Rocket Lab USA, Inc. (Nasdaq: RKLB) (“Rocket Lab”, “the

Company”, “we,” “us,” or “our”), a global leader in launch services

and space systems, today shared the financial results for fiscal

fourth quarter, ended December 31, 2024.

Rocket Lab founder and CEO, Sir Peter Beck, said: “2024 was a

record-setting year for Rocket Lab, with our highest annual revenue

ever posted of $436.2 million and a record Q4 2024 revenue of

$132.4 million – a 382% increase compared to Q4 2021, our first

full quarter following our debut on the Nasdaq as a publicly-traded

company. Top achievements across launch and space systems include a

record number of 16 launches for Electron in 2024 (a 60% increase

in launch cadence compared to 2023) and more than $450 million in

newly-secured launch and space systems contracts. We rounded out

the year with significant advancement across the Neutron program

ahead of a planned debut launch in the second half of 2025. The

Company’s strong performance across launch and space systems is

foundational to Rocket Lab’s momentum toward delivering its own

satellite service as a truly end-to-end space company. This has

been bolstered in Q1 2025 with the introduction of our new

constellation-class satellite platform designed for mass

manufacture, named Flatellite. Applicable to national security,

defense, and commercial services, the new satellite also signals a

bold, strategic step toward potential paths for operating our own

future constellation.”

Business Highlights for the Full Year & Fourth Quarter

2024, plus updates since December 31, 2024.

Launch:

- Achieved a record year of 16 Electron launches in 2024, up 60%

on the year prior, with a booked manifest which supports more than

20 Electron and HASTE launches for 2025 across both single

satellite and constellation deployment missions and hypersonic

technology test missions.

- Signed a second multi-launch Electron contract in Q1 2025 with

Institute for Q-shu Pioneers of Space, Inc. (iQPS), a Japan-based

Earth imaging company. Along with an earlier multi-launch contract

signed in 2024 with iQPS, the combined contracts represent one of

the largest Electron launch agreements to date.

- Selected by Kratos to support a $1.45 billion five-year federal

contract for hypersonic flight testing under the MACH-TB 2.0

Contract Award.

- Successfully completed the fourth of five dedicated launches

for Kineis in Q1 2025, with Electron expected to launch the fifth

and final mission in the coming weeks to complete full

constellation deployment in less than a year for the French

Internet-of-Things (IoT) constellation operator.

- Revealed details about Rocket Lab’s plans for a new ocean

landing platform for Neutron missions returning to Earth. Named

‘Return On Investment,’ the landing platform is expected to open

space access further by enabling even more mission opportunities

that require maximum Neutron performance.

- Shared progress on Neutron’s development ahead of planned debut

launch of the new reusable medium-lift rocket in the second half of

2025.

Space Systems:

- Introduced a new low-cost satellite tailored for mass

manufacture to serve large satellite constellations. Named

Flatellite, the satellite is a scalable and resilient platform that

offers high-speed connectivity and remote sensing capabilities. It

has been designed to meet the needs of the national security,

defense, and commercial markets, and signals a potential next step

in Rocket Lab developing, launching and operating its own

constellation to deliver data and services from space.

- Celebrated mission success for the latest Rocket Lab Pioneer

spacecraft which successfully operated in space, then deployed to

Earth, Varda’s latest orbital processing and hypersonic reentry

mission.

- Rocket Lab’s third Pioneer spacecraft produced for Varda has

already been completed and delivered for launch in early March, the

second that Rocket Lab has delivered for launch within a

month.

- Completed significant program milestones across two Rocket Lab

spacecraft programs advancing U.S. national defense: comprehensive

multi-day design reviews for Rocket Lab’s 18 spacecraft program for

the Space Development Agency’s (SDA) Tranche 2 Transport Layer-Beta

(T2TL-Beta) constellation, and for the U.S. Space Force’s VICTUS

HAZE program, a $32 million responsive space mission with Electron

and Rocket Lab’s own spacecraft that will launch with only 24

hours’ notice.

