and/or foreign tax purposes, including payroll taxes, that may be utilized without creating adverse accounting treatment for the Company with respect to this Award, as determined by the Committee. Any fraction of a Share required to satisfy such tax obligations shall be disregarded and the amount due shall be paid instead in cash to Participant. Participant acknowledges that there may be adverse tax consequences upon the receipt, vesting or settlement of this Award or disposition of the underlying shares and that Participant has been advised, and hereby is advised, to consult a tax advisor. Participant represents that Participant is in no manner relying on the Board, the Committee, the Company or an Affiliate or any of their respective managers, directors, officers, employees or authorized representatives (including attorneys, accountants, consultants, bankers, lenders, prospective lenders and financial representatives) for tax advice or an assessment of such tax consequences.

Article IV.

OTHER PROVISIONS

IV.1Adjustments. Participant acknowledges that the RSUs and the Shares subject to the RSUs are subject to adjustment, modification and termination in certain events as provided in this Agreement and the Plan.

IV.2Notices. All notices and other communications under this Agreement shall be in writing and shall be delivered to the parties at the following addresses (or at such other address for a party as shall be specified by like notice):

If to the Company, unless otherwise designated by the Company in a written notice to Participant (or other holder):

Maravai LifeSciences Holdings, Inc.

Attn: General Counsel

10770 Wateridge Circle Suite 200

San Diego, CA 92121

If to Participant, at Participant’s last known address on file with the Company. Any notice that is delivered personally or by overnight courier or telecopier in the manner provided herein shall be deemed to have been duly given to Participant when it is mailed by the Company or, if such notice is not mailed to Participant, upon receipt by Participant. Any notice that is

addressed and mailed in the manner herein provided shall be conclusively presumed to have been given to the party to whom it is addressed at the close of business, local time of the recipient, on the fourth day after the day it is so placed in the mail.

IV.3Titles. Titles are provided herein for convenience only and are not to serve as a basis for interpretation or construction of this Agreement.

IV.4Conformity to Securities Laws. Participant acknowledges that the Plan, the Grant Notice and this Agreement are intended to conform to the extent necessary with all Applicable Laws and, to the extent Applicable Laws permit, will be deemed amended as necessary to conform to Applicable Laws.

IV.5Successors and Assigns. The Company may assign any of its rights under this Agreement to single or multiple assignees, and this Agreement will inure to the benefit of the successors and assigns of the Company. Subject to the restrictions on transfer set forth in the Plan, this Agreement will be binding upon and inure to the benefit of the heirs, legatees, legal representatives, successors and assigns of the parties hereto.

IV.6Limitations Applicable to Section 16 Persons. Notwithstanding any other provision of the Plan or this Agreement, if Participant is subject to Section 16 of the Exchange Act, the Plan, the Grant Notice, this Agreement, the RSUs will be subject to any additional limitations set forth in any applicable exemptive rule under Section 16 of the Exchange Act (including any amendment to Rule 16b-3) that are requirements for the application of such exemptive rule. To the extent Applicable Laws permit, this Agreement will be deemed amended as necessary to conform to such applicable exemptive rule.

IV.7Entire Agreement. The Plan, the Grant Notice and this Agreement (including any exhibit hereto) constitute the entire agreement of the parties and supersede in their entirety all prior undertakings and agreements of the Company and Participant with respect to the subject matter hereof.

IV.8Agreement Severable. In the event that any provision of the Grant Notice or this Agreement is held illegal or invalid, the provision will be severable from, and the illegality or invalidity of the provision will not be construed to have any effect on, the remaining provisions of the Grant Notice or this Agreement.

IV.9Limitation on Participant’s Rights. Participation in the Plan confers no rights or interests other than as herein provided. This Agreement creates only a contractual obligation on the part of the Company as to amounts payable and may not be construed as creating a trust. Neither the Plan nor any underlying program, in and of itself, has any assets. Participant will have only the rights of a general unsecured creditor of the Company with respect to amounts credited and benefits payable, if any, with respect to the RSUs, and rights no greater than the right to receive cash or the Shares as a general unsecured creditor with respect to the RSUs, as and when settled pursuant to the terms of this Agreement.

