Radius Recycling, Inc. (NASDAQ: RDUS) (“Radius” or the “Company”)

today announced that it has entered into a definitive merger

agreement with Toyota Tsusho America, Inc. (“TAI”), a U.S.

subsidiary of Toyota Tsusho Corporation (8015.T) (“TTC”), under

which TAI will acquire all shares of Radius for $30.00 per share in

cash, representing an approximate 115% premium to Radius’ closing

share price on March 12, 2025, and an approximate 102% premium over

the 90-day volume-weighted average share price (VWAP). Upon

completion of the transaction, Radius will continue to operate from

its current headquarters in Portland, Oregon with its teams,

operating facilities, strategy, and brands retained.

The transaction brings together two companies dedicated to

advancing the circular economy by increasing recycling and reducing

waste across the industrial, manufacturing, and retail sectors.

For more than a century, Radius has supplied recycled materials

and products to customers in North America and around the world.

Over this time, the Company has expanded its platform to include

innovative metals recovery technologies, Third Party Recycling

(3PR™) services and solutions, Pick-N-Pull branded auto recycling

and used parts retail stores, and the Cascade electric arc furnace

and rolling mill in Oregon. TTC, an affiliate of the Toyota Group,

is a prominent Japanese trading company headquartered in Nagoya and

Tokyo with approximately $65 billion in global revenue and 70,000

employees worldwide. Like Radius, TTC is a proven leader in metals

and automotive recycling and has a successful track record of

acquisitions with meaningful investments in the growth and

employees of those companies. This transaction will provide Radius

with the opportunity to benefit from TTC’s financial strength,

recycling technology, and experience in providing recycling

services to the automotive sector.

“We are excited to have reached this agreement with TTC, which

builds on our longstanding relationship and provides us with

increased opportunities for our talented team, broader products and

services for our suppliers, customers and communities, and an

expanded platform for our more than 100 operating sites while

delivering significant immediate value to our shareholders,” said

Tamara L. Lundgren, Radius’ Chairman and Chief Executive Officer.

“Like Radius, TTC is a proven leader in metals and automotive

recycling services and solutions, and we look forward to enhancing

and expanding our offerings as part of their larger organization

while continuing to drive our strategy forward. I am grateful to

the entire Radius team, whose hard work and determination have

created a strong foundation for our Company, enabling us to embark

on this next chapter in our history with TTC.”

“We look forward to collaborating with Radius, whose position as

one of North America’s leading recycling companies aligns with our

efforts to holistically improve recycling across the supply chain,”

said Ichiro Kashitani, TTC’s President and Chief Executive Officer.

“Together, we will strengthen, amplify and grow Radius’ robust

networks and integrated operations, better positioning Radius to

meet the rapidly increasing demand to improve recycling rates and

value recovery and deliver long-term benefits to employees,

customers, suppliers, and communities.”

Accelerating Radius’ Strategic Priorities and Supporting

Our Stakeholders

- Increased Resources to Further Strategic

Priorities. With TTC’s financial support, Radius will have

a greater ability to invest in the continued development of its

metals recycling platform, Pick-N-Pull auto recycling business,

3PR™ recycling services and solutions, and Cascade electric arc

furnace and rolling mill. Radius will also benefit from TTC’s

recycling technologies that seek to increase the recovery of

ferrous and nonferrous metals and reduce material going to

landfills.

- Opportunity to Expand and Diversify Business.

Radius expects to benefit from TTC’s strong relationships with

automotive OEMs and Tier 1, 2, and 3 suppliers, enabling Radius to

expand its opportunities to partner with metals consumers. With a

further diversified customer base, Radius will have a more robust

operating platform from which to invest in its facilities, grow,

and provide enhanced products and services.

- Investment in Radius’ Operations. TTC

recognizes the importance of innovative, closed-loop solutions to

improving supply chains, manufacturing activity, and the

environment. TTC is committed to investing in the development of

Radius’ infrastructure and manufacturing capabilities across its

operating sites, with the goal of growing and diversifying Radius’

platform over the long-term.

- Commitment to Employees. TTC has a track

record of supporting its employees and is committed to protecting

and creating jobs within Radius. TTC’s high focus on ethics,

safety, and environmental stewardship are an excellent fit with

Radius’ culture of integrity and sustainability leadership. In

addition, TTC is committed to honoring collective bargaining

agreements and compensation and benefits programs for Radius

employees.

- Fostering Local Communities. Radius

headquarters will remain in Portland, Oregon, and TTC will preserve

Radius’ teams, brands, and legacy in local communities. TTC

recognizes Radius’ community engagement, including the advancement

of local workforce development, promotion of environmental

stewardship, support for public safety programs, and service as a

critical partner during disaster recovery activities.

- Meaningful Value for Shareholders. The $30.00

per share cash purchase price represents an approximate 115%

premium to Radius’ closing share price on March 12, 2025, and an

approximate 102% premium over the VWAP of Radius common stock for

the 90 days ending March 12, 2025. The implied total enterprise

value of the transaction, including net debt, is approximately

$1.34 billion.

