false2025Q30000891024--04-26http://fasb.org/us-gaap/2023#OtherNonoperatingIncomeExpensehttp://fasb.org/us-gaap/2023#OtherNonoperatingIncomeExpensexbrli:sharesiso4217:USDiso4217:USDxbrli:sharesxbrli:purepdco:segment00008910242024-04-282025-01-2500008910242025-02-1700008910242025-01-2500008910242024-04-2700008910242024-10-272025-01-2500008910242023-10-292024-01-2700008910242023-04-302024-01-270000891024us-gaap:CommonStockMember2023-04-290000891024us-gaap:AdditionalPaidInCapitalMember2023-04-290000891024us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-290000891024us-gaap:RetainedEarningsMember2023-04-290000891024us-gaap:NoncontrollingInterestMember2023-04-2900008910242023-04-290000891024us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-302023-07-2900008910242023-04-302023-07-290000891024us-gaap:RetainedEarningsMember2023-04-302023-07-290000891024us-gaap:NoncontrollingInterestMember2023-04-302023-07-290000891024us-gaap:CommonStockMember2023-04-302023-07-290000891024us-gaap:AdditionalPaidInCapitalMember2023-04-302023-07-290000891024us-gaap:CommonStockMember2023-07-290000891024us-gaap:AdditionalPaidInCapitalMember2023-07-290000891024us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-290000891024us-gaap:RetainedEarningsMember2023-07-290000891024us-gaap:NoncontrollingInterestMember2023-07-2900008910242023-07-290000891024us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-302023-10-2800008910242023-07-302023-10-280000891024us-gaap:RetainedEarningsMember2023-07-302023-10-280000891024us-gaap:NoncontrollingInterestMember2023-07-302023-10-280000891024us-gaap:CommonStockMember2023-07-302023-10-280000891024us-gaap:AdditionalPaidInCapitalMember2023-07-302023-10-280000891024us-gaap:CommonStockMember2023-10-280000891024us-gaap:AdditionalPaidInCapitalMember2023-10-280000891024us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-10-280000891024us-gaap:RetainedEarningsMember2023-10-280000891024us-gaap:NoncontrollingInterestMember2023-10-2800008910242023-10-280000891024us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-10-292024-01-270000891024us-gaap:RetainedEarningsMember2023-10-292024-01-270000891024us-gaap:NoncontrollingInterestMember2023-10-292024-01-270000891024us-gaap:CommonStockMember2023-10-292024-01-270000891024us-gaap:AdditionalPaidInCapitalMember2023-10-292024-01-270000891024us-gaap:CommonStockMember2024-01-270000891024us-gaap:AdditionalPaidInCapitalMember2024-01-270000891024us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-270000891024us-gaap:RetainedEarningsMember2024-01-270000891024us-gaap:NoncontrollingInterestMember2024-01-2700008910242024-01-270000891024us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-282024-04-2700008910242024-01-282024-04-270000891024us-gaap:RetainedEarningsMember2024-01-282024-04-270000891024us-gaap:NoncontrollingInterestMember2024-01-282024-04-270000891024us-gaap:CommonStockMember2024-01-282024-04-270000891024us-gaap:AdditionalPaidInCapitalMember2024-01-282024-04-270000891024us-gaap:CommonStockMember2024-04-270000891024us-gaap:AdditionalPaidInCapitalMember2024-04-270000891024us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-270000891024us-gaap:RetainedEarningsMember2024-04-270000891024us-gaap:NoncontrollingInterestMember2024-04-270000891024us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-282024-07-2700008910242024-04-282024-07-270000891024us-gaap:RetainedEarningsMember2024-04-282024-07-270000891024us-gaap:NoncontrollingInterestMember2024-04-282024-07-270000891024us-gaap:CommonStockMember2024-04-282024-07-270000891024us-gaap:AdditionalPaidInCapitalMember2024-04-282024-07-270000891024us-gaap:CommonStockMember2024-07-270000891024us-gaap:AdditionalPaidInCapitalMember2024-07-270000891024us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-07-270000891024us-gaap:RetainedEarningsMember2024-07-270000891024us-gaap:NoncontrollingInterestMember2024-07-2700008910242024-07-270000891024us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-07-282024-10-2600008910242024-07-282024-10-260000891024us-gaap:RetainedEarningsMember2024-07-282024-10-260000891024us-gaap:NoncontrollingInterestMember2024-07-282024-10-260000891024us-gaap:CommonStockMember2024-07-282024-10-260000891024us-gaap:AdditionalPaidInCapitalMember2024-07-282024-10-260000891024us-gaap:CommonStockMember2024-10-260000891024us-gaap:AdditionalPaidInCapitalMember2024-10-260000891024us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-10-260000891024us-gaap:RetainedEarningsMember2024-10-260000891024us-gaap:NoncontrollingInterestMember2024-10-2600008910242024-10-260000891024us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-10-272025-01-250000891024us-gaap:RetainedEarningsMember2024-10-272025-01-250000891024us-gaap:NoncontrollingInterestMember2024-10-272025-01-250000891024us-gaap:CommonStockMember2024-10-272025-01-250000891024us-gaap:AdditionalPaidInCapitalMember2024-10-272025-01-250000891024us-gaap:CommonStockMember2025-01-250000891024us-gaap:AdditionalPaidInCapitalMember2025-01-250000891024us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-01-250000891024us-gaap:RetainedEarningsMember2025-01-250000891024us-gaap:NoncontrollingInterestMember2025-01-2500008910242024-12-102024-12-100000891024pdco:InfusionConceptsLimitedAndMountainVetSupplyMember2024-07-282024-10-260000891024pdco:InfusionConceptsLimitedAndMountainVetSupplyMember2024-10-260000891024pdco:VeterinaryPractitionersAndAnimalCareTechnologiesMember2024-10-272025-01-250000891024pdco:MillerVetHoldingsLLCMember2023-04-302023-07-290000891024pdco:ReceivablesPurchaseAgreementsMember2025-01-250000891024pdco:ReceivablesPurchaseAgreementsMember2024-04-270000891024pdco:ReceivablesPurchaseAgreementsMember2024-04-282025-01-250000891024pdco:ReceivablesPurchaseAgreementsMember2023-04-302024-01-270000891024pdco:ReceivablesPurchaseAgreementsMember2023-04-290000891024pdco:ReceivablesPurchaseAgreementsMember2024-01-270000891024pdco:MitsubishiUFJFinancialGroupMember2024-04-282025-01-250000891024pdco:MitsubishiUFJFinancialGroupMember2025-01-250000891024pdco:CustomerFinanceContractsMember2025-01-250000891024pdco:CustomerFinanceContractsMember2024-10-272025-01-250000891024pdco:CustomerFinanceContractsMember2023-10-292024-01-270000891024pdco:CustomerFinanceContractsMember2024-04-282025-01-250000891024pdco:CustomerFinanceContractsMember2023-04-302024-01-270000891024pdco:UnsettledContractsMember2025-01-250000891024pdco:UnsettledContractsMember2024-04-270000891024pdco:CustomerFinanceContractsMember2024-04-270000891024pdco:CustomerFinanceContractsMember2023-04-290000891024pdco:CustomerFinanceContractsMember2024-01-270000891024us-gaap:InterestRateCapMember2025-01-250000891024pdco:InterestRateSwapAgreementMember2014-01-310000891024pdco:FivePointOneSevenPercentageSeniorNotesMember2014-01-310000891024pdco:A348SeniorNotesDue2025Member2015-03-250000891024pdco:InterestRateSwapAgreementMember2015-03-012015-03-310000891024us-gaap:InterestRateSwapMember2024-04-270000891024pdco:InterestRateSwapTwoMember2025-01-250000891024us-gaap:InterestRateSwapMember2025-01-250000891024pdco:InterestRateSwapAgreementMember2024-04-282025-01-250000891024pdco:InterestRateSwapAgreementMember2023-04-302024-01-270000891024us-gaap:InterestRateContractMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2025-01-250000891024us-gaap:InterestRateContractMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2024-04-270000891024us-gaap:InterestRateContractMemberus-gaap:OtherNoncurrentAssetsMember2025-01-250000891024us-gaap:InterestRateContractMemberus-gaap:OtherNoncurrentAssetsMember2024-04-270000891024us-gaap:InterestRateContractMemberpdco:OtherAccruedLiabilitiesMember2025-01-250000891024us-gaap:InterestRateContractMemberpdco:OtherAccruedLiabilitiesMember2024-04-270000891024us-gaap:InterestRateContractMemberus-gaap:OtherNoncurrentLiabilitiesMember2025-01-250000891024us-gaap:InterestRateContractMemberus-gaap:OtherNoncurrentLiabilitiesMember2024-04-270000891024us-gaap:InterestRateContractMember2024-10-272025-01-250000891024us-gaap:InterestRateContractMember2023-10-292024-01-270000891024us-gaap:InterestRateContractMember2024-04-282025-01-250000891024us-gaap:InterestRateContractMember2023-04-302024-01-270000891024us-gaap:InterestRateContractMemberus-gaap:NondesignatedMember2024-10-272025-01-250000891024us-gaap:InterestRateContractMemberus-gaap:NondesignatedMember2023-10-292024-01-270000891024us-gaap:InterestRateContractMemberus-gaap:NondesignatedMember2024-04-282025-01-250000891024us-gaap:InterestRateContractMemberus-gaap:NondesignatedMember2023-04-302024-01-270000891024us-gaap:FairValueInputsLevel1Member2025-01-250000891024us-gaap:FairValueInputsLevel2Member2025-01-250000891024us-gaap:FairValueInputsLevel3Member2025-01-250000891024us-gaap:FairValueInputsLevel1Member2024-04-270000891024us-gaap:FairValueInputsLevel2Member2024-04-270000891024us-gaap:FairValueInputsLevel3Member2024-04-270000891024pdco:VetsourceMember2024-04-270000891024pdco:VetsourceMember2024-10-272025-01-250000891024us-gaap:EstimateOfFairValueFairValueDisclosureMember2025-01-250000891024us-gaap:EstimateOfFairValueFairValueDisclosureMember2024-04-270000891024us-gaap:CarryingReportedAmountFairValueDisclosureMember2025-01-250000891024us-gaap:CarryingReportedAmountFairValueDisclosureMember2024-04-270000891024pdco:TechnologyPartnerInnovationsLLCMember2024-04-282024-07-270000891024pdco:TechnologyPartnerInnovationsLLCMember2024-04-282025-01-250000891024pdco:TechnologyPartnerInnovationsLLCMember2024-10-272025-01-250000891024pdco:TechnologyPartnerInnovationsLLCMember2023-10-292024-01-270000891024pdco:TechnologyPartnerInnovationsLLCMember2023-04-302024-01-270000891024country:US2024-10-272025-01-250000891024country:US2023-10-292024-01-270000891024country:US2024-04-282025-01-250000891024country:US2023-04-302024-01-270000891024country:GB2024-10-272025-01-250000891024country:GB2023-10-292024-01-270000891024country:GB2024-04-282025-01-250000891024country:GB2023-04-302024-01-270000891024country:CA2024-10-272025-01-250000891024country:CA2023-10-292024-01-270000891024country:CA2024-04-282025-01-250000891024country:CA2023-04-302024-01-270000891024country:USpdco:DentalSupplyMember2024-10-272025-01-250000891024country:USpdco:DentalSupplyMember2023-10-292024-01-270000891024country:USpdco:DentalSupplyMember2024-04-282025-01-250000891024country:USpdco:DentalSupplyMember2023-04-302024-01-270000891024country:CApdco:DentalSupplyMember2024-10-272025-01-250000891024country:CApdco:DentalSupplyMember2023-10-292024-01-270000891024country:CApdco:DentalSupplyMember2024-04-282025-01-250000891024country:CApdco:DentalSupplyMember2023-04-302024-01-270000891024pdco:DentalSupplyMember2024-10-272025-01-250000891024pdco:DentalSupplyMember2023-10-292024-01-270000891024pdco:DentalSupplyMember2024-04-282025-01-250000891024pdco:DentalSupplyMember2023-04-302024-01-270000891024country:USpdco:AnimalHealthMember2024-10-272025-01-250000891024country:USpdco:AnimalHealthMember2023-10-292024-01-270000891024country:USpdco:AnimalHealthMember2024-04-282025-01-250000891024country:USpdco:AnimalHealthMember2023-04-302024-01-270000891024country:GBpdco:AnimalHealthMember2024-10-272025-01-250000891024country:GBpdco:AnimalHealthMember2023-10-292024-01-270000891024country:GBpdco:AnimalHealthMember2024-04-282025-01-250000891024country:GBpdco:AnimalHealthMember2023-04-302024-01-270000891024country:CApdco:AnimalHealthMember2024-10-272025-01-250000891024country:CApdco:AnimalHealthMember2023-10-292024-01-270000891024country:CApdco:AnimalHealthMember2024-04-282025-01-250000891024country:CApdco:AnimalHealthMember2023-04-302024-01-270000891024pdco:AnimalHealthMember2024-10-272025-01-250000891024pdco:AnimalHealthMember2023-10-292024-01-270000891024pdco:AnimalHealthMember2024-04-282025-01-250000891024pdco:AnimalHealthMember2023-04-302024-01-270000891024country:USus-gaap:CorporateMember2024-10-272025-01-250000891024country:USus-gaap:CorporateMember2023-10-292024-01-270000891024country:USus-gaap:CorporateMember2024-04-282025-01-250000891024country:USus-gaap:CorporateMember2023-04-302024-01-270000891024us-gaap:CorporateMember2024-10-272025-01-250000891024us-gaap:CorporateMember2023-10-292024-01-270000891024us-gaap:CorporateMember2024-04-282025-01-250000891024us-gaap:CorporateMember2023-04-302024-01-270000891024pdco:ConsumablesMember2024-10-272025-01-250000891024pdco:ConsumablesMember2023-10-292024-01-270000891024pdco:ConsumablesMember2024-04-282025-01-250000891024pdco:ConsumablesMember2023-04-302024-01-270000891024pdco:EquipmentAndSoftwareMember2024-10-272025-01-250000891024pdco:EquipmentAndSoftwareMember2023-10-292024-01-270000891024pdco:EquipmentAndSoftwareMember2024-04-282025-01-250000891024pdco:EquipmentAndSoftwareMember2023-04-302024-01-270000891024pdco:OtherProductMember2024-10-272025-01-250000891024pdco:OtherProductMember2023-10-292024-01-270000891024pdco:OtherProductMember2024-04-282025-01-250000891024pdco:OtherProductMember2023-04-302024-01-270000891024pdco:DentalSupplyMemberpdco:ConsumablesMember2024-10-272025-01-250000891024pdco:DentalSupplyMemberpdco:ConsumablesMember2023-10-292024-01-270000891024pdco:DentalSupplyMemberpdco:ConsumablesMember2024-04-282025-01-250000891024pdco:DentalSupplyMemberpdco:ConsumablesMember2023-04-302024-01-270000891024pdco:DentalSupplyMemberpdco:EquipmentAndSoftwareMember2024-10-272025-01-250000891024pdco:DentalSupplyMemberpdco:EquipmentAndSoftwareMember2023-10-292024-01-270000891024pdco:DentalSupplyMemberpdco:EquipmentAndSoftwareMember2024-04-282025-01-250000891024pdco:DentalSupplyMemberpdco:EquipmentAndSoftwareMember2023-04-302024-01-270000891024pdco:DentalSupplyMemberpdco:OtherProductMember2024-10-272025-01-250000891024pdco:DentalSupplyMemberpdco:OtherProductMember2023-10-292024-01-270000891024pdco:DentalSupplyMemberpdco:OtherProductMember2024-04-282025-01-250000891024pdco:DentalSupplyMemberpdco:OtherProductMember2023-04-302024-01-270000891024pdco:AnimalHealthMemberpdco:ConsumablesMember2024-10-272025-01-250000891024pdco:AnimalHealthMemberpdco:ConsumablesMember2023-10-292024-01-270000891024pdco:AnimalHealthMemberpdco:ConsumablesMember2024-04-282025-01-250000891024pdco:AnimalHealthMemberpdco:ConsumablesMember2023-04-302024-01-270000891024pdco:AnimalHealthMemberpdco:EquipmentAndSoftwareMember2024-10-272025-01-250000891024pdco:AnimalHealthMemberpdco:EquipmentAndSoftwareMember2023-10-292024-01-270000891024pdco:AnimalHealthMemberpdco:EquipmentAndSoftwareMember2024-04-282025-01-250000891024pdco:AnimalHealthMemberpdco:EquipmentAndSoftwareMember2023-04-302024-01-270000891024pdco:AnimalHealthMemberpdco:OtherProductMember2024-10-272025-01-250000891024pdco:AnimalHealthMemberpdco:OtherProductMember2023-10-292024-01-270000891024pdco:AnimalHealthMemberpdco:OtherProductMember2024-04-282025-01-250000891024pdco:AnimalHealthMemberpdco:OtherProductMember2023-04-302024-01-270000891024us-gaap:CorporateMemberpdco:OtherProductMember2024-10-272025-01-250000891024us-gaap:CorporateMemberpdco:OtherProductMember2023-10-292024-01-270000891024us-gaap:CorporateMemberpdco:OtherProductMember2024-04-282025-01-250000891024us-gaap:CorporateMemberpdco:OtherProductMember2023-04-302024-01-270000891024us-gaap:OperatingSegmentsMemberpdco:DentalSupplyMember2024-10-272025-01-250000891024us-gaap:OperatingSegmentsMemberpdco:DentalSupplyMember2023-10-292024-01-270000891024us-gaap:OperatingSegmentsMemberpdco:DentalSupplyMember2024-04-282025-01-250000891024us-gaap:OperatingSegmentsMemberpdco:DentalSupplyMember2023-04-302024-01-270000891024us-gaap:OperatingSegmentsMemberpdco:AnimalHealthMember2024-10-272025-01-250000891024us-gaap:OperatingSegmentsMemberpdco:AnimalHealthMember2023-10-292024-01-270000891024us-gaap:OperatingSegmentsMemberpdco:AnimalHealthMember2024-04-282025-01-250000891024us-gaap:OperatingSegmentsMemberpdco:AnimalHealthMember2023-04-302024-01-270000891024us-gaap:OperatingSegmentsMemberus-gaap:CorporateMember2024-10-272025-01-250000891024us-gaap:OperatingSegmentsMemberus-gaap:CorporateMember2023-10-292024-01-270000891024us-gaap:OperatingSegmentsMemberus-gaap:CorporateMember2024-04-282025-01-250000891024us-gaap:OperatingSegmentsMemberus-gaap:CorporateMember2023-04-302024-01-270000891024us-gaap:OperatingSegmentsMemberpdco:DentalSupplyMember2025-01-250000891024us-gaap:OperatingSegmentsMemberpdco:DentalSupplyMember2024-04-270000891024us-gaap:OperatingSegmentsMemberpdco:AnimalHealthMember2025-01-250000891024us-gaap:OperatingSegmentsMemberpdco:AnimalHealthMember2024-04-270000891024us-gaap:OperatingSegmentsMemberus-gaap:CorporateMember2025-01-250000891024us-gaap:OperatingSegmentsMemberus-gaap:CorporateMember2024-04-270000891024us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2024-04-270000891024us-gaap:AccumulatedTranslationAdjustmentMember2024-04-270000891024us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2024-04-282025-01-250000891024us-gaap:AccumulatedTranslationAdjustmentMember2024-04-282025-01-250000891024us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-282025-01-250000891024us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2025-01-250000891024us-gaap:AccumulatedTranslationAdjustmentMember2025-01-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________________

