NewAmsterdam Pharma Company N.V. (Nasdaq: NAMS or “NewAmsterdam” or

the “Company”), a late-stage, clinical biopharmaceutical company

developing oral, non-statin medicines for patients at risk of

cardiovascular disease (“CVD”) with elevated low-density

lipoprotein cholesterol (“LDL-C”), for whom existing therapies are

not sufficiently effective or well-tolerated, today announced

financial results for the full year ended December 31, 2024 and

provided a corporate update.

"2024 was a transformative year for NewAmsterdam, marked by

compelling data from three pivotal Phase 3 trials – BROOKLYN,

TANDEM, and BROADWAY – where we observed durable LDL-C lowering by

obicetrapib for CVD patients. In 2025, we look forward to sharing

additional data and insights from these trials, including the

impact of obicetrapib on the exploratory endpoint of major adverse

cardiac events (“MACE”), at leading medical meetings and journal

publications, as well as advancing regulatory interactions,

including an anticipated EMA submission in the second half by our

partner Menarini,” said Michael Davidson, M.D., Chief Executive

Officer of NewAmsterdam.

“Additionally, we are increasing focus and efforts around launch

readiness with plans to scale up and build inventory and commercial

capabilities sufficient to support the launch of obicetrapib in

both the U.S. and Europe, if approved. Following our successful

$479 million upsized financing in December, we have the necessary

capital to fund operations beyond the PREVAIL cardiovascular

outcomes trial (“CVOT”) readout and commercial launch of

obicetrapib in the U.S., pending regulatory approval. We are

excited to build on the strong momentum from the past year, as we

work diligently to deliver a potentially transformative therapy to

millions of CVD patients globally,” continued Dr. Davidson.

Clinical Development Updates

NewAmsterdam is developing obicetrapib, an oral, low-dose and

once-daily, highly-selective cholesteryl ester transfer protein

(“CETP”) inhibitor, as a monotherapy and in fixed-dose combination

with ezetimibe, as the preferred LDL-C lowering therapy to be used

in patients at risk of CVD for whom existing therapies are not

sufficiently effective or well-tolerated.

Throughout 2024, NewAmsterdam announced positive topline results

for three Phase 3 clinical studies, each with safety comparable to

placebo:

- BROADWAY evaluated obicetrapib in 2,530 adult patients with

established atherosclerotic cardiovascular disease (“ASCVD”) and/or

heterozygous familial hypercholesterolemia (“HeFH”), whose LDL-C is

not adequately controlled despite being on maximally tolerated

lipid-lowering therapy. In December, NewAmsterdam reported positive

topline data from the BROADWAY study. The primary endpoint was the

least-squares (“LS”) mean of the percent change in LDL-C from

baseline to day 84 for obicetrapib 10 mg compared to placebo. The

primary endpoint was achieved with statistical significance with an

LS mean LDL-C reduction of 33% (p<0.0001) compared to placebo at

day 84. Mean and median reductions in LDL-C from placebo at day 84

were 33% and 36%, respectively. As part of the safety analysis, the

trial adjudicated MACE, as an exploratory analysis, a 21% reduction

in the composite of CHD death, non-fatal myocardial infarction,

non-fatal stroke and coronary revascularization favoring

obicetrapib was observed, after one year. NewAmsterdam expects to

report additional data at an upcoming medical conference and to

publish the data in a major medical journal.

- TANDEM evaluated obicetrapib as part of a fixed-dose

combination tablet with ezetimibe, a non-statin oral LDL-lowering

therapy, in 407 patients with established ASCVD or multiple risk

factors for ASCVD and/or HeFH, whose LDL-C is not adequately

controlled despite being on maximally tolerated lipid-lowering

therapy. In November, NewAmsterdam reported that the TANDEM trial

met all co-primary endpoints, including the obicetrapib-ezetimibe

fixed dose combination achieving an LS mean LDL-C reduction of 49%

(p < 0.0001) compared to placebo at day 84. Mean and median

reductions in LDL-C versus placebo at day 84 were 52% and 54%,

respectively. NewAmsterdam expects to report additional data at an

upcoming medical conference and to publish the data in a major

medical journal.

