PCB Bancorp (the “Company”) (NASDAQ: PCB), the holding company

of PCB Bank (the “Bank”), today reported net income available to

common shareholders of $6.7 million, or $0.46 per diluted common

share, for the fourth quarter of 2024, compared with $7.5 million,

or $0.52 per diluted common share, for the previous quarter and

$5.9 million, or $0.41 per diluted common share, for the year-ago

quarter. For 2024, net income available to common shareholders was

$25.0 million, or $1.74 per diluted common share, compared with

$30.7 million, or $2.12 per diluted common share, for the previous

year.

Q4 2024 and Full Year Highlights

- Net income available to common shareholders totaled $6.7

million, or $0.46 per diluted common share, for the current quarter

and $25.0 million, or $1.74 per diluted common share, for the

current year;

- Provision for credit losses was $2.0 million for the current

quarter compared with $50 thousand for the previous quarter and

$1.7 million for the year-ago quarter. For the current year,

provision (reversal) for credit losses was $3.4 million compared

with $(132) thousand for the previous year;

- Allowance for Credit Losses (“ACL”) on loans to loans

held-for-investment ratio was 1.16% at December 31, 2024 compared

with 1.17% at September 30, 2024 and 1.19% at December 31,

2023;

- Net interest income was $23.2 million for the current quarter

compared with $22.7 million for the previous quarter and $21.9

million for the year-ago quarter. Net interest margin was 3.18% for

the current quarter compared with 3.25% for the previous quarter

and 3.40% for the year-ago quarter. For the current year, net

interest income and net interest margin were $88.6 million and

3.17%, respectively, compared with $88.5 million and 3.57%,

respectively, for the previous year;

- Gain on sale of loans was $1.2 million for the current quarter

compared with $750 thousand for the previous quarter and $803

thousand for the year-ago quarter. For the current year, gain on

sale of loans was $3.8 million compared with $3.6 million for the

previous year;

- Total assets were $3.06 billion at December 31, 2024, an

increase of $174.1 million, or 6.0%, from $2.89 billion at

September 30, 2024 and an increase of $274.5 million, or 9.8%, from

$2.79 billion at December 31, 2023;

- Loans held-for-investment were $2.63 billion at December 31,

2024, an increase of $163.2 million, or 6.6%, from $2.47 billion at

September 30, 2024 and an increase of $305.9 million, or 13.2%,

from $2.32 billion at December 31, 2023; and

- Total deposits were $2.62 billion at December 31, 2024, an

increase of $156.1 million, or 6.3%, from $2.46 billion at

September 30, 2024 and an increase of $264.2 million, or 11.2%,

from $2.35 billion at December 31, 2023.

Henry Kim, President and CEO, commented, “Over the past few

weeks, we are saddened by the unspeakable devastation caused by the

wildfires in Southern California. We are currently in the process

of determining the overall impact on our customers. Fortunately,

our assessment of the current situation does not indicate any

significant losses to any of our customers at this time.”

Mr. Kim continued, “Our strong fourth quarter results reflect

strong loan growth combined with another solid credit metrics.

Additionally, we successfully maintained an efficiency ratio of 53%

for the quarter that was primarily driven by our bank-wide cost

saving measures and ongoing branch network optimizations.”

“During the past couple of years, we made significant steps in

strengthening our balance sheet and core earnings capacity. As we

look ahead in 2025 and beyond, we believe we are well positioned to

generate further growth in balance sheet, continue to operate

efficiently while expanding our branch network, and expand

profitability to create ongoing value for our shareholders.”

Financial Highlights

(Unaudited)

($ in thousands, except per share

data)

Three Months

Ended

Year Ended

12/31/2024

9/30/2024

% Change

12/31/2023

% Change

12/31/2024

12/31/2023

% Change

Net income

$

7,030

$

7,814

(10.0

)%

$

5,908

19.0

%

$

25,810

$

30,705

(15.9

)%

Net income available to common

shareholders

$

6,684

$

7,468

(10.5

)%

$

5,908

13.1

%

$

24,976

$

30,705

(18.7

)%

Diluted earnings per common share

$

0.46

$

0.52

(11.5

)%

$

0.41

12.2

%

$

1.74

$

2.12

(17.9

)%

Net interest income

$

23,164

$

22,719

2.0

%

$

21,924

5.7

%

$

88,617

$

88,504

0.1

%

Provision (reversal) for credit losses

2,002

50

3,904.0

%

1,698

17.9

%

3,401

(132

)

NM

Noninterest income

3,043

2,620

16.1

%

2,503

21.6

%

11,093

10,683

3.8

%

Noninterest expense

13,894

14,602

(4.8

)%

14,469

(4.0

)%

60,023

56,057

7.1

%

Return on average assets (1)

0.94

%

1.08

%

0.89

%

0.90

%

1.20

%

Return on average shareholders’ equity

(1)

7.69

%

8.70

%

6.82

%

7.26

%

9.02

%

Return on average tangible common equity

(“TCE”) (1),(2)

9.02

%

10.31

%

8.54

%

8.72

%

11.31

%

Net interest margin (1)

3.18

%

3.25

%

3.40

%

3.17

%

3.57

%

Efficiency ratio (3)

53.02

%

57.63

%

59.23

%

60.20

%

56.52

%

($ in thousands, except per share

data)

12/31/2024

9/30/2024

% Change

12/31/2023

% Change

Total assets

$

3,063,971

$

2,889,833

6.0

%

$

2,789,506

9.8

%

Net loans held-for-investment

2,598,759

2,437,244

6.6

%

2,295,919

13.2

%

Total deposits

2,615,791

2,459,682

6.3

%

2,351,612

11.2

%

Book value per common share (4)

$

25.30

$

25.39

$

24.46

TCE per common share (2)

$

20.49

$

20.55

$

19.62

Tier 1 leverage ratio (consolidated)

12.45

%

12.79

%

13.43

%

Total shareholders’ equity to total

assets

11.87

%

12.54

%

12.51

%

TCE to total assets (2), (5)

9.62

%

10.14

%

10.03

%

(1)

Ratios are presented on an

annualized basis.

(2)

Non-GAAP. See “Non-GAAP Measures”

for reconciliation of this measure to its most comparable GAAP

measure.

(3)

Calculated by dividing

noninterest expense by the sum of net interest income and

noninterest income.

(4)

Calculated by dividing total

shareholders’ equity by the number of outstanding common

shares.

(5)

The Company did not have any

intangible asset component for the presented periods.