FORM 10-Q

____________________________________________________________ | | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE QUARTERLY PERIOD ENDED January 25, 2025. | | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File No. 0-20572

__________________________________________________________

PATTERSON COMPANIES, INC.

(Exact Name of Registrant as Specified in Its Charter)

____________________________________________________________ | | | | | | | | |

| Minnesota | 41-0886515 |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer

Identification Number) |

| 1031 Mendota Heights Road | |

| St. Paul | Minnesota | 55120 |

| (Address of Principal Executive Offices) | (Zip Code) |

(651) 686-1600

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of exchange on which registered |

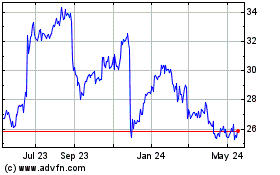

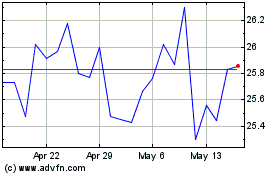

| Common Stock, par value $.01 | PDCO | NASDAQ Global Select Market |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | | ☒ | | Accelerated filer | | ☐ | | Non-accelerated filer | | ☐ |

| | | | | | |

| Smaller reporting company | | ☐ | | Emerging growth company | | ☐ | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of February 17, 2025, there were 88,474,000 shares of Common Stock of the registrant issued and outstanding.

PATTERSON COMPANIES, INC.

PART I—FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

PATTERSON COMPANIES, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except per share amounts)

(Unaudited)

| | | | | | | | | | | |

| January 25, 2025 | | April 27, 2024 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 134,996 | | | $ | 114,462 | |

Receivables, net of allowance for doubtful accounts of $2,518 and $2,731 | 469,924 | | | 547,287 | |

| Inventory, net | 889,348 | | | 782,898 | |

| Prepaid expenses and other current assets | 343,366 | | | 334,116 | |

| Total current assets | 1,837,634 | | | 1,778,763 | |

| Property and equipment, net | 227,802 | | | 229,081 | |

| Operating lease right-of-use assets, net | 121,613 | | | 122,295 | |

| Long-term receivables, net | 116,839 | | | 129,876 | |

| Goodwill | 159,622 | | | 156,328 | |

| Identifiable intangibles, net | 170,523 | | | 193,261 | |

| Investments | 88,649 | | | 166,320 | |

| Other non-current assets, net | 109,904 | | | 120,808 | |

| Total assets | $ | 2,832,586 | | | $ | 2,896,732 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 644,861 | | | $ | 745,375 | |

| Accrued payroll expense | 67,946 | | | 78,211 | |

| Other accrued liabilities | 136,794 | | | 167,399 | |

| Operating lease liabilities | 26,945 | | | 32,815 | |

| Current maturities of long-term debt | 126,875 | | | 122,750 | |

| Borrowings on revolving credit | 302,000 | | | 186,000 | |

| Total current liabilities | 1,305,421 | | | 1,332,550 | |

| Long-term debt | 321,763 | | | 328,911 | |

| Non-current operating lease liabilities | 98,053 | | | 92,464 | |

| Other non-current liabilities | 117,434 | | | 141,075 | |

| Total liabilities | 1,842,671 | | | 1,895,000 | |

| Stockholders’ equity: | | | |

Common stock, $0.01 par value: 600,000 shares authorized; 88,454 and 89,701 shares issued and outstanding | 885 | | | 897 | |

| Additional paid-in capital | 278,744 | | | 258,679 | |

| Accumulated other comprehensive loss | (96,868) | | | (89,915) | |

| Retained earnings | 806,800 | | | 831,483 | |

| | | |

| Total Patterson Companies, Inc. stockholders' equity | 989,561 | | | 1,001,144 | |

| Noncontrolling interests | 354 | | | 588 | |

| Total stockholders’ equity | 989,915 | | | 1,001,732 | |

| Total liabilities and stockholders’ equity | $ | 2,832,586 | | | $ | 2,896,732 | |

See accompanying notes

PATTERSON COMPANIES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

AND OTHER COMPREHENSIVE INCOME

(In thousands, except per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| January 25, 2025 | | January 27, 2024 | | January 25, 2025 | | January 27, 2024 |

| Net sales | $ | 1,572,411 | | | $ | 1,616,095 | | | $ | 4,788,528 | | | $ | 4,845,612 | |

| Cost of sales | 1,251,587 | | | 1,265,089 | | | 3,827,003 | | | 3,836,525 | |

| Gross profit | 320,824 | | | 351,006 | | | 961,525 | | | 1,009,087 | |

| Operating expenses | 275,383 | | | 280,994 | | | 849,079 | | | 843,950 | |

| Operating income | 45,441 | | | 70,012 | | | 112,446 | | | 165,137 | |

| Other income (expense): | | | | | | | |

| | | | | | | |

| Other income, net | 8,147 | | | 3,653 | | | 19,566 | | | 22,650 | |

| Interest expense | (10,753) | | | (11,725) | | | (35,774) | | | (31,879) | |

| Income before taxes | 42,835 | | | 61,940 | | | 96,238 | | | 155,908 | |

| Income tax expense | 11,665 | | | 14,347 | | | 24,733 | | | 37,330 | |

| | | | | | | |

| | | | | | | |

| Net income | 31,170 | | | 47,593 | | | 71,505 | | | 118,578 | |

| Net loss attributable to noncontrolling interests | (85) | | | (110) | | | (234) | | | (317) | |

| Net income attributable to Patterson Companies, Inc. | $ | 31,255 | | | $ | 47,703 | | | $ | 71,739 | | | $ | 118,895 | |

| Earnings per share attributable to Patterson Companies, Inc.: | | | | | | | |

| | | | | | | |

| | | | | | | |

| Basic | $ | 0.35 | | | $ | 0.52 | | | $ | 0.81 | | | $ | 1.26 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Diluted | $ | 0.35 | | | $ | 0.52 | | | $ | 0.81 | | | $ | 1.26 | |

| Weighted average shares: | | | | | | | |

| Basic | 88,306 | | | 92,009 | | | 88,197 | | | 94,088 | |

| Diluted | 89,070 | | | 92,519 | | | 88,871 | | | 94,704 | |

| | | | | | | |

| Comprehensive income: | | | | | | | |

| Net income | $ | 31,170 | | | $ | 47,593 | | | $ | 71,505 | | | $ | 118,578 | |

| Foreign currency translation (loss) gain | (11,760) | | | 12,538 | | | (7,735) | | | 2,317 | |

| Cash flow hedges, net of tax | 261 | | | 261 | | | 782 | | | 782 | |

| Comprehensive income | $ | 19,671 | | | $ | 60,392 | | | $ | 64,552 | | | $ | 121,677 | |

See accompanying notes

PATTERSON COMPANIES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Additional

Paid-in

Capital | | Accumulated

Other

Comprehensive

Loss | | Retained

Earnings | | | | Non-controlling Interests | | Total |

| Shares | | Amount | | | | | | |

| Balance at April 29, 2023 | 96,350 | | | $ | 964 | | | $ | 233,706 | | | $ | (89,262) | | | $ | 972,127 | | | | | $ | 1,000 | | | $ | 1,118,535 | |

| Foreign currency translation | — | | | — | | | — | | | 7,368 | | | — | | | | | — | | | 7,368 | |

| Cash flow hedges | — | | | — | | | — | | | 261 | | | — | | | | | — | | | 261 | |

| Net income (loss) | — | | | — | | | — | | | — | | | 31,234 | | | | | (104) | | | 31,130 | |

