RCM Technologies, Inc. (NasdaqGM: RCMT), a premier provider of

business and technology solutions designed to enhance and maximize

the operational performance of its customers through the adaptation

and deployment of advanced engineering, specialty health care, and

information technology services, today announced financial results

for the thirteen weeks ended March 30, 2024.

RCM Technologies reported revenue of $71.9 million

for the thirteen weeks ended March 30, 2024 (the current quarter),

an increase of 7.2% compared to $67.1 million for the thirteen

weeks ended April 1, 2023 (the comparable prior quarter). Gross

profit was $20.4 million for the current quarter, a 7.1% increase

compared to $19.0 million for the comparable prior quarter. The

Company experienced GAAP net income of $4.0 million, or $0.48 per

diluted share, for the current quarter compared to $3.8 million, or

$0.41 per diluted share, for the comparable prior quarter. The

Company experienced adjusted EBITDA (non-GAAP) of $6.8 million for

the current quarter compared to $6.1 million for the comparable

prior quarter. The Company experienced $0.53 of adjusted net income

per diluted share (non-GAAP) for the current quarter as compared to

$0.41 for the comparable prior quarter.

Bradley Vizi, Executive Chairman of RCM

Technologies, commented, “Our breadth of strategic focus is

widening and deepening throughout the organization, with all teams

executing on current initiatives while seeding new initiatives

designed to propel growth well into the future.”

Kevin Miller, Chief Financial Officer of RCM

Technologies, commented, “In the first quarter, adjusted EBITDA and

adjusted EPS increased 11.1% and 30.4%, respectively. Cash

conversion increased both sequentially and year over year. We

anticipate continued improvement in cash flow from operations in

each of the next two quarters.”

Conference Call On Thursday, May

9, 2024, RCM Technologies will host a conference call to discuss

these results. The call will begin at 11:30 a.m. Eastern Time. The

dial-in number is (800) 285-6670.

About RCM RCM

Technologies (NasdaqGM: RCMT) is a business and technology

solutions provider with world-class talent in key market segments.

We help design, build, and enable the Industries of Tomorrow,

Today. Operating at the intersection of resources, critical

infrastructure and modernization of industries through advanced

technologies, RCM is a provider of services in Health Care,

Engineering, Aerospace & Defense, Process & Industrial,

Life Sciences and Data & Solutions. www.rcmt.com.

The statements contained in this release that are

not purely historical are forward-looking statements within the

Private Securities Litigation Reform Act of 1995. They are subject

to various risks, uncertainties, and other factors that could cause

the Company’s actual results, performance, or achievements to

differ materially from those expressed or implied by such

forward-looking statements. These statements often include words

such as “may,” “will,” “expect,” “anticipate,” “continue,”

“estimate,” “project,” “intend,” “believe,” “plan,” “seek,”

“could,” “can,” “should,” “are confident” or similar expressions.

In addition, statements that are not historical should also be

considered forward-looking statements. These statements are based

on assumptions that we have made in light of our experience in the

industry, and our perceptions of historical trends, current

conditions, expected future developments, and other factors we

believe are appropriate in these circumstances. Forward-looking

statements include, but are not limited to, those relating to

demand for the Company’s services, expectations regarding our

future revenues and other financial results, such as cash flows,

our pipeline, and potential project wins, and our expectations for

investment and growth in our business. Such statements are based on

current expectations that involve several known and unknown risks,

uncertainties, and other factors, which may cause actual events to

be materially different from those expressed or implied by such

forward-looking statements. Risk, uncertainties, and other factors

may emerge from time to time that could cause the Company’s actual

results to differ from those indicated by the forward-looking

statements. Investors are directed to consider such risks,

uncertainties, and other factors described in documents filed by

the Company with the Securities and Exchange Commission, including

our most recent Annual Report on Form 10-K and subsequent Quarterly

Reports on Form 10-Q. The Company assumes no obligation (and

expressly disclaims any such obligation) to update any

forward-looking statements contained in this release as a result of

new information or future events or developments, except as may be

required by law.

Tables to Follow

RCM Technologies, Inc.

