UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐ Definitive Proxy Statement

☒ Definitive Additional Materials

☐ Soliciting Material under §240.14a-12

Nikola Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

[Script of prepared remarks for earnings call on May 7, 2024]

Good morning, and welcome to Nikola Corporation's First Quarter 2024 earnings and business update call. Currently, all participants are in a listen-only mode. We begin today's call with a short video presentation followed by management's prepared remarks. A brief question and answer session will follow the prepared remarks. If anyone should require operator assistance during the conference, please press *0 on your telephone keypad. As a reminder, this conference is being recorded. It is my pleasure to introduce Soei Shin, Head of Investor Relations.

Soei Shin, Investor Relations

Thank you, operator, and good morning, everyone. Welcome to Nikola Corporation's First Quarter 2024 earnings and business update call. Joining me today are Steve Girsky, President and CEO, and Tom Okray, Chief Financial Officer.

A press release detailing our financial and business results was distributed earlier this morning. This release can be found on the investor relations section of our website, along with presentation slides accompanying today’s call.

Today’s discussion includes references to non-GAAP measures. The presentation includes adjusted EBITDA, earnings per share, adjusted free cash flow and other non-GAAP measures. These measures are reconciled to the most comparable US GAAP measures and can be found at the end of the Q1 earnings press release we issued today.

Today’s discussion also includes forward-looking statements about our future results, expectations and plans. Actual results may differ materially from those stated, and some factors that could cause actual results to differ are also explained at the end of today’s earnings press release, on page 2 of our earnings call deck, and in our filings with the SEC. Forward-looking statements speak only as of the date on which they are made. You are cautioned not to put undue reliance on forward-looking statements.

After the video presentation, Steve and Tom will provide their prepared remarks, followed by analyst Q&A, then we will conclude with questions from our stockholders. Please begin the video presentation. Thank you.

Steve Girsky, President, and Chief Executive Officer

Thanks, Soei and good morning, everyone. Welcome to our First Quarter 2024 earnings and business update call.

We are thrilled to be joined for the first time by Tom Okray, our new Chief Financial Officer. Tom brings four decades of public company experience to Nikola, from GM to Amazon to Eaton; he’s approached our business with a fresh perspective. With this outlook and his keen sense of financial discipline, we look forward to the impact he’ll make on Nikola in the quarters to come.

Before handing it over to Tom, I’d like to talk about what’s going on with Nikola today. We continue to move forward rapidly and execute on our plans. And please keep that in mind – we are in the execution phase, not the planning or concepting phase. Last quarter, I talked about getting on the field with the first deliveries of our hydrogen fuel cell electric trucks. Today, we are executing plays, competing, and cultivating more green shoots as we expand upon current markets and enter new ones.

•At Nikola we emphasize that “this is not a science project, we have real trucks on North American roads,” and – as you’ve seen, we’re growing. At the end of Q1, we announced that we had wholesaled 40 hydrogen fuel cell electric trucks (FCEVs), all designated for end fleets. This exceeded the high-end of the guidance range. That makes 75 wholesaled fuel cell trucks in the first two quarters of serial production.

•We’re seeing green shoots with repeat and new fleets, some in new markets such as New York. While our initial focus has been California and Canada, we can expand our reach to meet the demands of end fleet users virtually anywhere in the U.S.

•We’ve spoken about the chicken and egg challenge for years. We’ve expanded HYLA’s North American reach in the quarter with the grand opening of our Ontario, California modular refueling station. And with our partners at ITD in Canada, we announced the first commercial modular refueling station in Edmonton, Alberta. HYLA’s Hydrogen Highway Plan remains on track for 2024. In fact, we recently opened another modular refueling station near the Port of Long Beach, California, to support primarily drayage fleets in this high-density area.

•We continue to be encouraged by opportunities in constructive green policies. We are pioneers for a zero-emissions world to decarbonize the trucking industry. We cannot do this alone. We need both private and public partners. The tailwinds we see from the Inflation Reduction Act of 2022, EPA Clean Ports Program, and state specific policies at CARB to name a few, support our mission.

