false

0000700841

DEF 14A

00007008412022-01-022022-12-31

thunderdome:item

000070084122022-01-022022-12-31

000070084112022-01-022022-12-31

iso4217:USD

0000700841rcmt:AverageInclusionOfEquityValuesForNonPEONEOsMember2020-01-032021-01-02

0000700841rcmt:AverageYearEndFairValueOfEquityAwardsGrantedDuringYearThatRemainedUnvestedAsOfLastDayOfYearForNonPEONEOsMember2020-01-032021-01-02

0000700841rcmt:AverageInclusionOfEquityValuesForNonPEONEOsMember2021-01-032022-01-01

0000700841rcmt:AverageChangeInFairValueFromLastDayOfPriorYearToLastDayOfYearOfUnvestedEquityAwardsForNonPEONEOsMember2021-01-032022-01-01

0000700841rcmt:AverageInclusionOfEquityValuesForNonPEONEOsMember2022-01-022022-12-31

0000700841rcmt:AverageChangeInFairValueFromLastDayOfPriorYearToVestingDateOfUnvestedEquityAwardsThatVestedDuringYearForNonPEONEOsMember2022-01-022022-12-31

0000700841rcmt:AverageChangeInFairValueFromLastDayOfPriorYearToLastDayOfYearOfUnvestedEquityAwardsForNonPEONEOsMember2022-01-022022-12-31

0000700841rcmt:AverageYearEndFairValueOfEquityAwardsGrantedDuringYearThatRemainedUnvestedAsOfLastDayOfYearForNonPEONEOsMember2022-01-022022-12-31

0000700841rcmt:InclusionOfEquityValuesForPEOMember2020-01-032021-01-02

0000700841rcmt:ChangeInFairValueFromLastDayOfPriorYearToVestingDateOfUnvestedEquityAwardsThatVestedDuringYearForPEOMember2020-01-032021-01-02

0000700841rcmt:YearEndFairValueOfEquityAwardsGrantedDuringYearThatRemainedUnvestedAsOfLastDayOfYearForPEOMember2020-01-032021-01-02

0000700841rcmt:InclusionOfEquityValuesForPEOMember2021-01-032022-01-01

0000700841rcmt:ChangeInFairValueFromLastDayOfPriorYearToVestingDateOfUnvestedEquityAwardsThatVestedDuringYearForPEOMember2021-01-032022-01-01

0000700841rcmt:VestingDateFairValueOfEquityAwardsGrantedDuringYearThatVestedDuringYearForPEOMember2021-01-032022-01-01

0000700841rcmt:ChangeInFairValueFromLastDayOfPriorYearToLastDayOfYearOfUnvestedEquityAwardsForPEOMember2021-01-032022-01-01

0000700841rcmt:YearEndFairValueOfEquityAwardsGrantedDuringYearThatRemainedUnvestedAsOfLastDayOfYearForPEOMember2021-01-032022-01-01

0000700841rcmt:InclusionOfEquityValuesForPEOMember2022-01-022022-12-31

0000700841rcmt:ChangeInFairValueFromLastDayOfPriorYearToVestingDateOfUnvestedEquityAwardsThatVestedDuringYearForPEOMember2022-01-022022-12-31

0000700841rcmt:ChangeInFairValueFromLastDayOfPriorYearToLastDayOfYearOfUnvestedEquityAwardsForPEOMember2022-01-022022-12-31

0000700841rcmt:YearEndFairValueOfEquityAwardsGrantedDuringYearThatRemainedUnvestedAsOfLastDayOfYearForPEOMember2022-01-022022-12-31

00007008412020-01-032021-01-02

0000700841rcmt:AverageExclusionOfStockAwardsForNonPEONEOsMember2020-01-032021-01-02

00007008412021-01-032022-01-01

0000700841rcmt:AverageExclusionOfStockAwardsForNonPEONEOsMember2022-01-022022-12-31

0000700841rcmt:ExclusionOfStockAwardsForPEOMember2020-01-032021-01-02

0000700841rcmt:ExclusionOfStockAwardsForPEOMember2021-01-032022-01-01

0000700841rcmt:ExclusionOfStockAwardsForPEOMember2022-01-022022-12-31

xbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☒

|

Definitive Proxy Statement

|

|

☐

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material under §240.14a-12

|

|

RCM TECHNOLOGIES, INC.

|

|

(Name of Registrant as Specified In Its Charter)

|

| |

| |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Copies to:

Payment of Filing Fee (Check all boxes that apply):

|

☒

|

No fee required.

|

|

☐

|

Fee paid previously with preliminary materials

|

|

☐

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

|

|

RCM Technologies, Inc.

|

Tel: 856.356.4500

|

|

2500 McClellan Avenue

|

Fax: 856.356.4600

|

|

Pennsauken, NJ 08109

|

www.rcmt.com

|

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD DECEMBER 14, 2023

To Our Stockholders:

The RCM Technologies, Inc. 2023 Annual Meeting of Stockholders will be held on Thursday, December 14, 2023, at 4:00 p.m. Eastern time. As it has been over the past several years, this year’s annual meeting will be a virtual meeting via live webcast on the Internet. You will be able to attend, vote and submit your questions during the live webcast of the meeting by visiting https://web.lumiagm.com/204238937 and entering password: rcm2023.

The purposes of the meeting are to:

| |

1.

|

Elect four directors to hold office until the Annual Meeting of Stockholders to be held in 2024 and until their successors are duly elected and qualified;

|

| |

2.

|

Ratify our Audit Committee’s selection of WithumSmith+Brown, PC as our independent accountants for our fiscal year ending December 30, 2023;

|

| |

3.

|

Conduct an advisory vote to approve the compensation of our named executive officers for 2022; and

|

| |

4.

|

Transact such other business as may properly come before the meeting or any adjournment(s) of the meeting.

|

We have fixed October 18, 2023 as the record date for determining the stockholders entitled to vote at the meeting. You are not entitled to notice of, or to vote at, the meeting if you were not a stockholder of record at the close of business on that date.

You are cordially invited to attend the meeting (on a virtual basis, which will be the only means of attending this year’s meeting). Whether or not you expect to attend the meeting, please sign, date and promptly return the enclosed proxy to ensure that your shares will be represented at the meeting. The enclosed envelope requires no postage if mailed within the United States. Most of our stockholders hold their shares in “street name” through brokers, banks and other nominees and may choose to vote their shares by telephone instead of using the enclosed proxy card. If you wish to vote by telephone, please follow the instructions on your proxy card. If you attend the meeting, you may revoke your proxy and vote in person.

| |

By Order of the Board of Directors, |

| |

|

| |

Kevin D. Miller

Secretary |

Pennsauken, New Jersey

November 9, 2023

RCM TECHNOLOGIES, INC.

2500 McClellan Avenue

Suite 350

Pennsauken, New Jersey 08109

________________________________

PROXY STATEMENT

________________________________

ANNUAL MEETING OF STOCKHOLDERS

DECEMBER 14, 2023

About this Proxy Statement

Our Board of Directors is soliciting proxies to be used at our 2023 Annual Meeting of Stockholders. The meeting will be a virtual meeting on Thursday, December 14, 2023, at 4:00 p.m. Eastern time. This proxy statement, the notice of annual meeting and the form of proxy will be mailed to stockholders beginning on or about November 9, 2023.

VOTING PROCEDURES

Who Can Vote

Only RCM common stockholders at the close of business on the record date, October 18, 2023, may vote at the annual meeting. You are entitled to cast one vote for each share of RCM common stock that you owned as of the close of business on the record date. At the close of business on the record date, there were 7,860,638 shares of RCM common stock outstanding.

