false000178453500017845352024-11-072024-11-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 7, 2024

PORCH GROUP, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-39142 | | 83-2587663 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | |

411 1st Avenue S., Suite 501 | |

Seattle, Washington | 98104 |

| (Address of principal executive offices) | (Zip Code) |

(855) 767-2400

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, par value $0.0001 | | PRCH | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02. Results of Operations and Financial Condition.

On November 7, 2024, Porch Group, Inc. (the “Company” or "Porch") issued an earnings release announcing financial results for its third quarter ended September 30, 2024. The full text of the press release issued in connection with the announcement is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 7.01. Regulation FD Disclosure.

On November 7, 2024, the Company will host an earnings call at 5:00 p.m. Eastern time to discuss its financial results for the quarter ended September 30, 2024. Live and archived webcasts of the presentation will also be available on the Company’s investor relations website at https://ir.porchgroup.com.

On November 7, 2024, the Company posted supplemental investor materials on its investor relations website. The Company uses its investor relations website as a means of disclosing material non-public information, announcing upcoming investor conferences and for complying with its disclosure obligations under Regulation FD. Accordingly, investors should monitor the Company’s investor relations website in addition to following the Company’s press releases, SEC filings and public conference calls and webcasts.

The information in Items 2.02 and 7.01 of this Current Report on Form 8-K and Exhibit 99.1 attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d)Exhibits.

| | | | | | | | |

Exhibit No. | | Description |

| | |

| 99.1 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| PORCH GROUP, INC. |

| | |

| By: | /s/ Shawn Tabak |

| | Name: | Shawn Tabak |

| | Title: | Chief Financial Officer |

Date: November 7, 2024

Porch Group Reports Third Quarter 2024 Results

Application for Reciprocal Exchange Approved

Strong Operational Performance Delivers Record Profitability

SEATTLE, November 7, 2024 (BUSINESS WIRE) – Porch Group, Inc. (“Porch Group” or “the Company”) (NASDAQ: PRCH), a homeowners insurance and vertical software platform, today reported third quarter results through September 30, 2024, with total revenue of $111.2 million. GAAP net income was $14.4 million, an improvement of $20.1 million compared to the prior year, and Adjusted EBITDA was $16.9 million, an improvement of $8.1 million compared to the prior year.

CEO Summary

“We are excited by today's update: the important approval of the Reciprocal Exchange formation, record profitability, and de-leveraging. The Reciprocal approval has been a long time coming, is a key milestone for Porch, and the culmination of tremendous work by the Porch team in partnership with the Texas Department of Insurance. We believe this will be the optimal structure for our insurance business, which we expect will result in a higher margin and a more predictable financial profile and equip our insurance operations to scale profitably in the future. Operational execution was strong and delivered profitability outperformance in the third-quarter. Our insurance business led the way, aided by strong underwriting improvements including the use of our unique property data to assess and price risk of homeowners insurance policies more accurately,” said Matt Ehrlichman, Chief Executive Officer, Chairman and Founder. “In addition, we have repurchased $43 million of our unsecured notes in the third quarter, reducing the outstanding balance due in September 2026.”

Third Quarter 2024 Financial Results

•Total revenue of $111.2 million, a decrease of (14)% or $18.4 million compared to prior year (third quarter 2023: $129.6 million), due to the prior year non-recurring benefit from the cancellation of the Vesttoo related reinsurance coverage1. This offset organic growth in the Insurance segment, including a 25% increase in premium per policy.

•Revenue less cost of revenue of $64.1 million, 58% of total revenue (third quarter 2023: $76.6 million, 59% of total revenue). Vertical Software Segment margin improved ~800bps, driven by price increases and strong cost control. In the Insurance Segment attritional losses were better than anticipated, offsetting the two Hurricane events.

•GAAP net income of $14.4 million, compared to a GAAP net loss of $5.7 million for the third quarter of 2023.

•Adjusted EBITDA of $16.9 million, a $8.1 million improvement from the prior year (third quarter 2023: $8.8 million), driven by the Insurance segment, SaaS price increases and strong cost control.

•Gross written premium for the quarter in our Insurance segment was $139 million with approximately 219 thousand policies in force.

•$404.5 million cash, cash equivalents, and investments at September 30, 2024.

Third Quarter 2024 Operational Highlights

•21% attritional loss ratio, an improvement from 32% in the prior year, driven by the insurance profitability actions.

•Repurchased $43 million aggregate principal amount of our 2026 unsecured notes for $20 million cash.

•Launched three new Home Factors as we continue to test which property characteristics correlate to predicting losses and risk.

•Continue to roll out further product enhancements in Vertical Software, as we increase pricing while maintaining high customer retention.

____________________________________________

(1)In Q3 2023 Porch discovered that one of the legacy reinsurance partners, Vesttoo, had committed a global fraud and therefore Porch terminated that reinsurance contract and looked for replacement reinsurance. During that time Porch had a period of lower reinsurance ceding that resulted in approximately an additional ~$30 million Revenue, ~$10 million Revenue less Cost of Revenue and ~$2 million Adjusted EBITDA.

