Current Report Filing (8-k)

16 April 2022 - 6:12AM

Edgar (US Regulatory)

0001574235

false

0001574235

2022-04-14

2022-04-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): April 14, 2022

PULMATRIX,

INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-36199 |

|

46-1821392 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

99

Hayden Avenue, Suite 390

Lexington,

MA 02421

(Address

of principal executive offices) (Zip Code)

(781)

357-2333

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4 (c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of exchange

on

which registered |

| Common

Stock, par value $0.0001 per share |

|

PULM |

|

The

NASDAQ Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers.

On

April 14, 2022, the Board of Directors of Pulmatrix, Inc. (the “Company”) appointed Peter Ludlum as Interim Chief Financial

Officer of the Company, effective as of April 18, 2022, to serve until a successor is chosen and qualified, or until his earlier resignation

or removal. Mr. Ludlum will also serve as the Company’s principal accounting officer and principal financial officer.

Mr.

Ludlum, age 66, has extensive finance and accounting leadership experience with 17 years as a C level executive in public and private

companies. Since December 2021, Mr. Ludlum has served as a consultant with Danforth Advisors, LLC (“Danforth”), a provider

of strategic and operational finance and accounting for life science companies, and, since December 2021, he has served as the Company’s

Strategic Advisor – Finance pursuant to a November 30, 2021 consulting agreement (the “Consulting Agreement”) between

the Company and Danforth. Previously, Mr. Ludlum served in several executive roles at Emmaus Life Sciences, Inc. (n/k/a EMI Holding,

Inc.), a commercial-stage biopharmaceutical company, including Chief Business Officer, Executive Vice President and Chief Financial Officer,

during his tenure from April 2012 until May 2017. Mr. Ludlum previously served as the Chief Financial Officer of Energy and Power Solutions,

Inc., an energy intelligence company, from April 2008 to December 2011. He received a B.S. in Business and Economics with a major in

accounting from Lehigh University and an MBA with a concentration in Finance from California State University, Fullerton.

Pursuant

to the Consulting Agreement, Mr. Ludlum will provide services to the Company under the Consulting Agreement as an independent contractor

and employee of Danforth. The Consulting Agreement may be terminated by the Company or Danforth (a) with cause (as defined in the Consulting

Agreement), immediately upon written notice to the other party or (b) without cause upon 30 days prior written notice to the other party.

Pursuant to the Consulting Agreement, Danforth will receive cash compensation at a rate of $400 per hour for Mr. Ludlum’s services.

There

is no family relationship between Mr. Ludlum and any director or executive officer of the Company. There are no transactions between

Mr. Ludlum and the Company that would be required to be reported under Item 404(a) of Regulation S-K of the Securities Exchange Act of

1934, as amended.

The

foregoing summary of the material terms of the Consulting Agreement does not purport to be complete and is subject to, and qualified

in its entirety by, the full and complete terms of the agreement, a copy of which is filed with this Current Report on Form 8-K as Exhibit

10.1 and incorporated herein by reference.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

| |

PULMATRIX, INC. |

| |

|

|

| Date: April 15, 2022 |

By: |

/s/ Teofilo

Raad |

| |

|

Teofilo Raad |

| |

|

Chief Executive Officer |

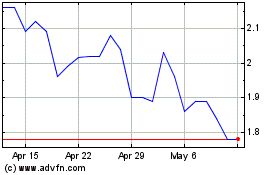

Pulmatrix (NASDAQ:PULM)

Historical Stock Chart

From Mar 2025 to Apr 2025

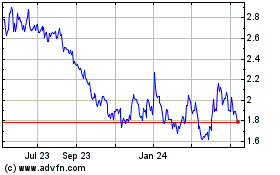

Pulmatrix (NASDAQ:PULM)

Historical Stock Chart

From Apr 2024 to Apr 2025