How You Can Vote

You can vote by:

| |

•

|

marking your proxy card, dating and signing it, and returning it in the postage-paid envelope we have provided,

|

| |

•

|

phoning in your vote using the information provided on your voting form, or

|

| |

•

|

attending the meeting and voting on line during the meeting; registered holders and beneficial owners with shares held in street name (held in the name of a broker or other nominee) may vote online at the meeting by visiting the following Internet website: https://web.lumiagm.com/204238937, entering password: rcm2023, and providing the 11-digit control number included in the notice of annual meeting, on their proxy card or on the instructions that accompanied the proxy materials. Beneficial owners with shares held in street name must obtain a legal proxy from their broker or other nominee to vote online at the meeting.

|

VOTING PROCEDURES (CONT’D)

How You Can Revoke Your Proxy or Change Your Vote

You can revoke your proxy at any time before it is voted at the meeting by:

| |

•

|

sending a written notice that you have revoked your proxy to our Secretary, Kevin D. Miller, at 2500 McClellan Avenue, Suite 350, Pennsauken, New Jersey 08109-4613,

|

| |

•

|

submitting a later-dated proxy card, or

|

| |

•

|

attending the meeting and voting on line in accordance with the process set forth above.

|

If a bank, broker or other holder of record holds your shares in its name, you must obtain a proxy card executed in your favor from the holder of record to be able to vote your shares at the meeting.

General Information on Voting

A quorum must exist for voting to take place at the meeting. A quorum exists if holders of a majority of the outstanding shares of our common stock are present at the meeting in person or are represented by proxy at the meeting.

Director nominees are elected by a majority vote, meaning that a nominee for director is elected only if he or she receives the affirmative vote of a majority of the total votes cast for and against such nominee. All other matters to be voted upon at the meeting must be approved by a majority of the votes cast on those matters.

Shares represented by a proxy marked “abstain” on any matter will be considered present at the meeting for purposes of determining whether there is a quorum but will not be considered as votes cast on that matter. Shares represented by a proxy as to which there is a “broker non-vote” (that is, where a broker holding your shares in “street” or “nominee” name indicates to us on a proxy that you have given the broker the discretionary authority to vote your shares on some but not all matters), will be considered present at the meeting for purposes of determining a quorum but will not be considered as votes cast on matters as to which there is a “broker non-vote.” Abstentions and “broker non-votes” will therefore have no effect on the outcome of any vote taken at the meeting.

Shares that have been properly voted and not revoked will be voted at the meeting in accordance with the instructions on your proxy card. If you sign your proxy card but do not mark your choices, Bradley S. Vizi or Kevin D. Miller, the persons named on the enclosed proxy card, will vote the shares represented by your proxy card:

| |

●

|

FOR the persons we nominated for election as directors (Proposal No. 1);

|

| |

●

|

FOR the ratification of our Audit Committee’s selection of WithumSmith+Brown, PC as our independent accountants for our fiscal year ending December 30, 2023 (Proposal No. 2); and

|

| |

●

|

FOR approval of an advisory resolution approving the compensation of our named executive officers for 2022 (Proposal No. 3).

|

If any other matters are properly presented at the meeting for consideration, Mr. Vizi and Mr. Miller will have the discretion to vote on those matters for you. Currently, we are not aware of any such matters.

Costs of Solicitation

We will pay for preparing, assembling and mailing this proxy statement. Our directors, officers and employees may solicit proxies through the mail, direct communication or otherwise. None of our directors, officers or employees will receive additional compensation for soliciting proxies. We may reimburse brokerage firms and other custodians, nominees or fiduciaries for their reasonable expenses for forwarding proxy and solicitation materials to stockholders.

Instructions to Attend the Meeting

Record Holders: If you were a holder of record of common stock of RCM at the close of business on October 18, 2023 (i.e. your shares are held in your own name in the records of RCM’s transfer agent, Equiniti Trust Company, LLC (“Equiniti”), you can attend the meeting by visiting https://web.lumiagm.com/204238937 and entering the 11-digit control number previously provided to you in your proxy materials. The password for the virtual meeting is rcm2023. If you are a shareholder of record and you have misplaced your 11-digit control number, please call Equiniti at (877) 773-6772.

Beneficial Owners: If you were a beneficial owner of common stock of RCM at the close of business on October 18, 2023 (i.e. you hold your shares in “street name” through an intermediary, such as a bank, broker or other nominee), you must register in advance in order to attend the meeting. To register, please obtain a legal proxy from the bank, broker or other nominee that is the record holder of your shares and then submit the legal proxy, along with your name and email address, to Equiniti to receive an 11-digit control number that may be used to access the virtual meeting site provided above. Any control number that was previously provided with your proxy materials, likely a 16-digit number, will not provide access to the virtual meeting site. Requests for registration and submission of legal proxies should be labeled as “Legal Proxy” and must be received by Equiniti no later than 5 p.m., Eastern Time, on December 9, 2023. All such requests should be submitted (1) by email to proxy@equiniti.com, (2) by facsimile to (718) 765-8730 or (3) by mail to Equiniti Trust Company, LLC, Attn: Proxy Tabulation Department, 6201 15th Avenue, Brooklyn, NY 11219. Obtaining a legal proxy may take several days and shareholders are advised to register as far in advance as possible. Once you have obtained your 11-digit control number from Equiniti, please follow the steps set forth above for shareholders of record to attend the meeting.

Attending the Meeting as a Guest: Guests may attend the meeting in “listen-only” mode by visiting https://web.lumiagm.com/204238937 and entering the information requested in the “Guest Login” section. Guests will not have the ability to vote or ask questions at the meeting.

Important Notice Regarding the Availability of

Proxy Materials for the Annual Meeting of Stockholders to be Held on December 14, 2023

This proxy statement and our 2022 annual report to stockholders are available at

http://www.astproxyportal.com/ast/08117/

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS,

DIRECTORS AND MANAGEMENT

Security Ownership of Certain Beneficial Owners

The following table lists the persons we know to be beneficial owners of at least five percent of our common stock as of October 27, 2023.

|

Name and Address of Beneficial Owner

|

|

Number

of Shares

|

|

|

Approximate

Percentage

of Outstanding

Common Stock(1)

|

|

| |

|

|

|

|

|

|

|

|

|

Renaissance Technologies LLC(2)

|

|

|

645,973 |

|

|

|

8.2 |

% |

|

800 Third Avenue

|

|

|

|

|

|

|

|

|

|

New York, NY 10022

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Ben Andrews(3)

|

|

|

530,048 |

|

|

|

6.7 |

% |

|

P. O. Box 357303

|

|

|

|

|

|

|

|

|

|

Gainesville, FL 32635

|

|

|

|

|

|

|

|

|

|

(1)

|

Based on 7,846,353 shares outstanding as of October 27, 2023.

|

| |

|

|

(2)

|

Based on Amendment No. 5 to Schedule 13G filed with the Commission on February 13, 2023. The filing states that Renaissance Technologies LLC has sole voting power over 545,773 shares and sole dispositive power over 645,973 shares.

|

| |

|

|

(3)

|

Based on the Schedule 13G filed with the Commission on May 15, 2023. The filing states that Mr. Andrews exercises sole voting and dispositive power over all such shares.

|

Security Ownership of Management

The following table lists the number of shares of our common stock beneficially owned, as of October 27, 2023, by each director and director nominee, each of our executive officers, certain members of our senior management, and by our directors and executive officers as a group. In general, beneficial ownership includes those shares a person has the power to vote or transfer, as well as shares owned by immediate family members who live with that person.

