false

0001401667

0001401667

2023-08-03

2023-08-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 3, 2023

PUMA BIOTECHNOLOGY, INC.

(Exact Name of Registrant as Specified in its Charter)

|

Delaware

|

|

001-35703

|

|

77-0683487

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

| |

|

10880 Wilshire Boulevard, Suite 2150

Los Angeles, California 90024

|

|

(Address of principal executive offices) (Zip Code)

|

(424) 248-6500

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

symbol

|

|

Name of each exchange

on which registered

|

|

Common Stock, par value $0.0001 per share

|

|

PBYI

|

|

The Nasdaq Stock Market LLC

(Nasdaq Global Select Market)

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 2.02

|

Results of Operations and Financial Condition.

|

On August 3, 2023, Puma Biotechnology, Inc. issued a press release announcing its financial results for the second quarter ended June 30, 2023. A copy of the press release is furnished herewith as Exhibit 99.1 and is incorporated by reference herein.

The information in this Item 2.02, including the accompanying exhibit, is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section. The information in this Item 2.02 shall not be incorporated by reference into any filing pursuant to the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits.

|

99.1

|

|

|

104

|

Cover Page Interactive Data File (formatted as inline XBRL).

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

PUMA BIOTECHNOLOGY, INC.

|

| |

|

|

|

Date: August 3, 2023

|

By:

|

/s/ Alan H. Auerbach

|

| |

|

Alan H. Auerbach

|

| |

|

Chief Executive Officer and President

|

Exhibit 99.1

News Release

Puma Biotechnology Reports Second Quarter Financial Results

LOS ANGELES, Calif., Aug. 3, 2023 - Puma Biotechnology, Inc. (NASDAQ: PBYI), a biopharmaceutical company, announced financial results for the second quarter ended June 30, 2023. Unless otherwise stated, all comparisons are for the second quarter of 2023 compared to the second quarter of 2022.

Product revenue, net consists entirely of sales revenue from NERLYNX®, Puma’s first commercial product. Product revenue, net in the second quarter of 2023 was $51.6 million, an increase from $51.3 million reported for the second quarter of 2022. Product revenue, net in the first six months of 2023 was $98.3 million, compared to $92.0 million in the first six months of 2022.

Based on accounting principles generally accepted in the United States (GAAP), Puma reported net income of $2.1 million, or $0.05 per basic and diluted share, for the second quarter of 2023, compared to net income of $9.4 million, or $0.21 per basic and diluted share, for the second quarter of 2022. Net income for the first six months of 2023 was $3.5 million, or $0.08 per basic share and $0.07 per diluted share, compared to net income of $6.0 million, or $0.14 per basic and diluted share, for the first six months of 2022.

Non-GAAP adjusted net income was $4.6 million, or $0.10 per basic and diluted share, for the second quarter of 2023, compared to $12.6 million, or $0.28 per basic and diluted share, for the second quarter of 2022. Non-GAAP adjusted net income for the first six months of 2023 was $8.8 million, or $0.19 per basic and diluted share, compared to $12.3 million, or $0.28 per basic and diluted share, for the first six months of 2022. Non-GAAP adjusted net income excludes stock-based compensation expense. For a reconciliation of GAAP net income to non-GAAP adjusted net income and GAAP net income per share to non-GAAP adjusted net income per share, please see the financial tables at the end of this news release.

Net cash provided by operating activities for the second quarter of 2023 was $3.3 million, compared to net cash used in operating activities of $13.9 million in the second quarter of 2022. Net cash provided by operating activities for the first six months of 2023 was $5.9 million, compared to net cash used in operating activities of $40.8 million in the first six months of 2022. At June 30, 2023, Puma had cash, cash equivalents and marketable securities of $74.4 million, compared to cash, cash equivalents and marketable securities of $81.1 million at December 31, 2022.