Result of Operations

(Unaudited)

Net Interest Income and Net Interest Margin

The following table presents the components of net interest

income for the periods indicated:

Three Months

Ended

Year Ended

($ in thousands)

12/31/2024

9/30/2024

% Change

12/31/2023

% Change

12/31/2024

12/31/2023

% Change

Interest income/expense on

Loans

$

42,309

$

42,115

0.5

%

$

37,189

13.8

%

$

164,301

$

136,029

20.8

%

Investment securities

1,388

1,384

0.3

%

1,271

9.2

%

5,328

4,679

13.9

%

Other interest-earning assets

2,622

2,499

4.9

%

2,491

5.3

%

11,188

10,469

6.9

%

Total interest-earning assets

46,319

45,998

0.7

%

40,951

13.1

%

180,817

151,177

19.6

%

Interest-bearing deposits

22,927

23,057

(0.6

)%

18,728

22.4

%

90,487

62,165

45.6

%

Borrowings

228

222

2.7

%

299

(23.7

)%

1,713

508

237.2

%

Total interest-bearing liabilities

23,155

23,279

(0.5

)%

19,027

21.7

%

92,200

62,673

47.1

%

Net interest income

$

23,164

$

22,719

2.0

%

$

21,924

5.7

%

$

88,617

$

88,504

0.1

%

Average balance of

Loans

$

2,538,310

$

2,456,015

3.4

%

$

2,242,457

13.2

%

$

2,445,080

$

2,137,851

14.4

%

Investment securities

147,943

147,528

0.3

%

139,227

6.3

%

144,455

140,596

2.7

%

Other interest-earning assets

207,234

175,711

17.9

%

175,336

18.2

%

203,279

198,809

2.2

%

Total interest-earning assets

$

2,893,487

$

2,779,254

4.1

%

$

2,557,020

13.2

%

$

2,792,814

$

2,477,256

12.7

%

Interest-bearing deposits

$

1,986,901

$

1,893,006

5.0

%

$

1,650,132

20.4

%

$

1,892,944

$

1,538,234

23.1

%

Borrowings

17,946

15,848

13.2

%

21,000

(14.5

)%

31,033

9,192

237.6

%

Total interest-bearing liabilities

$

2,004,847

$

1,908,854

5.0

%

$

1,671,132

20.0

%

$

1,923,977

$

1,547,426

24.3

%

Total funding (1)

$

2,548,818

$

2,443,615

4.3

%

$

2,249,026

13.3

%

$

2,463,240

$

2,177,200

13.1

%

Annualized average yield/cost

of

Loans

6.63

%

6.82

%

6.58

%

6.72

%

6.36

%

Investment securities

3.73

%

3.73

%

3.62

%

3.69

%

3.33

%

Other interest-earning assets

5.03

%

5.66

%

5.64

%

5.50

%

5.27

%

Total interest-earning assets

6.37

%

6.58

%

6.35

%

6.47

%

6.10

%

Interest-bearing deposits

4.59

%

4.85

%

4.50

%

4.78

%

4.04

%

Borrowings

5.05

%

5.57

%

5.65

%

5.52

%

5.53

%

Total interest-bearing liabilities

4.59

%

4.85

%

4.52

%

4.79

%

4.05

%

Net interest margin

3.18

%

3.25

%

3.40

%

3.17

%

3.57

%

Cost of total funding (1)

3.61

%

3.79

%

3.36

%

3.74

%

2.88

%

Supplementary information

Net accretion of discount on loans

$

645

$

773

(16.6

)%

$

806

(20.0

)%

$

2,782

$

3,003

(7.4

)%

Net amortization of deferred loan fees

$

295

$

246

19.9

%

$

449

(34.3

)%

$

1,214

$

1,097

10.7

%

(1)

Total funding is the sum of

interest-bearing liabilities and noninterest-bearing deposits. The

cost of total funding is calculated as annualized total interest

expense divided by average total funding.

Loans. The decrease in average

yield for the current quarter compared with the previous quarter

was primarily due to a decrease in market rates. The Federal Open

Market Committee decreased the Fed Funds rate by 50 bps, 25bps, and

25bps on September 18, November 7, and December 18, 2024,

respectively. The increase for the current year was primarily due

to increases in average interest rates on loans and net

amortization of deferred loan fees, partially offset by the

decrease in market interest rates during the second half of

2024.

The following table presents a composition of total loans by

interest rate type accompanied with the weighted-average

contractual rates as of the dates indicated:

12/31/2024

9/30/2024

12/31/2023

% to Total Loans

Weighted-Average Contractual

Rate

% to Total Loans

Weighted-Average Contractual

Rate

% to Total Loans

Weighted-Average Contractual

Rate

Fixed rate loans

17.4 %

5.23 %

18.3 %

5.06 %

21.2 %

4.86 %

Hybrid rate loans

37.3 %

5.27 %

37.6 %

5.14 %

39.0 %

4.93 %

Variable rate loans

45.3 %

7.63 %

44.1 %

8.10 %

39.8 %

8.51 %

Investment Securities. The

increases in average yield for the current quarter and year

compared with the same periods of 2023 were primarily due to higher

yields on newly purchased investment securities and a decrease in

net amortization of premium.

Other Interest-Earning Assets. The

decrease in average yield for the current quarter compared with the

previous and year-ago quarters was primarily due to a decrease in

average interest rate on cash held at the Federal Reserve Bank

(“FRB”), partially offset by an increase in dividends received on

Federal Home Loan Bank (“FHLB”) stock. The increase for the current

year was primarily due to increases in average interest rate on

cash held at the FRB and dividends received on FHLB stock.

Interest-Bearing Deposits. The

decrease in average cost for the current quarter compared with the

previous was primarily due to a decrease in market rates. The

increases in average cost for the current quarter and year compared

with the same periods of 2023 were primarily due to increases in

market rates throughout 2024.

Provision (Reversal) for Credit Losses

The following table presents a composition of provision

(reversal) for credit losses for the periods indicated:

Three Months

Ended

Year Ended

($ in thousands)

12/31/2024

9/30/2024

% Change

12/31/2023

% Change

12/31/2024

12/31/2023

% Change

Provision for credit losses on loans

$

2,044

$

193

959.1

%

$

1,935

5.6

%

$

3,488

$

497

601.8

%

Reversal for credit losses on off-balance

sheet credit exposure

(42

)

(143

)

(70.6

)%

(237

)

(82.3

)%

(87

)

(629

)

(86.2

)%

Total provision (reversal) for credit

losses

$

2,002

$

50

3,904.0

%

$

1,698

17.9

%

$

3,401

$

(132

)

NM

The provision for credit losses on loans for the current quarter

was primarily due to an increase in loans held-for-investment.

Noninterest Income

The following table presents the components of noninterest

income for the periods indicated:

Three Months

Ended

Year Ended

($ in thousands)

12/31/2024

9/30/2024

% Change

12/31/2023

% Change

12/31/2024

12/31/2023

% Change

Gain on sale of loans

$

1,161

$

750

54.8

%

$

803

44.6

%

$

3,752

$

3,570

5.1

%

Service charges and fees on deposits

404

399

1.3

%

391

3.3

%

1,545

1,475

4.7

%

Loan servicing income

861

786

9.5

%

751

14.6

%

3,365

3,330

1.1

%

Bank-owned life insurance income

246

239

2.9

%

202

21.8

%

949

753

26.0

%

Other income

371

446

(16.8

)%

356

4.2

%

1,482

1,555

(4.7

)%

Total noninterest income

$

3,043

$

2,620

16.1

%

$

2,503

21.6

%

$

11,093

$

10,683

3.8

%

Gain on Sale of Loans. The

following table presents information on gain on sale of loans for

the periods indicated:

Three Months

Ended

Year Ended

($ in thousands)