|

Name

|

|

Number

of Shares

|

|

|

Approximate

Percentage

of Outstanding

Common Stock(1)

|

|

|

Bradley S. Vizi

|

|

|

1,700,000 |

|

|

|

21.6 |

% |

| |

|

|

|

|

|

|

|

|

|

Chigozie O. Amadi(2)

|

|

|

9,607 |

|

|

|

* |

|

| |

|

|

|

|

|

|

|

|

|

Richard A. Genovese(2)

|

|

|

12,082 |

|

|

|

* |

|

| |

|

|

|

|

|

|

|

|

|

Swarna Srinivas Kakodkar(2)

|

|

|

52,927 |

|

|

|

* |

|

| |

|

|

|

|

|

|

|

|

|

Jayanth S. Komarneni(2)

|

|

|

57,819 |

|

|

|

* |

|

| |

|

|

|

|

|

|

|

|

|

Kevin D. Miller

|

|

|

580,387 |

|

|

|

7.4 |

% |

| |

|

|

|

|

|

|

|

|

|

Michael Saks

|

|

|

125,236 |

|

|

|

1.6 |

% |

| |

|

|

|

|

|

|

|

|

|

All directors and executive officers as a group (7 persons)(3)

|

|

|

2,538,058 |

|

|

|

32.3 |

% |

__________

|

*

|

Represents less than one percent of our outstanding common stock.

|

|

(1)

|

Based on 7,846,353 shares outstanding as of October 27, 2023.

|

| |

|

|

(2)

|

Includes 3,107 shares that will vest on December 15, 2023.

|

| |

|

|

(3)

|

Includes 12,428 shares that will vest on December 15, 2023.

|

PROPOSAL 1

___________________________

ELECTION OF DIRECTORS

Stockholders are being asked to elect four (4) directors at the Annual Meeting, each to serve until his or her successor is duly elected at the 2024 annual meeting and qualified. Your Board has nominated for election as director Bradley S. Vizi, Chigozie O. Amadi, Swarna Srinivas Kakodkar and Jayanth S. Komarneni. One of our current directors, Richard A. Genovese, who has served as a member of the Board of Directors since 2018, will not stand for reelection following the completion of his term at the Annual Meeting.

Ms. Srinivas Kakodkar and Messrs. Vizi, Amadi and Komarneni have consented to serve a term on our Board of Directors, and the persons named as proxy holders on the enclosed proxy card, Mr. Vizi and Mr. Miller, intend to vote FOR the election of Ms. Srinivas Kakodkar and Messrs. Vizi, Amadi and Komarneni unless you mark a contrary instruction on your proxy card. Unless you indicate otherwise on your proxy card, if any of Ms. Srinivas Kakodkar or Messrs. Vizi, Amadi and Komarneni is unable to serve as a director at the time of the Annual Meeting, Mr. Vizi or Mr. Miller will vote FOR the election of another person that the Board may nominate in their place.

Set forth below are brief descriptions of the nominees for election as director and of the continuing directors. The descriptions for the directors set forth the experience, qualifications, attributes and skills that have led the Board’s Nominating & Corporate Governance Committee and the Board to conclude that these individuals should serve as directors.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE ELECTION OF BRADLEY S. VIZI, CHIGOZIE O. AMADI, SWARNA SRINIVAS KAKODKAR AND JAYANTH S. KOMARNENI AS MEMBERS OF OUR BOARD OF DIRECTORS.

Nominees for Election as Directors

Bradley S. Vizi, Director since 2013, age 39

Mr. Vizi has served as our Executive Chairman & President since June 2018. Previously Mr. Vizi served as our Chairman of the Board since September 2015 and a board member since December 2013. From February 2016 to June 2022, Mr. Vizi served as a member of the Board of Directors at L.B. Foster (NASDAQ: FSTR), a leading manufacturer, fabricator, and distributor of products and services for the rail, construction, energy and utility markets with locations in North America and Europe. Mr. Vizi founded Legion Partners, Inc. in 2010 and Legion Partners Asset Management, LLC in 2012, where he served as Managing Director and Portfolio Manager until October 2017. From 2007 to 2010, Mr. Vizi was an investment professional at Shamrock Capital Advisors, Inc. (“Shamrock”), the alternative investment vehicle of the Disney Family. Prior to Shamrock, from 2006 to 2007, Mr. Vizi was an investment professional with the private equity group at Kayne Anderson Capital Advisors L.P. Mr. Vizi is a CFA Charterholder and graduated from the Wharton School at the University of Pennsylvania.

Mr. Vizi’s significant public company experience is particularly valuable in the areas of strategy, operations, capital allocation, compensation planning, corporate governance and marketing the Company to the investment community.

Nominees for Election as Directors (Continued)

Chigozie O. Amadi, Director since 2022, age 39

Mr. Amadi has served since October 2019 as the Chief Financial Officer for The Siegel Group, a conglomerate of private companies focusing on investments and management of real estate and food and beverage businesses. Mr. Amadi leads the departments of accounting, finance, payroll, acquisitions, and dispositions. Before his current role, Mr. Amadi previously served as Director of Real Estate Investments for The Siegel Group. Mr. Amadi also worked for Wells Fargo & Company, providing secured and unsecured financing to REITs and private real estate firms. Mr. Amadi holds a J.D. from Loyola Law School and a B.A. from the University of Pennsylvania and is an active member of the California Bar.

Mr. Amadi’s extensive experience overseeing the preparation and aggregation of the financial performance of multiple companies, in addition to supervising the audits and financial professionals responsible for those audits, and his legal acumen, allow him to make valuable contributions to all of the Company’s business segments.

Swarna Srinivas Kakodkar, Director since 2019, age 40

Ms. Kakodkar is a seasoned technology executive with over 15 years of experience building organizations that develop high-impact software to serve enterprises, developers, and consumers. Ms. Kakodkar currently leads a product management organization at Google. She previously led product and technical teams at Amazon Web Services, where she launched services that have touched millions of users. Prior to that, she held various roles at Facebook, where she oversaw the development of digital advertising products and global partnerships with some of Facebook’s largest customers. Prior to joining Facebook, Ms. Kakodkar worked at AOL Platforms, where she developed capital allocation strategies, managed M&A activity, and built technology partnership programs. She chairs our Compensation Committee, serves on our Audit Committee, and serves on our Nominating/Governance Committee. She holds an MBA from Harvard Business School and a B.A. from Harvard College.

Ms. Kakodkar’s extensive experience in digital marketing, financial modeling, enterprise software, implementation of new technologies, and management and retention of diverse employee groups, allow her to make valuable contributions to all of the Company’s business segments.

Nominees for Election as Directors (Continued)

Jayanth S. Komarneni, Director since 2020, age 40

Mr. Komarneni is the founder and chair of the Human Diagnosis Project (‘Human Dx’), an open medical intelligence system. Human Dx has brought together top medical organizations (including the American Medical Association, the American Board of Medical Specialties, and the National Association of Community Health Centers), health systems (including research collaborations with Harvard, Johns Hopkins, UCSF, Stanford, and Kaiser Permanente), and financial supporters (including the European Union, the MacArthur Foundation, the Gordon & Betty Moore Foundation, Union Square Ventures, and Andreessen Horowitz). Before founding Human Dx, Mr. Komarneni advised leadership at some of the world's preeminent organizations while working at McKinsey & Company and Bain & Company. Mr. Komarneni's work spanned stakeholders in the social, public, and private sectors, including foundations, governments, companies (in the life sciences, health care, technology, energy, and financial services industries), and alternative investment firms. After McKinsey and Bain, he helped launch and operate Greenoaks Capital Management, a global alternative investment firm, as its first employee. Mr. Komarneni also participated in Y Combinator, the world's leading technology accelerator. Mr. Komarneni has degrees that include an MSc in Global Health Science from the University of Oxford and an MBA from the Wharton School, and an M.S. in Biotechnology from the School of Engineering and Applied Science at the University of Pennsylvania.

Mr. Komarneni's prior background founding, advising, and working at leading organizations in the technology, healthcare, investment, professional services, and life sciences industries helps contribute across RCM's diverse business segments from strategic and operational perspectives.