Dividends declared ($0.26 per common share) | — | | | — | | | — | | | — | | | (25,134) | | | | | — | | | (25,134) | |

| Common stock issued | 565 | | | 5 | | | 1,569 | | | — | | | — | | | | | — | | | 1,574 | |

| Repurchases of common stock | (1,109) | | | (11) | | | — | | | — | | | (29,497) | | | | | — | | | (29,508) | |

| Stock-based compensation | — | | | — | | | 7,015 | | | — | | | — | | | | | — | | | 7,015 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Balance at July 29, 2023 | 95,806 | | | 958 | | | 242,290 | | | (81,633) | | | 948,730 | | | | | 896 | | | 1,111,241 | |

| Foreign currency translation | — | | | — | | | — | | | (17,589) | | | — | | | | | — | | | (17,589) | |

| Cash flow hedges | — | | | — | | | — | | | 260 | | | — | | | | | — | | | 260 | |

| Net income (loss) | — | | | — | | | — | | | — | | | 39,958 | | | | | (103) | | | 39,855 | |

Dividends declared ($0.26 per common share) | — | | | — | | | — | | | — | | | (24,897) | | | | | — | | | (24,897) | |

| Common stock issued | 180 | | | 2 | | | 3,226 | | | — | | | — | | | | | — | | | 3,228 | |

| Repurchases of common stock | (1,897) | | | (19) | | | (661) | | | — | | | (60,964) | | | | | — | | | (61,644) | |

| Stock-based compensation | — | | | — | | | 4,635 | | | — | | | — | | | | | — | | | 4,635 | |

| | | | | | | | | | | | | | | |

| Balance at October 28, 2023 | 94,089 | | | 941 | | | 249,490 | | | (98,962) | | | 902,827 | | | | | 793 | | | 1,055,089 | |

| Foreign currency translation | — | | | — | | | — | | | 12,538 | | | — | | | | | — | | | 12,538 | |

| Cash flow hedges | — | | | — | | | — | | | 261 | | | — | | | | | — | | | 261 | |

| Net income (loss) | — | | | — | | | — | | | — | | | 47,703 | | | | | (110) | | | 47,593 | |

Dividends declared ($0.26 per common share) | — | | | — | | | — | | | — | | | (23,591) | | | | | — | | | (23,591) | |

| Common stock issued | 103 | | | 1 | | | 1,844 | | | — | | | — | | | | | — | | | 1,845 | |

| Repurchases of common stock | (4,101) | | | (41) | | | (1,219) | | | — | | | (124,055) | | | | | — | | | (125,315) | |

| Stock-based compensation | — | | | — | | | 3,745 | | | — | | | — | | | | | — | | | 3,745 | |

| | | | | | | | | | | | | | | |

| Balance at January 27, 2024 | 90,091 | | | 901 | | | 253,860 | | | (86,163) | | | 802,884 | | | | | 683 | | | 972,165 | |

| Foreign currency translation | — | | | — | | | — | | | (4,012) | | | — | | | | | — | | | (4,012) | |

| Cash flow hedges | — | | | — | | | — | | | 260 | | | — | | | | | — | | | 260 | |

| Net income (loss) | — | | | — | | | — | | | — | | | 67,036 | | | | | (95) | | | 66,941 | |

Dividends declared ($0.26 per common share) | — | | | — | | | — | | | — | | | (23,521) | | | | | — | | | (23,521) | |

| Common stock issued | 107 | | | 1 | | | 2,462 | | | — | | | — | | | | | — | | | 2,463 | |

| Repurchases of common stock | (497) | | | (5) | | | (119) | | | — | | | (14,916) | | | | | — | | | (15,040) | |

| Stock-based compensation | — | | | — | | | 2,476 | | | — | | | — | | | | | — | | | 2,476 | |

| | | | | | | | | | | | | | | |

| Balance at April 27, 2024 | 89,701 | | | $ | 897 | | | $ | 258,679 | | | $ | (89,915) | | | $ | 831,483 | | | | | $ | 588 | | | $ | 1,001,732 | |

See accompanying notes

PATTERSON COMPANIES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Additional

Paid-in

Capital | | Accumulated

Other

Comprehensive

Loss | | Retained

Earnings | | | | Non-controlling Interests | | Total |

| Shares | | Amount | | | | | | |

| Balance at April 27, 2024 | 89,701 | | | $ | 897 | | | $ | 258,679 | | | $ | (89,915) | | | $ | 831,483 | | | | | $ | 588 | | | $ | 1,001,732 | |

| Foreign currency translation | — | | | — | | | — | | | 3,181 | | | — | | | | | — | | | 3,181 | |

| Cash flow hedges | — | | | — | | | — | | | 261 | | | — | | | | | — | | | 261 | |

| Net income (loss) | — | | | — | | | — | | | — | | | 13,715 | | | | | (76) | | | 13,639 | |

Dividends declared ($0.26 per common share) | — | | | — | | | — | | | — | | | (23,221) | | | | | — | | | (23,221) | |

| Common stock issued | 385 | | | 4 | | | (752) | | | — | | | — | | | | | — | | | (748) | |

| Repurchases of common stock | (1,940) | | | (20) | | | (403) | | | — | | | (49,980) | | | | | — | | | (50,403) | |

| Stock-based compensation | — | | | — | | | 8,060 | | | — | | | — | | | | | — | | | 8,060 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Balance at July 27, 2024 | 88,146 | | | 881 | | | 265,584 | | | (86,473) | | | 771,997 | | | | | 512 | | | 952,501 | |

| Foreign currency translation | — | | | — | | | — | | | 844 | | | — | | | | | — | | | 844 | |

| Cash flow hedges | — | | | — | | | — | | | 260 | | | — | | | | | — | | | 260 | |

| Net income (loss) | — | | | — | | | — | | | — | | | 26,769 | | | | | (73) | | | 26,696 | |

Dividends declared ($0.26 per common share) | — | | | — | | | — | | | — | | | (23,226) | | | | | — | | | (23,226) | |

| Common stock issued | 171 | | | 2 | | | 1,968 | | | — | | | — | | | | | — | | | 1,970 | |

| Repurchases of common stock | — | | | — | | | 32 | | | — | | | — | | | | | — | | | 32 | |

| Stock-based compensation | — | | | — | | | 4,372 | | | — | | | — | | | | | — | | | 4,372 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Balance at October 26, 2024 | 88,317 | | | 883 | | | 271,956 | | | (85,369) | | | 775,540 | | | | | 439 | | | 963,449 | |

| Foreign currency translation | — | | | — | | | — | | | (11,760) | | | — | | | | | — | | | (11,760) | |

| Cash flow hedges | — | | | — | | | — | | | 261 | | | — | | | | | — | | | 261 | |

| Net income (loss) | — | | | — | | | — | | | — | | | 31,255 | | | | | (85) | | | 31,170 | |

| Dividends | — | | | — | | | — | | | — | | | 5 | | | | | — | | | 5 | |

| Common stock issued | 137 | | | 2 | | | 2,607 | | | — | | | — | | | | | — | | | 2,609 | |

| Repurchases of common stock | — | | | — | | | 45 | | | — | | | | | | | — | | | 45 | |

| Stock-based compensation | — | | | — | | | 4,136 | | | — | | | — | | | | | — | | | 4,136 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Balance at January 25, 2025 | 88,454 | | | $ | 885 | | | $ | 278,744 | | | $ | (96,868) | | | $ | 806,800 | | | | | $ | 354 | | | $ | 989,915 | |

See accompanying notes

PATTERSON COMPANIES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

| | | | | | | | | | | |

| | Nine Months Ended |

| January 25, 2025 | | January 27, 2024 |

| Operating activities: | | | |

| Net income | $ | 71,505 | | | $ | 118,578 | |

| | | |

| | | |

| Adjustments to reconcile net income to net cash used in operating activities: | | | |

| Depreciation | 39,693 | | | 36,314 | |

| Amortization | 29,091 | | | 28,884 | |

| | | |

| | | |

| | | |

| Stock-based compensation | 16,568 | | | 15,395 | |

| | | |

| | | |

| | | |

| Non-cash (gains) losses and other, net | (9,695) | | | 4,120 | |

| | | |

| Change in assets and liabilities: | | | |

| Receivables | (615,136) | | | (744,275) | |

| Inventory | (107,461) | | | (106,328) | |

| Accounts payable | (101,856) | | | (43,533) | |

| Accrued liabilities | (16,348) | | | (14,510) | |

| | | |

| Other changes from operating activities, net | (41,429) | | | (14,494) | |

| | | |

| | | |

| Net cash used in operating activities | (735,068) | | | (719,849) | |

| Investing activities: | | | |

| Additions to property and equipment and software | (46,427) | | | (51,196) | |

| Collection of deferred purchase price receivables | 731,146 | | | 770,319 | |

| Payments related to acquisitions, net of cash acquired | (11,967) | | | (1,108) | |

| | | |

| Sale of investment | 86,408 | | | — | |

| | | |

| | | |

| | | |

| Net cash provided by investing activities | 759,160 | | | 718,015 | |

| Financing activities: | | | |

| Dividends paid | (69,165) | | | (75,021) | |

| Repurchases of common stock | (50,000) | | | (214,587) | |

| | | |

| | | |

| | | |

| Payments on long-term debt | (3,375) | | | (35,250) | |

| Draw on revolving credit | 116,000 | | | 286,000 | |

| Other financing activities | 3,505 | | | 4,767 | |

| Net cash used in financing activities | (3,035) | | | (34,091) | |

| Effect of exchange rate changes on cash | (523) | | | 254 | |

| Net change in cash and cash equivalents | 20,534 | | | (35,671) | |

| Cash and cash equivalents at beginning of period | 114,462 | | | 159,669 | |

| Cash and cash equivalents at end of period | $ | 134,996 | | | $ | 123,998 | |

| | | |

| Supplemental disclosure of non-cash investing activity: | | | |

| Retained interest in securitization transactions | $ | 690,225 | | | $ | 739,382 | |

See accompanying notes

PATTERSON COMPANIES, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Dollars, except per share amounts, and shares in thousands)

(Unaudited)

Note 1. General

Description of Business

Patterson Companies, Inc. (referred to herein as “Patterson” or in the first person notations “we,” “our,” and “us”) is a value-added specialty distributor serving the U.S. and Canadian dental supply and the U.S., Canadian and U.K. animal health supply markets. Patterson has three reportable segments: Dental, Animal Health and Corporate.