12/31/2024

9/30/2024

% Change

12/31/2023

% Change

12/31/2024

12/31/2023

% Change

Gain on sale of SBA loans

Sold loan balance

$

24,518

$

13,506

81.5

%

$

20,751

18.2

%

$

71,057

$

82,343

(13.7

)%

Premium received

1,910

1,185

61.2

%

1,250

52.8

%

5,747

5,612

2.4

%

Gain recognized

1,161

750

54.8

%

803

44.6

%

3,752

3,570

5.1

%

Gain on sale of residential mortgage

loans

Sold loan balance

$

—

$

676

(100.0

)%

$

—

—

%

$

676

$

—

NM

Gain recognized

—

—

—

%

—

—

%

—

—

—

%

Loan Servicing Income. The

following table presents information on loan servicing income for

the periods indicated:

Three Months

Ended

Year Ended

($ in thousands)

12/31/2024

9/30/2024

% Change

12/31/2023

% Change

12/31/2024

12/31/2023

% Change

Loan servicing income

Servicing income received

$

1,255

$

1,264

(0.7

)%

$

1,290

(2.7

)%

$

5,130

$

5,212

(1.6

)%

Servicing assets amortization

(394

)

(478

)

(17.6

)%

(539

)

(26.9

)%

(1,765

)

(1,882

)

(6.2

)%

Loan servicing income

$

861

$

786

9.5

%

$

751

14.6

%

$

3,365

$

3,330

1.1

%

Underlying loans at end of period

$

523,797

$

527,062

(0.6

)%

$

532,231

(1.6

)%

$

523,797

$

532,231

(1.6

)%

The Company services SBA loans and certain residential property

loans sold to the secondary market.

Noninterest Expense

The following table presents the components of noninterest

expense for the periods indicated:

Three Months

Ended

Year Ended

($ in thousands)

12/31/2024

9/30/2024

% Change

12/31/2023

% Change

12/31/2024

12/31/2023

% Change

Salaries and employee benefits

$

8,417

$

8,801

(4.4

)%

$

8,397

0.2

%

$

35,661

$

34,572

3.1

%

Occupancy and equipment

2,198

2,261

(2.8

)%

2,145

2.5

%

9,117

7,924

15.1

%

Professional fees

752

599

25.5

%

898

(16.3

)%

3,408

3,087

10.4

%

Marketing and business promotion

582

667

(12.7

)%

772

(24.6

)%

1,886

2,327

(19.0

)%

Data processing

205

397

(48.4

)%

393

(47.8

)%

1,499

1,552

(3.4

)%

Director fees and expenses

227

226

0.4

%

207

9.7

%

906

756

19.8

%

Regulatory assessments

322

309

4.2

%

285

13.0

%

1,256

1,103

13.9

%

Other expense

1,191

1,342

(11.3

)%

1,372

(13.2

)%

6,290

4,736

32.8

%

Total noninterest expense

$

13,894

$

14,602

(4.8

)%

$

14,469

(4.0

)%

$

60,023

$

56,057

7.1

%

Salaries and Employee Benefits. The

decrease for the current quarter compared with the previous quarter

was primarily due to decreases in salaries and vacation accruals

and an increase in direct loan origination cost, which offsets and

defers the recognition of salaries and benefits expense. The

increase for the current year was primarily due to increases in

salaries, bonus accrual, and incentives tied to sales of SBA loans

originated at loan production offices, partially offset by a

decrease in vacation accrual. The number of full-time equivalent

employees was 262, 264 and 270 as of December 31, 2024, September

30, 2024 and December 31, 2023, respectively.

Occupancy and Equipment. The

increases for the current quarter and year compared with the same

periods of 2023 were primarily due to an expansion of headquarters

location in the second half of 2023 and a relocation of a regional

office and two branches into one location in Orange County,

California in 2024.

Professional Fees. During the first

half of 2024, the Company incurred additional professional fees

related to a core system conversion, which was completed in April

2024.

Marketing and Business Promotion.

The decrease for the current quarter compared with the previous and

year-ago quarters were primarily due to a decrease in

advertisements. The decrease for the current year compared to 2023

was primarily due to a higher, nonrecurring volume of

advertisements in 2023 related to the Company’s 20th anniversary

celebration.

Data processing. The decrease for

the current quarter and year compared with the same periods of 2023

were primarily due to one-time new relationship credit from the

core system conversion completed in April 2024.

Other Expense. The increase for the

year was primarily due to a termination charge for the legacy core

system of $508 thousand and an expense of $815 thousand for a

reimbursement for an SBA loan guarantee previously paid by the SBA

on a loan originated in 2014 that subsequently defaulted and was

ultimately determined to be ineligible for the SBA guaranty during

the second quarter of 2024. The Company has retained a law firm

specializing in SBA recovery and intends to seek that SBA

reconsider its decision so that the Company may recoup all or part

of the reimbursement.

Balance Sheet

(Unaudited)

Total assets were $3.06 billion at December 31, 2024, an

increase of $174.1 million, or 6.0%, from $2.89 billion at

September 30, 2024 and an increase of $274.5 million, or 9.8%, from

$2.79 billion at December 31, 2023. The increases for the current

quarter and year were primarily due to increases in loans

held-for-investment and deferred tax assets.

Loans

The following table presents a composition of total loans

(includes both loans held-for-sale and loans held-for-investment)

as of the dates indicated:

($ in thousands)

12/31/2024

9/30/2024

% Change

12/31/2023

% Change

Commercial real estate:

Commercial property

$

940,931

$

874,824

7.6

%

$

855,270

10.0

%

Business property

595,547

579,461

2.8

%

558,772

6.6

%

Multifamily

194,220

185,485

4.7

%

132,500

46.6

%

Construction

21,854

21,150

3.3

%

24,843

(12.0

)%

Total commercial real estate

1,752,552

1,660,920

5.5

%

1,571,385

11.5

%

Commercial and industrial

472,763

407,024

16.2

%

342,002

38.2

%

Consumer:

Residential mortgage

392,456

383,377

2.4

%

389,420

0.8

%

Other consumer

11,616

14,853

(21.8

)%

20,645

(43.7

)%

Total consumer

404,072

398,230

1.5

%

410,065

(1.5

)%

Loans held-for-investment

2,629,387

2,466,174

6.6

%

2,323,452

13.2

%

Loans held-for-sale

6,292

5,170

21.7

%

5,155

22.1

%

Total loans

$

2,635,679

$

2,471,344

6.6

%

$

2,328,607

13.2

%

SBA loans included in:

Loans held-for-investment

$

146,940

$

142,819

2.9

%

$

145,603

0.9

%

Loans held-for-sale

$

6,292

$

5,170

21.7

%

$

5,155

22.1

%

The increase in loans held-for-investment for the current

quarter was primarily due to new funding of term loans of $189.9

million and net increase of lines of credit of $57.6 million,

partially offset by pay-downs and pay-offs of term loans of $83.8

million and charge-offs of $395 thousand. The increase for the

current year was primarily due to new funding of term loans of

$411.6 million and net increase of lines of credit of $163.6

million, partially offset by pay-downs and pay-offs of term loans

of $267.8 million, charge-offs of $691 thousand, a loan transferred

to loans held-for-sale of $676 thousand, and a loan transferred to

OREO of $94 thousand.

The increase in loans held-for-sale for the current quarter was

primarily due to new funding of $25.6 million, partially offset by

sales of $24.5 million and pay-downs of $7 thousand. The increase

for the current year was primarily due to new funding of $74.0

million and a loan transferred from loan held-for-investment of

$676 thousand, partially offset by sales of $71.7 million and

pay-downs of $1.8 million.