- BROOKLYN evaluated obicetrapib in 354 patients with HeFH, whose

LDL-C is not adequately controlled despite being on maximally

tolerated lipid-lowering therapy. In July, NewAmsterdam reported

that the BROOKLYN trial met its primary endpoint, achieving an LS

mean LDL-C reduction of 36% (p < 0.0001) compared to placebo at

day 84, with additional data presented at the American Heart

Association Scientific Sessions 2024 in November. Mean and median

reductions in LDL-C versus placebo at day 84 were 36% and 39%,

respectively.

In addition, NewAmsterdam announced that the United States

Patent and Trademark Office (“USPTO”) issued a new patent covering

the solid form of obicetrapib. The issuance of this composition of

matter patent provides intellectual property protection for

obicetrapib until July 2043 in the United States. The USPTO has now

issued or allowed a total of ten patents covering obicetrapib and

its uses.

Ongoing Trials:

Following the successful completion of the Phase 3 BROADWAY,

TANDEM, and BROOKLYN trials NewAmsterdam plans to announce

additional data over the course of 2025. NewAmsterdam also plans to

publish data on a significant number of topics that support the

overall benefit and differentiation of obicetrapib and the

fixed-dose combination of obicetrapib plus ezetimibe.

The following trials are currently ongoing:

- PREVAIL Phase 3 trial. PREVAIL is a CVOT evaluating obicetrapib

in patients with a history of ASCVD, whose LDL-C is not adequately

controlled despite being on maximally tolerated lipid-lowering

therapy. NewAmsterdam completed enrollment of over 9,500 patients

in April 2024.

- VINCENT Phase 2 trial. The trial will evaluate the effects of

obicetrapib alone and in combination with evolocumab on lipoprotein

(a) (“Lp(a)”) in patients with mild dyslipidemia. The single arm

study will treat patients with obicetrapib 10 mg daily for 8 weeks

followed by obicetrapib 10 mg daily plus evolocumab 140 mg/dL every

other week for 8 weeks. There will be two cohorts in the study. The

first cohort will include 39 participants with Lp(a) levels greater

than 125 nmol/L, and the second cohort will include 30 participants

with Lp(a) levels greater than 50 nmol/L but less than 125

nmol/L.

- REMBRANDT Phase 3 trial. The trial will utilize coronary

computed tomography angiography imaging to evaluate the effect of

obicetrapib plus ezetimibe FDC on coronary plaque. The

placebo-controlled, double-blind, randomized, Phase 3 study is

being conducted in adult participants with high-risk ASCVD with

evidence of coronary plaque who are not adequately controlled by

their maximally tolerated lipid-modifying therapy, to assess the

impact of the obicetrapib 10 mg + ezetimibe 10 mg FDC daily on

coronary plaque and inflammation characteristics. The study is

expected to enroll 300 patients.

Full Year 2024 Financial Results

- Cash Position: As of December 31, 2024,

NewAmsterdam recorded cash and cash equivalents of $771.7 million

and $62.5 million of marketable securities, compared to $340.5

million as of December 31, 2023. The increase in cash is primarily

driven by the proceeds of the follow-on public equity offerings

completed during the year, the achievement of a clinical

development milestone, warrant exercises and option exercises,

partially offset by cash outflows related to research and

development costs as the Company continues development of

obicetrapib and increased spending on selling, general and

administrative expenses to support the Company’s growing

organization.

- Revenue: NewAmsterdam recognized $45.6 million

in revenue for the year ended December 31, 2024, compared to $14.1

million in the year ended December 31, 2023. This increase is

primarily due to an increase in the revenue recognized related to

the achievement of a clinical success milestone and the recognition

of revenue related to a general development cost

reimbursement.

- Research and Development (“R&D”) Expenses:

R&D expenses were of $151.4 million for year ended December 31,

2024, compared to $159.4 million in the year ended December 31,

2023. This decrease is primarily due to a decrease in manufacturing

and clinical costs due to clinical trials which are complete or

nearing completion, partially offset by an increase in personnel

and regulatory expenses.

- Selling, General and Administrative (“SG&A”)

Expenses: SG&A expenses were $70.4 million for the

year ended December 31, 2024, compared to $37.6 million in the year

ended December 31, 2023. This increase is primarily due to

increased personnel and marketing and communication costs as we

begin to expand and build capabilities to support our planned

commercial launch of obicetrapib, if approved.

- Net loss: Net loss for the year ended December

31, 2024 was $241.6 million, compared to net loss of $176.9 million

in the year ended December 31, 2023. The individual components of

the change are described above in addition to non-cash losses

related to changes in the fair value of our derivative

liabilities.

