PCB Bancorp Declares Increased Quarterly Cash Dividend of $0.20 Per Common Share

31 January 2025 - 8:10AM

Business Wire

PCB Bancorp (the “Company”) (NASDAQ: PCB), the holding company

of PCB Bank, announced that on January 29, 2025, its Board of

Directors declared a quarterly cash dividend of $0.20 per common

share. The dividend will be paid on or about February 21, 2025, to

shareholders of record as of the close of business on February 14,

2025.

“I am pleased to announce another increase in our quarterly cash

dividend to $0.20 per common share from $0.18 per common share for

the first quarter of 2025,” said Henry Kim, President and Chief

Executive Officer. “We are committed to making corporate decisions

that directly benefit our shareholders.”

About PCB Bancorp

PCB Bancorp is the bank holding company for PCB Bank, a

California state chartered bank, offering a full suite of

commercial banking services to small to medium-sized businesses,

individuals and professionals, primarily in Southern California,

and predominantly in Korean-American and other minority

communities.

Cautionary Note Regarding

Forward-Looking Statements

This press release contains forward-looking statements. These

forward-looking statements represent plans, estimates, objectives,

goals, guidelines, expectations, intentions, projections and

statements of our beliefs concerning future events, business plans,

objectives, expected operating results and the assumptions upon

which those statements are based. Forward-looking statements

include without limitation, any statement that may predict,

forecast, indicate or imply future results, performance or

achievements, and are typically identified with words such as

“may,” “could,” “should,” “will,” “would,” “believe,” “anticipate,”

“estimate,” “expect,” “aim,” “intend,” “plan,” or words or phases

of similar meaning. We caution that the forward-looking statements

are based largely on our expectations and are subject to a number

of known and unknown risks and uncertainties that are subject to

change based on factors which are, in many instances, beyond our

control, including but not limited to the health of the national

and local economies including the impact on the Company and its

customers resulting from any adverse developments in real estate

markets and the level of, inflation and interest rates; the

Company’s ability to maintain and grow its deposit base; loan

demand and continued portfolio performance; the impact of adverse

developments at other banks, including bank failures, that impact

general sentiment regarding the stability and liquidity of banks

that could affect the Company’s liquidity, financial performance

and stock price; changes to valuations of the Company’s assets and

liabilities including the allowance for credit losses, earning

assets, and intangible assets; changes to the availability of

liquidity sources including borrowing lines and the ability to

pledge or sell certain assets; the Company's ability to attract and

retain skilled employees; customers' service expectations; cyber

security risks; the Company's ability to successfully deploy new

technology; acquisitions and branch and loan production office

expansions; operational risks including the ability to detect and

prevent errors and fraud; the effectiveness of the Company’s

enterprise risk management framework; litigation costs and

outcomes; changes in laws, rules, regulations, or interpretations

to which the Company is subject; the effects of severe weather

events, pandemics, wildfires and other disasters, other public

health crises, acts of war or terrorism, and other external events

on our business. These and other important factors are detailed in

the Company’s Annual Report on Form 10-K for the year ended

December 31, 2023 and other filings the Company makes with the SEC,

which are available without charge at the SEC’s website

(http://www.sec.gov) and on the investor relations section of the

Company’s website at www.mypcbbank.com. Actual results, performance

or achievements could differ materially from those contemplated,

expressed, or implied by the forward-looking statements. Any

forward-looking statements presented herein are made only as of the

date of this press release, and the Company does not undertake any

obligation to update or revise any forward-looking statements to

reflect changes in assumptions, the occurrence of unanticipated

events, or otherwise, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250130578191/en/

Timothy Chang Executive Vice President & Chief Financial

Officer 213-210-2000

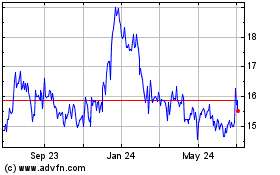

PCB Bancorp (NASDAQ:PCB)

Historical Stock Chart

From Dec 2024 to Jan 2025

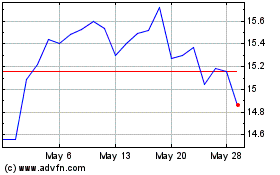

PCB Bancorp (NASDAQ:PCB)

Historical Stock Chart

From Jan 2024 to Jan 2025