•We’ve spoken many times of the one truck, two powertrain strategy. We promised that the first delivery of our improved battery-electric truck – which we refer to as the “BEV 2.0” - would be completed by the end of Q1. We delivered on this commitment.

Now let’s get to the business update. Again, we exceeded Q1 expectations and wholesaled 40 hydrogen fuel cell electric trucks (FCEVs), all designated for end fleet users.

•Repeat fleet customer IMC, the largest marine drayage company in the U.S. with more than 2,000 trucks in their fleet and operations coast-to-coast, ordered 10 fuel cell electric vehicles from our dealer network in Q1. This was after their initial order of 10 in Q4 and they’ve announced that they’re taking 30 more for a total of 50. IMC has expressed strong interest in growing with us as we continue to build out modular hydrogen refueling stations near critical ports such as Long Beach and along busy freight corridors where they operate.

•Fleets such as AJR demonstrate our focus to fulfill prior commitments and align ourselves with their business needs. AJR, with a total fleet of more than 500 trucks, is a leading carrier for the United States Postal Service and a major drayage operator in the Ports of Los Angeles and Long Beach. They announced a 50-unit purchase order for Nikola fuel cell trucks in May 2023. We delivered the first 15 fuel cell trucks of this order to our dealer network in Q1 and we are working to continue our relationship with them as fueling solutions come online in freight corridors critical to their operations.

•New fuel cell electric vehicle fleet users such as Green Transportation Group, or GTG, helped Nikola enter new markets in the northeast. GTG is a large full-service 100% emissions-free freight and logistics provider in the New York Tri-State area. We delivered 10 fuel cell trucks to our dealer network designated for GTG. Notably, GTG will locally source hydrogen from an authorized fueling provider independent from Nikola. Non-California or Canada customers such as GTG demonstrate that the sale of fuel cell electric vehicles can be decoupled from HYLA sourced hydrogen, which enable us to penetrate new markets with less capital. As Tom will explain later in the call, expanding geographical focus, especially with large volume accounts including national accounts is an important priority of ours going forward. Enabling our end fleet users to access hydrogen independently is a growth factor in this strategy.

•Program-to-date, Nikola fuel cell electric vehicles have accumulated over 830,000 miles with an average fuel economy exceeding our target of 7.2 mi/kg. We’re doing what it takes to delight prospective and existing customers with the best possible experience.

Moving to Chart 7, we maintained our dominant market share of HVIP vouchers for Class 8 fuel cell electric vehicles, ending the quarter with 362 of 367 or 99% of the vouchers that were requested in 2023 through March of 2024. We remained under soft cap review at CARB for much of Q1 after reaching a ceiling on unredeemed vouchers. For context, in response to the strong demand of our zero-emissions trucks, we have been requesting higher soft caps at CARB throughout 2023. Our most recent soft cap request for 500 unredeemed vouchers was granted in early April. On the battery electric vehicle side, we ended Q1 with 85 unredeemed vouchers or 30% market share during the same period.

Being a pioneer is not easy and again, we cannot do it alone. We share an aligned mission with CARB to help California achieve its air quality and emissions reduction goals.

HVIP is only one program – and we continue to be encouraged by opportunities in other constructive green policies. Two in particular, help us fund our business. CARB’s Heavy-Duty Omnibus Regulation allows us to monetize the NOx and particulate matter or PM credits we generate from selling zero-emissions trucks on a model year basis. Other OEMs or engine manufacturers that sell products above emissions standards in California, must purchase credits to enable sales of combustion engines. We are pleased to confirm that Nikola has executed its first sale agreement for credits generated for Model Year 22 and revenue from this transaction will be recognized in Q2 2024. We expect future revenue from the sale of CARB credits to grow over time and be meaningful.

California Advanced Clean Truck (ACT) Credits is another program that supports Nikola’s mission to decarbonize trucking. Again, we generate credits for selling zero-emissions trucks in California on a model year basis; OEMs that sell combustion trucks in California generate deficits that must be offset by purchased credits. We have an opportunity to be a market maker in this space and are actively negotiating with counterparties to monetize credits.

In addition, The EPA Clean Ports Program provides $3 billion to fund zero-emission port equipment and infrastructure as well as climate and air quality planning at U.S. ports. Nikola has engaged with several private and public entities at strategic ports across the U.S. to apply together for funding to help ports decarbonize and transition to zero-emissions.