First Quarter 2025 Guidance

For the first quarter of 2025, Rocket Lab expects:

- Revenue between $117 million and $123 million.

- GAAP Gross Margins between 25% and 27%.

- Non-GAAP Gross Margins between 30% and 32%.

- GAAP Operating Expenses between $93 million and $95

million.

- Non-GAAP Operating Expenses between $77 million and $79

million.

- Expected Interest Expense (Income), net $2.7 million.

- Adjusted EBITDA loss of $33 million and $35 million.

- Basic Weighted Average Common Shares Outstanding of 458

million, excluding approximately 51 million of Series A Convertible

Participating Preferred Stock.

See “Use of Non-GAAP Financial Measures” below for an

explanation of our use of Non-GAAP financial measures, and the

reconciliation of historical Non-GAAP measures to the comparable

GAAP measures in the tables attached to this press release.

We have not provided a reconciliation for the forward-looking

Non-GAAP Gross Margin, Non-GAAP Operating Expenses or Adjusted

EBITDA expectations for Q1 2025 described above because, without

unreasonable efforts, we are unable to predict with reasonable

certainty the amount and timing of adjustments that are used to

calculate these non-GAAP financial measures, particularly related

to stock-based compensation and its related tax effects.

Stock-based compensation is currently expected to range from $16

million to $18 million in Q1 2025.

Conference Call Information

Rocket Lab will host a conference call for investors at 2 p.m.

PT (5 p.m. ET) today to discuss these business highlights and

financial results for our fourth quarter, to provide our outlook

for the first quarter, and other updates.

The live webcast and a replay of the webcast will be available

on Rocket Lab’s Investor Relations website:

https://investors.rocketlabusa.com/events-and-presentations/events

About Rocket Lab

Founded in 2006, Rocket Lab is an end-to-end space company with

an established track record of mission success. We deliver reliable

launch services, satellite manufacture, spacecraft components, and

on-orbit management solutions that make it faster, easier, and more

affordable to access space. Headquartered in Long Beach,

California, Rocket Lab designs and manufactures the Electron small

orbital launch vehicle, a family of flight-proven spacecraft, and

the Company is developing the large Neutron launch vehicle for

constellation deployment. Since its first orbital launch in January

2018, Rocket Lab’s Electron launch vehicle has become the second

most frequently launched U.S. rocket annually and has delivered

more than 200 satellites to orbit for private and public sector

organizations, enabling operations in national security, scientific

research, space debris mitigation, Earth observation, climate

monitoring, and communications. Rocket Lab’s Photon spacecraft

platform has been selected to support NASA missions to the Moon and

Mars, as well as the first private commercial mission to Venus.

Rocket Lab has three launch pads at two launch sites, including two

launch pads at a private orbital launch site located in New Zealand

and a third launch pad in Virginia. To learn more, visit

www.rocketlabusa.com.

Forward Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. We intend such forward-looking statements to be covered by

the safe harbor provisions for forward looking statements contained

in Section 27A of the Securities Act of 1933, as amended (the

“Securities Act”) and Section 21E of the Securities Exchange Act of

1934, as amended (the “Exchange Act”). All statements contained in

this press release other than statements of historical fact,

including, without limitation, statements regarding our

expectations of financial results for the first quarter of 2025,

launch and space systems operations, launch schedule and window,

safe and repeatable access to space, Neutron development and

anticipated timeline to launch, operational expansion and business

strategy are forward-looking statements. The words “believe,”

“may,” “will,” “estimate,” “potential,” “continue,” “anticipate,”

“intend,” “expect,” “strategy,” “future,” “could,” “would,”