About Obicetrapib

Obicetrapib is a novel, oral, low-dose CETP inhibitor that

NewAmsterdam is developing to overcome the limitations of current

LDL-lowering treatments. In each of the Company’s Phase 2 trials,

ROSE2, TULIP, ROSE, and OCEAN, as well as the Company’s Phase 3

BROOKLYN, BROADWAY and TANDEM trials, evaluating obicetrapib as

monotherapy or combination therapy, the Company observed

statistically significant LDL-lowering combined with a side effect

profile similar to that of placebo. The Company commenced the Phase

3 PREVAIL cardiovascular outcomes trial in March 2022, which is

designed to assess the potential of obicetrapib to reduce

occurrences of MACE. The Company completed enrollment of PREVAIL in

April 2024 and randomized over 9,500 patients. Commercialization

rights of obicetrapib in Europe, either as a monotherapy or as part

of a fixed-dose combination with ezetimibe, have been exclusively

granted to the Menarini Group, an Italy-based, leading

international pharmaceutical and diagnostics company.

About Cardiovascular Disease

Cardiovascular disease remains the leading cause of death

globally, despite the availability of lipid-lowering therapies

(LLTs). By 2050 more than 184 million U.S. adults are expected to

be affected by CVD and hypertension, including 27 million with

coronary heart disease and 19 million with stroke. In the United

States from 2019 through 2022, CVD age-adjusted mortality rates

increased by 9%, reversing the trend observed since 2010 and

undoing nearly a decade of progress. Despite the availability of

high-intensity statins and non-statin LLTs, LDL-C target level

attainment remains low, contributing to residual cardiovascular

risk, and underscoring a significant clinical need for improved

therapeutic regimens. Even with 269 million LLT prescriptions

written over the last 12 months, 30 million under-treated US adults

are not at their risk-based LDL-C goal, of which 13 million have

ASCVD. Less than 1 in 4 patients with ASCVD achieve an LDL-C goal

of less than 70 mg/dL and only 10% of very high risk ASCVD patients

achieve the goal below 55 mg/dL. In addition to the 30 million

under-treated U.S. adults, there are 10 million patients diagnosed

with elevated LDL-C who are not taking any LLTs including statins.

Beyond LDL-C, additional factors are at play, such as lifestyle

choices, tobacco use, and obesity, as well as inflammation,

thrombosis, triglyceride levels, elevated Lp(a) levels, and type 2

diabetes.

About NewAmsterdam

NewAmsterdam Pharma (Nasdaq: NAMS) is a late-stage, clinical

biopharmaceutical company whose mission is to improve patient care

in populations with metabolic diseases where currently approved

therapies have not been adequate or well tolerated. We seek to fill

a significant unmet need for a safe, well-tolerated and convenient

LDL-lowering therapy. In multiple Phase 3 trials, NewAmsterdam is

investigating obicetrapib, an oral, low-dose and once-daily CETP

inhibitor, alone or as a fixed-dose combination with ezetimibe, as

LDL-C lowering therapies to be used as an adjunct to statin therapy

for patients at risk of CVD with elevated LDL-C, for whom existing

therapies are not sufficiently effective or well tolerated.

Forward-Looking Statements

Certain statements included in this document that are not

historical facts are forward-looking statements for purposes of the

safe harbor provisions under the United States Private Securities

Litigation Reform Act of 1995. Forward-looking statements generally

are accompanied by words such as “believe,” “may,” “will,”

“estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,”

“would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,”

“outlook” and similar expressions that predict or indicate future

events or trends or that are not statements of historical matters.

These forward-looking statements include, but are not limited to,

statements regarding the Company’s business and strategic plans,

the Company’s commercial opportunity, the therapeutic and curative

potential of the Company’s product candidate, the Company’s

clinical trials and the timing for enrolling patients, the timing

and forums for announcing data, the achievement and timing of

regulatory approvals, and plans for commercialization. These

statements are based on various assumptions, whether or not

identified in this document, and on the current expectations of the

Company’s management and are not predictions of actual performance.