OUR EXECUTIVE OFFICERS

The following table lists our executive officers. Our Board elects our executive officers annually for terms of one year and may remove any of our executive officers with or without cause.

|

Name

|

Age

|

Position

|

|

Bradley S. Vizi

|

39

|

Executive Chairman & President

|

|

Kevin D. Miller

|

57

|

Chief Financial Officer, Treasurer and Secretary

|

|

Michael Saks

|

67

|

Division President, Health Care Services

|

Bradley S. Vizi. See above.

Kevin D. Miller has served as our Chief Financial Officer, Secretary and Treasurer since October 2008. From July 1997 until September 2008, he was Senior Vice President of RCM. From 1996 until July 1997, Mr. Miller served as an Associate in the corporate finance department of Legg Mason Wood Walker, Incorporated. From 1995 to 1996, Mr. Miller was a business consultant for the Wharton Small Business Development Center. Mr. Miller previously served as a member of both the audit and corporate finance groups at Ernst & Young LLP. Mr. Miller has a Bachelor of Science in Accounting from The University of Delaware and a Masters in Business Administration with a concentration in Finance from the Wharton School at The University of Pennsylvania.

Michael Saks has served as our Division President of Health Care Services since June 2018. From May 2007 to June 2018 he was the Senior Vice President and General Manager of our Health Care Services Division. From January 1994 until May 2007 he was the Vice President and GM of our Health Care Services Division. Prior to joining RCM, Mr. Saks served as a corporate executive at MS Executive Resources, MA Management and Group 4 Executive Search. Mr. Saks has over 31 years of executive management, sales and recruiting experience. Mr. Saks has a Bachelor of Science in Accounting and Finance from Fairleigh Dickinson University.

EXECUTIVE COMPENSATION

The Compensation Committee of the Board has responsibility for establishing, implementing and continually monitoring adherence with the Company’s compensation philosophy. The Compensation Committee seeks to ensure that the total compensation paid to the executives is fair, reasonable and competitive. Generally, the types of compensation and benefits provided to our executives, including the named executive officers, are similar to those provided to other executive officers. Our named executive officers for the year ended December 31, 2022 (fiscal 2022) are Messrs. Vizi, Saks and Miller, as well as Frank Petraglia, who served as an executive officer of our company until leaving the Company on June 30, 2022, and is included as a named executive officer for fiscal 2022 in accordance with Item 402(a)(3)(iv) of Regulation S-K.

In addition to referring herein to fiscal 2022, we also refer to our fiscal years ended January 1, 2022 (fiscal 2021) and January 2, 2021 (fiscal 2020).

As part of our ongoing effort to better align our leadership, corporate governance structure and compensation methodologies with the interests and perspectives of our stockholders, members of our Board of Directors and management team periodically speak with many of our more significant stockholders. Mindful of the input of these stockholders and motivated by our commitment to the implementation of best practices in corporate governance and compensation, the Compensation Committee and our Board have undertaken over the last several years a series of efforts with respect to compensation reform, including the following steps:

| |

●

|

Limiting executive severance cash pay-outs to no more than 24 months’ base salary and bonus;

|

| |

●

|

Prohibiting tax gross-ups in all future employment agreements;

|

| |

●

|

Requiring future employment agreements to contain a “double trigger” with respect to executive change-in-control payments;

|

| |

●

|

Adopting an incentive payment claw back policy for named executive officers; and

|

| |

●

|

Developed the conceptual framework for a long term incentive plan containing performance-based stock units for the Company’s Chief Executive Officer and Chief Financial Officer.

|

In March 2023, the Compensation Committee awarded Messrs. Miller and Saks cash amounts of $255,000 and $345,000, respectively, per specific incentive targets in compensation plans approved by the Compensation Committee in fiscal 2022. On the date of such award, Mr. Saks elected, with the approval of the Compensation Committee, to receive $25,000 of this amount in the form of immediately vested shares of common stock, with the number of shares determined based on the closing price of the common stock on the Nasdaq Stock Market on such date. These cash payments and stock awards are reflected in the Summary Compensation Table as compensation for fiscal 2022, in accordance with applicable regulations of the Commission.

In December 2022, the Compensation Committee approved a performance-based grant of a target amount of 100,000 performance stock units (“PSUs”) to Mr. Vizi that based on certain performance metrics for our fiscal year ending December 30, 2023 could increase to 125,000 PSUs. In accordance with applicable regulations of the Commission, the value of these performance-based shares, based on the grant date share price, is included in the Summary Compensation Table for fiscal year 2022, since the grant date occurred during that year, However, this award will be earned based on performance during the current fiscal year ending December 30, 2023, and will serve as the sole long-term incentive award to Mr. Vizi with respect to performance during such period.

EXECUTIVE COMPENSATION (CONT’D)

In March 2022, the Compensation Committee awarded Messrs. Saks and Miller cash amounts of $240,000 and $225,000, respectively, per specific incentive targets in compensation plans approved by the Compensation Committee in fiscal 2021. These cash payments are reflected in the Summary Compensation Table as compensation for fiscal 2021, in accordance with applicable regulations of the Commission.

In January 2022, the Compensation Committee approved a performance-based grant of a target amount of 100,000 performance stock units (“PSUs”) to Mr. Vizi that based on certain performance metrics for fiscal 2022 could increase to 125,000 PSUs. In January 2023, the Compensation Committee awarded 125,000 shares under this grant. The value of these performance-based shares, based on the grant date share price and reflecting the 125,000 shares ultimately awarded, is $0.8 million and is included in the Summary Compensation Table for fiscal year 2022, the year in which the grant date occurred.

In March 2021, the Compensation Committee approved a performance-based grant of a target amount of 90,000 performance stock units (“PSUs”) to Mr. Vizi that based on certain performance metrics for fiscal year 2021 could increase to 125,000 PSUs. In January 2022, under the March 2021 performance-based grant, the Compensation Committee awarded 125,000 shares. The value of these performance-based shares, based on the grant date share price, is $407,500 and is included in the Summary Compensation Table as compensation for fiscal 2021, the year in which the grant date occurred.

In January 2021, the Compensation Committee awarded Mr. Vizi 125,000 shares of our common stock in recognition of various qualitative and financial accomplishments in fiscal 2020. While this grant was made in recognition of his service in 2020, in accordance with applicable regulations of the Commission, its value is included in the Summary Compensation Table with respect to fiscal 2021, since the grant date of the award occurred after that fiscal year. As such, its grant date fair value of $271,250 appears in the Summary Compensation Table as compensation for fiscal 2021, the year in which the grant date occurred.

In January 2020, the Compensation Committee granted to Mr. Vizi a total of 150,000 restricted stock units (RSUs), which become vested in three (3) equal annual installments of 50,000 RSUs on each anniversary of the date of grant, so long as Mr. Vizi remains continuously employed by the Company through such vesting dates, provided that vesting would be accelerated if his employment terminates before such vesting dates on account of death, disability or a covered termination following a change in control. The value of the January 2020 grant, based on the grant date share price, is $423,000 and is included in the Summary Compensation Table as compensation for fiscal 2020, the year in which the grant date occurred.