Overview of Transaction with Patient Square

On December 10, 2024, Patterson entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Paradigm Parent, LLC, a Delaware limited liability company (“Parent”), and Paradigm Merger Sub, Inc., a Minnesota corporation and a wholly owned subsidiary of Parent (“Merger Sub”). Parent and Merger Sub are indirect subsidiaries of funds managed and advised by Patient Square Capital, a dedicated health care investment firm. Upon the terms and subject to the conditions of the Merger Agreement, at closing (the “Effective Time”), Merger Sub will merge with and into Patterson, with Patterson continuing as the surviving corporation and as a wholly owned subsidiary of Parent (the “Merger”). At the Effective Time, by virtue of the Merger, each share of common stock of the Company issued and outstanding immediately prior to the Effective Time will be converted automatically into the right to receive $31.35 per share in cash. After the Merger, Patterson will cease to be a publicly traded company and will no longer be obligated to file periodic reports with the SEC.

The description of the Merger Agreement and the transactions contemplated thereby contained in this Quarterly Report on Form 10-Q are summaries only and are qualified in their entirety by reference to the full text of the Merger Agreement, which was included as Exhibit 2 to the Company’s Current Report on Form 8-K filed with the SEC on December 11, 2024.

The Merger is expected to close in April 2025, subject to the satisfaction of customary closing conditions, including (i) adoption and approval of the Merger Agreement, including the Merger, by holders of a majority of the Company’s shares of common stock then outstanding; (ii) consummation of the Merger not being restrained, enjoined or prohibited by any law or order of a court of competent jurisdiction or any other governmental entity; (iii) accuracy of the representations and warranties of Patterson, on the one hand, and Parent and Merger Sub, on the other hand, in the Merger Agreement, subject in some instances to materiality or “material adverse effect” qualifiers, at and as of the effective date of the Merger (except for representations and warranties that relate to a specific date or time); (iv) performance or compliance in all material respects by Patterson, on the one hand, and Parent and Merger Sub, on the other hand, of or with their respective covenants and agreements required to be performance or complied with by them under the Merger Agreement on or before the closing date of the Merger; and (v) absence of a continuing Company Material Adverse Effect (as defined in the Merger Agreement). The waiting period for the Merger under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, has now expired. Closing of the Merger is not subject to a financing condition.

Basis of Presentation

In the opinion of management, the accompanying unaudited Condensed Consolidated Financial Statements contain all adjustments necessary to present fairly the financial position of Patterson Companies, Inc. (referred to herein as "Patterson" or in the first person notations "we," "our," and "us") as of January 25, 2025, and our results of operations and cash flows for the periods ended January 25, 2025 and January 27, 2024. Such adjustments are of a normal, recurring nature. The results of operations for the three and nine months ended January 25, 2025 are not necessarily indicative of the results to be expected for any other interim period or for the year ending April 26, 2025. These financial statements should be read in conjunction with the financial statements included in our 2024 Annual Report on Form 10-K filed on June 18, 2024.

The unaudited Condensed Consolidated Financial Statements include the assets and liabilities of PDC Funding Company, LLC ("PDC Funding"), PDC Funding Company II, LLC ("PDC Funding II"), PDC Funding Company III, LLC ("PDC Funding III") and PDC Funding Company IV, LLC ("PDC Funding IV"), which are our wholly owned subsidiaries and separate legal entities formed under Minnesota law. PDC Funding and PDC Funding II are fully

consolidated special purpose entities established to sell customer installment sale contracts to unaffiliated financial institutions in the normal course of their business. PDC Funding III and PDC Funding IV are fully consolidated special purpose entities established to sell certain receivables to unaffiliated financial institutions. The assets of PDC Funding, PDC Funding II, PDC Funding III and PDC Funding IV would be available first and foremost to satisfy the claims of its creditors. There are no known creditors of PDC Funding, PDC Funding II, PDC Funding III or PDC Funding IV. The unaudited Condensed Consolidated Financial Statements also include the assets and liabilities of Technology Partner Innovations, LLC, which is further described in Note 8.

Fiscal Year End

We operate with a 52-53 week accounting convention with our fiscal year ending on the last Saturday in April. The third quarter of fiscal 2025 and 2024 represents the 13 weeks ended January 25, 2025 and January 27, 2024, respectively. Fiscal 2025 will include 52 weeks and fiscal 2024 included 52 weeks.

Other Income, Net

Other income, net consisted of the following:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| January 25, 2025 | | January 27, 2024 | | January 25, 2025 | | January 27, 2024 |

| Gain on investment | $ | — | | | $ | — | | | $ | 3,803 | | | $ | — | |

| (Loss) gain on interest rate swap agreements | 2,298 | | | (3,474) | | | (2,181) | | | 6,087 | |

| Investment income and other | 5,849 | | | 7,127 | | | 17,944 | | | 16,563 | |

| Other income, net | $ | 8,147 | | | $ | 3,653 | | | $ | 19,566 | | | $ | 22,650 | |

Comprehensive Income

Comprehensive income is computed as net income including certain other items that are recorded directly to stockholders’ equity. Significant items included in comprehensive income are foreign currency translation adjustments and the effective portion of cash flow hedges, net of tax. Foreign currency translation adjustments do not include a provision for income tax because earnings from foreign operations are considered to be indefinitely reinvested outside the U.S. The income tax expense related to cash flow hedges was $80 and $80 for the three months ended January 25, 2025 and January 27, 2024, respectively. The income tax expense related to cash flow hedges was $241 and $241 for the nine months ended January 25, 2025 and January 27, 2024, respectively.

Earnings Per Share ("EPS")

The following table sets forth the computation of the weighted average shares outstanding used to calculate basic and diluted EPS:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| January 25, 2025 | | January 27, 2024 | | January 25, 2025 | | January 27, 2024 |

| Denominator for basic EPS – weighted average shares | 88,306 | | | 92,009 | | | 88,197 | | | 94,088 | |

| Effect of dilutive securities – stock options, restricted stock and stock purchase plans | 764 | | | 510 | | | 674 | | | 616 | |

| Denominator for diluted EPS – weighted average shares | 89,070 | | | 92,519 | | | 88,871 | | | 94,704 | |

Potentially dilutive securities representing 942 and 997 shares for the three and nine months ended January 25, 2025 and 1,057 and 1,231 shares for the three and nine months ended January 27, 2024 were excluded from the calculation of diluted EPS because their effects were anti-dilutive using the treasury stock method.

Revenue Recognition

Revenues are generated from the sale of consumable products, equipment and support, software and support, technical service parts and labor, and other sources. Revenues are recognized when or as performance obligations are satisfied. Performance obligations are satisfied when the customer obtains control of the goods or services.

Consumable product, equipment, software and parts sales are recorded upon delivery, except in those circumstances where terms of the sale are FOB shipping point, in which case sales are recorded upon shipment. Technical service labor is recognized as it is provided. Revenue derived from equipment support and software services is recognized ratably over the period in which the support and services are provided.

In addition to revenues generated from the distribution of consumable products under arrangements (buy/sell agreements) where the full market value of the product is recorded as revenue, we earn commissions for services provided under agency agreements. The agency agreement contrasts to a buy/sell agreement in that we do not have control over the transaction, as we do not have the primary responsibility of fulfilling the promise of the good or service and we do not bill or collect from the customer in an agency relationship. Commissions under agency agreements are recorded when the services are provided.

Estimates for returns, damaged goods, rebates, loyalty programs and other revenue allowances are made at the time the revenue is recognized based on the historical experience for such items. The receivables that result from the recognition of revenue are reported net of related allowances. We maintain a valuation allowance based upon the expected collectability of receivables held. Estimates are used to determine the valuation allowance and are based on several factors, including historical collection data, economic trends and credit worthiness of customers. Receivables are written off when we determine the amounts to be uncollectible, typically upon customer bankruptcy or non-response to continuous collection efforts. The portions of receivable amounts that are not expected to be collected during the next twelve months are classified as long-term.

