Optinose Announces 1-for-15 Reverse Stock Split

26 December 2024 - 11:00PM

Optinose, Inc. (NASDAQ: OPTN), a pharmaceutical

company focused on patients treated by ear, nose and throat (ENT)

and allergy specialists, today announced that it will effect a

1-for-15 reverse stock split at 5:00 p.m. Eastern Standard Time, on

December 30, 2024. Beginning with the opening of trading on

December 31, 2024, Optinose’s common stock will trade on the Nasdaq

Global Select Market (“Nasdaq”) on a split-adjusted basis under a

new CUSIP number 68404V209 and Optinose’s existing trading symbol

“OPTN.”

The reverse stock split is intended to enable

Optinose to regain compliance with the $1.00 minimum closing bid

price required for continued listing on Nasdaq.

At a special meeting of stockholders held on

December 23, 2024, Optinose’s stockholders approved the proposal to

authorize Optinose’s Board of Directors (the “Board”) to file an

amendment to Optinose’s fourth amended and restated certificate of

incorporation (the “Certificate of Incorporation”) to effect a

reverse stock split within a range of 1-for-10 to a maximum of

1-for-100. The specific 1-for-15 ratio was subsequently approved by

the Board and the reverse stock split will be effected by filing a

Certificate of Amendment to the Certificate of Incorporation with

the Secretary of State of the State of Delaware. No further action

is required by any stockholders in connection with approving or

effecting the reverse stock split.

The reverse stock split will affect all issued

and outstanding shares of Optinose’s common stock. At the effective

time of the reverse stock split, the number of shares of common

stock issued and outstanding will be reduced from 150,829,507

shares to approximately 10,055,300 shares. All outstanding options

and warrants entitling their holders to purchase shares of

Optinose’s common stock will be adjusted as a result of the reverse

stock split, as required by the terms of each security. The number

of shares reserved for future issuance pursuant to Optinose’s 2010

Stock Incentive Plan and the number of shares reserved for future

issuance pursuant to Optinose’s 2017 Employee Stock Purchase Plan

also will be appropriately adjusted. The reverse stock split will

affect all stockholders uniformly and will not affect any

stockholder's ownership percentage of Optinose’s shares (except to

the extent that the reverse stock split would result in some of the

stockholders receiving cash in lieu of fractional shares).

Stockholders will receive cash in lieu of fractional shares based

on the closing price per share of Optinose’s common stock as quoted

on Nasdaq on December 30, 2024. The reverse stock split will not

reduce the number of authorized shares of common stock or preferred

stock or change the par values of Optinose’s common stock (which

will remain at $0.001 per share) or preferred stock (which will

remain at $0.001 per share).

Broadridge Corporate Issuer Solutions, Inc.

(“Broadridge”) is acting as the exchange agent and transfer agent

for the reverse stock split. Broadridge will provide instructions

to stockholders with physical certificates regarding the process

for exchanging their pre-split stock certificates for post-split

shares in book-entry form and receiving payment for any fractional

shares.

Additional information about the reverse stock

split can be found in Optinose’s Definitive Proxy Statement filed

with the Securities and Exchange Commission (“SEC”) on December 12,

2024. The Proxy Statement is available at www.sec.gov or at

Optinose’s website at www.optinose.com.

About Optinose

Optinose is a specialty pharmaceutical company

focused on serving the needs of patients cared for by ear, nose and

throat (ENT) and allergy specialists. To learn more, please visit

www.optinose.com or follow us on X and LinkedIn.

Safe Harbor Statement

This press release contains forward-looking

statements within the meaning of the United States Private

Securities Litigation Reform Act of 1995. Statements in this press

release that are not statements of historical fact are

forward-looking statements. Words such as “may,” “will,” “should,”

“expect,” “plan,” “anticipate,” “could,” “intend,” “target,”

“project,” “estimate,” “believe,” “predict,” “potential” or

“continue” or the negative of these terms or other similar

expressions are intended to identify forward-looking statements,

though not all forward-looking statements contain these identifying

words. Forward-looking statements in this press release include

statements concerning, among other things, the reverse stock split

and the timing thereof and expectations related thereto; and other

statements that are not historical fact.

Optinose may not actually achieve the plans,

intentions or expectations disclosed in the forward-looking

statements and you should not place undue reliance on the

forward-looking statements. These forward-looking statements

involve risks and uncertainties that could cause Optinose’s actual

results to differ materially from the results described in or

implied by the forward-looking statements. Some factors that may

cause Optinose’s actual results to differ materially from those

expressed or implied in the forward-looking statements in this

press release are described under the heading “Risk Factors” in

Optinose’s most recent Annual Report on Form 10-K and its Quarterly

Reports on Form 10-Q filed with the Securities and Exchange

Commission (the “SEC”), in Optinose’s other filings with the SEC,

and in Optinose’s future reports to be filed with the SEC and

available at www.sec.gov. Forward-looking statements contained in

this news release are made as of this date. Unless required to do

so by law, we undertake no obligation to publicly update or revise

any forward-looking statements, whether as a result of new

information, future events, or otherwise.

Optinose Investor

ContactJonathan Neelyjonathan.neely@optinose.com

267.521.0531

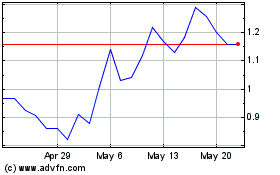

OptiNose (NASDAQ:OPTN)

Historical Stock Chart

From Nov 2024 to Dec 2024

OptiNose (NASDAQ:OPTN)

Historical Stock Chart

From Dec 2023 to Dec 2024