FISCAL 2025 FIRST QUARTER KEY FINANCIAL

HIGHLIGHTS

- First quarter revenues were the highest for a first quarter

since separation at $2.58 billion, a 3% increase compared to

$2.50 billion in the prior year, driven by growth at the

Digital Real Estate Services, Book Publishing and Dow Jones

segments

- Net income in the quarter was $144 million, a

significant improvement compared to net income of $58 million

in the prior year

- Total Segment EBITDA was the highest for a first quarter

since separation at $415 million, compared to $364 million in the

prior year

- In the quarter, reported EPS were $0.21 as compared to $0.05

in the prior year - Adjusted EPS were $0.21 compared to $0.16 in

the prior year

- REA Group posted record revenues for the quarter of $318

million, a 22% increase compared to the prior year, primarily

driven by robust Australian residential performance

- Dow Jones’ growth continued to be underpinned by robust

performance in its professional information business, where revenue

increased 8%, driven by growth of 16% at Risk & Compliance and

11% at Dow Jones Energy

- Book Publishing revenues grew 4% in the quarter, while

Segment EBITDA increased 25%, driven by record digital book sales,

which grew 15%, and strong backlist performance

News Corporation (“News Corp” or the “Company”) (Nasdaq: NWS,

NWSA; ASX: NWS, NWSLV) today reported financial results for the

three months ended September 30, 2024.

Commenting on the results, Chief Executive Robert Thomson

said:

“We have begun Fiscal 2025 robustly, with record first quarter

revenue, strong net income and record first quarter profitability.

Revenue rose 3 percent year-over-year to $2.58 billion, while our

net income jumped 148 percent to $144 million. Total Segment EBITDA

surged 14 percent to $415 million, and our EPS were 21 cents

compared to 5 cents in same quarter last year. That we have

achieved these record first quarter results in macro-conditions

which are far from auspicious is compelling evidence of the

successful transformation of News Corp over the past decade.

Meanwhile, the just-completed election has highlighted the

importance of trusted journalism in a media maelstrom in which some

journalists mistake virtue signaling for virtue. Artificial

intelligence recycles informational infelicities and it is critical

that journalistic inputs have integrity, which is why our

partnership with OpenAI is so crucial and why we intend to sue AI

companies abusing and misusing our trusted journalism.

Dow Jones and the New York Post have started proceedings against

the perplexing Perplexity, which is selling products based on our

journalism, and we are diligently preparing for further action

against other companies that have ingested our archives and are

synthesizing our intellectual property.”

FIRST QUARTER RESULTS

The Company reported fiscal 2025 first quarter total revenues of

$2.58 billion, a 3% increase compared to $2.50 billion in the prior

year period, primarily driven by higher Australian residential

revenues at REA Group, higher digital book sales combined with

improved returns at the Book Publishing segment and continued

growth in the professional information business at the Dow Jones

segment, in addition to a $35 million, or 1%, positive impact from

foreign currency fluctuations. The increase was partly offset by

lower revenues at the News Media segment. Adjusted Revenues (which

excludes the foreign currency impact, acquisitions and divestitures

as defined in Note 2) increased 2% compared to the prior year.

Net income for the quarter was $144 million, a 148% increase

compared to $58 million in the prior year, primarily driven by

higher Other, net, higher Total Segment EBITDA and lower impairment

and restructuring charges. These impacts were partially offset by

higher income tax expense and higher depreciation and

amortization.

The Company reported first quarter Total Segment EBITDA of $415

million, a 14% increase compared to $364 million in the prior year

primarily due to strong contributions from REA Group within the

Digital Real Estate Services segment, despite $12 million of deal

costs related to the withdrawn offer to acquire Rightmove, as well

as the Book Publishing segment. The increase was partly offset by

higher costs at the Subscription Video Services segment primarily

driven by the Hubbl product. Adjusted Total Segment EBITDA (as

defined in Note 2) increased 12%.

Net income per share attributable to News Corporation

stockholders was $0.21 as compared to $0.05 in the prior year.

Adjusted EPS (as defined in Note 3) were $0.21 compared to $0.16

in the prior year.

SEGMENT REVIEW

For the three months ended

September 30,

2024

2023

% Change

(in millions)

Better/

(Worse)

Revenues:

Dow Jones

$

552

$

537

3

%

Digital Real Estate Services

457

403

13

%

Book Publishing

546

525

4

%

Subscription Video Services

501

486

3

%

News Media

521

548

(5

)%

Other

—

—

—

%

Total Revenues

$

2,577

$

2,499

3

%

Segment EBITDA:

Dow Jones

$

131

$

124

6

%

Digital Real Estate Services

140

122

15

%

Book Publishing

81

65

25

%

Subscription Video Services

92

93

(1

)%

News Media

16

14

14

%

Other

(45

)

(54

)

17

%

Total Segment EBITDA

$

415

$

364

14

%

Dow Jones

Revenues in the quarter increased $15 million, or 3%, compared

to the prior year, driven by continued growth in the professional

information business, as well as higher content licensing revenue.

