Net Income Grew 18% on Improved

Margins

Retail Volumes Accelerated in Q4

Investing Strong Cash Flow in Future Revenue

Growth and Additional Margin Expansion

Reynolds Consumer Products Inc. (the “Company”) (Nasdaq: REYN)

today reported financial results for the fourth quarter and fiscal

year ended December 31, 2024.

Fiscal Year 2024 Highlights

- Net Revenues of $3,695 million vs. $3,756 million in

2023

- Retail Net Revenues of $3,518 million vs. $3,559 million in

2023

- Non-Retail Net Revenues, which comprises aluminum sales to food

service and industrial customers, of $177 million vs. $197 million

in 2023

- Net Income and Adjusted Net Income of $352 million vs.

$298 million in 2023

- EBITDA and Adjusted EBITDA of $678 million vs. $636

million in 2023

- Earnings Per Share and Adjusted Earnings Per Share of

$1.67 vs. $1.42 in 2023

- Operating Cash Flow of $489 million; 72% conversion of

Adjusted EBITDA

Retail volume decreased 1% for the year driven by a one-point

headwind from product portfolio optimization.

Net Income increased 18% to $352 million. Adjusted EBITDA

increased 7% to $678 million driven by lower operational costs,

partially offset by the impact of lower Net Revenues. Net Income

increased as a result of the same factors as well as lower interest

expense.

The Company reduced Net Debt Leverage1 from 2.7x on December 31,

2023 to 2.3x on December 31, 2024, within the stated target

leverage range of 2.0 to 2.5x.

“Our retail volume accelerated in the fourth quarter, and we

have the team, business model and resources to drive strong growth,

further margin expansion and consistently attractive shareholder

returns,” said Scott Huckins, President and Chief Executive

Officer. “Reynolds and Hefty are very strong brands, and we enter

2025 committed to executing new and existing programs to realize

even more of RCP’s potential.”

1Net Debt is defined as current

portion of long-term debt plus long-term debt less cash and cash

equivalents. Net Debt Leverage is defined as Net Debt divided by

Trailing Twelve Months Adjusted EBITDA. See “Use of Non-GAAP

Financial Measures” for additional information.

Fourth Quarter 2024 Highlights

- Net Revenues of $1,021 million vs. $1,007 million in Q4

2023

- Retail Net Revenues of $975 million vs. $972 million in Q4

2023

- Non-Retail Net Revenues of $46 million vs. $35 million in Q4

2023

- Net Income and Adjusted Net Income of $121 million vs.

$137 million in Q4 2023

- EBITDA and Adjusted EBITDA of $213 million vs. $238

million in Q4 2023

- Earnings Per Share and Adjusted Earnings Per Share of

$0.58 vs. $0.65 in Q4 2023

Retail volume grew 1%, consistent with overall category

performance, accelerated in all four business units and included a

one-point headwind from product portfolio optimization.

Net Income decreased 12% to $121 million. Adjusted EBITDA

decreased 11% to $213 million driven by the anticipated higher

operational costs and lower pricing. Net Income decreased as a

result of the same factors, partially offset by lower interest

expense. Fourth quarter 2023 earnings were a company record and

disproportionately contributed to the full year result relative to

history.

Reynolds Cooking & Baking

- Net Revenues increased $17 million to $374 million reflecting

retail and non-retail growth

- Adjusted EBITDA decreased $7 million to $82 million

Retail volume increased 3%, which included a one-point headwind

from product portfolio optimization, driven by Reynolds Wrap share

gains and growth of Reynolds Kitchens products.

The Adjusted EBITDA decrease was driven by higher operational

costs and lower pricing, partially offset by the benefit of higher

volume.

Hefty Waste & Storage

- Net Revenues increased $8 million to $245 million

- Adjusted EBITDA decreased $5 million to $68 million

Retail volume increased 3% with Hefty Waste & Storage

outperforming its categories. Hefty Fabuloso® waste bags, Hefty

Press to Close food bags and other new products continued to

deliver strong growth while expanding distribution.

The Adjusted EBITDA decrease was driven by higher operational

costs, partially offset by the benefit of higher volume.

Hefty Tableware

- Net Revenues decreased $8 million to $251 million

- Adjusted EBITDA decreased $6 million to $52 million

Retail volume decreased 2% as lower foam plate volume more than

offset modest growth of other tableware products. Volume excluding

foam plates outperformed its categories.

The Adjusted EBITDA decrease was driven by lower net revenues

and higher operational costs.

