Brightwood and PhenixFIN Provide Senior Secured Credit Facility and Preferred Equity Facility to Support the Refinancing of MB Precision Investment Holdings LLC

07 November 2024 - 1:00AM

Business Wire

Brightwood Capital Advisors, LLC (“Brightwood”), a private

credit firm, and PhenixFIN Corporation (“PhenixFIN”), a publicly

traded business development company (NASDAQ: PFX), today announced

that they have partnered with Insight Equity (“Insight”) to provide

a senior secured credit facility and preferred equity facility to

support the refinancing of MB Precision Investment Holdings LLC

(“Precision” or the “Company”) d/b/a Midstate Machine. Jim Ashton,

former Chairman of the Board and CEO of Precision Partners, will be

joining the Company’s Board of Directors as part of this

transaction. The financial terms of the transaction were not

disclosed.

Precision is a provider of high-precision components and

assemblies for the aerospace, defense, and industrial sectors, with

manufacturing facilities located in Winslow, ME, Cincinnati, OH,

and Phoenix, AZ. The company offers a comprehensive range of

engineering services and collaborates closely with clients to

deliver tailored, turnkey solutions. With decades of machining

expertise and a commitment to superior craftsmanship, Precision is

dedicated to producing reliable, mission-critical products that

enhance operational efficiency and address the dynamic needs of the

industry.

“We are excited to collaborate again with our valued partners at

PhenixFIN to support this transaction,” said Scott Porter, Managing

Director and Co-Head of Originations at Brightwood. “This

refinancing marks an important strategic milestone for Precision,

empowering the Company to build on its core platforms and scale its

offerings to better serve its clients. This partnership will

position Precision to effectively pursue its next phase of growth

and long-term success.”

“The combined expertise of Brightwood and PhenixFIN was critical

in the success of this transaction, and we are excited about this

new partnership,” said Mike Heinold, Chief Financial Officer of the

Precision management team. "Their strategic insights and support

will be invaluable as we move forward in pursuing our growth

objectives."

“Brightwood and PhenixFIN have been exceptionally supportive

throughout this process, fully understanding our financial goals

and providing valuable counsel and expertise to help us realize our

vision for Precision,” said Paul Pesek, Senior Vice President at

Insight. “Their combined knowledge of the aerospace, defense, and

industrial sectors has been instrumental, and the support from this

refinancing will enable the Company to pursue key growth

initiatives. We look forward to their continued partnership as we

embark on our next chapter.”

“We value our longstanding partnership with Brightwood and are

excited to engage with them on another transaction,” said David

Lorber, Chairman & Chief Executive Officer at PhenixFIN. “As a

flexible capital provider, we are committed to supporting Precision

during this pivotal growth inflection point, leveraging our

industry experience to contribute to their continued success.”

About Brightwood Capital Advisors

Brightwood Capital Advisors, LLC is a private credit firm with a

long-standing track record of investing in middle-market

businesses. Brightwood specializes in providing senior debt capital

primarily to U.S. businesses with $5-$75 million of EBITDA within

five core industries: technology & telecommunications,

healthcare, business services, transportation & logistics and

franchising. Brightwood partners with non-sponsored businesses as

well as private equity sponsors to provide customized financing

solutions for directly originated investments.

Founded in 2010, Brightwood is a minority-owned firm with a team

of over 50 employees who manage approximately $6 billion of assets

on behalf of its primarily institutional investor base (as of June

30, 2024). Brightwood is headquartered in New York City. For more

information, please visit: https://brightwoodlp.com/.

About PhenixFIN

PhenixFIN Corporation (NASDAQ: PFX) is an internally managed,

closed-end, business development company (“BDC”). PhenixFIN’s

management has a broad network of relationships and deep expertise

in originating, structuring, executing and managing credit and

equity investments. Our portfolio generally consists of senior

secured first lien loans, senior secured second lien loans, and

equity. PhenixFIN is headquartered in New York City.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106649800/en/

Media Brightwood Capital Advisors Ben Howard

bhoward@prosek.com (914) 552-4281

Investors Brightwood Capital Advisors

info@brightwoodlp.com

PhenixFIN Corporation Ryan Phalen rphalen@phenixfc.com

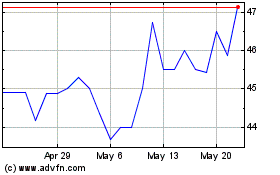

PhenixFIN (NASDAQ:PFX)

Historical Stock Chart

From Feb 2025 to Mar 2025

PhenixFIN (NASDAQ:PFX)

Historical Stock Chart

From Mar 2024 to Mar 2025