Quarterly Net Loss of $2.3 Million

Achieved Record Quarterly Adjusted EBITDA of

$1.6 Million

Wag! Group Co. (the “Company” or “Wag!”; Nasdaq: PET), which

strives to be the number one platform to solve the service,

product, and wellness needs of the modern U.S. pet household, today

announced financial results for the second quarter ended June 30,

2024.

Second Quarter 2024 Highlights:

- Revenues decreased 6% to $18.7 million, compared to $19.8

million in the second quarter of 2023 – comprised of $5.6 million

of Services revenue, $11.5 million of Wellness revenue, and $1.5

million of Pet Food & Treats revenue.

- Net loss improved to $2.3 million, compared to $3.9 million in

the second quarter of 2023.

- Adjusted EBITDA improved to $1.6 million, compared to $0.1

million in the second quarter of 2023.

"Our Q2 results were highly intentional, as we scaled back on

Sales & Marketing spend to increase near-term profitability

while we focus on addressing our debt obligations once the

prepayment penalty expires this month,” said Garrett Smallwood, CEO

and Chairman of Wag!. “Strengthening our balance sheet, driving

free cash flow and demonstrating consistent profitability are our

key priorities, and we look forward to making progress on these

objectives as move into the back half of the year.”

“We also look forward to benefiting from an enhanced balance

sheet as we continue to take the necessary steps to best position

the Company for continued growth, profitability, and shareholder

value creation.”

Recent Business Highlights:

- 467,000 Platform Participants in Q2 2024, versus 549,000 in Q2

2023.

- Achieved record quarterly Adjusted EBITDA of $1.6 million.

- Completed an underwritten registered public offering on July

18, 2024, the net proceeds of which were approximately $8.6 million

which we intend to use to pay down debt upon prepayment penalty

expiration on August 9, 2024.

Guidance

“In the second quarter, we delivered our highest quarterly

Adjusted EBITDA, which was driven by our focus on cost management

and operational efficiency,” said Alec Davidian, Wag! CFO. “Our

ability to generate free cash flow will allow us to service our

debt, improve our balance sheet and return to growth.”

For the third quarter 2024, we expect:

- Revenue in the range of $20 million to $24 million.

- Adjusted EBITDA1 in the range of $1.5 million to $2.5

million.

For the full year 2024, as previously communicated on July 10,

2024, we expect:

- Revenue in the range of $92 million to $102 million.

- Adjusted EBITDA1 in the range of $4 million to $8 million.

Our financial guidance includes the following outlook:

- We expect holidays to drive incremental overnight vs. daytime

service demand, but also expect that severe weather will impact

Services demand. Pet adoption during the holidays also positively

impacts pet insurance penetration and demand for wellness

plans.

- We anticipate that continued growth in the pet industry, driven

by factors such as higher rates of pet ownership, pet insurance

penetration, and increasing demand for premium pet products and

services, will have a positive impact on our full year 2024

results.

- We have factored in potential risks and opportunities related

to macroeconomic trends related to state of the economy, interest

rates, and consumer confidence in order to forecast our financial

performance.

- We expect Sales & Marketing efficiency within the Pet

category, our ability to manage CPCs and CPMs across key partners

and advertising platforms, and our ability to manage search engine

results and search engine optimization (SEO) within competitive

keywords.

- We recognize that there may be potential risks to our financial

performance in 2024, such as disruptions to global supply chains,

changes in consumer behavior due to unexpected events such as a

delayed or imbalanced return-to-office, digital and performance

marketing trends, the potential impact of AI, and our ability to

expand through partnerships.

________________ 1 Information reconciling forward-looking

Adjusted EBITDA to the most directly comparable GAAP financial

measure is unavailable to the company without unreasonable effort,

as discussed in our Non-GAAP Financial Measures and Other Operating

Metrics section below.

Wag!’s Second Quarter Results Conference Call

Wag! will host a conference call and live webcast today, August

07, 2024, at 4:30pm ET to discuss financial results. Investors and

analysts interested in participating in the call are invited to

dial 1-800-717-1738 (international callers please dial

1-646-307-1865) approximately 10 minutes prior to the start of the

call. A live audio webcast of the conference call will be available

online at https://investors.wag.co.

A recorded replay of the conference call will be available

approximately three hours after the conclusion of the call and can

be accessed online at https://investors.wag.co for 90 days.