The following tables present financial highlights of the Company’s third quarter 2024 results compared to the third quarter results of 2023 (dollars are in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Third Quarter 2024 (unaudited) | | Insurance | | Vertical Software | | Corporate | | Consolidated |

| Revenue | | $ | 79.9 | | | $ | 31.3 | | | $ | — | | | $ | 111.2 | |

| Year-over-year growth | | (16) | % | | (9) | % | | — | % | | (14) | % |

| Revenue less cost of revenue | | $ | 38.1 | | | $ | 26.0 | | | $ | — | | | $ | 64.1 | |

| Year-over-year growth | | (25) | % | | 1 | % | | — % | | (16) | % |

| As % of revenue | | 48 | % | | 83 % | | — % | | 58 % |

| GAAP net income | | | | | | | | $ | 14.4 | |

| Adjusted EBITDA (loss) | (1) | $ | 24.8 | | | $ | 5.1 | | | $ | (13.0) | | | $ | 16.9 | |

| Adjusted EBITDA (loss) as a percent of revenue | (2) | 31 | % | | 16 | % | | — % | | 15 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Third Quarter 2023 (unaudited) | | Insurance | | Vertical Software | | Corporate | | Consolidated |

| Revenue | | $ | 95.2 | | | $ | 34.3 | | | $ | — | | | $ | 129.6 | |

| Revenue less cost of revenue | | $ | 50.7 | | | $ | 25.9 | | | $ | — | | | $ | 76.6 | |

| As % of revenue | | 53 | % | | 75 | % | | — % | | 59 | % |

| GAAP net loss | | | | | | | | $ | (5.7) | |

| Adjusted EBITDA (loss) | (1) | $ | 19.0 | | | $ | 3.2 | | | $ | (13.4) | | | $ | 8.8 | |

| Adjusted EBITDA (loss) as a percent of revenue | (2) | 20 | % | | 9 | % | | — % | | 7 | % |

____________________________________________(1)See Non-GAAP Financial Measures section for the definition and Adjusted EBITDA (loss) table for the reconciliation to GAAP net income (loss)

(2)Adjusted EBITDA (loss) as a percent of revenue is calculated as Adjusted EBITDA (loss) divided by Revenue

The following table presents the Company’s key performance indicators(1).

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, |

| (unaudited) | | 2024 | | 2023 | | % Change |

| Gross Written Premium (in millions) | | $ | 139 | | | $ | 154 | | | (10) | % |

| Policies in Force (in thousands) | | 219 | | 334 | | (34) | % |

| Annualized Revenue per Policy (unrounded) | | $ | 1,460 | | | $ | 1,139 | | | 28 % |

| Annualized Premium per Policy (unrounded) | | $ | 2,208 | | | $ | 1,762 | | | 25 % |

| Premium Retention Rate | | 100% | | 100% | | |

| Gross Loss Ratio | | 57% | | 39% | | |

| Average Companies in Quarter (unrounded) | | 28,125 | | 30,675 | | (8) % |

| Average Monthly Revenue per Account in Quarter (unrounded) | | $ | 1,318 | | | $ | 1,436 | | | (8) % |

| Monetized Services (unrounded) | | 245,226 | | 225,096 | | 9 | % |

| Average Quarterly Revenue per Monetized Service (unrounded) | | $ | 377 | | | $ | 510 | | | (26) % |

_____________________________________

(1)Definitions of the key performance indicators presented in this table are included on page 10 of this release.

Balance Sheet Information (unaudited)

| | | | | | | | | | | | | | | | | | | | |

| (dollars are in millions) | | September 30,

2024 | | December 31, 2023 | | Change |

| Cash and cash equivalents | | $ | 206.7 | | | $ | 258.4 | | | (20%) |

| Investments | | 197.8 | | | 139.2 | | | 42% |

| Cash, cash equivalents, and investments | | $ | 404.5 | | | $ | 397.6 | | | 2% |

The Company ended the third quarter of 2024 with cash, cash equivalents, and investments of $404.5 million. Of this amount, Homeowner's of America (“HOA”), Porch's insurance carrier, held cash and cash equivalents of $150.5 million and investments of $166.0 million. Excluding HOA, Porch held $88.0 million of cash, cash equivalents, and investments. In addition, the Company ended the third quarter of 2024 with $10.0 million of restricted cash and cash equivalents, primarily for the captive and warranty businesses. Porch Group also holds a $49 million surplus note from HOA.

As of September 30, 2024, outstanding principal for convertible debt was $507.1 million. This includes $333.3 million of the 6.75% Senior Secured Convertible Notes due October 2028 (the “2028 Notes”) and $173.8 million of 0.75% Convertible Senior Notes due September 2026 (the “2026 Notes”).