Approvals and Timing

The transaction is expected to close in the second half of

calendar year 2025, subject to approval by Radius’ shareholders,

regulatory approvals, and other customary closing conditions.

Advisors

Goldman Sachs & Co. LLC is serving as lead financial

advisor, J.P. Morgan Securities LLC is serving as co-advisor, and

Simpson Thacher & Bartlett LLP is serving as legal counsel to

Radius. Mizuho Securities Co., Ltd. is acting as financial advisor

and White & Case LLP is serving as legal counsel to TTC.

About Radius

Radius is a leading North American recycler of ferrous and

nonferrous metals with 54 operating facilities across 25 states,

Puerto Rico, and Western Canada. The Company sells its products to

U.S. and export customers from its locations on both the East and

West Coasts of the U.S., the Southeast, Hawaii, and Puerto Rico.

Radius’ integrated operating platform also includes 50 stores

operating across the U.S. and Western Canada under its Pick-N-Pull

brand which sell serviceable used auto parts from salvaged vehicles

and receive over 4 million annual retail visits. The Company’s

electric arc furnace and rolling mill located in McMinnville,

Oregon is vertically integrated with its Pacific Northwest metals

recycling operations and produces rebar, wire rod, and other

specialty products that are sold to customers primarily in the

Western U.S. and Western Canada. Radius began operations in 1906 in

Portland, Oregon, where it remains headquartered.

About TTC

Toyota Tsusho was founded in 1948 as the trading company for the

Toyota Group. Toyota Tsusho Group is a global entity that develops

business together with its members’ employees in various countries

around the world. To pursue the value that we can provide to

society and our customers, Toyota Tsusho has established 8

mission-based sales divisions (Metal+(Plus)/ Circular Economy/

Supply Chain/ Mobility/ Green Infrastructure/ Digital Solutions/

Lifestyle/ Africa). Additionally, toward the realization of a

carbon-neutral world, Toyota Tsusho has declared its commitment to

halving its greenhouse gas emissions from 800,000 tons in 2019 by

2030 and to achieving carbon neutrality by 2050. Toyota Tsusho will

continue to reduce greenhouse gas emissions throughout its supply

chains to contribute to the realization of a decarbonized

society.

Non-GAAP Financial Measures

| Reconciliation of

debt, net of cash |

|

|

| ($ in thousands) |

|

|

|

|

|

November 30, 2024 |

|

Short-term borrowings |

|

$ |

5,573 |

| Long-term debt, net of current

maturities |

|

|

439,872 |

|

Total debt |

|

|

445,445 |

| Less: cash and cash

equivalents |

|

|

15,223 |

|

Total debt, net of cash |

|

$ |

430,222 |

|

|

Forward-Looking Statements

The foregoing contains “forward-looking

statements” within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended, or the Exchange Act. These statements often

contain words such as “outlook,” “target,” “aim,” “believes,”

“expects,” “anticipates,” “intends,” “assumes,” “estimates,”

“evaluates,” “may,” “will,” “should,” “could,” “opinions,”

“forecasts,” “projects,” “plans,” “future,” “forward,” “potential,”

“probable,” and similar expressions. The absence of these words or

similar expressions, however, does not mean that a statement is

not forward-looking. Forward-looking statements are made based

upon management’s current expectations and beliefs and are not

guarantees of future performance. Such forward-looking statements

are subject to a number of risks, uncertainties, assumptions and

other factors that could cause actual results and the timing of

certain events to differ materially from future results expressed

or implied by the forward-looking statements. These factors

include, among others: completion of the proposed transaction is

subject to various risks and uncertainties related to, among other

things, its terms, timing, structure, benefits, costs and

completion; required approvals to complete the proposed transaction

by our shareholders and the receipt of certain regulatory

approvals, to the extent required, and the timing and conditions

for such approvals; the stock price of Radius Recycling, Inc. prior

to the consummation of the proposed transaction; the satisfaction

of the closing conditions to the proposed transaction; potential

environmental cleanup costs related to the Portland Harbor

Superfund site or other locations; the impact of equipment

upgrades, equipment failures, and facility damage on production;

failure to realize or delays in realizing expected benefits from

capital and other projects, including investments in processing and

manufacturing technology improvements and information technology

systems; the cyclicality and impact of general economic conditions;

the impact of inflation and interest rate and foreign currency

fluctuations; changing conditions in global markets including the

impact of sanctions and tariffs, quotas, and other trade actions

and import restrictions; increases in the relative value of the

U.S. dollar; economic and geopolitical instability including as a

result of military conflict; volatile supply and demand conditions

affecting prices and volumes in the markets for raw materials and

other inputs we purchase; significant decreases in recycled metal

prices; imbalances in supply and demand conditions in the global

steel industry; difficulties associated with acquisitions and

integration of acquired businesses; supply chain disruptions;

reliance on third-party shipping companies, including with respect

to freight rates and the availability of transportation;

