UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

(RULE 14d-100)

Tender Offer Statement under Section 14(d)(1) or

13(e)(1)

of the Securities Exchange Act of 1934

(Amendment No. 9)

Performance

Shipping Inc.

(Name of Subject Company (Issuer))

Sphinx

Investment Corp.

(Offeror)

Maryport

Navigation Corp.

(Parent of Offeror)

George

Economou

(Affiliate of Offeror)

(Names of Filing Persons)

Common

shares, $0.01 par value

(including

the associated Preferred stock purchase rights)

(Title of Class of Securities)

Y67305154

(CUSIP Number of Class of Securities)

Kleanthis Spathias

c/o Levante Services Limited

Leoforos Evagorou 31, 2nd Floor,

Office 21

1066 Nicosia, Cyprus

+35 722 010610

(Name, address and telephone number of person authorized

to receive notices and communications on behalf of filing persons)

With a copy to:

Richard M. Brand

Kiran S. Kadekar

Cadwalader, Wickersham & Taft LLP

200 Liberty Street

New York, NY 10281

(212) 504-6000

| |

¨ |

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes below to designate

any transactions to which the statement relates:

| x |

third-party tender offer subject to Rule 14d-1. |

| ¨ |

issuer tender offer subject to Rule 13e-4. |

| ¨ |

going-private transaction subject to Rule 13e-3. |

| x |

amendment to Schedule 13D under Rule 13d-2. |

Check the following box if the filing is a final amendment

reporting the results of the tender offer: ¨

If applicable, check the appropriate box(es) below

to designate the appropriate rule provision(s) relied upon:

| ¨ |

Rule 13e-4(i) (Cross-Border Issuer Tender Offer) |

| ¨ |

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) |

As permitted by General Instruction G to Schedule

TO, this Schedule TO is also Amendment No. 14 to the Schedule 13D filed by Sphinx Investment Corp. (the “Offeror”),

Maryport Navigation Corp. and Mr. George Economou on August 25, 2023 (and amended on August 31, 2023, September 5,

2023 and September 15, 2023, further amended twice on each of October 11, 2023 and October 30, 2023, and further amended

on November 15, 2023, December 5, 2023, March 26, 2024, June 27, 2024, August 15, 2024 and September 17, 2024)

in respect of the Common Shares of the Company.

CUSIP No. Y67305154

| |

| |

| |

1. |

Names of Reporting Persons

Sphinx Investment Corp. |

| |

|

|

| |

2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

| |

|

(a) |

¨ |

| |

|

(b) |

x |

| |

|

|

| |

3. |

SEC Use Only |

| |

|

|

| |

4. |

Source of Funds (See Instructions)

WC |

| |

|

|

| |

5. |

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) o |

| |

|

|

| |

6. |

Citizenship or Place of Organization

Republic of the Marshall Islands |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole Voting Power

0 |

| 8. |

Shared Voting Power

1,033,859* |

| 9. |

Sole Dispositive Power

0 |

| 10. |

Shared Dispositive Power

1,033,859* |

| |

11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

1,033,859* |

| |

12. |

Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

| |

13. |

Percent of Class Represented by Amount in Row (11)

8.3%** |

| |

14. |

Type of Reporting Person (See Instructions)

CO |

| |

|

|

|

|

|

* All reported Common Shares are held by Sphinx

Investment Corp. Sphinx Investment Corp. is a wholly-owned subsidiary of Maryport Navigation Corp., which is a Liberian company controlled

by Mr. Economou.

** Based on the 12,432,158

Common Shares stated by the Issuer as being outstanding as at November 8, 2024 in

Exhibit 99.1 to Form 6-K filed with the United States Securities and Exchange Commission

(the “SEC”) on November 19, 2024 (the “Form 6-K”).

CUSIP No. Y67305154

| |

| |

| |

1. |

Names of Reporting Persons

Maryport Navigation Corp. |

| |

|

|

| |

2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

| |

|

(a) |

¨ |

| |

|

(b) |

x |

| |

|

|

| |

3. |

SEC Use Only |

| |

|

|

| |

4. |

Source of Funds (See Instructions)

AF |

| |

|

|

| |

5. |

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) o |

| |

|

|

| |

6. |

Citizenship or Place of Organization

Liberia |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole Voting Power

0 |

| 8. |

Shared Voting Power

1,033,859* |

| 9. |

Sole Dispositive Power

0 |

| 10. |

Shared Dispositive Power

1,033,859* |

| |

11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

1,033,859* |

| |

12. |

Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

| |

13. |

Percent of Class Represented by Amount in Row (11)

8.3%** |

| |

14. |

Type of Reporting Person (See Instructions)

CO |

| |

|

|

|

|

|

* All reported Common Shares are held by Sphinx

Investment Corp. Sphinx Investment Corp. is a wholly-owned subsidiary of Maryport Navigation Corp., which is a Liberian company controlled

by Mr. Economou.