In the quarter, the Company completed the repurchase of $43.2 million aggregate principal amount of 2026 Notes at an average 47% of par value for $20.2 million of cash.

Post Balance Sheet Events

On October 28, 2024, Porch announced that the Texas Department of Insurance (“TDI”) approved the Company’s application to form and license a reciprocal exchange, subject to customary administrative procedures. The Company believes this will be an optimal structure for the insurance business, which is expected to result in a more predictable, higher margin and less volatile financial profile for Porch.

The Company will form and fund a new reciprocal exchange called Porch Insurance Reciprocal Exchange (“PIRE”). Porch will provide an initial $10 million of funding in exchange for a surplus note. On or around January 1, 2025, Porch expects to sell HOA to this entity, and will receive an additional 9.75% plus SOFR (secured overnight financing rate) surplus note in exchange. The size of the note will be determined at the time of the HOA acquisition and will be equal to HOA’s surplus, which Porch expects to be approximately $100 million at year end, less Porch’s existing $49 million surplus note. The expectation is that in total Porch will hold approximately $110 million of surplus notes. HOA will be a subsidiary of PIRE and will hold all policies, premiums, and pay claims, commissions, and reinsurance-related expenses.

As with all reciprocal exchanges, the entity will in the future be owned by its policyholders. The policyholders provide surplus contributions in addition to the premiums which will grow the reciprocal exchange’s surplus position to fund operations and build surplus capital.

At Porch, we will have a new Insurance Services Segment which will include Porch Risk Management Services (“PRMS”) and Porch Insurance Capital Services (“PICS”). Through PRMS, Porch will operate PIRE, issuing policies and processing claims on its behalf. In return, PRMS will receive commissions and fees. PICS will provide financial solutions for PIRE, such as holding the surplus note investments.

Full Year 2024 Financial Outlook

Porch Group provides full year 2024 guidance based on current market conditions and expectations as of the date of this release. The Company is revising its full-year 2024 guidance:

•Revenue in 2024 is expected to grow low single digits. Noting the prior year Revenue included the impact of the Vesttoo matter in Q3 2023 and the divestiture of EIG in January of this year.

•Revenue less Cost of Revenue and Adjusted EBITDA guidance have increased, following the profitability improvements in the business.

•Guidance assumes a 2024 full year loss ratio of 68%. Catastrophic weather further in excess of historical experiences, would create downside to the lower end of the range.

Full year 2024 guidance is as follows:

| | |

Full Year 2024 Guidance |

|

Revenue $440m to $455m Growth of 2% to 6% (Previously: $450m to $470m) |

|

Revenue Less Cost of Revenue $200m to $210m (Previously: $190m to $200m) |

|

Adjusted EBITDA1 $(7.5)m to $2.5m (Previously: $(20)m to $(10)m) |

|

Gross Written Premium2 $460m to $470m (Previously: $460m to $480m) |

1Adjusted EBITDA is a non-GAAP measure.

22024 gross written premium (“GWP”) guidance is stated as the expected full-year GWP for 2024 and is the total premium written by our licensed insurance carrier(s) (before deductions for reinsurance) and premiums from our home warranty offerings (for the face value of one year’s premium). Note, full-year 2023 GWP included approximately $45 million from EIG placed with third party carriers. Post divestiture of EIG, any sales to third-party carriers is no longer included in GWP reporting.

Porch Group is not providing reconciliations of expected Adjusted EBITDA for future periods to the most directly comparable measures prepared in accordance with GAAP because the Company is unable to provide these reconciliations without unreasonable effort because certain information necessary to calculate such measures on a GAAP basis is unavailable or dependent on the timing of future events outside of the Company’s control.

Conference Call

Porch Group management will host a conference call today November 7, 2024, at 5:00 p.m. Eastern time (2:00 p.m. Pacific time). The call will be accompanied by a slide presentation available on the Investor Relations section of the Company’s website at ir.porchgroup.com. A question-and-answer session will follow management’s prepared remarks.

All are invited to listen to the event by registering for the webinar, a replay of the webinar will also be available. See the Investor Relations section of the Porch Group’s corporate website at ir.porchgroup.com.

About Porch Group

Porch Group, Inc. (“Porch”) is a homeowners insurance and vertical software platform. Porch's strategy to win in homeowners insurance is to leverage unique data for advantaged underwriting, provide the best services for homebuyers, and protect the whole home. The long-term competitive moats that create this differentiation come from Porch's leadership in home services software-as-a-service and its deep relationships with approximately 30 thousand companies that are key to the home-buying transaction, such as home inspectors, mortgage, and title companies.

To learn more about Porch, visit ir.porchgroup.com.

Investor Relations Contact

Lois Perkins, Head of Investor Relations

Porch Group, Inc.