restrictions on our business and financial covenants under the

agreement governing our bank credit facilities; potential

limitations on our ability to access capital resources and existing

credit facilities; the impact of impairment of goodwill and assets

other than goodwill; the impact of pandemics, epidemics, or other

public health emergencies; inability to achieve or sustain the

benefits from productivity, cost savings, and restructuring

initiatives; inability to renew facility leases; customer

fulfillment of their contractual obligations; the impact of

consolidation in the steel industry; product liability claims; the

impact of legal proceedings and legal compliance; the impact of

climate change; the impact of not realizing deferred tax assets;

the impact of tax increases and changes in tax rules; the impact of

one or more cybersecurity incidents; the impact of increasing

attention to environmental, social, and governance matters;

translation risks associated with fluctuation in foreign exchange

rates; the impact of hedging transactions; inability to obtain or

renew business licenses and permits; environmental compliance costs

and potential environmental liabilities; increased environmental

regulations and enforcement; compliance with climate change and

greenhouse gas emission laws and regulations; the impact of labor

shortages or increased labor costs; reliance on employees subject

to collective bargaining agreements; and the impact of the

underfunded status of multiemployer plans in which we participate;

and other risks set forth under the heading “Risk Factors,” of our

Annual Report on Form 10-K for the year ended August 31, 2024 and

in our subsequent filings with the Securities and Exchange

Commission. You should not rely upon forward-looking statements as

predictions of future events. Furthermore, such forward-looking

statements speak only as of the date of this report. Our actual

results could differ materially from the results described in or

implied by such forward-looking statements. Forward-looking

statements speak only as of the date hereof, and, except as

required by law, we undertake no obligation to update or revise

these forward-looking statements.

Additional Information and Where to Find it

This communication does not constitute an offer

to buy or sell or the solicitation of an offer to buy or sell any

securities or a solicitation of any vote or approval. This

communication relates to a proposed acquisition of Radius

Recycling, Inc. by Toyota Tsusho America, Inc., a wholly owned

subsidiary of Toyota Tsusho Corporation. In connection with this

proposed acquisition, Radius Recycling, Inc. plans to file one or

more proxy statements or other documents with the SEC. This

communication is not a substitute for any proxy statement or other

document that Radius Recycling, Inc. may file with the SEC in

connection with the proposed transaction. INVESTORS AND SECURITY

HOLDERS OF RADIUS RECYCLING, INC. ARE URGED TO READ THE PROXY

STATEMENT AND OTHER DOCUMENTS THAT MAY BE FILED WITH THE SEC

CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE

THEY WILL CONTAIN IMPORTANT INFORMATION. Any definitive proxy

statement(s) (if and when available) will be mailed to shareholders

of Radius Recycling, Inc. Investors and security holders will be

able to obtain free copies of these documents (if and when

available) and other documents filed with the SEC by Radius

Recycling, Inc. through the website maintained by the SEC at

http://www.sec.gov. Copies of the documents filed with the SEC by

Radius Recycling, Inc. will be available free of charge on Radius

Recycling, Inc.’s internet website at www.radiusrecycling.com

or upon written request to: Investor Relations, Radius Recycling,

Inc., 222 SW Columbia Street, Suite 1150, Portland, Oregon 97201 or

by telephone at (503) 323-2811.

Participants in Solicitation

Radius Recycling, Inc., its directors and

certain of its executive officers and employees may be deemed to be

participants in the solicitation of proxies in connection with the

proposed transaction. Information about the directors and executive

officers of Radius Recycling, Inc. is set forth in its proxy

statement for its 2025 annual meeting of shareholders, which was

filed with the SEC on December 16, 2024.

Additional information regarding the

participants in the proxy solicitation and a description of their

direct and indirect interests, by security holdings or otherwise,

will be contained in the proxy statement and other relevant

materials to be filed with the SEC when they become available.

These documents can be obtained free of charge from the sources

indicated above.

Radius Recycling, Inc.222 SW Columbia StreetSuite 1150Portland,

Oregon 97201Tel. (503) 323-2811www.radiusrecycling.com

Radius Contact:

Public Affairs & Communications:Eric

Potashner(415) 624-9885epotashner@rdus.com

Investor Relations:Michael Bennett(503)

323-2811mcbennett@rdus.com

Company

Info:www.radiusrecycling.comir@rdus.com

TTC Contact:Corporate Communications

Departmenthttps://www.toyota-tsusho.com/english/ttc_mr@pp.toyota-tsusho.com

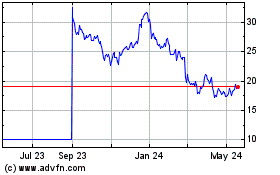

Radius Recycling (NASDAQ:RDUS)

Historical Stock Chart

From Mar 2025 to Apr 2025

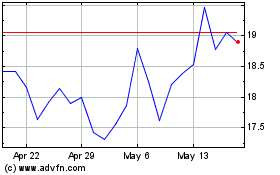

Radius Recycling (NASDAQ:RDUS)

Historical Stock Chart

From Apr 2024 to Apr 2025