The following table presents a composition of off-balance sheet

credit exposure as of the dates indicated:

($ in thousands)

12/31/2024

9/30/2024

% Change

12/31/2023

% Change

Commercial property

$

8,888

$

3,291

170.1

%

$

11,634

(23.6

)%

Business property

11,058

12,441

(11.1

)%

9,899

11.7

%

Multifamily

—

—

—

%

1,800

(100.0

)%

Construction

14,423

17,810

(19.0

)%

23,739

(39.2

)%

Commercial and industrial

364,731

394,428

(7.5

)%

351,025

3.9

%

Other consumer

1,475

5,590

(73.6

)%

3,421

(56.9

)%

Total commitments to extend credit

400,575

433,560

(7.6

)%

401,518

(0.2

)%

Letters of credit

6,795

6,673

1.8

%

6,583

3.2

%

Total off-balance sheet credit

exposure

$

407,370

$

440,233

(7.5

)%

$

408,101

(0.2

)%

Credit Quality

The following table presents a summary of non-performing loans

and assets, and classified assets as of the dates indicated:

($ in thousands)

12/31/2024

9/30/2024

% Change

12/31/2023

% Change

Nonaccrual loans

Commercial real estate:

Commercial property

$

1,851

$

1,633

13.3

%

$

958

93.2

%

Business property

2,336

2,367

(1.3

)%

2,865

(18.5

)%

Multifamily

—

2,038

(100.0

)%

—

—

%

Total commercial real estate

4,187

6,038

(30.7

)%

3,823

9.5

%

Commercial and industrial

79

124

(36.3

)%

68

16.2

%

Consumer:

Residential mortgage

403

414

(2.7

)%

—

NM

Other consumer

24

38

(36.8

)%

25

(4.0

)%

Total consumer

427

452

(5.5

)%

25

1,608.0

%

Total nonaccrual loans

held-for-investment

4,693

6,614

(29.0

)%

3,916

19.8

%

Loans past due 90 days or more and still

accruing

—

—

—

%

—

—

%

Non-performing loans (“NPLs”)

4,693

6,614

(29.0

)%

3,916

19.8

%

NPLs held-for-sale

—

—

—

%

—

—

%

Total NPLs

4,693

6,614

(29.0

)%

3,916

19.8

%

Other real estate owned (“OREO”)

—

466

(100.0

)%

2,558

(100.0

)%

Non-performing assets (“NPAs”)

$

4,693

$

7,080

(33.7

)%

$

6,474

(27.5

)%

Loans past due and still accruing

Past due 30 to 59 days

$

4,599

$

2,973

54.7

%

$

1,394

229.9

%

Past due 60 to 89 days

303

21

1,342.9

%

34

791.2

%

Past due 90 days or more

—

—

—

%

—

—

%

Total loans past due and still

accruing

$

4,902

$

2,994

63.7

%

$

1,428

243.3

%

Special mention loans

$

5,034

$

5,057

(0.5

)%

$

5,156

(2.4

)%

Classified assets

Classified loans held-for-investment

$

6,930

$

8,860

(21.8

)%

$

7,000

(1.0

)%

Classified loans held-for-sale

—

—

—

%

—

—

%

OREO

—

466

(100.0

)%

2,558

(100.0

)%

Classified assets

$

6,930

$

9,326

(25.7

)%

$

9,558

(27.5

)%

NPLs to loans held-for-investment

0.18

%

0.27

%

0.17

%

NPAs to total assets

0.15

%

0.24

%

0.23

%

Classified assets to total assets

0.23

%

0.32

%

0.34

%

Allowance for Credit Losses

The following table presents activities in ACL for the periods

indicated:

Three Months

Ended

Year Ended

($ in thousands)

12/31/2024

9/30/2024

% Change

12/31/2023

% Change

12/31/2024

12/31/2023

% Change

ACL on loans

Balance at beginning of period

$

28,930

$

28,747

0.6

%

$

25,599

13.0

%

$

27,533

$

24,942

10.4

%

Impact of ASC 326 adoption

—

—

NM

—

NM

—

1,067

NM

Charge-offs

(395

)

(111

)

255.9

%

(13

)

2,938.5

%

(691

)

(132

)

423.5

%

Recoveries

49

101

(51.5

)%

12

308.3

%

298

1,159

(74.3

)%

Provision for credit losses on loans

2,044

193

959.1

%

1,935

5.6

%

3,488

497

601.8

%

Balance at end of period

$

30,628

$

28,930

5.9

%

$

27,533

11.2

%

$

30,628

$

27,533

11.2

%

Percentage to loans held-for-investment

at end of period

1.16

%

1.17

%

1.19

%

1.16

%

1.19

%

ACL on off-balance sheet credit

exposure

Balance at beginning of period

$

1,232

$

1,375

(10.4

)%

$

1,514

(18.6

)%

$

1,277

$

299

327.1

%

Impact of ASC 326 adoption

—

—

NM

—

NM

—

1,607

NM

Reversal for credit losses on off-balance

sheet credit exposure

(42

)

(143

)

(70.6

)%

(237

)

(82.3

)%

(87

)

(629

)

(86.2

)%

Balance at end of period

$

1,190

$

1,232

(3.4

)%

$

1,277

(6.8

)%

$

1,190

$

1,277

(6.8

)%

On January 1, 2023, the Company adopted the provisions of ASC

326 through the application of the modified retrospective

transition approach. The initial adjustment to the ACL reflected

the expected lifetime credit losses associated with the composition

of financial assets within the scope of ASC 326 as of January 1,

2023, as well as management’s current expectation of future

economic conditions. The Company recorded a net decrease of $1.9

million to the beginning balance of retained earnings as of January

1, 2023 for the cumulative effect adjustment, reflecting an initial

adjustment to the ACL on loans of $1.1 million and the ACL on

off-balance sheet credit exposures of $1.6 million, net of related

deferred tax assets arising from temporary differences of $788

thousand.

Investment Securities

Total investment securities were $146.3 million at December 31,

2024, a decrease of $1.3 million, or 0.9%, from $147.6 million at

September 30, 2024, but an increase of $3.0 million, or 2.1%, from

$143.3 million at December 31, 2023. The decrease for the current

quarter was primarily due to principal pay-downs of $5.9 million,

net premium amortization of $36 thousand, and a fair value decrease

of $4.1 million, partially offset by purchases of $8.7 million. The

increase for the current year was primarily due to purchases of

$23.5 million, partially offset by principal pay-downs of $19.8

million, net premium amortization of $159 thousand and a fair value

decrease of $541 thousand.