Loisperkins@porch.com

Forward-Looking Statements

Certain statements in this release are considered forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995. These statements are based on the beliefs and assumptions of management. Although we believe that our plans, intentions, and expectations reflected in or suggested by these forward-looking statements are reasonable, we cannot assure you that we will achieve or realize these plans, intentions, or expectations. Forward-looking statements are inherently subject to risks, uncertainties, and assumptions. Generally, statements that are not historical facts, including statements concerning our financial outlook and guidance, possible or assumed future actions, business strategies, events, or results of operations, are forward-looking statements. Forward-looking statements in this release also include expectations regarding whether the reciprocal is the optimal structure for our insurance business and the benefits financial and otherwise thereof, including any expectations that the reciprocal will result in higher margins and a more predictable financial profile and equip our insurance operations to scale profitably in the future These statements may be preceded by, followed by, or include the words “believe,” “estimate,” “expect,” “project,” “forecast,” “may,” “will,” “should,” “seek,” “plan,” “scheduled,” “anticipate,” “intend,” or similar expressions.

Forward-looking statements are not guarantees of performance. You should not put undue reliance on these statements which speak only as of the date herein. Unless specifically indicated otherwise, the forward-looking statements in this Quarterly Report do not reflect the potential impact of any future transactions that have not been completed as of the date of this filing, including the licensure and formation of the reciprocal, the sale of our insurance carrier subsidiary, Homeowners of America Insurance Company (“HOA”), to the reciprocal, and the commencement of the reciprocal’s operations. You should understand that the following important factors, among others, could affect our future results and could cause those results or other outcomes to differ materially from those expressed or implied in our forward-looking statements:

•expansion plans and opportunities, and managing growth, to build a consumer brand;

•the incidence, frequency, and severity of weather events, extensive wildfires, and other catastrophes;

•economic conditions, especially those affecting the housing, insurance, and financial markets;

•expectations regarding revenue, cost of revenue, operating expenses, and the ability to achieve and maintain future profitability;

•existing and developing federal and state laws and regulations, including with respect to insurance, warranty, privacy, information security, data protection, and taxation, and management’s interpretation of and compliance with such laws and regulations;

•our reinsurance program, which includes the use of a captive reinsurer, the success of which is dependent on a number of factors outside management’s control, along with reliance on reinsurance to protect against loss;

•the possibility that a decline in our share price would result in a negative impact to HOA’s surplus position and may require further financial support to enable HOA to meet applicable regulatory requirements and maintain financial stability rating;

•the uncertainty and significance of the known and unknown effects on HOA and us due to the termination of a reinsurance contract following of fraud committed by Vesttoo Ltd. (“Vesttoo”), including, but not limited to, the outcome of Vesttoo’s Chapter 11 bankruptcy proceedings; our ability to successfully pursue claims arising out of the fraud, the costs associated with pursuing the claims, and the timeframe associated with any recoveries; HOA's ability to obtain and maintain adequate reinsurance coverage against excess losses; HOA’s ability to stay out of regulatory supervision and maintain its financial stability rating; and HOA’s ability to maintain a healthy surplus;

•uncertainties related to regulatory approval of insurance rates, policy forms, insurance products, license applications, acquisitions of businesses, or strategic initiatives, including the reciprocal restructuring, and other matters within the purview of insurance regulators (including the discount associated with the shares contributed to HOA);

•the ability of the Company and its affiliates to consummate the sale of HOA to the reciprocal exchange and to commence operations of the reciprocal exchange;

•our ability to successfully operate our businesses alongside a reciprocal exchange;

•our ability to implement our plans, forecasts and other expectations with respect to the reciprocal exchange business after the completion of the formation and to realize expected synergies and/or convert policyholders from our existing insurance carrier business into policyholders of the reciprocal exchange;

•potential business disruption following the formation of the reciprocal exchange;

•reliance on strategic, proprietary relationships to provide us with access to personal data and product information, and the ability to use such data and information to increase transaction volume and attract and retain customers;

•the ability to develop new, or enhance existing, products, services, and features and bring them to market in a timely manner;

•changes in capital requirements, and the ability to access capital when needed to provide statutory surplus;

•our ability to timely repay our outstanding indebtedness;

•the increased costs and initiatives required to address new legal and regulatory requirements arising from developments related to cybersecurity, privacy, and data governance and the increased costs and initiatives to protect against data breaches, cyber-attacks, virus or malware attacks, or other infiltrations or incidents affecting system integrity, availability, and performance;

•retaining and attracting skilled and experienced employees;

•costs related to being a public company; and

•other risks and uncertainties discussed in Part II, Item 1A, “Risk Factors,” in our Annual Report on Form 10-K (“Annual Report”) for the year ended December 31, 2023, and in Part II, Item 1A, “Risk Factors,” in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2024, as well as those discussed elsewhere in this report and in subsequent reports filed with the Securities and Exchange Commission (“SEC”), all of which are available on the SEC’s website at www.sec.gov.

We caution you that the foregoing list may not contain all the risks to forward-looking statements made in this release.

