Onfolio Holdings Inc. Provides Update on 506(c) Series A Preferred Share Offering

18 October 2023 - 11:00PM

Onfolio Holdings Inc. (Nasdaq: ONFO, ONFOW) (the "Company" or

"Onfolio") provides an update on its offering of up to 400,000

shares of its Series A Preferred Shares at $25 per share for an

aggregate offering amount of $10 million. To date, the Company has

raised more than one million dollars in non-dilutive funding from

Series A Preferred Shares and promissory notes.

Dominic Wells, Onfolio’s Chief Executive

Officer, stated, “Our fundraising efforts continue to go apace, and

we are pleased with the outcome to date. We continue to earmark

these funds for additional acquisitions and intend to continue the

offer of Series A Preferred Shares for the time being.”

The shares are being offered to accredited

investors only pursuant to Regulation D, Rule 506(c) under the

Securities Act of 1933, as amended (the "Securities Act"). Although

general solicitation is permitted under Rule 506(c) offerings,

purchasers must be accredited investors and meet certain Securities

and Exchange Commission (“SEC”) verification requirements for

validation of their "accredited investor" status. The Company

intends to use the net proceeds from this offering for acquisitions

purposes and general corporate purposes.

Onfolio’s Series A Preferred Shares are senior

in rank to shares of common stock with respect to dividends,

liquidation, and dissolution. Each share of Series A Preferred

carries an annual 12% cumulative, non-compounding dividend based on

the $25 liquidation value of the Series A Preferred Shares, payable

quarterly. The Series A Preferred Shares are redeemable at the

option of the Company commencing any time after January 1, 2026 at

a price equal to the purchase price ($25.00 per share) plus accrued

dividends.

The promissory notes are interest-only for two

years, mature at the end of the second year, and have no conversion

features. They were offered to known and/or existing investors in

the Company.

This press release does not constitute an offer

to sell nor a solicitation of an offer to purchase any securities

in any jurisdiction in which such an offer or solicitation is not

authorized and does not constitute an offer within any jurisdiction

to any person to whom such offer would be unlawful. Further, the

securities being offered by Onfolio have not been registered under

the Securities Act, any state securities laws or the securities

laws of any other jurisdiction and may not be offered or sold

absent registration or an applicable exemption from the

registration requirements.

For additional information about Onfolio and to

request our Regulation D, Rule 506(c) offering materials, please

visit: https://investinonfolio.com

About Onfolio Holdings Inc.

Onfolio acquires and manages a diversified

portfolio of online businesses across a broad range of verticals,

each with a niche content focus and brand identity. Onfolio

acquires business that meet its investment criteria, being that

such businesses operate in sectors with long-term growth

opportunities, have positive and stable cash flows, face minimal

threats of technological or competitive obsolescence and can be

managed by our existing team or have strong management teams

largely in place. The Company excels at finding acquisition

opportunities where the seller has not fully optimized their

business, and Onfolio’s experience and skillset allows it to add

increased value to these existing businesses.

Visit www.onfolio.com for more information.

Safe Harbor Statement

The information posted in this release may

contain forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. You can identify

these statements by use of the words “may,” “will,” “should,”

“plans,” “explores,” “expects,” “anticipates,” “continues,”

“estimates,” “projects,” “intends,” and similar expressions.

Examples of forward-looking statements include, among others,

statements we make regarding expected operating results, such as

revenue growth and earnings, and strategy for growth and

financial results. Forward-looking statements are neither

historical facts nor assurances of future performance. Instead,

they are based only on our current beliefs, expectations and

assumptions regarding the future of our business, future plans and

strategies, projections, anticipated events and trends, the economy

and other future conditions. Because forward-looking statements

relate to the future, they are subject to inherent uncertainties,

risks and changes in circumstances that are difficult to predict

and many of which are outside of our control. Our actual results

and financial condition may differ materially from those indicated

in the forward-looking statements. Therefore, you should not rely

on any of these forward-looking statements. Important factors that

could cause our actual results and financial condition to differ

materially from those indicated in the forward-looking statements

include, among others, the following: general economic and business

conditions, effects of continued geopolitical unrest and regional

conflicts, competition, changes in technology and methods of

marketing, delays in completing new customer offerings, changes in

customer order patterns, changes in customer offering mix,

continued success in technological advances and delivering

technological innovations, delays due to issues with outsourced

service providers, those events and factors described by us in Item

1.A "Risk Factors" in our most recent Form 10-K and other

risks to which our Company is subject, and various other factors

beyond the Company’s control. Any forward-looking statement made by

us in this press release is based only on information

currently available to us and speaks only as of the date on which

it is made. We undertake no obligation to publicly update any

forward-looking statement, whether written or oral, that may be

made from time to time, whether as a result of new information,

future developments or otherwise.

Company Contact:Derek McCarthyInvestor

CommunicationsOnfolio Holdings IncInvestors@Onfolio.com

Investors Relations:Bret ShapiroCORE

IRbrets@coreir.com516-222-2560

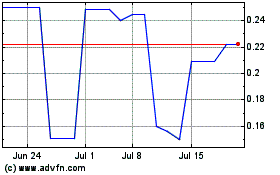

Onfolio (NASDAQ:ONFOW)

Historical Stock Chart

From Oct 2024 to Nov 2024

Onfolio (NASDAQ:ONFOW)

Historical Stock Chart

From Nov 2023 to Nov 2024