“We are pleased to report both positive net income and positive cash flow for the second quarter of 2023,” said Alan H. Auerbach, Chairman, Chief Executive Officer, and President of Puma. “In addition, we announced positive biomarker data from the randomized trial of alisertib plus paclitaxel versus paclitaxel alone in hormone receptor positive, HER2-negative breast cancer at the recent 2023 Annual Meeting of the American Society of Clinical Oncology (ASCO), which will be helpful as we move forward with the clinical development of alisertib in this indication.”

Mr. Auerbach added, “We anticipate the following key milestones over the next 12 months: (i) initiating a Phase II clinical trial of alisertib in small cell lung cancer (H2 2023); (ii) conducting a meeting with the FDA to discuss the clinical development and registration pathway for alisertib in hormone receptor positive, HER2-negative breast cancer (Q4 2023); and (iii) reporting data from an ongoing investigator sponsored Phase I/II trial of alisertib plus pembrolizumab for the treatment of patients with Rb-deficient head and neck squamous cell cancer (H2 2023).”

Revenue

Total revenue consists of product revenue, net from sales of NERLYNX, Puma’s first commercial product, license revenue from Puma’s sub-licensees and royalty revenue. For the second quarter of 2023, total revenue was $54.6 million, of which $51.6 million was net product revenue and $3.0 million was royalty revenue. This compares to total revenue of $59.5 million in the second quarter of 2022, of which $51.3 million was net product revenue and $8.2 million was royalty revenue. For the first six months of 2023, total revenue was $107.3 million, of which $98.3 million was net product revenue and $9.0 million was royalty revenue. This compares to total revenue for the first six months of 2022 of $105.3 million, of which $92.0 million was net product revenue and $13.3 million was royalty revenue.

Operating Costs and Expenses

Total operating costs and expenses were $49.7 million for the second quarter of 2023, compared to $47.4 million for the second quarter of 2022. Operating costs and expenses in the first six months of 2023 were $98.0 million, compared to $94.0 million in the first six months of 2022.

Cost of Sales

Cost of sales was $11.9 million for the second quarter of 2023, compared to $14.9 million for the second quarter of 2022. Cost of sales was $25.1 million for the first six months of 2023, compared to $25.8 million for the first six months of 2022. The decrease was due to lower royalty expense related primarily to the timing of sales made in China by Puma’s sub-licensee, partially offset by increased intangible amortization related to the $12.5 million paid to Pfizer for meeting a commercial sales milestone as of December 31, 2022.

Selling, General and Administrative Expenses

Selling, general and administrative (SG&A) expenses were $24.4 million for the second quarter of 2023, compared to $20.6 million for the second quarter of 2022. SG&A expenses for the first six months of 2023 were $46.8 million, compared to $41.0 million for the first six months of 2022. The $5.8 million year-over-year increase for the first six months resulted primarily from an increase in payroll and related costs of approximately $4.7 million, consisting of approximately $2.5 million due to salary and headcount increases in 2023, as well as a $2.0 million tax credit related to the CARES Act received during the period ended June 30, 2022. In addition, professional fees and expenses increased approximately $0.8 million from the first six months of 2022.

Research and Development Expenses

Research and development (R&D) expenses were $13.4 million for the second quarter of 2023, compared to $11.9 million for the second quarter of 2022. R&D expenses for the first six months of 2023 were $26.1 million, compared to $27.2 million for the first six months of 2022. The $1.1 million year-over-year decrease for the first six months resulted primarily from a decrease in clinical trial expense of approximately $3.6 million, primarily due to the reduction and closure of SUMMIT clinical trial sites, partially offset by an increase in internal R&D of approximately $2.9 million, due primarily to a $1.8 million tax credit related to the CARES Act received during the period ended June 30, 2022, as well as an increase in payroll-related expenses in 2023.

