false

0000788611

0000788611

2024-12-09

2024-12-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 9, 2024

NextTrip,

Inc.

(Exact

name of Registrant as Specified in Its Charter)

| Nevada |

|

001-38015 |

|

27-1865814 |

(State

or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

| 3900

Paseo del Sol |

|

|

| Santa

Fe, New Mexico |

|

87507 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

Registrant’s

Telephone Number, Including Area Code: (505) 438-2576

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.001 per share |

|

NTRP |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item

1.01 | Entry

into a Material Definitive Agreement. |

On

December 9, 2024, the Company and NextTrip Holdings, Inc. (“NTH”), via William Kerby as its shareholder representative, entered

into a forbearance agreement (the “Forbearance Agreement) related to the issuance of certain contingent shares (the “Contingent

Shares”) of Company common stock issuable upon NTH earning certain milestones as provided in that certain share exchange agreement

(the “Share Exchange Agreement”) entered into by and among the Company, NTH and NextTrip Group, LLC (“NTG”),

the sole stockholder of NTH, and the NTH shareholder representative, pursuant to which the Company acquired 100% of NTH (the “Acquisition”)

in exchange for shares of Company common stock, which we refer to as the “Exchange Shares”. As a result, NTH became a wholly

owned subsidiary of the Company as of December 29, 2023 (the “Closing Date”). Capitalized terms not otherwise defined herein

shall have the meaning set forth in the Share Exchange Agreement.

Upon

the closing of the Acquisition, the members of NTG, which we refer to collectively as the NTG Sellers, were issued a number of Exchange

Shares equal to 19.99% of the Company’s issued and outstanding shares of common stock immediately prior to the Closing Date. Under

the Share Exchange Agreement, the NTG Sellers are also entitled to receive additional Contingent Shares, subject to NTH’s achievement

of future business milestones specified in the Share Exchange Agreement as follows:

| Milestone |

|

Date

Earned |

|

Contingent

Shares |

| Launch

of NTH’s leisure travel booking platform by either (i) achieving $1,000,000 in cumulative sales under its historical “phase

1” business, or (ii) commencement of its marketing program under its enhanced “phase 2” business. |

|

As

of a date six months after the closing date |

|

1,450,000

Contingent Shares |

| |

|

|

|

|

| Launch

of NTH’s group travel booking platform and signing of at least five (5) entities to use the groups travel booking platform. |

|

As

of a date nine months from the closing date (or earlier date six months after the closing date) |

|

1,450,000

Contingent Shares |

| |

|

|

|

|

| Launch

of NTH’s travel agent platform and signing up of at least 100 travel agents to the platform (which calculation includes individual

agents of an agency that signs up on behalf of multiple agents). |

|

As

of a date 12 months from the closing date (or earlier date six months after the closing date) |

|

1,450,000

Contingent Shares |

| |

|

|

|

|

| Commercial

launch of PayDelay technology in the NXT2.0 system. |

|

As

of a date 15 months after the closing date (or earlier date six months after the closing date) |

|

1,650,000

Contingent Shares, less the Exchange Shares issued at the closing of the Acquisition |

Pursuant

to Section 2.3(b)(vi) of the Share Exchange Agreement, whether a Milestone Event is met and the Contingent Shares are issuable under

Section 2.3 is to be determined by the Company and NTH on a mutually agreeable date (each a “Milestone Payment Determination Date”)

no later than thirty (30) days following notice by NTH to the Company that such Milestone Event has been met. If Contingent Shares are

determined to be issuable under this Section, the Company is required to issue such additional Contingent Shares within 60 days following

each Milestone Payment Determination Date.

To

date, no Contingent Shares have been issued. NTH believes, and the Company does not dispute, that 3 of the 4 milestones have been met

as of the date hereof but that, as a result of delays with the Company’s Form S-1 registration statement and the Company’s

pending initial listing application with Nasdaq (the “Regulatory Delays”), NTH has not sent formal notice to the Company

because doing so without the approval of Nasdaq’s initial listing application could trigger a delisting and suspension of trading

of the Company’s common stock on Nasdaq.