“project,” “plan,” “target,” and similar expressions are intended

to identify forward-looking statements, though not all

forward-looking statements use these words or expressions. These

statements are neither promises nor guarantees, but involve known

and unknown risks, uncertainties and other important factors that

may cause our actual results, performance or achievements to be

materially different from any future results, performance or

achievements expressed or implied by the forward-looking

statements, including but not limited to the factors, risks and

uncertainties included in our Annual Report on Form 10-K for the

fiscal year ended December 31, 2024, as such factors may be updated

from time to time in our other filings with the Securities and

Exchange Commission (the “SEC”), accessible on the SEC’s website at

www.sec.gov and the Investor Relations section of our website at

www.rocketlabusa.com, which could cause our actual results to

differ materially from those indicated by the forward-looking

statements made in this press release. Any such forward-looking

statements represent management’s estimates as of the date of this

press release. While we may elect to update such forward-looking

statements at some point in the future, we disclaim any obligation

to do so, even if subsequent events cause our views to change.

+ Use of Non-GAAP Financial Measures

We supplement the reporting of our financial information

determined under Generally Accepted Accounting Principles in the

United States of America (“GAAP”) with certain non-GAAP financial

information. The non-GAAP financial information presented excludes

certain significant items that may not be indicative of, or are

unrelated to, results from our ongoing business operations. We

believe that these non-GAAP measures provide investors with

additional insight into the company's ongoing business performance.

These non-GAAP measures should not be considered in isolation or as

a substitute for the related GAAP measures, and other companies may

define such measures differently. We encourage investors to review

our financial statements and publicly filed reports in their

entirety and not to rely on any single financial measure.

Reconciliation of the non-GAAP financial information to the

corresponding GAAP measures for the historical periods disclosed

are included at the end of the tables in this press release. We

have not provided a reconciliation for forward-looking non-GAAP

financial measures because, without unreasonable efforts, we are

unable to predict with reasonable certainty the amount and timing

of adjustments that are used to calculate these non-GAAP financial

measures, particularly related to stock-based compensation and its

related tax effects. The following definitions are provided:

+ Adjusted EBITDA

EBITDA is defined as earnings before interest, taxes,

depreciation and amortization. Adjusted EBITDA further excludes

items of income or loss that we characterize as unrepresentative of

our ongoing operations. Such items are excluded from net income or

loss to determine Adjusted EBITDA. Management believes this measure

provides investors meaningful insight into results from ongoing

operations.

+ Other Non-GAAP Financial Measures

Non-GAAP gross profit, research and development, net, selling,

general and administrative, operating expenses, operating loss and

total other income (expense), net, further excludes items of income

or loss that we characterize as unrepresentative of our ongoing

operations. Such items are excluded from the applicable GAAP

financial measure. Management believes these non-GAAP measures

provide investors meaningful insight into results from ongoing

operations.

ROCKET LAB USA, INC. AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

OPERATIONS

FOR THE THREE MONTHS AND YEARS

ENDED DECEMBER 31, 2024 AND 2023

(unaudited; in thousands,

except share and per share data)

Three Months Ended

December 31,

Years Ended December

31,

2024

2023

2024

2023

Revenues:

Product revenues

$

84,003

$

47,868

$

289,851

$

156,560

Service revenues

48,385

12,123

146,363

88,032

Total revenues

132,388

59,991

436,214

244,592

Cost of revenues:

Cost of product revenues

60,620

31,104

213,835

115,342

Cost of service revenues

34,951

13,395

106,230

77,841

Total cost of revenues

95,571

44,499

320,065

193,183

Gross profit

36,817

15,492

116,149

51,409

Operating expenses:

Research and development, net

48,255

37,488

174,394

119,054

Selling, general and administrative

40,111

25,887

131,556

110,273

Total operating expenses

88,366

63,375

305,950

229,327

Operating loss

(51,549

)

(47,883

)

(189,801

)

(177,918

)

Other income (expense):

Interest expense, net

(1,778

)

(1,405

)

(3,954

)

(4,248

)

Gain (loss) on foreign exchange

378

(394

)

(87

)

(470

)

Other income, net

1,279

196

4,431

3,715

Total other income (expense), net

(121

)

(1,603

)

390

(1,003

)

Loss before income taxes

(51,670

)

(49,486

)

(189,411

)

(178,921

)

Provision for income taxes

(675

)

(1,011

)