Receivables from vendors earned as a result of volume rebates and reimbursements for customer pricing contracts and promotions are recorded as a reduction of cost of sales in the period in which the related revenue is recognized. We estimate the vendor receivables earned but not received based on sales forecasts, transactional data and historical vendor collection trends.

We offer customer financing contracts on equipment purchases by creditworthy customers. For financing contracts at a below-market interest rate, we record a subsidy as a reduction to net sales in the period the contract is originated. The subsidy on below-market rate contracts is estimated based on analyses of current publicly-available interest rate trends. We do not consider contracts with a term of one year or less to have a significant financing component and do not record a subsidy for these contracts.

We generally sell our customers’ financing contracts to unaffiliated financial institutions in the normal course of our business. These financing arrangements are accounted for as a sale of assets under the provisions of ASC 860, Transfers and Servicing. We receive the proceeds of the contracts upon sale to financial institutions, with a portion of the proceeds held by the financial institutions as a deferred purchase price (DPP) as security against eventual performance of the portfolio. Customer financing net sales include the impact of changes in interest rates on DPP receivables, as the average interest rate in our contract portfolio may not fluctuate at the same rate as interest rate markets, resulting in an increase or reduction of gain on contract sales. We enter into an interest rate swap to hedge a portion of the related interest rate risk. These agreements do not qualify for hedge accounting, and the gains or losses on an interest rate swap are reported in other income and expense in our Condensed Consolidated Statements of Operation and Other Comprehensive Income.

Our financing business is described in further detail in Note 4 to the Condensed Consolidated Financial Statements.

Patterson has a relatively large, dispersed customer base and no single customer accounts for more than 10% of consolidated net sales. In addition, the equipment sold to customers under finance contracts generally serves as collateral for the contract and the customer provides a personal guarantee as well.

Net sales do not include sales tax as we are considered a pass-through conduit for collecting and remitting sales tax.

Contract Balances

Contract balances represent amounts presented in our Condensed Consolidated Balance Sheets when either we have transferred goods or services to the customer or the customer has paid consideration to us under the contract. These contract balances include accounts receivable, contract assets and contract liabilities.

Contract asset balances as of January 25, 2025 and April 27, 2024 were $2,114 and $1,373, respectively. Our contract liabilities primarily relate to advance payments from customers, upfront payments for software and support provided over time, and options that provide a material right to customers, such as our customer loyalty programs.

At January 25, 2025 and April 27, 2024, contract liabilities of $35,472 and $37,399 were reported in other accrued liabilities, respectively. Contract liabilities are recognized as revenue when the performance obligation has been performed, which primarily occurs during the subsequent 12 months. During the nine months ended January 25, 2025, we recognized $30,928 of the amount previously deferred at April 27, 2024.

Recently Issued Accounting Pronouncements

In November 2024, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") No. 2024-03, "Income Statement—Reporting Comprehensive Income—Expense Disaggregation Disclosures (Subtopic 220-40): Disaggregation of Income Statement Expenses". This ASU requires new disclosures of additional disaggregation of certain expense captions into specific categories. The new standard is effective for annual disclosures in fiscal year 2028 and interim disclosures in fiscal year 2029, with early adoption permitted. We currently are evaluating the impact of adopting this pronouncement.

In December 2023, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") No. 2023-09, "Income Taxes (Topic 740): Improvements to Income Tax Disclosures". This ASU requires additional disclosures related to rate reconciliation and income taxes paid. The new standard is effective for annual disclosures in fiscal year 2026, with early adoption permitted. We currently are evaluating the impact of adopting this pronouncement.

In November 2023, the FASB issued ASU No. 2023-07, "Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures". This ASU requires disclosures of significant segment expenses and other segment items. Disclosures about a reportable segment's profit or loss and assets will be required for both annual and interim periods. This ASU also requires disclosure of the title and position of Chief Operating Decision Maker ("CODM") and an explanation of how the CODM uses the reported measures of profit or loss in assessing performance and allocating resources. The new standard is effective for annual disclosures in fiscal year 2025 and interim disclosures in fiscal year 2026, with early adoption permitted. We currently are evaluating the impact of adopting this pronouncement.

Note 2. Acquisitions

During the second quarter of fiscal 2025, we acquired Infusion Concepts Limited, a U.K. market leader in the supply of high-performance infusion, drainage and critical care products that benefit the veterinary profession and their animal patients. This strategic purchase expands the portfolio with high-quality products for veterinary customers. Also during the second quarter of fiscal 2025, we acquired substantially all of the assets of Mountain Vet Supply, a regional production animal veterinary distributor in the U.S. The benefits of the purchase include an established over-the-counter retail location which we will leverage with our existing infrastructure and distribution network.

The total purchase price for these acquisitions is $9,496, which includes holdbacks of $1,979 that will be paid within 18 months of the respective closing dates and working capital adjustments of $380, which are due from sellers. As of the acquisition dates, we have recorded $6,841 of identifiable intangibles, $3,913 of goodwill and net tangible liabilities of $878 in our Consolidated Balance Sheets related to these acquisitions. Intangible assets was decreased by $360 and goodwill was decreased by $20 subsequent to acquisition dates as a result of working capital adjustments and valuation procedures. A portion of the goodwill is deductible for income tax purposes. Goodwill was recorded within the Animal Health segment and represents the expected benefit of integrating these value-added platforms with our existing operations. We have included their results of operations in our financial statements since the date of acquisition within the Animal Health segment. The accounting for these acquisitions is not complete because certain information and analysis that may impact our initial valuations are still being obtained or reviewed. The acquisitions were not deemed significant and did not materially impact our financial statements, and, therefore, pro forma results are not provided.

During the third quarter of fiscal 2025, we used $4,070 to pay holdbacks following our acquisition of substantially all of the assets of Relief Services for Veterinary Practitioners and Animal Care Technologies (RSVP and ACT) and Dairy Tech, Inc. The payments were due on the 24-month anniversaries of the closing dates. During the first quarter of fiscal 2024, we used $1,108 to pay a holdback following our acquisition of substantially all of the assets of Miller Vet Holdings, LLC. The payment was due on the 24-month anniversary of the closing date.

Note 3. Receivables Securitization Program

We are party to certain receivables purchase agreements (the “Receivables Purchase Agreements”) with MUFG Bank, Ltd. ("MUFG") (f.k.a. The Bank of Tokyo-Mitsubishi UFJ, Ltd.), under which MUFG acts as an agent to

facilitate the sale of certain Patterson receivables (the “Receivables”) to certain unaffiliated financial institutions (the “Purchasers”). The sale of these receivables is accounted for as a sale of assets under the provisions of ASC 860, Transfers and Servicing. We utilize PDC Funding III and PDC Funding IV to facilitate the sale to fulfill requirements within the agreement. We use a daily unit of account for these Receivables.

The proceeds from the sale of these Receivables comprise a combination of cash and a deferred purchase price (“DPP”) receivable. The DPP receivable is ultimately realized by Patterson following the collection of the underlying Receivables sold to the Purchasers. The amount available under the Receivables Purchase Agreements fluctuates over time based on the total amount of eligible Receivables generated during the normal course of business, with maximum availability of $200,000 as of January 25, 2025, of which $200,000 was utilized.

We have no retained interests in the transferred Receivables, other than our right to the DPP receivable and collection and administrative service fees. We consider the fees received adequate compensation for services rendered, and accordingly have recorded no servicing asset or liability. As of January 25, 2025 and April 27, 2024, the fair value of outstanding trade receivables transferred to the Purchasers under the facility and derecognized from the Condensed Consolidated Balance Sheets were $363,068 and $400,626, respectively. Sales of trade receivables under this facility were $2,560,313 and $2,681,935, and cash collections from customers on receivables sold were $2,597,755 and $2,725,094 during the nine months ended January 25, 2025 and January 27, 2024, respectively.

The DPP receivable is recorded at fair value within the Condensed Consolidated Balance Sheets within prepaid expenses and other current assets. The difference between the carrying amount of the Receivables and the sum of the cash and fair value of the DPP receivable received at time of transfer is recognized as a gain or loss on sale of the related Receivables inclusive of bank fees and allowance for credit losses. In operating expenses in the Condensed Consolidated Statements of Operations and Other Comprehensive Income, we recorded losses of $2,701 and $3,110 during the three months ended January 25, 2025 and January 27, 2024, respectively, and $10,086 and $10,270 during the nine months ended January 25, 2025 and January 27, 2024, respectively, related to the Receivables.