Due

to the indefinite delays caused by regulatory matters and NTH desire to receive the Contingent Shares earned to date, NTH has expressed

an intent to the Company to deliver formal notice that such Milestone Events have been met. However, due to the fact that such issuance

could trigger consequences to all Parties involved, NTH, through the NTH Representative, and the Company have negotiated this Forbearance

Agreement, whereby NTH agrees to forbear from issuing the Milestone Payment Determination Date notice until January 31, 2025 or earlier

in the event of a default (the “Forbearance Expiration Date”) in exchange for an agreement by the Company that, if such Nasdaq

initial listing application is not approved by such date that, (i) all such earned Contingent Shares will be issued withing five (5)

business days of the Forbearance Expiration Date and (ii) all such board appointment rights will be exercised and such members will be

approved within five (5) business days of the Forbearance Expiration Date.

The

Company has filed the Forbearance Agreement as Exhibit 10.1 to this Current Report on Form 8-K and the foregoing disclosure is qualified

in its entirety by reference thereto.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

The

following exhibits are filed with this Current Report on Form 8-K:

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

|

|

NEXTTRIP,

INC. |

| |

|

|

|

|

| Date: |

December

13, 2024 |

|

By: |

/s/

William Kerby |

| |

|

|

Name: |

William

Kerby |

| |

|

|

Title: |

Chief

Executive Officer |

Exhibit

10.1

FORBEARANCE

AGREEMENT

This

FORBEARANCE AGREEMENT (the “Agreement”), dated as of December 9, 2024, is by and among NextTrip Holdings, Inc. (“Holdings”)

via William Kerby, in the capacity as the representative of Holdings shareholders (the “Holdings Representative”)

and NextTrip, Inc. (fka Sigma Additive Solutions, Inc.) (the “Company”). Holdings and the Company are collectively

referred to herein as the “Parties.” Capitalized terms not defined herein shall have the meaning prescribed in that

certain Share Exchange Agreement described below.

RECITALS

A.

On October 12, 2023, the Company entered into a Share Exchange Agreement with Holdings and NextTrip Group, LLC (“Group”),

the sole stockholder of Holdings and the Holdings Representative, pursuant to which the Company acquired 100% of Holdings (the “Acquisition”)

in exchange for shares of Company common stock, which we refer to as the “Exchange Shares”. As a result, Holdings

became a wholly owned subsidiary of the Company as of December 29, 2023 (the “Closing Date”).

B. Upon

the closing of the Acquisition, the shareholders of Group, which we refer to collectively as the Group Sellers, were issued a number

of Exchange Shares equal to 19.99% of the Company’s issued and outstanding shares of common stock immediately prior to the Closing

Date. Under the Share Exchange Agreement, the Group Sellers are also entitled to receive additional shares of Company common stock, referred

to as the “Contingent Shares”, subject to Holdings’ achievement of future business milestones specified in the

Share Exchange Agreement as follows:

| Milestone |

|

Date

Earned |

|

Contingent

Shares |

| Launch

of Holdings’ leisure travel booking platform by either (i) achieving $1,000,000 in cumulative sales under its historical “phase

1” business, or (ii) commencement of its marketing program under its enhanced “phase 2” business. |

|

As

of a date six months after the closing date |

|

1,450,000

Contingent Shares |

| |

|

|

|

|

| Launch

of Holdings’ group travel booking platform and signing of at least five (5) entities to use the groups travel booking platform. |

|

As

of a date nine months from the closing date (or earlier date six months after the closing date) |

|

1,450,000

Contingent Shares |

| |

|

|

|

|

| Launch

of Holdings’ travel agent platform and signing up of at least 100 travel agents to the platform (which calculation includes

individual agents of an agency that signs up on behalf of multiple agents). |

|

As

of a date 12 months from the closing date (or earlier date six months after the closing date) |

|

1,450,000

Contingent Shares |

| |

|

|

|

|

| Commercial

launch of PayDelay technology in the NXT2.0 system. |

|

As

of a date 15 months after the closing date (or earlier date six months after the closing date) |

|

1,650,000

Contingent Shares, less the Exchange Shares issued at the closing of the Acquisition |

C. Pursuant

to Section 2.3(b)(vi) of the Share Exchange Agreement, whether a Milestone Event is met and the Contingent Shares are issuable under

Section 2.3 is to be determined by the Company and Holdings on a mutually agreeable date (each a “Milestone Payment Determination

Date”) no later than thirty (30) days following notice by Holdings to the Company that such Milestone Event has been met. If

Contingent Shares are determined to be issuable under this Section, the Company shall issue such additional Contingent Shares within

60 days following each Milestone Payment Determination Date.

