Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

01 February 2025 - 12:04AM

Edgar (US Regulatory)

Issuer Free Writing Prospectus

Filed Pursuant to Rule 433

Registration File No. 333-284510

Relating to the

Preliminary

Prospectus Supplement

Dated January 27, 2025

(To Prospectus Dated January 27, 2025)

PRICING TERM SHEET

January 30, 2025

MicroStrategy Incorporated

Offering of

7,300,000

Shares of

8.00% Series A Perpetual Strike Preferred Stock

The information in this pricing term sheet supplements MicroStrategy Incorporated’s preliminary prospectus supplement, dated January 27, 2025

(the “Preliminary Prospectus Supplement”), and supersedes the information in the Preliminary Prospectus Supplement to the extent inconsistent with the information in the Preliminary Prospectus Supplement. Terms used, but not defined, in

this pricing term sheet have the respective meanings set forth in the Preliminary Prospectus Supplement. As used in this pricing term sheet, “we,” “our” and “us” refer to MicroStrategy Incorporated and not to its

subsidiaries.

|

|

|

| Issuer |

|

MicroStrategy Incorporated. |

|

|

| Securities Offered |

|

8.00% Series A Perpetual Strike Preferred Stock, $0.001 par value per share, of the Issuer (the “Perpetual Strike Preferred Stock”). |

|

|

| Amount Offered |

|

7,300,000 shares of Perpetual Strike Preferred Stock. |

|

|

| Public Offering Price |

|

$80.00 per share of Perpetual Strike Preferred Stock. |

|

|

| Trade Date |

|

January 31, 2025. |

|

|

| Settlement Date |

|

February 5, 2025, which will be the third business day after the Trade Date (this settlement cycle being referred to as “T+3”). Under Rule 15c6-1 under the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), trades in the secondary market generally must settle in one business day, unless the parties to the trade expressly agree otherwise. Accordingly, purchasers who wish to trade Perpetual Strike

Preferred Stock before the business day before the Settlement Date must, because the Perpetual Strike Preferred Stock initially will settle T+3, specify an alternate settlement cycle at the time of such trade to prevent a failed settlement. Those

purchasers should consult their advisors. |

- 1 -

|

|

|

| Class A Common Stock |

|

Class A Common Stock, $0.001 per share, of the Issuer. |

|

|

| Ticker / Exchange for Class A Common Stock |

|

MSTR / Nasdaq Global Select Market (“NASDAQ”). |

|

|

| Last Reported Sale Price per Share of Class A Common Stock on NASDAQ on January 30,

2025 |

|

$340.09. |

|

|

| Liquidation Preference |

|

$100 per share of Perpetual Strike Preferred Stock. |

|

|

| Regular Dividend Rate |

|

8.00% per annum. |

|

|

| Regular Dividend Payment Dates |

|

March 31, June 30, September 30 and December 31 of each year, beginning on March 31, 2025. |

|

|

| Regular Record Dates |

|

March 15, June 15, September 15 and December 15. |

|

|

| Initial Conversion Rate |

|

0.1000 shares of Class A Common Stock per share of Perpetual Strike Preferred Stock. The Conversion Rate is subject to adjustment in the manner described in the Preliminary Prospectus Supplement. |

|

|

| Initial Floor Price |

|

$119.03 per share of Class A Common Stock (which is equal to approximately 35% of the Last Reported Sale Price per Share of Class A Common Stock on NASDAQ on January 30, 2025). The Floor Price is subject to adjustment

in the manner described in the Preliminary Prospectus Supplement. |

|

|

| When the Perpetual Strike Preferred Stock May Be Converted |

|

Notwithstanding anything to the contrary in the Preliminary Prospectus Supplement, the Perpetual Strike Preferred Stock may be surrendered for conversion on any business day, subject to the following: |

|

|

|

|

• the Perpetual Strike Preferred Stock may be surrendered for conversion only

after the open of business and before the close of business on a business day; |

- 2 -

|

|

|

|

|

• if a preferred stockholder has validly delivered a fundamental change

repurchase notice with respect to any share of Perpetual Strike Preferred Stock, then such share may not be converted, except to the extent (i) such notice is withdrawn in accordance with the procedures described in the Preliminary Prospectus

Supplement under the caption “Description of Perpetual Strike Preferred Stock—Fundamental Change Permits Preferred Stockholders to Require Us to Repurchase Perpetual Strike Preferred Stock—Procedures to Exercise the Fundamental Change

