Office Properties Income Trust Announces Quarterly Dividend on Common Shares

16 October 2024 - 11:00PM

Business Wire

Office Properties Income Trust (Nasdaq: OPI) today announced a

regular quarterly cash distribution on its common shares of $0.01

per common share ($0.04 per share per year). This distribution will

be paid to OPI’s common shareholders of record as of the close of

business on October 28, 2024 and distributed on or about November

14, 2024.

About Office Properties Income Trust

OPI is a national REIT focused on owning and leasing office

properties to high credit quality tenants in markets throughout the

United States. As of June 30, 2024, approximately 61% of OPI's

revenues were from investment grade rated tenants. OPI owned 151

properties as of June 30, 2024, with approximately 20.3 million

square feet located in 30 states and Washington, D.C. In 2024, OPI

was named as an Energy Star® Partner of the Year for the seventh

consecutive year. OPI is managed by The RMR Group (Nasdaq: RMR), a

leading U.S. alternative asset management company with over $41

billion in assets under management as of June 30, 2024, and more

than 35 years of institutional experience in buying, selling,

financing and operating commercial real estate. OPI is

headquartered in Newton, MA. For more information, visit

opireit.com.

WARNING CONCERNING

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of 1995

and other securities laws. These forward-looking statements are

based upon OPI’s present intent, beliefs and expectations, but

these statements and the implications of these statements are not

guaranteed to occur and may not occur for various reasons, some of

which are beyond OPI’s control. For example:

In this press release, OPI states that its regular quarterly

cash distribution rate is $0.01 per share per quarter or $0.04 per

share per year. OPI’s Board of Trustees considers many factors when

setting or resetting OPI’s distribution rate, including OPI’s

historical and projected income, normalized funds from operations,

cash available for distribution, the then current and expected

needs and availability of cash to pay OPI’s obligations and fund

its investments, distributions which may be required to be paid to

maintain OPI’s qualification for taxation as a REIT and other

factors deemed relevant by OPI’s Board of Trustees. Accordingly,

future distributions to OPI’s shareholders may be increased or

decreased and OPI cannot be sure as to the rate at which future

distributions will be paid.

You should not place undue reliance upon forward-looking

statements.

Except as required by law, OPI does not intend to update or

change any forward-looking statements as a result of new

information, future events or otherwise.

A Maryland Real Estate Investment Trust with

transferable shares of beneficial interest listed on the

Nasdaq.

No shareholder, Trustee or officer is

personally liable for any act or obligation of the Trust.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241015066351/en/

Kevin Barry, Senior Director, Investor Relations (617)

219-1410

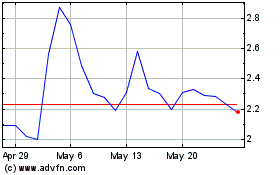

Office Properties Income (NASDAQ:OPI)

Historical Stock Chart

From Oct 2024 to Nov 2024

Office Properties Income (NASDAQ:OPI)

Historical Stock Chart

From Nov 2023 to Nov 2024