You should not rely upon forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this release primarily on our current expectations and projections about future events and trends we believe may affect our business, financial condition, results of operations and prospects. The outcome of the events described in these forward-looking statements is subject to risks, uncertainties, and other factors, including those described above and elsewhere in this release. We disclaim any obligation to update publicly any forward-looking statements, whether in response to new information, future events, or otherwise, except as required by applicable law.

Non-GAAP Financial Measures

This release includes non-GAAP financial measures, such as Adjusted EBITDA (Loss) and Adjusted EBITDA (Loss) as a percent of revenue.

We define Adjusted EBITDA (Loss) as net income (loss) adjusted for interest expense; income taxes; depreciation and amortization; gain or loss on extinguishment of debt; other expense (income), net; impairments of intangible assets and goodwill; impairments of property, equipment, and software; stock-based compensation expense; mark-to-market gains or losses recognized on changes in the value of contingent consideration arrangements, earnouts, warrants, and derivatives; restructuring costs; acquisition and other transaction costs; and non-cash bonus expense. Adjusted EBITDA (Loss) as a percent of revenue is defined as Adjusted EBITDA (Loss) divided by total revenue.

Our management uses these non-GAAP financial measures as supplemental measures of our operating and financial performance, for internal budgeting and forecasting purposes, to evaluate financial and strategic planning matters, and to establish certain performance goals for incentive programs. We believe that the use of these non-GAAP financial measures provides investors with useful information to evaluate our operating and financial performance and trends and in comparing our financial results with competitors, other similar companies and companies across different industries, many of which present similar non-GAAP financial measures to investors. However, our definitions and methodology in calculating these non-GAAP measures may not be comparable to those used by other companies. In addition, we may modify the presentation of these non-GAAP financial measures in the future, and any such modification may be material.

You should not consider these non-GAAP financial measures in isolation, as a substitute to or superior to financial performance measures determined in accordance with GAAP. The principal limitation of these non-GAAP financial measures is that they exclude specified income and expenses, some of which may be significant or material, that are required by GAAP to be recorded in our consolidated financial statements. We may also incur future income or expenses similar to those excluded from these non-GAAP financial measures, and the presentation of these measures should not be construed as an inference that future results will be unaffected by unusual or non-recurring items. In addition, these non-GAAP financial measures reflect the exercise of management judgment about which income and expense are included or excluded in determining these non-GAAP financial measures.

You should review the tables accompanying this release for reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measure. We are not providing reconciliations of non-GAAP financial measures for future periods to the most directly comparable measures prepared in accordance with GAAP. We are unable to provide these reconciliations without unreasonable effort because certain information necessary to calculate such measures on a GAAP basis is unavailable or dependent on the timing of future events outside of our control.

The following tables reconcile Net income (loss) to Adjusted EBITDA (Loss) for the periods presented (dollar amounts in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| (Unaudited) | 2024 | | 2023 | | 2024 | | 2023 |

| Net income (loss) | $ | 14,382 | | | $ | (5,744) | | | $ | (63,303) | | | $ | (131,447) | |

| Interest expense | 10,645 | | | 10,267 | | | 31,758 | | | 21,230 | |

| Income tax provision (benefit) | (183) | | | 116 | | | 683 | | | 34 | |

| Depreciation and amortization | 6,049 | | | 6,272 | | | 18,568 | | | 18,501 | |

| Gain on extinguishment of debt | (22,545) | | | — | | | (27,436) | | | (81,354) | |

| Impairment loss on intangible assets and goodwill | — | | | — | | | — | | | 57,232 | |

Loss (gain) on reinsurance contract (1) | (285) | | | (7,043) | | | (1,391) | | | 41,201 | |

| Impairment loss on property, equipment, and software | — | | | — | | | — | | | 254 | |

| Stock-based compensation expense | 6,735 | | | 6,979 | | | 19,208 | | | 20,277 | |

| Mark-to-market losses (gains) | 1,140 | | | (1,557) | | | 6,538 | | | (1,777) | |

Other income, net (2) | (773) | | | (1,185) | | | (22,979) | | | (3,525) | |

Restructuring costs (3) | 1,668 | | | 712 | | | 3,460 | | | 2,789 | |

| Acquisition and other transaction costs | 102 | | | 22 | | | 268 | | | 408 | |

| Non-cash bonus expense | — | | | — | | | — | | | — | |

| Adjusted EBITDA (Loss) | $ | 16,935 | | | $ | 8,839 | | | $ | (34,626) | | | $ | (56,177) | |

| Adjusted EBITDA (Loss) as a percentage of revenue | 15 | % | | 7 | % | | (10) | % | | (18) | % |

______________________________________

(1)See Note 10 in the notes to unaudited condensed consolidated financial statements.

(2)Difference from Other Income, net in Condensed Consolidated Statements of Operations and Comprehensive Income (Loss) is primarily due to a portion of the income resulting from the Aon business collaboration agreement, disclosed in Note 10, that is not a non-GAAP adjustment.

(3)Primarily consists of costs related to forming a reciprocal exchange and share contributions to HOA (see Note 8).