Presto Products

- Net revenues were unchanged at $153 million

- Adjusted EBITDA decreased $4 million to $30 million

Retail volume was unchanged, which included a one-point headwind

from product portfolio optimization.

The Adjusted EBITDA decrease was driven by higher operational

costs.

Balance Sheet and Cash Flow Highlights

Cash and cash equivalents were $137 million at December 31,

2024, and debt was $1,686 million resulting in net debt of $1,549

million, which resulted in Net Debt Leverage of 2.3x on December

31, 2024.

Operating cash flow of $489 million for the year ended December

31, 2024 was driven by strong profitability and disciplined working

capital management.

Capital expenditures were $120 million for the year ended

December 31, 2024 compared to $104 million in the prior year,

reflecting increased investment in automation and other cost

savings programs to drive margin expansion and support additional

growth.

Subsequent to quarter end, the Company made a voluntary

principal payment of $50 million on its term loan facility.

“The strength of our balance sheet, cash flows and capital

allocation discipline position us very well for increased

investment, growth and profitability,” said Nathan Lowe, Chief

Financial Officer. “We are applying our returns-based framework to

a robust pipeline of product innovation and cost savings programs,

and we look forward to unlocking even more of RCP’s potential in

2025 and over the long-term.”

Fiscal Year 2025 and First Quarter 2025 Outlook2

Full-year 2025 Net Revenues are expected to be down low single

digits versus 2024 Net Revenues of $3,695 million, with retail

volume at or above category performance. Full-year 2025 Adjusted

EBITDA is expected to be between $670 million and $690 million.

Full-year Adjusted EPS is expected to be $1.61 to $1.68.

First quarter 2025 Net Revenues are expected to be down low

single digits versus first quarter 2024 Net Revenues of $833

million which considers the Easter timing shift. First quarter 2025

Adjusted EBITDA is expected to be approximately $115 million to

$120 million. First quarter Adjusted EPS is expected to be $0.22 to

$0.24.

Full-year 2025 Adjusted EBITDA and Adjusted EPS reflect the

following estimated adjustments from Net Income: depreciation and

amortization of approximately $130 million and $25 million to $35

million of pre-tax costs related to CEO transition and other

investments in certain strategic initiatives.

Quarterly Dividend

The Company’s Board of Directors has approved a quarterly

dividend of $0.23 per common share. The Company expects to pay this

dividend on February 28, 2025, to shareholders of record as of

February 14, 2025.

Earnings Webcast

The Company will host a live webcast this morning at 7:00 a.m.

CT (8:00 a.m. ET). A link to the webcast and all related earnings

materials will be available on the Company’s Investor Relations

website at https://investors.reynoldsconsumerproducts.com.

About Reynolds Consumer Products Inc.

Reynolds Consumer Products is a leading provider of household

products that simplify daily life so consumers can enjoy what

matters most. With a presence in 95% of households across the

United States, Reynolds Consumer Products manufactures and sells

products that people use in their homes across three broad

categories: cooking, waste and storage, and disposable tableware.

Iconic brands include Reynolds Wrap® aluminum foil and Hefty®

tableware and trash bags, in addition to dedicated store brands

which are strategically important to retail customers. Overall,

Reynolds Consumer Products holds the No. 1 or No. 2 U.S. market

share position in the majority of product categories it serves. For

more information, visit

https://investors.reynoldsconsumerproducts.com.

2The Company is not able to

quantify certain other items that will be excluded from

forward-looking Adjusted EBITDA and Adjusted EPS without reasonable

efforts due to uncertainties and potential variability of those

items. Such unavailable information is not expected to have a

significant impact on the Company’s future GAAP financial

results.

Forward Looking Statements

This press release contains statements reflecting our views

about our future performance that constitute “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995, including our first quarter and fiscal year

2025 guidance. In some cases, you can identify these statements by

forward-looking words such as “may,” “might,” “will,” “should,”

“expects,” “intends,” “outlook,” “forecast”, “position”,

“committed,” “plans,” “anticipates,” “believes,” “estimates,”

“predicts,” “model”, “assumes,” “confident,” “look forward,”

“potential” “on track”, or “continue,” the negative of these terms

and other comparable terminology. These forward-looking statements,

which are subject to risks, uncertainties and assumptions about us,

may include projections of our future financial performance, our

anticipated growth and recovery of profitability, management of

costs and other disruptions and other strategies, and anticipated

trends in our business, including expected levels of commodity

costs and volume. These statements are only predictions based on

our current expectations and projections about future events. There

are important factors that could cause our actual results, level of

activity, performance or achievements to differ materially from the

results, level of activity, performance or achievements expressed

or implied by the forward-looking statements, including but not

limited to the risk factors set forth in our most recent Annual

Report on Form 10-K and in our Quarterly Reports on Form 10-Q.