These forward-looking statements are provided for illustrative

purposes only and are not intended to serve as and must not be

relied on as a guarantee, an assurance, a prediction, or a

definitive statement of fact or probability. Actual events and

circumstances are difficult or impossible to predict and may differ

from assumptions. Many actual events and circumstances are beyond

the control of the Company. These forward-looking statements are

subject to a number of risks and uncertainties, including changes

in domestic and foreign business, market, financial, political, and

legal conditions; risks related to the approval of the Company’s

product candidate and the timing of expected regulatory and

business milestones, including potential commercialization; whether

topline, initial or preliminary results from a particular clinical

trial will be predictive of the final results of that trial and

whether results of early clinical trials will be indicative of the

results of later clinical trials, or whether projections regarding

clinical outcomes will reflect actual results in future clinical

trials or clinical use of our product candidate, if approved;

ability to negotiate definitive contractual arrangements with

potential customers; the impact of competitive product candidates;

ability to obtain sufficient supply of materials; global economic

and political conditions, including the Russia-Ukraine and

Israel-Hamas conflicts; the effects of competition on the Company’s

future business; and those factors described in the Company’s

public filings with the Securities and Exchange Commission.

Additional risks related to the Company’s business include, but are

not limited to: uncertainty regarding outcomes of the Company’s

ongoing clinical trials, particularly as they relate to regulatory

review and potential approval for its product candidate; risks

associated with the Company’s efforts to commercialize a product

candidate; the Company’s ability to negotiate and enter into

definitive agreements on favorable terms, if at all; the impact of

competing product candidates on the Company’s business;

intellectual property related claims; the Company’s ability to

attract and retain qualified personnel; and ability to continue to

source the raw materials for the Company’s product candidate. If

any of these risks materialize or the Company’s assumptions prove

incorrect, actual results could differ materially from the results

implied by these forward-looking statements. There may be

additional risks that the Company does not presently know or that

the Company currently believes are immaterial that could also cause

actual results to differ from those contained in the

forward-looking statements. In addition, forward-looking statements

reflect the Company’s expectations, plans, or forecasts of future

events and views as of the date of this document and are qualified

in their entirety by reference to the cautionary statements herein.

The Company anticipates that subsequent events and developments may

cause the Company’s assessments to change. These forward-looking

statements should not be relied upon as representing the Company’s

assessment as of any date subsequent to the date of this

communication. Accordingly, undue reliance should not be placed

upon the forward-looking statements. Neither the Company nor any of

its affiliates undertakes any obligation to update these

forward-looking statements, except as may be required by law.

Company ContactMatthew PhilippeP:

1-917-882-7512matthew.philippe@newamsterdampharma.com

Media ContactSpectrum Science on behalf of

NewAmsterdamJaryd LeadyP:

1-856-803-7855jleady@spectrumscience.com

Investor ContactPrecision AQ on behalf of

NewAmsterdamAustin MurtaghP:

1-212-698-8696austin.murtagh@precisionaq.com

| |

|

NewAmsterdam Pharma Company

N.V.Consolidated Balance Sheet |

| |

| |

As at December 31, |

|

| |

2024 |

|

|

2023 |

|

| (In thousands of USD) |

|

|

|

|

|

|

Assets |

|

| Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

771,743 |

|

|

|

340,450 |

|

|

Prepayments and other receivables |

|

24,272 |

|

|

|

6,341 |

|

|

Employee receivables |

|

4,951 |

|

|

|

— |

|

|

Marketable securities |

|

62,447 |

|

|

|

— |

|

|

Total current assets |

|

863,413 |

|

|

|

346,791 |

|

| Property, plant and equipment,

net |

|

242 |

|

|

|

46 |

|

| Operating right of use

asset |

|

431 |

|

|

|

55 |

|

| Intangible assets |

|

534 |

|

|

|

170 |

|

| Long term prepaid

expenses |

|

— |

|

|

|

35 |

|

|

Total assets |

|

864,620 |

|

|

|

347,097 |

|

| Liabilities and

Shareholders' Equity |

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

4,744 |

|

|

|

16,923 |

|

|

Accrued expenses and other current liabilities |

|

13,608 |

|

|

|

11,398 |

|

|

Deferred revenue, current |

|

6,008 |

|

|

|

8,942 |

|

|

Lease liability, current |

|

246 |

|

|

|

60 |

|

|

Derivative earnout liability, current |

|

44,798 |

|

|

|

— |

|

|

Derivative warrant liabilities |

|

37,514 |

|

|

|

12,574 |

|

|

Total current liabilities |

|

106,918 |

|

|

|

49,897 |

|

| Deferred revenue, net of

current portion |

|

— |

|

|

|

1,019 |

|

| Lease liability, net of

current portion |

|

202 |

|

|

|

— |

|

| Derivative earnout liability,

net of current portion |

|

— |

|

|

|

7,788 |

|

|

Total liabilities |

|

107,120 |

|

|

|

58,704 |

|

| Commitments and contingencies

(Note 13) |

|

|

|

|

|

| Shareholders' Equity: |

|

|

|

|

|

|

Ordinary shares, €0.12 par value; 400,000,000 shares authorized;