(764

)

(3,650

)

Net loss

$

(52,345

)

$

(50,497

)

$

(190,175

)

$

(182,571

)

Net loss per share attributable to Rocket

Lab USA, Inc.:

Basic and diluted

$

(0.10

)

$

(0.10

)

$

(0.38

)

$

(0.38

)

Weighted-average common shares

outstanding:

Basic and diluted

501,748,897

486,959,454

495,929,861

481,768,060

ROCKET LAB USA, INC. AND

SUBSIDIARIES

CONSOLIDATED BALANCE

SHEETS

AS OF DECEMBER 31, 2024 AND

2023

(unaudited; in thousands,

except share and per share data)

December 31,

2024

2023

Assets

Current assets:

Cash and cash equivalents

$

271,042

$

162,518

Marketable securities, current

147,948

82,255

Accounts receivable, net

36,440

35,176

Contract assets

63,108

12,951

Inventories

119,074

107,857

Prepaids and other current assets

55,009

66,949

Assets held for sale

—

9,016

Total current assets

692,621

476,722

Non-current assets:

Property, plant and equipment, net

194,838

145,409

Intangible assets, net

58,637

68,094

Goodwill

71,020

71,020

Right-of-use assets - operating leases

53,664

59,401

Right-of-use assets - finance leases

14,396

14,987

Marketable securities, non-current

60,686

79,247

Restricted cash

4,260

3,916

Deferred income tax assets, net

3,010

3,501

Other non-current assets

31,210

18,914

Total assets

$

1,184,342

$

941,211

Liabilities and Stockholders’

Equity

Current liabilities:

Trade payables

$

53,059

$

29,303

Accrued expenses

19,460

5,590

Employee benefits payable

20,847

16,342

Contract liabilities

216,160

139,338

Current installments of long-term

borrowings

12,045

17,764

Other current liabilities

17,954

15,036

Total current liabilities

339,525

223,373

Non-current liabilities:

Convertible senior notes, net

345,392

—

Long-term borrowings, excluding current

installments

44,049

87,587

Non-current operating lease

liabilities

51,965

56,099

Non-current finance lease liabilities

14,970

15,238

Deferred tax liabilities

891

426

Other non-current liabilities

5,097

3,944

Total liabilities

801,889

386,667

COMMITMENTS AND CONTINGENCIES

Stockholders’ equity:

Preferred stock, $0.0001 par value;

authorized shares: 100,000,000; no shares issued and outstanding at

December 31, 2024 and December 31, 2023

—

—

Common stock, $0.0001 par value;

authorized shares: 2,500,000,000; issued and outstanding shares:

504,453,785 and 488,923,055 at December 31, 2024 and December 31,

2023, respectively

50

49

Additional paid-in capital

1,198,909

1,176,484

Accumulated deficit

(813,701

)

(623,526

)

Accumulated other comprehensive (loss)

income

(2,805

)

1,537

Total stockholders’ equity

382,453

554,544

Total liabilities and stockholders’

equity

$

1,184,342

$

941,211

ROCKET LAB USA, INC. AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

CASH FLOWS

FOR THE YEARS ENDED DECEMBER

31, 2024 AND 2023

(unaudited; in

thousands)

Years Ended December

31,

2024

2023

CASH FLOWS FROM OPERATING

ACTIVITIES:

Net loss

$

(190,175

)

$

(182,571

)

Adjustments to reconcile net loss to net

cash used in operating activities:

Depreciation and amortization

33,655

29,744

Stock-based compensation expense

56,816

53,461

Gain on disposal of assets

(2,828

)

(111

)

Loss on extinguishment of long-term

debt

1,330

1,732

Amortization of debt issuance costs and

discount

3,091

2,904

Noncash lease expense

5,951

5,787

Change in the fair value of contingent

consideration

(218

)

1,343

Accretion of marketable securities

purchased at a discount

(2,901

)

(4,571

)

Deferred income taxes

599

708

Changes in operating assets and

liabilities:

Accounts receivable, net

(1,428

)

