– Significant improvement in gross profit

dollars compared to last year –

– GoodWheat™ pasta named “Best

New Product” by Retail Dietitians Business Alliance –

Arcadia Biosciences, Inc.® (Nasdaq: RKDA), a producer and

marketer of innovative, plant-based health and wellness products,

today released its financial and business results for the first

quarter of 2023.

“We continue to focus on growing high quality revenue streams,

as we closely manage resources,” said Stan Jacot, president and

CEO. “And the impact of this focus is clearly seen in our Q1

results, with notable improvements in gross profit dollars and

operating expenses compared to last year.”

The company is also supporting expansion of GoodWheat™ pasta

brand. “Less than one year after launch, we believe we have only

begun to see the potential of our GoodWheat pasta with expanding

store count, improving velocity and award-winning product

performance.”

In addition to receiving the American Heart Association’s Heart

Check Certification earlier this year, GoodWheat pasta was recently

named the “Best New Product” by the Retail Dietitians Business

Alliance, a network of registered dietitians serving over 1,000

retailer-employed dietitians throughout the US and Canada.

Jacot provided an update on Project Greenfield, Arcadia’s 3-year

plan to drive shareholder value, including GoodWheat’s retail

expansion, driving growth of core brands and partnerships, as well

as maintaining an agile organization to cultivate next generation

wellness products. “As we enter the second year of Project

Greenfield, our plans include category expansion for our

proprietary GoodWheat technology, through both innovation and

acquisition. Along with channel expansion and innovations in Zola®

coconut water, these plans present opportunities for substantial

growth in revenue and gross profit dollars.”

Arcadia Biosciences,

Inc.

Financial Snapshot

(Unaudited)

($ in thousands)

Three Months Ended March

31,

2023

2022

Favorable / (Unfavorable)

$

%

Total Revenues

1,509

3,220

(1,711

)

(53

%)

Total Operating Expenses

5,557

7,843

2,286

29

%

Loss From Operations

(4,048

)

(4,623

)

575

12

%

More detailed financial statements are included in the Form 8-K

filed today, available in the Investors section of the company’s

website under SEC Filings.

Revenues

In the first quarter of 2023, revenues were $1.5 million

compared to revenues of $3.2 million during the same period in

2022. Revenues in the first quarter of 2022 included $1.8 million

in sales of grain and body care products that are no longer part of

the Arcadia product portfolio.

Operating Expenses

In the first quarter of 2023, operating expenses were $5.6

million compared to $7.8 million in the first quarter of 2022.

Cost of revenues was $825,000 in the first quarter of 2023

compared to $3.5 million during the same period in 2022, resulting

in an improvement of $922,000 in gross profit. Cost of revenues in

the first quarter of 2022 included grain sold at cost, low-margin

body care product sales and higher inventory write-downs.

Research and development (R&D) spending decreased by $36,000

in the first quarter of 2023 compared to the first quarter of 2022.

The decrease was driven by the company’s continued focus on

commercialization, which has led to lower R&D employee-related

expenses and activity costs.

Selling, general and administrative costs for the first quarter

of 2023 were $43,000 higher than in the first quarter of 2022

despite a 43% increase in marketing expenses in 2023.

Complete financial statements for the first quarter of 2023 will

be available next week when the company files its Quarterly Report

on Form 10-Q. Due to the complexity of the company’s March 2023

private placement financing, the impact of that financing on the

net loss is still under review.

Conference Call and Webcast

The company has scheduled a conference call for 4:30 p.m.

Eastern time (1:30 p.m. Pacific time) today, May 11, to discuss

first-quarter results and key strategic achievements. Interested

participants can join the conference call using the following

options:

- An audio-only webcast of the conference call will be available

in the Investors section of Arcadia’s website.

- To join the live call, please register here, and a dial-in

number and unique PIN will be provided.

Following completion of the call, a recorded replay will be

available on the company’s investor website.

About Arcadia Biosciences, Inc.

Since 2002, Arcadia Biosciences (Nasdaq: RKDA) has been

innovating crops to provide high-value, healthy ingredients to meet

consumer demands for healthier choices. With its roots in

agricultural innovation, Arcadia cultivates next-generation

wellness products that make every body feel good, inside and out.

The company’s food, beverage and body care products include

GoodWheat™, Zola® coconut water, ProVault™ topical pain relief and

SoulSpring™ bath and body care. For more information, visit

www.arcadiabio.com.

Safe Harbor Statement

“Safe Harbor” statement under the Private Securities Litigation

Reform Act of 1995: This press release and the accompanying

conference call contain forward-looking statements about the

company and its products, including statements relating to the

company’s growth, retail expansion, financial performance and

commercialization of products. Forward-looking statements are

subject to risks and uncertainties that could cause actual results

to differ materially, and reported results should not be considered

as an indication of future performance. These risks and

uncertainties include, but are not limited to: the company’s and

its partners’ and affiliates’ ability to successfully develop and

sell commercial products incorporating its traits and to complete

the regulatory review process for such products; the company’s

compliance with laws and regulations that impact the company’s

business; the growth of the global wheat market; our ability to

continue to make acquisitions and execute on divestitures in

accordance with our business strategy or effectively manage the

growth from acquisitions; and the company’s future capital

requirements and ability to satisfy its capital needs. Further

information regarding these and other factors that could affect the

company’s financial results is included in filings the company

makes with the Securities and Exchange Commission from time to

time, including the section entitled “Risk Factors” and additional

information set forth in its Form 10-K for the year ended December

31, 2022, and other filings. These forward-looking statements speak

only as of the date hereof, and Arcadia Biosciences, Inc.

undertakes no duty to update this information.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230511005862/en/

Arcadia Biosciences Contact: T.J. Schaefer

ir@arcadiabio.com

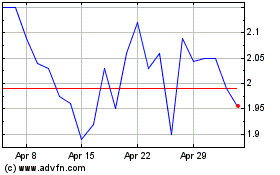

Arcadia Biosciences (NASDAQ:RKDA)

Historical Stock Chart

From Jan 2025 to Feb 2025

Arcadia Biosciences (NASDAQ:RKDA)

Historical Stock Chart

From Feb 2024 to Feb 2025