Condensed Consolidated Statements of Operations

(Unaudited) (In Thousands, Except Per

Share Amounts)

|

|

Thirteen Weeks Ended |

|

| |

March 30, 2024 |

|

April 1, 2023 |

|

| Revenue |

$71,939 |

|

$67,124 |

|

|

Cost of services |

|

51,572 |

|

|

48,100 |

|

| Gross

profit |

|

20,367 |

|

|

19,024 |

|

| Selling,

general and administrative |

|

14,199 |

|

|

13,396 |

|

| Depreciation

and amortization of property and equipment |

|

287 |

|

|

271 |

|

| Amortization

of acquired intangible assets |

|

45 |

|

|

45 |

|

| Gain on sale

of assets |

|

- |

|

|

(395 |

) |

| Operating

income |

|

5,836 |

|

|

5,707 |

|

| Other

expense, net |

|

426 |

|

|

407 |

|

| Income

before income taxes |

|

5,410 |

|

|

5,300 |

|

| Income tax

expense |

|

1,458 |

|

|

1,463 |

|

| Net

income |

$3,952 |

|

$3,837 |

|

| |

|

|

|

|

| Diluted net

earnings per share data |

$0.48 |

|

$0.41 |

|

| Diluted

weighted average shares outstanding |

|

8,170,839 |

|

|

9,401,867 |

|

RCM Technologies, Inc.

Supplemental Operating Results on a Non-GAAP Basis

(Unaudited) (In Thousands)

The following non-GAAP measures, which adjust for

the categories of expenses described below, are non-GAAP financial

measures. Our management believes that these non-GAAP financial

measures (“Adjusted operating income,” “EBITDA” and “Adjusted

EBITDA”) are useful information for investors, shareholders, and

other stakeholders of our Company in gauging our results of

operations on an ongoing basis and to enhance investors’ overall

understanding of our current financial performance and

period-to-period comparisons. Adjusted operating income, EBITDA and

Adjusted EBITDA should not be considered alternatives to net income

as an indicator of performance. In addition, Adjusted operating

income, EBITDA and Adjusted EBITDA do not take into account changes

in certain assets and liabilities and interest and income taxes

that can affect cash flows. We do not intend the presentation of

these non-GAAP measures to be considered in isolation or as a

substitute for results prepared in accordance with GAAP. These

non-GAAP measures should be read-only in conjunction with our

consolidated financial statements prepared in accordance with

GAAP.

The following unaudited table presents the

Company’s GAAP net income and the corresponding adjustments used to

calculate Adjusted operating income, EBITDA and Adjusted EBITDA for

the thirteen ended March 30, 2024 and April 1, 2023.

| |

Thirteen Weeks Ended |

|

| |

March 30, 2024 |

|

April 1, 2023 |

|

| GAAP

operating income |

$5,836 |

|

$5,707 |

|

|

Adjustments |

|

|

|

|

|

Gain on sale of assets |

|

- |

|

|

(395 |

) |

|

Equity compensation |

|

635 |

|

|

496 |

|

| Adjusted

operating income (non-GAAP) |

$6,471 |

|

$5,808 |

|

| |

|

|

|

|

| GAAP net

income |

$3,952 |

|

$3,837 |

|

| Income tax

expense |

|

1,458 |

|

|

1,463 |

|

| Interest

expense, net |

|

478 |

|

|

360 |

|

| Depreciation

of property and equipment |

|

287 |

|

|

271 |

|

| Amortization

of acquired intangible assets |

|

45 |

|

|

45 |

|

| EBITDA

(non-GAAP) |

$6,220 |

|

$5,976 |

|

| |

|

|

|

|

|

Adjustments |

|

|

|

|

|

Gain on sale of assets |

|

- |

|

|

(395 |

) |

|

(Gain) loss on foreign currency transactions |

|

(52 |

) |

|

47 |

|

|

Equity compensation |

|

635 |

|

|

496 |

|

| Adjusted

EBITDA (non-GAAP) |

$6,803 |

|

$6,124 |

|

RCM Technologies, Inc.

Supplemental Operating Results on a Non-GAAP Basis

(Continued) (Unaudited) (In

Thousands)