Digital revenues at Dow Jones in the quarter represented 82% of

total revenues compared to 81% in the prior year. Adjusted Revenues

increased 2%.

Circulation and subscription revenues increased $23 million, or

5%, primarily driven by an 8% increase in professional information

business revenues, led by 16% growth in Risk & Compliance

revenues to $81 million and 11% growth in Dow Jones Energy revenues

to $68 million. Circulation revenues increased 1% compared to the

prior year, as the continued growth in digital-only subscriptions

was mostly offset by lower print volume. Digital circulation

revenues accounted for 72% of circulation revenues for the quarter,

compared to 70% in the prior year.

During the first quarter, total average subscriptions to Dow

Jones’ consumer products were over 5.9 million, an 11% increase

compared to the prior year. Digital-only subscriptions to Dow

Jones’ consumer products grew 15% to over 5.3 million. Total

subscriptions to The Wall Street Journal grew 7% compared to the

prior year, to nearly 4.3 million average subscriptions in the

quarter. Digital-only subscriptions to The Wall Street Journal grew

10% to over 3.8 million average subscriptions in the quarter, and

represented 90% of total Wall Street Journal subscriptions.

For the three months ended

September 30,

2024

2023

% Change

(in thousands, except %)

Better/(Worse)

The Wall Street Journal

Digital-only subscriptions

3,811

3,457

10

%

Total subscriptions

4,255

3,991

7

%

Barron’s Group

Digital-only subscriptions

1,325

1,055

26

%

Total subscriptions

1,446

1,197

21

%

Total Consumer

Digital-only subscriptions

5,325

4,611

15

%

Total subscriptions

5,908

5,308

11

%

Advertising revenues decreased $6 million, or 7%, primarily due

to a 10% decline in print advertising revenues and a 5% decline in

digital advertising revenues driven by lower advertising spend in

the technology and finance sectors. Digital advertising accounted

for 67% of total advertising revenues in the quarter, compared to

66% in the prior year.

Segment EBITDA for the quarter increased $7 million, or 6%,

primarily as a result of the higher revenues discussed above and

lower newsprint, production and distribution costs, partially

offset by higher marketing and employee costs. Adjusted Segment

EBITDA increased 5%.

Digital Real Estate Services

Revenues in the quarter increased $54 million, or 13%, compared

to the prior year, driven by strong performance at REA Group.

Segment EBITDA in the quarter increased $18 million, or 15%,

compared to the prior year, due to higher contribution from REA

Group, despite $12 million of deal costs related to the withdrawn

offer to acquire Rightmove, and included a $3 million, or 3%,

positive impact from foreign currency fluctuations. The increase

was partly offset by modestly lower contribution from Move.

Adjusted Revenues and Adjusted Segment EBITDA (as defined in Note

2) increased 11% and 13%, respectively.

In the quarter, revenues at REA Group increased $57 million, or

22%, to $318 million, primarily driven by higher Australian

residential revenues due to price increases, increased depth

penetration and an increase in national listings, a $7 million, or

3%, positive impact from foreign currency fluctuations and higher

revenue from REA India. Australian national residential buy listing

volumes in the quarter increased 7% compared to the prior year,

with listings in Sydney and Melbourne up 11% and 9%,

respectively.

Move’s revenues in the quarter decreased $2 million, or 1%, to

$140 million, primarily as a result of lower real estate revenues.

Real estate revenues, which represented 77% of total Move revenues,

decreased 4%, driven by the ongoing impact of the macroeconomic

environment on the housing market, which led to lower lead and

transaction volumes. Revenues from the referral model, which

includes the ReadyConnect Concierge℠ product, and the core lead

generation product decreased due to these factors. The decline was

partially offset by strong growth in seller, new homes and rentals,

including the partnership with Zillow, and increased advertising

revenues. Based on Move’s internal data, average monthly unique

users of Realtor.com®’s web and mobile sites for the fiscal first

quarter grew 2% compared to the prior year to 77 million. Lead

volume was down 1% year over year as it continues to be impacted by

high mortgage rates.

Book Publishing

Revenues in the quarter increased $21 million, or 4%, compared

to the prior year, primarily driven by higher digital and backlist

book sales and improved returns. Key titles in the quarter included

Hillbilly Elegy by J.D. Vance, A Death in Cornwall by Daniel Silva

and The Au Pair Affair by Tessa Bailey. Bible sales were also

strong. Adjusted Revenues increased 3%.

Digital sales increased 15% compared to the prior year, driven

by 26% growth from audiobook sales, which benefited from the

continued contribution from the Spotify partnership and strong

market conditions, in addition to higher e-book sales, which

increased 7% compared to the prior year. Digital sales represented

25% of Consumer revenues for the quarter compared to 22% in the

prior year. Backlist sales represented approximately 64% of

Consumer revenues in the quarter compared to 61% in the prior

year.