The following rollforward summarizes the activity related to the DPP receivable:

| | | | | | | | | | | | | | | |

| | | Nine Months Ended |

| | | | | January 25, 2025 | | January 27, 2024 |

| Beginning DPP receivable balance | | | | | $ | 198,827 | | | $ | 227,946 | |

| Non-cash additions to DPP receivable | | | | | 640,842 | | | 697,887 | |

| Cash collections on DPP receivable | | | | | (678,004) | | | (740,664) | |

| Ending DPP receivable balance | | | | | $ | 161,665 | | | $ | 185,169 | |

Note 4. Customer Financing

As a convenience to our customers, we offer several different financing alternatives, including a third party program and a Patterson-sponsored program. For the third party program, we act as a facilitator between the customer and the third party financing entity with no on-going involvement in the financing transaction. Under the Patterson-sponsored program, equipment purchased by creditworthy customers may be financed up to a maximum of $2,000. We generally sell our customers’ financing contracts to unaffiliated financial institutions in the normal course of our business. These financing arrangements are accounted for as a sale of assets under the provisions of ASC 860, Transfers and Servicing. We use a monthly unit of account for these financing contracts.

We operate under an agreement to sell a portion of our equipment finance contracts to commercial paper conduits with MUFG serving as the agent. We utilize PDC Funding to fulfill a requirement of participating in the commercial paper conduit. We receive the proceeds of the contracts upon sale to MUFG. At least 15.0% of the proceeds are held by the conduit as security against eventual performance of the portfolio. This percentage can be greater and is based upon certain ratios defined in the agreement with MUFG. The capacity under the agreement with MUFG at January 25, 2025 was $525,000.

We service the financing contracts for which we are paid a servicing fee. The servicing fees we receive are considered adequate compensation for services rendered. Accordingly, no servicing asset or liability has been recorded.

The portion of the purchase price for the receivables held by the conduits is deemed a DPP receivable, which is paid to PDC Funding as payments on the customers’ financing contracts are collected by Patterson from customers. The difference between the carrying amount of the receivables sold under these programs and the sum of the cash and fair value of the DPP receivable received at time of transfer is recognized as a gain or loss on sale of the related receivables and recorded in net sales in the Condensed Consolidated Statements of Operations and Other Comprehensive Income. Expenses incurred related to customer financing activities are recorded in operating expenses in our Condensed Consolidated Statements of Operations and Other Comprehensive Income.

During the nine months ended January 25, 2025 and January 27, 2024, we sold $193,443 and $197,712 of contracts under these arrangements, respectively. In net sales in the Condensed Consolidated Statements of Operations and Other Comprehensive Income, we recorded a loss of $2,058 and a gain of $9,117 during the three months ended January 25, 2025 and January 27, 2024, respectively, related to these contracts sold. In net sales in the Condensed Consolidated Statements of Operations and Other Comprehensive Income, we recorded a gain of $7,787 and a loss of $3,763 during the nine months ended January 25, 2025 and January 27, 2024, respectively, related to these contracts sold. Cash collections on financed receivables sold were $248,951 and $211,827 during the nine months ended January 25, 2025 and January 27, 2024, respectively. Unamortized discounts of $2,178 and $3,097 were recorded as of January 25, 2025 and April 27, 2024, respectively, which represent subsidies on contracts with below-market interest rates.

Included in cash and cash equivalents in the Condensed Consolidated Balance Sheets are $32,360 and $33,813 as of January 25, 2025 and April 27, 2024, respectively, which represent cash collected from previously sold customer financing contracts that have not yet been settled. Included in current receivables in the Condensed Consolidated Balance Sheets are $48,586 and $74,430 as of January 25, 2025 and April 27, 2024, respectively, of finance contracts we have not yet sold. A total of $553,111 of finance contracts receivable sold under the arrangements was outstanding at January 25, 2025. Since the internal financing program began in 1994, bad debt write-offs have amounted to less than 1% of the loans originated.

The following rollforward summarizes the activity related to the DPP receivable:

| | | | | | | | | | | | | | | | |

| | | | Nine Months Ended |

| | | | | | January 25, 2025 | | January 27, 2024 |

| Beginning DPP receivable balance | | | | | | $ | 114,259 | | | $ | 102,979 | |

| Non-cash additions to DPP receivable | | | | | | 49,383 | | | 41,495 | |

| Cash collections on DPP receivable | | | | | | (53,142) | | | (29,655) | |

| Ending DPP receivable balance | | | | | | $ | 110,500 | | | $ | 114,819 | |

The arrangements require us to maintain a minimum current ratio and maximum leverage ratio. We were in compliance with those covenants at January 25, 2025.

Note 5. Derivative Financial Instruments

We are a party to certain offsetting and identical interest rate cap agreements entered into to fulfill certain covenants of the equipment finance contract sale agreements. The interest rate cap agreements also provide a credit enhancement feature for the financing contracts sold by PDC Funding to the commercial paper conduit.

The interest rate cap agreements are entered into periodically to maintain consistency with the dollar maximum of the sale agreements and the maturity of the underlying financing contracts. As of January 25, 2025, PDC Funding had purchased an interest rate cap from a bank with a notional amount of $525,000 and a maturity date of July 2032. We sold an identical interest rate cap to the same bank.

These interest rate cap agreements do not qualify for hedge accounting treatment and, accordingly, we record the fair value of the agreements as an asset or liability and the change in fair value as income or expense during the period in which the change occurs.

In January 2014, we entered into a forward interest rate swap agreement with a notional amount of $250,000 and accounted for it as a cash flow hedge, in order to hedge interest rate fluctuations in anticipation of refinancing the 5.17% senior notes due March 25, 2015. These notes were repaid on March 25, 2015 and replaced with new $250,000 3.48% senior notes due March 24, 2025. A cash payment of $29,003 was made in March 2015 to settle

the interest rate swap. This amount is recorded in other comprehensive income (loss), net of tax, and is recognized as interest expense over the life of the related debt.

We utilize forward interest rate swap agreements to hedge against interest rate fluctuations that impact the amount of net sales we record related to our customer financing contracts. These interest rate swap agreements do not qualify for hedge accounting treatment and, accordingly, we record the fair value of the agreements as an asset or liability and the change in fair value as income or expense during the period in which the change occurs.

As of April 27, 2024, the remaining notional amount for interest rate swap agreements was $565,420, with the latest maturity date in fiscal 2031. During the nine months ended January 25, 2025, we entered into forward interest rate swap agreements with a notional amount of $189,008. As of January 25, 2025, the remaining notional amount for interest rate swap agreements was $545,964, with the latest maturity date in fiscal 2032.

Net cash receipts of $4,248 and $10,893 were received during the nine months ended January 25, 2025 and January 27, 2024, respectively, to settle a portion of our assets and liabilities related to interest rate swap agreements. These receipts are reflected as cash flows in the Condensed Consolidated Statements of Cash Flows within net cash used in operating activities.

The following presents the fair value of derivative instruments included in the Condensed Consolidated Balance Sheets:

| | | | | | | | | | | | | | |

| Derivative type | Classification | January 25, 2025 | | April 27, 2024 |

| Assets: | | | | |

| Interest rate contracts | Prepaid expenses and other current assets | $ | 2,340 | | | $ | 5,781 | |

| Interest rate contracts | Other non-current assets, net | 5,156 | | | 21,193 | |

| Total asset derivatives | | $ | 7,496 | | | $ | 26,974 | |

| Liabilities: | | | | |

| Interest rate contracts | Other accrued liabilities | $ | 475 | | | $ | 259 | |

| Interest rate contracts | Other non-current liabilities | 3,667 | | | 13,198 | |

| Total liability derivatives | | $ | 4,142 | | | $ | 13,457 | |

The following tables present the pre-tax effect of derivative instruments on the Condensed Consolidated Statements of Operations and Other Comprehensive Income:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Amount of Loss Reclassified from Accumulated Other Comprehensive Loss into Income (Effective Portion) |

| | | | Three Months Ended | | Nine Months Ended |

| Derivatives in cash flow hedging relationships | | Statements of operations location | | January 25, 2025 | | January 27, 2024 | | January 25, 2025 | | January 27, 2024 |

| Interest rate contracts | | Interest expense | | $ | (341) | | | $ | (341) | | | $ | (1,023) | | | $ | (1,023) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Amount of Gain (Loss) Recognized in Income on Derivatives |

| | | | Three Months Ended | | Nine Months Ended |

| Derivatives not designated as hedging instruments | | Statements of operations location | | January 25, 2025 | | January 27, 2024 | | January 25, 2025 | | January 27, 2024 |

| Interest rate contracts | | Other income, net | | $ | 2,298 | | | $ | (3,474) | | | $ | (2,181) | | | $ | 6,087 | |

There were no gains or losses recognized in other comprehensive income (loss) on cash flow hedging derivatives during the three and nine months ended January 25, 2025 or January 27, 2024.

We recorded no ineffectiveness during the three and nine month periods ended January 25, 2025 and January 27, 2024. As of January 25, 2025, the estimated pre-tax portion of accumulated other comprehensive loss that is expected to be reclassified into earnings over the next twelve months is $227, which will be recorded as an increase to interest expense.

Note 6. Fair Value Measurements

Fair value is the price at which an asset could be exchanged in a current transaction between knowledgeable, willing parties. The fair value hierarchy of measurements is categorized into one of three levels based on the lowest level of significant input used:

Level 1 - Quoted prices in active markets for identical assets and liabilities at the measurement date.

Level 2 - Observable inputs other than quoted prices included in Level 1, such as quoted prices for similar assets and liabilities in active markets; quoted prices for identical or similar assets and liabilities in markets that are not active; or other inputs that are observable or can be corroborated by observable market data.