108,064,340 and 82,469,768 shares issued and outstanding at

December 31, 2024 and 2023, respectively |

|

13,444 |

|

|

|

10,173 |

|

|

Additional paid-in capital |

|

1,298,160 |

|

|

|

590,771 |

|

|

Accumulated loss |

|

(558,571 |

) |

|

|

(316,973 |

) |

|

Accumulated other comprehensive income |

|

4,467 |

|

|

|

4,422 |

|

|

Total shareholders' equity |

|

757,500 |

|

|

|

288,393 |

|

| Total liabilities and

shareholders' equity |

|

864,620 |

|

|

|

347,097 |

|

| |

|

NewAmsterdam Pharma Company

N.V.Consolidated Statements of Operations and

Comprehensive Income (Loss) |

| |

| |

For the year ended December 31, |

|

| |

2024 |

|

|

2023 |

|

|

2022 |

|

| (In thousands of USD, except

per share amounts) |

|

|

|

|

|

|

|

|

|

Revenue |

|

45,563 |

|

|

|

14,090 |

|

|

|

102,694 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

Research and development expenses |

|

151,406 |

|

|

|

159,424 |

|

|

|

86,744 |

|

|

Selling, general and administrative expenses |

|

70,446 |

|

|

|

37,633 |

|

|

|

19,507 |

|

|

Total operating expenses |

|

221,852 |

|

|

|

197,057 |

|

|

|

106,251 |

|

| Operating loss |

|

(176,289 |

) |

|

|

(182,967 |

) |

|

|

(3,557 |

) |

| Other income (expense): |

|

|

|

|

|

|

|

|

|

Interest income |

|

16,881 |

|

|

|

11,283 |

|

|

|

— |

|

|

Interest expense |

|

— |

|

|

|

— |

|

|

|

(287 |

) |

|

Fair value change – earnout |

|

(37,010 |

) |

|

|

(266 |

) |

|

|

(707 |

) |

|

Fair value change – warrants |

|

(38,583 |

) |

|

|

(10,018 |

) |

|

|

(334 |

) |

|

Fair value change – profit rights |

|

— |

|

|

|

— |

|

|

|

(12,390 |

) |

|

Fair value change – tranche rights |

|

— |

|

|

|

— |

|

|

|

4,388 |

|

|

Foreign exchange gains/(losses) |

|

(6,598 |

) |

|

|

5,058 |

|

|

|

(9,747 |

) |

| Loss before tax |

|

(241,599 |

) |

|

|

(176,910 |

) |

|

|

(22,634 |

) |

|

Income tax expense (benefit) |

|

(1 |

) |

|

|

27 |

|

|

|

— |

|

| Loss for the year |

|

(241,598 |

) |

|

|

(176,937 |

) |

|

|

(22,634 |

) |

| Other comprehensive

income/(loss) |

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustments |

|

— |

|

|

|

— |

|

|

|

11,126 |

|

|

Unrealized gain on available-for-sale securities |

|

45 |

|

|

|

— |

|

|

|

— |

|

|

Income tax effects of other comprehensive income/(loss) |

|

— |

|

|

|

— |

|

|

|

— |

|

| Total comprehensive loss for

the year, net of tax |

|

(241,553 |

) |

|

|

(176,937 |

) |

|

|

(11,508 |

) |

| |

|

|

NewAmsterdam Pharma Company

N.V.Consolidated Statements of Mezzanine Equity

and Shareholders' Equity (Deficit) |

|

| |

|

| |

Mezzanine Equity |

|

|

|

Shareholders' Equity |

|

| (In thousands of USD, except

share amounts) |

Shares |

|

|

Amount |

|

|

|

Shares |

|

|

Amount |

|

|

AdditionalPaid-InCapital |

|

|

AccumulatedLoss |

|

|

Accumulatedothercomprehensiveincome (loss) |

|

|

TotalShareholders'Equity |

|

|

Opening balance at January 1, 2022 |

|

6,039,728 |

|

|

|

84,541 |

|

|

|

|

5,285,714 |

|

|

|

58 |

|

|

|

3,417 |

|

|

|

(110,587 |

) |

|

|

(6,704 |

) |

|

|

(113,816 |

) |

|

Equity contribution (Series A - Tranche II) |

|

5,691,430 |

|

|

|

90,468 |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Repayment of loan (CEO Restricted Share Award) |