** Based on the 12,432,158

Common Shares stated by the Issuer as being outstanding as at November 8, 2024 in

its Form 6-K.

CUSIP No. Y67305154

| |

| |

| |

1. |

Names of Reporting Persons

George Economou |

| |

|

|

| |

2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

| |

|

(a) |

o |

| |

|

(b) |

x |

| |

|

|

| |

3. |

SEC Use Only |

| |

|

|

| |

4. |

Source of Funds (See Instructions)

AF |

| |

|

|

| |

5. |

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ¨ |

| |

|

|

| |

6. |

Citizenship or Place of Organization

Greece |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole Voting Power

0 |

| 8. |

Shared Voting Power

1,033,859* |

| 9. |

Sole Dispositive Power

0 |

| 10. |

Shared Dispositive Power

1,033,859* |

| |

11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

1,033,859* |

| |

12. |

Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

| |

13. |

Percent of Class Represented by Amount in Row (11)

8.3%** |

| |

14. |

Type of Reporting Person (See Instructions)

IN |

| |

|

|

|

|

|

* All reported Common Shares are held by Sphinx

Investment Corp. Sphinx Investment Corp. is a wholly-owned subsidiary of Maryport Navigation Corp., which is a Liberian company controlled

by Mr. Economou.

** Based on the 12,432,158

Common Shares stated by the Issuer as being outstanding as at November 8, 2024 in

its Form 6-K.

This Amendment No. 9

(this “Amendment No. 9”) is filed by the Offeror (as defined below), Maryport (as defined below) and Mr. George

Economou and amends and supplements the Tender Offer Statement on Schedule TO originally filed with the Securities and Exchange Commission

(the “SEC”) on October 11, 2023 and amended and supplemented pursuant to Amendment No. 1 and Amendment No. 2,

each of which was filed with the SEC on October 30, 2023, Amendment No. 3 which was filed with the SEC on November 15,

2023, Amendment No. 4 which was filed with the SEC on December 5, 2023, Amendment No. 5 which was filed with the SEC on

March 26, 2024, Amendment No. 6 which was filed with the SEC on June 27, 2024, Amendment No. 7 which was filed with

the SEC on August 15, 2024 and Amendment No. 8 which was filed with the SEC on September 17, 2024 (such original Tender Offer Statement

on Schedule TO as so amended and supplemented (including any exhibits and annexes attached thereto), the “Original Schedule TO”),

and as hereby amended and supplemented (including by the exhibits and annexes hereto), together with any subsequent amendments and supplements

thereto, this “Schedule TO”) by Sphinx Investment Corp., a corporation organized under the laws of the Republic of

the Marshall Islands (the “Offeror”), Maryport Navigation Corp., a corporation organized under the laws of the Republic

of Liberia that is the direct parent of the Offeror (“Maryport”), and Mr. George Economou, who directly owns Maryport

and controls each of the Offeror and Maryport. This Schedule TO relates to the tender offer by the Offeror to purchase all of the issued

and outstanding common shares, par value $0.01 per share (the “Common Shares”),

of Performance Shipping Inc., a corporation organized under the laws of the

Republic of the Marshall Islands (the “Company”) (including the associated preferred stock purchase rights (the

“Rights”, and together with the Common Shares, the “Shares”) issued pursuant to the Stockholders’

Rights Agreement, dated as of December 20, 2021, between the Company and Computershare

Inc. as Rights Agent (as it may be amended from time to time)), for $3.00 per Share in cash, without interest, less any applicable

withholding taxes, upon the terms and subject to the conditions set forth in (a) the Amended and Restated Offer to Purchase, dated

October 30, 2023, a copy of which is attached to the Schedule TO as Exhibit (a)(1)(G), as amended and supplemented by the Supplement

to the Amended and Restated Offer to Purchase dated December 5, 2023, a copy of which is attached to the Schedule TO as Exhibit (a)(1)(O) (the

“Offer to Purchase”), (b) the related revised Letter of Transmittal, a copy of which is attached to the Schedule

TO as Exhibit (a)(1)(H) (the “Letter of Transmittal”), and (c) the related revised Notice of Guaranteed

Delivery, a copy of which is attached to the Schedule TO as Exhibit (a)(1)(I) (the “Notice of Guaranteed Delivery”)

(which three documents, including any amendments or supplements thereto, collectively constitute the “Offer”).