Segment EBITDA for the quarter increased $16 million, or 25%,

compared to the prior year, primarily due to the higher revenues

discussed above, partially offset by higher employee costs.

Subscription Video Services

Revenues of $501 million in the quarter increased $15 million,

or 3%, compared with the prior year, primarily driven by higher

revenues from Kayo and BINGE from increases in both volume and

pricing, and an $11 million, or 2%, positive impact from foreign

currency fluctuations, partly offset by the impact from fewer

residential broadcast subscribers. Adjusted Revenues of $490

million increased 1% compared to the prior year. Foxtel Group

streaming subscription revenues represented 34% of total segment

circulation and subscription revenues in the quarter, as compared

to 30% in the prior year.

As of September 30, 2024, Foxtel’s total closing paid

subscribers were over 4.6 million, a 1% increase compared to the

prior year, driven by growth in Kayo and BINGE subscribers, partly

offset by fewer residential broadcast subscribers. Broadcast

subscriber churn in the quarter was 11.0% compared to 11.4% in the

prior year, while Broadcast ARPU for the quarter continued to

increase, up 4% year-over-year to A$89 (US$60).

As of September 30,

2024

2023

(in 000's)

Broadcast Subscribers

Residential

1,185

1,310

Commercial

237

233

Streaming Subscribers - Total (Paid)

Kayo

1,511 (1,499)

1,411 (1,403)

BINGE

1,571 (1,552)

1,506 (1,449)

Foxtel Now

134 (131)

167 (161)

Total Subscribers - Total (Paid)

4,658 (4,622)

4,646 (4,573)

Segment EBITDA of $92 million in the quarter decreased $1

million, or 1%, compared with the prior year, primarily due to $11

million of Hubbl costs, higher sports programming costs related to

contractual increases and higher production costs, partially offset

by declines in other costs, including marketing and entertainment

programming costs, and the higher revenues discussed above.

Adjusted Segment EBITDA decreased 3%.

News Media

Revenues in the quarter decreased $27 million, or 5%, as

compared to the prior year, including a positive $12 million, or

2%, impact from foreign currency fluctuations, primarily driven by

lower other revenues from the transfer of third-party printing

revenue contracts to News UK’s joint venture with DMG Media and

lower advertising revenues. Adjusted Revenues for the segment

decreased 7% compared to the prior year.

Circulation and subscription revenues decreased $4 million, or

1%, compared to the prior year, primarily due to lower print

volumes, partially offset by cover price increases and the $6

million, or 3%, positive impact from foreign currency

fluctuations.

Advertising revenues decreased $10 million, or 5%, compared to

the prior year, primarily due to lower print advertising revenues

at News Corp Australia and lower digital advertising revenues at

News UK mainly driven by a decline in traffic at some mastheads due

to algorithm changes at certain platforms, partially offset by a $5

million, or 2%, positive impact from foreign currency

fluctuations.

In the quarter, Segment EBITDA increased $2 million, or 14%,

compared to the prior year, driven by cost savings at News UK as a

result of the combination of its printing operations with those of

DMG Media and other cost savings initiatives, including lower Talk

costs, largely offset by the lower revenues discussed above.

Adjusted Segment EBITDA increased 7%.

Digital revenues represented 39% of News Media segment revenues

in the quarter, compared to 37% in the prior year, and represented

37% of the combined revenues of the newspaper mastheads. Digital

subscribers and users across key properties within the News Media

segment are summarized below:

- Closing digital subscribers at News Corp Australia as of

September 30, 2024 were 1,127,000 (979,000 for news mastheads),

compared to 1,049,000 (937,000 for news mastheads) in the prior

year (Source: Internal data)

- The Times and Sunday Times closing digital subscribers,

including the Times Literary Supplement, as of September 30, 2024

were 600,000, compared to 572,000 in the prior year (Source:

Internal data).

- The Sun’s digital offering reached 80 million global monthly

unique users in September 2024, compared to 134 million in the

prior year (Source: Meta Pixel)

- New York Post’s digital network reached 103 million unique

users in September 2024, compared to 127 million in the prior year

(Source: Google Analytics)

CASH FLOW

The following table presents a reconciliation of net cash

provided by (used in) operating activities to free cash flow:

For the three months ended

September 30,

2024

2023

(in millions)

Net cash provided by (used in) operating

activities

$

64

$

(55

)

Less: Capital expenditures

(95

)

(124

)

Free cash flow

$

(31

)

$

(179

)

Net cash provided by operating activities of $64 million for the

three months ended September 30, 2024 was $119 million higher than

net cash used in operating activities of $(55) million in the prior

year, primarily due to lower working capital and higher Total

Segment EBITDA, as noted above, partly offset by higher tax

payments.