IV.10Non-Transferability. During the lifetime of Participant, the RSUs may not be sold, pledged, assigned or transferred in any manner other than by will or the laws of descent and distribution, unless and until the Shares underlying the RSUs have been issued, and all restrictions applicable to such Shares have lapsed. Neither the RSUs not any interest or right therein shall be liable for the debts, contracts or engagements of Participant or his or her successors in interest or shall be subject to disposition by transfer, alienation, anticipation, pledge, encumbrance, assignment or any other means whether such disposition be voluntary or involuntary or by operation of law by judgment, levy, attachment, garnishment or any other legal

or equitable proceedings (including bankruptcy), and any attempted disposition thereof shall be null and void and of no effect, except to the extent that such disposition is permitted by the preceding sentence.

IV.11Legends. If a stock certificate is issued with respect to the Shares delivered hereunder, such certificate shall bear such legend or legends as the Committee deems appropriate in order to reflect the restrictions set forth in this Agreement and to ensure compliance with the terms and provisions of this Agreement, the rules, regulations and other requirements of the Securities and Exchange Commission and any other Applicable Laws. If the Shares issued hereunder are held in book-entry form, then such entry will reflect that the Shares are subject to the restrictions set forth in this Agreement.

IV.12No Right to Continued Service or Awards. Nothing in the Plan, the Grant Notice or this Agreement confers upon Participant any right to continue in the service of the Company or any Affiliate or interferes with or restricts in any way the rights of the Company and its Subsidiaries, which rights are hereby expressly reserved, to discharge or terminate the services of Participant at any time for any reason whatsoever, with or without Cause, except to the extent expressly provided otherwise in a written agreement between the Company or an Affiliate and Participant. The grant of the RSUs is a one-time benefit and does not create any contractual or other right to receive a grant of Awards or benefits in lieu of Awards in the future. Any future Awards will be granted at the sole discretion of the Company.

IV.13Satisfaction of Claims. Any issuance or transfer of Shares or other property to Participant or Participant’s legal representative, heir, legatee or distribute, in accordance with the Plan, the Grant Notice and this Agreement shall be in full satisfaction of all claims of such person hereunder.

IV.14Counterparts. The Grant Notice may be executed in one or more counterparts, including by way of any electronic signature, subject to Applicable Law, each of which will be deemed an original and all of which together will constitute one instrument.

IV.15Company Recoupment of Awards. Participant’s rights with respect to this Award shall in all events be subject to (a) any right that the Company may have under any Company recoupment policy or other agreement or arrangement with Participant, or (b) any right or obligation that the Company may have regarding the clawback of “incentive-based compensation” under Section 10D of the Exchange Act and any applicable rules and regulations promulgated thereunder from time to time by the U.S. Securities and Exchange Commission.

* * * * *

Exhibit 99.1

Maravai LifeSciences Appoints R. Andrew Eckert as Chairman of the Board of Directors

Carl Hull to Retire as Executive Chairman

SAN DIEGO, Calif.; – December 5, 2024 - Maravai LifeSciences Holdings, Inc. (“Maravai” or the “Company”) (NASDAQ: MRVI), a global provider of life science reagents and services to researchers and biotech innovators, announced that Carl Hull will retire from his position as Executive Chairman of the Board and that the Board of Directors has unanimously elected R. Andrew Eckert to succeed him as Chairman of the Board, effective December 5, 2024.

Carl Hull founded Maravai in 2014 and served as Chief Executive Officer, assuming the role of Executive Chairman in October 2022.

“Leading Maravai has been the single most rewarding experience in my career. I am extremely proud of what we have accomplished together over the past 10 years,” stated Carl Hull. “I extend my sincere thanks to Trey Martin, our CEO, the rest of our leadership team and to the dedicated employees across the world who enthusiastically serve our customers and their communities every day. I am excited about the company’s future prospects and am confident that Maravai has the team, the talent, and the technology to deliver on its long-term objectives.”

"On behalf of the entire Board, I thank Carl for his incredible commitment to Maravai since he founded the Company in 2014.” said Constantine (“Dean”) Mihas, Board member and Co-CEO of GTCR. “I congratulate him for his distinguished career and deeply appreciate his vision and unwavering service to building Maravai and positioning the company for long-term success. He has been a model of corporate leadership and integrity in our industry and beyond, and we wish him well in his well-deserved retirement."

Mihas continued, “We also want to welcome Andy as our new Chair and Board member. Andy is a healthcare industry veteran with extensive experience as an executive officer of several healthcare companies. He brings deep knowledge of operations, strategic planning, product development and marketing to our Board and has valuable corporate governance insight gained from having served as Chief Executive Officer and Director of publicly held companies. We look forward to leveraging his impressive executive experience to help guide Maravai to achieve significant scale.”