Our HYLA team is executing its Hydrogen Highway Plan, and we remain on track. Previously we had committed to 9 additional HYLA refueling stations in California by year-end 2024. Now we are expecting to provide 9 hydrogen fueling solutions by mid-year 2024 and 14 by year-end 2024. These solutions include modular fuelers and partner stations in California, Canada and our home station at our Coolidge, Arizona manufacturing facility. We want to emphasize that building the hydrogen ecosystem requires industry wide collaboration for the benefit of all. We need partners and they come in different forms and stages of infrastructure development. The shared mission is to build an open ecosystem accessible to all.

As mentioned, during Q1, we launched HYLA’s first modular fueling station in Ontario, California. This station is live with 24/7 operations to support fleets. We also recently opened a refueling station near the Port of Long Beach. This is a critical site for us to support the heavy drayage operations out of the Port for fleets like IMC. Lastly, we announced Alberta’s first commercial hydrogen refueling station along Highway 2, a vital freight corridor connecting Edmonton to Calgary. This station supports our close collaboration with the Alberta Motor Transport Association (AMTA) and our Canadian dealer, ITD Industries.

Finally, we completed the first delivery of the remediated BEV in Q1. We continue to prioritize returning BEVs to customers and dealers and now expect to complete remediation of these units by year-end 2024. Our ability to sell Nikola’s on-hand inventory, however, will be dependent upon future battery supply; we now expect to opportunistically sell on-hand inventory for revenue in 2025.

We’ve also taken this opportunity to “future proof” the BEV 2.0, as it now shares significant software commonality with the battery and operating systems of the fuel cell electric vehicle, allowing customers to receive next-generation upgrades seamlessly over-the-air as they are deployed. We’ve kept our fleet users front and center as we’ve engineered over-the-air enhancements, including dynamic data gathering for predictive diagnostics, improved truck performance and field issue identification. We’ve also deployed new Advanced Driver Assistance Systems (ADAS) features to effectively manage powertrain demand in aggressive route conditions such as mountainous driving.

Again, growing Nikola is about being nimble, learning as we go and adapting to meet the demands of our customers.

Passing it to Tom to cover the financial results, welcome Tom.

Tom Okray, Chief Financial Officer

Thanks, Steve. I’ve learned a great deal in the two months I’ve been at Nikola. The energy and unflinching spirit I see here is inspirational. We’re pioneers at Nikola and bringing the world closer to our zero-emissions vision. Remaining committed to our mission, and consistently following through on what we say we’re going to do, will make our vision a reality.

Moving to Chart 12, the profitability flywheel. As we have highlighted, we are excited about being in serial production and delivering 40 fuel cell trucks in the quarter and 75 trucks in the last two quarters. There is a market for our trucks, and we’ve begun to demonstrate that.

That said, profitability will not be where we want it to be until we can build scale. Simply put, it is not practical to optimize our cost structure without a meaningful level of volume.

So, what are we doing differently to build the volume? There are a few things that I would like to highlight.

First, we are putting a greater focus on selling to national accounts, which we define as fleets with greater than 1,000 trucks.

Second, we are being more forgiving on the economics of the initial deal to build confidence with our end fleet users. We are confident, once end fleet users drive our trucks, they will be delighted and want more.

Finally, we are expanding our geographical focus beyond California and Canada. In short, we will leverage partnerships to build volume across North America.

With meaningful volume, we will be able to provide our supplier partners with a consistent orderbook. The orderbook will enable suppliers to optimize their cost structure by enabling economies of scale to reduce our bill of material.

In addition, we will utilize the scale to optimize our costs, reducing our operating expenses and optimizing our manufacturing costs.

The flywheel described above will not only lead to profitability, but also put Nikola in the driver’s seat of the hydrogen economy, attracting partners who believe in this mission and want to get a head start.

Chart 13 contains our financial highlights. As noted previously, absent meaningful volume, profitability will be below our expectations. For the quarter we had a gross loss of ($57.6M).