Free cash flow in the three months ended September 30, 2024 was

$(31) million compared to $(179) million in the prior year. The

improvement in free cash flow was primarily due to higher cash

provided by operating activities, as mentioned above, in addition

to lower capital expenditures.

Free cash flow is a non-GAAP financial measure. Free cash flow

is defined as net cash provided by (used in) operating activities,

less capital expenditures. Free cash flow may not be comparable to

similarly titled measures reported by other companies, since

companies and investors may differ as to what items should be

included in the calculation of free cash flow.

Free cash flow does not represent the total increase or decrease

in the cash balance for the period and should be considered in

addition to, not as a substitute for, the net change in cash and

cash equivalents as presented in the Company’s consolidated

statements of cash flows prepared in accordance with GAAP, which

incorporates all cash movements during the period. The Company

believes free cash flow provides useful information to management

and investors about the Company’s liquidity and cash flow

trends.

OTHER ITEMS

Strategic Review

In response to third party interest, the Company is continuing

to assess strategic and financial options for the Foxtel Group,

including its capital structure and assets. There is no assurance

regarding the timing of any action or transaction, nor that the

strategic review will result in a transaction or other strategic

change.

COMPARISON OF NON-GAAP TO U.S. GAAP INFORMATION

Adjusted Revenues, Total Segment EBITDA, Adjusted Total Segment

EBITDA, Adjusted Segment EBITDA, adjusted net income attributable

to News Corporation stockholders, Adjusted EPS, constant currency

revenues and free cash flow are non-GAAP financial measures

contained in this earnings release. The Company believes these

measures are important tools for investors and analysts to use in

assessing the Company’s underlying business performance and to

provide for more meaningful comparisons of the Company’s operating

performance between periods. These measures also allow investors

and analysts to view the Company’s business from the same

perspective as Company management. These non-GAAP measures may be

different than similar measures used by other companies and should

be considered in addition to, not as a substitute for, measures of

financial performance calculated in accordance with GAAP.

Reconciliations for the differences between non-GAAP measures used

in this earnings release and comparable financial measures

calculated in accordance with U.S. GAAP are included in Notes 1, 2,

3 and 4 and the reconciliation of net cash provided by (used in)

operating activities to free cash flow is included above.

Conference call

News Corporation’s earnings conference call can be heard live at

5:00 p.m. EST on November 7, 2024. To listen to the call, please

visit http://investors.newscorp.com.

Annual Meeting of Stockholders

News Corporation’s 2024 Annual Meeting of Stockholders will be

held exclusively via live webcast on Wednesday, November 20, 2024,

beginning at 1:00 p.m. EST. The webcast can be accessed at

www.virtualshareholdermeeting.com/NWS2024. A replay will be

available at the same location for a period of time following the

meeting.

Cautionary Statement Concerning Forward-Looking

Statements

This document contains certain “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995. These forward-looking statements include, but are not

limited to, statements regarding trends and uncertainties affecting

the Company’s business, results of operations and financial

condition, the Company’s strategy and strategic initiatives,

including potential acquisitions, investments and dispositions, the

Company’s cost savings initiatives and the outcome of contingencies

such as litigation and investigations. These statements are based

on management’s views and assumptions regarding future events and

business performance as of the time the statements are made. Actual

results may differ materially from these expectations due to the

risks, uncertainties and other factors described in the Company’s

filings with the Securities and Exchange Commission. More detailed

information about factors that could affect future results is

contained in our filings with the Securities and Exchange

Commission. The “forward-looking statements” included in this

document are made only as of the date of this document and we do

not have and do not undertake any obligation to publicly update any

“forward-looking statements” to reflect subsequent events or

circumstances, and we expressly disclaim any such obligation,

except as required by law or regulation.

About News Corporation

News Corp (Nasdaq: NWS, NWSA; ASX: NWS, NWSLV) is a global,

diversified media and information services company focused on

creating and distributing authoritative and engaging content and

other products and services. The company comprises businesses

across a range of media, including: information services and news,

digital real estate services, book publishing and subscription

video services in Australia. Headquartered in New York, News Corp

operates primarily in the United States, Australia, and the United

Kingdom, and its content and other products and services are

distributed and consumed worldwide. More information is available

at: www.newscorp.com.

