UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

SCHEDULE

13D/A

Under

the Securities Exchange Act of 1934

(Amendment

No. 4)*

Lucid

Diagnostics Inc.

(Name

of Issuer)

Common

Stock, par value $0.001 per share

(Title

of Class of Securities)

54948X

109

(CUSIP

Number)

Lishan

Aklog, M.D.

Chairman

and Chief Executive Officer, PAVmed Inc.

360

Madison Avenue, 25th Floor

New

York, New York 10017

(917)

813-1828

(Name,

Address and Telephone Number of Person Authorized to Receive Notices and Communications)

November

22, 2024

(Date

of Event which Requires Filing of This Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note.

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7

for other parties to whom copies are to be sent.

| * | The

remainder of this cover page shall be filled out for a reporting person’s initial filing

on this form with respect to the subject class of securities, and for any subsequent amendment

containing information which would alter disclosures provided in a prior cover page. |

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18

of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall

be subject to all other provisions of the Act (however, see the Notes).

| 1.

|

NAMES

OF REPORTING PERSONS

PAVmed

Inc. |

| 2.

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (see instructions)

(a)

☐ (b) ☐

|

| 3.

|

SEC

USE ONLY

|

| 4.

|

SOURCE

OF FUNDS (see instructions)

WC |

| 5.

|

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) ☐ |

| 6.

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

Delaware |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH |

7.

|

|

SOLE

VOTING POWER

31,302,444 |

| 8. |

|

SHARED

VOTING POWER

0 |

| 9. |

|

SOLE

DISPOSITIVE POWER

31,302,444 |

| 10. |

|

SHARED

DISPOSITIVE POWER

0 |

| 11.

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

31,302,444 |

| 12.

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions) ☐

|

| 13.

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

52.7%(1) |

| 14.

|

TYPE

OF REPORTING PERSON (see instructions)

CO |

| (1) | Based

on 59,342,479 shares of Common Stock (as defined below) outstanding as of November 8, 2024

as stated in the Quarterly Report on Form 10-Q filed by the Issuer (as defined below) on

November 12, 2024. |

SCHEDULE

13D

This

Amendment No. 4 (this “Amendment”) to the Schedule 13D filed on October 27, 2021, as previously amended by Amendment

No.1 (“Amendment No. 1”) filed on December 2, 2022, Amendment No. 2 (“Amendment No. 2”) filed on

February 4, 2024, and Amendment No. 3 (“Amendment No. 3”) filed on February 20, 2024 (as amended to date, this “Schedule

13D”), is filed on behalf of PAVmed Inc., a Delaware corporation (the “Reporting Person”), with respect

to the common stock, par value $0.001 per share (“Common Stock”), of Lucid Diagnostics Inc. (the “Issuer”).

Except as modified or supplemented by this Amendment, the Schedule 13D as in effect prior to this Amendment remains unchanged. Capitalized

terms used but not defined in this Amendment have the meanings ascribed to them in the Schedule 13D as in effect prior to this Amendment.

| Item

2. | Identity

and Background |

(a)

This statement is filed by the Reporting Person. All disclosures herein with respect to the Reporting Person are made only by the Reporting

Person. Any disclosures herein with respect to persons other than the Reporting Person are made on information and belief after making

inquiry to the appropriate party. The executive officers and directors of the Reporting Person are Lishan Aklog, M.D., Chairman and Chief

Executive Officer, Dennis M. McGrath, President and Chief Financial Officer, Shaun O’Neil, Chief Operating Officer, Michael A.

Gordon, General Counsel, Michael J. Glennon, Vice Chairman, and Sundeep Agrawal, M.D., Tim Baxter, Ronald M. Sparks, and Debra J. White,

each a member of the board of directors (the “Principals”).

(b)

The address of the principal office of the Reporting Person and the business address of each of the Principals is 360 Madison Avenue,

25th Floor, New York, New York 10017.

(c)

The Reporting Person is a diversified commercial-stage medical technology company operating in the medical device, diagnostics, and digital

health sectors, including through the Issuer, a commercial-stage cancer prevention diagnostics company, and Veris Health Inc., a private

digital health company focused on enhanced personalized cancer care through remote patient monitoring using implantable biologic sensors

with wireless communication along with a custom suite of connected external devices. The Principals are the executive officers and directors

of the Reporting Person. Dr. Aklog also serves as the Chairman and Chief Executive Officer of the Issuer, Mr. McGrath also serves as

the Chief Financial Officer of the Issuer, Mr. O’Neil also serves as President and Chief Operating Officer of the Issuer, Mr. Gordon

also serves as General Counsel of the Issuer, and Mr. Sparks and Ms. White also serve as members of the board of directors of the Issuer.