As permitted by General Instruction

G to Schedule TO, this Schedule TO is also Amendment No. 14 to the Schedule 13D filed by the Offeror, Maryport and Mr. Economou

on August 25, 2023 (and amended on August 31, 2023, September 5, 2023 and September 15, 2023, further amended twice

on each of October 11, 2023 and October 30, 2023, and further amended on November 15, 2023, December 5, 2023, March 26,

2024, June 27, 2024, August 15, 2024 and September 17, 2024) in respect of the Common Shares.

This Amendment No. 9

is being filed to amend and supplement the Schedule TO. Except as amended hereby to the extent specifically provided herein, all terms

of the Offer and all other disclosures set forth in the Schedule TO and the Exhibits thereto remain unchanged and are hereby expressly

incorporated into this Amendment No. 9 by reference. Capitalized terms used and not otherwise defined in this Amendment No. 9

shall have the meanings assigned to such terms in the Schedule TO and the Offer to Purchase.

Items 1 through 9 and Item 11

| The Offer to Purchase and Items 1 through 9 and Item 11 of the Schedule TO are hereby amended and supplemented as set forth below: |

| 1. | The information set forth in

the section of the Offer to Purchase entitled “SUMMARY TERM SHEET” is hereby amended and supplemented by deleting

the discussion set forth under the caption “DO YOU INTEND TO CONDUCT A PROXY SOLICITATION TO REPLACE ANY MEMBERS OF THE PERFORMANCE

BOARD OF DIRECTORS OR TO PASS ANY OTHER PROPOSALS?” in its entirety and replacing it with the following: |

“No. While, the Offeror, Maryport and Mr.

George Economou (the “Sphinx Parties”) previously furnished a Proxy Statement on Schedule 13D on October 11, 2023 in

respect of thesolicitation of proxies (the “Proxy Solicitation”) for certain shareholder proposals and the election

of the Sphinx Nominee to the Board at the Company’s 2024 Shareholder Meeting; the Sphinx Parties no longer intend to pursue the

Proxy Solicitation. As previously disclosed by the Offeror, the Offeror brought RMI Cancellation Proceedings in the High Court of the

Republic of the Marshall Islands (the “High Court”) that seek to, among other things, invalidate super-voting Series

C Preferred Stock that the Offeror believes disenfranchises non-insider stockholders and was improperly issued as part of a scheme to

entrench the Company’s insiders. Notwithstanding the ongoing RMI Cancellation Proceedings, on November

19, 2024, the Board announced its intention to hold the 2024 Shareholder Meeting on December 17, 2024, prior to the High Court

being in a position to render a judgment on the merits as to the validity (or lack thereof) of the Series C Preferred Stock. In

the view of the Offeror, holding the 2024 Shareholder Meeting at such time under such circumstances renders it legally impossible for

anyone other than the Company’s Board nominees to win the election and will also suppress the turnout of the non-insider stockholders

at the 2024 Shareholder Meeting. The Offeror, Maryport and Mr. George Economou will not spend further resources to solicit proxies

for a shareholder vote that they believe will be a farce.

The Sphinx Parties, for the avoidance of doubt,

are not withdrawing the nomination of the Sphinx Nominee for election to the Board at the

2024 Shareholder Meeting. If elected to the Board, the Sphinx Nominee would succeed

Aliki Paliou, chairperson of the Board and sole shareholder of Mango, the Company’s controlling shareholder, whose current term

on the Board expires at the 2024 Shareholder Meeting. The Sphinx Parties are also not withdrawing the Declassification Proposal or any

of the Vote of No Confidence Proposals.