NEWS CORPORATION

CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited; in

millions, except per share amounts)

For the three months ended

September 30,

2024

2023

Revenues:

Circulation and subscription

$

1,157

$

1,129

Advertising

381

391

Consumer

521

502

Real estate

357

311

Other

161

166

Total Revenues

2,577

2,499

Operating expenses

(1,263

)

(1,273

)

Selling, general and administrative

(899

)

(862

)

Depreciation and amortization

(189

)

(171

)

Impairment and restructuring charges

(24

)

(38

)

Equity losses of affiliates

(3

)

(2

)

Interest expense, net

(18

)

(23

)

Other, net

23

(35

)

Income before income tax expense

204

95

Income tax expense

(60

)

(37

)

Net income

144

58

Net income attributable to noncontrolling

interests

(25

)

(28

)

Net income attributable to News

Corporation stockholders

$

119

$

30

Weighted average shares outstanding:

Basic

569.2

572.3

Diluted

571.2

574.1

Net income attributable to News

Corporation stockholders per share, basic and diluted

$

0.21

$

0.05

NEWS CORPORATION

CONSOLIDATED BALANCE SHEETS (Unaudited; in

millions)

As of September 30, 2024

As of June 30, 2024

ASSETS

Current assets:

Cash and cash equivalents

$

1,778

$

1,960

Receivables, net

1,698

1,503

Inventory, net

378

296

Other current assets

652

613

Total current assets

4,506

4,372

Non-current assets:

Investments

458

430

Property, plant and equipment, net

1,919

1,914

Operating lease right-of-use assets

965

958

Intangible assets, net

2,324

2,322

Goodwill

5,258

5,186

Deferred income tax assets, net

323

332

Other non-current assets

1,174

1,170

Total assets

$

16,927

$

16,684

LIABILITIES AND EQUITY

Current liabilities:

Accounts payable

$

374

$

314

Accrued expenses

1,213

1,231

Deferred revenue

559

551

Current borrowings

194

54

Other current liabilities

929

905

Total current liabilities

3,269

3,055

Non-current liabilities:

Borrowings

2,706

2,855

Retirement benefit obligations

130

125

Deferred income tax liabilities, net

112

119

Operating lease liabilities

1,036

1,027

Other non-current liabilities

508

492

Commitments and contingencies

Equity:

Class A common stock

4

4

Class B common stock

2

2

Additional paid-in capital

11,157

11,254

Accumulated deficit

(1,779

)

(1,889

)

Accumulated other comprehensive loss

(1,131

)

(1,251

)

Total News Corporation stockholders'

equity

8,253

8,120

Noncontrolling interests

913

891

Total equity

9,166

9,011

Total liabilities and equity

$

16,927

$

16,684

NEWS CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited; in

millions)

For the three months ended

September 30,

2024

2023

Operating activities:

Net income

$

144

$

58

Adjustments to reconcile net income to net

cash provided by (used in) operating activities:

Depreciation and amortization

189

171

Operating lease expense

25

24

Equity losses of affiliates

3

2

Impairment charges

—

21

Deferred income taxes

14

13

Other, net

(23

)

36

Change in operating assets and

liabilities, net of acquisitions:

Receivables and other assets

(107

)

(128

)

Inventories, net

(68

)

(55

)

Accounts payable and other liabilities

(113

)

(197

)

Net cash provided by (used in) operating

activities

64

(55

)

Investing activities:

Capital expenditures

(95

)

(124

)

Acquisitions, net of cash acquired

(12

)

(20

)

Purchases of investments in equity

affiliates and other

(51

)

(31

)

Proceeds from sales of investments in

equity affiliates and other

22

16

Net cash used in investing activities

(136

)

(159

)

Financing activities:

Borrowings

153

925

Repayment of borrowings

(185

)

(933

)

Repurchase of shares

(38

)

(29

)

Dividends paid

(35

)

(28

)

Other, net

(42

)

—

Net cash used in financing activities

(147

)

(65

)

Net change in cash and cash

equivalents

(219

)

(279

)

Cash and cash equivalents, beginning of

year

1,960

1,833

Effect of exchange rate changes on cash

and cash equivalents

37

(25

)

Cash and cash equivalents, end of

period

$

1,778

$

1,529

NOTE 1 – TOTAL SEGMENT EBITDA

Segment EBITDA is defined as revenues less operating expenses

and selling, general and administrative expenses. Segment EBITDA

does not include: depreciation and amortization, impairment and

restructuring charges, equity losses of affiliates, interest

(expense) income, net, other, net and income tax (expense) benefit.

Management believes that Segment EBITDA is an appropriate measure

for evaluating the operating performance of the Company’s business

segments because it is the primary measure used by the Company’s

chief operating decision maker to evaluate the performance of and

allocate resources within the Company’s businesses. Segment EBITDA

provides management, investors and equity analysts with a measure

to analyze the operating performance of each of the Company’s

business segments and its enterprise value against historical data

and competitors’ data, although historical results may not be

indicative of future results (as operating performance is highly

contingent on many factors, including customer tastes and

preferences).