(d)

None of the Reporting Person or the Principals has, during the last five years, been convicted in a criminal proceeding (excluding traffic

violations or similar misdemeanors).

(e)

None of the Reporting Person or the Principals has, during the last five years, been a party to civil proceeding of a judicial administrative

body of competent jurisdiction and, as a result of such proceeding, was, or is subject to, a judgment, decree or final order enjoining

future violations of, or prohibiting or mandating activities subject to, Federal or state securities laws or finding any violation with

respect to such laws.

(f)

The Reporting Person is a Delaware corporation. Each of Dr. Aklog, Mr. McGrath, Mr. O’Neil, Mr. Gordon, Mr. Glennon, Dr. Agrawal,

Mr. Baxter and Mr. Sparks is a citizen of the United States. Ms. White is a citizen of the United Kingdom.

| Item

4. | Purpose

of the Transaction |

On

February 22, 2024, the Issuer granted to each of Mr. Sparks and Ms. White a stock option to purchase 150,000 shares of Common Stock at

an exercise price of $1.25 per share, with each such stock option grant vesting: (i) one-third on December 31, 2024; and (ii) the remaining

vesting ratably on a quarterly basis commencing March 31, 2025 with a final quarterly vesting date of December 31, 2026.

On

May 7, 2024, the Issuer granted to each of Dr. Aklog, Mr. McGrath, Mr. O’Neil and Mr. Gordon a restricted stock award covering

400,000 shares of Common Stock. Each of the awards vests on May 20, 2026, subject to acceleration in certain circumstances.

Between December

4, 2024 and December 6, 2024, Mr. Glennon purchased 170,000 shares of Common Stock in open market transactions for an aggregate purchase

price of $148,549, or approximately $0.874 per share. Mr. Glennon used his personal funds for such purchases.

On

November 22, 2024, the Issuer closed on the sale of $21.98 million in principal amount of Senior Secured Convertible Notes (collectively,

the “2024 Convertible Notes”), in a private placement, to certain accredited investors (the “2024 Note Investors”).

The sale of the 2024 Convertible Notes was completed pursuant to the terms of a Securities Purchase Agreement, dated as of November 12,

2024 (the “2024 SPA”), between the Issuer and the 2024 Note Investors. In connection with the sale of the 2024 Convertible

Notes, among other things, the Issuer granted certain of the investors the collective right to designate one individual to be appointed

to the Issuer’s board of directors, subject to certain limitations and subject to the policies and procedures of the Issuer’s

nominating and corporate governance committee. In connection with the closing, the Reporting Person agreed (i) to vote its shares of

Common Stock in favor of a proposal to approve, for the purposes of the listing rules of The Nasdaq Stock Market, the issuance of shares

of Common Stock in respect of the 2024 Convertible Notes, (ii) to vote its shares of Common Stock in favor of the election of the investors’

designee, and (iii) not to sell, transfer or dispose of, directly or indirectly, any shares of the Common Stock for six months from the

closing, subject to certain limited exceptions, including in the event of a fundamental transaction involving the Issuer.

The

Reporting Person is the parent company of the Issuer and, with its ownership of approximately 52.7% of the outstanding shares of Common

Stock (which constitutes 37.1% of the outstanding voting power of the Issuer), has the power to significantly influence the election

of directors and all other matters that would require the vote of the outstanding shares of Common Stock of the Issuer. Subject to the

restrictions on transfer set forth above, the Reporting Person or any of the Principals, respectively, may acquire additional securities

of the Issuer (including in connection with the settlement of (i) management fees owed by the Issuer to the Reporting Person pursuant

to the MSA (as defined in Amendment No. 1), (ii) reimbursements owed by the Issuer to the Reporting Person pursuant to the PBERA (as

defined in Amendment No. 1), and (iii) other obligations between the Issuer and the Reporting Person) and may retain or sell all or a

portion of the securities then held in the open market or in privately negotiated transactions, although none of the Reporting Person

or the Principals has any present intention to acquire or sell any securities of the Issuer. Each of the Reporting Person and each of

the Principals, respectively, intends to review its ownership of the Issuer on a continuing basis. Any actions the Reporting Person or

any Principal might undertake with respect to the Common Stock may be made at any time and from time to time without prior notice and

will be dependent upon the Reporting Person’s review of numerous factors, including, but not limited to: an ongoing evaluation

of the Issuer’s business, financial condition, operations and prospects; price levels of the Issuer’s securities; general

market, industry and economic conditions; the relative attractiveness of alternative business and investment opportunities; and other

future developments relating to the Reporting Person and/or Principal(s) and the Issuer.

