Nutanix, Inc. (“Nutanix”) (Nasdaq: NTNX), a leader in hybrid

multicloud computing, today announced its intention to offer,

subject to market conditions and other factors, $750 million

aggregate principal amount of convertible senior notes due 2029

(the “notes”) in a private placement (the “offering”) to persons

reasonably believed to be qualified institutional buyers pursuant

to Rule 144A under the Securities Act of 1933, as amended (the

“Securities Act”). Nutanix also expects to grant the initial

purchasers of the notes an option to purchase up to an additional

$112.5 million aggregate principal amount of the notes within a

13-day period from, and including, the initial issuance date of the

notes.

The notes will be unsecured senior

obligations of Nutanix. Interest will be payable semi-annually in

arrears. The notes will mature on December 15, 2029, unless earlier

converted, redeemed, or repurchased. The notes will be convertible

at the option of holders, subject to certain conditions and during

certain periods. Upon conversion, the notes may be settled in cash,

shares of Nutanix’s Class A common stock or a combination of cash

and shares of Nutanix’s Class A common stock, at Nutanix’s

election. The interest rate, initial conversion rate and other

terms of the notes are to be determined at the time of the pricing

of the offering.

Nutanix intends to use the net proceeds from the offering to (i)

repurchase a portion of its outstanding 0.25% Convertible Senior

Notes due 2027 (the “2027 notes”) concurrently with the pricing of

the offering in separate and privately negotiated transactions with

certain holders of its 2027 notes (the “concurrent note

repurchases”) effected through one of the initial purchasers of the

notes or its affiliate, acting as Nutanix’s agent, and (ii)

repurchase up to $200.0 million of shares of Nutanix’s Class A

common stock in privately negotiated transactions with

institutional investors effected through one of the initial

purchasers of the notes or its affiliate, acting as Nutanix’s

agent, at a price per share equal to the last reported sale price

of Nutanix’s Class A common stock on the Nasdaq Global Select

Market on the date of the pricing of the notes (the “Share

Repurchase”). Any such Share Repurchase would not reduce the amount

available for future repurchases under Nutanix’s existing share

repurchase program. Nutanix intends to use the remaining net

proceeds from the offering for general corporate purposes,

including working capital, capital expenditures and potential

acquisitions. From time to time, Nutanix evaluates potential

acquisitions of businesses, technologies or products. Currently,

however, Nutanix does not have any understandings or agreements

with respect to any acquisitions.

The terms of the concurrent note

repurchases are anticipated to be individually negotiated with each

holder of the 2027 notes participating in the concurrent note

repurchases, and will depend on several factors, including the

market price of Nutanix’s Class A common stock and the trading

price of the 2027 notes at the time of each such concurrent note

repurchase. Certain holders of any 2027 notes that Nutanix agrees

to repurchase may have hedged their equity price risk with respect

to such 2027 notes and may, concurrently with the pricing of the

notes, unwind all or part of their hedge positions by buying

Nutanix’s Class A common stock and/or entering into or unwinding

various derivative transactions with respect to Nutanix’s Class A

common stock. Any repurchase of the 2027 notes, and the potential

related market activities by holders of the 2027 notes

participating in the concurrent note repurchases, together with the

repurchase by Nutanix of any of its Class A common stock

concurrently with the pricing of the notes, could increase (or

reduce the size of any decrease in) the market price of Nutanix’s

Class A common stock, which may affect the trading price of the

notes at that time and the initial conversion price of the notes.

Nutanix cannot predict the magnitude of such market activity or the

overall effect it will have on the price of the notes or its Class

A common stock. No assurance can be given as to how much, if any,

of the 2027 notes or the Class A common stock will be repurchased

or the terms on which they will be repurchased.

Neither the notes nor the shares of

Nutanix’s Class A common stock potentially issuable upon conversion

of the notes, if any, have been, or will be, registered under the

Securities Act or the securities laws of any other jurisdiction,

and unless so registered, may not be offered or sold in the United

States, except pursuant to an applicable exemption from, or in a

transaction not subject to, such registration requirements.

This announcement is neither an offer

to sell nor a solicitation of an offer to buy any of these

securities and shall not constitute an offer, solicitation, or sale

in any jurisdiction in which such offer, solicitation, or sale is

unlawful.

About NutanixNutanix is a global leader in

cloud software, offering organizations a single platform for

running applications and managing data, anywhere. With Nutanix,

companies can reduce complexity and simplify operations, freeing

them to focus on their business outcomes. Building on its legacy as

the pioneer of hyperconverged infrastructure, Nutanix is trusted by

companies worldwide to power hybrid multicloud environments

consistently, simply, and cost-effectively.

Forward-Looking StatementsThis press release

includes forward-looking statements within the meaning of Section

27A of the Securities Act and Section 21E of the Securities

Exchange Act of 1934, as amended, including statements regarding

Nutanix’s financing plans, Nutanix’s ability to complete the

offering, the timing and size of the offering, the concurrent note

repurchases and the Share Repurchase, Nutanix’s intended use of the

net proceeds of the offering. These statements involve risks and

uncertainties that could cause actual results to differ materially,

including, but not limited to, whether Nutanix will be able to

consummate the offering, the final terms of the offering, the

satisfaction of customary closing conditions with respect to the

offering of the notes, prevailing market conditions, the

anticipated use of the net proceeds of the offering of the notes,

which could change as a result of market conditions or for other

reasons, and the impact of general economic, industry or political

conditions in the United States or internationally. Forward-looking

statements may be identified by the use of the words “may,” “will,”

“expect,” “intend,” and other similar expressions. These

forward-looking statements are based on estimates and assumptions

by Nutanix’s management that, although believed to be reasonable,

are inherently uncertain and subject to a number of risks. Actual

results may differ materially from those anticipated or predicted

by Nutanix’s forward-looking statements. All forward-looking

statements are subject to other risks detailed in Nutanix’s Annual

Report on Form 10-K for the fiscal year ended July 31, 2024, and

the risks discussed in Nutanix’s other filings with the Securities

and Exchange Commission. You are cautioned not to place undue

reliance on these forward-looking statements, which speak only as

of the date hereof. All forward-looking statements are qualified in

their entirety by this cautionary statement, and Nutanix undertakes

no obligation to revise or update this news release to reflect

events or circumstances after the date hereof, except as required

by applicable law.

© 2024 Nutanix, Inc. All rights reserved. Nutanix, the Nutanix

logo, and all Nutanix product and service names mentioned herein

are registered trademarks or unregistered trademarks of Nutanix,

Inc. (“Nutanix”) in the United States and other countries. Other

brand names or marks mentioned herein are for identification

purposes only and may be the trademarks of their respective

holder(s). This press release is for informational purposes only

and nothing herein constitutes a warranty or other binding

commitment by Nutanix.

Investor Contact:Richard

Valerair@nutanix.com

Media Contact:Lia

Biganopr@nutanix.com

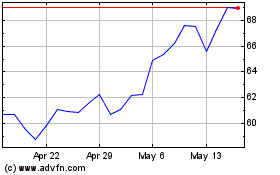

Nutanix (NASDAQ:NTNX)

Historical Stock Chart

From Nov 2024 to Dec 2024

Nutanix (NASDAQ:NTNX)

Historical Stock Chart

From Dec 2023 to Dec 2024