1,452

Contract assets

(50,161

)

(3,501

)

Inventories

(12,398

)

(15,562

)

Prepaids and other current assets

7,591

(14,586

)

Other non-current assets

(12,922

)

(11,470

)

Trade payables

24,800

15,585

Accrued expenses

9,086

(3,275

)

Employee benefits payable

5,304

5,484

Contract liabilities

76,865

30,992

Other current liabilities

3,249

(7,563

)

Non-current lease liabilities

(6,405

)

(5,076

)

Other non-current liabilities

2,209

227

Net cash used in operating activities

(48,890

)

(98,867

)

CASH FLOWS FROM INVESTING

ACTIVITIES:

Purchases of property, equipment and

software

(67,093

)

(54,707

)

Proceeds on disposal of assets, net

12,542

3,660

Cash paid for business combinations and

asset acquisitions, net of acquired cash and restricted cash

—

(18,966

)

Purchases of marketable securities

(162,161

)

(207,266

)

Maturities of marketable securities

116,242

269,204

Sale of marketable securities

2,143

20,093

Net cash (used in) provided by investing

activities

(98,327

)

12,018

CASH FLOWS FROM FINANCING

ACTIVITIES:

Proceeds from the exercise of stock

options

3,507

2,444

Proceeds from Employee Stock Purchase

Plan

5,683

4,988

Proceeds from sale of employees restricted

stock units to cover taxes

35,254

15,995

Minimum tax withholding paid on behalf of

employees for restricted stock units

(35,336

)

(15,722

)

Payment of contingent consideration

—

(1,000

)

Finance lease principal payments

(329

)

(336

)

Purchase of capped calls related to

issuance of convertible senior notes

(43,168

)

—

Proceeds from issuance of convertible

senior notes

355,000

—

Proceeds from secured term loan

—

110,000

Repayments on secured term loans

(51,724

)

(107,573

)

Payment of debt issuance costs

(12,205

)

(1,427

)

Net cash provided by financing

activities

256,682

7,369

Effect of exchange rate changes on cash

and cash equivalents

(597

)

43

Net increase (decrease) in cash and cash

equivalents and restricted cash

108,868

(79,437

)

Cash and cash equivalents, and restricted

cash, beginning of period

166,434

245,871

Cash and cash equivalents, and restricted

cash, end of period

$

275,302

$

166,434

ROCKET LAB USA, INC. AND

SUBSIDIARIES

RECONCILIATION OF NON-GAAP

FINANCIAL MEASURES

FOR THE THREE MONTHS AND YEARS

ENDED DECEMBER 31, 2024 AND 2023

(unaudited; in

thousands)

The tables provided below reconcile the

non-GAAP financial measures Adjusted EBITDA, Non-GAAP gross profit,

Non-GAAP research and development, net, Non-GAAP selling, general

and administrative, Non-GAAP operating expenses, Non-GAAP operating

loss and Non-GAAP total other income (expense), net with the most

directly comparable GAAP financial measures. See above for

additional information on the use of these non-GAAP financial

measures.

Three Months Ended

December 31,

Years Ended December

31,

2024

2023

2024

2023

NET LOSS

$

(52,345

)

$

(50,497

)

$

(190,175

)

$

(182,571

)

Depreciation

5,854

4,571

20,367

16,034

Amortization

3,285

3,596

13,288

13,710

Stock-based compensation expense

16,872

10,063

56,816

53,461

Transaction costs

2,187

30

2,594

341

Interest expense, net

1,778

1,405

3,954

4,248

Change in fair value of contingent

consideration

—

205

(218

)

1,343

Performance reserve escrow

—

31

—

5,457

Provision for income taxes

675

1,011

764

3,650

(Gain) loss on foreign exchange

(378

)

394

87

470

Accretion of marketable securities

purchased at a discount

(650

)

(1,179

)

(2,922

)

(4,780

)

Gain on disposal of assets

(472

)

(351

)

(2,828

)

(111

)

Employee retention credit

—

—

—

(3,841

)