Deposits

The following table presents the Company’s deposit mix as of the

dates indicated:

12/31/2024

9/30/2024

12/31/2023

($ in thousands)

Amount

% to Total

Amount

% to Total

Amount

% to Total

Noninterest-bearing demand deposits

$

547,853

20.9

%

$

540,068

22.0

%

$

594,673

25.3

%

Interest-bearing deposits

Savings

5,765

0.2

%

5,718

0.2

%

6,846

0.3

%

NOW

13,761

0.5

%

15,873

0.6

%

16,825

0.7

%

Retail money market accounts

447,360

17.1

%

470,347

19.1

%

397,531

16.8

%

Brokered money market accounts

1

0.1

%

1

0.1

%

1

0.1

%

Retail time deposits of

$250,000 or less

493,644

18.9

%

492,430

20.0

%

456,293

19.4

%

More than $250,000

605,124

23.1

%

580,166

23.6

%

515,702

21.9

%

State and brokered time deposits

502,283

19.2

%

355,079

14.4

%

363,741

15.5

%

Total interest-bearing deposits

2,067,938

79.1

%

1,919,614

78.0

%

1,756,939

74.7

%

Total deposits

$

2,615,791

100.0

%

$

2,459,682

100.0

%

$

2,351,612

100.0

%

Estimated total deposits not covered by

deposit insurance

$

1,036,451

39.6

%

$

1,042,366

42.4

%

$

954,591

40.6

%

Total retail deposits were $2.11 billion at December 31, 2024,

an increase of $8.9 million, or 0.4%, from $2.10 billion at

September 30, 2024 and an increase of $125.6 million, or 6.3%, from

$1.99 billion at December 31, 2023.

The increase in retail time deposits for the current quarter was

primarily due to new accounts of $94.7 million, renewals of the

matured accounts of $338.2 million and balance increases of $15.7

million, partially offset by matured and closed accounts of $422.5

million. The increase for the current year was primarily due to new

accounts of $367.4 million, renewals of the matured accounts of

$898.6 million and balance increases of $44.1 million, partially

offset by matured and closed accounts of $1.18 billion.

Liquidity

The following table presents a summary of the Company’s

liquidity position as of the dates indicated:

($ in thousands)

12/31/2024

12/31/2023

% Change

Cash and cash equivalents

$

198,792

$

242,342

(18.0

)%

Cash and cash equivalents to total

assets

6.5

%

8.7

%

Available borrowing capacity

FHLB advances

$

722,439

$

602,976

19.8

%

Federal Reserve Discount Window

586,525

528,893

10.9

%

Overnight federal funds lines

50,000

65,000

(23.1

)%

Total

$

1,358,964

$

1,196,869

13.5

%

Total available borrowing capacity to

total assets

44.4

%

42.9

%

Shareholders’ Equity

Shareholders’ equity was $363.8 million at December 31, 2024, an

increase of $1.5 million, or 0.4%, from $362.3 million at September

30, 2024 and an increase of $14.9 million, or 4.3%, from $348.9

million at December 31, 2023. The increase for the current quarter

was primarily due to net income and proceeds from stock option

exercises of $143 thousand, partially offset by an increase in

accumulated other comprehensive loss of $2.9 million, cash

dividends declared on common stock of $2.6 million and preferred

stock dividends of $346 thousand. The increase for the current year

was primarily due to net income and proceeds from stock option

exercises of $353 thousand, partially offset by an increase in

accumulated other comprehensive loss of $395 thousand, cash

dividends declared on common stock of $10.3 million, preferred

stock dividends of $834 thousand, and repurchase of common stock of

$222 thousand.

Stock Repurchases

In 2023, the Company repurchased and retired 512,657 shares of

common stock at a weighted-average price of $17.22, totaling $8.8

million. In 2024, the Company repurchased and retired 14,947 shares

of common stock at a weighted-average price of $14.88, totaling

$222 thousand. As of December 31, 2024, the Company is authorized

to purchase 577,777 additional shares under its current stock

repurchase program, which expires on August 2, 2025.

Series C Preferred Stock

On May 24, 2022, the Company issued 69,141 shares of Senior

Non-Cumulative Perpetual Preferred Stock, Series C, liquidation

preference of $1,000 per share (“Series C Preferred Stock”) for the

capital investment of $69.1 million from the U.S. Treasury under

the Emergency Capital Investment Program (“ECIP”). The ECIP

investment is treated as tier 1 capital for regulatory capital

purposes.

The Series C Preferred Stock bore no dividend for the first 24

months following the investment date. Thereafter, the dividend rate

is determined quarterly based on the lending growth criteria listed

in the terms of the ECIP investment with an annual dividend rate of

up to 2%. After the tenth anniversary of the investment date, the

dividend rate will be fixed based on the average annual amount of

lending in years 2 through 10.

The Company began paying quarterly dividends on the Series C

Preferred Stock at an annualized dividend rate of 2% in the second

quarter of 2024. The dividends totaled $346 thousand and $834

thousand for the current quarter and year, respectively.

Capital Ratios

Historically, the Company has operated under the Federal

Reserve’s Small Bank Holding Company Policy Statement, which

exempts bank holding companies with total consolidated assets of

less than $3.0 billion from the Federal Reserve’s risk-based- and

leverage consolidated capital requirements. Because the Company’s

total consolidated assets exceeded $3.0 billion as December 31,

2024, the Company is now subject to the Federal Reserve’s

consolidated capital requirements. A bank holding company that

crosses the $3.0 billion total consolidated assets threshold as of

June 30 of a particular year is no longer permitted to file Federal

Reserve reports as a small holding company beginning the following

March. If the Company’s total assets exceed $3.0 billion as of June

30, 2025, the Company will not be eligible to file financial

reports with the Federal Reserve as a small bank holding company

beginning in March 2026. The following table presents capital

ratios for the Company and the Bank as of the dates indicated:

12/31/2024

9/30/2024

12/31/2023

Well Capitalized Minimum

Requirements

PCB Bancorp

Common tier 1 capital (to risk-weighted

assets)

11.44 %

11.92 %

12.23 %

N/A

Total capital (to risk-weighted

assets)

15.24 %

15.88 %

16.39 %

N/A

Tier 1 capital (to risk-weighted

assets)

14.04 %

14.68 %

15.16 %

N/A

Tier 1 capital (to average assets)

12.45 %

12.79 %

13.43 %

N/A

PCB Bank

Common tier 1 capital (to risk-weighted

assets)

13.72 %

14.33 %

14.85 %

6.5 %

Total capital (to risk-weighted

assets)

14.92 %

15.54 %

16.07 %

10.0 %

Tier 1 capital (to risk-weighted

assets)

13.72 %

14.33 %

14.85 %

8.0 %

Tier 1 capital (to average assets)

12.16 %

12.49 %

13.16 %

5.0 %

About PCB Bancorp

PCB Bancorp is the bank holding company for PCB Bank, a

California state chartered bank, offering a full suite of

commercial banking services to small to medium-sized businesses,

individuals and professionals, primarily in Southern California,

and predominantly in Korean-American and other minority

communities.