Wag! also provides announcements regarding financial performance

and other matters, including SEC filings, investor events, press

and earnings releases, on our investor relations website

(https://investors.wag.co), and/or

social media outlets, as a means of disclosing material information

and complying with disclosure obligations under Regulation FD. The

list of social media channels that Wag! uses may be updated on the

investor relations website from time to time. In addition, you may

automatically receive email alerts and other information about Wag!

when you enroll your email address by visiting the “Email Alerts”

section at (https://investors.wag.co/ir-resources/email-alerts).

About Wag! Group Co.

Wag! Group Co. strives to be the number one platform to solve

the service, product, and wellness needs of the modern U.S. pet

household. Wag! pioneered on-demand dog walking in 2015 with the

Wag! app, which offers access to 5-star dog walking, sitting, and

one-on-one training from a community of over 500,000 Pet Caregivers

nationwide. In addition, Wag! Group Co. operates Petted, one of the

nation’s largest pet insurance comparison marketplaces; Dog Food

Advisor, one of the most visited and trusted pet food review

platforms; WoofWoofTV, a multi-media company bringing delightful

pet content to over 18 million followers across social media;

maxbone, a digital platform for modern pet essentials; and Furmacy,

software to simplify pet prescriptions. For more information, visit

Wag.co.

Non-GAAP Financial Measures and Other Operating

Metrics

Adjusted EBITDA is a non-GAAP financial measure defined as net

income (loss) adjusted for interest expense, net; income taxes;

depreciation and amortization; and stock-based compensation, as

well as other items to be consistent with definitions typically

used by lenders, including transaction costs. Additionally, we

exclude the impact of certain non-recurring items which are not

indicative of our operating performance as well as other

transaction-specific costs that do not represent an ongoing

operating expense of the business, including but not limited to,

integration and transaction costs associated with acquired

businesses, severance costs, loss on extinguishment of debt, and

legal settlements. Adjusted EBITDA margin is calculated by dividing

Adjusted EBITDA by revenues. Adjusted EBITDA and Adjusted EBITDA

margin provide a basis for comparison of our business operations

between current, past, and future periods by excluding items from

net income (loss) that we do not believe are indicative of our core

operating performance.

Platform Participant is defined as a Pet Parent or Pet Caregiver

who transacted on the Wag! platform for a service in the quarter.

Services include dog walking, sitting, boarding, drop-ins,

training, premium telehealth services, wellness plans, and pet

insurance plan comparison.

Information reconciling forward-looking Adjusted EBITDA to the

most directly comparable GAAP financial measure is unavailable to

the Company without unreasonable effort. The Company is not able to

provide a reconciliation of Adjusted EBITDA to the most directly

comparable GAAP financial measure because certain items required

for such reconciliation are outside of the Company’s control and/or

cannot be reasonably predicted, such as the provision for income

taxes. Preparation of such a reconciliation would require a

forward-looking statement of income, prepared in accordance with

GAAP, and such forward-looking financial statements are unavailable

to the company without unreasonable effort. The Company provides a

range for its Adjusted EBITDA forecast that it believes will be

achieved; however, it cannot accurately predict all the components

of the Adjusted EBITDA calculation. The Company provides an

Adjusted EBITDA forecast because it believes that Adjusted EBITDA,

when viewed with the Company’s results under GAAP, provides useful

information for the reasons noted above. However, Adjusted EBITDA

is not a measure of financial performance or liquidity under GAAP

and, accordingly, should not be considered as an alternative to net

income (loss) or cash flow from operating activities as an

indicator of operating performance.

Forward-Looking Statements

This press release contains certain forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995. Some of the forward-looking statements can be identified

by the use of forward-looking words. Statements that are not

historical in nature, including the words “anticipate,” “expect,”

“suggests,” “plan,” “believe,” “intend,” “estimates,” “targets,”

“projects,” “should,” “could,” “would,” “may,” “will,” “forecast”

and other similar expressions are intended to identify

forward-looking statements. These statements include those related

to the Company’s ability to further develop and advance its pet

service, product and wellness offerings and achieve scale; ability

to attract and retain personnel; market opportunity, anticipated

growth, ability to achieve and maintain profitability; intended use

of proceeds from the Company’s underwritten public offering, and

future financial performance, including management’s financial

outlook for the future. Forward-looking statements are predictions,

projections and other statements about future events that are based

on current expectations and assumptions and, as a result, are

subject to risks and uncertainties. Many factors could cause actual

future events to differ materially from the forward-looking

statements in this press release, including but not limited to:

management’s financial outlook for the future; market adoption of

the Company’s pet service, product and wellness offerings and

solutions; failure to realize the financial benefits of

acquisitions; the ability of the Company to protect its

intellectual property; changes in the competitive industries in

which the Company operates; changes in laws and regulations

affecting the Company’s business; the Company’s ability to

implement its business plans, forecasts and other expectations, and

identify and realize additional partnerships and opportunities; and

the risk of downturns in the market and the technology industry.