Level 3 - Unobservable inputs for which there is little or no market data available. These inputs reflect management’s assumptions of what market participants would use in pricing the asset or liability.

Our hierarchy for assets and liabilities measured at fair value on a recurring basis is as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| January 25, 2025 |

| Total | | Level 1 | | Level 2 | | Level 3 |

| Assets: | | | | | | | |

| Cash equivalents | $ | 2,648 | | | $ | 2,648 | | | $ | — | | | $ | — | |

| DPP receivable - receivables securitization program | 161,665 | | | — | | | — | | | 161,665 | |

| DPP receivable - customer financing | 110,500 | | | — | | | — | | | 110,500 | |

| Derivative instruments | 7,496 | | | — | | | 7,496 | | | — | |

| Total assets | $ | 282,309 | | | $ | 2,648 | | | $ | 7,496 | | | $ | 272,165 | |

| Liabilities: | | | | | | | |

| Derivative instruments | $ | 4,142 | | | $ | — | | | $ | 4,142 | | | $ | — | |

| | | | | | | | | | | | | | | | | | | | | | | |

| April 27, 2024 |

| Total | | Level 1 | | Level 2 | | Level 3 |

| Assets: | | | | | | | |

| Cash equivalents | $ | 4,685 | | | $ | 4,685 | | | $ | — | | | $ | — | |

| DPP receivable - receivables securitization program | 198,827 | | | — | | | — | | | 198,827 | |

| DPP receivable - customer financing | 114,259 | | | — | | | — | | | 114,259 | |

| Derivative instruments | 26,974 | | | — | | | 26,974 | | | — | |

| Total assets | $ | 344,745 | | | $ | 4,685 | | | $ | 26,974 | | | $ | 313,086 | |

| Liabilities: | | | | | | | |

| Derivative instruments | $ | 13,457 | | | $ | — | | | $ | 13,457 | | | $ | — | |

Cash equivalents – We value cash equivalents at their current market rates. The carrying value of cash equivalents approximates fair value and maturities are less than three months.

DPP receivable – receivables securitization program – We value this DPP receivable based on a discounted cash flow analysis using unobservable inputs, which include the estimated timing of payments and the credit quality of the underlying creditor. Significant changes in any of the significant unobservable inputs in isolation would not result in a materially different fair value estimate. The interrelationship between these inputs is insignificant.

DPP receivable - customer financing – We value this DPP receivable based on a discounted cash flow analysis using unobservable inputs, which include a forward yield curve, the estimated timing of payments and the credit quality of the underlying creditor. Significant changes in any of the significant unobservable inputs in isolation would not result in a materially different fair value estimate. The interrelationship between these inputs is insignificant.

Derivative instruments – Our derivative instruments consist of interest rate cap agreements and interest rate swaps. These instruments are valued using inputs such as interest rates and credit spreads.

Certain assets are measured at fair value on a non-recurring basis. These assets are not measured at fair value on an ongoing basis, but are subject to fair value adjustments under certain circumstances. We adjust the carrying value of our non-marketable equity securities to fair value when observable transactions of identical or similar securities occur, or due to an impairment.

We had an investment in Vetsource, a commercial partner and leading home delivery provider for veterinarians. The investment was valued based on the selling price of the portion of the investment we sold in the first quarter of fiscal 2022. The carrying value of the investment was $56,849 as of April 27, 2024. Concurrent with the sale completed in the first quarter of fiscal 2022, we obtained rights that would allow us, under certain circumstances, to require another shareholder of Vetsource to purchase our remaining shares. The carrying value of this put option, which was subject to a floor, as of April 27, 2024 was $25,757, and was reported within investments in our Condensed Consolidated Balance Sheets. Concurrent with obtaining this put option, we also granted rights to the same Vetsource shareholder allowed such shareholder, under certain circumstances, to require us to sell our remaining shares at fair value. In the second quarter of fiscal 2025, the VetSource shareholder exercised the option and purchased Patterson's investment in VetSource. We recorded a pre-tax gain of $3,803 in other income, net in our Condensed Consolidated Statements of Operations and Other Comprehensive Income as a result of this sale. The cash received of $86,408 is reported within investing activities in our Condensed Consolidated Statements of Cash Flows.

Our debt is not measured at fair value in the Condensed Consolidated Balance Sheets. The estimated fair value of our debt as of January 25, 2025 and April 27, 2024 was $447,918 and $448,287, respectively, as compared to a carrying value, net of deferred debt issuance costs, of $448,638 and $451,661 at January 25, 2025 and April 27, 2024, respectively. The fair value of debt was measured using a discounted cash flow analysis based on expected market based yields (i.e., level 2 inputs).

The carrying amounts of receivables, net of allowances, accounts payable, and certain accrued and other current liabilities approximated fair value at January 25, 2025 and April 27, 2024.

Note 7. Income Taxes

The effective income tax rate for the three months ended January 25, 2025 and January 27, 2024 was 27.2% and 23.2%, respectively. The increase in the rate was primarily due to the impact of provision to return adjustments in the prior year quarter as compared to the current quarter.

The effective income tax rate for the nine months ended January 25, 2025 and January 27, 2024 was 25.7% and 23.9%, respectively. The increase in the rate is primarily due to a less favorable impact of excess tax benefits associated with stock compensation in the current year as compared to the prior year.

The Organization for Economic Cooperation and Development (“OECD”) has published a framework to implement a global minimum income tax rate of 15% through its Base Erosion and Profit Shifting Pillar Two project (“BEPS Pillar Two”). This new legislation became effective in certain countries where the Company operates starting in fiscal 2025. We continue to evaluate the impact of this new legislation. At this time, we do not expect the impact of this legislation to be material to our effective tax rate.

Note 8. Technology Partner Innovations, LLC ("TPI")

In fiscal 2019, we entered into an agreement with Cure Partners to form TPI, which offers a cloud-based practice management software, NaVetor, to its customers. We have determined that TPI is a variable interest entity, and we consolidate the results of operations of TPI as we have concluded that we are the primary beneficiary of TPI. Since TPI was formed, there have been no changes in ownership interests. No additional net assets were contributed during the nine months ended January 25, 2025 or fiscal year ended April 27, 2024. As of January 25, 2025, we had noncontrolling interests of $354 on our Condensed Consolidated Balance Sheets.

Net loss attributable to the noncontrolling interest was $85 and $110 for the three months ended January 25, 2025 and January 27, 2024, respectively and $234 and $317 for the nine months ended January 25, 2025 and January 27, 2024, respectively.

Note 9. Segment and Geographic Data

We present three reportable segments: Dental, Animal Health and Corporate. Dental and Animal Health are strategic business units that offer similar products and services to different customer bases. Dental provides a virtually complete range of consumable dental products, equipment, software, turnkey digital solutions and value-

added services to dentists, dental laboratories, institutions, and other healthcare professionals throughout North America. Animal Health is a leading, full-line distributor in North America and the U.K. of animal health products, services and technologies to both the production-animal and companion-pet markets. Our Corporate segment is comprised of general and administrative expenses, including home office support costs in areas such as information technology, finance, legal, human resources and facilities. In addition, customer financing and other miscellaneous sales are reported within Corporate results. Corporate assets consist primarily of cash and cash equivalents, accounts receivable, property and equipment and long-term receivables. We evaluate segment performance based on operating income. The costs to operate the fulfillment centers are allocated to the operating units based on the through-put of the unit.

The following table provides a breakdown of sales by geographic region:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| January 25, 2025 | | January 27, 2024 | | January 25, 2025 | | January 27, 2024 |

| Consolidated net sales | | | | | | | |

| United States | $ | 1,306,696 | | | $ | 1,335,821 | | | $ | 3,964,973 | | | $ | 4,010,344 | |

| United Kingdom | 180,784 | | | 187,735 | | | 570,994 | | | 559,806 | |

| Canada | 84,931 | | | 92,539 | | | 252,561 | | | 275,462 | |

| Total | $ | 1,572,411 | | | $ | 1,616,095 | | | $ | 4,788,528 | | | $ | 4,845,612 | |

| Dental net sales | | | | | | | |

| United States | $ | 543,490 | | | $ | 577,516 | | | $ | 1,604,024 | | | $ | 1,661,560 | |

| Canada | 52,838 | | | 59,621 | | | 154,343 | | | 169,258 | |

| Total | $ | 596,328 | | | $ | 637,137 | | | $ | 1,758,367 | | | $ | 1,830,818 | |

| Animal Health net sales | | | | | | | |

| United States | $ | 759,503 | | | $ | 746,624 | | | $ | 2,340,169 | | | $ | 2,336,879 | |

| United Kingdom | 180,784 | | | 187,735 | | | 570,994 | | | 559,806 | |

| Canada | 32,093 | | | 32,918 | | | 98,218 | | | 106,204 | |

| Total | $ | 972,380 | | | $ | 967,277 | | | $ | 3,009,381 | | | $ | 3,002,889 | |

| Corporate net sales | | | | | | | |

| United States | $ | 3,703 | | | $ | 11,681 | | | $ | 20,780 | | | $ | 11,905 | |