Cautionary Note Regarding

Forward-Looking Statements

This press release contains forward-looking statements. These

forward-looking statements represent plans, estimates, objectives,

goals, guidelines, expectations, intentions, projections and

statements of our beliefs concerning future events, business plans,

objectives, expected operating results and the assumptions upon

which those statements are based. Forward-looking statements

include without limitation, any statement that may predict,

forecast, indicate or imply future results, performance or

achievements, and are typically identified with words such as

“may,” “could,” “should,” “will,” “would,” “believe,” “anticipate,”

“estimate,” “expect,” “aim,” “intend,” “plan,” or words or phases

of similar meaning. We caution that the forward-looking statements

are based largely on our expectations and are subject to a number

of known and unknown risks and uncertainties that are subject to

change based on factors which are, in many instances, beyond our

control, including but not limited to the health of the national

and local economies including the impact on the Company and its

customers resulting from any adverse developments in real estate

markets and the level of, inflation and interest rates; the

Company’s ability to maintain and grow its deposit base; loan

demand and continued portfolio performance; the impact of adverse

developments at other banks, including bank failures, that impact

general sentiment regarding the stability and liquidity of banks

that could affect the Company’s liquidity, financial performance

and stock price; changes to valuations of the Company’s assets and

liabilities including the allowance for credit losses, earning

assets, and intangible assets; changes to the availability of

liquidity sources including borrowing lines and the ability to

pledge or sell certain assets; the Company's ability to attract and

retain skilled employees; customers' service expectations; cyber

security risks; the Company's ability to successfully deploy new

technology; acquisitions and branch and loan production office

expansions; operational risks including the ability to detect and

prevent errors and fraud; the effectiveness of the Company’s

enterprise risk management framework; litigation costs and

outcomes; changes in laws, rules, regulations, or interpretations

to which the Company is subject; the effects of severe weather

events, pandemics, wildfires and other disasters, other public

health crises, acts of war or terrorism, and other external events

on our business. These and other important factors are detailed in

the Company’s Annual Report on Form 10-K for the year ended

December 31, 2023 and other filings the Company makes with the SEC,

which are available without charge at the SEC’s website

(http://www.sec.gov) and on the investor relations section of the

Company’s website at www.mypcbbank.com. Actual results, performance

or achievements could differ materially from those contemplated,

expressed, or implied by the forward-looking statements. Any

forward-looking statements presented herein are made only as of the

date of this press release, and the Company does not undertake any

obligation to update or revise any forward-looking statements to

reflect changes in assumptions, the occurrence of unanticipated

events, or otherwise, except as required by law.

PCB Bancorp and Subsidiary

Consolidated Balance Sheets

(Unaudited)

($ in thousands, except share and per

share data)

12/31/2024

9/30/2024

% Change

12/31/2023

% Change

Assets

Cash and due from banks

$

27,100

$

29,981

(9.6

)%

$

26,518

2.2

%

Interest-bearing deposits in other

financial institutions

171,692

163,083

5.3

%

215,824

(20.4

)%

Total cash and cash equivalents

198,792

193,064

3.0

%

242,342

(18.0

)%

Securities available-for-sale, at fair

value

146,349

147,635

(0.9

)%

143,323

2.1

%

Loans held-for-sale

6,292

5,170

21.7

%

5,155

22.1

%

Loans held-for-investment

2,629,387

2,466,174

6.6

%

2,323,452

13.2

%

Allowance for credit losses on loans

(30,628

)

(28,930

)

5.9

%

(27,533

)

11.2

%

Net loans held-for-investment

2,598,759

2,437,244

6.6

%

2,295,919

13.2

%

Premises and equipment, net

8,280

8,414

(1.6

)%

5,999

38.0

%

Federal Home Loan Bank and other bank

stock

14,042

14,042

—

%

12,716

10.4

%

Other real estate owned, net

—

466

(100.0

)%

2,558

(100.0

)%

Bank-owned life insurance

31,766

31,520

0.8

%

30,817

3.1

%

Deferred tax assets, net

7,249

—

NM

—

NM

Servicing assets

5,837

5,902

(1.1

)%

6,666

(12.4

)%

Operating lease assets

17,254

17,932

(3.8

)%

18,913

(8.8

)%

Accrued interest receivable

10,466

9,896

5.8

%

9,468

10.5

%

Other assets

18,885

18,548

1.8

%

15,630

20.8

%

Total assets

$

3,063,971

$

2,889,833

6.0

%

$

2,789,506

9.8

%

Liabilities

Deposits

Noninterest-bearing demand

$

547,853

$

540,068

1.4

%

$

594,673

(7.9

)%

Savings, NOW and money market accounts

466,887

491,939

(5.1

)%

421,203

10.8

%

Time deposits of $250,000 or less

935,927

787,509

18.8

%

760,034

23.1

%

Time deposits of more than $250,000

665,124

640,166

3.9

%

575,702

15.5

%

Total deposits

2,615,791

2,459,682

6.3

%

2,351,612

11.2

%

Other short-term borrowings

15,000

—

NM

—

NM

Federal Home Loan Bank advances

—

—

—

%

39,000

(100.0

)%

Deferred tax liabilities, net

—

1,168

(100.0

)%

876

(100.0

)%

Operating lease liabilities

18,671

19,301

(3.3

)%

20,137

(7.3

)%

Accrued interest payable and other

liabilities

50,695

47,382

7.0

%

29,009

74.8

%

Total liabilities

2,700,157

2,527,533

6.8

%

2,440,634

10.6

%

Commitments and contingent liabilities

Shareholders’ equity

Preferred stock

69,141

69,141

—

%

69,141

—

%

Common stock

143,195

142,926

0.2

%

142,563

0.4

%

Retained earnings

160,797

156,680

2.6

%

146,092

10.1

%

Accumulated other comprehensive loss,

net

(9,319

)

(6,447

)

44.5

%

(8,924

)

4.4

%

Total shareholders’ equity

363,814

362,300

0.4

%

348,872

4.3

%

Total liabilities and shareholders’

equity

$

3,063,971

$

2,889,833

6.0

%

$

2,789,506

9.8

%

Outstanding common shares

14,380,651

14,266,725

14,260,440

Book value per common share (1)

$

25.30

$

25.39

$

24.46

TCE per common share (2)

$

20.49

$

20.55

$

19.62

Total loan to total deposit ratio

100.76

%

100.47

%

99.02

%

Noninterest-bearing deposits to total

deposits

20.94

%

21.96

%

25.29

%

(1)

The ratios are calculated by

dividing total shareholders’ equity by the number of outstanding

common shares. The Company did not have any intangible equity

components for the presented periods.

(2)

Non-GAAP. See “Non-GAAP Measures”

for reconciliation of this measure to its most comparable GAAP

measure.

PCB Bancorp and Subsidiary

Consolidated Statements of Income

(Unaudited)

($ in thousands, except share and per

share data)

Three Months

Ended

Year Ended

12/31/2024

9/30/2024

% Change

12/31/2023

% Change

12/31/2024

12/31/2023

% Change

Interest and dividend income

Loans, including fees

$

42,309

$

42,115

0.5

%

$

37,189

13.8

%

$

164,301

$

136,029

20.8

%

Investment securities

1,388

1,384

0.3

%

1,271

9.2

%

5,328

4,679

13.9

%

Other interest-earning assets

2,622

2,499

4.9

%

2,491

5.3

%

11,188

10,469

6.9

%

Total interest income

46,319

45,998

0.7

%

40,951

13.1

%

180,817

151,177

19.6

%

Interest expense

Deposits

22,927

23,057

(0.6

)%

18,728

22.4

%

90,487

62,165

45.6

%

Other borrowings

228

222

2.7

%

299

(23.7

)%

1,713

508

237.2

%

Total interest expense

23,155

23,279

(0.5

)%

19,027

21.7

%

92,200

62,673

47.1

%

Net interest income

23,164

22,719

2.0

%

21,924

5.7

%

88,617

88,504

0.1

%

Provision (reversal) for credit losses

2,002

50

3,904.0

%

1,698

17.9

%

3,401

(132

)