|

— |

|

|

|

— |

|

|

|

|

— |

|

|

|

— |

|

|

|

747 |

|

|

|

— |

|

|

|

— |

|

|

|

747 |

|

|

Elimination of old shares (NewAmsterdam Pharma shareholders) |

|

(11,731,158 |

) |

|

|

(175,009 |

) |

|

|

|

(5,285,714 |

) |

|

|

(58 |

) |

|

|

(4,164 |

) |

|

|

— |

|

|

|

— |

|

|

|

(4,222 |

) |

|

Equity contribution (NewAmsterdam Pharma shareholders) |

|

— |

|

|

|

— |

|

|

|

|

36,258,312 |

|

|

|

4,470 |

|

|

|

174,761 |

|

|

|

— |

|

|

|

— |

|

|

|

179,231 |

|

|

Equity contribution (FLAC shareholders) |

|

— |

|

|

|

— |

|

|

|

|

13,185,138 |

|

|

|

1,625 |

|

|

|

66,252 |

|

|

|

— |

|

|

|

— |

|

|

|

67,877 |

|

|

Equity contribution (PIPE Financing) |

|

— |

|

|

|

— |

|

|

|

|

23,460,000 |

|

|

|

2,892 |

|

|

|

231,708 |

|

|

|

— |

|

|

|

— |

|

|

|

234,600 |

|

|

Equity contribution (Amgen & MTPC shareholders) |

|

— |

|

|

|

— |

|

|

|

|

8,656,330 |

|

|

|

1,068 |

|

|

|

84,371 |

|

|

|

— |

|

|

|

— |

|

|

|

85,439 |

|

|

Transaction costs on issue of shares |

|

— |

|

|

|

— |

|

|

|

|

— |

|

|

|

— |

|

|

|

(5,794 |

) |

|

|

— |

|

|

|

— |

|

|

|

(5,794 |

) |

|

Earnout obligation upon Closing (NewAmsterdam Pharma

shareholders) |

|

— |

|

|

|

— |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(6,815 |

) |

|

|

— |

|

|

|

(6,815 |

) |

|

Share-based compensation |

|

— |

|

|

|

— |

|

|

|

|

— |

|

|

|

— |

|

|

|

4,327 |

|

|

|

— |

|

|

|

— |

|

|

|

4,327 |

|

|

Total profit or loss and comprehensive loss for the year |

|

— |

|

|

|

— |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(22,634 |

) |

|

|

11,126 |

|

|

|

(11,508 |

) |

| As at December 31,

2022 |

|

— |

|

|

|

— |

|

|

|

|

81,559,780 |

|

|

|

10,055 |

|

|

|

555,625 |

|

|

|

(140,036 |

) |

|

|

4,422 |

|

|

|

430,066 |

|

|

Exercise of warrants |

|

— |

|

|

|

— |

|

|

|

|

749,741 |

|

|

|

97 |

|

|

|

10,116 |

|

|

|

— |

|

|

|

— |

|

|

|

10,213 |

|

|

Exercise of stock options |

|

— |

|

|

|

— |

|

|

|

|

160,247 |

|

|

|

21 |

|

|

|

269 |

|

|

|

— |

|

|

|

— |

|

|

|

290 |

|

|

Share-based compensation |

|

— |

|

|

|

— |

|

|

|

|

— |

|

|

|

— |

|

|

|