Total Segment EBITDA is a non-GAAP measure and should be

considered in addition to, not as a substitute for, net income

(loss), cash flow and other measures of financial performance

reported in accordance with GAAP. In addition, this measure does

not reflect cash available to fund requirements and excludes items,

such as depreciation and amortization and impairment and

restructuring charges, which are significant components in

assessing the Company’s financial performance. The Company believes

that the presentation of Total Segment EBITDA provides useful

information regarding the Company’s operations and other factors

that affect the Company’s reported results. Specifically, the

Company believes that by excluding certain one-time or non-cash

items such as impairment and restructuring charges and depreciation

and amortization, as well as potential distortions between periods

caused by factors such as financing and capital structures and

changes in tax positions or regimes, the Company provides users of

its consolidated financial statements with insight into both its

core operations as well as the factors that affect reported results

between periods but which the Company believes are not

representative of its core business. As a result, users of the

Company’s consolidated financial statements are better able to

evaluate changes in the core operating results of the Company

across different periods. The following table reconciles net income

to Total Segment EBITDA for the three months ended September 30,

2024 and 2023:

For the three months ended

September 30,

2024

2023

Change

% Change

(in millions)

Net income

$

144

$

58

$

86

148

%

Add:

Income tax expense

60

37

23

62

%

Other, net

(23

)

35

(58

)

**

Interest expense, net

18

23

(5

)

(22

)%

Equity losses of affiliates

3

2

1

50

%

Impairment and restructuring charges

24

38

(14

)

(37

)%

Depreciation and amortization

189

171

18

11

%

Total Segment EBITDA

$

415

$

364

$

51

14

%

**Not meaningful

NOTE 2 – ADJUSTED REVENUES, ADJUSTED TOTAL SEGMENT EBITDA AND

ADJUSTED SEGMENT EBITDA

The Company uses revenues, Total Segment EBITDA and Segment

EBITDA excluding the impact of acquisitions, divestitures, fees and

costs, net of indemnification, related to the claims and

investigations arising out of certain conduct at The News of the

World (the “U.K. Newspaper Matters”), charges for other

significant, non-ordinary course legal or regulatory matters

(“litigation charges”) and foreign currency fluctuations (“Adjusted

Revenues,” “Adjusted Total Segment EBITDA” and “Adjusted Segment

EBITDA,” respectively) to evaluate the performance of the Company’s

core business operations exclusive of certain items that impact the

comparability of results from period to period such as the

unpredictability and volatility of currency fluctuations. The

Company calculates the impact of foreign currency fluctuations for

businesses reporting in currencies other than the U.S. dollar by

multiplying the results for each quarter in the current period by

the difference between the average exchange rate for that quarter

and the average exchange rate in effect during the corresponding

quarter of the prior year and totaling the impact for all quarters

in the current period.

The calculation of Adjusted Revenues, Adjusted Total Segment

EBITDA and Adjusted Segment EBITDA may not be comparable to

similarly titled measures reported by other companies, since

companies and investors may differ as to what type of events

warrant adjustment. Adjusted Revenues, Adjusted Total Segment

EBITDA and Adjusted Segment EBITDA are not measures of performance

under generally accepted accounting principles and should not be

construed as substitutes for amounts determined under GAAP as

measures of performance. However, management uses these measures in

comparing the Company’s historical performance and believes that

they provide meaningful and comparable information to investors to

assist in their analysis of our performance relative to prior

periods and our competitors.

The following table reconciles reported revenues and reported

Total Segment EBITDA to Adjusted Revenues and Adjusted Total

Segment EBITDA for the three months ended September 30, 2024 and

2023:

Revenues

Total Segment EBITDA

For the three months ended

September 30,

For the three months ended

September 30,

2024

2023

Difference

2024

2023

Difference

(in millions)

(in millions)

As reported

$

2,577

$

2,499

$

78

$

415

$

364

$

51

Impact of acquisitions

(2

)

—

(2

)

1

—

1

Impact of foreign currency

fluctuations

(35

)

—

(35

)

(8

)

—

(8

)

Net impact of U.K. Newspaper Matters

—

—

—

2

3

(1

)

As adjusted

$

2,540

$

2,499

$

41

$

410

$

367

$

43

Foreign Exchange Rates

Average foreign exchange rates used in the calculation of the

impact of foreign currency fluctuations for the three months ended

September 30, 2024 and 2023 are as follows:

Fiscal Year 2025

Q1

U.S. Dollar per Australian Dollar

$0.67

U.S. Dollar per British Pound Sterling

$1.30

Fiscal Year 2024

Q1

U.S. Dollar per Australian Dollar

$0.65

U.S. Dollar per British Pound Sterling

$1.27

Adjusted Revenues and Adjusted Segment EBITDA by segment for the

three months ended September 30, 2024 and 2023 are as follows:

For the three months ended

September 30,

2024

2023

% Change

(in millions)

Better/(Worse)

Adjusted Revenues:

Dow Jones

$

549

$

537

2

%

Digital Real Estate Services

449

403

11

%

Book Publishing

543

525

3

%

Subscription Video Services

490

486

1

%

News Media

509

548

(7

)%

Other

—

—

—

%

Adjusted Total Revenues

$

2,540

$

2,499

2

%

Adjusted Segment EBITDA:

Dow Jones

$

130

$

124

5

%

Digital Real Estate Services

138

122

13

%

Book Publishing

80

65

23

%

Subscription Video Services

90

93

(3

)%

News Media

15

14

7

%

Other

(43

)

(51

)

16

%

Adjusted Total Segment EBITDA

$

410

$

367

12

%

The following tables reconcile reported revenues and Segment

EBITDA by segment to Adjusted Revenues and Adjusted Segment EBITDA

by segment for the three months ended September 30, 2024 and

2023:

For the three months ended

September 30, 2024

As Reported

Impact of Acquisitions

Impact of Foreign Currency

Fluctuations

Net Impact of U.K. Newspaper

Matters

As Adjusted

(in millions)

Revenues:

Dow Jones

$

552

$

(1

)

$

(2

)

$

—

$

549

Digital Real Estate Services

457

(1

)

(7

)

—

449

Book Publishing

546

—

(3

)

—

543

Subscription Video Services

501

—

(11

)

—

490

News Media

521

—

(12

)

—

509

Other

—

—

—

—

—

Total Revenues

$

2,577

$

(2

)

$

(35

)

$

—

$

2,540

Segment EBITDA:

Dow Jones

$

131

$

—

$

(1

)

$

—

$

130

Digital Real Estate Services

140

1

(3

)

—

138

Book Publishing

81

—

(1

)

—

80

Subscription Video Services

92

—

(2

)

—

90

News Media

16

—

(1

)

—

15

Other

(45

)

—

—

2

(43

)

Total Segment EBITDA

$

415

$

1

$

(8

)

$

2

$

410

For the three months ended

September 30, 2023

As Reported

Impact of Acquisitions

Impact of Foreign Currency

Fluctuations

Net Impact of U.K. Newspaper

Matters

As Adjusted

(in millions)

Revenues:

Dow Jones

$

537

$

—

$

—

$

—

$

537

Digital Real Estate Services

403

—

—

—

403

Book Publishing

525

—

—

—

525

Subscription Video Services

486

—

—

—

486

News Media

548

—

—

—

548

Other

—

—

—

—

—

Total Revenues

$

2,499

$

—

$

—

$

—

$

2,499

Segment EBITDA:

Dow Jones

$

124

$

—

$

—

$

—

$

124

Digital Real Estate Services

122

—

—

—

122

Book Publishing

65

—

—

—

65

Subscription Video Services

93

—

—

—

93

News Media

14

—

—

—

14

Other

(54

)

—

—

3

(51

)

Total Segment EBITDA

$

364

$

—

$

—

$

3

$

367

NOTE 3 – ADJUSTED NET INCOME (LOSS) ATTRIBUTABLE TO NEWS

CORPORATION STOCKHOLDERS AND ADJUSTED EPS

The Company uses net income (loss) attributable to News

Corporation stockholders and diluted earnings per share (“EPS”)

excluding expenses related to U.K. Newspaper Matters, litigation

charges, impairment and restructuring charges and “Other, net”, net

of tax, recognized by the Company or its equity method investees,

as well as the settlement of certain pre-Separation tax matters

(“adjusted net income (loss) attributable to News Corporation

stockholders” and “adjusted EPS,” respectively), to evaluate the

performance of the Company’s operations exclusive of certain items

that impact the comparability of results from period to period, as

well as certain non-operational items. The calculation of adjusted

net income (loss) attributable to News Corporation stockholders and

adjusted EPS may not be comparable to similarly titled measures

reported by other companies, since companies and investors may

differ as to what type of events warrant adjustment. Adjusted net

income (loss) attributable to News Corporation stockholders and

adjusted EPS are not measures of performance under generally

accepted accounting principles and should not be construed as

substitutes for consolidated net income (loss) attributable to News

Corporation stockholders and net income (loss) per share as

determined under GAAP as a measure of performance. However,

management uses these measures in comparing the Company’s

historical performance and believes that they provide meaningful

and comparable information to investors to assist in their analysis

of our performance relative to prior periods and our

competitors.

The following table reconciles reported net income attributable

to News Corporation stockholders and reported diluted EPS to

adjusted net income attributable to News Corporation stockholders

and adjusted EPS for the three months ended September 30, 2024 and

2023:

For the three months ended

September 30, 2024

For the three months ended

September 30, 2023

(in millions, except per share data)

Net income attributable to

stockholders

EPS

Net income attributable to

stockholders

EPS

Net income

$

144

$

58

Net income attributable to noncontrolling

interests

(25

)

(28

)

Net income attributable to News

Corporation stockholders

$

119

$

0.21

$

30

$

0.05

U.K. Newspaper Matters

2

0.01

3

0.01

Impairment and restructuring

charges(a)

24

0.04

38

0.06

Other, net

(23

)

(0.04

)

35

0.06

Tax impact on items above

(3

)

(0.01

)

(19

)

(0.03

)

Impact of noncontrolling interest on items

above

(1

)

—

3

0.01

As adjusted

$

118

$

0.21

$

90

$

0.16

(a)

During the three months ended September

30, 2023, the Company recognized non-cash impairment charges of $21

million at the News Media segment related to the write-down of

fixed assets associated with the combination of News UK’s printing

operations with those of DMG Media.