NM

Net interest income after provision

(reversal) for credit losses

21,162

22,669

(6.6

)%

20,226

4.6

%

85,216

88,636

(3.9

)%

Noninterest income

Gain on sale of loans

1,161

750

54.8

%

803

44.6

%

3,752

3,570

5.1

%

Service charges and fees on deposits

404

399

1.3

%

391

3.3

%

1,545

1,475

4.7

%

Loan servicing income

861

786

9.5

%

751

14.6

%

3,365

3,330

1.1

%

Bank-owned life insurance income

246

239

2.9

%

202

21.8

%

949

753

26.0

%

Other income

371

446

(16.8

)%

356

4.2

%

1,482

1,555

(4.7

)%

Total noninterest income

3,043

2,620

16.1

%

2,503

21.6

%

11,093

10,683

3.8

%

Noninterest expense

Salaries and employee benefits

8,417

8,801

(4.4

)%

8,397

0.2

%

35,661

34,572

3.1

%

Occupancy and equipment

2,198

2,261

(2.8

)%

2,145

2.5

%

9,117

7,924

15.1

%

Professional fees

752

599

25.5

%

898

(16.3

)%

3,408

3,087

10.4

%

Marketing and business promotion

582

667

(12.7

)%

772

(24.6

)%

1,886

2,327

(19.0

)%

Data processing

205

397

(48.4

)%

393

(47.8

)%

1,499

1,552

(3.4

)%

Director fees and expenses

227

226

0.4

%

207

9.7

%

906

756

19.8

%

Regulatory assessments

322

309

4.2

%

285

13.0

%

1,256

1,103

13.9

%

Other expense

1,191

1,342

(11.3

)%

1,372

(13.2

)%

6,290

4,736

32.8

%

Total noninterest expense

13,894

14,602

(4.8

)%

14,469

(4.0

)%

60,023

56,057

7.1

%

Income before income taxes

10,311

10,687

(3.5

)%

8,260

24.8

%

36,286

43,262

(16.1

)%

Income tax expense

3,281

2,873

14.2

%

2,352

39.5

%

10,476

12,557

(16.6

)%

Net income

7,030

7,814

(10.0

)%

5,908

19.0

%

25,810

30,705

(15.9

)%

Preferred stock dividends

346

346

—

%

—

NM

834

—

NM

Net income available to common

shareholders

$

6,684

$

7,468

(10.5

)%

$

5,908

13.1

%

$

24,976

$

30,705

(18.7

)%

Earnings per common share

Basic

$

0.47

$

0.52

$

0.41

$

1.75

$

2.14

Diluted

$

0.46

$

0.52

$

0.41

$

1.74

$

2.12

Average common shares

Basic

14,254,584

14,241,014

14,223,831

14,242,057

14,301,691

Diluted

14,406,756

14,356,384

14,316,581

14,342,361

14,417,938

Dividend paid per common share

$

0.18

$

0.18

$

0.18

$

0.72

$

0.69

Return on average assets (1)

0.94

%

1.08

%

0.89

%

0.90

%

1.20

%

Return on average shareholders’ equity

(1)

7.69

%

8.70

%

6.82

%

7.26

%

9.02

%

Return on average TCE (1), (2)

9.02

%

10.31

%

8.54

%

8.72

%

11.31

%

Efficiency ratio (3)

53.02

%

57.63

%

59.23

%

60.20

%

56.52

%

(1)

Ratios are presented on an

annualized basis.

(2)

Non-GAAP. See “Non-GAAP Measures”

for reconciliation of this measure to its most comparable GAAP

measure.

(3)

The ratios are calculated by

dividing noninterest expense by the sum of net interest income and

noninterest income.

PCB Bancorp and Subsidiary

Average Balance, Average Yield, and

Average Rate (Unaudited)

($ in thousands)

Three Months Ended

12/31/2024

9/30/2024

12/31/2023

Average Balance

Interest

Income/Expense

Avg. Yield/Rate(6)

Average Balance

Interest

Income/Expense

Avg. Yield/Rate(6)

Average Balance

Interest Income/

Expense

Avg. Yield/Rate(6)

Assets

Interest-earning assets

Total loans (1)

$

2,538,310

$

42,309

6.63

%

$

2,456,015

$

42,115

6.82

%

$

2,242,457

$

37,189

6.58

%

Mortgage-backed securities

113,231

1,030

3.62

%

111,350

1,000

3.57

%

100,500

855

3.38

%

Collateralized mortgage obligation

21,819

228

4.16

%

22,661

244

4.28

%

23,970

259

4.29

%

SBA loan pool securities

6,253

62

3.94

%

6,571

69

4.18

%

7,453

81

4.31

%

Municipal bonds (2)

2,440

21

3.42

%

2,698

24

3.54

%

3,110

29

3.70

%

Corporate bonds

4,200

47

4.45

%

4,248

47

4.40

%

4,194

47

4.45

%

Other interest-earning assets

207,234

2,622

5.03

%

175,711

2,499

5.66

%

175,336

2,491

5.64

%

Total interest-earning assets

2,893,487

46,319

6.37

%

2,779,254

45,998

6.58

%

2,557,020

40,951

6.35

%

Noninterest-earning assets

Cash and due from banks

23,639

24,098

23,034

ACL on loans

(28,833

)

(28,797

)

(25,663

)

Other assets

92,348

92,152

87,759

Total noninterest-earning assets

87,154

87,453

85,130

Total assets

$

2,980,641

$

2,866,707

$

2,642,150

Liabilities and Shareholders’

Equity

Interest-bearing liabilities

Deposits

NOW and money market accounts

$

479,238

4,479

3.72

%

$

496,158

5,129

4.11

%

$

450,408

4,418

3.89

%

Savings

5,952

4

0.27

%

6,204

4

0.26

%

6,947

4

0.23

%

Time deposits

1,501,711

18,444

4.89

%

1,390,644

17,924

5.13

%

1,192,777

14,306

4.76

%

Total interest-bearing deposits

1,986,901

22,927

4.59

%

1,893,006

23,057

4.85

%

1,650,132

18,728

4.50

%

Other borrowings

17,946

228

5.05

%

15,848

222

5.57

%

21,000

299

5.65

%

Total interest-bearing liabilities

2,004,847

23,155

4.59

%

1,908,854

23,279

4.85

%

1,671,132

19,027

4.52

%

Noninterest-bearing liabilities

Noninterest-bearing demand

543,971

534,761

577,894

Other liabilities

67,995

65,716

49,389

Total noninterest-bearing liabilities

611,966

600,477

627,283

Total liabilities

2,616,813

2,509,331

2,298,415

Total shareholders’ equity

363,828

357,376

343,735

Total liabilities and shareholders’

equity

$

2,980,641

$

2,866,707

$

2,642,150

Net interest income

$

23,164

$

22,719

$

21,924

Net interest spread (3)

1.78

%

1.73

%

1.83

%

Net interest margin (4)

3.18

%

3.25

%

3.40

%

Total deposits

$

2,530,872

$

22,927

3.60

%

$

2,427,767

$

23,057

3.78

%

$

2,228,026

$

18,728

3.33

%

Total funding (5)

$

2,548,818

$

23,155

3.61

%

$

2,443,615

$

23,279

3.79

%

$

2,249,026

$

19,027

3.36

%

(1)

Total loans include both loans

held-for-sale and loans held-for-investment.