“I'm honored to join the Board of Directors at Maravai, a company dedicated to innovation to help our customers improve human health,” said Eckert. “I look forward to contributing to the success and transformative impact of this remarkable organization while concurrently driving long-term shareholder value."

About R. Andrew Eckert

Mr. Eckert is a Senior Adviser to Permira, a global private equity leader. Prior to Permira, he served as CEO of Zelis, a healthcare payments and cost containment business. Before Zelis, he served as CEO of wound care leader Kinetic Concepts, Inc. (KCI) from 2017 until its sale to 3M in

2019. Prior to joining KCI, he served as Chief Executive Officer of Valence Health, an emerging leader in value-based healthcare, until its sale in 2016. Andy previously served as Chief Executive Officer of TriZetto, a leader in payer information technology (acquired by Cognizant), and as Chairman and Chief Executive Officer of CRC Health Group, a leading behavioral health treatment provider (acquired by Acadia). Earlier in his career, he was Chief Executive Officer of Eclipsys Corporation from 2005 to 2009, and Chief Executive Officer of SumTotal Systems from 2002 to 2005. Andy began his career at ADAC Laboratories, including four years as Chairman and Chief Executive Officer until its sale to Philips Medical Systems in 2000. Andy has served on several corporate boards and is currently the Chairman of Kipu Health, Lead Director at Fortrea (NASDAQ: FTRE), and a Director at Becton, Dickinson and Company (NYSE: BDX). He was Chairman of Varian Medical Systems for seven years until its acquisition by Siemens Healthineers in 2021. He has a Bachelor of Science in Industrial Engineering and a Master of Business Administration, both from Stanford University.

About Maravai

Maravai is a leading life sciences company providing critical products to enable the development of drug therapies, diagnostics, and novel vaccines and to support research on human diseases. Maravai’s companies are leaders in providing products and services in the fields of nucleic acid synthesis and biologics safety testing to many of the world's leading biopharmaceutical, vaccine, diagnostics and cell and gene therapies companies.

Forward-looking Statements

This press release may contain "forward-looking statements" within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Investors are cautioned that statements in this press release which are not strictly historical statements constitute forward-looking statements, including, without limitation, statements related to the expectation that Mr. Eckert will help Maravai achieve scale and drive long-term shareholder value, constitute forward-looking statements identified by words like “plan,” “will,” “expect,” “may,” “anticipate,” or “could” and similar expressions. Such forward-looking statements are subject to a number of risks and uncertainties that could cause actual results to differ materially from those anticipated, including, without limitation, the risks and uncertainties described in greater detail in the “Risk Factors” section of our most recent Annual Report on Form 10-K and other filings with the U.S. Securities and Exchange Commission. Actual results may differ materially from those contemplated by these forward-looking statements, and therefore you should not rely upon them. These forward-looking statements reflect our current views and we do not undertake to update any of these forward-looking statements to reflect a change in its views or events or circumstances that occur after the date hereof except as required by law.

Contact Information:

Deb Hart

Maravai LifeSciences

+ 1 858-988-5917

ir@maravai.com

v3.24.3

Cover

|

Dec. 03, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Dec. 03, 2024

|

| Entity Registrant Name |

Maravai LifeSciences Holdings, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39725

|

| Entity Tax Identification Number |

85-2786970

|

| Entity Address, Address Line One |

10770 Wateridge Circle

|

| Entity Address, Address Line Two |

Suite 200

|

| Entity Address, City or Town |

San Diego

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92121

|

| City Area Code |

858

|

| Local Phone Number |

546-0004

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A Common Stock, $0.01 par value

|

| Trading Symbol |

MRVI

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001823239

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

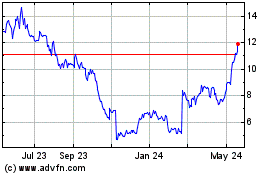

Maravai LifeSciences (NASDAQ:MRVI)

Historical Stock Chart

From Nov 2024 to Dec 2024

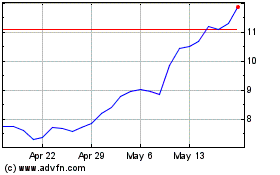

Maravai LifeSciences (NASDAQ:MRVI)

Historical Stock Chart

From Dec 2023 to Dec 2024