NOTE 4 – CONSTANT CURRENCY REVENUES

The Company believes that the presentation of revenues excluding

the impact of foreign currency fluctuations (“constant currency

revenues”) provides useful information regarding the performance of

the Company’s core business operations exclusive of distortions

between periods caused by the unpredictability and volatility of

currency fluctuations. The Company calculates the impact of foreign

currency fluctuations for businesses reporting in currencies other

than the U.S. dollar as described in Note 2.

Constant currency revenues are not measures of performance under

generally accepted accounting principles and should not be

construed as substitutes for revenues as determined under GAAP as

measures of performance. However, management uses these measures in

comparing the Company’s historical performance and believes that

they provide meaningful and comparable information to investors to

assist in their analysis of our performance relative to prior

periods and our competitors.

The following tables reconcile reported revenues to constant

currency revenues for the three months ended September 30,

2024:

Q1 Fiscal 2024

Q1 Fiscal 2025

FX impact

Q1 Fiscal 2025 constant

currency

% Change - reported

% Change - constant currency

($ in millions)

Better/(Worse)

Consolidated results:

Circulation and subscription

$

1,129

$

1,157

$

18

$

1,139

2

%

1

%

Advertising

391

381

6

375

(3

)%

(4

)%

Consumer

502

521

3

518

4

%

3

%

Real estate

311

357

6

351

15

%

13

%

Other

166

161

2

159

(3

)%

(4

)%

Total revenues

$

2,499

$

2,577

$

35

$

2,542

3

%

2

%

Dow Jones:

Circulation and subscription

$

436

$

459

$

2

$

457

5

%

5

%

Advertising

91

85

—

85

(7

)%

(7

)%

Other

10

8

—

8

(20

)%

(20

)%

Total Dow Jones segment revenues

$

537

$

552

$

2

$

550

3

%

2

%

Digital Real Estate Services:

Circulation and subscription

$

3

$

2

$

—

$

2

(33

)%

(33

)%

Advertising

35

38

—

38

9

%

9

%

Real estate

311

357

6

351

15

%

13

%

Other

54

60

1

59

11

%

9

%

Total Digital Real Estate Services segment

revenues

$

403

$

457

$

7

$

450

13

%

12

%

REA Group revenues

$

261

$

318

$

7

$

311

22

%

19

%

Q1 Fiscal 2024

Q1 Fiscal 2025

FX impact

Q1 Fiscal 2025 constant

currency

% Change - reported

% Change - constant currency

($ in millions)

Better/(Worse)

Book Publishing:

Consumer

$

502

$

521

$

3

$

518

4

%

3

%

Other

23

25

—

25

9

%

9

%

Total Book Publishing segment revenues

$

525

$

546

$

3

$

543

4

%

3

%

Subscription Video Services:

Circulation and subscription

$

415

$

425

$

10

$

415

2

%

—

%

Advertising

62

65

1

64

5

%

3

%

Other

9

11

—

11

22

%

22

%

Total Subscription Video Services segment

revenues

$

486

$

501

$

11

$

490

3

%

1

%

News Media:

Circulation and subscription

$

275

$

271

$

6

$

265

(1

)%

(4

)%

Advertising

203

193

5

188

(5

)%

(7

)%

Other

70

57

1

56

(19

)%

(20

)%

Total News Media segment revenues

$

548

$

521

$

12

$

509

(5

)%

(7

)%

News UK

Circulation and subscription

$

144

$

146

$

4

$

142

1

%

(1

)%

Advertising

59

50

2

48

(15

)%

(19

)%

Other

25

11

—

11

(56

)%

(56

)%

Total News UK revenues

$

228

$

207

$

6

$

201

(9

)%

(12

)%

News Corp Australia

Circulation and subscription

$

107

$

103

$

2

$

101

(4

)%

(6

)%

Advertising

93

90

2

88

(3

)%

(5

)%

Other

38

41

1

40

8

%

5

%

Total News Corp Australia revenues

$

238

$

234

$

5

$

229

(2

)%

(4

)%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107961040/en/

Investor Relations Michael Florin

212-416-3363 mflorin@newscorp.com

Anthony Rudolf 212-416-3040 arudolf@newscorp.com

Corporate Communications Arthur

Bochner 646-422-9671 abochner@newscorp.com

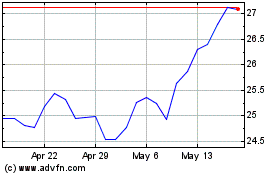

News (NASDAQ:NWS)

Historical Stock Chart

From Oct 2024 to Nov 2024

News (NASDAQ:NWS)

Historical Stock Chart

From Nov 2023 to Nov 2024