Total Other Income (Expenses)

Total other expenses were $2.6 million for the second quarter of 2023, essentially unchanged from the second quarter of 2022. Total other expenses were $5.4 million for the first six months of 2023, compared to total other expenses of $5.2 million for the first six months of 2022. The $0.2 million year-over-year increase in other expenses for the first six months of 2023 reflects higher interest rates on our outstanding notes as well as imputed interest on a legal settlement, largely offset by increased interest income.

Third Quarter and Full Year 2023 Financial Outlook

| |

Third Quarter 2023

|

Full Year 2023

|

|

Product Revenue, Net

|

$51 million - $53 million

|

$205 million - $210 million

|

|

Royalty Revenue

|

$3 million - $5 million

|

$25 million - $30 million

|

|

Net Income

|

$3 million - $4 million

|

$20 million - $24 million

|

|

Gross to Net Adjustment

|

17.5% - 18.5%

|

19% - 20%

|

Conference Call

Puma Biotechnology will host a conference call to report its second quarter 2023 financial results and provide an update on the Company’s business and outlook at 1:30 p.m. PDT/4:30 p.m. EDT on Thursday, August 3, 2023. The call may be accessed by dialing (877) 709-8150 (domestic) or (201) 689-8354 (international). Please dial in at least 10 minutes in advance and inform the operator that you would like to join the “Puma Biotechnology Conference Call.” A live webcast of the conference call and presentation slides may be accessed on the Investors section of the Puma Biotechnology website at https://www.pumabiotechnology.com. A replay of the call will be available shortly after completion of the call and will be archived on Puma’s website for 90 days.

About Puma Biotechnology

Puma Biotechnology, Inc. is a biopharmaceutical company with a focus on the development and commercialization of innovative products to enhance cancer care. Puma in-licensed the global development and commercialization rights to PB272 (neratinib, oral), PB272 (neratinib, intravenous) and PB357. Neratinib, oral was approved by the U.S. Food and Drug Administration in 2017 for the extended adjuvant treatment of adult patients with early stage HER2-overexpressed/amplified breast cancer, following adjuvant trastuzumab-based therapy, and is marketed in the United States as NERLYNX® (neratinib) tablets. In February 2020, NERLYNX was also approved by the FDA in combination with capecitabine for the treatment of adult patients with advanced or metastatic HER2-positive breast cancer who have received two or more prior anti-HER2-based regimens in the metastatic setting. NERLYNX was granted marketing authorization by the European Commission in 2018 for the extended adjuvant treatment of adult patients with early stage hormone receptor-positive HER2-overexpressed/amplified breast cancer and who are less than one year from completion of prior adjuvant trastuzumab-based therapy. NERLYNX is a registered trademark of Puma Biotechnology, Inc.

In September 2022, Puma entered into an exclusive license agreement for the development and commercialization of the anti-cancer drug alisertib, a selective, small molecule, orally administered inhibitor of aurora kinase A. Initially, Puma intends to focus the development of alisertib on the treatment of small cell lung cancer and breast cancer.

To help ensure patients have access to NERLYNX, Puma has implemented the Puma Patient Lynx support program to assist patients and healthcare providers with reimbursement support and referrals to resources that can help with financial assistance. More information on the Puma Patient Lynx program can be found at https://www.NERLYNX.com or by calling 1-855-816-5421.

Further information about Puma Biotechnology may be found at https://www.pumabiotechnology.com.

INDICATIONS

| |

●

|

NERLYNX® (neratinib) tablets, for oral use, is a kinase inhibitor indicated:

|

| |

●

|

As a single agent, for the extended adjuvant treatment of adult patients with early stage HER2-positive breast cancer, to follow adjuvant trastuzumab-based therapy.

|

| |

●

|

In combination with capecitabine, for the treatment of adult patients with advanced or metastatic HER2-positive breast cancer, who have received two or more prior anti-HER2 based regimens in the metastatic setting.