That said, we are making progress. With respect to the top line, we exceeded the high end of our volume guidance by delivering 40 fuel cell trucks, with revenue of approximately $15M – also above the high end of guidance – after adjusting for BEV returns associated with dealer cancellations. Further, the average sales price of the 40 fuel cell trucks improved sequentially by $30k per unit to $381,000.

On the operating side, R&D and SG&A – on an adjusted basis - were favorable to guidance.

With respect to cash, our unrestricted cash declined ($119M) sequentially. Our cash burn improved sequentially versus the 4th quarter in 2023.

We have a lot of work to do, but we are making progress.

Moving on to Chart 14. For Fiscal Year 2024, our fuel cell wholesale delivery guidance remains unchanged at 300 to 350 trucks, with Q2 being between 50 and 60 wholesale deliveries.

For the reasons highlighted earlier, with respect to the BEV, we will look to sell our on-hand inventory opportunistically in 2025.

Profitability is related to execution of the flywheel discussed earlier in the call. As such, we will be focused on gaining momentum.

Finally, we have demonstrated an ability to raise capital and as we continue to execute our plan, it will only increase as the flywheel gains momentum.

Back to Steve for closing remarks.

Steve Girsky, President and Chief Executive Officer

Thanks, Tom. We’re glad you’re here.

To close on a personal note, I have invested more than four years in Nikola and have been through the ups and downs of the company. I believe in our leadership team, our board and what the team has created. As a leader, I am financially invested in the company and I have never sold one share of Nikola stock, outside of paying tax obligations. Period. I am focused on removing unnecessary distractions, growing our business and progressing on the path to profitability.

As Nikola moves forward, we will keep hitting on milestones. On April 29, our 100th production fuel cell electric vehicle drove off our Coolidge line. This is truly a testament to our Arizona teams in Phoenix, Coolidge and supplier partners around the world. This is just the beginning.

I remain inspired by the people at Nikola, the faith of our stockholders and the mission that we all share, to decarbonize trucking and pioneer solutions for a zero-emissions world. These words are what our team lives by, and we thank you for being a part of it.

This concludes our prepared remarks. Operator, please open the line for analyst questions.

Thank you. I will now hand the call back over to Soei Shin for investor questions.

Soei Shin, Investor Relations

Thank you, operator. We received questions from retail investors through the SAY platform, most of which can be summed up into 3 topics: The reverse split proposal, subsequent potential for dilution, and finally, our path to growth and profitability.

1.First question: What is the rationale for the proposed reverse split? Why is it necessary and why now?

I’ll take that one. The Nikola team has worked hard to reset the operational focus of the company since 2023. We are proud to have the first two quarters of fuel cell serial production under our belt and as Steve mentioned, this is just the beginning. Now it's time to reset our financial foundation so that Nikola has the characteristics of a company that is ready to climb. Therefore, three reasons for the reverse split:

First, there is the need to address the potential of delisting. If Nikola stock trades below $1 for a certain period, we can be delisted from Nasdaq, which has severe consequences for a company

like ours, such as limiting our ability to access markets and raise capital. The reverse split should allow the stock to trade above $1, thereby reducing the risk of delisting.

Second, it broadens the pool of investors that may be interested in investing in Nikola by attracting new investors who are prohibited from or prefer not to invest in shares that trade at lower share prices.

Third, the reverse split makes available additional shares needed for future capital raises and potential partnerships so we can be a company poised to climb. Of course, we are mindful of dilution and will only use the additional shares as necessary.

In short, we need flexibility and choices, and the reverse split is the best, most efficient option to get us there.

2.Second Question: Why is this strategy being referred to as a reduction in authorized shares when it effectively increases the potential dilution for current shareholders?

It’s important for a growing company like Nikola to have access to capital. Therefore, having the flexibility to best position Nikola to raise capital efficiently and effectively is of critical importance. If not for a reverse split, we would have had to request shareholder approval for authorization of additional shares to support the business.

We analyzed both options - the reverse split or authorizing more shares - and the impact on shareholders in depth. We concluded that the reverse split provided the most financial flexibility we needed – discussed in the prior question - to achieve our objectives.

3.The final question: What is Nikola’s roadmap to profitability? Can you talk about the potential for partnerships and large accounts?