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| (Unaudited) | 2024 | | 2023 | | 2024 | | 2023 |

| Segment Adjusted EBITDA (Loss) | | | | | | | |

| Vertical Software | $ | 5,138 | | | $ | 3,179 | | | $ | 11,039 | | | $ | 4,599 | |

| Insurance | 24,829 | | | 19,038 | | | (5,376) | | | (19,328) | |

| Subtotal | 29,967 | | | 22,217 | | | 5,663 | | | (14,729) | |

| Corporate and other | (13,032) | | | (13,378) | | | (40,289) | | | (41,448) | |

| Adjusted EBITDA (Loss) | $ | 16,935 | | | $ | 8,839 | | | $ | (34,626) | | | $ | (56,177) | |

The following table presents Segment Adjusted EBITDA (Loss) as a percentage of segment revenue for the periods presented:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| (Unaudited) | 2024 | | 2023 | | 2024 | | 2023 |

| Segment Adjusted EBITDA (Loss) as a Percentage of Revenue | | | | |

| Vertical Software | 16.4 % | | 9.3 % | | 12.1 % | | 4.7 % |

| Insurance | 31.1 | % | | 20.0 | % | | (2.2) | % | | (8.9) | % |

Key Performance Indicators

In the management of these businesses, we identify, measure and evaluate various operating metrics. The key performance measures and operating metrics used in managing the businesses are discussed below. These key performance measures and operating metrics are not prepared in accordance with generally accepted accounting principles in the United States (“GAAP”) and may not be comparable to or calculated in the same way as other similarly titled measures and metrics used by other companies.

Gross Written Premium — We define Gross Written Premium as the total premium written by our licensed insurance carrier(s) (before deductions for reinsurance); premiums from our home warranty offerings (for the face value of one year’s premium); and premiums of policies placed with third-party insurance companies for which we earn a commission.

Policies in Force — We define Policies in Force as the number of in-force policies at the end of the period for the Insurance segment, including policies and warranties written by us and policies and warranties written by third parties for which we earn a commission.

Annualized Revenue per Policy — We define Annualized Revenue per Policy as quarterly revenue for the Insurance segment, divided by the number of Policies in Force in the Insurance segment, multiplied by four.

Annualized Premium per Policy — We define Annualized Premium per Policy as the total direct earned premium for HOA, our insurance carrier, divided by the number of active insurance policies at the end of the period, multiplied by four.

Premium Retention Rate — We define Premium Retention Rate as the ratio of our insurance carrier’s renewed premiums over the last four quarters to base premiums, which is the sum of the preceding year’s premiums that either renewed or expired.

Gross Loss Ratio — We define Gross Loss Ratio as our insurance carrier’s gross losses divided by the gross earned premium for the respective period on an accident year basis.

Average Companies in Quarter — We define Average Companies in Quarter as the straight-line average of the number of companies as of the end of period compared with the beginning of period across all of our home services verticals that (i) generate recurring revenue and (ii) generated revenue in the quarter. For new acquisitions, the number of companies is determined in the initial quarter based on the percentage of the quarter the acquired business is a part of Porch.

Average Monthly Revenue per Account in Quarter — We view our ability to increase revenue generated from existing customers as a key component of our growth strategy. Average Monthly Revenue per Account in Quarter is defined as the average revenue per month generated across all home services company customer accounts in a quarterly period. Average Monthly Revenue per Account in Quarter is derived from all customers and total revenue.

Monetized Services — We connect consumers with home services companies nationwide and offer a full range of products and services where homeowners can, among other things: (1) compare and buy home insurance policies (along with auto, flood and umbrella policies) and warranties with competitive rates and coverage; (2) arrange for a variety of services in connection with their move, from labor to load or unload a truck to full-service, long-distance moving services; (3) discover and install home automation and security systems; (4) compare internet and television options for their new home; (5) book small handyman jobs at fixed, upfront prices with guaranteed quality; and (6) compare bids from home improvement professionals who can complete bigger jobs. We track the number of monetized services performed through our platform each quarter and the revenue generated per service performed in order to measure market penetration with homebuyers and homeowners and our ability to deliver high-revenue services within those groups. Monetized Services is defined as the total number of services from which we generated revenue, including, but not limited to, new and renewing insurance and warranty customers, completed moving jobs, security installations, TV/Internet installations or other home projects, measured over the period.

Average Quarterly Revenue per Monetized Service — We believe that shifting the mix of services delivered to homebuyers and homeowners toward higher revenue services is an important component of our growth strategy. Average Quarterly Revenue per Monetized Service is the average revenue generated per monetized service performed in a quarterly period. When calculating Average Quarterly Revenue per Monetized Service, average revenue is defined as total quarterly service transaction revenues generated from monetized services.

PORCH GROUP, INC.