Repurchase Right”; or (ii) we fail to pay the related fundamental change repurchase price for such share; and |

|

|

|

|

• if we call the Perpetual Strike Preferred Stock for redemption, then the

Perpetual Strike Preferred Stock may not be converted after the close of business on the second business day immediately before the related redemption date (unless we fail to pay the redemption price due on such redemption date in full, in which

case the Perpetual Strike Preferred Stock may be converted at any time until such time as we pay such redemption price in full). |

|

|

|

|

The final prospectus supplement for this offering will reflect the changes described in the previous paragraph. |

|

|

| Directed Share Program |

|

At our request, the underwriters have reserved up to 365,000 shares of the Perpetual Strike Preferred Stock, or 5% of the shares offered, for sale at the public offering price through a directed share program to certain of our

employees based in the United States. The number of shares of the Perpetual Strike Preferred Stock available for sale to the general public will be reduced to the extent that such persons purchase such reserved shares. Any reserved shares not so

purchased will be offered by the underwriters to the general public on the same basis as the other shares offered in this offering. Fidelity Brokerage Services LLC and Fidelity Capital Markets, a division of National Financial Services LLC, a

selling group member in this offering, will administer our directed share program. See “Underwriting—Directed Share Program” in the Preliminary Prospectus Supplement. |

|

|

| Listing |

|

No public market currently exists for the Perpetual Strike Preferred Stock. We have applied to list the Perpetual Strike Preferred Stock on The Nasdaq Global Select Market under the symbol “STRK.” If the listing is

approved, we expect trading in the Perpetual Strike Preferred Stock to commence within 30 days after the Settlement Date. |

- 3 -

|

|

|

| Use of Proceeds |

|

We estimate that the net proceeds to us from this offering will be approximately $563.4 million, after deducting the underwriting discounts and commissions and our estimated offering expenses. We intend to use the net proceeds

from this offering for general corporate purposes, including the acquisition of bitcoin and for working capital. |

|

|

| Book-Running Managers |

|

Barclays Capital Inc. |

|

|

Moelis & Company LLC |

|

|

BTIG, LLC |

|

|

TD Securities (USA) LLC |

|

|

Keefe, Bruyette & Woods, Inc. |

|

|

| Co-Managers |

|

AmeriVet Securities, Inc. |

|

|

Bancroft Capital, LLC |

|

|

The Benchmark Company, LLC |

|

|

| CUSIP / ISIN Numbers for the Perpetual Strike Preferred Stock |

|

594972 887 / US5949728878. |

* * *

We

have filed a registration statement (including a prospectus) and the Preliminary Prospectus Supplement with the SEC for the offering to which this communication relates. Before you invest, you should read the Preliminary Prospectus Supplement and

the prospectus in that registration statement and other documents we have filed with the SEC for more complete information about us and this offering. You may get these documents free by visiting EDGAR on the SEC website at

www.sec.gov. Alternatively, we, any underwriter or any dealer participating in the offering will arrange to send you the Preliminary Prospectus Supplement (or, when available, the final prospectus supplement) and the

accompanying prospectus upon request to: Barclays Capital Inc., c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717, by email at barclaysprospectus@broadridge.com or telephone at (888)

603-5847, Moelis & Company LLC, 399 Park Avenue, 4th Floor, New York, New York 10022 or by telephone at (800) 539-9413, BTIG, LLC, 65 East 55th Street, New

York, NY 10022, by telephone at (212) 593-7555, TD Securities (USA) LLC, 1 Vanderbilt Avenue, New York, NY 10017, by email at TD.ECM_Prospectus@tdsecurities.com or by telephone at (855) 495-9846 or Keefe, Bruyette & Woods, Inc., 787 Seventh Avenue, 4th Floor, New York, NY 10019, Attention: Equity Capital Markets, by telephone at (800) 966-1559 or by

email at USCapitalMarkets@kbw.com.

The information in this pricing term sheet is not a complete description of the Perpetual Strike Preferred

Stock or the offering. You should rely only on the information contained or incorporated by reference in the Preliminary Prospectus Supplement and the accompanying prospectus, as supplemented by this pricing term sheet, in making an investment

decision with respect to the Perpetual Strike Preferred Stock.

- 4 -

ANY DISCLAIMERS OR OTHER NOTICES THAT MAY APPEAR BELOW ARE NOT APPLICABLE TO THIS COMMUNICATION AND

SHOULD BE DISREGARDED. SUCH DISCLAIMERS OR OTHER NOTICES WERE AUTOMATICALLY GENERATED AS A RESULT OF THIS COMMUNICATION BEING SENT VIA BLOOMBERG OR ANOTHER EMAIL SYSTEM.

- 5 -

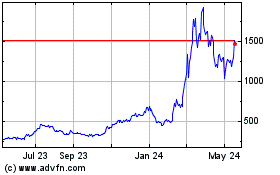

MicroStrategy (NASDAQ:MSTR)

Historical Stock Chart

From Feb 2025 to Mar 2025

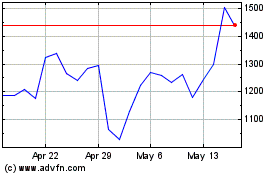

MicroStrategy (NASDAQ:MSTR)

Historical Stock Chart

From Mar 2024 to Mar 2025