(2)

The yield on municipal bonds has

not been computed on a tax-equivalent basis.

(3)

Net interest spread is calculated

by subtracting average rate on interest-bearing liabilities from

average yield on interest-earning assets.

(4)

Net interest margin is calculated

by dividing annualized net interest income by average

interest-earning assets.

(5)

Total funding is the sum of

interest-bearing liabilities and noninterest-bearing deposits. The

cost of total funding is calculated as annualized total interest

expense divided by average total funding.

(6)

Annualized.

PCB Bancorp and Subsidiary

Average Balance, Average Yield, and

Average Rate (Unaudited)

($ in thousands)

Year Ended

12/31/2024

12/31/2023

Average Balance

Interest

Income/Expense

Avg. Yield/Rate

Average Balance

Interest

Income/Expense

Avg. Yield/Rate

Assets

Interest-earning assets

Total loans (1)

$

2,445,080

$

164,301

6.72

%

$

2,137,851

$

136,029

6.36

%

Mortgage-backed securities

107,768

3,780

3.51

%

98,903

3,001

3.03

%

Collateralized mortgage obligation

22,806

975

4.28

%

25,466

1,039

4.08

%

SBA loan pool securities

6,756

283

4.19

%

8,166

325

3.98

%

Municipal bonds (2)

2,917

102

3.50

%

3,788

126

3.33

%

Corporate bonds

4,208

188

4.47

%

4,273

188

4.40

%

Other interest-earning assets

203,279

11,188

5.50

%

198,809

10,469

5.27

%

Total interest-earning assets

2,792,814

180,817

6.47

%

2,477,256

151,177

6.10

%

Noninterest-earning assets

Cash and due from banks

23,044

21,565

ACL on loans

(28,397

)

(25,495

)

Other assets

90,425

76,433

Total noninterest-earning assets

85,072

72,503

Total assets

$

2,877,886

$

2,549,759

Liabilities and Shareholders’

Equity

Interest-bearing liabilities

Deposits

NOW and money market accounts

$

475,754

19,149

4.02

%

$

470,750

16,190

3.44

%

Savings

6,312

16

0.25

%

7,499

18

0.24

%

Time deposits

1,410,878

71,322

5.06

%

1,059,985

45,957

4.34

%

Total interest-bearing deposits

1,892,944

90,487

4.78

%

1,538,234

62,165

4.04

%

Other borrowings

31,033

1,713

5.52

%

9,192

508

5.53

%

Total interest-bearing liabilities

1,923,977

92,200

4.79

%

1,547,426

62,673

4.05

%

Noninterest-bearing liabilities

Noninterest-bearing demand

539,263

629,774

Other liabilities

59,026

32,051

Total noninterest-bearing liabilities

598,289

661,825

Total liabilities

2,522,266

2,209,251

Total shareholders’ equity

355,620

340,508

Total liabilities and shareholders’

equity

$

2,877,886

$

2,549,759

Net interest income

$

88,617

$

88,504

Net interest spread (3)

1.68

%

2.05

%

Net interest margin (4)

3.17

%

3.57

%

Total deposits

$

2,432,207

$

90,487

3.72

%

$

2,168,008

$

62,165

2.87

%

Total funding (5)

$

2,463,240

$

92,200

3.74

%

$

2,177,200

$

62,673

2.88

%

(1)

Total loans include both loans

held-for-sale and loans held-for-investment.

(2)

The yield on municipal bonds has

not been computed on a tax-equivalent basis.

(3)

Net interest spread is calculated

by subtracting average rate on interest-bearing liabilities from

average yield on interest-earning assets.

(4)

Net interest margin is calculated

by dividing annualized net interest income by average

interest-earning assets.

(5)

Total funding is the sum of

interest-bearing liabilities and noninterest-bearing deposits. The

cost of total funding is calculated as annualized total interest

expense divided by average total funding.

PCB Bancorp and Subsidiary Non-GAAP Measures ($ in

thousands)

Return on average tangible common equity, tangible common

equity per common share and tangible common equity to total assets

ratios

The Company's TCE is calculated by subtracting preferred stock

from shareholders’ equity. The Company does not have any intangible

assets for the presented periods. Return on average TCE, TCE per

common share, and TCE to total assets constitute supplemental

financial information determined by methods other than in

accordance with GAAP. These non-GAAP measures are used by

management in its analysis of the Company's performance. These

non-GAAP measures should not be viewed as substitutes for results

determined in accordance with GAAP, nor are they necessarily

comparable to non-GAAP measures that may be presented by other

companies. The following tables provide reconciliations of the

non-GAAP measures with financial measures defined by GAAP.

($ in thousands)

Three Months

Ended

Year Ended

12/31/2024

9/30/2024

12/31/2023

12/31/2024

12/31/2023

Average total shareholders' equity

(a)

$

363,828

$

357,376

$

343,735

$

355,620

$

340,508

Less: average preferred stock

(b)

69,141

69,141

69,141

69,141

69,141

Average TCE

(c)=(a)-(b)

$

294,687

$

288,235

$

274,594

$

286,479

$

271,367

Net income

(d)

$

7,030

$

7,814

$

5,908

$

25,810

$

30,705

Return on average shareholder's equity

(1)

(d)/(a)

7.69

%

8.70

%

6.82

%

7.26

%

9.02

%

Net income available to common

shareholders

(e)

$

6,684

$

7,468

$

5,908

$

24,976

$

30,705

Return on average TCE (1)

(e)/(c)

9.02

%

10.31

%

8.54

%

8.72

%

11.31

%

(1) Annualized.

($ in thousands, except per share

data)

12/31/2024

9/30/2024

12/31/2023

Total shareholders' equity

(a)

$

363,814

$

362,300

$

348,872

Less: preferred stock

(b)

69,141

69,141

69,141

TCE

(c)=(a)-(b)

$

294,673

$

293,159

$

279,731

Outstanding common shares

(d)

14,380,651

14,266,725

14,260,440

Book value per common share

(a)/(d)

$

25.30

$

25.39

$

24.46

TCE per common share

(c)/(d)

$

20.49

$

20.55

$

19.62

Total assets

(e)

$

3,063,971

$

2,889,833

$

2,789,506

Total shareholders' equity to total

assets

(a)/(e)

11.87

%

12.54

%

12.51

%

TCE to total assets

(c)/(e)

9.62

%

10.14

%

10.03

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250130214899/en/

Timothy Chang Executive Vice President & Chief Financial

Officer 213-210-2000

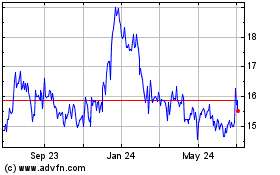

PCB Bancorp (NASDAQ:PCB)

Historical Stock Chart

From Dec 2024 to Jan 2025

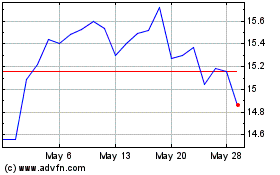

PCB Bancorp (NASDAQ:PCB)

Historical Stock Chart

From Jan 2024 to Jan 2025