EXECUTIVE COMPENSATION (CONT’D)

Summary Compensation Table

The following table lists, for fiscal 2022, fiscal 2021 and fiscal 2020, cash and other compensation paid to, or accrued by us, for our chief executive officer, our chief financial officer and our other executive officer serving as of December 31, 2022, as well as a former executive officer who left the Company on June 30, 2022, and is included in this table in accordance with Item 402(a)(3)(iv) of Regulation S-K.

|

Name and

Principal Position

|

Year

|

|

Salary

|

|

|

Bonus

|

|

|

Stock

Awards(1)

|

|

|

Non-Equity

Incentive Plan

Compensation

|

|

|

All Other

Compensation(2)

|

|

|

Total

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bradley S. Vizi

|

2022

|

|

$ |

475,000 |

|

|

$ |

- |

|

|

$ |

1,964,750 |

|

|

$ |

- |

|

|

$ |

6,450 |

|

|

$ |

2,446,200 |

|

|

Executive Chairman & President

|

2021

|

|

$ |

375,000 |

|

|

$ |

- |

|

|

$ |

678,750 |

|

|

$ |

- |

|

|

$ |

5,986 |

|

|

$ |

1,059,736 |

|

| |

2020

|

|

$ |

250,000 |

|

|

$ |

- |

|

|

$ |

423,000 |

|

|

$ |

- |

|

|

$ |

5,411 |

|

|

$ |

678,411 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Kevin Miller

|

2022

|

|

$ |

370,000 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

255,000 |

|

|

$ |

22,389 |

|

|

$ |

647,389 |

|

|

Chief Financial Officer

|

2021

|

|

$ |

370,000 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

225,000 |

|

|

$ |

21,613 |

|

|

$ |

616,613 |

|

| |

2020

|

|

$ |

370,000 |

|

|

$ |

75,000 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

17,682 |

|

|

$ |

462,682 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Michael Saks

|

2022

|

|

$ |

285,000 |

|

|

$ |

- |

|

|

$ |

70,900 |

|

|

$ |

345,000 |

(3) |

|

$ |

15,021 |

|

|

$ |

715,984 |

|

|

Division President,

|

2021

|

|

$ |

285,000 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

240,000 |

|

|

$ |

14,518 |

|

|

$ |

539,518 |

|

|

Health Care Services

|

2020

|

|

$ |

275,000 |

|

|

$ |

75,000 |

|

|

$ |

15,500 |

|

|

$ |

- |

|

|

$ |

11,960 |

|

|

$ |

377,460 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Frank Petraglia

|

2022

|

|

$ |

162,500 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

8,484 |

|

|

$ |

170,984 |

|

|

Former Division President,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Engineering Services

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

____________

|

(1)

|

With respect to Mr. Vizi, these amounts represent the following:

|

| |

a.

|

For 2022, the aggregate value of the award granted on January 25, 2022, with respect to performance during the fiscal 2022, and the award granted on December 27, 2022, with respect to performance during the current fiscal year ending December 30, 2023.

The value given to the fiscal award for fiscal 2022 is $768,750, which is the grant date fair value of the 125,000 shares determined in January 2023 by the Compensation Committee to have been earned with respect to this award.

The value given to the fiscal award for the current fiscal year ending December 30, 2023 is $1,196,000, which is the grant date fair value of the award assuming achievement at target. The grant date fair value of the award assuming achievement of the maximum performance level would be $1,495,000.

While both the January 25, 2022 and December 27, 2022 grants appear in the Summary Compensation Table for fiscal 2022 based on their grant dates both occurring during fiscal 2022, the award made on December 27, 2022 will be earned based on performance during the current fiscal year ending December 30, 2023, and will serve as the sole long-term incentive award to Mr. Vizi with respect to performance during such period.

|

| |

b.

|

For 2021, the aggregate value of the award granted in March 2021, which was earned with respect to performance for fiscal 2021, and the award granted on January 15, 2021, which was granted with respect to performance during fiscal 2020, but is shown in the Summary Compensation Table for fiscal 2021, since the grant date occurred during that year.

|

EXECUTIVE COMPENSATION (CONT’D)

Summary Compensation Table (Continued)

| |

c.

|

For 2020, the grant date fair value of the award of RSUs made in January 2020.

|

With respect to Mr. Saks, these amounts represent the following:

| |

a.

|

For 2022, the grant date fair value of the award of RSUs made in March 2022.

|

| |

b.

|

For 2020, the aggregate of the grant date fair values of awards of RSUs made in June 2020 and August 2020.

|

| |

(2)

|

These amounts primarily represent premiums paid for medical, life and disability insurance on each of the officers named in this table, as follows: 2022, Messrs. Vizi, Miller, Saks and Petraglia, $6,450, $21,139, $13,771 and $7,234, respectively; 2021, Messrs. Vizi, Miller and Saks, $5,986, $20,363 and $13,268, respectively; and 2020, Messrs. Vizi, Miller and Saks, $5,411, $17,682 and $11,960, respectively.

|

| |

(3)

|

On March 23, 2023, the date on which the Compensation Committee determined the amount of this award, Mr. Saks elected, with the approval of the Compensation Committee, to receive $25,000 of this amount in the form of immediately vested shares of Common Stock, with the number of shares determined based on the closing price of the common stock on the Nasdaq Stock Market on such date.

|

During our 2022, 2021 and 2020 fiscal years, certain of the officers named in this table received personal benefits not reflected in the amounts of their respective annual salaries or bonuses. The dollar amount of these benefits did not, for any individual in any fiscal year, exceed $10,000.

EXECUTIVE COMPENSATION (CONT’D)

Grants of Plan-Based Awards

The following table summarizes each grant of an award made to Named Executive Officers in 2022. These awards were made as discussed above in the “Compensation Discussion and Analysis” section. No other awards were made to the Named Executive Officers during 2022.

| |

|

|

|

|

|

Estimated Possible Payouts Under Non-

Equity Incentive Plan Awards

|

|

|

Estimated Future Payouts Under

Equity Incentive Plan Awards

|

|

|

All Other

Stock Awards:

Number of

|

|

|

Grant

Date Fair

Value of

Stock

and

|

|

|

Name

|

|

Grant

Date

|

|

|

Threshold

($)

|

|

|

Target

($)

|

|

|

Maximum

($)

|

|

|

Threshold

(#)

|

|

|

Target

(#)

|

|

|

Maximum

(#)

|

|

|

Shares of

Stock (#)

|

|

|

Option

Awards ($)

|

|

|

Bradley S. Vizi

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PSUs(1)

|

|

1/25/2022

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

75,000 |

|

|

|

100,000 |

|

|

|

125,000 |

|

|

|

— |

|

|

$ |

768,750 |

|

|

PSUs(2)

|

|

12/27/2022

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

50,000 |

|

|

|

100,000 |

|

|

|

125,000 |

|

|

|

— |

|

|

$ |

1,196,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Kevin Miller

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annual Incentive Plan(3)

|

|

4/5/2022

|

|

|

$ |

30,000 |

|

|

$ |

150,000 |

|

|

$ |

315,000 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Michael Saks

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annual Incentive Plan(4)

|

|

4/5/2022

|

|

|

|

— |

|

|

$ |

85,000 |

|

|

$ |

345,000 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

RSUs(5)

|

|

2/28/2022

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

10,000 |

|

|

$ |

70,900 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Frank Petraglia

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annual Incentive Plan(6)

|

|

|

— |

|

|

|

— |

|

|

$ |

50,000 |

|

|

$ |

90,000 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

(1)

|

Consists of an award of a target amount of 100,000 performance stock units. The number of PSUs that will ultimately be earned and vested shall be determined as follows: 50% based on the level of achievement of established levels of EBITDA and 50% based on the level of achievement with respect to certain individual performance goals established by the Compensation Committee, both during a performance period beginning on January 2, 2022 and ending on December 31, 2022. With respect to both the EBITDA and individual performance goals, threshold, target and maximum levels of performance have been established, with the following number of PSUs to be earned with respect to each such level: threshold – 37,500; target – 50,000; maximum – 62,500. It was determined by the Compensation Committee in January 2023 that 125,000 shares were earned under this grant.