Loss on extinguishment of debt

—

1,732

1,330

1,732

ADJUSTED EBITDA

$

(23,194

)

$

(28,989

)

$

(96,943

)

$

(90,857

)

Three Months Ended

December 31,

Years Ended December

31,

2024

2023

2024

2023

GAAP Gross profit

$

36,817

$

15,492

$

116,149

$

51,409

Stock-based compensation

6,452

2,196

16,657

12,521

Amortization of purchased intangibles and

favorable lease

1,751

1,710

6,998

6,839

Performance reserve escrow

—

1

—

210

Employee retention credit

—

—

—

(2,130

)

Non-GAAP Gross profit

$

45,020

$

19,399

$

139,804

$

68,849

Non-GAAP Gross margin

34.0

%

32.3

%

32.0

%

28.1

%

GAAP Research and development,

net

$

48,255

$

37,488

$

174,394

$

119,054

Stock-based compensation

(1,966

)

(3,828

)

(15,626

)

(21,721

)

Amortization of purchased intangibles and

favorable lease

(226

)

(314

)

(912

)

(647

)

Employee retention credit

—

—

—

631

Non-GAAP Research and development,

net

$

46,063

$

33,346

$

157,856

$

97,317

GAAP Selling, general and

administrative

$

40,111

$

25,887

$

131,556

$

110,273

Stock-based compensation

(8,454

)

(4,039

)

(24,533

)

(19,219

)

Amortization of purchased intangibles and

favorable lease

(1,046

)

(1,378

)

(4,320

)

(5,585

)

Transaction costs

(2,187

)

(30

)

(2,594

)

(341

)

Performance reserve escrow

—

(30

)

—

(5,247

)

Change in fair value of contingent

consideration

—

(205

)

218

(1,343

)

Employee retention credit

—

—

—

1,080

Non-GAAP Selling, general and

administrative

$

28,424

$

20,205

$

100,327

$

79,618

GAAP Operating expenses

$

88,366

$

63,375

$

305,950

$

229,327

Stock-based compensation

(10,420

)

(7,867

)

(40,159

)

(40,940

)

Amortization of purchased intangibles and

favorable lease

(1,272

)

(1,692

)

(5,232

)

(6,232

)

Transaction costs

(2,187

)

(30

)

(2,594

)

(341

)

Performance reserve escrow

—

(30

)

—

(5,247

)

Change in fair value of contingent

consideration

—

(205

)

218

(1,343

)

Employee retention credit

—

—

—

1,711

Non-GAAP Operating expenses

$

74,487

$

53,551

$

258,183

$

176,935

GAAP Operating loss

$

(51,549

)

$

(47,883

)

$

(189,801

)

$

(177,918

)

Total non-GAAP adjustments

22,082

13,731

71,422

69,832

Non-GAAP Operating loss

$

(29,467

)

$

(34,152

)

$

(118,379

)

$

(108,086

)

GAAP Total other income (expense),

net

$

(121

)

$

(1,603

)

$

390

$

(1,003

)

(Gain) loss on foreign exchange

(378

)

394

87

470

Gain on disposal of assets

(472

)

(351

)

(2,828

)

(111

)

Loss on extinguishment of debt

—

1,732

1,330

1,732

Non-GAAP Total other income (expense),

net

$

(971

)

$

172

$

(1,021

)

$

1,088

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250227056608/en/

+ Rocket Lab Investor Relations Contact Patrick Vorenkamp

investors@rocketlabusa.com

+ Rocket Lab Media Contact Murielle Baker

media@rocketlabusa.com

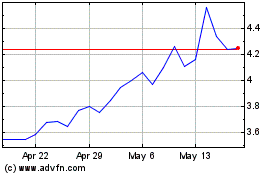

Rocket Lab USA (NASDAQ:RKLB)

Historical Stock Chart

From Feb 2025 to Mar 2025

Rocket Lab USA (NASDAQ:RKLB)

Historical Stock Chart

From Mar 2024 to Mar 2025