|

Important Safety Information Regarding NERLYNX® (neratinib) U.S. Indication

CONTRAINDICATIONS: None

WARNINGS AND PRECAUTIONS:

| |

●

|

Diarrhea: Manage diarrhea through either NERLYNX dose escalation or loperamide prophylaxis. If diarrhea occurs despite recommended prophylaxis, treat with additional antidiarrheals, fluids, and electrolytes as clinically indicated. Withhold NERLYNX in patients experiencing severe and/or persistent diarrhea. Permanently discontinue NERLYNX in patients experiencing Grade 4 diarrhea or Grade ≥ 2 diarrhea that occurs after maximal dose reduction.

|

| |

●

|

Hepatotoxicity: Monitor liver function tests monthly for the first 3 months of treatment, then every 3 months while on treatment and as clinically indicated. Withhold NERLYNX in patients experiencing Grade 3 liver abnormalities and permanently discontinue NERLYNX in patients experiencing Grade 4 liver abnormalities.

|

| |

●

|

Embryo-Fetal Toxicity: NERLYNX can cause fetal harm. Advise patients of potential risk to a fetus and to use effective contraception.

|

ADVERSE REACTIONS: The most common adverse reactions (reported in ≥ 5% of patients) were as follows:

| |

●

|

NERLYNX as a single agent: Diarrhea, nausea, abdominal pain, fatigue, vomiting, rash, stomatitis, decreased appetite, muscle spasms, dyspepsia, AST or ALT increased, nail disorder, dry skin, abdominal distention, epistaxis, weight decreased, and urinary tract infection.

|

| |

●

|

NERLYNX in combination with capecitabine: Diarrhea, nausea, vomiting, decreased appetite, constipation, fatigue/asthenia, weight decreased, dizziness, back pain, arthralgia, urinary tract infection, upper respiratory tract infection, abdominal distention, renal impairment, and muscle spasms.

|

To report SUSPECTED ADVERSE REACTIONS, contact Puma Biotechnology, Inc. at 1-844-NERLYNX (1-844-637-5969) or FDA at 1-800-FDA-1088 or www.fda.gov/medwatch.

DRUG INTERACTIONS:

| |

●

|

Gastric acid reducing agents: Avoid concomitant use with proton pump inhibitors. Separate NERLYNX by at least 2 hours before or 10 hours after H2-receptor antagonists. Or separate NERLYNX by at least 3 hours with antacids.

|

| |

●

|

Strong CYP3A4 inhibitors: Avoid concomitant use.

|

| |

●

|

P-gp and moderate CYP3A4 dual inhibitors: Avoid concomitant use.

|

| |

●

|

Strong or moderate CYP3A4 inducers: Avoid concomitant use.

|

| |

●

|

Certain P-gp substrates: Monitor for adverse reactions of P-gp substrates for which minimal concentration change may lead to serious adverse reactions when used concomitantly with NERLYNX.

|

USE IN SPECIFIC POPULATIONS:

| |

●

|

Lactation: Advise women not to breastfeed.

|

Please see Full Prescribing Information for additional safety information.

Forward-Looking Statements

This press release contains forward-looking statements, including statements regarding Puma’s anticipated milestones and estimates of future financial results for the third quarter and full year 2023. All forward-looking statements involve risks and uncertainties that could cause Puma’s actual results to differ materially from the anticipated results and expectations expressed in these forward-looking statements. These statements are based on current expectations, forecasts and assumptions, and actual outcomes and results could differ materially from these statements due to a number of factors, which include, but are not limited to, any adverse impact on Puma’s business or the global economy and financial markets, any changes in Puma’s product candidates’ regulatory approvals, results from Puma’s clinical trials, any litigation involving Puma, any changes to Puma’s in-licensed intellectual property and the risk factors disclosed in the periodic and current reports filed by Puma with the Securities and Exchange Commission from time to time, including Puma’s Annual Report on Form 10-K for the year ended December 31, 2022 and subsequent filings. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Puma assumes no obligation to update these forward-looking statements, except as required by law.