24,761 |

|

|

|

— |

|

|

|

— |

|

|

|

24,761 |

|

|

Total profit or loss and comprehensive loss for the year |

|

— |

|

|

|

— |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(176,937 |

) |

|

|

— |

|

|

|

(176,937 |

) |

| As at December 31,

2023 |

|

— |

|

|

|

— |

|

|

|

|

82,469,768 |

|

|

|

10,173 |

|

|

|

590,771 |

|

|

|

(316,973 |

) |

|

|

4,422 |

|

|

|

288,393 |

|

|

February 2024 Issuance of Ordinary Shares and Pre-Funded Warrants,

net of issuance costs |

|

— |

|

|

|

— |

|

|

|

|

5,871,909 |

|

|

|

759 |

|

|

|

189,206 |

|

|

|

— |

|

|

|

— |

|

|

|

189,965 |

|

|

December 2024 Issuance of Ordinary Shares and Pre-Funded Warrants,

net of issuance costs |

|

|

|

|

|

|

|

|

14,667,347 |

|

|

|

1,851 |

|

|

|

451,564 |

|

|

|

— |

|

|

|

— |

|

|

|

453,415 |

|

|

Exercise of Pre-Funded Warrants |

|

— |

|

|

|

— |

|

|

|

|

2,105,248 |

|

|

|

279 |

|

|

|

(279 |

) |

|

|

— |

|

|

|

— |

|

|

|

- |

|

|

Exercise of warrants |

|

— |

|

|

|

— |

|

|

|

|

1,288,790 |

|

|

|

168 |

|

|

|

27,673 |

|

|

|

— |

|

|

|

— |

|

|

|

27,841 |

|

|

Exercise of stock options |

|

— |

|

|

|

— |

|

|

|

|

1,661,278 |

|

|

|

214 |

|

|

|

5,496 |

|

|

|

— |

|

|

|

— |

|

|

|

5,710 |

|

|

Share-based compensation |

|

— |

|

|

|

— |

|

|

|

|

— |

|

|

|

— |

|

|

|

33,729 |

|

|

|

— |

|

|

|

— |

|

|

|

33,729 |

|

|

Total loss and comprehensive loss for the period |

|

— |

|

|

|

— |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(241,598 |

) |

|

|

45 |

|

|

|

(241,553 |

) |

| As at December 31,

2024 |

|

— |

|

|

|

— |

|

|

|

|

108,064,340 |

|

|

|

13,444 |

|

|

|

1,298,160 |

|

|

|

(558,571 |

) |

|

|

4,467 |

|

|

|

757,500 |

|

| |

|

|

NewAmsterdam Pharma Company

N.V.Consolidated Statements of Cash

Flows |

|

| |

|

| |

For the year ended December 31, |

|

| |

2024 |

|

|

2023 |

|

|

2022 |

|

| (In thousands of USD) |

|

|

|

|

|

|

|

|

| Operating

activities: |

|

|

|

|

|

|

|

|

|

Loss for the year |

|

(241,598 |

) |

|

|

(176,937 |

) |

|

|

(22,634 |

) |

| Non-cash adjustments to

reconcile loss before tax to net cash flows: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