|

|

(2)

|

Consists of an award of a target amount of 100,000 performance stock units. The number of PSUs that will ultimately be earned and vested shall be determined as follows: 50% based on the level of achievement of established levels of EBITDA and 50% based on the level of achievement with respect to certain individual performance goals established by the Compensation Committee, both during a performance period beginning on January 1, 2023 and ending on December 30, 2023. With respect to both the EBITDA and individual performance goals, threshold, target and maximum levels of performance have been established, with the following number of PSUs to be earned with respect to each such level: threshold – 25,000; target – 50,000; maximum – 62,500.

|

|

(3)

|

Consists of an incentive award based 40% on the achievement of certain EBIT targets and 60% on the achievement of certain EBITDA targets, both during a performance period beginning on January 2, 2022 and ending on December 31, 2022.

|

|

(4)

|

Consists of an incentive award based on the achievement of certain net operating income targets with respect to the Company’s Healthcare business, both during a performance period beginning on January 2, 2022 and ending on December 31, 2022.

|

EXECUTIVE COMPENSATION (CONT’D)

Grants of Plan-Based Awards (Continued)

|

(5)

|

Consists of an award of time-based RSUs which will become vested on the fifth anniversary of the date of grant, so long as Mr. Saks remains continuously employed by the Company through such vesting date.

|

|

(6)

|

Consists of an incentive award based on the achievement of certain net operating income targets with respect to the Company’s Engineering business, both during a performance period beginning on January 2, 2022 and ending on December 31, 2022. Mr. Petraglia forfeited any amounts receivable pursuant to this award upon departing the Company in June 2022.

|

Outstanding Equity Awards at Fiscal Year-End

The following table sets forth information concerning unvested restricted share units as of December 31, 2022. No options to purchase common stock were outstanding on such date.

|

Name

|

|

Number of

Shares or

Units of

Stock

That Have

Not Vested

|

|

|

Market

Value of

Shares or

Units of

Stock

That Have

Not Vested(1)

|

|

|

Equity

Incentive

Plan Awards:

Number of

Unearned

Shares,

Units or

Other Rights

That Have

Not Vested(2)

|

|

|

Equity

Incentive

Plan Awards:

Market or

Payout Value

of Unearned

Shares,

Units or

Other Rights

That Have

Not Vested(1)

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bradley S. Vizi

|

|

|

225,000 |

|

|

$ |

2,776,500 |

|

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Michael Saks

|

|

|

20,000 |

|

|

$ |

246,800 |

|

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Kevin Miller

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Frank Petraglia

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

____________

| |

(1)

|

Calculated by multiplying the number of shares in the preceding column by $12.34, the closing price per share of the Company’s common stock on December 30, 2022, the last trading day of our last fiscal year.

|

| |

(2)

|

Mr. Vizi’s shares include 50,000 restricted stock units (RSUs) granted on January 16, 2020 which vested on January 16, 2023, 125,000 performance-based stock units (PSUs) granted in January 2022 which vested in January 2023 and 50,000 PSUs, the threshold amount of a grant made in December 2022 that will vest in January 2024, subject to the achievement of certain performance measures in fiscal 2023, and may be increased to up to 125,000 PSUs depending on the level of such achievement. Mr. Saks received 10,000 RSUs in August 2020 that will vest in August 2023 and 10,000 RSUs in February 2022 that will vest in February 2027.

|

EXECUTIVE COMPENSATION (CONT’D)

Stock Vested

The following table summarizes the vesting of restricted stock units and performance stock units for the Named Executive Officers during 2022. None of the Named Executive Officers exercised any stock options, SARs or other similar instruments during 2022.

|

Name

|

|

Number of Shares

Acquired on Vesting

|

|

|

Value Realized

on Vesting(1)

|

|

| |

|

|

|

|

|

|

|

|

|

Bradley S. Vizi

|

|

|

175,000 |

|

|

$ |

2,159,500 |

|

| |

|

|

|

|

|

|

|

|

|

Michael Saks

|

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

Kevin Miller

|

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

Frank Petraglia

|

|

|

- |

|

|

|

- |

|

____________

| |

(1)

|

Calculated by multiplying the number of shares acquired on vesting by $12.34, the closing price per share of the Company’s common stock on December 30, 2022, the last trading day of our last fiscal year.

|

Compensation of Directors

Our employee directors do not receive any compensation for serving on our Board or its committees, other than the compensation they receive for serving as employees of RCM.

Non-employee members of the Board received compensation in accordance with the following structure, which was approved by our Compensation Committee on, and implemented effective, January 1, 2018:

|

●

|

Annual cash retainer of $45,000, payable in equal monthly installments.

|

|

●

|

Annual equity grants of $45,000, in the form of RSUs with 1-year vesting feature (subject to acceleration upon Change in Control or separation from service in the same manner as the RSU grants made in December 2017), with delivery of the shares of common stock underlying to such RSUs to be made upon vesting; provided that, except for sales of shares in an amount no greater than required to generate an amount equal to the income tax on such shares, non-employee directors shall be required to retain shares delivered upon vesting unless, immediately following any such sale, such director would comply with the Company’s ownership guidelines.

|

|

●

|

Payment of the following additional annual retainers: Chairman of the Board (if independent) $25,000; Audit Committee chair $10,000; Compensation Committee chair $10,000; Nominating and Corporate Governance Committee chair $5,000.

|

|

●

|

No other committee fees, for service or for meetings.

|

EXECUTIVE COMPENSATION (CONT’D)

The following table lists cash and other compensation paid to, or accrued by us for, our Board of Directors for our fiscal year ended December 31, 2022.

Non-Employee Director Compensation Table

|

Name and

Principal Position

|

|

Fees

Earned

Or Paid

In Cash

|

|

|

Equity

Awards(1)

|

|

|

All Other

Compensation

|

|

|

Total

|

|

|

Roger H. Ballou(2)

|

|

$ |

70,000 |

|

|

$ |

45,000 |

|

|

|

- |

|

|

$ |

115,000 |

|

|

Chigozie O. Amadi

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Richard A. Genovese

|

|

$ |

55,000 |

|

|

$ |

45,000 |

|

|

|

- |

|

|

$ |

100,000 |

|

|

Swarna Srinivas Kakodkar

|

|

$ |

55,000 |

|

|

$ |

45,000 |

|

|

|

- |

|

|

$ |

100,000 |

|

|

Jayanth S. Komarneni

|

|

$ |

50,000 |

|

|

$ |

45,000 |

|

|

|

- |

|

|

$ |

95,000 |

|

| |

(1)

|

These amounts are based upon the grant date fair value of the option awards calculated in accordance with ASC Topic 718. The assumptions used in determining the amounts in the column are set forth in Note 11 to our consolidated financial statements in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 filed with the Commission. As of December 31, 2022, none of our non-employee directors has any unvested equity awards outstanding. On January 3, 2023, each of our non-employee directors serving on that date received a grant of 3,107 restricted stock units.

|

| |

(2)

|

Mr. Ballou left the Board at the end of his term at the Annual Meeting of Stockholders held in December 2022.

|

EXECUTIVE COMPENSATION (CONT’D)

Executive Severance Agreement and Change in Control Agreement

The Company is a party to an Executive Severance Agreement (the “Executive Severance Agreement”) with each of Bradley S. Vizi, the Company's Executive Chairman and President (dated as of June 1, 2018), and Kevin D. Miller, the Company’s Chief Financial Officer (dated as of February 28, 2014, as amended), which set forth the terms and conditions of certain payments to be made by the Company to the executive in the event, while employed by the Company, such executive experiences (a) a termination of employment unrelated to a “Change in Control” (as defined therein) or (b) there occurs a Change in Control and either (i) the executive’s employment is terminated for a reason related to the Change in Control or (ii) in the case of Mr. Miller, the executive remains continuously employed with the Company for a period of three months following the Change in Control.