Condensed Consolidated Balance Sheets (Unaudited)

(all numbers in thousands)

| | | | | | | | | | | |

| September 30, 2024 | | December 31, 2023 |

| Assets | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 206,728 | | | $ | 258,418 | |

| Accounts receivable, net | 21,318 | | | 24,288 | |

| Short-term investments | 31,843 | | | 35,588 | |

| Reinsurance balance due | 103,429 | | | 83,582 | |

| Prepaid expenses and other current assets | 17,027 | | | 13,214 | |

| Deferred policy acquisition costs | 16,575 | | | 27,174 | |

| Restricted cash and cash equivalents | 9,950 | | | 38,814 | |

| Total current assets | 406,870 | | | 481,078 | |

| Property, equipment, and software, net | 21,141 | | | 16,861 | |

| Goodwill | 191,907 | | | 191,907 | |

| Long-term investments | 165,935 | | | 103,588 | |

| Intangible assets, net | 73,273 | | | 87,216 | |

| | | |

| Other assets | 8,138 | | | 18,743 | |

| Total assets | $ | 867,264 | | | $ | 899,393 | |

| | | |

| Liabilities and Stockholders' Deficit | | | |

| Current liabilities | | | |

| Accounts payable | $ | 5,145 | | | $ | 8,761 | |

| Accrued expenses and other current liabilities | 46,946 | | | 59,396 | |

| Deferred revenue | 251,777 | | | 248,683 | |

| Refundable customer deposits | 13,126 | | | 17,980 | |

| Current debt | 150 | | | 244 | |

| Losses and loss adjustment expense reserves | 100,610 | | | 95,503 | |

| Other insurance liabilities, current | 73,753 | | | 31,585 | |

| Total current liabilities | 491,507 | | | 462,152 | |

| Long-term debt | 398,882 | | | 435,495 | |

| | | |

| | | |

| | | |

| | | |

| Other liabilities | 53,918 | | | 37,429 | |

| Total liabilities | 944,307 | | | 935,076 | |

| Commitments and contingencies | | | |

| Stockholders' deficit | | | |

| Common stock | 10 | | | 10 | |

| | | |

| | | |

| Additional paid-in capital | 709,364 | | | 690,223 | |

| Accumulated other comprehensive loss | (1,058) | | | (3,860) | |

| Accumulated deficit | (785,359) | | | (722,056) | |

| Total stockholders' deficit | (77,043) | | | (35,683) | |

| Total liabilities and stockholders' deficit | $ | 867,264 | | | $ | 899,393 | |

PORCH GROUP, INC.

Condensed Consolidated Statements of Operations (Unaudited)

(all numbers in thousands except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenue | $ | 111,200 | | $ | 129,556 | | $ | 337,487 | | $ | 315,690 |

| Operating expenses: | | | | | | | |

| Cost of revenue | 47,076 | | 52,961 | | 214,566 | | 185,566 |

| Selling and marketing | 27,233 | | 40,135 | | 94,378 | | 107,357 |

| Product and technology | 14,559 | | 14,446 | | 43,210 | | 43,891 |

| General and administrative | 24,875 | | 28,659 | | 75,504 | | 77,267 |

Provision for (recovery of) doubtful accounts | (39) | | (6,844) | | (520) | | 42,111 |

| Impairment loss on intangible assets and goodwill | — | | — | | — | | 57,232 |

| Total operating expenses | 113,704 | | 129,357 | | 427,138 | | 513,424 |

Operating income (loss) | (2,504) | | 199 | | (89,651) | | (197,734) |

| Other income (expense): | | | | | | | |

| Interest expense | (10,645) | | (10,267) | | (31,758) | | (21,230) |

| | | | | | | |

| Change in fair value of private warrant liability | 50 | | 260 | | 1,076 | | 620 |

| Change in fair value of derivatives | (1,048) | | 510 | | (7,772) | | (2,440) |

| Gain on extinguishment of debt | 22,545 | | — | | 27,436 | | 81,354 |

| Investment income and realized gains, net of investment expenses | 3,787 | | 2,485 | | 10,957 | | 4,492 |

| Other income, net | 2,014 | | 1,185 | | 27,092 | | 3,525 |

| Total other income (expense) | 16,703 | | (5,827) | | 27,031 | | 66,321 |

| Income (loss) before income taxes | 14,199 | | (5,628) | | (62,620) | | (131,413) |

Income tax provision | 183 | | (116) | | (683) | | (34) |

| Net income (loss) | $ | 14,382 | | $ | (5,744) | | (63,303) | | (131,447) |

| | | | | | | |

| Net income (loss) per share - basic | $ | 0.14 | | $ | (0.06) | | $ | (0.64) | | $ | (1.37) |

| Net income (loss) per share - diluted | $ | 0.12 | | $ | (0.06) | | $ | (0.64) | | $ | (1.37) |

| | | | | | | |

The following table summarizes the classification of stock-based compensation expense in the unaudited consolidated statements of operations.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Selling and marketing | $ | 732 | | | $ | 1,087 | | | $ | 2,136 | | | $ | 3,028 | |

| Product and technology | 1,413 | | | 1,947 | | | 3,934 | | | 4,650 | |

| General and administrative | 4,590 | | | 3,945 | | | 13,138 | | | 12,599 | |

| Total stock-based compensation expense | $ | 6,735 | | | $ | 6,979 | | | $ | 19,208 | | | $ | 20,277 | |

PORCH GROUP, INC.