113 |

|

|

|

49 |

|

|

|

9 |

|

|

Non-cash rent expense |

|

12 |

|

|

|

6 |

|

|

|

10 |

|

|

Fair value change - tranche rights |

|

— |

|

|

|

— |

|

|

|

(4,388 |

) |

|

Fair value change - IPR&D |

|

— |

|

|

|

— |

|

|

|

12,390 |

|

|

Fair value change - derivative earnout and warrants |

|

75,593 |

|

|

|

10,284 |

|

|

|

1,041 |

|

|

Foreign exchange (gains)/losses |

|

6,598 |

|

|

|

(5,058 |

) |

|

|

9,747 |

|

|

Amortization of premium/discount on available-for-sale debt

securities |

|

(227 |

) |

|

|

— |

|

|

|

— |

|

|

Share-based compensation |

|

33,619 |

|

|

|

24,572 |

|

|

|

4,117 |

|

| Changes in working

capital: |

|

|

|

|

|

|

|

|

|

Changes in prepayments (current and non-current) and other

receivables |

|

(17,459 |

) |

|

|

4,031 |

|

|

|

(4,185 |

) |

|

Changes in accounts payable |

|

(12,948 |

) |

|

|

5,070 |

|

|

|

4,809 |

|

|

Changes in accrued expenses and other current liabilities |

|

1,686 |

|

|

|

5,470 |

|

|

|

(8,679 |

) |

|

Changes in deferred revenue |

|

(3,953 |

) |

|

|

(8,705 |

) |

|

|

18,428 |

|

| Net cash (used

in)/provided by operating activities |

|

(158,564 |

) |

|

|

(141,218 |

) |

|

|

10,665 |

|

| Investing

activities: |

|

|

|

|

|

|

|

|

|

Purchase of property, plant and equipment, including internal use

software |

|

(672 |

) |

|

|

(24 |

) |

|

|

(221 |

) |

|

Purchase of available-for-sale debt securities |

|

(62,176 |

) |

|

|

— |

|

|

|

— |

|

| Net cash used in

investing activities |

|

(62,848 |

) |

|

|

(24 |

) |

|

|

(221 |

) |

| Financing

activities: |

|

|

|

|

|

|

|

|

|

Proceeds from issuing equity securities (Series A) |

|

— |

|

|

|

— |

|

|

|

90,469 |

|

|

Proceeds from issuing equity securities (FLAC shareholders) |

|

— |

|

|

|

— |

|

|

|

71,883 |

|

|

Proceeds from issuing equity securities (PIPE Financing) |

|

— |

|

|

|

— |

|

|

|

234,600 |

|

|

Transaction costs on issue of equity securities |

|

— |

|

|

|

— |

|

|

|

(5,794 |

) |

|

Proceeds from payment of shareholder loan |

|

— |

|

|

|

— |

|

|

|

747 |

|

|

Proceeds from February 2024 offering of Ordinary Shares and

Pre-Funded Warrants |

|

190,481 |

|

|

|

— |

|

|

|

— |

|

|

Transaction costs on February 2024 issue of Ordinary Shares and

Pre-Funded Warrants |

|

(515 |

) |

|

|

— |

|

|

|

— |

|

|

Proceeds from December 2024 offering of Ordinary Shares and

Pre-Funded Warrants |

|

455,026 |

|

|

|

— |

|

|

|

— |

|

|

Transaction costs on December 2024 issue of Ordinary Shares and

Pre-Funded Warrants |

|

(25 |

) |

|

|

— |

|

|

|

— |

|

|

Proceeds from exercise of warrants |

|

13,761 |

|

|

|

8,622 |

|

|

|

— |

|

|

Proceeds from exercise of options |

|

1,768 |

|

|

|

290 |

|

|

|

— |

|

|

Payment of withholding taxes related to net share settlement of

exercised options |

|

(989 |

) |

|

|

— |

|

|

|

— |

|

| Net cash provided by

financing activities |

|

659,507 |

|

|

|

8,912 |

|

|

|

391,905 |

|

| Net change in cash and cash

equivalents |

|

438,095 |

|

|

|

(132,330 |

) |

|

|

402,349 |

|

| Foreign exchange

differences |

|

(6,802 |

) |

|

|

5,052 |

|

|

|

5,248 |

|

| Cash and cash equivalents at

the beginning of the year |

|

340,450 |

|

|

|

467,728 |

|

|

|

60,131 |

|

| Cash and cash

equivalents at the end of the year |

|

771,743 |

|

|

|

340,450 |

|

|

|

467,728 |

|

| Noncash financing and

investing activities |

|

|

|

|

|

|

|

|

|

Derivative earnout obligation recognized related to the Business

Combination (as defined in Note 3) |

|

— |

|

|

|

— |

|

|

|

6,815 |

|

|

Liabilities assumed in the Business Combination (as defined in Note

3) |

|

— |

|

|

|

— |

|

|

|

(4,006 |

) |

|

Contribution of interest in NewAmsterdam Pharma Holding B.V. by

Participating Shareholders (as defined in Note 3) |

|

— |

|

|

|

— |

|

|

|

(179,231 |

) |

|

Issuance of Ordinary Shares to Participating Shareholders (as

defined in Note 3) |

|

— |

|

|

|

— |

|

|

|

179,231 |

|

|

Recognition of ROU asset |

|

562 |

|

|

|

— |

|

|

|

— |

|

| Supplemental cash flow

disclosures |

|

|

|

|

|

|

|

|

|

Cash paid for interest |

|

— |

|

|

|

— |

|

|

|

277 |

|

|

Cash paid for income taxes |

|

1 |

|

|

|

27 |

|

|

|

— |

|

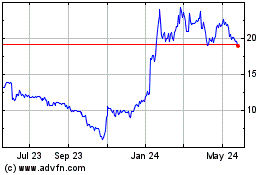

NewAmsterdam Pharma Comp... (NASDAQ:NAMS)

Historical Stock Chart

From Feb 2025 to Mar 2025

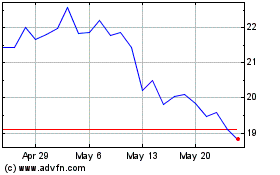

NewAmsterdam Pharma Comp... (NASDAQ:NAMS)

Historical Stock Chart

From Mar 2024 to Mar 2025