The foregoing list of factors is not exhaustive. You should

carefully consider the foregoing factors and the other risks and

uncertainties described in the “Risk Factors” section of the

Company’s filings with the Securities and Exchange Commission,

including the most recent Annual Report on Form 10-K and Quarterly

Reports on Form 10-Q. These filings identify and address other

important risks and uncertainties that could cause actual events

and results to differ materially from those contained in the

forward-looking statements. Forward-looking statements speak only

as of the date they are made. Readers are cautioned not to put

undue reliance on forward-looking statements, and the Company

assumes no obligation and does not intend to update or revise these

forward-looking statements, whether as a result of new information,

future events, or otherwise. The Company does not give any

assurance that it will achieve its expectations.

Wag! Group Co.

Condensed Consolidated Balance

Sheets

(unaudited)

June 30, 2024

December 31,

2023

(in thousands)

ASSETS

Current assets:

Cash and cash equivalents

$

9,234

$

18,323

Accounts receivable, net

7,512

10,023

Prepaid expenses and other current

assets

2,256

3,428

Total current assets

19,002

31,774

Property and equipment, net

1,144

347

Operating lease right-of-use assets

894

1,045

Intangible assets, net

7,860

8,828

Goodwill

4,646

4,646

Other assets

52

57

Total assets

$

33,598

$

46,697

LIABILITIES AND STOCKHOLDERS’

EQUITY (DEFICIT)

Current liabilities:

Accounts payable

$

6,850

$

9,919

Accrued expenses and other current

liabilities

2,044

4,015

Deferred revenue

1,642

1,781

Deferred purchase consideration – current

portion

185

547

Operating lease liabilities – current

portion

396

386

Notes payable – current portion

2,075

1,751

Total current liabilities

13,192

18,399

Operating lease liabilities – non-current

portion

645

816

Notes payable – non-current portion, net

of debt discount and warrant allocation of $2,721 and $4,563 as of

June 30, 2024 and December 31, 2023, respectively

21,468

25,664

Other non-current liabilities

78

172

Total liabilities

35,383

45,051

Commitments and contingencies

Stockholders’ equity (deficit):

Common stock

4

4

Additional paid-in capital

166,437

163,376

Accumulated deficit

(168,226

)

(161,734

)

Total stockholders’ equity (deficit)

(1,785

)

1,646

Total liabilities and stockholders’ equity

(deficit)

$

33,598

$

46,697

Wag! Group Co.

Condensed Consolidated

Statements of Operations

(unaudited)

Three Months Ended

Six Months Ended

June 30, 2024

June 30, 2023

June 30, 2024

June 30, 2023

(in thousands, except per share

amounts)

Revenues

$

18,651

$

19,820

$

41,870

$

40,443

Costs and expenses:

Cost of revenues (exclusive of

depreciation and amortization shown separately below)

1,158

1,243

2,728

2,269

Platform operations and support

2,714

3,492

5,674

6,662

Sales and marketing

11,037

10,758

26,692

24,033

Royalty

—

1,791

—

1,791

General and administrative

3,809

4,821

8,048

9,805

Depreciation and amortization

580

375

1,158

756

Total costs and expenses

19,298

22,480

44,300

45,316

Interest expense

1,597

1,897

3,482

3,771

Interest income

(75

)

(238

)

(227

)

(482

)

Loss on extinguishment of debt

—

—

726

—

Other expense, net

—

65

—

9

Loss before income taxes

(2,169

)

(4,384

)

(6,411

)

(8,171

)

Income taxes

82

38

81

38

Equity in net earnings of equity method

investments

—

553

—

553

Net loss

$

(2,251

)

$

(3,869

)

$

(6,492

)

$

(7,656

)

Loss per share, basic and diluted

$

(0.06

)

$

(0.10

)

$

(0.16

)

$

(0.20

)

Weighted-average common shares outstanding

used in computing loss per share, basic and diluted

40,914

38,109

40,496

37,590

Wag! Group Co.