For additional information on these and other factors that could

cause our actual results to materially differ from those set forth

herein, please see our filings with the Securities and Exchange

Commission, including our most recent Annual Report on Form 10-K

and subsequent filings. Investors are cautioned not to place undue

reliance on any such forward-looking statements, which speak only

as of the date they are made. The Company undertakes no obligation

to update any forward-looking statement, whether as a result of new

information, future events or otherwise.

REYN-F

Reynolds Consumer Products

Inc.

Consolidated Statements of

Income

(amounts in millions, except for

per share data)

For the Three Months

Ended

For the Years Ended

December 31,

December 31,

2024

2023

2024

2023

Net revenues

$

1,000

$

985

$

3,618

$

3,673

Related party net revenues

21

22

77

83

Total net revenues

1,021

1,007

3,695

3,756

Cost of sales

(741

)

(698

)

(2,717

)

(2,814

)

Gross profit

280

309

978

942

Selling, general and administrative

expenses

(100

)

(103

)

(429

)

(430

)

Other expense, net

—

—

—

—

Income from operations

180

206

549

512

Interest expense, net

(22

)

(28

)

(98

)

(119

)

Income before income taxes

158

178

451

393

Income tax expense

(37

)

(41

)

(99

)

(95

)

Net income

$

121

$

137

$

352

$

298

Earnings per share

Basic

$

0.58

$

0.65

$

1.68

$

1.42

Diluted

$

0.58

$

0.65

$

1.67

$

1.42

Weighted average shares outstanding:

Basic

210.2

210.0

210.1

210.0

Diluted

210.9

210.0

210.4

210.0

Reynolds Consumer Products

Inc.

Consolidated Balance

Sheets

As of December 31

(amounts in millions, except for

per share data)

2024

2023

Assets

Cash and cash equivalents

$

137

$

115

Accounts receivable, net

337

347

Other receivables

7

7

Related party receivables

6

7

Inventories

567

524

Other current assets

47

41

Total current assets

1,101

1,041

Property, plant and equipment, net

758

732

Operating lease right-of-use assets,

net

90

56

Goodwill

1,895

1,895

Intangible assets, net

972

1,001

Other assets

57

55

Total assets

$

4,873

$

4,780

Liabilities

Accounts payable

$

319

$

219

Related party payables

34

34

Current operating lease liabilities

20

16

Income taxes payable

5

22

Accrued and other current liabilities

161

187

Total current liabilities

539

478

Long-term debt

1,686

1,832

Long-term operating lease liabilities

73

42

Deferred income taxes

342

357

Long-term postretirement benefit

obligation

14

16

Other liabilities

77

72

Total liabilities

$

2,731

$

2,797

Stockholders’ equity

Common stock, $0.001 par value; 2,000

shares authorized; 210.2 shares issued and outstanding

—

—

Additional paid-in capital

1,413

1,396

Accumulated other comprehensive income

35

50

Retained earnings

694

537

Total stockholders’ equity

2,142

1,983

Total liabilities and stockholders’

equity

$

4,873

$

4,780

Reynolds Consumer Products

Inc.

Consolidated Statements of

Cash Flows

For the Years Ended December

31

(amounts in millions)

2024

2023

Cash provided by operating

activities

Net income

$

352

$

298

Adjustments to reconcile net income to

operating cash flows:

Depreciation and amortization

129

124

Deferred income taxes

(11

)

(5

)

Stock compensation expense

19

14

Change in assets and liabilities:

Accounts receivable, net

11

—

Other receivables

1

7

Related party receivables

1

—

Inventories

(42

)

198

Accounts payable

95

(31

)

Related party payables

—

(12

)

Income taxes payable / receivable

(17

)

9

Accrued and other current liabilities

(26

)

42

Other assets and liabilities

(23

)

—

Net cash provided by operating

activities

489

644

Cash used in investing

activities

Acquisition of property, plant and

equipment

(120

)

(104

)

Acquisition of business

—

(6

)

Net cash used in investing

activities

(120

)

(110

)

Cash used in financing

activities

Repayment of long-term debt

(150

)

(262

)

Dividends paid

(192

)

(192

)

Other financing activities

(4

)

(3

)

Net cash used in financing

activities

(346

)

(457

)

Effect of exchange rate changes on cash

and cash equivalents

(1

)

—

Cash and cash equivalents:

Increase (decrease) in cash and cash

equivalents

22

77

Balance as of beginning of the year

115

38

Balance as of end of the year

$

137

$

115

Cash paid:

Interest – long-term debt, net of interest

rate swaps

98

114

Income taxes

125

90

Reynolds Consumer Products

Inc.