Under the terms of the Executive Severance Agreement, if either (a) the executive is involuntarily terminated by the Company for any reason other than “Cause” (as defined therein), “Disability” (as defined therein) or death, or (b) the executive resigns for “Good Reason” (as defined therein), and, in each case, the termination is not a “Termination Related to a Change in Control” (as defined below), the executive will receive the following severance payments: (i) an amount equal to 1.5 times the sum of (a) the executive’s annual base salary as in effect immediately prior to the termination date (before taking into account any reduction that constitutes Good Reason) (“Annual Base Salary”) and (b) the highest annual bonus paid to the executive in any of the three fiscal years immediately preceding the executive’s termination date (“Bonus”), to be paid in installments over the twelve month period following the executive’s termination date; and (ii) for a period of eighteen months following the executive’s termination date, a monthly payment equal to the monthly COBRA premium that the executive is required to pay to continue medical, vision, and dental coverage, for himself and, where applicable, his spouse and eligible dependents.

Notwithstanding the above, if the executive has a termination as described above and can reasonably demonstrate that such termination would constitute a Termination Related to a Change in Control, and a Change in Control occurs within 120 days following the executive’s termination date, the executive will be entitled to receive the payments set forth below for a Termination Related to a Change in Control, less any amounts already paid to the executive, upon consummation of the Change in Control.

Under the terms of the Executive Severance Agreement, if a Change in Control occurs and (a) the executive experiences a Termination Related to a Change in Control on account of (i) an involuntary termination by the Company for any reason other than Cause, death, or Disability, (ii) an involuntary termination by the Company within a specified period of time following a Change in Control (12 months for Mr. Vizi and three months for Mr. Miller) on account of Disability or death, or (iii) a resignation by the executive with Good Reason; or (b) in the case of Mr. Miller, the executive resigns, with or without Good Reason, which results in a termination date that is the last day of the three month period following the Change in Control, then the executive will receive the following severance payments: (1) a lump sum payment equal to two times the sum of the executive’s (a) Annual Base Salary and (b) Bonus; and (2) a lump sum payment equal to 24 multiplied by the monthly COBRA premium cost, as in effect immediately prior to the executive’s termination date, for the executive to continue medical, dental and vision coverage, as applicable, in such Company plans for himself and, if applicable, his spouse and eligible dependents. Upon the occurrence of a Change in Control, the Company shall establish an irrevocable rabbi trust and contribute to the rabbi trust the applicable amounts due under the Executive Severance Agreement. If Mr. Miller receives the Change in Control Payment following his resignation at the end of the three month period following the Change in Control, he will not be eligible to receive any severance payments under his Executive Severance Agreement.

Executive Severance Agreement and Change in Control Agreement (Continued)

Mr. Saks, along with several other members of the Company’s senior management (not including Mr. Vizi and Mr. Miller), is covered by our Change in Control Plan for Selected Executive Management (the “CIC Plan”).

The CIC Plan sets forth the terms and conditions of severance and benefits to be provided to a covered employee in the event (a) the covered employee experiences a covered termination of employment after a “Potential Change in Control” (as defined in the CIC Plan), but prior to a “Change in Control” (as defined in the CIC Plan), and a Change in Control that relates to the Potential Change in Control occurs within the six month period following the covered employee’s termination, or (b) the covered employee is employed by the Company on the date of a Change in Control. The CIC Plan also sets forth the terms and conditions of severance payments to be made to a covered employee in the event such employee is employed on the date of a Change in Control and is subsequently terminated on account of a covered termination during his “Designated Severance Period” (a period specified by the Company for each covered employee that is measured from the date of an applicable Change in Control, which is 18 months for Mr. Saks.

Under the terms of the CIC Plan, if a covered employee is (a) employed on the date of a Potential Change in Control, (b) terminated by the Company for a reason other than “Cause” (as defined in the CIC Plan), death, or disability, and (c) a Change in Control to which the Potential Change in Control relates occurs within the six month period following the covered employee’s covered termination, the covered employee will receive, if the covered employee executes and does not revoke a release of claims, severance payments at the covered employee’s annual base salary rate in regular payroll installments for the duration of the covered employee’s Designated Severance Period. If the covered employee dies before receiving the entire amount that is owed, the remaining portion will be paid to the covered employee’s estate. Severance payments will be discontinued if it is determined that the covered employee has engaged in any actions constituting Cause.

Under the terms of the CIC Plan, if a covered employee is employed on the date of a Change in Control and the covered employee executes and does not revoke a release of claims:

| |

●

|

all outstanding Company equity-based awards granted to the covered employee prior to the date of the Change in Control will be immediately fully vested;

|

| |

●

|

the Compensation Committee may, in its sole discretion, determine that the covered employee will receive a pro-rated annual bonus if (a) the Committee determines that the Change in Control is an asset sale with respect to an entity in which the covered employee is associated, (b) the covered employee’s employment with the Company terminates in connection with such asset sale, and (c) the covered employee was eligible to participate in the Company’s annual bonus plan at the time of the Change in Control; any such pro-rated annual bonus will be determined based on the level of achievement under the annual bonus plan at the time of the Change in Control; and

|

| |

●

|

the Committee may, in its sole discretion, determine that the covered employee will receive a discretionary bonus upon a Change in Control.

|

Any bonuses paid under the CIC Plan upon a Change in Control will be paid in a single lump sum following the Change in Control.

Executive Severance Agreement and Change in Control Agreement (Continued)

Under the terms of the Plan, if a covered employee’s employment with the “Employer” (as defined in the CIC Plan) is terminated during the covered employee’s Designated Severance Period following the occurrence of a Change in Control (a) by the Employer for any reason other than Cause, death, or disability, or (b) by the covered employee for “Good Reason” (as defined in the CIC Plan), and the covered employee executes and does not revoke a release of claims, the Employer will continue to pay to the covered employee his annual base salary in regular payroll installments for the remainder of the covered employee’s Designated Severance Period. A covered employee is not eligible for severance benefits from the Company after a Change in Control if the Change in Control is an asset sale with respect to the covered employee and the successor to the Company offers the covered employee employment with a level of compensation and benefits that in the aggregate are at least as favorable as the level of the covered employee’s compensation and benefits with the Company prior to the Change in Control. If the covered employee dies before receiving the entire amount that is owed, the remaining portion will be paid to the covered employee’s estate. Severance payments will be discontinued if the Employer determines that the covered employee has engaged in any actions constituting Cause.

Based on the terms of the severance plans and treatment of equity awards for each upon termination of employment as outlined above, the table below illustrates the amounts that each named executive officer would receive in each of the potential termination scenarios. Mr. Petraglia is not included in the following table as he departed the Company during fiscal 2022 and did not receive any severance amounts.

|

Event and Amounts

|

|

Bradley

Vizi

|

|

|

Kevin

Miller

|

|

|

Michael

Saks

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Death or Disability

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash Severance

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

Time-Based Equity Awards

|

|

$ |

617,000 |

|

|

|

- |

|

|

$ |

246,800 |

|

|

Performance-Based Equity Awards

|

|

$ |

1,542,500 |

|

|

|

- |

|

|

|

- |

|

|

Continuation of Benefits

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

$ |

2,159,500 |

|

|

$ |

- |

|

|

$ |

246,800 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Involuntary Termination Without Cause

