Porch Group, Inc. (“Porch” or “the Company”) (NASDAQ: PRCH), a

homeowners insurance and vertical software platform, today

announced the completed formation of the Porch Insurance Reciprocal

Exchange (“PIRE”) and sale of Homeowners of America Insurance

Company (“HOA”) to PIRE.

The final terms of the transaction were consistent with

expectations, with Porch selling HOA to PIRE for a purchase price

equal to HOA’s December 31, 2024 expected surplus1 of approximately

$105 million, less the existing 2023 surplus note of $49 million

and less $9 million of outstanding interest expected to be paid in

2025. This brings the total surplus notes2 held by Porch to

approximately $106 million. With this transaction now complete,

going forward all insurance policies, premium and related claims,

as well as all HOA assets and liabilities will be owned by PIRE.

Porch Group will receive commissions and fees for providing

operating and other services to PIRE, which is expected to deliver

more predictable and higher-margin financial results for Porch

Group Shareholders.

The upcoming launch marks a pivotal milestone in Porch’s journey

to build a large, highly profitable homeowners insurance company

that makes the home simple. Porch differentiates by leveraging its

unique property data to provide more accurate pricing and by

utilizing Porch’s unique capabilities to tailor solutions for

homebuyers. With PIRE now in place, Porch plans to scale insurance

written premiums.

“We are thrilled to announce the formation of the Porch

Insurance Reciprocal Exchange, a transformative step in our journey

to redefine the homeowner experience while enhancing profitability

for Porch shareholders,” said Matt Ehrlichman, Chief Executive

Officer. “This is just the beginning of an exciting new chapter. We

look forward to delivering exceptional value to our stakeholders

and continuing to innovate in the homeowners insurance

industry.”

- HOA’s expected surplus of $105 million as at December 31, 2024

is based on Company’s best estimate to facilitate the transaction

closing.

- A surplus note is a subordinated financial instrument that pays

an interest-bearing coupon with excess surplus generated by the

Reciprocal.

About Porch Group

Porch Group, Inc., (“Porch”) is a new kind of homeowners

insurance company. Porch’s strategy to win in homeowners insurance

is to deploy leading vertical software solutions in select

home-related industries, provide the best services for homebuyers

including important moving services, leverage unique data for

advantaged underwriting, and provide more protection for

policyholders.

To learn more about Porch, visit ir.porchgroup.com.

Forward-Looking Statements

Certain statements in this release may be considered

forward-looking statements as defined by the Private Securities

Litigation Reform Act of 1995. These statements are based on the

beliefs and assumptions of management. Although we believe that our

plans, intentions, and expectations reflected in or suggested by

these forward-looking statements are reasonable, we cannot assure

you that we will achieve or realize these plans, intentions, or

expectations. Forward-looking statements are inherently subject to

risks, uncertainties, and assumptions. Generally, statements that

are not historical facts, including statements concerning our

financial outlook, guidance, and targets possible or assumed future

actions, business strategies, events, or results of operations, are

forward-looking statements. Forward-looking statements in this

presentation include expectations regarding whether the reciprocal

will deliver more predictable and higher-margin financials for

Porch and plans to scale insurance operations. These statements may

be preceded by, followed by, or include the words “believe,”

“estimate,” “expect,” “project,” “forecast,” “may,” “will,”

“should,” “seek,” “plan,” “scheduled,” “anticipate,” “intend,” or

similar expressions.

Forward-looking statements are not guarantees of performance.

You should not put undue reliance on these statements which speak

only as of the date hereof. Unless specifically indicated

otherwise, the forward-looking statements in this release do not

reflect the potential impact of any future transactions that have

not been completed as of the date of this filing, including the

licensure and formation of the reciprocal, the sale of our

insurance carrier subsidiary, Homeowners of America Insurance

Company (“HOA”), to the reciprocal, and the commencement of the

reciprocal’s operations. You should understand that the following

important factors, among others, could affect our future results

and could cause those results or other outcomes to differ

materially from those expressed or implied in our forward-looking

statements:

(1) expansion plans and opportunities, and managing growth, to

build a consumer brand;

(2) the incidence, frequency, and severity of weather events,

extensive wildfires, and other catastrophes;

(3) economic conditions, especially those affecting the housing,

insurance, and financial markets;

(4) expectations regarding revenue, cost of revenue, operating

expenses, and the ability to achieve and maintain future

profitability;