Segment Results

(amounts in millions)

Reynolds

Cooking

& Baking

Hefty

Waste &

Storage

Hefty

Tableware

Presto

Products

Unallocated(1)

Total

Revenues

Three Months Ended December 31, 2024

$

374

$

245

$

251

$

153

$

(2

)

$

1,021

Three Months Ended December 31, 2023

357

237

259

153

1

1,007

Year Ended December 31, 2024

1,247

959

918

596

(25

)

3,695

Year Ended December 31, 2023

1,273

942

967

593

(19

)

3,756

Adjusted EBITDA

Three Months Ended December 31, 2024

$

82

$

68

$

52

$

30

$

(19

)

$

213

Three Months Ended December 31, 2023

89

73

58

34

(16

)

238

Year Ended December 31, 2024

222

272

147

130

(93

)

678

Year Ended December 31, 2023

184

261

174

112

(95

)

636

(1)

The unallocated net revenues include

elimination of inter-segment revenues and other revenue

adjustments. The unallocated Adjusted EBITDA represents the

combination of corporate expenses which are not allocated to our

segments and other unallocated revenue adjustments.

Components of Change in Net

Revenues for the Three Months Ended December 31, 2024 vs. the Three

Months Ended December 31, 2023

Price

Volume/Mix

Total

Retail

Non-Retail

Reynolds Cooking & Baking

(1)

%

3

%

3

%

5

%

Hefty Waste & Storage

—

%

3

%

—

%

3

%

Hefty Tableware

(1)

%

(2)

%

—

%

(3)

%

Presto Products

—

%

—

%

—

%

—

%

Total RCP

(1)

%

1

%

1

%

1

%

Components of Change in Net

Revenues for the Twelve Months Ended December 31, 2024 vs. the

Twelve Months Ended December 31, 2023

Price

Volume/Mix

Total

Retail

Non-Retail

Reynolds Cooking & Baking

—

%

(1)

%

(1)

%

(2)

%

Hefty Waste & Storage

1

%

1

%

—

%

2

%

Hefty Tableware

(2)

%

(3)

%

—

%

(5)

%

Presto Products

1

%

—

%

—

%

1

%

Total RCP

(1)

%

(1)

%

—

%

(2)

%

Use of Non-GAAP Financial Measures

We use non-GAAP financial measures “Adjusted EBITDA,” “Adjusted

Net Income,” “Adjusted Earnings Per Share,” “Net Debt,” “Net Debt

to Trailing Twelve Months Adjusted EBITDA,” “Free Cash Flow,” and

“Conversion of Adjusted EBITDA” in evaluating our past results and

future prospects. We define Adjusted EBITDA as net income

calculated in accordance with GAAP, plus the sum of income tax

expense, net interest expense, depreciation and amortization and

further adjusted to exclude IPO and separation-related costs, as

well as other non-recurring costs. We define Adjusted Net Income

and Adjusted Earnings Per Share (“Adjusted EPS”) as Net Income and

Earnings Per Share (“EPS”) calculated in accordance with GAAP, plus

IPO and separation-related costs, as well as other non-recurring

costs. We define Net Debt as the current portion of long-term debt

plus long-term debt less cash and cash equivalents. We define Net

Debt to Trailing Twelve Months Adjusted EBITDA as Net Debt (as

defined above) as of the end of the period to Adjusted EBITDA (as

defined above) for the period. We define Free Cash Flow as net cash

provided by operating activities in the period minus the

acquisition of property, plant and equipment in the period. We

define Conversion of Adjusted EBITDA as the ratio of net cash

provided by operating activities in the period to Adjusted EBITDA

(as defined above) for the period, expressed as a percentage.