D. Holdings

believes, and the Company does not dispute, that 3 of the 4 milestones have been met as of the date hereof but that, as a result of delays

with the Company’s S-1 registration statement and the pending initial listing application with Nasdaq (the “Regulatory

Delays”), Holdings has not sent formal notice to the Company because doing so without the approval of Nasdaq’s initial

listing application would trigger a delisting and suspension of trading of the Company’s common stock on Nasdaq

E. Due

to the indefinite delays caused by regulatory matters and Holdings desire to receive the Contingent Shares earned to date, Holdings has

expressed an intent to the Company to deliver formal notice that such Milestone Events have been met. However, due to the fact that such

issuance would trigger consequences to all Parties involved, Holdings, through the Holdings Representative, and the Company have negotiated

this Agreement, whereby Holdings agrees to forbear from issuing the Milestone Payment Determination Date notice until the Forbearance

Expiration Date in exchange for an agreement by the Company that, if such Nasdaq initial listing application is not approved by such

date that, (i) all such earned Contingent Shares will be issued withing five (5) business days of the Forbearance Expiration Date and

(ii) all such board appointment rights will be exercised and such members will be approved within five (5) business days of the Forbearance

Expiration Date.

F. As

provided in this Agreement, the Company has requested that Holdings agree to forbear from exercising its rights and remedies with respect

to said delays and Holdings is willing to so forbear from exercising its remedies subject to the terms and conditions herein.

NOW,

THEREFORE, the parties hereto agree as follows:

1. Definitions.

The following terms shall have the following meanings as provided herein:

“Forbearance

Default” means (a) the delisting of the Company’s common stock from trading on the Nasdaq; or (b) the formal rejection

by the Nasdaq of the Company’s initial listing application, in each case, during the Forbearance Period.

“Forbearance

Expiration Date” shall mean the earlier to occur of (i) any Forbearance Default and (ii) January 31, 2025.

“Forbearance

Period” means the period of time commencing on the date hereof and shall automatically terminate on the Forbearance Expiration

Date.

2. Forbearance.

Subject to the terms and conditions set forth in this Agreement, during the Forbearance Period, provided that no Forbearance Default

occurs, Holdings will forbear from exercising its rights or remedies against the Company arising solely as a result of the Regulatory

Delays. From and after the Forbearance Expiration Date, Holdings shall be entitled to exercise all of its rights and remedies under the

Share Exchange Agreement, at law or in equity, without further notice. Nothing herein constitutes a waiver of the Regulatory Delays,

and the Company acknowledges that Holdings has not waived, and has not committed to waive, the Regulatory Delays, or any other defaults

under the Share Exchange Agreement. Additionally, Holdings is not obligated to forbear from exercising any rights or remedies with respect

to the Regulatory Delays following the termination of the Forbearance Period, or any other defaults at any time. In accordance with the

terms of this Agreement, Holdings hereby reserves all rights and remedies available to it.

3. Accuracy

of Recitals and Acknowledgement of Delays. The Company acknowledges:

(a) The

accuracy of the Recitals set forth above; and

(b) That

the Regulatory Delays exists under the Share Exchange Agreement and, but for the forbearance provided under this Agreement, Holdings

is entitled to exercise all of the rights and remedies contained in the Share Exchange Agreement and under applicable law.

4. Covenants.

In addition to any other covenant in the Share Exchange Agreement, the Company covenants with Holdings:

(a) Reporting

on Sale Process. During the Forbearance Period, at least twice a month, the Company shall (i) provide Holdings an update on the status

of the Regulatory Delays and (ii) allow Holdings to participate in calls with the Company’s board of directors and legal counsel.