Sure, I’ll take that one Steve. This gets to the heart of our message today. We need to build scale. Without scale, profitability will be below our expectations. Simply put, it’s not practical to optimize our cost structure without a meaningful level of volume.

We’re putting a greater focus on national accounts. In order to do this, we will be deal driven and less sensitive to ASP, in the short term, to build confidence with our end fleet users.

Finally, while our main focus remains California and Canada, we are expanding our geographical footprint beyond California and Canada, thereby increasing the addressable market.

Working towards zero-emissions and building out the hydrogen ecosystem should benefit all.

We look to develop and leverage partnerships wherever we can to build volume and hydrogen infrastructure across North America.

Soei Shin, Investor Relations

Thank you, Steve and Tom. We appreciate you all taking the time to join us today and on behalf of all Nikola employees, we thank you.

Forward-Looking Statements

This communication contains certain forward-looking statements within the meaning of federal securities laws with respect to Nikola Corporation (the "Company"), including statements relating to: the Company's future financial and business performance, business plan, strategy, focus, opportunities and milestones; customer demand for trucks; the Company’s beliefs regarding its competition and competitive position; the Company’s business outlook; the Company’s expectations regarding hydrogen refueling solutions, including timing thereof; expectations related to the battery-electric truck recall, including timing of truck deliveries and future sales; the Company’s beliefs regarding the benefits and attributes of its trucks, and customer experience; government incentives, including CARB credits and expectations regarding related revenue and opportunities to monetize credits; the Company’s expanding geographical focus; potential effects of a Nasdaq delisting; and the Company’s beliefs regarding the potential benefits of a reverse stock split, including its potential effect on the Company’s stock price, Nasdaq listing, the ability to increase investor interest and facilitate raising future capital and other intended benefits. These forward-looking statements other than statements of historical fact, and generally are identified by words such as "believe," "project," "expect," "anticipate," "estimate," "intend," "strategy," "future," "opportunity," "plan," "may," "should," "will," "would," and similar expressions. Forward-looking statements are predictions, projections, and other statements about future events based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this communication, including but not limited to: successful execution of the Company’s business plan; design and manufacturing changes and delays, including shortages of parts and materials and other supply challenges; general economic, financial, legal, regulatory, political and business conditions and changes in domestic and foreign markets; demand for and customer acceptance of the Company’s trucks and hydrogen refueling solutions; the results of customer pilot testing; the execution and terms of definitive agreements with strategic partners and customers; the failure to convert LOIs or MOUs into binding orders; the cancellation of orders; risks associated with development and testing of fuel cell power modules and hydrogen storage systems; risks related to the recall, including higher than expected costs, the discovery of additional problems, delays retrofitting the trucks and delivering such trucks to customers, supply chain and other issues that may create additional delays, order cancellations as a result of the recall, litigation, complaints and/or product liability claims, and reputational harm; risks related to the rollout of the Company’s business and milestones and the timing of expected business milestones; the effects of competition on the Company’s business; the Company’s ability to raise capital; the Company’s ability to achieve cost reductions and decrease its cash usage; the grant, receipt and continued availability of federal and state incentives; the actual effect of any reverse stock split on the Company’s stock price; the ability of the Company to attract additional investors; whether a reverse split is implemented and at what ratio; and the factors, risks and uncertainties regarding the Company's business described in the "Risk Factors" section of the Company's Annual Report on Form 10-K, as amended, for the year ended

December 31, 2023 filed with the SEC, in addition to the Company's subsequent filings with the SEC. These filings identify and address other important risks and uncertainties that could cause the Company's actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and, except as required by law, the Company assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise.

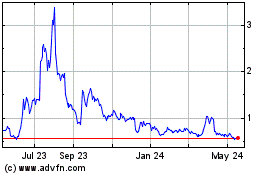

Nikola (NASDAQ:NKLA)

Historical Stock Chart

From Apr 2024 to May 2024

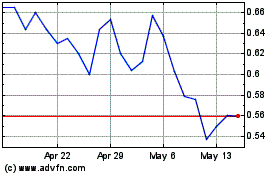

Nikola (NASDAQ:NKLA)

Historical Stock Chart

From May 2023 to May 2024