| |

Thirteen Weeks Ended |

|

| |

March 30, 2024 |

|

April 1, 2023 |

|

| GAAP net

income |

$3,952 |

|

$3,837 |

|

|

Adjustments |

|

|

|

|

|

Gain on sale of assets |

|

- |

|

|

(395 |

) |

|

(Gain) loss on foreign currency transactions |

|

(52 |

) |

|

47 |

|

|

Equity compensation |

|

635 |

|

|

496 |

|

|

Tax impact from normalized rate |

|

(174 |

) |

|

(136 |

) |

| Adjusted net

income (non-GAAP) |

$4,361 |

|

$3,849 |

|

| |

|

|

|

|

| GAAP diluted

net earnings per share |

$0.48 |

|

$0.41 |

|

|

Adjustments |

|

|

|

|

|

Gain on sale of assets |

|

- |

|

|

(0.04 |

) |

|

(Gain) loss on foreign currency transactions |

|

0.00 |

|

|

0.00 |

|

|

Equity compensation |

|

0.08 |

|

|

0.05 |

|

|

Tax impact from normalized rate |

|

(0.03 |

) |

|

(0.01 |

) |

| Adjusted

diluted net earnings per share (non-GAAP) |

$0.53 |

|

$0.41 |

|

RCM Technologies, Inc.

Summary of Selected Income Statement Data

(Unaudited) (In Thousands)

| |

Thirteen Weeks Ended March 30, 2024 |

|

| |

Specialty Health Care |

|

Engineering |

|

Life Sciences and IT |

|

Consolidated |

|

| |

|

|

|

|

|

|

|

|

| Revenue |

$38,182 |

|

$23,505 |

|

$10,252 |

|

$71,939 |

|

|

Cost of services |

|

27,108 |

|

|

18,003 |

|

|

6,461 |

|

|

51,572 |

|

| Gross

profit |

$11,074 |

|

$5,502 |

|

$3,791 |

|

$20,367 |

|

| Gross profit

margin |

|

29.0 |

% |

|

23.4 |

% |

|

37.0 |

% |

|

28.3 |

% |

| |

Thirteen Weeks Ended April 1, 2023 |

|

| |

Specialty Health Care |

|

Engineering |

|

Life Sciences and IT |

|

Consolidated |

|

| |

|

|

|

|

|

|

|

|

| Revenue |

$39,130 |

|

$18,490 |

|

$9,504 |

|

$67,124 |

|

|

Cost of services |

|

27,458 |

|

|

14,444 |

|

|

6,198 |

|

|

48,100 |

|

| Gross

profit |

$11,672 |

|

$4,046 |

|

$3,306 |

|

$19,024 |

|

| Gross profit

margin |

|

29.8 |

% |

|

21.9 |

% |

|

34.8 |

% |

|

28.3 |

% |

RCM Technologies, Inc.

Condensed Consolidated Balance Sheets

(Unaudited) (In Thousands, Except Share

Amounts)