We present Adjusted EBITDA because it is a key measure used by

our management team to evaluate our operating performance, generate

future operating plans and make strategic decisions. In addition,

our chief operating decision maker uses Adjusted EBITDA of each

reportable segment to evaluate the operating performance of such

segments. We use Adjusted Net Income and Adjusted Earnings Per

Share as supplemental measures to evaluate our business’

performance in a way that also considers our ability to generate

profit without the impact of certain items. We use Net Debt as we

believe it is a more representative measure of our liquidity. We

use Net Debt to Trailing Twelve Months Adjusted EBITDA because it

reflects our ability to service our debt obligations. We use Free

Cash Flow because it measures our ability to generate additional

cash from our business operations. We present Conversion of

Adjusted EBITDA as it measures our management of working capital

and profit conversion to cash. Accordingly, we believe presenting

these measures provide useful information to investors and others

in understanding and evaluating our operating results in the same

manner as our management team and board of directors.

Non-GAAP information should be considered as supplemental in

nature and is not meant to be considered in isolation or as a

substitute for the related financial information prepared in

accordance with GAAP. In addition, our non-GAAP financial measures

may not be the same as or comparable to similar non-GAAP financial

measures presented by other companies.

Guidance for fiscal year and first quarter 2025, where adjusted,

is provided on a non-GAAP basis. While the Company is providing

estimated amounts for certain of the expected adjustments in this

release, the Company cannot provide full reconciliations for its

expected first quarter and fiscal year 2025 Adjusted EBITDA and

Adjusted EPS to expected Net Income and expected EPS under “Fiscal

Year 2025 and First Quarter 2025 Outlook” without unreasonable

effort because certain items that impact Net Income and EPS and

other reconciling metrics are out of the Company’s control and/or

cannot be reasonably predicted at this time, which unavailable

information is not expected to have a significant impact on the

Company’s GAAP financial results.

Please see reconciliations of non-GAAP measures used in this

release (with the exception of our first quarter 2025 Adjusted

EBITDA and Adjusted EPS outlook, as described above) to the most

directly comparable GAAP measures, beginning on the following

page.

Reynolds Consumer Products

Inc.

Reconciliation of Net Income

to EBITDA and Adjusted EBITDA

(amounts in millions)

For the Three Months Ended

December 31,

For the Years Ended December

31,

2024

2023

2024

2023

(in millions)

(in millions)

Net income – GAAP

$

121

$

137

$

352

$

298

Income tax expense

37

41

99

95

Interest expense, net

22

28

98

119

Depreciation and amortization

33

32

129

124

EBITDA and Adjusted EBITDA

(Non-GAAP)

$

213

$

238

$

678

$

636

Reynolds Consumer Products

Inc.

Reconciliation of Total Debt

to Net Debt and Calculation of Net Debt to Trailing Twelve Months

Adjusted EBITDA

(amounts in millions, except for

Net Debt to Trailing Twelve Months Adjusted EBITDA)

As of December 31, 2024

Current portion of long-term debt

$

—

Long-term debt

1,686

Total debt

1,686

Cash and cash equivalents

(137

)

Net debt (Non-GAAP)

$

1,549

For the twelve months ended December

31, 2024

Adjusted EBITDA (Non-GAAP)

$

678

Net Debt to Trailing Twelve Months

Adjusted EBITDA

2.3x

As of December 31, 2023

Current portion of long-term debt

$

—

Long-term debt

1,832

Total debt

1,832

Cash and cash equivalents

(115

)

Net debt (Non-GAAP)

$

1,717

For the twelve months ended December

31, 2023

Adjusted EBITDA (Non-GAAP)

$

636

Net Debt to Trailing Twelve Months

Adjusted EBITDA

2.7x

Reynolds Consumer Products

Inc.

Reconciliation of Net Cash

Provided by Operating Activities to Free Cash Flow

(amounts in millions)

For the Years Ended December

31

2024

2023

Net cash provided by operating

activities

$

489

$

644

Acquisition of property, plant and

equipment

(120

)

(104

)

Free cash flow

$

369

$

540

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250205634087/en/

Investor Contact Mark Swartzberg

Mark.Swartzberg@reynoldsbrands.com (847) 482-4081

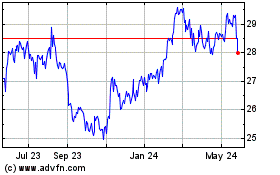

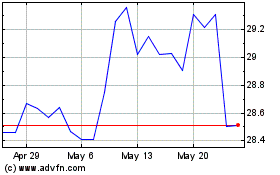

Reynolds Consumer Products (NASDAQ:REYN)

Historical Stock Chart

From Mar 2025 to Apr 2025

Reynolds Consumer Products (NASDAQ:REYN)

Historical Stock Chart

From Apr 2024 to Apr 2025