Contacts

Alan H. Auerbach or Mariann Ohanesian, Puma Biotechnology, Inc., +1 424 248 6500

info@pumabiotechnology.com

ir@pumabiotechnology.com

David Schull or Olipriya Das, Russo Partners, +1 212 845 4200

david.schull@russopartnersllc.com

olipriya.das@russopartnersllc.com

# # # # #

|

PUMA BIOTECHNOLOGY, INC. AND SUBSIDIARY

|

|

CONSOLIDATED STATEMENTS OF OPERATIONS

|

|

(in millions except share and per share data)

|

| |

|

Three Months Ended

|

|

|

Six Months Ended

|

|

| |

|

June 30,

|

|

|

June 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

| |

|

(Unaudited)

|

|

|

(Unaudited)

|

|

|

(Unaudited)

|

|

|

(Unaudited)

|

|

|

Revenues:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product revenue, net

|

|

$ |

51.6 |

|

|

$ |

51.3 |

|

|

$ |

98.3 |

|

|

$ |

92.0 |

|

|

License revenue

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Royalty revenue

|

|

|

3.0 |

|

|

|

8.2 |

|

|

|

9.0 |

|

|

|

13.3 |

|

|

Total revenue

|

|

|

54.6 |

|

|

|

59.5 |

|

|

|

107.3 |

|

|

|

105.3 |

|

|

Operating costs and expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales

|

|

|

11.9 |

|

|

|

14.9 |

|

|

|

25.1 |

|

|

|

25.8 |

|

|

Selling, general and administrative

|

|

|

24.4 |

|

|

|

20.6 |

|

|

|

46.8 |

|

|

|

41.0 |

|

|

Research and development

|

|

|

13.4 |

|

|

|

11.9 |

|

|

|

26.1 |

|

|

|

27.2 |

|

|

Total operating costs and expenses

|

|

|

49.7 |

|

|

|

47.4 |

|

|

|

98.0 |

|

|

|

94.0 |

|

|

Income from operations

|

|

|

4.9 |

|

|

|

12.1 |

|

|

|

9.3 |

|

|

|

11.3 |

|

|

Other income (expenses):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

|

0.7 |

|

|

|

0.1 |

|

|

|

1.2 |

|

|

|

0.1 |

|

|

Interest expense

|

|

|

(3.4 |

) |

|

|

(2.7 |

) |

|

|

(6.6 |

) |

|

|

(5.3 |

) |

|

Legal verdict expense

|

|

|

— |

|

|

|

(0.1 |

) |

|

|

— |

|

|

|

(0.1 |

) |

|

Other income

|

|

|

0.1 |

|

|

|

0.1 |

|

|

|

— |

|

|

|

0.1 |

|

|

Total other expenses, net

|

|

|

(2.6 |

) |

|

|

(2.6 |

) |

|

|

(5.4 |

) |

|

|

(5.2 |

) |

|

Net income before income taxes

|

|

$ |

2.3 |

|

|

$ |

9.5 |

|

|

$ |

3.9 |

|

|

$ |

6.1 |

|

|

Income tax expense

|

|

|

(0.2 |

) |

|

|

(0.1 |

) |

|

|

(0.4 |

) |

|

|

(0.1 |

) |

|

Net income

|

|

$ |

2.1 |

|

|

$ |

9.4 |

|

|

$ |

3.5 |

|

|

$ |

6.0 |

|

|

Net income per share of common stock—basic

|

|

$ |

0.05 |

|

|

$ |

0.21 |

|

|

$ |

0.08 |

|

|

$ |

0.14 |

|

|

Net income per share of common stock—diluted

|

|

$ |

0.05 |

|

|

$ |

0.21 |

|

|

$ |

0.07 |

|

|

$ |

0.14 |

|

|

Weighted-average shares of common stock outstanding—basic

|

|

|

46,759,062 |

|

|

|

45,058,924 |

|

|

|

46,697,912 |

|

|

|

43,641,193 |

|

|

Weighted-average shares of common stock outstanding—diluted

|

|

|

47,201,185 |

|

|

|

45,358,739 |

|

|

|

47,172,752 |

|

|

|

43,889,556 |

|

|

PUMA BIOTECHNOLOGY, INC. AND SUBSIDIARY

|

|

LIQUIDITY AND CAPITAL RESOURCES

|

|

(in millions)