|

|

March 30, |

|

December 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

|

(Unaudited) |

|

|

|

|

Current assets: |

|

|

|

|

| |

Cash and cash equivalents |

$2,099 |

|

$6,284 |

|

| |

Accounts receivable, net |

|

73,486 |

|

|

70,690 |

|

| |

Transit accounts receivable |

|

9,722 |

|

|

8,891 |

|

| |

Prepaid expenses and other current assets |

|

4,515 |

|

|

4,637 |

|

|

|

|

Total current assets |

|

89,822 |

|

|

90,502 |

|

| |

|

|

|

|

|

|

|

Property and equipment, net |

|

4,386 |

|

|

4,005 |

|

|

|

|

|

|

|

|

Deposits |

|

290 |

|

|

313 |

|

|

Deferred income taxes, foreign |

|

53 |

|

|

55 |

|

|

Goodwill |

|

22,147 |

|

|

22,147 |

|

|

Operating right of use asset |

|

3,147 |

|

|

2,779 |

|

|

Intangible assets, net |

|

638 |

|

|

683 |

|

| |

|

Total other

assets |

|

26,275 |

|

|

25,977 |

|

| |

|

|

|

|

|

|

| |

|

Total

assets |

$120,483 |

|

$120,484 |

|

|

Current liabilities: |

|

|

|

|

| |

Accounts payable and accrued expenses |

$13,596 |

|

$12,454 |

|

| |

Transit accounts payable |

|

31,715 |

|

|

31,102 |

|

| |

Accrued payroll and related costs |

|

12,174 |

|

|

11,203 |

|

| |

Finance lease payable |

|

116 |

|

|

233 |

|

| |

Income taxes payable |

|

778 |

|

|

330 |

|

| |

Operating right of use liability |

|

615 |

|

|

693 |

|

| |

Contingent consideration from acquisitions |

|

300 |

|

|

300 |

|

| |

Deferred revenue |

|

3,514 |

|

|

1,881 |

|

|

|

|

Total current liabilities |

|

62,808 |

|

|

58,196 |

|

|

|

|

|

|

|

|

Deferred income taxes, net, foreign |

|

185 |

|

|

187 |

|

|

Deferred income taxes, net, domestic |

|

1,619 |

|

|

1,568 |

|

|

Contingent consideration from acquisitions, net of current

position |

|

1,671 |

|

|

1,671 |

|

|

Operating right of use liability, net of current position |

|

2,644 |

|

|

2,268 |

|

|

Borrowings under line of credit |

|

22,159 |

|

|

30,804 |

|

|

|

Total

liabilities |

|

91,086 |

|

|

94,694 |

|

|

|

|

|

|

|

|

Contingencies (note 15) |

|

- |

|

|

- |

|

|

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

| |

Preferred stock, $1.00 par value; 5,000,000 shares authorized; |

|

|

|

|

| |

|

no shares

issued or outstanding |

|

- |

|

|

- |

|

| |

Common stock, $0.05 par value; 40,000,000 shares authorized; |

|

|

|

|

| |

|

17,775,693

shares issued and 7,947,087 shares outstanding at March 30, 2024

and 17,673,427 shares issued and 7,844,821 shares outstanding at

December 30, 2023 |

|

887 |

|

|

882 |

|

| |

Additional paid-in capital |

|

116,256 |

|

|

116,579 |

|

| |

Accumulated other comprehensive loss |

|

(2,840 |

) |

|

(2,813 |

) |

| |

Accumulated deficit |

|

(15,313 |

) |

|

(19,265 |

) |

| |

Treasury stock, 9,828,606 shares at March 30, 2024 and |

|

|

|

|

| |

December 30, 2023, at cost |

|

(69,593 |

) |

|

(69,593 |

) |

| |

|

Total

stockholders’ equity |

|

29,397 |

|

|

25,790 |

|

| |

|

|

|

|

|

|

| |

|

Total

liabilities and stockholders’ equity |

$120,483 |

|

$120,484 |

|

RCM Technologies, Inc.

Condensed Consolidated Statements of Cash Flows

(Unaudited) (In Thousands)

| |

Thirteen Weeks Ended |

|

| |

March 30, 2024 |

|

April 1, 2023 |

|

|

Net income |

$3,952 |

|

$3,837 |

|

|

Adjustments to reconcile net income to cash used in operating

activities |

|

1,250 |

|

|

703 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Accounts receivable |

|

(2,802 |

) |

|

(8,035 |

) |

| |

Prepaid

expenses and other current assets |

|

120 |

|

|

960 |

|

| |

Net of

transit accounts receivable and payable |

|

(219 |

) |

|

1,472 |

|

| |

Accounts

payable and accrued expenses |

|

1,345 |

|

|

(1,667 |

) |

| |

Accrued

payroll and related costs |

|

976 |

|

|

2,404 |

|

| |

Right of use

liabilities |

|

(304 |

) |

|

(348 |

) |

| |

Income taxes

payable |

|

451 |

|

|

141 |

|

| |

Deferred

revenue |

|

1,633 |

|

|

(310 |

) |

| |

Deposits |

|

24 |

|

|

11 |

|

|

Total adjustments |

|

2,474 |

|

|

(4,669 |

) |

|

Net cash provided by (used in) operating activities |

|

6,426 |

|

|

(832 |

) |

|

|

|

|

|

|

|

Net cash used in investing activities |

|

(669 |

) |

|

(332 |

) |

|

Net cash (used in) provided by financing activities |

|

(9,714 |

) |

|

2,416 |

|

|

Effect of exchange rate changes on cash and cash equivalents |

|

(228 |

) |

|

234 |

|

|

(Decrease) increase in cash and cash equivalents |

($ |

4,185 |

) |

$1,486 |

|

|

RCM Technologies, Inc. |

Tel: 856.356.4500 |

Corporate Contacts: |

| 2500

McClellan Avenue |

info@rcmt.com |

Bradley S. Vizi |

| Pennsauken,

NJ 08109 |

www.rcmt.com |

Executive

Chairman |

| |

|

Kevin D. Miller |

| |

|

Chief

Financial Officer |

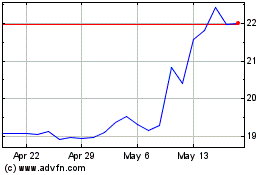

RCM Technologies (NASDAQ:RCMT)

Historical Stock Chart

From Apr 2024 to May 2024

RCM Technologies (NASDAQ:RCMT)

Historical Stock Chart

From May 2023 to May 2024