(5) existing and developing federal and state laws and

regulations, including with respect to insurance, warranty,

privacy, information security, data protection, and taxation, and

management’s interpretation of and compliance with such laws and

regulations;

(6) our reinsurance program, which includes the use of a captive

reinsurer, the success of which is dependent on a number of factors

outside management’s control, along with reliance on reinsurance to

protect against loss;

(7) the possibility that a decline in our share price would

result in a negative impact to our insurance carrier subsidiary’s,

Homeowners of America Insurance Company (“HOA”), surplus position

and may require further financial support to enable HOA to meet

applicable regulatory requirements and maintain financial stability

rating;

(8) the uncertainty and significance of the known and unknown

effects on our insurance carrier subsidiary, Homeowners of America

Insurance Company (“HOA”), and us due to the termination of a

reinsurance contract following the fraud committed by Vesttoo Ltd.

(“Vesttoo”), including, but not limited to, the outcome of

Vesttoo’s Chapter 11 bankruptcy proceedings; our ability to

successfully pursue claims arising out of the fraud, the costs

associated with pursuing the claims, and the timeframe associated

with any recoveries; HOA's ability to obtain and maintain adequate

reinsurance coverage against excess losses; HOA’s ability to stay

out of regulatory supervision and maintain its financial stability

rating; and HOA’s ability to maintain a healthy surplus

(9) uncertainties related to regulatory approval of insurance

rates, policy forms, insurance products, license applications,

acquisitions of businesses, or strategic initiatives, including the

reciprocal restructuring, and other matters within the purview of

insurance regulators (including the discount associated with the

shares contributed to HOA);

(10) our ability to successfully operate its businesses

alongside a reciprocal exchange;

(11) our ability to implement our plans, forecasts and other

expectations with respect to the reciprocal exchange business after

the completion of the formation and to realize expected synergies

and/or convert policyholders from its existing insurance carrier

business into policyholders of the reciprocal exchange;

(12) potential business disruption following the formation of

the reciprocal exchange;

(13) reliance on strategic, proprietary relationships to provide

us with access to personal data and product information, and the

ability to use such data and information to increase transaction

volume and attract and retain customers;

(14) the ability to develop new, or enhance existing, products,

services, and features and bring them to market in a timely

manner;

(15) changes in capital requirements, and the ability to access

capital when needed to provide statutory surplus;

(16) our ability to timely repay our outstanding

indebtedness;

(17) the increased costs and initiatives required to address new

legal and regulatory requirements arising from developments related

to cybersecurity, privacy, and data governance and the increased

costs and initiatives to protect against data breaches,

cyber-attacks, virus or malware attacks, or other infiltrations or

incidents affecting system integrity, availability, and

performance;

(18) retaining and attracting skilled and experienced

employees;

(19) costs related to being a public company; and

(20) other risks and uncertainties discussed in Part II, Item

1A, “Risk Factors,” in the Company’s Annual Report on Form 10-K for

the year ended December 31, 2023, as well as those discussed in

Part II, Item 1A, “Risk Factors,” in the Company’s Quarterly Report

on Form 10-Q for the quarter ended September 30, 2024 and in

subsequent reports filed with the Securities and Exchange

Commission (“SEC”), all of which are available on the SEC’s website

at www.sec.gov.

We caution you that the foregoing list may not contain all the

risks to forward-looking statements made in this release.

You should not rely upon forward-looking statements as

predictions of future events. We have based the forward-looking

statements contained in this release primarily on our current

expectations and projections about future events and trends we

believe may affect our business, financial condition, results of

operations and prospects. The outcome of the events described in

these forward-looking statements is subject to risks,

uncertainties, and other factors, including those described above

and elsewhere in this release. We disclaim any obligation to update

publicly any forward-looking statements, whether in response to new

information, future events, or otherwise, except as required by

applicable law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250107440222/en/

Investor Relations Contact: Lois Perkins, Head of

Investor Relations Porch Group, Inc. Loisperkins@porch.com

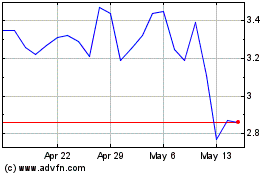

Porch (NASDAQ:PRCH)

Historical Stock Chart

From Feb 2025 to Mar 2025

Porch (NASDAQ:PRCH)

Historical Stock Chart

From Mar 2024 to Mar 2025