|

| |

|

June 30,

|

|

|

December 31,

|

|

| |

|

2023

|

|

|

2022

|

|

| |

|

(Unaudited)

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

60.0 |

|

|

$ |

76.2 |

|

|

Marketable securities

|

|

|

14.4 |

|

|

|

4.9 |

|

|

Working capital

|

|

|

58.5 |

|

|

|

56.8 |

|

|

Short term debt

|

|

|

11.3 |

|

|

|

— |

|

|

Long term debt

|

|

|

87.6 |

|

|

|

98.3 |

|

|

Stockholders' equity

|

|

|

30.4 |

|

|

|

21.6 |

|

| |

|

Six Months

|

|

|

Six Months

|

|

| |

|

Ended

|

|

|

Ended

|

|

| |

|

June 30,

|

|

|

June 30,

|

|

| |

|

2023

|

|

|

2022

|

|

| |

|

(Unaudited)

|

|

|

(Unaudited)

|

|

|

Cash provided by (used in):

|

|

|

|

|

|

|

|

|

|

Operating activities

|

|

$ |

5.9 |

|

|

$ |

(40.7 |

) |

|

Investing activities

|

|

|

(22.1 |

) |

|

|

11.0 |

|

|

Financing activities

|

|

|

— |

|

|

|

9.8 |

|

| |

|

|

|

|

|

|

|

|

|

Decrease in cash and cash equivalents, and restricted cash

|

|

$ |

(16.2 |

) |

|

$ |

(19.9 |

) |

Use of Non-GAAP Measures

In addition to operating results as calculated in accordance with GAAP, Puma uses certain non-GAAP financial measures when planning, monitoring, and evaluating operational performance. The following table presents the Company’s net income and net income per share calculated in accordance with GAAP and as adjusted to remove the impact of stock-based compensation expense. For the three months and six months ended June 30, 2023, stock-based compensation represented approximately 6.4% and 7.2% of total selling, general and administrative expense and research and development expense, respectively and 9.9% and 9.3% for the same periods in 2022. Puma’s management believes that these non-GAAP financial measures are useful to enhance understanding of Puma’s financial performance, are more indicative of its operational performance, and facilitate a better comparison among fiscal periods. These non-GAAP financial measures are not, and should not be viewed as, substitutes for GAAP reporting measures.

|

PUMA BIOTECHNOLOGY, INC. AND SUBSIDIARY

|

|

Reconciliation of GAAP Net Income to Non-GAAP Adjusted Net Income and

|

|

GAAP Net Income Per Share to Non-GAAP Adjusted Net Income Per Share

|

|

(in millions except share and per share data)

|

|

(Unaudited)

|

| |

|

Three Months Ended June 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

GAAP net income

|

|

$ |

2.1 |

|

|

$ |

9.4 |

|

|

Adjustments:

|

|

|

|

|

|

|

|

|

|

Stock-based compensation -

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative (1)

|

|

|

1.8 |

|

|

|

2.1 |

|

|

Research and development (2)

|

|

|

0.8 |

|

|

|

1.1 |

|

|

Non-GAAP adjusted net income

|

|

$ |

4.6 |

|

|

$ |

12.6 |

|

| |

|

|

|

|

|

|

|

|

|

GAAP net income per share—basic

|

|

$ |

0.05 |

|

|

$ |

0.21 |

|

|

Adjustment to net income (as detailed above)