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash Severance

|

|

$ |

1,135,500 |

|

|

$ |

892,500 |

|

|

$ |

- |

|

|

Time-Based Equity Awards

|

|

|

- |

|

|

|

- |

|

|

$ |

123,400 |

|

|

Performance-Based Equity Awards

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Continuation of Benefits

|

|

$ |

15,495 |

|

|

$ |

53,327 |

|

|

$ |

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

$ |

1,150,995 |

|

|

$ |

945,827 |

|

|

$ |

123,400 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Change In Control

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash Severance

|

|

$ |

1,796,000 |

|

|

$ |

1,190,000 |

|

|

$ |

427,500 |

|

|

Time-Based Equity Awards

|

|

$ |

617,000 |

|

|

|

- |

|

|

$ |

246,800 |

|

|

Performance-Based Equity Awards

|

|

$ |

1,542,500 |

|

|

|

- |

|

|

|

- |

|

|

Continuation of Benefits

|

|

$ |

20,660 |

|

|

$ |

71,103 |

|

|

$ |

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

$ |

3,976,160 |

|

|

$ |

1,261,103 |

|

|

$ |

674,300 |

|

Pay Versus Performance

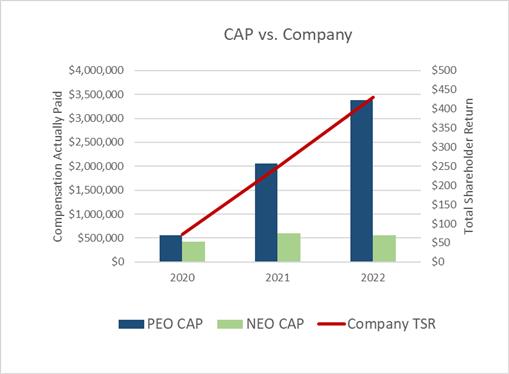

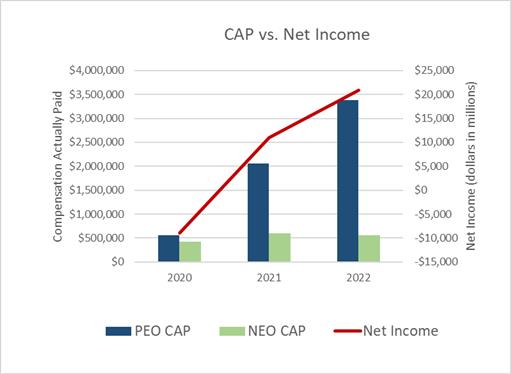

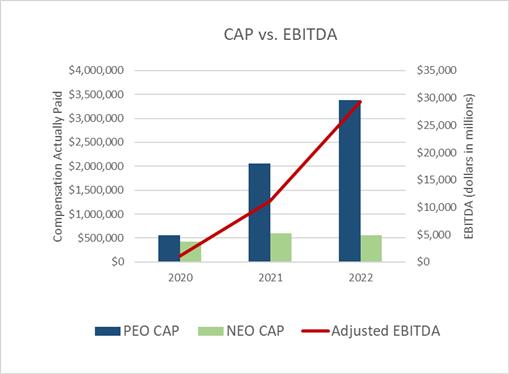

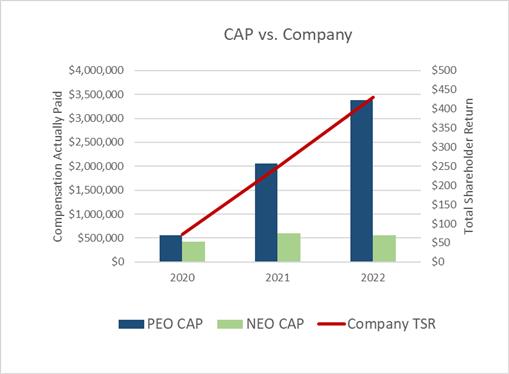

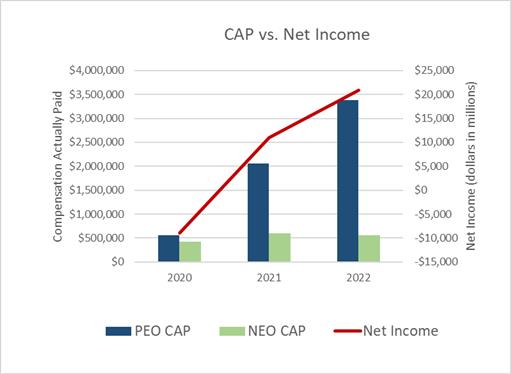

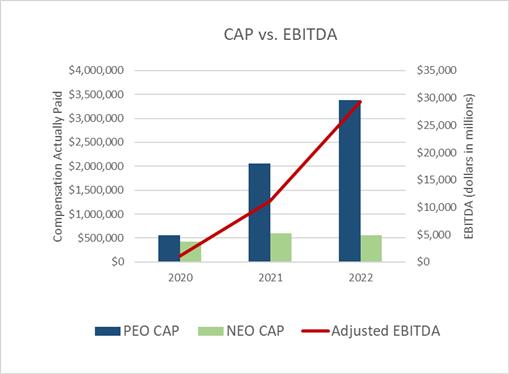

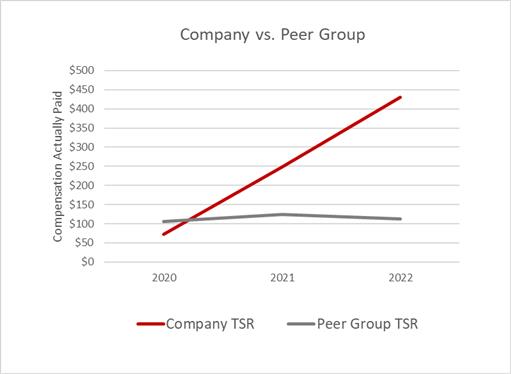

In accordance with rules adopted by the Securities and Exchange Commission pursuant to the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, we provide the following disclosure regarding executive compensation for our principal executive officer (“PEO”) and Non-PEO NEOs and Company performance for the fiscal years listed below. The Compensation Committee did not consider the pay versus performance disclosure below in making its pay decisions for any of the years shown.

| |

|

Summary Compensation |

|

|

Compensation |

|

|

Average

Summary

Compensation

|

|

|

Average

Compensation

Actually

|

|

|

Value of Initial Fixed |

|

|

|

|

|

|

|

|

|

| Year |

|

Table

Total

for PEO¹

($)

|

|

|

Actually

Paid to

PEO¹˒²˒³

($)

|

|

|

Table Total

for Non-PEO

NEOs1

($)

|

|

|

Paid to

Non-PEO

NEOs1,2,3

($)

|

|

|

TSR

($)

|

|

|

Peer

Group

TSR

($)

|

|

|

Net

Income

($ Millions)

|

|

|

Adjusted

EBITDA⁵

($ Millions)

|

|

|

(a)

|

|

(b)

|

|

|

(c)

|

|

|

(d)

|

|

|

(e)

|

|

|

(f)

|

|

|

(g)

|

|

|

(h)

|

|

|

(i)

|

|

|

2022

|

|

$ |

2,446,200 |

|

|

$ |

3,379,700 |

|

|

$ |

511,452 |

|

|

$ |

557,152 |

|

|

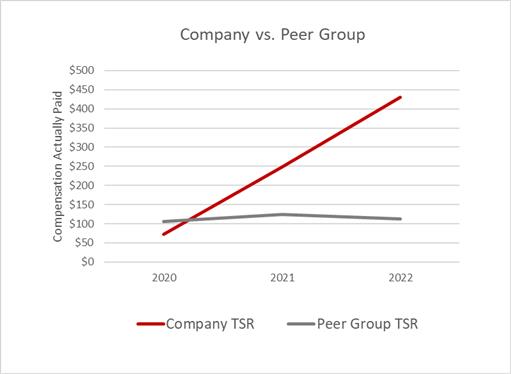

$ |

429.97 |

|

|

$ |

113.00 |

|

|

$ |

20,884 |

|

|

$ |

29,257 |

|

|

2021

|

|

$ |

1,059,736 |

|

|

$ |

2,052,236 |

|

|