Condensed Consolidated

Statements of Cash Flows

(unaudited)

Six Months Ended

June 30, 2024

June 30, 2023

(in thousands)

Cash flow from operating activities:

Net loss

$

(6,492

)

$

(7,656

)

Adjustments to reconcile net loss to net

cash used in operating activities:

Stock-based compensation

2,952

2,463

Non-cash interest expense

1,229

1,350

Depreciation and amortization

1,158

756

Reduction in carrying amount of operating

lease right-of-use assets

151

168

Equity in net earnings of equity method

investments

—

(553

)

Loss on extinguishment of debt

726

—

Changes in operating assets and

liabilities, net of effect of acquired business:

Accounts receivable

2,511

(1,850

)

Prepaid expenses and other current

assets

1,007

1,049

Other assets

5

(5

)

Accounts payable

(3,069

)

2,241

Accrued expenses and other current

liabilities

(1,806

)

(700

)

Deferred revenue

(139

)

368

Operating lease liabilities

(160

)

(176

)

Other non-current liabilities

(94

)

218

Net cash used in operating activities

(2,021

)

(2,327

)

Cash flows from investing activities:

Cash paid for acquisitions, net of cash

acquired

(128

)

(9,503

)

Cash paid for equity method investment

—

(1,470

)

Purchase of property and equipment

(860

)

(31

)

Net cash used in investing activities

(988

)

(11,004

)

Cash flows from financing activities:

Repayment of debt

(5,714

)

(551

)

Debt prepayment penalty

(100

)

—

Proceeds from exercises of stock

options

109

90

Other

(375

)

(382

)

Net cash used in financing activities

(6,080

)

(843

)

Net change in cash and cash

equivalents

(9,089

)

(14,174

)

Cash and cash equivalents, beginning of

period

18,323

38,966

Cash and cash equivalents, end of

period

$

9,234

$

24,792

Wag! Group Co.

Adjusted EBITDA (Loss)

Reconciliation

(unaudited)

Three Months Ended

Six Months Ended

June 30, 2024

June 30, 2023

June 30, 2024

June 30, 2023

(in thousands, except

percentages)

Net loss

$

(2,251

)

$

(3,869

)

$

(6,492

)

$

(7,656

)

Interest expense, net

1,522

1,659

3,255

3,289

Income taxes

82

38

81

38

Depreciation and amortization

580

375

1,158

756

Stock-based compensation

1,656

1,121

2,952

2,463

Integration and transaction costs

associated with acquired business

—

152

—

189

Severance costs

50

131

127

131

Loss on extinguishment of debt

—

—

726

—

Legal settlement

—

500

—

500

Adjusted EBITDA (loss)

$

1,639

$

107

$

1,807

$

(290

)

Revenues

$

18,651

$

19,820

$

41,870

$

40,443

Adjusted EBITDA (loss) margin

8.8

%

0.5

%

4.3

%

(0.7

)%

Wag! Group Co.

Key Operating and Financial

Metrics

(unaudited)

Three Months Ended

Six Months Ended

June 30, 2024

June 30, 2023

June 30, 2024

June 30, 2023

(in thousands, except

percentages)

Platform Participants (as of period

end)

467

549

467

549

Revenues

$

18,651

$

19,820

$

41,870

$

40,443

Net loss

$

(2,251

)

$

(3,869

)

$

(6,492

)

$

(7,656

)

Net loss margin

(12.1

)%

(19.5

)%

(15.5

)%

(18.9

)%

Net cash provided by (used in) operating

activities

$

(2,189

)

$

1,253

$

(2,021

)

$

(2,327

)

Adjusted EBITDA (loss)

$

1,639

$

107

$

1,807

$

(290

)

Adjusted EBITDA (loss) margin

8.8

%

0.5

%

4.3

%

(0.7

)%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240807728499/en/

Media: Media@wagwalking.com

Investor Relations Wag!: IR@wagwalking.com Gateway for

Wag!: PET@gateway-grp.com

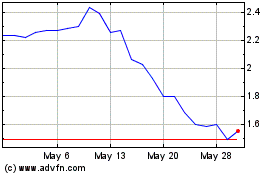

Wag (NASDAQ:PET)

Historical Stock Chart

From Jan 2025 to Feb 2025

Wag (NASDAQ:PET)

Historical Stock Chart

From Feb 2024 to Feb 2025