Neither the Offer to Purchase nor the Offer constitutes

(i) a solicitation of any proxy, consent or authorization for or with respect to the 2024 Shareholder Meeting or any other meeting of

Company shareholders or (ii) a solicitation of any consent or authorization in the absence of any such meeting.”

| 2. | The information set forth in Section 18 of the Offer to Purchase entitled “LEGAL PROCEEDINGS”

is hereby amended and supplemented by inserting the following paragraph set forth below as the penultimate paragraph therein: |

“On September 27, 2024, the defendants in

the RMI Cancellation Proceedings filed motions to dismiss the RMI Cancellation Proceedings. On October 25, 2024, the Offeror filed an

omnibus opposition memorandum of law in response to such motions. On November 15, 2024, the defendants filed reply memoranda of law in

further support of their motions to dismiss. As of December 12, 2024, the High Court has neither scheduled oral argument nor issued a

decision with respect to the motions to dismiss.”

SIGNATURES

After due inquiry and to the

best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: December 12, 2024

| |

SPHINX INVESTMENT CORP. |

| |

|

| |

By: Levante Services Limited |

| |

|

| |

By: |

/s/ Kleanthis Costa Spathias |

| |

Kleanthis Costa Spathias |

| |

Director |

| |

|

| |

MARYPORT NAVIGATION CORP. |

| |

|

| |

By: Levante Services Limited |

| |

|

| |

By: |

/s/ Kleanthis Costa Spathias |

| |

Kleanthis Costa Spathias |

| |

Director |

| |

|

| |

George Economou |

| |

|

| |

/s/ George Economou |

| |

George Economou |

EXHIBIT INDEX

| Exhibit |

|

Description |

| |

|

|

| (a)(1)(A) |

|

Offer to Purchase* |

| |

|

|

| (a)(1)(B) |

|

Form of Letter of Transmittal* |

| |

|

|

| (a)(1)(C) |

|

Form of Notice of Guaranteed Delivery* |

| |

|

|

| (a)(1)(D) |

|

Form of Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees* |

| |

|

|

| (a)(1)(E) |

|

Form of Letter to Clients for Use by Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees* |

| |

|

|

| (a)(1)(F) |

|

Form of Summary Advertisement as published in the New York Times on October 11, 2023 * |

| |

|

|

| (a)(1)(G) |

|

Amended and Restated Offer to Purchase* |

| |

|

|

| (a)(1)(H) |

|

Form of revised Letter of Transmittal* |

| |

|

|

| (a)(1)(I) |

|

Form of revised Notice of Guaranteed Delivery* |

| |

|

|

| (a)(1)(J) |

|

Form of revised Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees* |

| |

|

|

| (a)(1)(K) |

|

Form of revised Letter to Clients for Use by Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees* |

| |

|

|

| (a)(1)(L) |

|

Complaint filed by Sphinx Investment Corp. in the Supreme Court of the State of New York located in the County of New York* |

| |

|

|

| (a)(1)(M) |

|

Press Release issued by Sphinx Investment Corp. on October 30, 2023* |

| |

|

|

| (a)(1)(N) |

|

Press Release issued by Sphinx Investment Corp. on November 15, 2023* |

| |

|

|

| (a)(1)(O) |

|

Supplement to Amended and Restated Offer to Purchase dated December 5, 2023* |

| |

|

|

| (a)(1)(P) |

|

Press Release issued by Sphinx Investment Corp. on March 26, 2024* |

| |

|

|

| (a)(1)(Q) |

|

Press Release issued by Sphinx Investment Corp. on June 27, 2024* |

| |

|

|

| (a)(1)(R) |

|

Complaint filed by Sphinx Investment Corp. in the High Court of the Republic of the Marshall Islands on August 13, 2024 (and stamped by such Court as received on August 15, 2024)* |

| |

|

|

| (a)(1)(S) |

|

Press Release issued by Sphinx Investment Corp. on September 17, 2024* |

| |

|

|

| (b) |

|

Not applicable. |

| |

|

|

| (d) |

|

Not applicable. |

| |

|

|

| (g) |

|

Not applicable. |

| |

|

|

| (h) |

|

Not applicable. |

| |

|

|

| 107 |

|

Filing Fee Table* |

* Previously filed

** Filed herewith

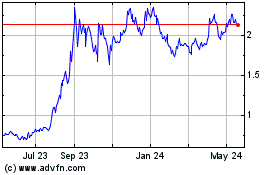

Performance Shipping (NASDAQ:PSHG)

Historical Stock Chart

From Feb 2025 to Mar 2025

Performance Shipping (NASDAQ:PSHG)

Historical Stock Chart

From Mar 2024 to Mar 2025