Other

than as described above, and except in accordance with the Reporting Person’s role as the parent company of the Issuer and the

Principals’ roles as officers and directors of the Reporting Person and the Issuer, the Reporting Person and Principals do not

currently have any plans or proposals that relate to, or would result in, any of the matters listed in Items 4(a)–(j) of Schedule

13D, although, depending on the factors discussed herein, the Reporting Persons may change their purpose or formulate different plans

or proposals with respect thereto at any time.

| Item

5. | Interest

in Securities of the Issuer |

(a)-(b)

The number and percentage of shares of Common Stock beneficially owned by the Reporting Person (on the basis of a total of 59,342,479

shares of Common Stock outstanding as described on the cover page to this Amendment) are as follows:

| |

|

|

|

Amount |

|

|

Percentage |

|

| (a) |

Amount

beneficially owned: |

|

|

31,302,444 |

|

|

|

52.7 |

% |

| (b) |

Number

of shares to which the Reporting Person has: |

|

|

|

|

|

|

|

|

| |

(i) |

Sole

power to vote or to direct the vote: |

|

|

31,302,444 |

|

|

|

52.7 |

% |

| |

(ii) |

Shared

power to vote or to direct the vote: |

|

|

0 |

|

|

|

0.0 |

% |

| |

(iii) |

Sole

power to dispose or to direct the disposition of: |

|

|

31,302,444 |

|

|

|

52.7 |

% |

| |

(iv) |

Shared

power to dispose or to direct the disposition of: |

|

|

0 |

|

|

|

0.0 |

% |

Each

of the Principals beneficially own the number and percentage of shares of Common Stock set forth below. Each of the foregoing Principals

has sole power to vote and dispose of the Common Stock he or she beneficially owns.

| | |

Amount | | |

Percentage | |

| Lishan Aklog, M.D. | |

| 1,241,627 | | |

| 2.0 | % |

| Dennis M. McGrath | |

| 1,093,569 | | |

| 1.8 | % |

| Shaun O’Neil | |

| 576,763 | | |

| 1.0 | % |

| Michael A. Gordon | |

| 583,333 | | |

| 1.0 | % |

| Michael J. Glennon | |

| 293,432 | | |

| 0.5 | % |

| Sundeep Agrawal, M.D. | |

| 0 | | |

| 0 | % |

| Tim Baxter | |

| 0 | | |

| 0 | % |

| Ronald M. Sparks | |

| 310,328 | | |

| 0.5 | % |

| Debra J. White | |

| 233,334 | | |

| 0.4 | % |

(c)

Since the filing of Amendment No. 3 on February 20, 2024, the Reporting Person and the Principals have effected the transactions described

in Item 4.

(d)

Not applicable.

(e)

Not applicable.

| Item

6. | Contracts,

Arrangements, Understandings or Relationships With Respect to Securities of the Issuer |

The

information set forth in the third paragraph under Item 4 is incorporated herein by reference, as a supplement to the disclosure contained

in the amendments to this Schedule 13D filed prior to the date hereof.

Signatures

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete

and correct.

| |

PAVMED

INC. |

| |

|

| Dated:

December 12, 2024 |

By: |

/s/

Lishan Aklog |

| |

|

Lishan

Aklog, M.D. |

| |

|

Chief

Executive Officer |

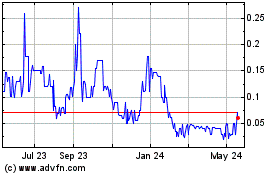

PAVmed (NASDAQ:PAVMZ)

Historical Stock Chart

From Mar 2025 to Apr 2025

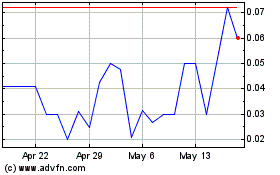

PAVmed (NASDAQ:PAVMZ)

Historical Stock Chart

From Apr 2024 to Apr 2025