Wag! Group Co. Announces Pricing of Public Offering of $10 Million of Shares of Common Stock

17 July 2024 - 9:30PM

Business Wire

Wag! Group Co. (the “Company” or “Wag!”; Nasdaq: PET), which

strives to be the number one platform to solve the service,

product, and wellness needs of the modern U.S. pet household, today

announced the pricing of its underwritten public offering of

7,407,407 shares of its common stock at a price to the public of

$1.35 per share. The gross proceeds to Wag! from the offering,

before deducting underwriting discounts and commissions and other

offering expenses, are expected to be $10 million. Wag! intends to

use the net proceeds from the offering to repay approximately $8.5

million of indebtedness, with any remainder to be used for working

capital and general corporate purposes. The offering is expected to

close on or about July 18, 2024, subject to the satisfaction of

customary closing conditions.

Craig-Hallum is acting as sole managing underwriter for the

offering.

The shares described above are being offered by Wag! pursuant to

a shelf registration statement on Form S-3, including a base

prospectus, that was filed with the Securities and Exchange

Commission (“SEC”) and declared effective on September 13, 2023.

The offering is being made only by means of a prospectus supplement

and the accompanying prospectus that will form a part of the

registration statement. A preliminary prospectus supplement and the

accompanying prospectus relating to the offering was filed with the

SEC on July 16, 2024. The final prospectus supplement and the

accompanying prospectus relating to the offering will be filed with

the SEC and available on the SEC’s website at www.sec.gov. When

available, copies of the final prospectus supplement and the

accompanying prospectus relating to this offering may be obtained

from Craig-Hallum Capital Group LLC, Attention: Equity Capital

Markets, 222 South Ninth Street, Suite 350, Minneapolis, MN 55402,

by telephone at (612) 334-6300 or by email at

prospectus@chlm.com.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy, nor shall there be any sale of

these securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to the registration or

qualification under the securities laws of any such

jurisdiction.

About Wag! Group Co.

Wag! Group Co. strives to be the number one platform to solve

the service, product, and wellness needs of the modern U.S. pet

household. Wag! pioneered on-demand dog walking in 2015 with the

Wag! app, which offers access to 5-star dog walking, sitting, and

one-on-one training from a community of over 500,000 Pet Caregivers

nationwide. In addition, Wag! Group Co. operates Petted, one of the

nation’s largest pet insurance comparison marketplaces; Dog Food

Advisor, one of the most visited and trusted pet food review

platforms; WoofWoofTV, a multi-media company bringing delightful

pet content to over 18 million followers across social media;

maxbone, a digital platform for modern pet essentials; and Furmacy,

software to simplify pet prescriptions.

Forward-Looking Statements

This press release contains certain forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995. Some of the forward-looking statements can be identified

by the use of forward-looking words. Statements that are not

historical in nature, including the words “anticipate,” “expect,”

“suggests,” “plan,” “believe,” “intend,” “estimates,” “targets,”

“projects,” “should,” “could,” “would,” “may,” “will,” “forecast”

and other similar expressions are intended to identify

forward-looking statements. These statements include, but are not

limited to, those related to the expected gross proceeds from the

offering, the intended use of proceeds and the closing date of the

offering. Forward-looking statements are predictions, projections

and other statements about future events that are based on current

expectations and assumptions and, as a result, are subject to risks

and uncertainties. Many factors could cause actual future events to

differ materially from the forward-looking statements in this press

release, including but not limited to, factors related to market

conditions, the closing date of the offering and Wag!’s ability to

further develop and advance its pet service offerings and achieve

scale. You should carefully consider the foregoing factors and the

other risks and uncertainties described in the “Risk Factors”

section of the preliminary prospectus supplement and the

accompanying prospectus, Wag!’s filings with the SEC, including

Wag!’s Annual Report on Form 10-K and Quarterly Reports on Form

10-Q. Forward-looking statements speak only as of the date they are

made. Readers are cautioned not to put undue reliance on

forward-looking statements, and Wag! assumes no obligation and does

not intend to update or revise these forward-looking statements,

whether as a result of new information, future events, or

otherwise, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240717028531/en/

Media: Media@wagwalking.com

Investor Relations Wag!: IR@wagwalking.com Gateway for

Wag!: PET@gateway-grp.com

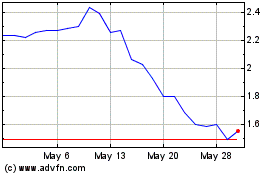

Wag (NASDAQ:PET)

Historical Stock Chart

From Jan 2025 to Feb 2025

Wag (NASDAQ:PET)

Historical Stock Chart

From Feb 2024 to Feb 2025