The Company shall also provide Holdings with information, including but not limited to documentation, regarding the status of the Regulatory

Delays as reasonably requested by Holdings.

(b) Further

Assurances. The Company shall execute, deliver, and provide to Holdings such additional agreements, documents, and

instruments as reasonably requested by Holdings to effectuate the intent of this Agreement.

5. Costs

and Expenses. All costs and expenses incurred by the Company associated with this Agreement and the transactions and documents related

thereto will be paid by the Company. All reasonable costs and expenses actually incurred by Holdings associated with this Agreement and

the transactions and documents related thereto will be paid by Holdings.

6. Amendments.

No amendment or modification of any provision of this Agreement shall be effective without the written agreement of the Parties, and

no termination or waiver of any provision of this Agreement, or consent to any departure by the Company therefrom, shall in any event

be effective without the written concurrence of Holdings. Any waiver or consent shall be effective only in the specific instance and

for the specific purpose for which it was given. No notice to or demand upon the Company in any case shall entitle the Company to any

other or further notice or demand in similar or other circumstances.

7. Binding

Effect. The Company understands and agrees that this Agreement is legally binding on and shall inure to the benefit of it and its

respective successors and assigns.

8. Entire

Agreement; Change; Discharge; Termination or Waiver. The Share Exchange Agreement, as modified by this Agreement, contains the entire

understanding and agreement of the Company and Holdings in respect of the Share Exchange Agreement and supersedes all prior representations,

warranties, agreements and understandings.

9. No

Third-Party Beneficiaries. This Agreement is solely for the benefit of the Parties hereto and no persons other than the undersigned

shall be entitled to claim or receive any benefit by reason of this Agreement.

10. Counterparts.

This Agreement may be executed in any number of counterparts, all of which taken together shall constitute one agreement, and any of

the parties hereto may execute this Agreement signing any such counterpart. Delivery of an executed counterpart of a signature page of

this Agreement by facsimile or in electronic (i.e., “pdf” or “tif”) format shall be effective as delivery

of a manually executed counterpart of this Agreement.

11. Governing

Law. This Agreement shall be governed by and construed in accordance with the Laws of the State of Delaware, without regard to conflicts

of Laws principles. Each of the Parties submits to the jurisdiction of any state or federal court sitting in Delaware in any action or

proceeding arising out of or relating to this Agreement and agrees that all claims in respect of the action or proceeding may be heard

and determined in any such court. Each of the Parties waives any defense of inconvenient forum to the maintenance of any action or proceeding

so brought and waives any bond, surety, or other security that might be required of any other Party with respect thereto. Any Party may

make service on any other Party by sending or delivering a copy of the process to the Party to be served at the address and in the manner

provided for the giving of notices in Section 11.3 of the Share Exchange Agreement. Nothing in this section, however, shall affect the

right of any Party to serve legal process in any other manner permitted by Law or at equity. Each Party agrees that a final judgment

in any action or proceeding so brought shall be conclusive and may be enforced by suit on the judgment or in any other manner provided

by Law or at equity.

[Remainder

of Page Intentionally Left Blank]

IN

WITNESS WHEREOF, Holdings and Company have executed this Agreement as of the date first above written.

| |

HOLDINGS: |

| |

|

| |

NextTrip

Holdings, Inc., |

| |

by

the NextTrip Holdings Inc. Representative: |

| |

|

|

| |

By: |

/s/ William

Kerby |

| |

Name:

|

William

Kerby |

| |

Title:

|

Shareholder

Representative |

| |

|

|

| |

COMPANY: |

| |

|

| |

NextTrip,

Inc. |

| |

|

|

| |

By: |

/s/ Frank

Orzechowski |

| |

Name:

|

Frank

Orzechowski |

| |

Title:

|

CFO |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

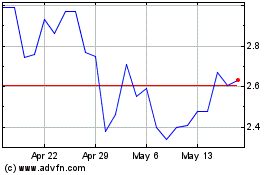

NextTrip (NASDAQ:NTRP)

Historical Stock Chart

From Jan 2025 to Feb 2025

NextTrip (NASDAQ:NTRP)

Historical Stock Chart

From Feb 2024 to Feb 2025