|

|

|

0.05 |

|

|

|

0.07 |

|

|

Non-GAAP adjusted basic net income per share

|

|

$ |

0.10 |

(3) |

|

$ |

0.28 |

(4) |

| |

|

|

|

|

|

|

|

|

|

GAAP net income per share—diluted

|

|

$ |

0.05 |

|

|

$ |

0.21 |

|

|

Adjustment to net income (as detailed above)

|

|

|

0.05 |

|

|

|

0.07 |

|

|

Non-GAAP adjusted diluted net income per share

|

|

$ |

0.10 |

(5) |

|

$ |

0.28 |

(6) |

| |

|

Six Months Ended June 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

GAAP net income

|

|

$ |

3.5 |

|

|

$ |

6.0 |

|

|

Adjustments:

|

|

|

|

|

|

|

|

|

|

Stock-based compensation -

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative (1)

|

|

|

3.7 |

|

|

|

4.2 |

|

|

Research and development (2)

|

|

|

1.6 |

|

|

|

2.1 |

|

|

Non-GAAP adjusted net income

|

|

$ |

8.8 |

|

|

$ |

12.3 |

|

| |

|

|

|

|

|

|

|

|

|

GAAP net income per share—basic

|

|

$ |

0.08 |

|

|

$ |

0.14 |

|

|

Adjustment to net income (as detailed above)

|

|

|

0.11 |

|

|

|

0.14 |

|

|

Non-GAAP adjusted basic net income per share

|

|

$ |

0.19 |

(3) |

|

$ |

0.28 |

(4) |

| |

|

|

|

|

|

|

|

|

|

GAAP net income per share—diluted

|

|

$ |

0.07 |

|

|

$ |

0.14 |

|

|

Adjustment to net income (as detailed above)

|

|

|

0.12 |

|

|

|

0.14 |

|

|

Non-GAAP adjusted diluted net income per share

|

|

$ |

0.19 |

(5) |

|

$ |

0.28 |

(6) |

|

(1) To reflect a non-cash charge to operating expense for selling, general, and administrative stock-based compensation.

|

|

(2) To reflect a non-cash charge to operating expense for research and development stock-based compensation.

|

|

(3) Non-GAAP adjusted basic net income per share was calculated based on 46,759,062 and 46,697,912 weighted-average shares of common stock outstanding for the three and six months ended June 30, 2023, respectively.

|

|

(4) Non-GAAP adjusted basic net income per share was calculated based on 45,058,924 and 43,641,193 weighted-average shares of common stock outstanding for the three and six months ended June 30, 2022, respectively.

|

|

(5) Non-GAAP adjusted diluted net income per share was calculated based on 47,201,185 and 47,172,752 weighted-average shares of common stock outstanding for the three and six months ended June 30, 2023, respectively.

|

|

(6) Non-GAAP adjusted diluted net income per share was calculated based on 45,358,739 and 43,889,556 weighted-average shares of common stock outstanding for the three and six months ended June 30, 2022, respectively.

|

v3.23.2

Document And Entity Information

|

Aug. 03, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

PUMA BIOTECHNOLOGY, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Aug. 03, 2023

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-35703

|

| Entity, Tax Identification Number |

77-0683487

|

| Entity, Address, Address Line One |

10880 Wilshire Boulevard, Suite 2150

|

| Entity, Address, City or Town |

Los Angeles

|

| Entity, Address, State or Province |

CA

|

| Entity, Address, Postal Zip Code |

90024

|

| City Area Code |

424

|

| Local Phone Number |

248-6500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

PBYI

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001401667

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

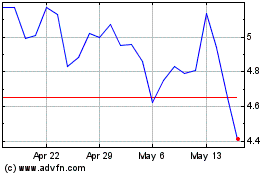

Puma Biotechnology (NASDAQ:PBYI)

Historical Stock Chart

From Apr 2024 to May 2024

Puma Biotechnology (NASDAQ:PBYI)

Historical Stock Chart

From May 2023 to May 2024