Condensed Consolidated Statements of Cash Flows (Unaudited)

(all numbers in thousands)

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| 2024 | | 2023 |

| Cash flows from operating activities: | | | |

| Net loss | $ | (63,303) | | | $ | (131,447) | |

| Adjustments to reconcile net loss to net cash provided by (used in) operating activities | | | |

| Depreciation and amortization | 18,568 | | | 18,501 | |

| Provision for (recovery of) doubtful accounts | (520) | | | 42,111 | |

| Impairment loss on intangible assets and goodwill | — | | | 57,232 | |

| Gain on extinguishment of debt | (27,436) | | | (81,354) | |

| Loss on divestiture of business | 5,331 | | | — | |

| Change in fair value of private warrant liability | (1,076) | | | (620) | |

| Change in fair value of contingent consideration | (158) | | | (3,597) | |

| Change in fair value of derivatives | 7,772 | | | 2,440 | |

| Stock-based compensation | 19,208 | | | 20,277 | |

| Non-cash interest expense | 27,624 | | | 20,214 | |

| Gain on settlement of contingent consideration | (14,930) | | | — | |

| Other | (2,956) | | | 1,002 | |

| Change in operating assets and liabilities, net of acquisitions and divestitures | | | |

| Accounts receivable | (1,675) | | | (1,344) | |

| Reinsurance balance due | (18,456) | | | 159,368 | |

| | | |

| Deferred policy acquisition costs | 10,599 | | | (23,746) | |

| Accounts payable | (3,616) | | | 2,778 | |

| Accrued expenses and other current liabilities | (12,153) | | | (9,323) | |

| Losses and loss adjustment expense reserves | 5,107 | | | 29,143 | |

| Other insurance liabilities, current | 42,168 | | | (7,527) | |

| Deferred revenue | 2,777 | | | (4,696) | |

| Refundable customer deposits | (4,948) | | | (12,248) | |

| Other assets and liabilities, net | 6,993 | | | (2,266) | |

| Net cash provided by (used in) operating activities | (5,080) | | | 74,898 | |

| Cash flows from investing activities: | | | |

| Purchases of property and equipment | (331) | | | (776) | |

| Capitalized internal use software development costs | (8,590) | | | (6,923) | |

| Purchases of short-term and long-term investments | (98,148) | | | (59,851) | |

| Maturities, sales of short-term and long-term investments | 43,990 | | | 35,321 | |

| Proceeds from sale of business | 10,870 | | | — | |

| Acquisitions, net of cash acquired | — | | | (1,974) | |

| Net cash used in investing activities | (52,209) | | | (34,203) | |

| Cash flows from financing activities: | | | |

| | | |

| Proceeds from advance funding | — | | | 319 | |

| Repayments of advance funding | — | | | (2,962) | |

| Proceeds from issuance of debt | — | | | 116,667 | |

| Repayments of principal | (23,199) | | | (10,150) | |

| Cash paid for debt issuance costs | — | | | (4,650) | |

| | | |

| | | |

| | | |

| | | |

| Repurchase of stock | — | | | (5,608) | |

| Other | (66) | | | (1,202) | |

| Net cash provided by (used in) financing activities | (23,265) | | | 92,414 | |

| Net change in cash and cash equivalents & restricted cash and cash equivalents | $ | (80,554) | | | $ | 133,109 | |

| Cash and cash equivalents & restricted cash and cash equivalents, beginning of period | $ | 297,232 | | | $ | 228,605 | |

| Cash and cash equivalents & restricted cash and cash equivalents, end of period | $ | 216,678 | | | $ | 361,714 | |

Document and Entity Information

|

Nov. 07, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 07, 2024

|

| Entity Registrant Name |

PORCH GROUP, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39142

|

| Entity Tax Identification Number |

83-2587663

|

| Entity Address, Address Line One |

411 1st Avenue S.

|

| Entity Address, Address Line Two |

Suite 501

|

| Entity Address, City or Town |

Seattle

|

| Entity Address, State or Province |

WA

|

| Entity Address, Postal Zip Code |

98104

|

| City Area Code |

855

|

| Local Phone Number |

767-2400

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.0001

|

| Trading Symbol |

PRCH

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001784535

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

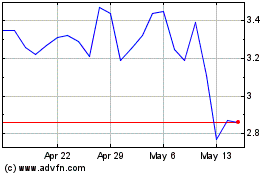

Porch (NASDAQ:PRCH)

Historical Stock Chart

From Nov 2024 to Dec 2024

Porch (NASDAQ:PRCH)

Historical Stock Chart

From Dec 2023 to Dec 2024